Online Apparel & Footwear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437854 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Online Apparel & Footwear Market Size

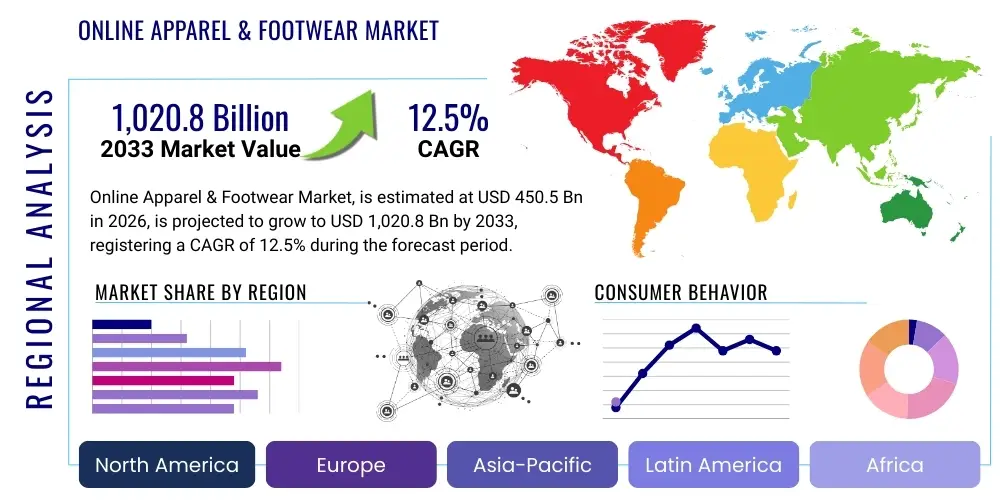

The Online Apparel & Footwear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 1,020.8 Billion by the end of the forecast period in 2033.

Online Apparel & Footwear Market introduction

The Online Apparel & Footwear Market encompasses the retail sale of clothing, accessories, and footwear conducted through digital channels, including dedicated e-commerce websites, mobile applications, and third-party marketplaces. This expansive market segment has fundamentally reshaped global retail dynamics, transitioning consumer purchasing habits from traditional brick-and-mortar stores to highly personalized and convenient online shopping experiences. The products offered span a wide spectrum, ranging from daily casual wear and specialized athletic gear (athleisure) to high-end luxury fashion and formal business attire. Digital platforms enable brands to offer unparalleled inventory depth and geographical reach, catering to diverse consumer preferences across the globe instantaneously.

Major applications of online apparel and footwear retail extend beyond simple transactional purchasing to include subscription box services, peer-to-peer resale platforms, and virtual try-on experiences utilizing augmented reality (AR) technologies. Key benefits driving the massive migration to online channels include the inherent convenience of 24/7 shopping accessibility, the ability to compare prices and styles across numerous retailers effortlessly, and the extensive consumer reviews and social validation available digitally, which inform purchasing decisions. Furthermore, online channels excel in providing size inclusivity and variety that physical stores often cannot match due to inventory constraints, catering specifically to niche markets and specialty sizes.

The market growth is primarily driven by accelerating global digitalization, characterized by high smartphone penetration and improvements in logistics infrastructure, particularly in emerging economies. The strategic use of influencer marketing and social commerce—where purchasing pathways are integrated directly into social media platforms—has significantly lowered the friction associated with online buying. Moreover, the COVID-19 pandemic acted as a major catalyst, accelerating the shift towards digital adoption across all demographics. Sustained investment in personalized recommendation engines, coupled with advancements in reverse logistics designed to streamline returns, further solidifies the foundational driving factors propelling this market toward substantial valuation expansion.

Online Apparel & Footwear Market Executive Summary

The Online Apparel & Footwear Market is characterized by vigorous competition and rapid technological integration, driving several crucial business trends, most notably the shift towards Direct-to-Consumer (DTC) models and hyper-personalization powered by artificial intelligence. DTC allows brands to control the customer experience entirely, foster greater brand loyalty, and maximize margin potential by bypassing traditional retail intermediaries. Business strategies are increasingly focused on building sophisticated omnichannel experiences that seamlessly blend online browsing with offline services, such as in-store pickup or returns, responding to the consumer demand for flexibility. Sustainability and ethical sourcing have also emerged as critical competitive differentiators, with consumers increasingly favoring brands that offer transparency regarding their supply chains and environmental impact, thereby influencing inventory decisions and marketing narratives across the sector.

Regional trends demonstrate a clear disparity in growth velocity, with the Asia Pacific (APAC) region continuing its dominance, propelled by its massive consumer base, high mobile commerce adoption rates, and sophisticated digital ecosystems, particularly in China and India. While North America and Europe remain mature markets, their growth is sustained by high average transaction values (ATV) and the continuous adoption of advanced technologies like AR fitting rooms and virtual merchandising. Conversely, emerging markets in Latin America and the Middle East and Africa (MEA) are experiencing exponential growth, albeit from a lower base, supported by improving digital payment infrastructure and increasing urbanization, presenting significant future expansion opportunities for major global players.

Segment trends underscore the rising significance of the athleisure category, which continues to blur the lines between performance wear and casual apparel, capturing significant market share. Furthermore, the luxury sector has successfully navigated the digital transition, utilizing exclusive online drops and high-quality digital content to maintain brand prestige while increasing accessibility. Technologically, the integration of blockchain for enhanced product traceability and Non-Fungible Tokens (NFTs) to authenticate luxury goods and engage with the Metaverse are becoming defining features for premium segments. Crucially, the focus on inclusivity, particularly in offering extensive sizing options (plus-size and petite), is no longer a niche requirement but a mainstream expectation influencing the strategic inventory planning of all major online retailers.

AI Impact Analysis on Online Apparel & Footwear Market

Common user inquiries concerning AI's role in the Online Apparel & Footwear Market primarily revolve around addressing historical pain points such as inaccurate sizing, high return rates, and ineffective product discovery. Users are keenly interested in how AI can deliver personalized shopping experiences that rival or surpass the guidance offered by in-store assistants, specifically asking about the accuracy of AI-driven size recommendation engines and the feasibility of virtual try-ons. There is significant concern regarding data privacy and the ethical use of consumer behavioral data collected to train these algorithms. Furthermore, businesses are seeking clarity on AI’s capabilities in optimizing operational efficiencies, including inventory forecasting, trend prediction, and streamlining complex logistics for international fulfillment, highlighting a major theme of seeking operational perfection through predictive analytics to minimize waste and maximize customer satisfaction.

The integration of artificial intelligence is fundamentally transforming the online apparel and footwear landscape from reactive retailing to proactive commerce. AI algorithms leverage vast datasets of past purchasing behavior, fit preferences, and browsing patterns to offer highly accurate and relevant product recommendations, significantly improving conversion rates and increasing the average order value. By moving beyond simple collaborative filtering, AI is enabling true personalized merchandising, ensuring that the digital storefront is unique to every visitor, which dramatically enhances the customer journey and reduces choice fatigue. This level of customization ensures that marketing spend is optimized, targeting consumers with products they are statistically most likely to purchase.

Operationally, AI’s impact is perhaps even more profound, particularly in solving the industry’s persistent challenge of returns, which can reach up to 40% for online apparel. Machine learning models analyze fit data and garment construction to predict potential sizing issues before the purchase is finalized, guiding the user toward the correct size based on their unique body profile and the specific cut of the item. Furthermore, AI-driven demand forecasting allows retailers to minimize overstocking and understocking, ensuring that seasonal inventory investments are optimized and reducing the reliance on aggressive discounting. The application of AI extends into visual search capabilities, allowing consumers to upload an image of an item they like and instantly find similar products across the retailer's inventory, demonstrating a holistic technological enhancement across the entire retail value chain.

- Enhanced Personalized Product Recommendations through deep learning models.

- Reduction of Return Rates via AI-driven size and fit prediction engines.

- Optimized Inventory Management and Demand Forecasting based on real-time trend analysis.

- Improved Customer Service using AI chatbots for 24/7 inquiry resolution and style advice.

- Advanced Visual Search capabilities allowing users to shop based on images.

- Dynamic Pricing strategies adjusting prices in real-time based on demand and competitor analysis.

- Supply Chain Optimization by predicting delays and identifying potential logistical bottlenecks.

DRO & Impact Forces Of Online Apparel & Footwear Market

The Online Apparel & Footwear Market is driven by the confluence of technological advancements and evolving consumer behaviors, primarily underpinned by the rapid global proliferation of mobile commerce and the influential power of social media. The convenience offered by mobile shopping applications, coupled with seamless payment gateway integration, has made impulsive and frequent purchasing commonplace. Social media platforms, particularly Instagram, TikTok, and YouTube, serve not merely as marketing channels but as primary discovery and purchasing engines, where influencer endorsements translate directly into sales. These drivers create a highly dynamic environment where speed-to-market and effective digital engagement are critical for competitive success, constantly pushing brands to innovate their digital experience and logistical capabilities.

However, the market faces significant restraints, most prominently the persistently high rate of product returns, often cited as the industry’s greatest operational and environmental hurdle. Returns are expensive, complex to process, and negatively impact inventory turnover, largely stemming from sizing discrepancies and consumers’ inability to assess the look and feel of textiles accurately online. Furthermore, the intense saturation of the e-commerce landscape and fierce price competition often lead to compressed profit margins, especially for mass-market retailers who must constantly offer free shipping and returns. Addressing these restraints necessitates significant investment in advanced technologies like 3D body scanning and material visualization software to build consumer confidence pre-purchase.

Substantial opportunities lie in the commercialization of Augmented Reality (AR) and Virtual Reality (VR) technologies, offering fully immersive virtual try-on experiences that directly tackle the sizing and fit restraints. Furthermore, geographical expansion into rapidly digitizing emerging markets, such as Southeast Asia and Africa, offers untapped potential for growth. The sustained consumer shift towards sustainability presents an opportunity for brands to leverage circular economy models, including resale, rental, and repair services, creating new revenue streams and enhancing brand reputation. The market impact forces, derived from Porter's Five Forces analysis, indicate strong rivalry among existing competitors (due to low switching costs for consumers), moderate bargaining power of suppliers (varied based on raw materials and manufacturing scale), and increasing bargaining power of buyers (due to transparent pricing and vast choice), while the threat of new entrants remains moderate, balanced by high investment requirements in logistics and digital infrastructure.

Segmentation Analysis

The Online Apparel & Footwear Market is highly segmented, allowing for targeted marketing and specialized product development tailored to distinct consumer profiles and needs. Segmentation is typically performed based on product type (apparel vs. footwear), end-user gender (men, women, children), price range (mass-market, mid-range, luxury), and geographic location. This multi-dimensional segmentation strategy enables retailers to optimize inventory assortment and digital presentation, ensuring that niche markets, such as sustainable fashion, plus-size clothing, or specialized sports footwear, receive appropriate attention and dedicated platforms, contributing significantly to overall market diversity and expansion.

Understanding these segments is crucial for strategic market positioning. For example, the women's apparel segment holds the largest market share due to higher frequency of purchasing, but the men's segment exhibits faster growth in specific categories like premium casual wear and specialized athletic footwear. The luxury segment, though smaller in volume, dictates technological innovation and digital experience quality, which often trickle down to mid-range and mass-market players. The ongoing analysis of these segment dynamics informs investments in supply chain capabilities, particularly in ensuring rapid fulfillment for high-demand product types like fast fashion and technical performance gear.

- By Product Type:

- Apparel (Outerwear, Underwear and Sleepwear, Formal Wear, Casual Wear, Sportswear/Activewear)

- Footwear (Athletic Footwear, Non-Athletic Footwear, Specialty Footwear)

- Accessories (Bags, Watches, Jewelry, Other Accessories)

- By End User:

- Men

- Women

- Children

- Unisex/Other

- By Price Range/Tier:

- Mass/Value

- Mid-range

- Premium/Luxury

- By Operating Model:

- Brand Websites (DTC)

- E-commerce Multi-brand Platforms (Marketplaces)

- Subscription Services

Value Chain Analysis For Online Apparel & Footwear Market

The value chain for the Online Apparel & Footwear Market begins with complex upstream activities encompassing raw material sourcing, design, and manufacturing. Upstream analysis involves assessing the sourcing strategies for textiles, leather, and synthetic materials, with increasing focus on sustainable and traceable origins (e.g., organic cotton, recycled polyester). Manufacturing is often outsourced to specialized factories in Asia, requiring robust supply chain management systems to ensure quality control, ethical labor practices, and timely production schedules. Efficiency at this stage is crucial, as delayed production directly impacts the ability to capitalize on fast-moving seasonal trends and creates significant logistical pressures further downstream.

The downstream component of the value chain is focused on reaching the customer and managing post-purchase services. This involves inventory management, warehousing, fulfillment, and last-mile delivery. Due to the high-touch nature of online retail, sophisticated logistics networks are essential for providing rapid shipping options and handling the extensive volume of reverse logistics (returns processing). Effective downstream operations rely heavily on data analytics to optimize inventory allocation across multiple fulfillment centers and ensure a seamless delivery experience, which is a major determinant of customer satisfaction and repeat business.

Distribution channels in this market are predominantly digital, categorized primarily as Direct-to-Consumer (DTC) channels—where brands sell directly via their proprietary websites and apps—and indirect channels, which involve large e-commerce marketplaces (such as Amazon, Zalando, Tmall). The DTC channel offers higher margins and direct customer data but requires significant investment in digital marketing and web infrastructure. Conversely, indirect channels provide immediate access to vast customer bases and sophisticated logistics support but require brands to relinquish some control over pricing and customer interaction. Successful players often employ a hybrid strategy, utilizing marketplaces for wide visibility while nurturing brand loyalty and exclusivity through their DTC platforms.

Online Apparel & Footwear Market Potential Customers

Potential customers for the Online Apparel & Footwear Market span across all age groups and demographics, but they are critically defined by their high degree of digital literacy and expectation of personalized, seamless shopping experiences. The primary target demographic includes Millennials (ages 27-42) and Gen Z (ages 12-26), who represent the largest cohort of digital native consumers. These groups prioritize brand alignment with social values, sustainability, and authenticity, and they rely heavily on social media and peer reviews for product discovery. They seek convenience, value personalized recommendations, and are highly responsive to influencer marketing campaigns, making them the crucial drivers of volume growth.

Beyond the young digital natives, the market also serves specific niche buyers and older generations who have accelerated their digital adoption. Niche buyers include fitness enthusiasts seeking specialized performance gear, luxury consumers expecting highly curated and exclusive digital experiences, and plus-size shoppers who frequently rely on online channels due to better size availability compared to physical stores. These customers are driven by specific product quality demands and are often less price-sensitive if their functional or luxury expectations are met, requiring retailers to segment their inventory and marketing communications precisely.

Furthermore, the growth of the secondhand and rental markets has generated a distinct customer segment focused on circular fashion and sustainability. These buyers prioritize product longevity, ethical consumption, and value-driven purchases, often utilizing specialized resale platforms and marketplaces. Retailers seeking to capture this segment must integrate comprehensive product authentication processes and transparent material sourcing information into their digital offerings. The expansion of cross-border e-commerce also positions international consumers, especially those in regions with limited local luxury retail options, as significant potential customers, driving demand for robust global fulfillment capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 1,020.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon, Alibaba Group, ASOS, Zalando, PUMA SE, Nike Inc., Adidas AG, Inditex (Zara), H&M Hennes & Mauritz AB, Fast Retailing (Uniqlo), JD.com, Rakuten, LVMH, Kering, SHEIN, Stitch Fix, Farfetch, Revolve, Under Armour, VF Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Apparel & Footwear Market Key Technology Landscape

The Online Apparel & Footwear Market is heavily reliant on a sophisticated array of technologies designed to bridge the gap between physical touch and digital interaction. One major technological shift involves the adoption of headless commerce architecture, which decouples the front-end presentation layer (customer experience) from the back-end commerce engine (inventory, payments, fulfillment). This allows retailers to quickly deploy personalized content and experiences across various touchpoints—websites, mobile apps, social media, and IoT devices—without disrupting core transactional functionality, thereby ensuring rapid iteration and optimization of the user interface crucial for high-conversion rates in fast fashion.

Furthermore, the application of immersive technologies, specifically Augmented Reality (AR) and 3D visualization, is rapidly becoming a standard expectation rather than a novelty. AR try-on features, often accessed via smartphone cameras, allow users to virtually visualize how clothing or shoes look on them, dramatically reducing purchase uncertainty related to fit and style. The underlying technology relies on high-resolution 3D modeling and complex spatial mapping algorithms. This technology is instrumental in mitigating the primary restraint of the market—high returns—by giving consumers a realistic, near-physical shopping experience from the comfort of their homes.

Beyond customer-facing innovations, technologies like Blockchain and advanced logistics automation are vital for backend efficiency and transparency. Blockchain technology is increasingly used to establish immutable records of a garment’s journey, tracing raw materials to the finished product, which satisfies the growing consumer demand for supply chain transparency, particularly concerning sustainability and ethical production. Simultaneously, automation in fulfillment centers, utilizing robotic picking and packing systems, coupled with sophisticated route optimization software, ensures that the pressure of fast, affordable global shipping can be met economically, maintaining profitability in a highly competitive e-commerce landscape.

Regional Highlights

- Asia Pacific (APAC): The largest and fastest-growing market globally, primarily driven by massive consumer populations in China and India, coupled with extremely high mobile penetration rates. APAC demonstrates advanced social commerce integration, with platforms like WeChat and Taobao seamlessly blending shopping and social interaction. Investments are centered on optimizing domestic logistics and expanding cross-border e-commerce capabilities to serve rapidly emerging middle-class consumers.

- North America (NA): Characterized by high average transaction values and strong brand loyalty, North America is a mature market focusing heavily on premiumization, personalization through AI, and sustainability initiatives. The region sees rapid adoption of omnichannel strategies, ensuring consumers can fluidly move between online research, mobile purchases, and physical store interactions for returns and pickups.

- Europe: This region is highly fragmented but demonstrates significant demand for sustainable and ethically produced apparel. Western European countries, particularly the UK, Germany, and France, lead in online penetration, supported by strong local e-commerce players like Zalando and ASOS. Regulatory emphasis on data protection (GDPR) forces retailers to adopt sophisticated, compliant data handling practices while still delivering personalization.

- Latin America (LATAM): Exhibits high potential with rapidly increasing internet access and improving digital payment infrastructures. Brazil and Mexico are the core markets, showing strong growth in both domestic and international online purchasing. Challenges remain in logistics infrastructure and customs complexity, driving strategic investments in local fulfillment centers and regional partnerships.

- Middle East and Africa (MEA): Emerging market characterized by strong growth in the GCC countries, fueled by high disposable incomes and a tech-savvy youth population. Demand for luxury and international brands is strong, particularly through specialized online luxury portals. The African market is beginning to show exponential growth, largely driven by mobile money and basic mobile commerce platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Apparel & Footwear Market.- Amazon

- Alibaba Group

- ASOS

- Zalando

- PUMA SE

- Nike Inc.

- Adidas AG

- Inditex (Zara)

- H&M Hennes & Mauritz AB

- Fast Retailing (Uniqlo)

- JD.com

- Rakuten

- LVMH

- Kering

- SHEIN

- Stitch Fix

- Farfetch

- Revolve

- Under Armour

- VF Corporation

Frequently Asked Questions

Analyze common user questions about the Online Apparel & Footwear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Online Apparel & Footwear Market?

The Online Apparel & Footwear Market is projected to experience robust expansion, forecasting a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033, driven primarily by continuous digitalization and consumer preference for mobile shopping convenience.

How is AI mitigating high return rates in online apparel sales?

AI addresses high return rates through sophisticated size and fit prediction algorithms that analyze consumer data, garment specifications, and historical return patterns. Technologies like virtual try-on and 3D body scanning integrated with AI models provide personalized sizing recommendations, significantly reducing purchase uncertainty and associated returns.

Which geographical region dominates the Online Apparel & Footwear market?

The Asia Pacific (APAC) region currently dominates the market size and exhibits the fastest growth trajectory, largely attributable to its massive digitally native population, high mobile commerce adoption, and strong presence of local and global e-commerce giants.

What major trends are shaping the future of online apparel retail?

Key future trends include the increasing adoption of circular economy models (rental, resale), hyper-personalization powered by AI, the integration of Augmented Reality (AR) for immersive product experiences, and a sustained focus on transparent and sustainable supply chain practices.

What are the primary restraints hindering the market’s full potential?

The main restraints are operational complexity stemming from persistently high product return rates due to sizing and visual discrepancies, coupled with the pressure of maintaining low-cost logistics (such as free shipping) in a highly competitive and price-sensitive digital marketplace.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager