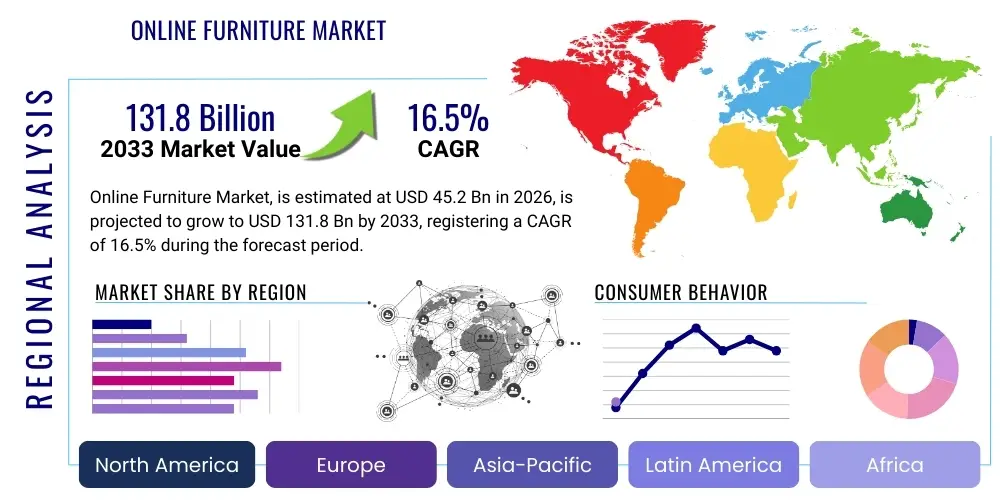

Online Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435172 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Online Furniture Market Size

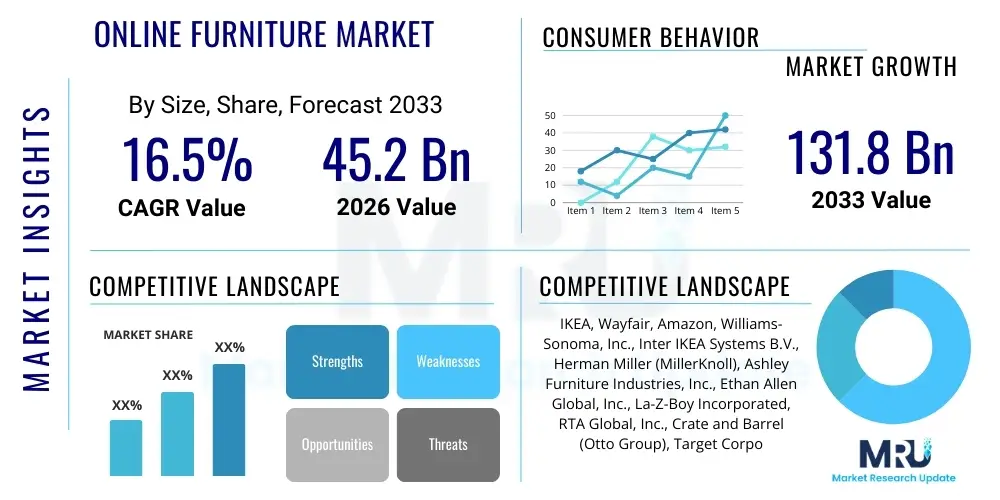

The Online Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 131.8 Billion by the end of the forecast period in 2033.

Online Furniture Market introduction

The Online Furniture Market encompasses the retail sale of residential and commercial furnishings, including seating, storage, tables, and bedroom sets, conducted entirely through e-commerce platforms. This sector leverages digital infrastructure to facilitate browsing, selection, payment, and delivery of large, complex goods, significantly disrupting traditional brick-and-mortar retail models. The fundamental shift driving this market is the consumer preference for convenience, wider product variety not limited by physical store space, and competitive pricing often achieved through direct-to-consumer (DTC) models, eliminating intermediary costs. Products range from ready-to-assemble (RTA) pieces to custom-made luxury items, serving diverse functional and aesthetic needs across various consumer demographics. This digital transformation is accelerating, integrating advanced visualization tools like Augmented Reality (AR) to enhance the remote shopping experience, addressing the critical challenge of assessing size and fit.

Major applications of online furniture procurement span residential uses—including apartments, houses, and specialized home office setups—and commercial applications, such as small business fit-outs, hospitality sector furnishing, and educational institutions upgrading facilities. The primary benefits driving adoption include unparalleled access to global designs, simplified price comparison tools, detailed customer reviews aiding informed decision-making, and specialized logistics capabilities ensuring safe, often white-glove, delivery services. The market caters heavily to younger, digitally native generations who prioritize speed and seamless transactional experiences, reinforcing the structural growth of the sector far beyond transient pandemic-related boosts. Furthermore, the rise of specialized niche markets, such as sustainable and ergonomic furniture, finds a scalable distribution channel through online platforms, broadening the market’s appeal.

Key driving factors fueling the robust growth of the Online Furniture Market include the exponential increase in global internet penetration and smartphone usage, making online shopping accessible to billions. Urbanization trends, particularly the demand for multifunctional and space-saving furniture in smaller living environments, are perfectly addressed by customized online catalogs. Crucially, the continuous refinement of logistics networks, including optimized last-mile delivery for bulky items, has reduced shipping friction and costs, improving the overall value proposition for consumers. Finally, aggressive digital marketing and personalized recommendation engines deployed by major e-commerce players continually draw traffic and convert interest into sales, establishing deep brand loyalty within a crowded retail space, thereby solidifying the market’s upward trajectory.

Online Furniture Market Executive Summary

The Online Furniture Market is characterized by intense competition driven by shifting business trends focusing on operational efficiency and customer experience innovation. Key business trends include the proliferation of personalized direct-to-consumer (DTC) brands that bypass traditional retail channels, offering customized products and competitive pricing. There is a strong movement towards integrated omnichannel strategies, where retailers blend online visualization tools with limited physical showrooms to provide tactile engagement while retaining the convenience of digital purchasing. Furthermore, sustainability and ethical sourcing are becoming non-negotiable standards, prompting major players to invest in transparent supply chains and eco-friendly materials, responding directly to evolving consumer values and regulatory pressures, which is a significant factor in long-term market differentiation and brand resonance.

Regional trends indicate that North America and Asia Pacific (APAC) remain the most dynamic and largest markets globally, though for different reasons. North America is driven by high disposable income, well-established e-commerce infrastructure, and a culture of large-scale home renovations. Conversely, APAC, particularly China and India, is experiencing explosive growth fueled by rapid digital adoption, a burgeoning middle class, and increasing urbanization, leading to massive scale opportunities for both regional specialists and international retailers. European markets show a mature but steady growth pattern, emphasizing design quality, durability, and a strong preference for locally sourced or ethically produced goods. Emerging markets in Latin America and the Middle East are accelerating their digital transitions, albeit hampered sometimes by logistical challenges, yet presenting untapped potential for foundational growth in the next decade due to increasing internet penetration.

Segmentation trends highlight the dominance of the residential segment, particularly in living room and bedroom furniture, driven by cyclical replacement and remodeling activities. However, the fastest-growing segment is modular and ready-to-assemble (RTA) furniture, which appeals to younger, transient consumers and those prioritizing affordability and quick setup. By material, wood and engineered wood products maintain the largest market share, while eco-friendly materials such as bamboo and recycled plastics are rapidly gaining traction, reflecting consumer demand for greener alternatives. The rising prominence of artificial intelligence (AI) in optimizing inventory management, predictive demand forecasting, and highly targeted marketing campaigns is streamlining operations, ensuring that the online furniture supply chain becomes more responsive and less capital-intensive, ultimately translating into enhanced market efficiency and increased profitability across segments.

AI Impact Analysis on Online Furniture Market

Common user questions regarding AI’s impact on the Online Furniture Market predominantly center on how technology can bridge the sensory gap—specifically, "How can AI help me visualize furniture accurately in my home before buying?" and "Will AI reduce delivery times and costs?" There is also significant interest in personalized shopping, such as "Can AI recommend furniture based on my existing décor and style preferences?" and concerns about market fairness, inquiring whether AI-driven pricing is equitable or predatory. Based on this analysis, the key themes summarize user expectations for AI to enhance visualization (using AR/VR), dramatically improve supply chain logistics, and deliver highly personalized, tailored shopping journeys that mimic or surpass the advice of an in-store consultant, all while ensuring competitive and transparent pricing structures remain intact. Users view AI not merely as a tool for retailers, but as a crucial element for mitigating the risks and uncertainties associated with purchasing large, non-returnable items online.

The integration of sophisticated Artificial Intelligence (AI) and Machine Learning (ML) models is revolutionizing the operational framework of the Online Furniture Market, moving beyond basic recommendation engines into critical areas like predictive analytics and customer service automation. Retailers are deploying ML algorithms to analyze vast datasets of consumer behavior, encompassing browsing history, purchase patterns, and product reviews, enabling highly accurate demand forecasting. This predictive capability significantly reduces stockouts and minimizes excessive inventory holding costs, directly contributing to higher profit margins and allowing companies to dynamically adjust pricing in real-time based on competitive analysis and inventory levels. Moreover, AI powers conversational commerce via sophisticated chatbots that handle routine customer inquiries, guide complex product configuration, and process returns, ensuring 24/7 service availability and freeing human agents to focus on high-value interactions, drastically improving customer satisfaction scores.

Furthermore, the technological synergy between AI and Augmented Reality (AR) is fundamentally addressing the consumer hesitation regarding sizing and aesthetic compatibility, a traditional barrier to online furniture sales. AI-driven AR applications allow customers to place virtual 3D models of furniture pieces within their actual homes using smartphone cameras, scaling them accurately to judge fit, color matching, and spatial arrangement. Concurrently, AI algorithms are optimizing complex logistics routes for bulky shipments. By analyzing factors such as warehouse location, current traffic conditions, vehicle capacity, and customer availability windows, these systems ensure the most efficient route planning and scheduling, directly translating into faster delivery times, lower fuel consumption, and reduced instances of failed deliveries, thereby enhancing operational sustainability and profitability in the highly complex last-mile delivery segment of heavy goods.

- AI enhances personalized product recommendations based on interior design styles, purchase history, and visual search inputs.

- Implementation of AI-driven Augmented Reality (AR) tools improves visualization accuracy, reducing purchase anxiety and return rates.

- Machine Learning (ML) optimizes supply chain logistics, including predictive demand forecasting and dynamic inventory management.

- Automated pricing algorithms adjust product costs in real-time based on competitor analysis and seasonal consumer demand shifts.

- AI-powered chatbots provide instant 24/7 customer support for FAQs, order tracking, and basic troubleshooting.

- Computer vision technology analyzes user-uploaded photos to suggest complementary items and identify furniture styles.

DRO & Impact Forces Of Online Furniture Market

The Online Furniture Market is fundamentally shaped by a confluence of accelerating drivers, persistent restraints, and significant opportunities, which collectively determine its growth trajectory and competitive landscape. Key drivers include the pervasive adoption of e-commerce platforms globally, particularly post-pandemic, cementing online shopping as a habitual behavior for diverse consumer goods, including large-ticket items. Simultaneously, significant restraints persist, primarily centered around the logistical complexity and cost associated with shipping large, heavy, and often fragile items, leading to high delivery and return costs that can erode profit margins. Opportunities are vast, focusing heavily on leveraging emerging technologies like virtual reality (VR) to create fully immersive virtual showrooms, and expanding into niche, high-growth segments such as customized, modular, and sustainable furniture solutions that command premium pricing and attract environmentally conscious consumers.

The market impact forces dictate the speed and direction of disruption. High market rivalry, driven by low entry barriers for small DTC brands and intense price competition among large established players like Amazon and specialized retailers like Wayfair, forces continuous innovation in pricing, product differentiation, and service quality. Supplier power remains moderate; while large retailers possess buying power, specialized or rare material sourcing can empower niche suppliers. Buyer power is exceptionally high due to the abundance of choices, detailed comparative pricing available instantly, and the extensive use of review systems, mandating superior customer service and competitive pricing strategies to retain market share. The threat of substitutes is relatively low, as furniture generally requires a physical replacement, although innovative rental and subscription models pose a minor disruptive risk, particularly in urban, short-term rental markets. Finally, the threat of new entrants is moderate, lowered by the complexity of establishing robust logistics networks but heightened by the ease of setting up a visually appealing e-commerce frontend.

In terms of specific drivers, the sustained global trend of remote working has significantly boosted demand for dedicated, ergonomic home office furniture, a specialized category that thrives online due to the necessity for detailed technical specifications and customization. However, the primary restraint remains the challenge of product quality assessment; consumers often lack confidence in judging material durability and comfort without physical interaction, leading to higher rates of hesitation and sometimes costly returns. Addressing this, the core opportunity lies in the development of hyper-realistic digital twins of products, coupled with advanced materiality testing and certification displayed prominently online, building trust and mitigating the tactile deficit inherent in the digital purchasing process. Furthermore, international expansion into rapidly digitizing economies presents massive scaling potential, provided that localized logistics and payment systems are effectively integrated into the existing e-commerce infrastructure.

Segmentation Analysis

The Online Furniture Market is comprehensively segmented based on product type, end-user, material, and pricing range, providing a granular view of consumer behavior and market dynamics. This segmentation is crucial for retailers to tailor their inventory, marketing efforts, and supply chain logistics to specific high-potential demographic and functional needs. The product type segmentation distinguishes between essentials like seating and storage, which are high-volume, frequent purchases, and less frequent, larger purchases like complete bedroom sets or commercial fittings. End-user segmentation clearly separates the high-volume, personalized residential demand from the bulk, durability-focused commercial demand. Material segmentation highlights the shift from traditional wood to engineered and sustainable materials, reflecting cost sensitivity and environmental awareness, while pricing range segmentation dictates the profitability and competitive strategies across luxury, mid-range, and budget categories, defining the market’s economic landscape.

- By Product Type:

- Seating (Sofas, Chairs, Stools)

- Tables (Dining Tables, Coffee Tables, Side Tables)

- Storage Units (Shelves, Cabinets, Wardrobes)

- Bedroom Furniture (Beds, Dressers, Nightstands)

- Office Furniture (Desks, Ergonomic Chairs, Filing Cabinets)

- Other Furniture (Outdoor, Decorative, Specialized)

- By Material:

- Wood and Engineered Wood

- Metal

- Plastic and Fiber

- Glass

- Others (Bamboo, Rattan, Sustainable Materials)

- By End-User:

- Residential (Individual Consumer Purchases)

- Commercial (Hotels, Offices, Educational Institutions, Retail)

- By Pricing Range:

- High-End/Luxury

- Mid-Range

- Budget/Economy

Value Chain Analysis For Online Furniture Market

The value chain of the Online Furniture Market is defined by a shift from complex traditional distribution networks to streamlined, digitally integrated operations, characterized by significant disintermediation. The upstream analysis involves raw material sourcing—encompassing lumber mills, metal processing plants, and textile suppliers—where sustained emphasis is placed on cost management, quality consistency, and increasingly, sustainability compliance, driven by retailer requirements. Following material procurement, manufacturing and design optimization are critical, utilizing CAD/CAM technologies and modular design principles to facilitate cost-effective mass customization and quick assembly. The unique complexity lies in managing inventory for large, diverse product catalogs, pushing advanced warehousing and robotic automation to the forefront of operational efficiency, aiming to reduce storage footprint and retrieval times before the item enters the sales pipeline.

The core midstream activity is the digital retailing platform itself, which requires massive investment in robust e-commerce infrastructure, user experience (UX) design, high-quality content generation (3D models, high-resolution images, detailed specifications), and sophisticated digital marketing campaigns. Direct channels dominate this space, linking manufacturers or central distribution centers directly to the consumer, cutting out multiple levels of wholesale and traditional retail markups. This direct interaction allows companies to gather invaluable first-party data, enabling precise product development and personalized marketing efforts. Indirect channels, primarily large marketplace aggregators like Amazon, also play a significant role, providing vast reach but often demanding lower margins due to their platform fees and high traffic volumes.

Downstream analysis focuses heavily on fulfillment and customer engagement, which are the primary differentiators in the online furniture space. Distribution channels are highly specialized, requiring dedicated logistics partners or in-house fleets capable of handling oversized, heavy items. Last-mile delivery complexity mandates specialized handling (often requiring two-person teams) and scheduled delivery windows, which contrasts sharply with standard parcel logistics. Post-sales service, including assembly instructions, warranty claims, and returns processing, must be seamless and highly responsive. The efficiency of this downstream segment directly impacts customer satisfaction and operational profitability; therefore, investment in proprietary transport technology, real-time tracking, and localized assembly services is paramount for achieving a sustainable competitive advantage in this complex physical-digital nexus.

Online Furniture Market Potential Customers

Potential customers for the Online Furniture Market are broadly segmented into two primary categories: residential end-users and commercial buyers, each possessing distinct procurement needs and buying behaviors. Residential buyers represent the largest volume segment, primarily driven by demographic shifts (new household formation, marriage, family expansion), cyclical renewal (replacing worn items), and discretionary spending related to home renovation trends influenced heavily by social media and interior design platforms. Within the residential category, Millennials and Gen Z are key targets, characterized by their high digital literacy, preference for speed and transparency, and a high demand for modular, multi-functional, and sustainably sourced products suitable for smaller urban living spaces. These buyers prioritize value, convenience, and immersive shopping experiences, leveraging AR and personalized recommendation tools extensively before committing to a purchase, making high-quality product visualization a critical conversion factor.

Commercial customers constitute a high-value, high-volume segment, encompassing businesses such as hotel chains, corporate offices, healthcare facilities, educational institutions, and real estate developers seeking large-scale procurement. Their primary drivers are durability, compliance with commercial safety and fire standards, bulk pricing efficiencies, and streamlined professional installation services. Procurement decisions in the commercial space are typically governed by long decision cycles involving facility managers and procurement departments, emphasizing long-term warranties and reliable after-sales support over aesthetic novelty. The demand for specialized items, such as ergonomic office chairs or contract-grade hospitality furniture, is growing rapidly, driven by global shifts toward hybrid working models and improved workplace well-being standards, requiring online retailers to offer dedicated B2B platforms with credit accounts and specialized bulk logistics capabilities.

A rapidly emerging customer demographic is the remote worker and the home-based small business owner, whose needs straddle both residential aesthetics and commercial functionality. This group seeks furniture that integrates seamlessly into a home environment while meeting ergonomic standards required for long working hours. Furthermore, environmental consciousness is creating a strong customer base focused exclusively on sustainable and circular economy furniture models. These environmentally conscious buyers are willing to pay a premium for certified materials, low-VOC finishes, and products offered with robust end-of-life recycling programs, signaling a shift in purchasing priorities towards ethical sourcing and long-term environmental impact, forcing online retailers to ensure supply chain transparency to capture this valuable, values-driven consumer segment effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 131.8 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKEA, Wayfair, Amazon, Williams-Sonoma, Inc., Inter IKEA Systems B.V., Herman Miller (MillerKnoll), Ashley Furniture Industries, Inc., Ethan Allen Global, Inc., La-Z-Boy Incorporated, RTA Global, Inc., Crate and Barrel (Otto Group), Target Corporation, Walmart Inc., Home Depot, Alibaba Group, JD.com, Pepperfry, Urban Ladder, Nitori Holdings, and Restoration Hardware (RH). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Furniture Market Key Technology Landscape

The technological landscape of the Online Furniture Market is rapidly evolving, driven primarily by the need to overcome the inherent challenges of selling bulky, visually dependent products remotely. The cornerstone of this innovation lies in advanced 3D modeling and visualization technologies, specifically Augmented Reality (AR) and Virtual Reality (VR), which enable customers to virtually 'place' furniture in their physical spaces, addressing the major barrier of size and fit assessment. AR tools, often deployed via mobile apps, utilize existing smartphone camera capabilities to project photorealistic 3D models into the user’s environment, offering accurate scale representation and color rendering. This technology not only boosts consumer confidence but significantly reduces the high cost associated with product returns due to size incompatibility, thereby streamlining operational efficiency and improving customer loyalty.

Beyond visualization, sophisticated e-commerce platform technology forms the backbone of the market, integrating complex inventory management systems capable of tracking thousands of unique Stock Keeping Units (SKUs) with varying dimensions and logistics requirements. Key innovations include headless commerce architectures, which allow retailers to decouple the front-end user experience from the back-end commerce engine, enabling faster deployment of personalized user interfaces and seamless integration across multiple sales channels, including social media and third-party marketplaces. Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are deeply embedded in optimizing pricing strategies, personalizing product curation through recommendation engines, and automating customer service via advanced conversational AI, ensuring highly efficient operations from browsing to post-sale support.

The logistics and supply chain segment increasingly relies on proprietary technological solutions designed specifically for heavy goods delivery. This includes the use of Internet of Things (IoT) sensors for real-time tracking of large shipments, monitoring environmental conditions (e.g., humidity and shock) to prevent damage, and optimizing route planning using algorithms that factor in volumetric weight and specialized handling needs. Cloud computing infrastructure underpins the massive data processing required for these integrated systems, allowing companies to scale rapidly and manage volatile demand fluctuations effectively. The adoption of blockchain technology is also emerging, primarily for verifying the provenance of materials in high-end or sustainable furniture segments, ensuring transparency and accountability in the supply chain to meet growing consumer demand for ethical sourcing verification.

Regional Highlights

North America currently holds the largest share of the Online Furniture Market, propelled by extremely high rates of digital penetration, sophisticated logistics infrastructure, and substantial disposable income levels that fuel cyclical home furnishing upgrades and renovations. The market is highly competitive, dominated by major players like Wayfair, Amazon, and specialized DTC brands. Consumer behavior in this region emphasizes convenience, speed of delivery, and seamless integration of smart home technology with furniture design. The United States specifically accounts for the majority of the regional revenue, driven by a large, affluent consumer base constantly adopting new technologies, particularly AR shopping features. Regulatory environments are generally favorable, supporting e-commerce growth, although increasing focus on sustainability and material traceability is starting to influence procurement and design decisions across the supply chain, demanding more eco-friendly and transparent material sourcing practices from retailers.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, driven by rapid urbanization, expanding middle-class populations in China and India, and phenomenal growth in mobile commerce adoption. While logistical infrastructure is complex due to geographic diversity, massive investments in warehousing and last-mile delivery networks, particularly in dense urban centers, are mitigating these challenges. Localized preferences dictate product offerings; for instance, space-saving, modular furniture is exceptionally popular in markets like Japan and South Korea, where living spaces are often compact. Regional giants like Alibaba and JD.com, alongside localized specialty platforms like Pepperfry, leverage their immense user bases and supply chain mastery to dominate the market, often integrating financial services like installment payment plans to make high-ticket items more accessible to emerging consumers. The sheer scale and rising affluence make APAC the critical long-term growth engine for the global market.

Europe represents a mature market characterized by a strong consumer preference for design quality, longevity, and sustainability, often prioritizing ethically sourced materials and local craftsmanship. Western Europe, particularly Germany, the UK, and France, shows high online adoption rates, though growth is steady rather than explosive compared to APAC. Retailers here must navigate stricter consumer protection laws and environmental regulations, pushing innovations in the circular economy, such as furniture rental and refurbishment programs. Eastern Europe is gradually catching up in terms of online penetration, offering moderate future growth potential. Latin America and the Middle East & Africa (MEA) are emerging regions, presenting significant opportunities as internet access improves, but they face substantial headwinds related to fragmented logistics, volatile economies, and low credit card penetration, requiring retailers to adapt with localized payment solutions and specialized, secure delivery partnerships to ensure market penetration and sustained growth momentum.

- North America: Market leader, driven by high disposable income, mature e-commerce ecosystem, and rapid adoption of AR visualization tools. Strong focus on home office and high-end residential segments.

- Asia Pacific (APAC): Highest growth region, fueled by urbanization, massive middle-class expansion, and mobile-first consumer behavior, with emphasis on modular and space-saving furniture.

- Europe: Mature market prioritizing sustainability, design quality, and robust consumer protection standards. Steady growth observed in Western economies, accelerating in Eastern Europe.

- Latin America (LATAM): Emerging market characterized by increasing internet penetration but challenged by logistics complexity and the need for localized payment options.

- Middle East & Africa (MEA): Growing potential driven by high youth population and luxury furniture demand in the Gulf Cooperation Council (GCC) states, requiring tailored, high-touch delivery services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Furniture Market.- IKEA (Inter IKEA Systems B.V.)

- Wayfair Inc.

- Amazon.com, Inc.

- Williams-Sonoma, Inc.

- Ashley Furniture Industries, Inc.

- Herman Miller (MillerKnoll)

- Ethan Allen Global, Inc.

- La-Z-Boy Incorporated

- Crate and Barrel (Otto Group)

- Target Corporation

- Walmart Inc.

- Home Depot Inc.

- Alibaba Group Holding Limited

- JD.com, Inc.

- Restoration Hardware (RH)

- Nitori Holdings Co., Ltd.

- Pepperfry

- Urban Ladder (Reliance Retail)

- Made.com (now part of Next PLC)

- Dorel Industries Inc.

Frequently Asked Questions

Analyze common user questions about the Online Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Online Furniture Market?

The Online Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% during the forecast period from 2026 to 2033, reflecting accelerating consumer shift to digital purchasing platforms for home goods.

How does Augmented Reality (AR) impact online furniture sales?

AR significantly impacts sales by allowing consumers to visualize furniture pieces accurately scaled within their own physical space. This technology addresses buyer hesitation regarding size and aesthetics, thereby boosting conversion rates and substantially reducing product return rates.

Which region currently dominates the Online Furniture Market?

North America currently holds the largest market share, driven by its established e-commerce infrastructure, high consumer spending, and early adoption of retail technologies such as advanced logistics and digital visualization tools.

What are the primary restraints affecting the growth of the market?

The primary restraints include the high cost and complexity of last-mile logistics for bulky items, the difficulty consumers face in assessing material quality and comfort without physical contact, and the resulting high incidence of costly product returns due to dimensional mismatch.

What segment is showing the fastest growth in the Online Furniture Market?

The Ready-to-Assemble (RTA) and modular furniture segment is experiencing the fastest growth, appealing to urban, younger consumers due to its affordability, ease of assembly, and adaptability to smaller living spaces, coupled with streamlined online delivery logistics.

What role does sustainability play in current online furniture procurement?

Sustainability is becoming a crucial market differentiator, particularly for mid-range and luxury segments. Consumers are increasingly demanding transparency regarding material sourcing, eco-friendly manufacturing processes, and clear end-of-life recycling or disposal options, pushing retailers to adopt certified and traceable supply chains.

How is AI being utilized to optimize the furniture supply chain?

AI is utilized for predictive demand forecasting, which optimizes inventory levels and reduces storage costs. Furthermore, it aids in dynamic route optimization for complex last-mile delivery, minimizing transit times, lowering fuel costs, and improving the overall logistical efficiency of bulky item handling.

Who are the major end-users driving demand in this market?

The major end-users are Residential consumers, driven by home renovation and household formation, and the Commercial sector, specifically corporate offices and hospitality industries, which require durable, bulk purchases for business environment upgrades and expansions.

How do DTC brands achieve a competitive edge in online furniture sales?

Direct-to-Consumer (DTC) brands gain an edge by eliminating intermediary costs, allowing for more competitive pricing or higher investment in product quality. They also focus on personalized customer experiences and often leverage unique, niche designs or sustainability claims that resonate strongly with targeted online communities.

What technological advancements are key to improving customer trust in online furniture?

Key technological advancements include hyper-realistic 3D product visualizations, comprehensive customer review and rating systems integrated with verified purchase badges, detailed materiality specifications, and transparent, real-time order and delivery tracking systems, all aimed at mitigating the inability to physically inspect the product before purchase.

What is the significance of the shift towards omnichannel retail in furniture?

The shift towards omnichannel retail signifies the blending of online and offline touchpoints. It allows customers to use digital tools (AR visualization, online configuration) while retaining the option to experience high-value items tactilely in limited physical showrooms, bridging the digital trust gap and maximizing sales conversion by offering flexibility.

How are emerging markets in APAC influencing global furniture trends?

Emerging markets in APAC, particularly India and Southeast Asia, are driving global trends toward affordability and functionality. The high demand for space-saving, modular, and readily available furniture solutions due to dense urban living is influencing global supply chains to prioritize design versatility and cost-effective manufacturing methods.

Why is the last-mile delivery segment so challenging for online furniture retailers?

Last-mile delivery is challenging due to the size and weight of furniture, requiring specialized handling, two-person teams, scheduled appointments, and often assembly services. This complexity significantly increases operational costs and requires specialized carrier networks, unlike standard small package delivery.

What role does mobile commerce play in the Online Furniture Market?

Mobile commerce is paramount, especially in fast-growing regions like APAC. High mobile usage ensures that the primary browsing and purchasing journey, including the utilization of AR features for visualization, happens predominantly via smartphone applications and mobile-optimized websites, necessitating responsive and intuitive mobile interfaces.

In the Value Chain, where is the highest value capture potential located?

The highest value capture potential is concentrated in the midstream (digital retailing platform and brand ownership) and downstream (specialized logistics and post-sales service). Establishing proprietary technology platforms and optimizing the complex last-mile experience are key differentiators that allow for premium pricing and strong brand loyalty.

How do macro trends like remote work influence the market?

The sustained trend of remote work has created explosive demand for dedicated, ergonomic home office furniture, including specialized desks, professional storage, and high-quality task chairs. This trend drives recurring high-value sales that prioritize health and productivity features over simple aesthetics.

What is the threat of substitution in the online furniture sector?

The threat of substitution is generally low because furniture serves essential physical functions. However, emerging business models like furniture rental and subscription services, particularly popular in highly transient urban centers, represent a minor disruptive threat to traditional outright ownership models.

What are the typical materials showing increasing demand online?

While engineered wood remains dominant for cost-efficiency, materials showing increasing demand include eco-friendly alternatives like bamboo, recycled plastics, and certified ethically sourced hardwoods. Consumers are willing to pay more for materials that align with sustainable and transparent production practices.

How do competitive forces affect pricing strategies in the market?

Intense rivalry and high buyer power mandate competitive pricing. Retailers often utilize dynamic pricing algorithms, frequently powered by AI, to adjust prices in real-time based on competitor activity, inventory levels, and specific consumer segment demand elasticity, ensuring maximal profitability without sacrificing competitiveness.

What is the role of large marketplace aggregators like Amazon and Alibaba in this sector?

Large marketplace aggregators play a critical role by offering vast traffic and consumer trust, particularly for mid-range and budget furniture. While they facilitate scale for sellers, they often exert significant margin pressure due to platform fees and high competition, primarily dominating the RTA and lower-cost segments.

What technological challenge must the market overcome to sustain high growth?

The key technological challenge is perfecting the tactile experience digitally. While AR solves sizing, developing haptic feedback or hyper-realistic material simulation technologies that accurately convey texture, comfort, and durability will be crucial for overcoming the remaining sensory gap in the online purchasing journey.

How does the segmentation by end-user differ in terms of procurement?

Residential procurement is typically consumer-driven, focusing on aesthetics and individual needs, often involving impulse or short-cycle purchases. Commercial procurement is process-driven, characterized by bulk orders, strict compliance checks, long decision cycles, and emphasis on durability and long-term contracts.

What are the key differences between the North American and European markets?

North America is driven by scale, speed, and technology adoption, while Europe emphasizes design heritage, sustainability standards, and product longevity. European consumers often exhibit stronger preferences for local or regional manufacturers and stricter adherence to ethical sourcing guidelines.

How is cloud computing infrastructure supporting the market?

Cloud computing provides the scalable, flexible, and robust infrastructure needed to handle massive product catalogs, high traffic volumes, complex AR/VR rendering demands, and the intensive data analytics required for AI-driven logistics and personalized marketing, enabling rapid international expansion without massive fixed IT investments.

What are the long-term impacts of urbanization on online furniture demand?

Urbanization drives increased demand for smaller, more functional, and modular furniture that maximizes limited space. This trend favors online retailers who can efficiently categorize and market specialized, space-saving designs, making their offerings highly relevant to the growing global urban population seeking sophisticated, compact living solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager