Online Dance Training Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434551 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Online Dance Training Market Size

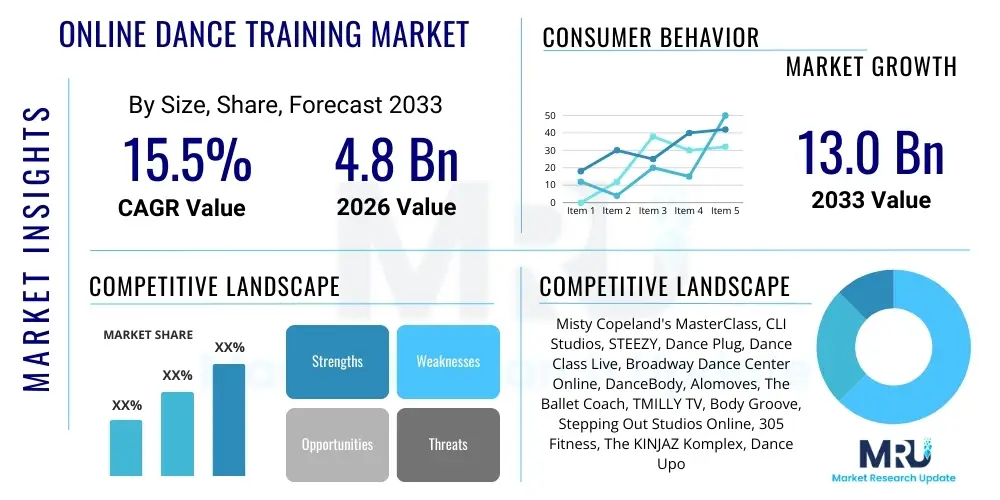

The Online Dance Training Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 13.0 Billion by the end of the forecast period in 2033.

Online Dance Training Market introduction

The Online Dance Training Market encompasses digital platforms, applications, and streaming services that deliver instructional content and interactive classes related to various dance forms. These platforms offer unparalleled access to professional instruction regardless of geographical location, driving significant adoption among enthusiasts, professional dancers, and fitness seekers globally. Key offerings include pre-recorded video tutorials, live-streamed masterclasses, personalized feedback mechanisms, and structured curriculum paths designed for all skill levels, from beginner fundamentals to advanced choreography. This market leverages technological advancements suchating high-definition video delivery, robust user interfaces, and integrated community features to replicate and often enhance the traditional studio experience, positioning it as a dynamic segment within the broader EdTech and fitness industries. The accessibility and affordability inherent in the online model serve as major catalysts for market expansion, particularly in emerging economies where physical studios are scarce or cost-prohibitive.

Product descriptions within this market vary widely, covering genres such as ballet, hip-hop, contemporary, jazz, ballroom, and specific fitness dances like Zumba and barre. The core product is the subscription-based access to a library of instructional videos and live sessions, often categorized by difficulty, dance style, and instructor expertise. Major applications include personal skill development, fitness and wellness regimens, professional audition preparation, and supplementary training for studio students. Furthermore, online platforms have become critical tools for instructors seeking to monetize their expertise beyond local geographic constraints, allowing them to build global brand recognition and diverse revenue streams. The adaptability of content across devices, including smartphones, tablets, and smart TVs, ensures maximum user engagement and convenience, supporting consistent training schedules.

The principal benefits driving market expansion include flexibility in scheduling, cost-effectiveness compared to private studio lessons, and the ability to learn from world-renowned dancers and choreographers who might otherwise be inaccessible. Driving factors are primarily the increasing global penetration of high-speed internet, the widespread adoption of smart devices suitable for video streaming, and the growing consumer demand for personalized and convenient fitness and hobby solutions. The recent global shift towards remote learning and home fitness accelerated the market trajectory, establishing online dance training as a permanent and recognized mode of instruction. Additionally, the development of specialized niche content catering to specific cultural dances or highly technical choreography further fuels user subscriptions and retention rates across various demographic profiles.

Online Dance Training Market Executive Summary

The Online Dance Training Market is characterized by robust growth driven by accelerating digitalization in the education and fitness sectors. Key business trends involve the consolidation of smaller niche platforms by larger media and EdTech companies, increasing investments in interactive features such as two-way video communication for personalized feedback, and the rising popularity of hybrid models that integrate virtual training with occasional in-person workshops. Content monetization strategies are evolving, moving beyond simple subscription fees to include tiered access models, pay-per-view masterclasses, and digital merchandise sales. Technology remains central, with significant expenditure directed towards improving streaming quality, mobile optimization, and enhancing the overall user experience to reduce churn and maintain a competitive edge against free, ad-supported content available on platforms like YouTube. Strategic partnerships between online providers and established dance institutions are emerging to validate and accredit virtual curricula, ensuring perceived quality and professional relevance.

Regional trends indicate North America and Europe currently dominate the market due to high disposable incomes, mature digital infrastructure, and a strong established culture of structured dance education and fitness pursuits. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding internet connectivity, a massive population base of young learners, and increasing affordability of digital services. Countries like China and India are seeing explosive growth, driven by localized content offerings and partnerships with regional influencers. The Middle East and Africa (MEA) and Latin America are also showing promising potential, driven primarily by demand for specialized, globally accessible training options that fill gaps left by localized physical institutions. The regional competition is prompting providers to localize content, offer multi-lingual support, and accept diverse payment methods to capture market share effectively in these developing territories.

Segment trends highlight significant growth in the application of online dance training for fitness and wellness, such as cardio-dance and movement therapy, which appeals to a broader demographic than traditional skill-based training. Segmentation by dance style shows contemporary, hip-hop, and fusion styles leading in popularity, reflecting current cultural trends and social media influence. Furthermore, the segmentation based on device usage clearly demonstrates the supremacy of mobile platforms, necessitating developers to prioritize responsive design and application performance on smartphones. The end-user segment reveals a stable base of amateur learners seeking recreational enrichment, coupled with a rapidly growing segment of professional dancers utilizing online resources for cross-training, specialization, and access to highly specific instructional modules that supplement their primary training curriculum. Customization and personalized learning paths, often powered by initial assessment tools, are becoming defining features across all successful segments.

AI Impact Analysis on Online Dance Training Market

Common user questions regarding AI's impact on online dance training center around concerns about whether technology can truly replicate the nuanced feedback of a human instructor, how personalized training algorithms function, and the future viability of traditional dance studios versus fully virtual, AI-enhanced training environments. Users frequently ask about AI's ability to correct posture and technique in real-time using visual data, and whether these systems are accessible and affordable for independent dancers. There is also significant curiosity regarding the application of generative AI in creating novel choreography and how AI might facilitate accessible dance training for individuals with physical limitations. Essentially, the user base seeks reassurance that AI integration will enhance, rather than dehumanize, the artistic and instructional process, emphasizing accuracy and personalization.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the online dance training landscape by introducing levels of personalization and interaction previously confined to one-on-one studio sessions. AI-driven video analysis tools can track a dancer's body movements, compare them against professional benchmarks, and provide immediate, objective feedback on alignment, timing, and execution. This real-time corrective input addresses a major limitation of pre-recorded online classes, significantly improving the efficacy of self-guided practice. Furthermore, ML algorithms analyze user performance data, progress rates, and preference history to dynamically adjust curriculum paths, recommending specific drills or masterclasses that target identified weaknesses or facilitate mastery of desired styles, thus maximizing learner engagement and accelerating skill acquisition.

Beyond technical feedback, AI is enhancing content discovery and instructional design. Natural Language Processing (NLP) is used to process user inquiries and provide tailored assistance, acting as a virtual assistant for training queries, scheduling, and community management. The adoption of computer vision techniques enables automated assessment submissions, where students upload practice videos and receive a comprehensive, data-backed evaluation, streamlining the instructor's workload while providing detailed qualitative and quantitative analysis to the student. This fusion of artistic instruction and hard data analytics is paving the way for hyper-personalized learning experiences, offering distinct competitive advantages to platforms that invest heavily in sophisticated, robust AI infrastructure tailored specifically for kinematic analysis and artistic instruction delivery.

- AI-powered motion tracking provides real-time posture and technique correction.

- Machine learning algorithms enable dynamic personalization of curriculum paths based on performance data.

- Computer Vision facilitates automated submission grading and objective skill assessment.

- Generative AI tools are being explored for creating personalized warm-ups or choreographic sequence variations.

- Virtual Instructor Assistants (VIA) offer instant answers to student questions and scheduling support.

- Improved content recommendation engines boost user retention by suggesting relevant classes and instructors.

DRO & Impact Forces Of Online Dance Training Market

The Online Dance Training Market is significantly shaped by a confluence of accelerating drivers, structural restraints, and compelling opportunities that determine its overall trajectory and competitive dynamics. Key drivers include the global mandate for accessible education, the sustained growth of the health and wellness industry leading to increased participation in physical activities like dance, and the undeniable convenience and lower entry cost associated with digital learning models. The rise of social media platforms, acting as both marketing channels and content dissemination venues, further amplifies the demand, showcasing professional dancers and inspiring new cohorts of learners globally. These forces collectively push market penetration into demographics and geographic regions previously underserved by traditional dance education structures.

Despite strong drivers, several restraints pose challenges to sustained growth. A primary restraint is the requirement for high-speed, stable internet access, which remains a barrier in many developing and rural areas, limiting market reach. Another significant limitation is the psychological difficulty of maintaining motivation and adherence in an isolated, remote learning environment compared to the social pressure and structure of a physical studio. Furthermore, quality concerns persist regarding the accuracy of feedback in non-interactive sessions and the perceived lack of professional accreditation for entirely online training programs. Protecting intellectual property and content against unauthorized distribution (piracy) also represents a substantial ongoing operational and financial constraint for content creators and platform providers, necessitating continuous investment in security features.

Opportunities within the market are abundant, focusing heavily on technological evolution and market diversification. The primary opportunities lie in the adoption of immersive technologies like Virtual Reality (VR) and Augmented Reality (AR) to create truly interactive and studio-like practice environments, overcoming spatial and physical limitations. Expanding the market scope to include corporate wellness programs and educational institution partnerships presents significant B2B revenue streams. The rising demand for specialized certifications and professional development courses accessible online further creates a lucrative niche for premium, accredited content. Strategic partnerships with fitness equipment manufacturers and wearable technology providers also offer avenues for integrating biofeedback data, deepening the personalization and measurable results offered by online training programs.

Segmentation Analysis

The Online Dance Training Market is extensively segmented based on criteria such as the type of offering, dance style, device compatibility, subscription model, and end-user base. This comprehensive segmentation allows vendors to tailor their marketing strategies and content libraries to distinct demographic and skill-level groups, optimizing user acquisition and retention rates. The core segmentation revolves around differentiating between live, synchronous classes requiring scheduling and pre-recorded, asynchronous video libraries which offer maximal flexibility. Analyzing these segments provides critical insights into consumer preferences regarding interaction levels, scheduling demands, and price sensitivity across various global regions, aiding in focused product development efforts and resource allocation.

Segmentation by dance style is crucial, as demand is highly dependent on cultural trends and regional interests; for instance, ballet and contemporary classes are traditionally popular in Western markets, while Bollywood and specific regional folk dances drive demand in Asia. The division by device type (mobile vs. desktop/smart TV) dictates technical requirements and user interface design priority, with mobile optimization being paramount due to the prevalence of smartphone usage for streaming. Furthermore, the segmentation by end-user, differentiating between professional dancers seeking supplementary training and amateur learners focusing on recreational fitness, profoundly impacts content depth, instructional pace, and pricing strategy, driving a move towards highly specialized, vertical content platforms rather than broad, generalized offerings.

Effective management of these varied segments is essential for establishing market leadership. Platforms must simultaneously address the needs of high-frequency subscribers requiring vast, diverse content libraries and low-frequency users seeking short, specific instructional modules for temporary fitness goals. The development of tiered subscription models—ranging from basic access to premium plans offering personalized one-on-one sessions and instructor feedback—is a direct result of segment analysis designed to maximize lifetime customer value across the entire spectrum of potential users, from casual hobbyists to professional artists and competitive dancers.

- By Type of Offering:

- Live Sessions/Classes

- Pre-recorded Video Library (On-Demand Content)

- Hybrid Models (Combining live interaction with on-demand access)

- By Dance Style:

- Ballet and Pointe

- Hip-Hop and Street Dance

- Contemporary and Modern

- Jazz and Tap

- Ballroom and Latin Dance

- Fitness Dance (Zumba, Cardio Dance)

- By Device Compatibility:

- Mobile Applications (Smartphones/Tablets)

- Desktop/Web Platforms

- Smart TV and Console Integration

- By End-User:

- Amateur/Recreational Learners

- Professional Dancers and Trainees

- Dance Educators and Choreographers (for supplemental training)

Value Chain Analysis For Online Dance Training Market

The value chain of the Online Dance Training Market begins with the upstream activities centered on content creation and technology development. Upstream analysis involves sourcing and securing highly qualified instructors and choreographers, who are the primary asset and content generators. This phase also includes significant investment in high-quality production studios, filming equipment, and technical personnel necessary to produce high-definition, visually compelling instructional video content. Crucially, proprietary technology development, including the creation of robust streaming platforms, interactive features (like AI feedback loops), and secure content management systems (CMS), forms the backbone of the upstream structure, requiring ongoing research and development to maintain competitive superiority in delivery and user experience.

The distribution channel represents the midstream component, which is predominantly digital. Direct distribution occurs when content providers manage their own proprietary platform, website, and mobile applications, ensuring full control over branding, user data, and revenue streams. Indirect distribution involves partnering with major third-party platforms, such as educational aggregators, fitness marketplaces, or smart TV providers (e.g., Apple TV, Roku), to expand reach into diverse user bases. The efficiency of this midstream process hinges on cloud infrastructure scalability, global Content Delivery Networks (CDNs) for minimized latency, and effective digital rights management (DRM) to prevent piracy and ensure secure access across multiple devices and global regions, optimizing the viewer’s experience regardless of location.

Downstream activities focus heavily on customer acquisition, retention, and support. This involves targeted digital marketing, Search Engine Optimization (SEO), and strong social media engagement to drive traffic and subscriptions. Post-acquisition services, including personalized customer support, community management, and mechanisms for interactive feedback, are vital for reducing subscriber churn. The downstream value is realized through successful subscription renewals and premium content purchases, demonstrating the critical importance of a seamless user experience, reliable platform performance, and continuous content refresh cycles to maintain high perceived value. The direct engagement with end-users also provides valuable data for continuous loop improvement in upstream content strategy and technological refinement.

Online Dance Training Market Potential Customers

The primary target demographic and end-users of the Online Dance Training Market are incredibly diverse, spanning across age groups, skill levels, and geographic boundaries, unified by a desire for convenient and high-quality movement instruction. The largest segment comprises amateur or recreational learners, including individuals seeking flexible fitness routines, those exploring dance as a hobby, and busy professionals who cannot commit to fixed studio schedules. These customers prioritize convenience, variety of styles, and affordability, often subscribing to general access, broad library platforms that offer introductory to intermediate levels across multiple genres like hip-hop, contemporary, and fusion fitness routines such as Zumba or cardio barre classes to enhance their overall physical well-being and artistic expression.

A second, highly valuable segment consists of professional dancers, dance students enrolled in traditional conservatories, and advanced trainees. This group utilizes online training platforms not for primary instruction but for supplementary purposes, such as cross-training in related styles, mastering highly specific techniques (e.g., pointe variations, intricate partnering work), or accessing masterclasses from globally renowned, specialized choreographers who are geographically inaccessible otherwise. For this demographic, the emphasis shifts from general convenience to instructional depth, credentialed instructors, and platform features that facilitate self-assessment and high-fidelity technical feedback, often favoring platforms offering intensive, certification-track programs or exclusive, live mentorship opportunities.

Additionally, the B2B segment, including K-12 educational institutions, universities offering dance minors, corporate wellness programs, and small independent physical dance studios, represents a growing potential customer base. Educational institutions use online libraries as standardized curriculum resources or substitute instruction during travel or pandemic-related disruptions. Corporate entities leverage these services as part of employee fitness and stress reduction packages, valuing the flexibility and scalability of digital access. Small studio owners purchase bundled access to offer certified supplementary content to their students, enhancing their local offerings without needing to hire additional specialized faculty, thus making the B2B sphere a critical area for market monetization through bulk licensing agreements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 13.0 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Misty Copeland's MasterClass, CLI Studios, STEEZY, Dance Plug, Dance Class Live, Broadway Dance Center Online, DanceBody, Alomoves, The Ballet Coach, TMILLY TV, Body Groove, Stepping Out Studios Online, 305 Fitness, The KINJAZ Komplex, Dance Upon A Time |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Dance Training Market Key Technology Landscape

The technological landscape underpinning the Online Dance Training Market is sophisticated, relying heavily on advanced streaming technologies to deliver high-quality, uninterrupted video content globally. Central to this is the use of high-definition (HD) and ultra-high-definition (UHD) streaming capabilities, supported by robust Content Delivery Networks (CDNs) to ensure minimal latency and buffer-free viewing across diverse geographic locations and fluctuating internet speeds. Adaptive bitrate streaming (ABS) technology is essential, automatically adjusting video quality based on the user's connection strength, which is vital for maintaining accessibility in markets with variable infrastructure quality. Furthermore, mobile-first development strategies are paramount, utilizing native mobile applications optimized for iOS and Android environments that prioritize touch interaction, offline downloading capabilities, and seamless integration with external casting devices for viewing on larger screens.

Beyond content delivery, interactive technologies are rapidly gaining traction as a differentiator. Two-way video communication platforms, often integrated into the learning management system (LMS), facilitate real-time, synchronous feedback during live classes, mimicking the crucial personalized attention found in physical studios. This interaction is further augmented by AI-powered computer vision and motion tracking software. These technologies utilize the user's device camera to analyze body geometry and movement fidelity, providing data-driven corrections regarding angle, symmetry, and timing. The development of proprietary algorithms capable of accurate kinematic analysis specific to dance disciplines (e.g., recognizing turnout in ballet or isolation quality in hip-hop) represents a significant technological barrier to entry and a source of competitive advantage in the premium segment of the market, ensuring objective feedback mechanisms are integrated into the learning loop.

Emerging technologies like Virtual Reality (VR) and Augmented Reality (AR) are poised to redefine immersion and spatial learning in the dance training sector. VR environments allow users to feel fully immersed in a virtual studio setting, potentially practicing alongside avatars or remote instructors in a shared 3D space, which addresses the sense of isolation. AR applications, usable via smartphone cameras or specialized goggles, can overlay instructional cues, foot placement guides, or holographic representations of the instructor directly onto the user's physical environment, offering immediate visual guidance during practice. Furthermore, the integration of wearable technology allows platforms to gather biofeedback data, such as heart rate and caloric expenditure, seamlessly merging the artistic and fitness dimensions of dance training, enriching the overall data available for personalized curriculum refinement and progress tracking.

Regional Highlights

Regional dynamics play a crucial role in shaping the Online Dance Training Market, reflecting disparities in digital infrastructure, cultural affinity for specific dance styles, and discretionary spending on fitness and educational subscriptions. North America, particularly the United States and Canada, leads the market in terms of revenue share, primarily due to the high density of technological early adopters, established broadband penetration, and a mature subscription-based digital economy. The demand here is largely driven by fitness-focused dance classes (cardio, barre) and high-quality classical ballet and contemporary instruction provided by renowned industry professionals. European countries, including the UK, Germany, and France, represent another significant hub, characterized by strong consumer spending on cultural enrichment and fitness, with notable growth in ballroom and classical training segments, often supported by regulatory frameworks that encourage digital education and skill development.

The Asia Pacific (APAC) region stands out for its potential and projected highest CAGR, offering unprecedented growth opportunities driven by demographic factors and rapidly improving internet infrastructure in major economies like China, India, and Southeast Asian nations. Demand in APAC is heavily influenced by local cultural preferences, leading to high subscription rates for K-Pop dance, regional folk dances, and specialized street styles. Market expansion in this area necessitates strong localized content strategies, including multi-language support and partnerships with regional social media influencers to build trust and market visibility. The sheer size of the student population in countries like India further positions APAC as the future volume driver for the global market, requiring platforms to focus on scalability and localized pricing strategies to ensure accessibility across vast populations with diverse economic backgrounds.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller, yet rapidly expanding, market shares. Growth in LATAM is driven by high interest in fitness dance and Latin styles (salsa, tango), coupled with increasing mobile internet usage, although payment processing complexities and infrastructure limitations in certain areas remain hurdles. In MEA, the demand is often centered around accessing high-quality, international instruction that may be unavailable locally, positioning online platforms as crucial bridges for specialized artistic education. As mobile connectivity continues to proliferate and digital payment systems become more integrated across these regions, platforms that successfully navigate local regulations and establish reliable infrastructure partnerships will be well-positioned to capitalize on the increasing appetite for convenient, globally sourced dance training, diversifying their global revenue streams beyond the established Western markets.

- North America: Market leader, strong adoption of fitness dance and professional development courses, characterized by high subscription willingness.

- Europe: Mature market, high emphasis on classical and structured dance forms, strong regulatory support for digital education integration.

- Asia Pacific (APAC): Highest projected growth rate (CAGR), driven by massive young population, rapid internet expansion, and high demand for K-Pop and localized styles.

- Latin America (LATAM): Growth fueled by mobile penetration and regional dance style popularity, requires overcoming localized payment and infrastructure challenges.

- Middle East & Africa (MEA): Emerging market, primarily seeking access to specialized, international expertise and professional certification opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Dance Training Market.- Misty Copeland's MasterClass

- CLI Studios

- STEEZY

- Dance Plug

- Dance Class Live

- Broadway Dance Center Online

- DanceBody

- Alomoves

- The Ballet Coach

- TMILLY TV

- Body Groove

- Stepping Out Studios Online

- 305 Fitness

- The KINJAZ Komplex

- Dance Upon A Time

- Open Dance Academy

- Dancio

- Gotta Dance Studio

- Salsa on2 Academy

- The Movement

Frequently Asked Questions

Analyze common user questions about the Online Dance Training market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Online Dance Training Market?

The Online Dance Training Market is projected to experience substantial expansion, driven by continuous digital adoption and demand for home fitness solutions. The market is forecasted to grow at a robust Compound Annual Growth Rate (CAGR) of 15.5% between the years 2026 and 2033, reaching an estimated value of USD 13.0 Billion by the end of the forecast period.

How does AI technology enhance the effectiveness of online dance lessons?

AI significantly enhances effectiveness by providing real-time, objective feedback on movement execution and posture. Utilizing computer vision, AI tracks body kinematics, identifies technical errors, and offers personalized corrections, simulating the detailed attention of a human instructor, thereby accelerating skill acquisition and ensuring proper form during remote training sessions.

Which regional market is expected to show the highest growth rate?

The Asia Pacific (APAC) region is expected to demonstrate the highest growth rate (CAGR) in the online dance training sector. This surge is attributed to rapidly increasing internet and smartphone penetration, a large youth demographic, growing disposable income, and high regional interest in dance styles such as K-Pop and Bollywood, fueling massive subscription volume.

What are the primary challenges or restraints affecting market expansion?

Key market restraints include the mandatory requirement for high-speed, reliable internet connectivity, which remains a limiting factor in rural or developing regions. Additional challenges involve user retention due to lack of in-person motivation and the ongoing difficulty in universally standardizing professional accreditation for entirely virtual dance training curricula.

What are the main segments of the Online Dance Training Market by offering type?

The market is primarily segmented into three offering types: Live Sessions (synchronous, scheduled classes providing real-time interaction), Pre-recorded Video Libraries (asynchronous, on-demand content offering maximum scheduling flexibility), and Hybrid Models, which strategically combine scheduled live interactions with extensive access to existing on-demand instructional video libraries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager