Online Legal Education Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436771 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Online Legal Education Tools Market Size

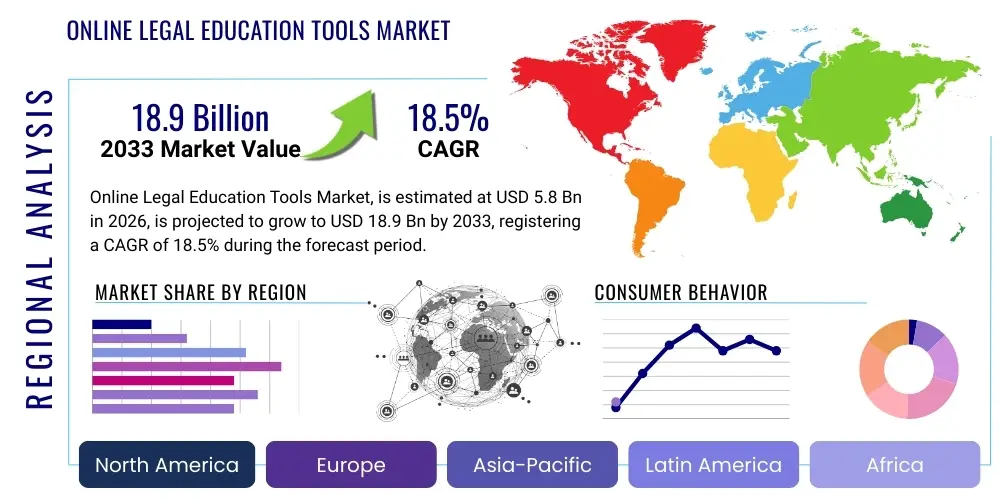

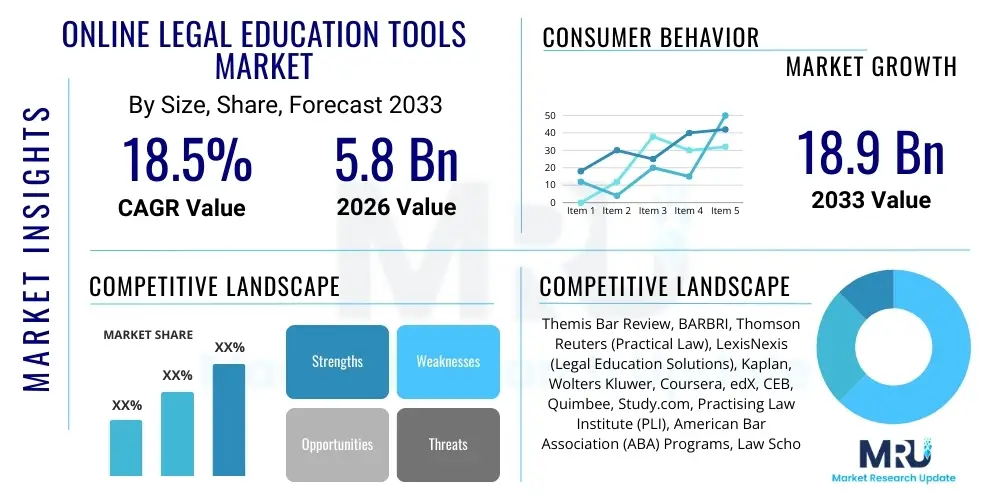

The Online Legal Education Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 18.9 Billion by the end of the forecast period in 2033.

Online Legal Education Tools Market introduction

The Online Legal Education Tools Market encompasses digital platforms, software, and services designed to facilitate legal instruction, training, and continuous professional development (CPD) for law students, practicing attorneys, corporate legal teams, and compliance professionals. These tools leverage technology—including Learning Management Systems (LMS), interactive simulations, video conferencing, and specialized legal databases—to deliver flexible and accessible legal knowledge globally. The primary product description involves solutions ranging from full Juris Doctor (JD) programs delivered online to micro-credential courses focused on specific regulatory compliance areas like GDPR or anti-money laundering (AML). Major applications include bar exam preparation, continuing legal education (CLE), specialized corporate compliance training, and academic degree completion. The inherent benefits, such as reduced costs associated with physical infrastructure, increased accessibility for remote learners, and the capacity for personalized learning paths, are the core driving factors pushing market expansion.

Online Legal Education Tools Market Executive Summary

The Online Legal Education Tools Market is currently characterized by significant fragmentation and innovation, summarized by several key trends across business, regional, and segment perspectives. Business trends indicate a move toward niche specialization, with companies focusing on high-demand areas like intellectual property law, cybersecurity law, and complex international compliance, often resulting in strategic mergers and acquisitions among content providers and technology platforms to consolidate market share and broaden educational offerings. Regionally, while North America and Europe maintain maturity in terms of established infrastructure and high adoption rates for CLE/CPD requirements, the Asia Pacific (APAC) region is poised for explosive growth due to massive underserved student populations and increasing regulatory complexity necessitating widespread professional training. Segment trends show a clear pivot towards adaptive learning technologies and AI-driven platforms that personalize the learning experience, alongside robust demand growth in the B2B sector, where corporate legal departments are actively seeking scalable, verifiable, and on-demand compliance training solutions, prioritizing outcome-based education metrics.

AI Impact Analysis on Online Legal Education Tools Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Online Legal Education Tools frequently center on three critical themes: efficiency gains, pedagogical transformation, and ethical considerations. Users are keen to understand how AI can automate tasks like grading assignments, generating hyper-realistic legal scenarios for practice (simulations), and providing instant feedback on written legal arguments, thereby enhancing instructor efficiency and student engagement. Concerns often arise around data privacy, the potential for algorithmic bias affecting legal reasoning assessment, and the extent to which AI-driven tools might devalue human mentorship and critical thinking necessary for legal practice. Expectations are high that AI will lead to truly personalized learning paths, ensuring every student masters foundational concepts before moving to complex analysis, and that AI-powered legal research assistants embedded within educational tools will bridge the gap between academic learning and practical application in real-world legal contexts.

- AI enables highly personalized learning paths, adapting content and pace based on individual student performance data.

- Automated assessment and grading systems reduce instructor workload, offering instant, objective feedback on basic legal assignments.

- Simulation and scenario generation tools utilize AI to create complex, dynamic, and realistic mock trial or negotiation environments.

- AI-driven legal research integration accelerates student familiarity with advanced research databases and techniques.

- Predictive analytics help institutions identify students at risk of failure, allowing for proactive intervention strategies.

- Ethical training modules are increasingly required to address the implications of AI in future legal practice and judicial systems.

DRO & Impact Forces Of Online Legal Education Tools Market

The market is predominantly shaped by the rapid digital transformation of the education sector (Driver), coupled with persistent regulatory complexities and accreditation challenges (Restraint), which simultaneously generate significant opportunities in underserved global markets and specialized compliance needs (Opportunity). Key impact forces highlight the transition from purely academic focus to skills-based, outcome-oriented professional development, driven by the immediate needs of the legal industry for specialized talent. The inherent demand for Continuous Legal Education (CLE) and Continuous Professional Development (CPD) mandated by various bar associations globally serves as a non-negotiable driver, ensuring a sustained revenue stream. However, the high initial investment required for developing sophisticated, jurisdiction-specific content and robust security infrastructure, coupled with resistance from traditional institutions regarding online program credibility, creates notable market friction, requiring careful strategic maneuvering by key market players.

The primary drivers are rooted in accessibility, cost efficiency, and the immediate need for specialized, up-to-date legal knowledge. Traditional legal education is often geographically restricted and prohibitively expensive. Online tools democratize access to high-quality legal training, allowing professionals in remote areas or those juggling full-time work to pursue certification or advanced degrees. Furthermore, the increasing speed of legislative and regulatory changes, particularly in global fields like cybersecurity, trade law, and environmental law, mandates ongoing education. Online tools provide the only viable mechanism for rapidly deploying updated training materials to a dispersed professional workforce, making them indispensable for maintaining compliance and professional competency across corporate and governmental sectors.

Restraints largely involve the high barrier to entry concerning regulatory approval and the challenge of replicating the immersive, Socratic method teaching often found in traditional law schools. Accreditation bodies are often slow to recognize fully online JD programs, which restricts market potential for comprehensive degree platforms. Moreover, concerns persist about the rigor and security of online examination processes, leading some firms and institutions to view purely online credentials with skepticism. Opportunities, conversely, lie heavily in the B2B compliance sector, where the market for customized, verifiable training modules is vast and rapidly growing. Additionally, the development of sophisticated virtual reality (VR) and augmented reality (AR) tools presents an opportunity to overcome the engagement limitations of standard video-based content, offering simulated courtroom experiences and client interaction practice that closely mimics real-world scenarios, thereby enhancing practical skills training and addressing institutional skepticism regarding educational quality.

Segmentation Analysis

The Online Legal Education Tools Market is segmented based on the type of offering, deployment model, application, and end-user, reflecting the diverse needs of both academic institutions and professional bodies. Segmentation by offering ranges from full-scale degree programs to specialized certification and non-degree courses. Deployment models vary, encompassing cloud-based Software-as-a-Service (SaaS) platforms preferred by smaller firms for flexibility, and on-premise solutions favored by large academic institutions or government bodies requiring maximum data control. Application segmentation highlights the difference between foundational academic training, crucial bar examination preparation, and the continuous, recurring need for mandatory professional development (CLE/CPD). End-user categories clearly distinguish between the academic consumer (students), the professional consumer (attorneys, judges), and the organizational consumer (corporations, regulatory bodies).

- By Offering Type:

- Full Degree Programs (e.g., Online LL.M., Online JD)

- Certification and Diploma Courses (e.g., Paralegal certification, Tax Law specialization)

- Continuing Legal Education (CLE) and Continuous Professional Development (CPD) Courses

- Bar Examination Preparation Tools

- Non-Degree Courses and Micro-credentials

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- By Application:

- Academic Learning and Assessment

- Professional Skill Enhancement

- Regulatory Compliance Training (B2B)

- Specialized Legal Research Training

- By End-User:

- Individual Students and Learners

- Legal and Law Firms

- Corporate Legal Departments

- Government and Regulatory Bodies

- Academic Institutions

Value Chain Analysis For Online Legal Education Tools Market

The value chain for Online Legal Education Tools commences with content creation and acquisition (upstream analysis), where subject matter experts, legal academics, and industry practitioners develop high-quality, relevant curricular materials. This phase requires substantial investment in intellectual property rights, robust quality assurance processes, and ensuring content is jurisdictionally accurate and compliant with educational standards. The materials are then adapted into digital formats—video lectures, interactive modules, simulations—by specialized instructional designers. This content moves into the operational phase, which includes the development, hosting, and maintenance of the technology platform (LMS or proprietary software) that delivers the education. This midstream process is capital-intensive, focusing heavily on user experience, data security, and scalability, often involving complex integration with existing university or corporate HR systems.

Downstream analysis focuses on the distribution channels and direct engagement with the end-users. Distribution utilizes both direct and indirect channels. Direct distribution involves platforms selling subscriptions or courses directly to individual consumers or corporate clients through proprietary websites. This channel allows for greater control over pricing and customer relationship management. Indirect channels utilize partnerships with existing academic institutions (universities licensing content), major legal associations (for CLE distribution), or third-party Massive Open Online Course (MOOC) platforms like Coursera or edX, which offer broader market reach but involve revenue sharing and less direct control over the end-user experience. Effective marketing, tailored specifically to professional cohorts and academic calendars, is essential at this stage to drive adoption and ensure high course completion rates.

The final stage involves certification, tracking, and post-sales support. For professional users, the value chain is completed through verifiable credentialing systems (often utilizing blockchain technology for immutable records) that track course completion and compliance with mandatory professional development requirements. Customer service and technical support are crucial components of the value chain, as users, especially professionals, expect flawless functionality and prompt resolution of technical issues to minimize disruption to their learning schedules. Efficiency in the entire chain is measured by student outcomes, professional job placement rates, and the platform’s ability to retain corporate clients through high-quality, updated compliance content, demonstrating the market's shift toward verified educational outcomes as the ultimate measure of value.

Online Legal Education Tools Market Potential Customers

The Online Legal Education Tools Market targets a broad yet distinct spectrum of customers, segmented primarily into academic consumers and professional/organizational consumers. Academic consumers include prospective law students seeking preparatory courses for exams like the LSAT, current law school students requiring supplementary study aids, and those pursuing advanced legal degrees (LL.M., SJD) fully or partially online due to geographical or professional constraints. This segment values high-quality content that aligns directly with curriculum requirements, robust practice exams, and cost-effective alternatives to traditional tutoring. Platforms must offer content structured for specific law school syllabi and be highly accessible via mobile devices to serve this digitally native demographic effectively.

Professional consumers represent the largest and most lucrative segment, driven by mandatory continuous education requirements (CLE/CPD). This group includes practicing attorneys, paralegals, judges, and legal support staff who need specialized training in areas such as emerging regulations, litigation technology, or niche practice management skills. For these professionals, the key value proposition is flexibility—the ability to complete necessary credit hours on their own schedule—and verifiable relevance. Platforms serving this segment must be accredited by relevant bar associations and focus on content that provides immediate, actionable insights applicable to daily professional tasks, often preferring short-form, focused modules over lengthy, academic courses.

Organizational customers, comprising corporate legal departments, financial institutions, and government agencies, constitute the fastest-growing customer base. These organizations utilize online tools for standardized, scalable compliance training covering areas like anti-corruption (FCPA, UK Bribery Act), data privacy (GDPR, CCPA), and anti-money laundering (AML). Their requirements center on administrative features: robust reporting dashboards to track employee completion rates, integration with enterprise HR systems, and customization capabilities to tailor content to internal policies. These customers view online legal education not just as a training expense, but as a critical risk mitigation tool, driving demand for platforms that offer legally defensible proof of employee training and competency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 18.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Themis Bar Review, BARBRI, Thomson Reuters (Practical Law), LexisNexis (Legal Education Solutions), Kaplan, Wolters Kluwer, Coursera, edX, CEB, Quimbee, Study.com, Practising Law Institute (PLI), American Bar Association (ABA) Programs, Law School Admission Council (LSAC), AltaClaro, Clio (Training Division), Lawline, LegalED, The College of Legal Practice, Aspira Education. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Legal Education Tools Market Key Technology Landscape

The foundational technology for the Online Legal Education Tools market revolves around sophisticated Learning Management Systems (LMS) designed to handle complex content delivery and user tracking, far beyond general-purpose educational platforms. These specialized LMS solutions integrate features such as secure proctoring capabilities, advanced plagiarism detection tools tailored for legal writing, and robust data analytics dashboards to monitor student progress against learning outcomes. Furthermore, the market is increasingly adopting microlearning architectures, which break down complex legal concepts into short, digestible modules accessible on mobile devices, facilitating continuous learning for busy professionals. The efficiency of content delivery is paramount, requiring high-definition streaming capabilities and responsive design that ensures seamless experience across diverse operating systems and screen sizes.

Beyond standard LMS infrastructure, cutting-edge technologies are rapidly defining the competitive landscape. Virtual Reality (VR) and Augmented Reality (AR) are gaining traction, particularly in providing experiential learning. VR simulations allow students to practice soft skills critical to legal practice, such as interviewing clients, conducting depositions, or presenting arguments in a virtual courtroom environment, offering a safe space for repetitive practice and immediate performance feedback. These technologies address the historical challenge of integrating practical skills into online legal curricula. Furthermore, natural language processing (NLP) capabilities are being embedded to analyze student responses in simulated client correspondence or contract drafting exercises, providing automated, qualitative assessments of legal reasoning and communication clarity.

The integrity of credentials and the need for personalized learning are driving the adoption of specialized technologies. Blockchain technology is emerging as a critical tool for ensuring immutable, verifiable digital transcripts and professional certifications, solving the prevalent issue of fraudulent credentials and simplifying the process for attorneys to demonstrate compliance to bar associations or employers. Concurrently, adaptive learning algorithms powered by machine learning are analyzing learner performance data in real-time, dynamically adjusting the difficulty level and sequence of educational materials. This ensures optimal cognitive load and maximized knowledge retention, moving away from a one-size-fits-all approach to legal education and establishing a clear technological advantage for platforms that can offer true personalization and outcome optimization.

Regional Highlights

The Online Legal Education Tools market exhibits distinct regional dynamics driven by differing regulatory frameworks, mandatory professional requirements, and digital infrastructure maturity. North America, dominated by the United States, represents the largest and most mature market segment. High levels of institutional adoption of online degree programs, coupled with stringent state-mandated Continuous Legal Education (CLE) requirements, ensure a constant demand for high-quality, accredited digital content. US providers are pioneers in specialized bar examination preparation tools and are leading the charge in integrating AI and adaptive learning systems into legal pedagogy. The competitive environment is fierce, characterized by large established players and niche technology startups specializing in specific areas like e-discovery or litigation analytics training.

Europe shows strong growth, particularly in Western European nations with established legal systems, driven significantly by the need for multi-jurisdictional compliance training, especially concerning pan-European regulations such as GDPR and new sustainability directives. The market is fragmented by linguistic and national legal systems, demanding localized content strategies. However, the rise of international law firms and cross-border practice drives significant B2B demand for standardized, online corporate compliance training. The UK remains a central hub, leveraging its strong university reputation to offer postgraduate online law programs globally, while continental Europe focuses heavily on CPD accredited by national bar councils and specialized legal societies.

The Asia Pacific (APAC) region is projected to experience the highest growth rate during the forecast period. This acceleration is fueled by vast, digitally connected student populations, a lack of physical infrastructure in many developing nations to support traditional law schools, and a surging demand for legal expertise corresponding to rapid economic growth and increasing cross-border investment. Countries like India, China, and Australia are seeing intense investment in localized online legal resources. While regulatory environments can be challenging, the sheer volume of potential learners and professionals seeking foundational legal education or advanced international commercial law certifications makes APAC a strategic priority for global market expansion. Latin America and the Middle East and Africa (MEA) present nascent but emerging markets, constrained by varying internet penetration rates and regulatory instability but offering long-term opportunities, especially in areas like energy law and international commercial arbitration training.

- North America: Market maturity, leading adoption of AI in education, high demand driven by mandatory CLE credits, focus on bar prep tools.

- Europe: Strong B2B compliance training demand (GDPR, transnational law), fragmented market requiring linguistic localization, significant academic online program offerings from UK institutions.

- Asia Pacific (APAC): Highest projected growth due to massive student base, increasing digital infrastructure, focus on international trade law and IP specialization.

- Latin America: Emerging market potential, driven by professional modernization, primarily focused on basic certification and foundational legal education.

- Middle East and Africa (MEA): Growth concentrated in oil, gas, and arbitration law training, reliant on localized partnerships and overcoming infrastructural deficits.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Legal Education Tools Market.- BARBRI

- Themis Bar Review

- Practising Law Institute (PLI)

- Thomson Reuters (Practical Law)

- LexisNexis (Legal Education Solutions)

- Wolters Kluwer

- Kaplan, Inc.

- Quimbee

- Lawline

- AltaClaro

- CEB (Continuing Education of the Bar)

- Aspira Education

- Study.com

- The College of Legal Practice

- Law School Admission Council (LSAC)

- Clio (Training and Education Services)

- LegalED

- Coursera (Specialized Legal Programs)

- edX (Legal Course Offerings)

- National Institute for Trial Advocacy (NITA) Online

Frequently Asked Questions

Analyze common user questions about the Online Legal Education Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the massive growth in the Online Legal Education Tools Market?

The growth is primarily driven by mandatory continuous professional development (CPD/CLE) requirements for practicing attorneys, the high cost and geographical limitations of traditional legal education, and the increasing global demand for specialized regulatory compliance training in corporate sectors (B2B).

How is Artificial Intelligence (AI) being utilized within legal education platforms?

AI is used to personalize learning paths, automate the grading of complex legal assignments, provide real-time feedback on writing and reasoning skills, and create sophisticated virtual legal simulations for practical training scenarios.

Which geographical region holds the largest market share for these tools?

North America currently holds the largest market share due to its established infrastructure, stringent mandatory CLE requirements, and high initial adoption rates across both academic institutions and professional legal firms.

Are online legal education tools accredited or recognized by professional bodies?

Yes, leading online tools and platforms offering CLE/CPD must be accredited by relevant state or national bar associations to ensure credit hour recognition. Accreditation for full online degree programs (JD/LL.M.) varies by jurisdiction and institution.

What are the key technological challenges facing the market?

Key challenges include maintaining the security and integrity of online examinations (proctoring), ensuring high-quality, up-to-date content specific to numerous legal jurisdictions, and overcoming institutional skepticism regarding the efficacy of virtual practical skills training.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager