Online Payday Loans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431537 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Online Payday Loans Market Size

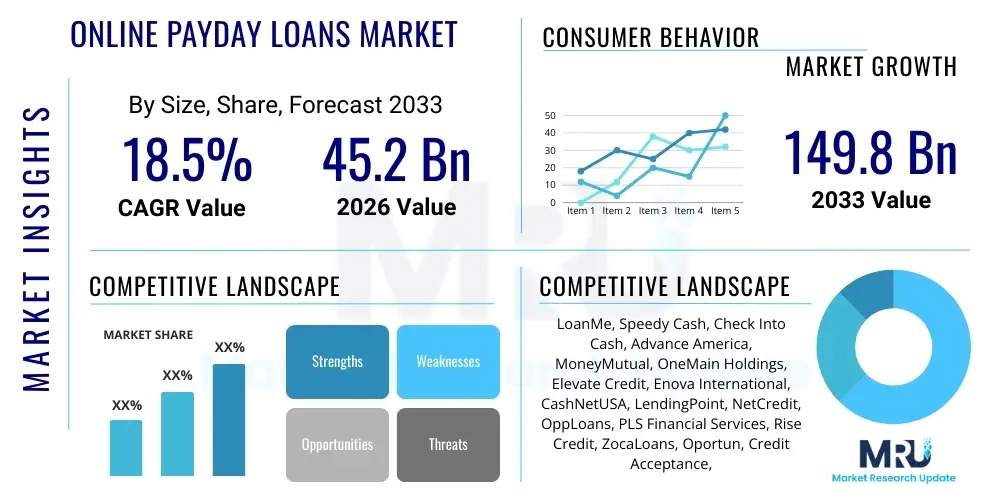

The Online Payday Loans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 149.8 Billion by the end of the forecast period in 2033.

Online Payday Loans Market introduction

The Online Payday Loans Market encompasses the provision of short-term, small-principal unsecured loans distributed entirely through digital platforms. These financial products are designed primarily to bridge temporary liquidity gaps experienced by consumers until their next paycheck. The core function of these products is rapid disbursement and minimal documentation requirements, contrasting sharply with traditional banking processes. The accessibility offered by online channels, facilitated by advanced credit scoring models and instant verification technologies, has propelled the market’s expansion, particularly among underbanked populations seeking immediate financial relief.

The operational framework of online payday lending relies heavily on sophisticated algorithms to assess borrower risk, determine appropriate interest rates, and ensure compliance with varying state and federal regulations. Major applications of these loans include covering unexpected emergency medical expenses, car repairs, utility bill payments, and preventing overdraft fees. While providing essential access to credit for those with limited options, the industry faces persistent scrutiny regarding high Annual Percentage Rates (APRs) and potential debt cycles, leading to continuous evolution in regulatory oversight and product structure across key geographies.

Key benefits driving market growth include speed, convenience, and 24/7 availability, appealing directly to modern consumer demands for instant financial solutions. Driving factors such as increasing internet penetration, widespread adoption of mobile banking technologies, and macroeconomic volatility necessitating short-term financial buffers are crucial. Furthermore, the development of alternative credit scoring methods utilizing non-traditional data sources allows lenders to serve a broader segment of consumers who might otherwise be rejected by conventional financial institutions, thereby accelerating market penetration and overall transaction volume.

Online Payday Loans Market Executive Summary

The Online Payday Loans Market is characterized by intense technological competition and a dynamic regulatory environment, reflecting significant shifts in consumer financial behavior and digital adoption. Business trends indicate a movement toward hybrid lending models that integrate installment loans and lines of credit alongside traditional payday products to mitigate regulatory risks and improve customer retention. Furthermore, key industry players are heavily investing in proprietary Artificial Intelligence (AI) and Machine Learning (ML) algorithms to enhance risk assessment accuracy, reduce default rates, and optimize the user experience, establishing clear competitive advantages based on efficiency and speed of service delivery. Strategic partnerships with fintech companies and digital payment processors are also becoming central to expanding reach and streamlining the funding process.

Regional trends highlight North America, particularly the United States, as the dominant market due to a highly developed digital infrastructure and a large, accessible underbanked population, although growth is moderated by state-level legislative caps on interest rates. The Asia Pacific region is emerging as the fastest-growing market, propelled by rapid urbanization, increasing smartphone penetration, and a regulatory environment that, while tightening, still offers substantial opportunities for market entry and expansion in developing economies. Europe demonstrates a more fragmented and mature market, with stringent consumer protection laws fostering a shift toward more transparent, often government-regulated, short-term lending models.

Segmentation trends reveal that the mobile application channel is rapidly outpacing desktop platforms in terms of transaction volume, reflecting consumer preference for seamless, on-the-go loan applications. Subsegment analysis by loan amount shows strong growth in the mid-range loan category, driven by increasing consumer reliance on flexible financing for minor emergencies. From a borrower perspective, individuals aged 25–45, often residing in urban areas and possessing moderate to high digital literacy, constitute the primary demographic segment utilizing these online services. The industry is also seeing a structural shift toward lenders that emphasize transparent fee structures and offer integrated financial literacy tools to address consumer concerns regarding ethical lending practices.

AI Impact Analysis on Online Payday Loans Market

User inquiries regarding AI's impact on the Online Payday Loans Market predominantly revolve around three critical themes: fairness in credit scoring, potential job displacement in compliance and underwriting roles, and the enhancement of fraud detection capabilities. Users express expectations that AI will significantly streamline the application process, offering near-instantaneous approval decisions and personalized repayment schedules. Conversely, there are substantial concerns about algorithmic bias, specifically how ML models might inadvertently perpetuate discrimination against historically underserved demographic groups, especially when relying on non-traditional or proxy data points for creditworthiness assessment. The market anticipates that the primary value of AI implementation will be in reducing operational expenditure, minimizing human error, and creating more nuanced risk profiles that move beyond binary pass/fail assessments, thereby optimizing portfolio performance and regulatory compliance reporting.

- Enhanced Predictive Analytics: AI/ML models improve credit scoring accuracy by analyzing thousands of non-traditional data points (e.g., utility payments, transaction patterns).

- Fraud Detection and Prevention: Real-time monitoring and anomaly detection capabilities significantly reduce application fraud and identity theft risks.

- Instant Underwriting Decisions: Automation of the approval process allows for loan disbursement within minutes, fulfilling the core consumer need for speed.

- Personalized Product Customization: AI segments customers to offer tailored loan amounts, repayment terms, and interest rates, optimizing loan structure for borrower success.

- Regulatory Compliance Monitoring: Automated systems track evolving state and federal regulations, flagging potentially non-compliant lending practices instantaneously.

- Customer Service Automation: Deployment of sophisticated chatbots and virtual assistants handles routine customer inquiries, improving efficiency and availability.

- Algorithmic Fairness Testing: The need for explainable AI (XAI) is growing to ensure models are auditable, fair, and free from discriminatory biases in lending decisions.

- Cost Reduction and Operational Efficiency: Automation minimizes the need for extensive human intervention in verification and processing, reducing overhead costs per loan.

DRO & Impact Forces Of Online Payday Loans Market

The dynamics of the Online Payday Loans Market are governed by a complex interplay of facilitating drivers, restrictive restraints, emerging opportunities, and significant external impact forces. The primary driver is the pervasive need for immediate, small-scale credit, amplified by global economic uncertainties and the inability of traditional banks to service subprime borrowers effectively. This demand is met by the convenience and speed offered by online platforms. However, the market is severely restrained by increasingly strict and fragmented regulatory frameworks globally, particularly regarding interest rate caps and transparency requirements, which directly erode profitability margins and increase operational complexity for lenders operating across multiple jurisdictions.

Opportunities for market expansion are centered on technological advancements, such as utilizing blockchain for secure data management and decentralized lending structures, and expanding into underpenetrated emerging markets where digital adoption is high but access to formal credit is low. Furthermore, product innovation focusing on lower-APR installment loans and integrated financial wellness tools presents a pathway for lenders to improve their ethical standing and attract a more stable customer base. Addressing the negative public perception through greater corporate social responsibility (CSR) initiatives and focusing on clear, responsible lending practices is paramount to sustained growth and mitigating regulatory backlash.

The impact forces influencing the market are strong and multifaceted. Sociocultural forces, driven by consumer advocacy groups and media scrutiny, pressure lenders toward greater fairness and transparency. Economic instability, such as high inflation or unemployment spikes, acts as a primary catalyst for demand, while technological forces continuously push the boundaries of risk assessment and service delivery speed. Politico-legal forces, embodied by landmark regulatory decisions and consumer financial protection acts, determine the operational viability and long-term structure of the industry, often forcing rapid and costly adjustments to business models. The confluence of these forces mandates constant adaptation and proactive compliance strategies for market longevity.

Segmentation Analysis

The Online Payday Loans Market is comprehensively segmented based on various critical parameters, including loan amount, interest rate structure, repayment period, application channel, and end-user profile. Analyzing these segments provides a granular understanding of consumer behavior, operational efficiency, and regulatory vulnerabilities within the industry. Segmentation by application channel, specifically the distinction between mobile apps and web platforms, reflects the ongoing digital transformation, with mobile leading due to convenience. Furthermore, differentiating loan products by maximum repayment duration, separating standard two-week cycles from longer installment periods, is crucial as regulations increasingly favor extended repayment terms to reduce borrower stress.

The primary segment driving revenue is loans ranging from $300 to $500, aligning with typical emergency financial needs. However, the fastest growth is observed in installment loans (often capped between $1,000 and $2,500), which are gaining traction as regulated alternatives to traditional payday models. Geographically, segmentation is pivotal, as lending laws vary dramatically, requiring localized marketing and product development strategies. The clear delineation of segments allows lenders to focus resources, optimize risk assessment models specific to borrower profiles (e.g., student loans vs. gig economy workers), and navigate the complex compliance landscape with targeted precision.

- By Loan Amount:

- Small-Scale Loans (Less than $300)

- Medium-Scale Loans ($300 - $500)

- Large-Scale Loans (Above $500, including installment options)

- By Interest Rate Structure:

- Fixed Rate Loans

- Variable Rate Loans

- By Repayment Period:

- Traditional Payday (14–30 days)

- Short-Term Installment (1–3 months)

- Medium-Term Installment (3–12 months)

- By Application Channel:

- Web-Based Platforms (Desktop/Laptop)

- Mobile Applications (Smartphone/Tablet)

- Aggregators and Lead Generators

- By End-User (Borrower Profile):

- Employed Individuals (Full-Time/Part-Time)

- Gig Economy Workers/Freelancers

- Unemployed/Fixed Income Recipients

Value Chain Analysis For Online Payday Loans Market

The value chain of the Online Payday Loans Market is primarily digital and highly streamlined, emphasizing speed and minimizing traditional physical infrastructure. The process begins with upstream activities focused heavily on technological development, including the creation and maintenance of sophisticated, proprietary credit assessment algorithms, secure data aggregation platforms, and user-friendly mobile application interfaces. Upstream also includes the critical function of capital sourcing, where lenders secure the necessary funding lines, often through institutional investors or specialized credit funds, to meet high liquidity demands.

The mid-stream activities involve the core lending processes: marketing and customer acquisition (often leveraging extensive digital advertising and lead generation networks), instant application processing, algorithmic underwriting, and regulatory compliance checks. Effective lead generation and efficient verification technology are crucial bottlenecks in this stage. The seamless integration of third-party verification services, such as bank statement aggregators and identity verification providers, defines the operational efficiency and competitive edge of modern online lenders.

Downstream activities focus on post-disbursement services, including loan servicing, payment collection, and managing defaults. The distribution channel is almost exclusively direct (lender-to-consumer) via proprietary online portals or mobile apps, ensuring lenders maintain full control over the customer experience and data. Indirect distribution occasionally occurs through lead generation marketplaces, which serve as crucial intermediaries by connecting potential borrowers with multiple approved lenders, although the final transaction remains direct. The efficiency of the downstream collection process, increasingly utilizing automated communication tools and flexible payment arrangements, significantly impacts profitability and regulatory standing.

Online Payday Loans Market Potential Customers

The primary target demographic and potential customers for the Online Payday Loans Market are individuals experiencing short-term cash flow deficits, typically categorized as underbanked or subprime borrowers who have limited access to conventional credit options due to low credit scores or insufficient banking relationships. These customers are characterized by an immediate need for funds, high digital literacy, and a willingness to accept higher interest rates in exchange for speed and convenience. They frequently use these loans to cover unforeseen essential expenses that cannot wait until their next pay cycle.

A significant segment includes gig economy workers and freelancers whose income streams are volatile and unpredictable. This group often requires flexible and rapid financing solutions that traditional banks are ill-equipped to provide due to stringent income stability requirements. Furthermore, urban millennials and Gen Z consumers, accustomed to instant service delivery, increasingly turn to online payday and short-term installment lenders when facing unexpected financial shocks, valuing the absence of complex paperwork and in-person interviews.

Market expansion is focusing on integrating financial education and budgeting tools, aiming to convert episodic users into long-term clients utilizing a broader range of high-yield savings or credit-building products. The potential customer base is expanding globally in regions undergoing rapid digitalization, particularly in parts of Southeast Asia and Latin America, where the combination of high mobile penetration and limited traditional banking infrastructure creates a massive, underserved population urgently requiring accessible digital credit options for economic stability and participation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 149.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LoanMe, Speedy Cash, Check Into Cash, Advance America, MoneyMutual, OneMain Holdings, Elevate Credit, Enova International, CashNetUSA, LendingPoint, NetCredit, OppLoans, PLS Financial Services, Rise Credit, ZocaLoans, Oportun, Credit Acceptance, Acima, Varo Money, Dave |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Payday Loans Market Key Technology Landscape

The operational backbone of the Online Payday Loans Market is built upon a sophisticated stack of financial technology designed for speed, security, and scalability. Central to this landscape is the application of proprietary Artificial Intelligence (AI) and Machine Learning (ML) algorithms used for rapid and accurate credit assessment. Unlike traditional FICO scoring, these systems ingest vast amounts of alternative data—such as utility payment histories, publicly available social data points, and sophisticated behavioral metrics—to develop a highly predictive, near-instantaneous risk profile for applicants lacking conventional credit files. This technological capability directly addresses the market's core competitive differentiator: the ability to provide instant funding decisions while minimizing default risks.

Another crucial technological pillar involves advanced cybersecurity and data encryption technologies, necessitated by the highly sensitive nature of the financial and personal information processed. Lenders must employ robust protocols compliant with global data protection standards (like GDPR and CCPA) to maintain consumer trust and regulatory adherence. Furthermore, the integration of Application Programming Interfaces (APIs) for seamless bank verification (Open Banking initiatives), identity verification (Know Your Customer/KYC processes), and automated payment processing (ACH network integration) allows for the end-to-end digital lifecycle of the loan, from initial application to final repayment collection, without human intervention.

Emerging technologies, particularly distributed ledger technology (blockchain), are being piloted to create decentralized and immutable records of lending transactions and repayment histories, potentially lowering operational costs and improving transparency in credit reporting. Mobile technology remains paramount; best-in-class lenders offer highly optimized, intuitive mobile applications that leverage smartphone features (like biometric authentication and GPS data) to further enhance security and streamline the user experience, ensuring that the majority of traffic and loan applications are processed effortlessly on handheld devices. The adoption of cloud computing infrastructure is also standard practice, providing the scalability and resilience required to handle fluctuating transaction volumes and maintain compliance across diverse regulatory environments.

Regional Highlights

North America: North America, particularly the United States, represents the largest and most mature segment of the Online Payday Loans Market, driven by high consumer debt levels, significant digital penetration, and a large population of underbanked individuals. The market's structure is heavily influenced by the patchwork of state-specific regulations; while some states have implemented strict APR caps that effectively ban traditional payday lending, others allow for more permissive operational frameworks. This fragmentation mandates sophisticated geo-targeting and regulatory compliance management systems for national lenders. Technological innovation, especially in AI-driven alternative credit scoring, originates heavily in this region, leading to enhanced competitive advantages for major U.S. fintech lenders who can accurately assess risk outside the traditional credit bureau system. Canada also contributes significantly, though it generally maintains stricter national oversight on short-term lending practices compared to the varying U.S. state laws, focusing lending toward more regulated installment products.

Europe: The European market is characterized by high levels of regulation, prioritizing consumer protection and transparency, particularly following the implementation of stricter guidelines across key markets like the UK, Germany, and Spain. The emphasis here is on responsible lending, often resulting in lower average APRs and a structural shift away from traditional short-term payday loans toward installment loans with extended repayment schedules and lower overall costs. The Open Banking initiative, originating largely from Europe, has profoundly impacted the lending ecosystem by enabling third-party access to financial data, thereby improving the efficiency and accuracy of credit checks. Growth remains steady, driven by smaller, often localized, fintech lenders that can comply rigorously with localized consumer credit directives (e.g., the Consumer Credit Directive) and meet the demand for short-term financial solutions in the face of economic volatility and fluctuating employment markets across the continent. Eastern European countries are showing higher growth rates as digital infrastructure improves and regulatory frameworks begin to solidify.

Asia Pacific (APAC): The APAC region is poised for the most explosive growth, fueled by massive, rapidly urbanizing populations, soaring mobile and internet penetration rates, and a vast unbanked population seeking access to formal financial services for the first time. Countries like India, Indonesia, and the Philippines represent enormous potential due to their demographic profiles and the significant gap between demand for credit and the supply from traditional financial institutions. While regulations are rapidly evolving, they often lag behind the pace of digital lending innovation, creating both high opportunity and high risk. The technological landscape in APAC is focused heavily on mobile-first strategies, leveraging mobile wallets and super-apps for loan origination and servicing. The primary challenge remains establishing consistent regulatory oversight to prevent predatory lending practices while fostering an environment conducive to responsible fintech growth, requiring international players to partner with local institutions to navigate diverse cultural and legal landscapes effectively.

Latin America (LATAM): The LATAM market is defined by economic volatility, high inflation rates, and significant financial inclusion challenges, making short-term online credit highly appealing. Countries like Brazil, Mexico, and Colombia are major growth hubs. Digital lending services are particularly critical here as a hedge against unexpected financial stress in economies prone to rapid currency devaluation. The proliferation of local fintech startups is driving innovation, utilizing sophisticated social data and alternative behavioral metrics to provide credit in populations where formal credit histories are sparse or non-existent. Regulatory development is slow but moving toward consumer protection, often in response to high default rates and concerns over loan sharks. Success in LATAM requires robust anti-fraud measures and operational models designed to withstand high levels of economic unpredictability, emphasizing localized language support and flexible repayment tools tailored to diverse income profiles.

Middle East and Africa (MEA): The MEA market is developing unevenly, with the Middle East focusing on sharia-compliant financial products and technologically advanced lending platforms, particularly in the UAE and Saudi Arabia, leveraging high wealth and digital literacy rates. The African segment, however, is driven almost entirely by mobile technology, reflecting the leapfrog phenomenon where mobile money (M-Pesa) infrastructure is used as the foundational platform for digital lending. Countries like Kenya, Nigeria, and South Africa exhibit strong demand for micro-loans and short-term credit accessed entirely via mobile phone. The regulatory environment in Africa is catching up to the pace of innovation, with several central banks attempting to establish ethical lending limits. Challenges include low consumer data availability, infrastructure intermittency, and the need for localized AI models that account for diverse regional dialects and cultural payment norms, necessitating a localized, agile approach to market entry and scaling.

- North America: Market leader, characterized by AI-driven scoring and fragmented state-level regulation in the U.S.

- Europe: Highly regulated, emphasizing consumer protection, transparency, and a shift toward installment credit products driven by Open Banking standards.

- Asia Pacific: Fastest-growing region, driven by mobile-first strategies and vast underbanked populations in India, Indonesia, and the Philippines.

- Latin America: High growth potential fueled by economic volatility and fintech addressing financial exclusion challenges; requires strong anti-fraud technology.

- Middle East and Africa: Diverse market; sophisticated sharia-compliant lending in the Middle East; mobile-money-centric micro-lending dominates the African segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Payday Loans Market.- LoanMe

- Speedy Cash

- Check Into Cash

- Advance America

- MoneyMutual

- OneMain Holdings

- Elevate Credit

- Enova International

- CashNetUSA

- LendingPoint

- NetCredit

- OppLoans

- PLS Financial Services

- Rise Credit

- ZocaLoans

- Oportun

- Credit Acceptance

- Acima

- Varo Money

- Dave

Frequently Asked Questions

Analyze common user questions about the Online Payday Loans market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Online Payday Loans Market?

The Online Payday Loans Market is projected to experience robust growth, anticipating a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. This growth is primarily fueled by increasing digital adoption, the necessity for instant financing solutions, and advancements in alternative credit scoring technologies.

How is AI impacting credit risk assessment in online lending platforms?

AI significantly impacts credit risk assessment by enabling lenders to analyze non-traditional data sources and behavioral metrics, offering a more nuanced and instantaneous understanding of borrower creditworthiness than traditional FICO scores, thereby accelerating approval times and improving default prediction accuracy.

What major regulatory challenges are affecting the profitability of online payday lenders?

Major regulatory challenges include the widespread implementation of state and federal interest rate caps (APR limits), mandatory underwriting standards, and requirements for increased loan transparency and extended repayment options, which collectively compress profit margins and necessitate constant technological adjustments for compliance.

Which geographical region is expected to lead the market growth during the forecast period?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, driven by enormous underserved populations, rapid urbanization, and high mobile penetration, particularly in emerging economies such as India and Indonesia where digital credit access is transforming financial inclusion.

What is the primary difference between traditional payday loans and new installment loan products?

Traditional payday loans are typically small-principal, short-duration (two-week) loans with high fees, designed to be repaid on the borrower’s next paycheck. Installment loan products, increasingly adopted by online lenders, offer larger principals, significantly longer repayment terms (several months to a year), and generally lower, though still substantial, Annual Percentage Rates (APRs), promoting more sustainable repayment structures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager