Online Receipt Generator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434216 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Online Receipt Generator Market Size

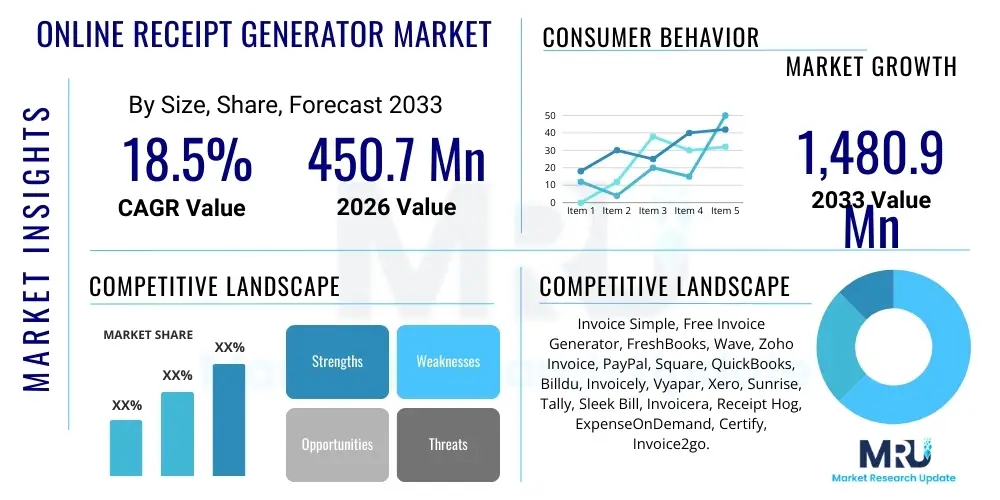

The Online Receipt Generator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450.7 Million in 2026 and is projected to reach USD 1,480.9 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global transition towards digital financial documentation, facilitated by the proliferation of cloud-based accounting solutions and increasing regulatory mandates favoring electronic record-keeping. Small and medium-sized enterprises (SMEs) are the primary adopters, seeking cost-effective and efficient tools to manage transactional records, enhance tax compliance, and streamline internal accounting processes.

The acceleration of e-commerce and the gig economy further fuels the demand for instant, customizable, and legally compliant digital receipts. Businesses require solutions that can seamlessly integrate with Point of Sale (POS) systems, payment gateways, and comprehensive Enterprise Resource Planning (ERP) software. The market growth is also supported by continuous innovation in user interface design, focusing on mobile compatibility and intuitive operation, making professional receipt generation accessible to non-technical users such as freelancers and micro-businesses.

Technological advancements, particularly the incorporation of advanced security features like blockchain verification and secure cloud storage, are bolstering user confidence in these platforms. Moreover, market vendors are increasingly offering feature-rich platforms that extend beyond simple generation to include expense management, basic invoicing, and financial reporting capabilities, thereby maximizing the utility and perceived value proposition for the end-user base across diverse geographical regions.

Online Receipt Generator Market introduction

The Online Receipt Generator Market encompasses software-as-a-service (SaaS) tools and platforms designed to instantaneously create, customize, and deliver professional digital receipts for business transactions. These essential tools serve as a core component of modern financial infrastructure, enabling businesses of all sizes, from sole proprietors to large corporations, to document sales and purchases accurately. The product typically functions via a web browser or dedicated mobile application, offering various templates, currency options, and tax calculation features, thereby ensuring compliance and enhancing customer satisfaction through professional documentation.

Major applications of online receipt generators span across retail, hospitality, e-commerce, and professional service sectors. They are critical for managing proof of purchase, handling returns and exchanges, simplifying expense reporting for employees, and maintaining rigorous audit trails necessary for regulatory and tax compliance. Key benefits derived from adopting these platforms include significant reductions in paper usage and storage costs, increased processing speed, minimized human error in record keeping, and enhanced data security through encryption and cloud backup, ensuring business continuity.

The market is predominantly driven by compelling factors such as the pervasive global trend of business digitization, the rapid growth of mobile commerce necessitating instant documentation, and stringent government regulations worldwide requiring businesses to maintain precise digital financial records. The ease of integration with existing accounting and payment systems, coupled with competitive pricing models (often freemium or subscription-based), acts as a powerful catalyst for widespread adoption across emerging and established economies alike, cementing the generator’s role as an indispensable business utility.

Online Receipt Generator Market Executive Summary

The Online Receipt Generator Market is characterized by robust growth, driven primarily by favorable business trends favoring digital transformation, particularly within the SME segment. The current landscape highlights intense competition focused on feature differentiation, notably API integration capabilities and sophisticated customization tools for branding. Key business trends include a migration from standalone applications to integrated financial suites, where receipt generation is bundled with invoicing, expense tracking, and basic bookkeeping services, enhancing customer lifetime value. Furthermore, the reliance on cloud infrastructure (Cloud-based Deployment segment) remains paramount, ensuring scalability and real-time accessibility for global operations, contributing significantly to market capitalization and rapid deployment cycles.

Regional trends indicate North America and Europe currently hold the largest market shares due to high digital literacy, early adoption of SaaS financial technologies, and well-established regulatory frameworks encouraging digital documentation. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is attributed to massive growth in e-commerce penetration, increasing governmental initiatives promoting digital payments, and the proliferation of micro and small enterprises adopting digital tools to manage transactions efficiently, especially in emerging economies like India and Southeast Asian nations.

Segment trends reveal that the Small and Medium-sized Enterprises (SMEs) segment continues to dominate the end-user landscape, recognizing the tools as essential for operational efficiency without requiring substantial capital expenditure. In terms of functionality, advanced features such as automated tax calculation, multi-currency support, and direct integration with major accounting platforms (e.g., QuickBooks, Xero) are experiencing rapid uptake. The services industry and the rapidly expanding gig economy represent specialized segments driving demand for highly flexible and mobile-centric receipt solutions that can handle variable pricing structures and decentralized payment methods, demanding continuous feature enhancements.

AI Impact Analysis on Online Receipt Generator Market

Common user inquiries regarding AI’s influence on the Online Receipt Generator Market typically revolve around automation efficiency, enhanced fraud detection, and the future role of manual data entry. Users frequently question how AI can expedite the reconciliation process, verify the authenticity of receipts against defined policy rules, and automatically categorize expenses with higher accuracy than current rule-based systems. There is strong user expectation that AI will transition the tools from simple generators to intelligent financial assistants capable of predictive spending analysis and seamless integration into broader financial governance systems. Key themes summarize to a demand for 'intelligent receipts'—documents that are not just outputs, but active data inputs, requiring minimal human intervention and significantly reducing compliance risk through real-time auditing and verification capabilities.

- AI-powered fraud detection: Utilizing machine learning algorithms to identify anomalies, duplicated receipts, or fabricated transactional data, significantly bolstering internal controls and minimizing financial loss.

- Intelligent data extraction and categorization: Automated Optical Character Recognition (OCR) combined with AI to accurately read and classify receipt details (vendor, amount, tax, date) across varying formats, feeding directly into accounting software.

- Personalized receipt generation and delivery: AI analyzing customer purchase history and preferences to deliver highly customized, branded receipts via preferred channels (email, SMS, wallet), enhancing post-purchase engagement.

- Predictive expense forecasting: Analyzing historical receipt data to forecast future departmental or operational spending, aiding in budget planning and financial decision-making for enterprises.

- Automated compliance verification: Real-time checking of generated receipts against local tax laws and internal company expense policies, flagging non-compliant submissions before processing.

- Enhanced accessibility features: AI improving multilingual support and generating receipts compliant with various global regulatory standards, widening the platform’s international utility.

DRO & Impact Forces Of Online Receipt Generator Market

The Online Receipt Generator Market is fundamentally shaped by powerful Driving forces (D) centered on the global pivot to digital finance and the resultant need for instantaneous, verifiable transactional records. Restraints (R) primarily involve user concerns regarding data security, privacy compliance, and the complexity introduced by varying international tax and regulatory frameworks that digital tools must seamlessly navigate. Opportunities (O) are abundant, largely residing in advanced integration capabilities, particularly embedding receipt generation functionality within comprehensive ERP systems and leveraging emerging technologies like blockchain for immutable record-keeping. These forces collectively dictate market trajectory, pushing vendors toward highly secure, integrated, and regulatory-aware solutions.

Impact forces, defined by factors such as the intensity of competitive rivalry among existing players, the threat of new entrants, the bargaining power of suppliers, and the bargaining power of buyers, significantly influence pricing strategies and innovation cycles. High competition forces continuous platform enhancements and aggressive pursuit of integration partnerships. The increasing bargaining power of technology-savvy SME buyers demands flexible, low-cost subscription models and superior customer support. Furthermore, the pervasive adoption of mobile banking and digital wallets acts as a macro-environmental force accelerating the shift away from physical documentation toward instant digital proof of purchase, driving market expansion.

Addressing these dynamics requires strategic responses: mitigating Restraints through robust, industry-standard data encryption and obtaining globally recognized compliance certifications; capitalizing on Opportunities by prioritizing R&D into AI-driven expense management features; and navigating Drivers by expanding geographic coverage and multilingual support. The interplay between these forces ensures that only the most adaptable and technologically advanced platforms will achieve sustainable growth and market dominance in the increasingly digitized financial ecosystem.

Segmentation Analysis

The Online Receipt Generator Market is meticulously segmented based on Deployment Type, End-User, Feature Set, and Industry Vertical, providing a granular view of market dynamics and adoption patterns. This segmentation helps vendors tailor their product offerings, pricing structures, and marketing efforts to specific user needs, optimizing resource allocation and maximizing market penetration. The diversity in segmentation highlights the applicability of these tools across various operational scales, from individual freelancers requiring basic functionality to multinational corporations demanding complex, integrated financial features. Understanding these segments is crucial for strategic business planning and identifying high-growth niches within the broader financial technology landscape, particularly those underserved segments seeking enhanced digital efficiency.

- By Deployment Type:

- Cloud-based (SaaS)

- On-Premise

- By End-User:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Freelancers and Gig Workers

- Individual Consumers

- By Feature Set:

- Basic Functionality (Template generation, simple input)

- Advanced/Integrated Features (Multi-currency, Tax calculation, API integration, Expense tracking)

- By Industry Vertical:

- Retail and Consumer Goods

- Hospitality and Travel

- Services (Consulting, IT, Professional)

- E-commerce and Online Services

- Healthcare and Wellness

Value Chain Analysis For Online Receipt Generator Market

The value chain of the Online Receipt Generator Market begins with upstream activities focused on core software development and cloud infrastructure provision. Upstream providers include specialized SaaS developers, database management vendors, and major cloud service providers (AWS, Azure, Google Cloud) that supply the necessary computational power, security protocols, and scalability required for generating millions of receipts securely and instantaneously. The quality and reliability of these upstream inputs directly determine the performance, uptime, and data protection capabilities of the final product, influencing overall user trust and platform stability in a highly regulated financial environment.

Midstream activities involve the platform development itself, including user interface (UI) and user experience (UX) design, integration with third-party payment gateways and accounting software (API development), and the implementation of advanced features like taxation engines and fraud detection algorithms. This stage represents the core value addition, transforming raw infrastructure into a functional, user-centric financial tool. Companies differentiate themselves here by offering superior customization, compliance modules, and robust security frameworks, ensuring the generated receipts meet various international legal standards for transactional documentation.

Downstream activities focus on distribution channels, market reach, and customer support. Distribution is heavily dominated by direct channels through proprietary websites and mobile app stores (iOS/Android). Indirect channels, though less common, include partnerships with financial software resellers, accounting firms, and integration partners (e.g., POS system providers) who bundle the receipt generator tool into their comprehensive business packages. Effective downstream engagement, including proactive customer onboarding and localized technical support, is vital for high retention rates and sustaining a competitive advantage, especially in highly fragmented global markets where localized compliance is essential for widespread adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.7 Million |

| Market Forecast in 2033 | USD 1,480.9 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Invoice Simple, Free Invoice Generator, FreshBooks, Wave, Zoho Invoice, PayPal, Square, QuickBooks, Billdu, Invoicely, Vyapar, Xero, Sunrise, Tally, Sleek Bill, Invoicera, Receipt Hog, ExpenseOnDemand, Certify, Invoice2go. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Online Receipt Generator Market Potential Customers

Potential customers for Online Receipt Generator tools are predominantly defined by their volume of daily transactions and their compliance requirements for financial documentation. The largest segment remains Small and Medium-sized Enterprises (SMEs) across all industry verticals, particularly those transitioning away from manual bookkeeping or legacy systems. These businesses seek solutions that offer immediate cost savings, high efficiency in transaction processing, and user-friendly interfaces that do not necessitate specialized accounting personnel. For SMEs, the ability to generate customized, legally compliant receipts quickly and integrate them seamlessly into existing expense management workflows is the primary buying motivation.

A rapidly expanding segment consists of freelancers, independent contractors, and participants in the gig economy. These individuals require highly mobile, accessible, and often free or low-cost tools to document their professional income and expenses for tax reporting purposes. Their needs prioritize speed, mobile compatibility, and the ability to handle highly variable transactions, often across multiple clients and payment methods. The demand from this segment drives innovation in mobile-first generator applications and simplified tax categorization features designed for non-business experts.

Finally, Large Enterprises, while often possessing robust ERP systems, represent a specific high-value customer subset, particularly concerning employee expense management. They utilize online receipt generators (often integrated via API) to standardize documentation submitted by employees globally, ensuring consistency, reducing manual reconciliation effort, and facilitating rapid reimbursement processes. Their focus is heavily weighted towards security, compliance with complex corporate policies, and advanced auditing features, driving demand for enterprise-level solutions with rigorous access controls and robust data retention policies.

Online Receipt Generator Market Key Technology Landscape

The technological foundation of the Online Receipt Generator market is primarily based on modern Software-as-a-Service (SaaS) architecture, leveraging high-availability cloud computing resources to ensure global accessibility and scalability. Key technologies include robust APIs (Application Programming Interfaces) which facilitate essential integration with external financial ecosystems, such as major banking institutions, payment processors like Stripe and PayPal, and established accounting software like Xero and QuickBooks. This interoperability is non-negotiable for enterprise adoption and operational efficiency. Furthermore, the reliance on secure, scalable database technologies is crucial for storing sensitive transactional data in compliance with data protection regulations such as GDPR and CCPA, necessitating high-grade encryption protocols and regular security audits to maintain user trust.

Another significant technological component involves sophisticated template rendering engines built using web standards (HTML5, CSS, JavaScript frameworks) capable of producing visually customizable and print-optimized PDF or image file outputs. These engines must handle complex formatting rules, including multiple currencies, varying tax structures (VAT, sales tax, GST), and multilingual text. The advent of AI and Machine Learning (ML) is beginning to shape the future landscape, primarily through intelligent OCR technology that automates data input when converting paper receipts into digital records, significantly reducing data entry time and error rates.

Finally, mobile technology forms a vital pillar of this market, with many leading platforms prioritizing native mobile applications (iOS and Android). This emphasis allows users to generate and share receipts instantly from any location, catering directly to the needs of the gig economy and field service employees. Secure user authentication methods, including multi-factor authentication (MFA), are standard across leading platforms to protect user accounts and transactional integrity, ensuring that the technology landscape remains aligned with stringent financial security standards.

Regional Highlights

- North America: This region holds the largest market share, characterized by early and pervasive adoption of cloud-based financial software, high digital maturity among SMEs, and a well-developed fintech ecosystem. The United States and Canada lead the region, driven by complex tax regulations necessitating meticulous digital documentation and a large population of tech-savvy independent professionals.

- Europe: Europe is the second-largest market, exhibiting strong growth propelled by regulatory pressures such as PSD2 and mandatory electronic invoicing initiatives (e.g., in Italy and France). High awareness regarding data privacy (GDPR compliance) mandates that receipt generator platforms invest heavily in robust data protection features, driving competition based on security and compliance capabilities.

- Asia Pacific (APAC): Expected to show the highest CAGR. Growth is primarily fuelled by the explosive expansion of e-commerce, massive digitalization drives in emerging economies (India, China, Southeast Asia), and government support for digital payment systems. The market is highly sensitive to local currency support and localized regulatory compliance due to the diversity of jurisdictions.

- Latin America (LATAM): The LATAM market is rapidly evolving, driven by the need for better financial transparency and increased penetration of mobile banking services. Countries like Brazil and Mexico are witnessing significant adoption, often catalyzed by local governmental efforts to curb the informal economy and promote formalized business documentation.

- Middle East and Africa (MEA): This region shows nascent but accelerating adoption, primarily concentrated in the Gulf Cooperation Council (GCC) countries where ambitious digital transformation visions (e.g., Saudi Vision 2030) are promoting the use of cloud technology across business operations. The need for specialized receipt solutions catering to complex VAT structures is a key driver.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Online Receipt Generator Market.- Invoice Simple

- Free Invoice Generator

- FreshBooks

- Wave Financial Inc.

- Zoho Invoice

- PayPal Holdings, Inc.

- Square, Inc. (Block, Inc.)

- Intuit QuickBooks

- Billdu

- Invoicely

- Vyapar

- Xero Limited

- Sunrise by Lendio

- Tally Solutions Private Limited

- Sleek Bill

- Invoicera

- Receipt Hog

- ExpenseOnDemand

- Certify (Emburse)

- Invoice2go

Frequently Asked Questions

Analyze common user questions about the Online Receipt Generator market and generate a concise list of summarized FAQs reflecting key topics and concerns.How does an online receipt generator ensure tax compliance across different regions?

Leading online receipt generators utilize advanced, regularly updated tax engines integrated into their platforms. These systems allow users to select their geographical location (e.g., EU VAT, US Sales Tax, India GST) and automatically apply the correct tax rates and required legal formatting to the generated receipt, ensuring compliance with local financial regulations and simplifying audit preparation for businesses operating internationally or domestically. Platforms must maintain constant vigilance regarding regulatory changes to guarantee accuracy, often leveraging partnerships with localized financial experts.

What security measures are implemented to protect sensitive transactional data generated by these tools?

Security is paramount; top-tier providers implement industry-standard protocols, including end-to-end encryption (SSL/TLS) for data transmission and AES-256 encryption for data at rest on secure, often ISO 27001 certified, cloud servers. Multi-factor authentication (MFA) protects user access, and strict adherence to global data privacy laws (like GDPR and CCPA) ensures responsible data handling, guaranteeing the integrity and confidentiality of sensitive financial information against unauthorized access or breaches.

Can online receipt generators integrate with existing business accounting software?

Yes, robust API integration is a primary differentiator. Most advanced online receipt generators offer direct, bidirectional synchronization with major accounting and ERP platforms, including QuickBooks, Xero, and SAP. This integration allows generated receipt data to flow automatically into the business's general ledger, streamlining expense categorization, reconciliation, and financial reporting processes without manual data entry, significantly improving operational workflow efficiency.

What is the primary benefit of cloud-based deployment versus on-premise solutions in this market?

Cloud-based (SaaS) deployment offers superior scalability, real-time accessibility from any device globally, and automatic software updates and security patches managed entirely by the vendor. This model is significantly more cost-effective for SMEs and freelancers due to lower upfront investment and reduced IT maintenance complexity, driving its market dominance over restrictive, high-maintenance on-premise setups.

How is Artificial Intelligence (AI) enhancing the functionality of receipt generators beyond simple creation?

AI is transforming receipt generators into intelligent financial tools by incorporating features such as advanced Optical Character Recognition (OCR) for accurate data extraction from uploaded images, predictive expense categorization based on historical patterns, and sophisticated algorithmic detection of potentially fraudulent or duplicate receipts. This elevates the tool from a mere generator to an integral component of proactive, automated financial risk management and auditing systems.

Are online generated receipts legally valid documentation for auditing purposes?

Yes, digital receipts generated by professional platforms are legally valid documentation, provided they contain all mandatory elements required by local tax authorities (such as vendor name, date, transaction amount, tax breakdown, and item description). The authenticity and non-repudiation are often further secured through timestamping and secure digital storage, making them fully compliant with audit requirements globally, often superseding the legal requirements for fragile paper receipts.

What role does mobile compatibility play in the adoption rates of these platforms?

Mobile compatibility is a critical driver of market adoption, particularly within the hospitality, retail, and gig economy sectors. Native mobile applications enable users to generate, customize, and immediately send receipts directly from their smartphones or tablets at the point of transaction, providing superior customer experience and ensuring instantaneous record-keeping, which is essential for modern decentralized business models.

How do basic and advanced feature sets differ within the segmentation analysis?

Basic feature sets generally include simple template selection, data input fields (amount, date, vendor), and PDF/image export. Advanced/Integrated feature sets include multi-currency conversion, automated calculation of complex taxes (VAT, GST), integrated expense reporting, dedicated API access for third-party system integration, customizable branding controls, and secure cloud archival, targeting larger businesses with complex operational needs.

Which industry vertical is showing the fastest growth in adopting online receipt generators?

The E-commerce and Online Services vertical is demonstrating the fastest adoption growth. The nature of online transactions requires instant, digital proof of purchase delivered electronically. Furthermore, the rapid expansion of cross-border e-commerce necessitates tools capable of easily handling multi-currency receipts and varying international tax obligations without manual intervention, driving intense demand for highly automated solutions.

What are the primary restraints affecting the overall growth of the market?

The primary restraints include persistent concerns regarding the security and integrity of cloud-stored sensitive financial data, coupled with the heterogeneity of global regulatory environments. The cost and complexity associated with ensuring full compliance across multiple jurisdictions often pose a significant barrier, particularly for platforms targeting smaller, localized businesses which may lack dedicated compliance teams.

How does the digitalization of accounting drive the demand for online receipt solutions?

The digitalization of accounting requires all transactional inputs, including receipts, to be in a structured, digital format for efficient processing. Online receipt generators fulfill this demand by providing standardized digital records that seamlessly integrate into digitized bookkeeping systems, eliminating the need for manual data entry and subsequent risk of error, which is critical for optimizing automated financial workflows and reducing auditing time.

What defines the market opportunity in terms of integration capabilities?

The market opportunity is significantly defined by the capacity for deep integration with Point of Sale (POS) systems, CRM software, and supply chain management platforms. Embedding the receipt generation functionality directly into these operational systems creates a seamless ecosystem, offering businesses a unified platform for sales, documentation, and financial reconciliation, moving the tools beyond standalone utilities to essential infrastructure components.

Why is the Asia Pacific (APAC) region projected to register the highest CAGR?

The high projected CAGR for APAC is attributed to the region’s accelerating pace of internet penetration, rapidly growing middle-class consumer base driving e-commerce adoption, and proactive government efforts in countries like India and Indonesia to promote digital payments and formalize business transactions, creating a massive, receptive market for basic and advanced digital financial tools.

What is the significance of blockchain technology in the future of digital receipts?

Blockchain technology offers the potential to create tamper-proof, immutable digital records of transactions. Integrating blockchain could significantly enhance the security and legal veracity of online generated receipts, providing an indisputable audit trail and minimizing the risk of fraud, thereby establishing a higher level of trust and operational transparency in digital financial documentation systems.

How do competitive strategies among key players focus on customer retention?

Competitive strategies prioritize customer retention through the development of intuitive user interfaces (UI/UX), highly responsive customer support, and the bundling of receipt generation with complementary financial services (invoicing, basic bookkeeping). Offering flexible, value-based pricing tiers, and continuous platform enhancements based on user feedback are crucial elements to ensure long-term subscriber loyalty and reduce churn.

What are the key differences between generating a receipt versus an invoice?

A receipt confirms that a payment has been received for a transaction that has already occurred (proof of payment), while an invoice is a request for payment issued before the transaction is finalized (request for funds). Online generators often offer both functionalities within a single suite, but their legal and accounting roles differ significantly in the financial workflow cycle.

How does the market cater to the specific needs of freelancers and the gig economy?

The market caters to the gig economy by offering highly affordable (often freemium), mobile-first applications that prioritize quick, on-the-go receipt generation. These tools feature simplified interfaces, integrated time tracking, and easy expense categorization relevant to independent workers, bypassing the need for complex, enterprise-level financial system knowledge.

What impact does the bargaining power of buyers have on market dynamics?

The high bargaining power of buyers (especially SMEs and individual freelancers) forces vendors to maintain highly competitive pricing, offer generous freemium models, and continuously innovate their features. This power dynamic prevents market stagnation, ensuring that platforms remain user-centric, cost-effective, and aligned with evolving demands for efficiency and integration.

What challenges do vendors face regarding data localization and sovereignty requirements?

Vendors face significant challenges in meeting data localization requirements, which mandate that certain transactional data must be physically stored within the user's country or region. Compliance requires substantial investment in regional data center infrastructure and adherence to specific national data sovereignty laws, adding operational complexity, especially for global service providers.

How is the market addressing the environmental trend towards paperless operations?

The market inherently supports the paperless movement by providing high-quality digital receipts delivered via email or secure links, eliminating the reliance on thermal paper receipts. This aligns with corporate social responsibility goals and reduces operating costs associated with consumables, acting as a strong marketing point and a key driver for environmentally conscious businesses.

What are the core functionalities of an advanced receipt generation platform?

Core functionalities include multi-template selection, dynamic field insertion (customer data, company logos), multi-currency calculation, automated tax computation, secure PDF/image generation, instant delivery options (email/SMS), and, critically, API connectivity for synchronizing data immediately with external accounting and expense management software for real-time reporting.

In the value chain, where is the highest value addition created?

The highest value addition is created in the midstream activities, specifically in platform development and system integration. This is where proprietary algorithms for security, compliance modules, user experience design, and robust API development transform basic infrastructure into a highly functional, indispensable financial utility that solves complex business problems beyond simple document creation.

Why is the On-Premise segment seeing declining market share?

The On-Premise segment is declining due to the significant upfront capital investment required, high internal IT maintenance costs, lack of immediate remote accessibility, and inability to receive instant feature or security updates. The flexibility, lower total cost of ownership (TCO), and scalability offered by the Cloud-based SaaS model have rendered on-premise solutions less competitive and appealing to modern businesses, especially SMEs.

How do global economic conditions influence market investment and consumer adoption?

Positive global economic conditions encourage increased transaction volumes, greater business formation (especially SMEs), and higher technology spending, directly boosting the demand for receipt generators. Conversely, economic downturns drive demand for cost-efficient tools, favoring freemium or low-cost SaaS solutions over expensive, integrated financial systems, focusing adoption on cost minimization and core compliance needs.

What role does branding customization play in the competitive landscape?

Branding customization is essential for professional credibility and customer experience. Platforms offering extensive options for incorporating company logos, specific color schemes, and tailored messaging on receipts gain a competitive edge. This feature ensures that the digital receipt serves not just as a financial record but also as a final, professional touchpoint in the customer journey, reinforcing brand identity.

How frequently are updates rolled out to accommodate regulatory changes?

SaaS providers targeting global markets must roll out updates continuously, often quarterly or even monthly, to integrate new tax rate changes, revised compliance documentation requirements, or updated data privacy protocols mandated by specific jurisdictions. This rapid deployment capability is a key advantage of the Cloud-based architecture and vital for maintaining the platform's utility and legal compliance.

What are the typical pricing models used in the Online Receipt Generator Market?

The market primarily utilizes three pricing models: Freemium (offering basic functions for free with paid access to advanced features), Subscription-based (monthly or annual fees based on feature tier or usage volume, such as number of receipts generated), and Enterprise licensing (custom, usage-based contracts for large corporations requiring bespoke integration and dedicated support).

How do generators handle multi-currency transactions and exchange rate fluctuations?

Advanced generators incorporate real-time or frequently updated exchange rate feeds from reputable financial data providers. This allows businesses conducting international sales to generate receipts accurately reflecting the local currency paid, the base currency of the business, and the relevant conversion rate at the time of transaction, which is crucial for accurate internal accounting and reconciliation across borders.

What differentiates a receipt generator from a full accounting software suite?

A receipt generator is a specialized tool focused narrowly on the input or output of transactional proof. A full accounting software suite (like QuickBooks or Xero) offers comprehensive functionality including General Ledger management, payroll, inventory tracking, accounts payable/receivable, and complex financial reporting, typically integrating generators as a modular component rather than a primary function.

What is the key trend driving adoption among large enterprises?

For large enterprises, the key trend is the centralization and standardization of employee expense documentation. They utilize generators, often via API integration, to force global employees to adhere to a unified, digital receipt format, dramatically accelerating the processing of expense claims, improving audit efficiency, and enforcing corporate spending policies globally.

Why is developer support crucial for market growth?

Developer support, particularly robust API documentation and SDKs, is crucial because it facilitates seamless integration with the myriad of existing third-party POS, CRM, and financial systems utilized by businesses. High-quality developer resources encourage platform adoption by system integrators and internal IT departments, accelerating the generator's embedment within complex enterprise IT environments.

How does the threat of new entrants influence the market?

The threat of new entrants is moderate; while building a basic web generator is simple, achieving market credibility requires high levels of security, complex regulatory compliance features, and deep integration partnerships, creating high barriers to entry. New players usually focus on highly niche segments (e.g., specialized industry verticals) or offer aggressive freemium models to gain initial traction against established, integrated platforms.

What measures ensure the long-term archival and accessibility of generated receipts?

Long-term archival is ensured through secure cloud storage with high redundancy and strict data retention policies compliant with financial regulations (often 7 to 10 years). Platforms utilize dedicated storage architecture that allows users to access historical receipts quickly via search and filtering features, supporting necessary financial audits long after the transaction date.

Explain the importance of real-time data flow in modern receipt generation.

Real-time data flow is essential for modern financial transparency and instant reconciliation. Generating receipts and immediately pushing that data to accounting and inventory systems allows managers to view accurate, up-to-the-minute cash flow and stock levels. This immediacy is critical for timely decision-making and preventing discrepancies in financial reporting, a capability central to modern cloud accounting practices.

How are vendors utilizing data analytics generated from receipts?

Vendors utilize aggregated and anonymized receipt data to provide insights into consumer spending patterns, industry benchmarks, and transactional trends. For individual business users, data analytics within the platform helps identify top-selling products, peak sales times, and spending categories, transforming raw transactional data into actionable business intelligence for optimizing operations.

What is the impact of the hospitality and travel sector on demand for these tools?

The hospitality and travel sectors are significant drivers, needing mobile-friendly, instant receipt generation for decentralized operations (e.g., hotel check-outs, restaurant table service, tour operators). Furthermore, complex requirements for generating receipts that detail service charges, tips, and various tax components make specialized, high-functionality receipt tools indispensable in this industry vertical.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager