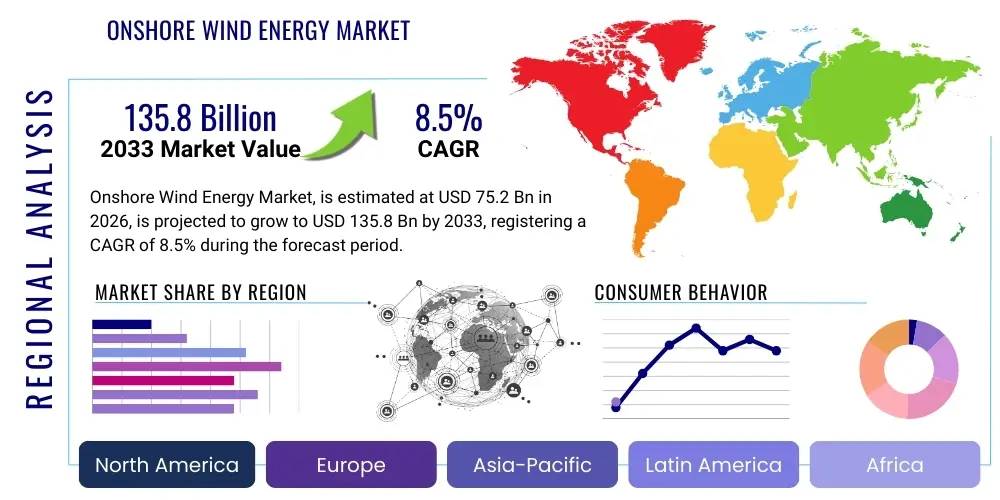

Onshore Wind Energy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437078 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Onshore Wind Energy Market Size

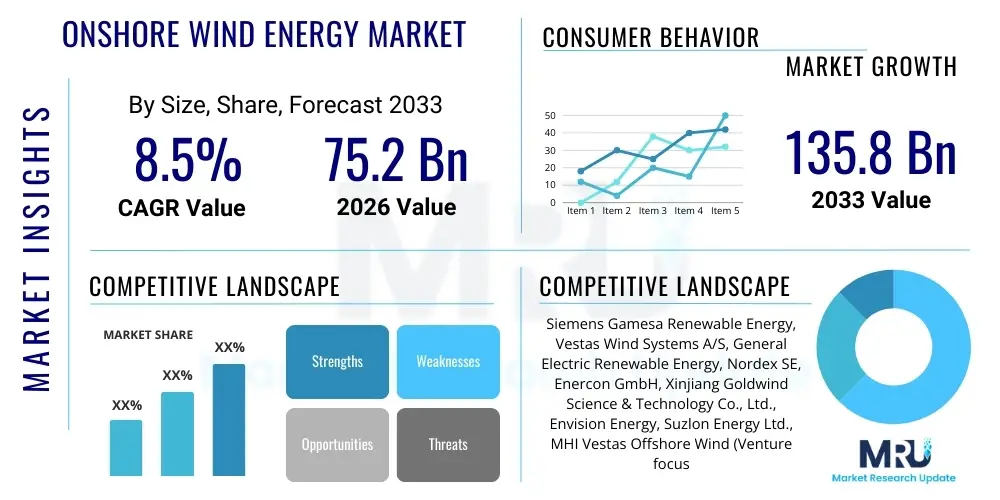

The Onshore Wind Energy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $75.2 Billion in 2026 and is projected to reach $135.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by global decarbonization mandates and the continued advancements in turbine efficiency, which have significantly lowered the Levelized Cost of Energy (LCOE) for onshore wind power generation. Furthermore, robust governmental support through renewable energy targets, tax credits, and favorable auction mechanisms in mature markets like Europe and North America, and rapidly developing markets in Asia Pacific, cement the long-term growth trajectory of this vital renewable energy sector.

Onshore Wind Energy Market introduction

The Onshore Wind Energy Market encompasses the development, manufacturing, installation, operation, and maintenance of wind turbine farms situated on land to convert wind kinetic energy into electrical power. These installations typically involve large-scale utility projects, though distributed generation systems also contribute to market growth. Major applications span the utility sector, feeding national grids, industrial complexes utilizing dedicated power sources, and increasingly, commercial enterprises engaging in Power Purchase Agreements (PPAs) to meet corporate sustainability goals. The key benefits of onshore wind energy include low carbon emissions, indigenous energy production enhancing energy security, scalability across various geographic regions, and long operational lifetimes (often exceeding 25 years).

Driving factors for this market include rapidly declining technology costs, ambitious global climate change mitigation goals set forth by international treaties like the Paris Agreement, and the critical need for diversification away from fossil fuels, especially in energy-intensive economies. Continued innovations in rotor aerodynamics, gearbox efficiency, and advanced materials science are consistently pushing the boundaries of what is technically and economically feasible for onshore deployments. The product scope includes megawatt-scale wind turbines, specialized foundations tailored to diverse geotechnical conditions, sophisticated grid connection systems, and comprehensive digital solutions for optimized operational performance.

Onshore Wind Energy Market Executive Summary

The Onshore Wind Energy Market is experiencing a paradigm shift characterized by larger turbine capacities and increasing integration with digital technologies for enhanced efficiency and predictability. Business trends highlight a strong movement towards turbine standardization in emerging markets coupled with customized, high-capacity solutions (5MW+) tailored for constrained geographies in mature markets. Supply chain resilience, particularly concerning critical components like rare-earth magnets and sophisticated composite materials for blades, remains a central strategic focus for major manufacturers. The competitive landscape is intensely focused on reducing LCOE through improved operational efficiency and lower maintenance costs, driving consolidation among turbine providers and expansion into hybrid renewable energy projects.

Regionally, Asia Pacific, primarily China and India, dominates new installation capacity due to massive national electrification and decarbonization programs, positioning it as the foremost growth engine. Europe maintains a strong focus on repowering older wind farms and maximizing capacity factors through advanced technological retrofits. North America, driven by supportive federal policies and state-level Renewable Portfolio Standards (RPS), continues robust utility-scale development, particularly in the Midwest and Texas. Segment trends indicate the medium-scale capacity segment (1 MW - 5 MW) accounts for the largest share of installations globally, providing a balance between utility needs and logistical feasibility. Furthermore, the operations and maintenance (O&M) segment is poised for rapid expansion, driven by the aging fleet of operational turbines globally and the necessity for sophisticated predictive maintenance solutions.

AI Impact Analysis on Onshore Wind Energy Market

User inquiries regarding the application of Artificial Intelligence (AI) in the Onshore Wind Energy Market primarily revolve around three critical areas: maximizing energy yield, predictive maintenance and asset longevity, and optimizing grid integration. Users are keen to understand how AI-driven algorithms can accurately forecast wind speed and power generation several days in advance, thereby minimizing imbalances and penalties. There is significant interest in AI's role in diagnosing potential turbine failures before they occur, using sensor data analysis to reduce costly downtime. Additionally, users are examining how machine learning can enhance the overall stability and reliability of the grid by dynamically adjusting power output based on real-time supply, demand, and storage availability.

AI is transforming the lifecycle of onshore wind assets, moving wind farm management from reactive maintenance to prescriptive operations. Through the implementation of Digital Twins, AI models simulate real-world conditions, allowing operators to test optimization strategies safely and efficiently. This level of complexity is crucial as turbine sizes increase, making failures more expensive and logistically challenging to repair. Furthermore, AI applications extend into optimizing micro-siting decisions, analyzing complex geographical, topographical, and environmental data sets to determine the exact optimal placement of turbines within a farm to maximize aerodynamic efficiency and minimize wake effects, a critical factor for large-scale projects.

The integration of advanced machine learning models is also vital for managing the increasing volume of SCADA and sensor data generated by modern turbines. AI-powered diagnostic tools are capable of detecting subtle anomalies in acoustic signatures, vibration patterns, and temperature fluctuations that human analysts might miss. This proactive approach not only extends the mean time between failures (MTBF) but also significantly lowers operational expenditures (OPEX) over the project's lifetime, thereby enhancing the financial viability and overall LCOE competitiveness of onshore wind energy compared to conventional generation sources.

- AI optimizes predictive maintenance schedules, reducing unplanned downtime by analyzing vibrational and acoustic data.

- Machine learning algorithms enhance resource assessment and micro-siting, leading to higher capacity factors and energy yield.

- Advanced forecasting models improve grid stability by providing highly accurate, short-term generation predictions for grid operators.

- AI-driven automated control systems adjust blade pitch and yaw angles in real-time to maximize power capture under varying wind conditions.

- Digital Twin technology, underpinned by AI, facilitates scenario testing and life-extension studies for aging wind infrastructure.

- Computer vision and drone inspections leverage AI for automated defect detection on turbine blades and structural components.

DRO & Impact Forces Of Onshore Wind Energy Market

The Onshore Wind Energy Market is shaped by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include aggressive global decarbonization targets and supportive regulatory environments, such as feed-in tariffs and competitive auction schemes, which provide financial certainty for investors. A major restraint is the increasing difficulty in securing large tracts of suitable land due to public resistance (NIMBYism) and complex permitting processes, particularly in densely populated regions. Opportunities arise significantly from the repowering of older sites with higher capacity turbines and the integration of wind energy into hybrid systems (wind-solar-storage) to enhance firm capacity. The market dynamics are highly influenced by impact forces such as volatile fossil fuel prices, advancements in battery storage technology, and shifting governmental policies regarding renewable energy subsidies and land use regulations.

The primary drivers are anchored in macro-environmental mandates. The continually decreasing LCOE of wind power, making it cost-competitive or cheaper than new fossil fuel capacity in many regions, acts as a self-sustaining driver. Furthermore, the drive for enhanced energy security, especially in geopolitical hotspots, pushes nations to invest heavily in domestic, inexhaustible resources like wind. However, the operational challenge of intermittency remains a major restraint; while forecasting improves, the inherent variability of wind power necessitates substantial investment in grid upgrades and energy storage infrastructure to maintain system reliability, which can inflate project costs and complexity.

The core opportunity in the coming decade is centered around technological innovation and market expansion beyond traditional utility scales. Repowering allows existing infrastructure, grid connections, and land rights to be leveraged, offering a high-return, lower-risk pathway for capacity expansion. Furthermore, the rising demand for green power from large corporations through PPAs offers a stable, non-governmental revenue stream, mitigating policy risk. Impact forces, such as rapid technological improvements in rotor materials (e.g., carbon fiber composites) that enable larger, lighter blades, and significant changes in transmission infrastructure investment policies, dictate the speed and scale of market adoption and geographical distribution of projects.

Segmentation Analysis

The Onshore Wind Energy Market segmentation provides a granular view of the industry structure, revealing distinct growth patterns across various components, applications, and operational capacities. The Component segment, comprising the turbine (nacelle, rotor, tower) and balance of plant infrastructure (foundations, electrical systems), is critical for tracking manufacturing output and technological investment. The Application segmentation differentiates between massive utility-scale projects feeding national grids, industrial self-consumption facilities, and smaller distributed generation systems, each subject to different regulatory and economic drivers. Understanding these segments is crucial for manufacturers to tailor their product offerings, such as designing specialized turbines for low-wind-speed sites or modular designs for remote installations.

The Capacity segmentation (Small, Medium, Large) is particularly indicative of market maturity and logistical feasibility. Large-scale capacity installations (>5 MW per turbine) are increasingly prevalent in land-constrained, high-wind regions like parts of Europe and the U.S., leveraging economies of scale. Conversely, small and medium-scale turbines remain essential for decentralized electrification efforts and corporate or community-owned projects in developing economies. The services segment, encompassing installation, operation, and maintenance (O&M), is growing faster than the equipment segment, driven by the need to optimize the performance of an ever-expanding global fleet and the demand for advanced digital solutions like SCADA systems and remote monitoring services to maximize asset availability and minimize OPEX.

- Component:

- Turbine (Rotor Blades, Nacelle, Tower)

- Foundation (Concrete, Steel structures)

- Electrical Infrastructure (Transformers, Switchgear, Cables)

- Support Services (Installation, Operation & Maintenance)

- Application:

- Utility Sector (Grid Connected)

- Industrial Sector (Captive Power Generation)

- Commercial and Residential Sector (Distributed Generation)

- Capacity:

- Small-scale (100 kW - 1 MW)

- Medium-scale (1 MW - 5 MW)

- Large-scale (> 5 MW)

Value Chain Analysis For Onshore Wind Energy Market

The Onshore Wind Energy value chain is highly complex, starting with upstream activities involving raw material extraction and component manufacturing. Upstream activities include the production of essential raw materials such as steel, fiberglass, and specialized composite resins for blades, and the manufacturing of high-precision components like gearboxes, generators, and converters. Key industry bottlenecks often occur at this stage, particularly concerning the supply of large, specialized castings and rare-earth magnets used in direct-drive generators. The quality and availability of these materials directly influence the reliability and cost of the finished turbine.

Midstream activities focus on turbine assembly, project development, financing, and installation. Project development is arguably the most intricate step, encompassing site assessment, permitting, financing (often non-recourse project finance), and engineering, procurement, and construction (EPC). Distribution channels for large onshore wind components are primarily direct, involving original equipment manufacturers (OEMs) selling directly to independent power producers (IPPs), utility companies, or specialized project developers. Indirect channels, involving specialized component suppliers, often feed into the major OEMs.

Downstream analysis covers the operation and maintenance (O&M) and power generation stages. Once operational, the farm requires continuous monitoring, scheduled maintenance, and timely repairs. Direct distribution dominates the O&M service delivery, often provided under long-term service agreements (LTSAs) by the original equipment manufacturer or specialized third-party service providers (TSPs). The ultimate output, electricity, is typically sold through long-term PPAs to utilities or corporate customers, thereby completing the value cycle and providing predictable revenue streams essential for mitigating financial risk.

Onshore Wind Energy Market Potential Customers

The primary customers for onshore wind energy products and services fall into distinct categories, all seeking reliable, cost-effective, and low-carbon electricity generation. Independent Power Producers (IPPs) and large national utility companies constitute the largest segment of buyers, as they require massive generation capacity to fulfill public grid demands and meet regulatory compliance targets. These entities typically purchase utility-scale turbines and full EPC services, often demanding extensive warranties and long-term O&M contracts to ensure asset reliability and predictable cash flows over the project’s lifespan. Their purchasing decisions are highly sensitive to LCOE and regulatory stability.

A rapidly emerging customer segment includes large industrial consumers, particularly those in energy-intensive sectors such as mining, data centers, and manufacturing. These entities increasingly seek to secure their energy supply through Corporate Power Purchase Agreements (CPPAs) or by developing captive wind farms, driven by corporate social responsibility goals and the desire to hedge against volatile fossil fuel prices. Their demand focuses on securing long-term price stability and verifying the source of clean energy to meet internal sustainability metrics. They often prefer medium to large-scale solutions that can be geographically located near their operations or delivered via virtual PPAs.

Furthermore, local governmental bodies and community energy groups represent potential buyers, especially for smaller-scale projects aimed at decentralized power generation and energy independence. These customers prioritize localized economic benefits, ease of maintenance, and compatibility with local distribution networks. Their procurement decisions are often influenced by local financial incentives and public engagement levels. The overall customer base is moving towards sophisticated purchasing models that emphasize performance guarantees, digital integration capabilities, and supply chain transparency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $75.2 Billion |

| Market Forecast in 2033 | $135.8 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, General Electric Renewable Energy, Nordex SE, Enercon GmbH, Xinjiang Goldwind Science & Technology Co., Ltd., Envision Energy, Suzlon Energy Ltd., MHI Vestas Offshore Wind (Venture focus shifting), Acciona Energía, Ming Yang Smart Energy Group Limited, Shanghai Electric Wind Power Group Co., Ltd., ReGen Powertech, Guodian United Power Technology, XEMC Windpower, Inox Wind Limited, Wind World (India) Ltd., CSIC (Chongqing) Haizhuang Windpower Equipment Co., Ltd., China Ming Yang, Zhejiang Windey Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Onshore Wind Energy Market Key Technology Landscape

The technological evolution within the Onshore Wind Energy Market is fundamentally centered on maximizing aerodynamic efficiency, enhancing structural longevity, and improving grid integration capabilities. Modern onshore turbines are transitioning to larger rotor diameters (often exceeding 170 meters) and taller hub heights to capture higher quality, less turbulent wind resources, particularly in low-wind-speed regions. This shift necessitates advancements in materials science, specifically the use of sophisticated composite materials like carbon fiber and hybrid glass/carbon fiber combinations for lighter yet stronger blades. These material innovations are crucial for maintaining the structural integrity of longer blades while reducing the overall weight and stress on the gearbox and tower infrastructure.

Another crucial technological area is the advancement in drivetrain design, with a notable trend towards permanent magnet synchronous generators (PMSGs) and direct-drive systems, which eliminate the gearbox, simplifying the mechanical assembly, reducing maintenance requirements, and improving overall reliability. Variable speed operation, facilitated by advanced power electronics and full-scale power converters, is standard, allowing turbines to operate efficiently across a wider range of wind speeds. Furthermore, pitch control systems are becoming highly sophisticated, utilizing real-time sensor data and AI algorithms to adjust blade angles individually (independent pitch control), minimizing loads and optimizing power curve adherence, especially during gusty conditions.

Digitization is a cornerstone of the modern technology landscape. The implementation of Supervisory Control and Data Acquisition (SCADA) systems and advanced condition monitoring systems (CMS) is mandatory for large-scale operations. These systems provide real-time data streaming on mechanical and electrical parameters, feeding into centralized digital platforms. These platforms utilize AI and machine learning for predictive maintenance, remote diagnostics, and fleet-wide performance benchmarking. Finally, technologies supporting grid resilience, such as advanced inverters capable of providing reactive power support, fault ride-through capabilities, and synthetic inertia, are critical for managing the high penetration levels of variable renewable energy sources into existing electricity infrastructure.

Regional Highlights

- Asia Pacific (APAC): The Global Growth Engine

The APAC region, specifically driven by China and India, represents the largest market for new onshore wind installations globally. China maintains its position as the world leader, fueled by massive governmental targets aiming for carbon neutrality by 2060 and the continuous expansion of its manufacturing base, providing robust domestic supply chains. The market in APAC is characterized by a rapid shift towards subsidy-free, grid-parity projects. Investment is heavily directed towards improving regional grid infrastructure and deploying turbines optimized for local wind conditions, including low-wind-speed technologies. India's market growth is propelled by competitive auction mechanisms and the national focus on achieving 500 GW of non-fossil fuel capacity by 2030, necessitating vast onshore deployment in states like Gujarat and Tamil Nadu. The logistical challenges associated with transporting extremely large components across diverse terrains remain a key consideration in the region.

- Europe: Focus on Repowering and High Capacity Factors

Europe is a mature market where growth is shifting from greenfield development to repowering older, less efficient wind farms (typically 1-2 MW capacity) with cutting-edge turbines (>5 MW). This strategy maximizes energy yield on existing land plots and utilizes established grid connections, adhering to strict land use and environmental regulations. Countries such as Germany, Spain, and the UK are prioritizing auction mechanisms that favor projects demonstrating high capacity factors and reliable grid integration capabilities. The European Union's ambitious renewable energy directive (RED III) and the push for greater energy independence following geopolitical shifts reinforce the continuous strategic importance of onshore wind. Innovation in Europe is highly focused on developing specialized towers (e.g., hybrid concrete/steel) to reach greater hub heights and minimize transportation footprint.

- North America: Policy Stability Driving Investment

The North American market, dominated by the United States, is characterized by large-scale, utility-driven project development, primarily in the central plains. Key drivers include the federal Inflation Reduction Act (IRA), which provides long-term stability via production and investment tax credits, significantly de-risking financial commitments. This stability has led to increased manufacturing investment within the U.S. to comply with local content requirements and secure supply chains. Canada also sees steady growth, leveraging vast land resources, though regulatory variations between provinces influence project feasibility. The regional focus is on enhancing transmission capacity (especially inter-state lines) to move wind power from resource-rich areas to demand centers, and on incorporating storage solutions to mitigate intermittency challenges effectively.

- Latin America: Emerging Market Potential

Latin America is emerging as a critical growth region, characterized by exceptional wind resources in specific corridors, particularly in Brazil, Chile, and Mexico. Brazil leads the market, driven by competitive auctions and the need to diversify its predominantly hydro-based energy mix, which is vulnerable to drought. The region benefits from strong foreign direct investment but faces challenges related to economic volatility, transmission infrastructure limitations in remote areas, and complex permitting processes. Market strategies involve securing long-term PPAs with industrial consumers and leveraging regional development banks for financing, focusing heavily on proven turbine technologies with established reliability records in demanding climates.

- Middle East and Africa (MEA): Untapped Resource Development

The MEA region presents substantial, largely untapped onshore wind potential, especially in North Africa (Egypt, Morocco) and South Africa. Development is motivated by rapid population growth, increasing energy demand, and a strategic shift away from reliance on hydrocarbon revenues. Projects often utilize the Independent Power Producer (IPP) model, supported by strong government guarantees and international financial institution backing. Challenges include extreme climate conditions (dust, sand), which require specialized turbine coatings and filtration systems, and the need for significant initial investment in transmission infrastructure. The deployment is often part of large, national mega-projects aimed at achieving significant renewable capacity milestones in a compressed timeframe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Onshore Wind Energy Market.- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- General Electric Renewable Energy

- Nordex SE

- Enercon GmbH

- Xinjiang Goldwind Science & Technology Co., Ltd.

- Envision Energy

- Suzlon Energy Ltd.

- Acciona Energía

- Ming Yang Smart Energy Group Limited

- Shanghai Electric Wind Power Group Co., Ltd.

- ReGen Powertech

- Guodian United Power Technology

- XEMC Windpower

- Inox Wind Limited

- Wind World (India) Ltd.

- CSIC (Chongqing) Haizhuang Windpower Equipment Co., Ltd.

- Zhejiang Windey Co., Ltd.

- Doosan Heavy Industries & Construction Co., Ltd.

- Senvion GmbH (Asset restructuring implications)

Frequently Asked Questions

Analyze common user questions about the Onshore Wind Energy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current LCOE trend for onshore wind energy globally?

The Levelized Cost of Energy (LCOE) for onshore wind is demonstrating a persistent downward trend, primarily due to increased turbine efficiency (larger rotors, taller towers) and favorable financing conditions. In many high-resource areas, onshore wind now consistently achieves grid parity, offering generation costs competitive with or lower than new fossil fuel power plants, solidifying its economic advantage.

How do technological advancements influence turbine size and efficiency in the onshore market?

Technological advancements, particularly in composite materials for longer blades and the adoption of direct-drive generators, are enabling the deployment of significantly larger turbines (5 MW+) with hub heights exceeding 150 meters. This increases swept area, allowing better capture of high-altitude wind and optimizing power generation even in traditionally low-wind-speed sites, thereby substantially boosting the capacity factor and overall annual energy production.

What are the primary logistical and permitting challenges facing new onshore wind farm development?

Key challenges include the complex and lengthy permitting processes often involving environmental assessments and public consultations, particularly in densely populated regions. Logistically, the transportation of increasingly large turbine components (especially massive blades and nacelles) requires specialized infrastructure upgrades and careful route planning, often restricting project locations to areas accessible by suitable roads or ports.

What role does energy storage play in facilitating higher onshore wind penetration?

Energy storage, predominantly lithium-ion battery solutions, is critical for stabilizing the grid and enabling higher penetration of variable onshore wind power. Storage systems absorb excess generation during peak wind periods and release power when wind generation is low, effectively mitigating intermittency and providing crucial ancillary services like frequency regulation, thereby enhancing the grid's operational reliability.

Which geographical regions are expected to drive the highest growth in onshore wind installation capacity?

Asia Pacific, led by China and India, is projected to drive the highest absolute growth in installation capacity, capitalizing on large-scale government decarbonization initiatives and robust domestic manufacturing capabilities. North America (U.S.) and selective regions in Latin America (Brazil) are also expected to demonstrate strong, stable growth supported by long-term, favorable policy mechanisms and abundant land availability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager