Online Brokers and Trading Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437830 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Online Brokers and Trading Platform Market Size

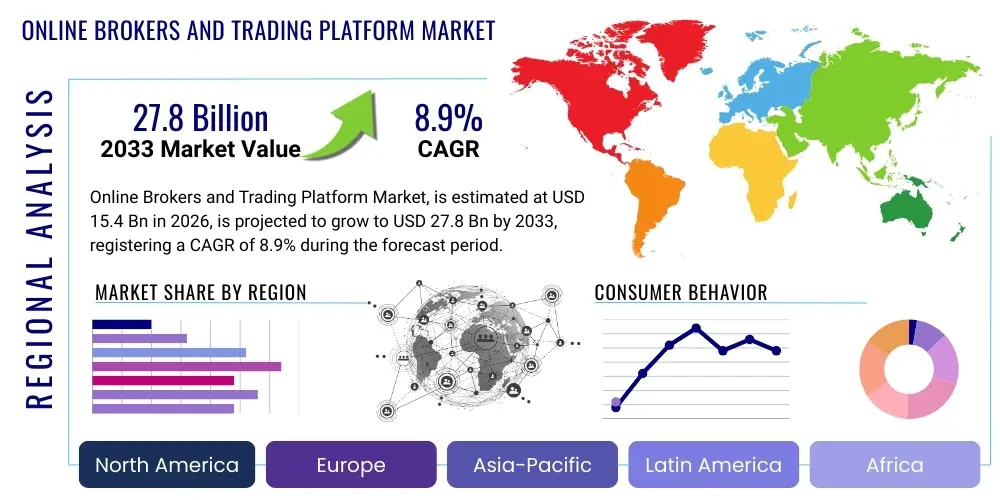

The Online Brokers and Trading Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 15.4 billion in 2026 and is projected to reach USD 27.8 billion by the end of the forecast period in 2033. This substantial growth is primarily fueled by the continued digitalization of financial services, increased retail investor participation across emerging and developed economies, and the widespread adoption of mobile trading applications that lower barriers to entry for new market participants. The migration from traditional, high-cost brokerage services to commission-free or low-fee online platforms is a major catalyst sustaining this robust expansion trajectory.

Online Brokers and Trading Platform Market introduction

The Online Brokers and Trading Platform Market encompasses firms that facilitate the buying and selling of financial securities, such as stocks, bonds, options, futures, and cryptocurrencies, through digital interfaces, primarily web-based portals and mobile applications. These platforms offer crucial services including order execution, market data, research tools, portfolio management capabilities, and educational resources, catering to both retail and institutional investors. The fundamental product is the digital infrastructure that enables users to connect directly to exchanges and liquidity providers, ensuring efficient and timely transaction processing. Modern platforms often integrate sophisticated features like algorithmic trading support, advanced charting, and integrated financial news feeds, positioning them as comprehensive investment hubs rather time mere transaction channels.

Major applications of online trading platforms span active day trading, long-term portfolio investment, retirement savings management, and complex derivatives speculation. Benefits derived from utilizing these platforms are extensive, including significantly reduced transaction costs, increased accessibility to global markets, enhanced control over investment decisions, and the ability to execute trades instantly from virtually any location. The democratization of finance, driven by these technologies, allows a broader demographic to engage in capital market activities previously reserved for high-net-worth individuals or professional traders. Furthermore, the availability of fractional share trading and micro-investing features has further broadened the addressable market.

Driving factors supporting the market’s explosive growth are multifaceted. Technological advancements, particularly in high-speed data processing and cloud computing, have improved platform reliability and execution speed, directly enhancing the user experience. Regulatory shifts, such as the implementation of MiFID II in Europe and similar investor protection measures globally, encourage transparency and competitive pricing among brokers. Moreover, the increasing financial literacy among millennials and Gen Z, coupled with the influence of social media and dedicated investment communities, is spurring higher participation rates. The competitive push towards zero-commission models has fundamentally reshaped market economics, making investment more attractive to retail users globally.

Key market participants are continually innovating, focusing heavily on user interface design, cybersecurity, and the integration of artificial intelligence for personalized insights and risk management. The differentiation in this highly saturated market increasingly depends on the quality of proprietary research, the breadth of asset classes offered (especially niche or emerging assets like specific cryptocurrencies or tokenized securities), and the robustness of customer support. As digital wealth management services converge with execution-only platforms, the market is moving towards a holistic financial ecosystem, providing banking, investing, and planning tools all under one integrated digital roof, thereby securing stronger client loyalty and increasing lifetime value.

Online Brokers and Trading Platform Market Executive Summary

The Online Brokers and Trading Platform Market is undergoing rapid transformation, characterized by intense competition driving innovation in pricing models and technology integration. Key business trends indicate a definitive shift toward unified investment accounts capable of handling multi-asset trading, moving beyond traditional equity and bond offerings to include digital assets and private market investments. Zero-commission trading remains a dominant trend, compelling brokers to diversify revenue streams through services like payment for order flow (PFOF), lending securities, and premium subscription tiers offering enhanced data or advisory tools. Consolidation activity is robust, with larger financial institutions acquiring fintech-focused brokers to rapidly expand their digital capabilities and capture younger, digitally native clientele, ensuring scale and efficiency in backend operations.

Regionally, North America maintains its dominance due to high levels of disposable income, mature regulatory infrastructure, and significant penetration of robo-advisory services. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, driven by burgeoning middle-class populations, increasing internet and smartphone penetration, and favorable regulatory reforms in countries like India and China aimed at modernizing capital markets. European markets are focusing heavily on cross-border trading solutions and regulatory compliance, particularly around investor protection and data privacy (GDPR), which shapes platform design and operational procedures. Emerging markets in Latin America and MEA are seeing substantial organic growth, fueled by local fintech innovation bypassing traditional banking structures.

Segmentation trends highlight the increasing importance of mobile-first platforms, which are capturing the largest share of new retail users due to their convenience and intuitive design. In terms of asset class segmentation, the trading of cryptocurrencies and decentralized finance (DeFi) products is a rapidly expanding segment, attracting platforms that traditionally focused only on conventional securities. Furthermore, the investor type segmentation shows a polarization: while self-directed retail trading flourishes on commission-free apps, the segment requiring comprehensive wealth management advice is driving the demand for integrated hybrid models that combine automated technology with personalized human guidance. Technology segmentation underscores the rising adoption of sophisticated APIs for integration with third-party tools and the implementation of advanced data analytics for risk modeling.

AI Impact Analysis on Online Brokers and Trading Platform Market

Common user questions regarding AI's impact on online brokerage platforms center on fairness, efficiency, and accessibility. Users frequently inquire about the reliability and efficacy of AI-driven trading algorithms, how AI personalization influences investment decisions, and the ethical implications of using machine learning for risk scoring and recommendation systems. Key concerns often revolve around whether AI eliminates job roles, the potential for algorithmic bias leading to unfair trade execution or unequal access to opportunities, and the need for explainable AI (XAI) to understand complex automated decisions. Users also express high expectations for AI to deliver hyper-personalized portfolio risk assessment, enhanced fraud detection, superior customer service via intelligent chatbots, and predictive market insights, seeking a technological edge that minimizes manual effort and maximizes return potential. This summarizes that users view AI as both a powerful efficiency tool and a potential source of systemic risk if not governed properly.

- AI-driven algorithmic trading optimizes trade execution speed and price discovery, reducing slippage and improving efficiency, particularly for institutional and high-frequency traders.

- Machine learning enhances risk management models by analyzing vast datasets to predict market volatility and identify complex behavioral patterns indicative of fraud or market abuse.

- Natural Language Processing (NLP) powers sophisticated chatbots and virtual assistants, providing 24/7 client support, answering complex investment queries, and streamlining onboarding processes.

- AI enables advanced personalization, offering tailored investment recommendations, customized educational content, and risk-adjusted portfolio rebalancing strategies for individual users.

- Predictive analytics allows platforms to forecast client churn, optimize marketing spend, and identify high-value customer segments, improving overall business profitability.

- Integration of deep learning techniques facilitates the analysis of unstructured data, such as news sentiment and social media trends, providing proprietary market intelligence that informs trading decisions.

DRO & Impact Forces Of Online Brokers and Trading Platform Market

The market dynamics are defined by a powerful interplay of drivers, restraints, and opportunities, collectively shaping the competitive landscape and growth trajectory. The predominant drivers include the pervasive trend of financial digitalization, the removal of commission barriers globally making trading accessible to all income levels, and the increasing sophistication of mobile technology which supports intuitive, on-the-go trading experiences. These forces have significantly expanded the total addressable market (TAM) for online brokers. However, the market faces significant restraints, primarily regulatory scrutiny related to data privacy, systemic risk management, and the controversial practice of Payment For Order Flow (PFOF), which attracts attention from financial regulators concerned about best execution practices for retail clients. Furthermore, the intense saturation and subsequent price wars have pressured profit margins for established firms, requiring continuous capital expenditure in technology to remain competitive.

Opportunities in the market are abundant, centered around emerging asset classes and geographical expansion. The growing acceptance of digital assets, including cryptocurrencies and blockchain-based tokenized securities, presents a major revenue pathway for innovative platforms willing to navigate the evolving regulatory frameworks. Moreover, geographic expansion into rapidly digitizing markets in Southeast Asia, Latin America, and Africa, where retail investor penetration is still low but growing exponentially, offers substantial long-term growth potential. Developing hybrid wealth management solutions that successfully merge robo-advisory with human interaction also presents a crucial opportunity to capture the valuable mass affluent segment seeking personalized, yet cost-effective, financial planning services, thereby shifting the value proposition from simple transaction execution to comprehensive financial partnership.

The impact forces within this market are high. The industry operates under high external pressure from technological disruption and low internal stability due to constant pricing competition. The increasing reliance on APIs and cloud infrastructure means that operational risk, particularly concerning system outages or cyberattacks, carries significant financial and reputational impact. Regulatory risk is also critical; sudden changes in rules regarding margin requirements, leverage limits, or PFOF disclosure can fundamentally alter revenue models overnight. The convergence of traditional banking services with brokerage services, driven by large tech companies and integrated financial platforms, acts as a powerful transformative force, challenging traditional brokerages to evolve into holistic financial technology providers rather than just trading executors. These forces collectively demand strategic agility and massive investment in security and compliance infrastructure for sustained market success.

Segmentation Analysis

The Online Brokers and Trading Platform Market is comprehensively segmented based on various technical, service, and user-related parameters, allowing for precise market sizing and strategic targeting. Key segmentation categories include platform type (e.g., dedicated trading terminals vs. mobile-only apps), asset class (e.g., equities, FX, derivatives, crypto), investor type (e.g., retail, institutional, active traders, passive investors), and technology deployed (e.g., API-based, proprietary software, cloud-based). The detailed analysis of these segments reveals shifts in demand, showing that while retail investors flock to user-friendly, mobile-first platforms for basic equity trading, sophisticated institutional clients continue to demand highly customized, low-latency, and complex proprietary trading terminals capable of executing algorithmic strategies across global exchanges simultaneously. Understanding these nuanced demands is essential for brokers aiming to allocate development resources effectively and tailor their product offerings to maximize specific segment penetration and profitability.

Further granularity in segmentation highlights the growing relevance of niche sub-segments, such as platforms specializing in social trading or copy trading, which cater to less experienced investors seeking to replicate the strategies of successful peers. Geographically, segmentation is critical, as regulatory requirements and investor preferences differ vastly; for example, platforms serving European clients must prioritize MiFID II compliance and detailed investor reporting, whereas those in developing Asian markets may prioritize multi-language support and local currency accounts. The interplay between these segments defines market strategy; for instance, a firm targeting high-volume retail FX traders (investor type) will focus on offering high leverage and tight spreads (service attribute) on a dedicated, low-latency web terminal (platform type), distinct from a firm targeting long-term retirement savers who prioritize automated rebalancing and low management fees via a simple mobile app.

- By Platform Type:

- Standard Desktop Trading Terminals

- Web-Based Platforms

- Mobile Trading Applications (iOS and Android)

- API-Based Trading Infrastructure

- By Asset Class:

- Equities (Stocks and ETFs)

- Foreign Exchange (FX)

- Derivatives (Options and Futures)

- Bonds and Fixed Income

- Cryptocurrencies and Digital Assets

- Commodities

- By Investor Type:

- Retail Investors (Self-Directed and Managed)

- Institutional Investors (Hedge Funds, Asset Managers)

- High-Net-Worth Individuals (HNWIs)

- By Service Model:

- Execution-Only Brokerage

- Robo-Advisory Services

- Hybrid Advisory Models

- By Deployment Model:

- Cloud-Based

- On-Premise

Value Chain Analysis For Online Brokers and Trading Platform Market

The value chain of the Online Brokers and Trading Platform Market is highly complex, involving multiple interdependent layers stretching from market data provision to final trade settlement. The chain begins with upstream activities focused on technology development and regulatory adherence. Upstream suppliers include core technology vendors (e.g., enterprise software providers, cloud infrastructure services like AWS or Azure, and specialized cybersecurity firms), as well as market data providers (e.g., Refinitiv, Bloomberg, exchange proprietary data feeds) crucial for pricing and analysis tools. Brokerages must invest heavily in proprietary trading technology and high-performance server architecture to ensure ultra-low latency execution, which is a key competitive differentiator, particularly for active traders and institutional clients. Regulatory compliance forms a foundational upstream layer, demanding continuous auditing and reporting infrastructure to meet global financial standards such as KYC/AML and investor protection mandates, which significantly impacts operational costs and system design complexity.

The core brokerage activity forms the midstream, where the value proposition is actualized. This involves platform development, customer acquisition (through digital marketing and educational resources), trade execution and routing, and asset custody. Brokers act as intermediaries, routing client orders to various liquidity venues, including exchanges, dark pools, and market makers, optimizing for speed and price (best execution). Revenue generation at this stage is multifaceted, derived from spreads (in FX/CFDs), PFOF, interest on margin loans, and often management or subscription fees for premium services. The efficiency and reliability of the matching engine and risk management systems are paramount midstream functions, defining the platform's reputation and scalability. Successful midstream operations hinge on minimizing latency and ensuring robustness against high-volume trading spikes.

Downstream activities involve client support, post-trade settlement, and distribution channels. The settlement process requires integration with clearing houses, custodians, and central securities depositories (CSDs) to finalize the transfer of ownership and funds, a crucial step managed typically by sophisticated backend systems. Distribution is largely direct-to-consumer (D2C) via proprietary web and mobile applications, eliminating traditional intermediary layers. However, indirect channels also exist, particularly through partnerships with Independent Financial Advisors (IFAs) or integration with third-party wealth management software via APIs, which allow external platforms to offer brokerage services. The quality of customer service, often augmented by AI chatbots and comprehensive educational libraries, significantly impacts customer retention and word-of-mouth growth, completing the value cycle by reinforcing client trust and loyalty.

Online Brokers and Trading Platform Market Potential Customers

Potential customers for Online Brokers and Trading Platforms span a wide and diverse spectrum, ranging from novice retail investors making their first stock purchase to sophisticated institutional players executing multi-million dollar algorithmic trades. The primary buyer segment remains the retail investor demographic, segmented further by investment frequency (active traders vs. passive buy-and-hold investors) and net worth (mass market vs. mass affluent). Active retail traders demand high leverage, low commissions, advanced charting tools, and fast execution speeds, often utilizing platforms that specialize in derivatives or FX. Conversely, mass market investors, often new entrants, prioritize ease-of-use, educational content, fractional share availability, and integrated micro-investing features, seeking simplicity over complexity in their trading applications. The growing trend of financial independence (FIRE movement) globally is continually feeding this segment with financially aware, digitally empowered users.

Beyond the retail sphere, institutional buyers represent a high-value segment demanding bespoke solutions. These end-users include hedge funds, pension funds, mutual funds, and large corporate treasury departments. Their needs are highly specialized, focusing on direct market access (DMA), comprehensive pre- and post-trade risk management, robust reporting capabilities tailored for regulatory mandates (e.g., MiFID II transaction reporting), and access to diverse liquidity sources, including dark pools and specialized algorithmic execution strategies. Furthermore, the market for robo-advisors and hybrid platforms targets the mass affluent and Gen X demographic who require professional portfolio management advice but are sensitive to the high fees charged by traditional human advisors. This segment is driven by efficiency and the need for automated tax-loss harvesting and goal-based planning, representing a significant growth opportunity for platforms that can seamlessly integrate human support with scalable technology infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.4 Billion |

| Market Forecast in 2033 | USD 27.8 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Interactive Brokers, Charles Schwab, Fidelity Investments, Robinhood Markets, eToro, TD Ameritrade (now Schwab), Webull, FxPro, Plus500, IG Group, TradeStation, Saxo Bank, Zacks Trade, E*TRADE (now Morgan Stanley), Pepperstone, AvaTrade, CMC Markets, IC Markets, Degiro, Public.com |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Brokers and Trading Platform Market Key Technology Landscape

The technological underpinnings of the Online Brokers and Trading Platform Market are characterized by a relentless pursuit of speed, scalability, and security, driven by high transaction volumes and stringent regulatory requirements. Central to this landscape is the widespread adoption of cloud computing services (e.g., multi-cloud and hybrid environments), which provide the necessary elasticity to handle massive fluctuations in trading activity, especially during periods of high market volatility. Cloud infrastructure allows brokers to scale computing power dynamically, optimize data storage for rapid access to historical market information, and ensure geographical redundancy for business continuity. Furthermore, the use of microservices architecture is increasingly prevalent, enabling brokers to develop, deploy, and update individual platform components (like order routing or charting modules) independently, leading to faster feature iteration and improved platform stability without relying on monolithic legacy systems. This architectural shift significantly enhances agility and reduces time-to-market for new service offerings.

Data analytics and artificial intelligence form another critical layer, transforming raw market data into actionable intelligence. High-Performance Computing (HPC) is utilized to process massive real-time data streams, facilitating the instantaneous generation of indicators and execution of complex algorithms, essential for high-frequency trading (HFT) and smart order routing (SOR). Machine learning models are being deployed not only for quantitative trading strategies but also for enhancing operational security, specifically in detecting fraudulent activities, identifying suspicious account behavior, and performing real-time Know Your Customer (KYC) checks, thereby minimizing compliance risk. Furthermore, Natural Language Generation (NLG) is used to automate the creation of personalized portfolio reports and market summaries, delivering professional-grade communication at scale, reducing the operational load on human analysts and advisors.

The reliance on robust Application Programming Interfaces (APIs) is defining the ecosystem's future, enabling seamless integration between the brokerage platform and third-party financial tools, external data sources, and even client-developed trading bots. Open banking and API standardization allow brokerages to integrate banking and payment services, creating integrated financial applications that enhance user convenience and engagement. Cybersecurity technology, including multi-factor authentication, advanced encryption standards (AES-256), and dedicated intrusion detection systems, is paramount to protect client assets and sensitive data from increasingly sophisticated cyber threats targeting financial institutions. Finally, the slow but steady integration of Distributed Ledger Technology (DLT) or blockchain is beginning to influence post-trade settlement processes, promising potential reduction in settlement times and counterparty risk, although widespread adoption still requires clearer regulatory consensus on asset tokenization and settlement standards.

Regional Highlights

Regional dynamics within the Online Brokers and Trading Platform Market exhibit significant variance driven by disparate regulatory landscapes, varying levels of economic maturity, and local investor behavior. North America, encompassing the United States and Canada, remains the largest and most mature market, characterized by intense technological innovation, particularly in zero-commission trading and robo-advisory services. The presence of major global players, sophisticated retail investor base, and high adoption rates of advanced trading technologies contribute to its dominance. Regulatory bodies like the SEC and FINRA ensure strong investor protection, fostering trust in the digital platforms, which further encourages market participation. The region is leading the trend in incorporating complex derivative trading and sophisticated data analytics tools aimed at institutional-level retail traders.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, buoyed by the rapid expansion of the middle class in emerging economies such as China, India, and Southeast Asian nations, coupled with dramatic increases in mobile and internet penetration. Regulatory modernization efforts in countries like India, aiming to boost domestic capital markets, are lowering entry barriers for international brokers and stimulating local fintech development. Demand in APAC is largely centered on multi-asset platforms that offer access to both local stock exchanges and popular international markets, catering to a younger demographic eager to participate in wealth creation. The shift towards mobile-only solutions is most pronounced here, reflecting the preference for high-frequency, accessible trading on smartphones over traditional desktop interfaces.

Europe represents a highly fragmented yet technologically advanced market, heavily influenced by the European Union's regulatory framework, notably MiFID II, which enforces transparency and best execution rules. The market is characterized by strong cross-border competition and high demand for sophisticated FX and CFD trading capabilities. Regulatory differences across key countries, such as Germany, the UK, and France, necessitate localized compliance strategies for pan-European brokers. The European market shows a robust demand for sustainable and ESG (Environmental, Social, and Governance) investment platforms, driving brokers to integrate non-financial data and ESG scoring into their research offerings, a distinguishing factor compared to North America's focus on technological execution efficiency. Latin America and the Middle East and Africa (MEA) are emerging regions, where growth is driven by localized fintech solutions addressing issues of financial inclusion and leveraging mobile technology to leapfrog traditional banking infrastructure, offering substantial, albeit riskier, untapped market potential.

- North America: Dominant market share; characterized by zero-commission models, mature regulatory framework, high adoption of robo-advisory, and leading innovation in PFOF mechanisms and sophisticated execution technologies.

- Asia Pacific (APAC): Highest CAGR; driven by demographic tailwinds, rising digital literacy, explosive smartphone penetration, localized multi-asset trading demands, and supportive regulatory reforms in emerging economies.

- Europe: Highly regulated (MiFID II and GDPR compliance is essential); strong demand for FX and CFD products; significant focus on cross-border operations and ESG-focused investment platforms.

- Latin America (LATAM): Rapid growth potential fueled by mobile-first strategies; challenges include currency volatility and regulatory inconsistency; focus on basic equity and crypto access for financial inclusion.

- Middle East & Africa (MEA): Nascent growth driven by high-net-worth individuals and rapid urbanization; opportunity in specialized Sharia-compliant investment platforms; technology adoption concentrated in key financial hubs like UAE and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Brokers and Trading Platform Market.- Interactive Brokers

- Charles Schwab

- Fidelity Investments

- Robinhood Markets

- eToro

- Webull

- FxPro

- Plus500

- IG Group

- TradeStation

- Saxo Bank

- Zacks Trade

- Morgan Stanley (E*TRADE)

- Pepperstone

- AvaTrade

- CMC Markets

- IC Markets

- Degiro

- Public.com

- Interactive Investor

Frequently Asked Questions

Analyze common user questions about the Online Brokers and Trading Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the market shift towards zero-commission trading models?

The primary factor driving the shift is intense competitive pressure, led by fintech startups and major brokers seeking to acquire massive volumes of retail investors. While commissions are eliminated, brokers monetize through alternative revenue streams, primarily Payment For Order Flow (PFOF), lending securities, and margin account interest, maximizing user volume over per-trade fees.

How is regulatory scrutiny impacting the growth and operation of online trading platforms?

Regulatory scrutiny is increasing the operational burden and compliance costs, particularly concerning data security (GDPR), investor protection (MiFID II), and transparency in execution pricing, especially regarding PFOF. While this poses restraints, it ultimately stabilizes the market by building greater consumer trust and forcing higher operational standards.

What role does Artificial Intelligence (AI) play in enhancing the user experience on trading platforms?

AI significantly enhances user experience by optimizing trade execution speed, providing personalized investment advice via robo-advisors, powering sophisticated fraud detection systems, and offering 24/7 intelligent customer support through chatbots. AI algorithms also help in providing personalized market insights based on user behavior and portfolio risk profile.

Which asset class is seeing the most significant expansion in terms of platform integration and trading volume?

The cryptocurrency and digital assets segment is experiencing the most significant expansion. Increasing institutional acceptance, rising retail demand for non-traditional assets, and the development of clear regulatory pathways in several jurisdictions are compelling online brokers to integrate spot crypto trading and related derivative products.

What are the key technological challenges faced by online brokers today?

Key technological challenges include maintaining ultra-low latency execution across global markets during peak volatility, ensuring resilience against highly sophisticated cyberattacks, securely managing vast quantities of client data in compliance with global privacy regulations, and continually scaling infrastructure rapidly using cloud technology to handle exponential user growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager