Opaque Fused Quartz Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436841 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Opaque Fused Quartz Market Size

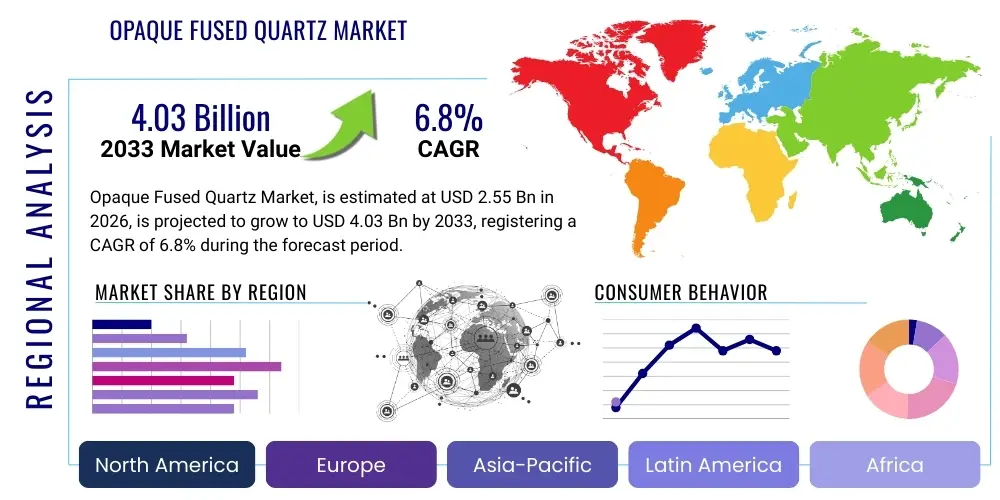

The Opaque Fused Quartz Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.55 Billion in 2026 and is projected to reach USD 4.03 Billion by the end of the forecast period in 2033.

Opaque Fused Quartz Market introduction

Opaque Fused Quartz, often referred to as ceramic quartz or milky quartz, is a high-purity glass material characterized by its non-transparent, milky appearance, which results from minute air bubbles trapped within the quartz matrix during the fusion process. This material is synthesized by melting high-purity silica sand at extremely high temperatures, resulting in exceptional thermal shock resistance, excellent dielectric properties, and very low thermal conductivity compared to transparent fused quartz. Its opacity is a critical feature for applications requiring maximum light diffusion or shielding sensitive components from direct thermal radiation, making it an indispensable component in high-temperature industrial processes and advanced manufacturing environments.

The primary applications of Opaque Fused Quartz span several high-tech industries, most notably semiconductor fabrication, where it is utilized for furnace tubes, boat supports, and specialized wafer processing equipment due to its chemical inertness and resistance to temperature cycling. Furthermore, it plays a vital role in the lighting industry, particularly in the production of high-intensity discharge lamps and specialized UV curing systems, where light diffusion is required. The material’s robust physical properties—such as a softening point near 1700°C and resistance to most acids—provide significant advantages over traditional ceramics or glasses, ensuring durability and reliability in corrosive and extreme thermal settings. This versatility is driving sustained demand across electronics, photovoltaic, and industrial heating sectors.

Key benefits driving the adoption of Opaque Fused Quartz include its superior thermal stability and insulation properties, which are crucial for maintaining precise temperature uniformity in diffusion and oxidation furnaces used in chip manufacturing. The market growth is fundamentally driven by the relentless expansion of the global semiconductor industry, particularly the investment in new fabrication plants (fabs) and the push toward smaller node technologies. Additionally, increasing investments in renewable energy infrastructure, specifically solar cell manufacturing utilizing high-temperature diffusion processes, and the rising demand for sophisticated industrial heating elements in metallurgy and materials processing, further propel market expansion globally.

Opaque Fused Quartz Market Executive Summary

The Opaque Fused Quartz Market is undergoing robust growth, propelled primarily by significant capital expenditure in the global semiconductor sector, coupled with expanding requirements from the photovoltaic industry for high-efficiency solar cell production. Current business trends indicate a strong emphasis on developing ultra-high-purity opaque quartz grades that minimize contamination risk, crucial for sub-10nm chip manufacturing. Supply chain resilience remains a key focus, as the reliance on specialized raw silica sources and energy-intensive manufacturing processes requires strategic planning. Furthermore, companies are investing heavily in automation and advanced processing techniques to improve material uniformity and reduce defect rates, addressing the stringent quality demands of end-users.

Geographically, Asia Pacific (APAC) dominates the market share and is expected to exhibit the highest growth rate during the forecast period, largely attributed to the concentration of major semiconductor manufacturers (Taiwan, South Korea, China) and massive solar cell production capabilities within the region. North America and Europe maintain a significant market presence, driven by established R&D activities, specialized aerospace applications, and increasing revitalization of domestic semiconductor supply chains spurred by governmental initiatives like the CHIPS Act. Regional trends show a fragmentation of manufacturing, with specialized suppliers focusing on niche high-ppurity applications in Western markets, while high-volume production is centralized in Eastern Asia.

Segment trends reveal that the Semiconductor Manufacturing application segment holds the largest revenue share, reflecting its critical dependence on high-purity quartzware for thermal processes. Within this segment, demand for larger diameter components, compatible with 300mm and emerging 450mm wafers, is escalating. The Photovoltaic segment, while smaller, is growing rapidly, driven by global mandates for carbon neutrality and the subsequent scaling of solar panel production lines. Technological advancements are also highlighting the importance of specialty opaque quartz for UV lighting systems, offering enhanced safety and performance compared to standard materials, thus securing a stable, albeit niche, growth trajectory for the illumination application segment.

AI Impact Analysis on Opaque Fused Quartz Market

User queries regarding the impact of Artificial Intelligence (AI) on the Opaque Fused Quartz Market primarily center on two main areas: optimizing production processes and predicting demand shifts driven by AI hardware expansion. Users are concerned with how AI-driven predictive maintenance and quality control systems can be applied to the complex, high-temperature quartz fusion process to reduce defects, improve yields, and lower energy consumption—a significant cost factor. Furthermore, there is substantial interest in quantifying the indirect impact of AI, specifically how the massive, accelerating demand for AI accelerators (GPUs, TPUs) and memory chips translates into a direct, sustained requirement for high-purity quartzware used in the fabrication of these specialized semiconductors. The common expectation is that AI will enhance operational efficiency while simultaneously acting as a primary driver of end-user market growth, leading to higher demand stability and more predictable material consumption patterns.

AI’s role in material science is also a key theme, as advanced algorithms are increasingly utilized to model and predict the performance characteristics of new opaque quartz formulations, focusing on improving thermal gradients and extending component lifespan under extreme conditions. This capability allows manufacturers to expedite R&D cycles and tailor specific quartz properties (e.g., bubble density, wall thickness uniformity) for highly specialized applications like extreme ultraviolet (EUV) lithography systems. By integrating sensor data with machine learning models, manufacturers are moving towards 'smart manufacturing,' where material properties and process parameters are continuously optimized, ensuring that the quartzware meets the increasingly stringent cleanliness and performance metrics required by leading-edge semiconductor nodes.

Ultimately, the consensus among users is that while AI does not directly replace Opaque Fused Quartz components, it fundamentally transforms how the material is produced, utilized, and demanded. The operational efficiencies gained through AI implementation—such as minimizing downtime in diffusion furnaces and optimizing energy usage during the melting phase—will provide a competitive edge to companies that adopt these technologies early. Crucially, the explosion in computational power needed for large language models and other AI applications is directly fueling the construction of new fabrication plants, solidifying AI as the most potent indirect market driver for high-purity opaque fused quartz over the next decade.

- AI optimizes manufacturing yield and quality control in quartz processing via predictive analytics.

- Predictive maintenance systems reduce furnace downtime, extending the operational life of quartz components.

- Machine learning accelerates R&D for new opaque quartz materials with tailored thermal properties.

- The massive computational demand for AI chips (GPUs, TPUs) drives exponential growth in semiconductor fabrication, directly increasing quartzware demand.

- AI-driven supply chain management improves forecasting and inventory optimization for raw silica and finished quartz products.

- Automation enhanced by AI minimizes human contact, ensuring ultra-high purity required for advanced semiconductor nodes.

DRO & Impact Forces Of Opaque Fused Quartz Market

The dynamics of the Opaque Fused Quartz Market are primarily shaped by a powerful confluence of drivers and significant technical restraints, while emerging technological shifts present considerable opportunities. The principal driver is the structural and sustained expansion of the semiconductor industry, specifically the scaling of wafer sizes and the continuous drive for smaller process nodes (e.g., 5nm, 3nm), which necessitates ultra-high purity, thermally stable materials for thermal processing equipment. This demand is further amplified by the global energy transition, which mandates increased efficiency and volume in photovoltaic (PV) cell production, relying heavily on opaque fused quartz components for high-temperature diffusion and annealing processes. The inherent material properties, such as low thermal expansion and chemical inertness, position it as a critical enabling material across these high-growth sectors, ensuring its essential nature in advanced manufacturing.

Despite strong demand, the market faces notable restraints, chiefly the extremely high capital expenditure required for establishing and maintaining high-purity quartz production facilities, which limits market entry and concentrates supply among a few established players. Furthermore, the material itself, while thermally stable, exhibits inherent brittleness, making components susceptible to breakage during rapid thermal cycling or improper handling, leading to significant replacement costs and potential downtime in end-user operations. The manufacturing process is also highly energy-intensive, making profitability vulnerable to fluctuations in global energy prices and increasing regulatory pressure related to environmental sustainability, compelling manufacturers to invest in energy-efficient melting technologies, which adds to the operational overhead.

Opportunities for market expansion are abundant, particularly in niche high-value sectors and specialized material innovation. The growing interest in quantum computing and advanced display technologies (OLED/MicroLED) presents new avenues for specialized quartzware. Manufacturers can capitalize on these opportunities by developing proprietary opaque quartz grades that offer enhanced resistance to specific process chemistries or tailored thermal insulation capabilities. The long-term trajectory of the market suggests that strategic partnerships between quartz suppliers and major semiconductor equipment manufacturers (OEMs) will be crucial to co-develop next-generation products that seamlessly integrate into future fabrication processes, securing long-term revenue streams and addressing the increasingly complex demands of miniaturization.

Segmentation Analysis

The Opaque Fused Quartz Market is segmented primarily based on purity level (Type), functional application, and end-user industry, reflecting the diverse and stringent requirements of its consumer base. Segmentation by Type distinguishes between high-purity and standard-grade quartz, with high-purity materials dominating high-value applications in semiconductor and optical fiber manufacturing where trace element contamination must be minimized to parts per billion (ppb) levels. The high-purity segment typically commands premium pricing due to the rigorous purification processes and stringent quality control necessary to meet advanced manufacturing standards. This segmentation ensures that manufacturers can align their product offerings with the specific performance criteria demanded by various technological applications, maximizing material utility and cost-effectiveness across different industries.

Application segmentation highlights the critical role of opaque fused quartz in thermal processes. Semiconductor Manufacturing, which includes diffusion, oxidation, and annealing processes, represents the largest application segment, relying heavily on opaque quartz for furnace tubes, end caps, and boat carriers that must withstand extended exposure to high temperatures and corrosive gases while maintaining thermal uniformity. The Lighting segment, involving high-intensity discharge lamps and UV curing systems, is another significant consumer, utilizing the material's excellent light diffusion properties. Meanwhile, the Photovoltaic segment, driven by global solar capacity expansion, uses specialized opaque quartz for high-volume diffusion furnaces necessary for producing crystalline silicon solar cells, marking it as a high-growth area.

The complexity of the market necessitates detailed segmentation to accurately capture revenue streams and growth potential across diverse end-use sectors. The Electronics and Semiconductor segment remains the powerhouse, driven by global digital transformation and the constant requirement for new chip architectures. Conversely, the Industrial segment encompasses a broader range of high-temperature heating and metallurgical applications, requiring opaque quartz for reliable insulation and thermal stability in challenging environments. This structured segmentation allows both market participants and investors to dissect market trends, identify lucrative niche markets, and tailor their strategic initiatives toward the most impactful areas of demand generation.

- By Type:

- High Purity Opaque Fused Quartz

- Standard Grade Opaque Fused Quartz

- By Application:

- Semiconductor Manufacturing (Furnace Tubes, Wafer Carriers, End Caps)

- Lighting (Halogen Lamps, UV Curing Systems, High-Intensity Discharge Lamps)

- Solar/Photovoltaic (Diffusion Furnaces, Process Vessels)

- Optical Instruments (Specialized Filters, Shields)

- Industrial and Other High-Temperature Processes

- By End-User Industry:

- Electronics and Semiconductor

- Photovoltaic (Solar)

- Industrial Heating and Metallurgy

- Automotive (Lighting Components)

- Medical and Biotechnology (Sterilization Equipment)

Value Chain Analysis For Opaque Fused Quartz Market

The value chain for Opaque Fused Quartz begins with the upstream segment, dominated by the sourcing and refinement of ultra-high purity natural quartz sand, primarily sourced from limited geological deposits globally. Key upstream activities involve meticulous cleaning, grinding, and chemical purification processes to reduce trace metal impurities (such as Al, Fe, Na, K) to levels below 10 ppm, often reaching ppb levels for semiconductor-grade material. This material preparation is critical, as the purity of the raw silica directly dictates the performance and lifespan of the final opaque quartz product, particularly in thermal stability and resistance to devitrification. Suppliers in this phase, often specialized mining and chemical processing firms, exert significant influence over material costs and availability, forming the foundational layer of the supply chain.

The middle segment encompasses the core manufacturing process, where purified silica powder is subjected to high-temperature fusion (typically electric or gas-fired) to create the opaque fused quartz glass. Manufacturers utilize specialized techniques, often involving specific atmospheric controls or additives, to introduce controlled microscopic bubbles that generate the opaque, milky appearance while maintaining structural integrity. Following the fusion and cooling stages, the resulting billets or ingots undergo complex fabrication processes, including cutting, grinding, polishing, and precise dimensional machining, necessary to produce the final quartzware components like furnace tubes, boats, and plates. This stage is highly capital-intensive and requires specialized expertise in glassworking and precision engineering, defining the competitive landscape among primary quartz product manufacturers.

The downstream segment involves the distribution channel and the interaction with end-users. Distribution often follows a dual path: direct sales channels handle high-volume, custom orders to major semiconductor and photovoltaic equipment OEMs (Original Equipment Manufacturers), ensuring strict adherence to technical specifications and just-in-time delivery. Indirect channels involve specialized distributors or agents who serve smaller industrial customers and replacement part markets. End-user feedback, especially from high-volume semiconductor fabrication plants, is crucial as it influences product design modifications (e.g., thermal resistance enhancements, surface finish improvements). Success in the downstream market hinges on strong technical support, application expertise, and efficient logistics to minimize end-user downtime, thereby ensuring the opaque fused quartz material is effectively integrated into advanced industrial processes.

Opaque Fused Quartz Market Potential Customers

The primary and most lucrative customers for Opaque Fused Quartz are large multinational corporations operating within the high-tech electronics and semiconductor manufacturing sector. These customers include integrated device manufacturers (IDMs) and pure-play foundries that require vast quantities of high-purity quartzware for their wafer processing facilities. Their purchasing decisions are driven by stringent requirements for material purity, dimensional stability, thermal endurance, and supplier reliability, as any material failure or contamination can result in multi-million dollar production losses. These customers typically engage in long-term supply contracts with established quartz manufacturers to secure consistent quality and volume, particularly for critical components like large-diameter furnace tubes and high-load wafer carriers used in diffusion and oxidation steps.

The secondary major segment comprises companies in the rapidly expanding photovoltaic (solar energy) industry. Manufacturers of crystalline silicon solar cells are heavy users of opaque fused quartz, especially for lining the diffusion furnaces required to introduce dopants into silicon wafers. For these customers, cost-effectiveness and durability in high-volume production environments are paramount. While the purity requirements may be slightly less stringent than for advanced semiconductor nodes, the sheer volume of material needed for large-scale solar cell production makes this a significant and steadily growing customer base. Furthermore, industrial furnace manufacturers and equipment integrators who supply the solar industry act as indirect customers, specifying opaque quartz components within their overall equipment designs.

Beyond electronics and solar, other important potential customers include specialized industrial manufacturers, particularly those involved in high-temperature metallurgy, chemical processing, and advanced ceramics. These industries leverage opaque quartz for its insulating properties and chemical inertness in challenging environments, such as laboratory equipment, specialized heating elements, and process vessels where corrosive materials are handled at elevated temperatures. Finally, companies focused on specialized lighting, including manufacturers of high-power UV lamps used in water purification, industrial curing, and photolithography, represent a stable customer segment that values the material's optical diffusion and thermal stability features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.55 Billion |

| Market Forecast in 2033 | USD 4.03 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heraeus, Momentive Technologies, TOSOH, Quartz Scientific, Technical Glass Products, Atlantic Ultraviolet Corporation, Litetec, Jelight Company, Shin-Etsu Quartz Products, Guidinger Quartz, Ohara, CCTY, Feilihua Quartz Glass, Saint-Gobain Quartz, PGO GmbH, Raesch Quarz (Germany) GmbH, Jiangsu Pacific Quartz, Russia Quartz. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Opaque Fused Quartz Market Key Technology Landscape

The technological landscape of the Opaque Fused Quartz Market is characterized by continuous refinement in fusion techniques, sophisticated purification methods, and advanced fabrication technologies designed to meet the escalating demands for purity and precision, especially from the semiconductor industry. Traditional production methods involve high-temperature electric arc melting or flame fusion, but modern manufacturers are increasingly adopting proprietary, energy-efficient melting systems. A key technological focus is the optimization of the controlled bubbling process—the mechanism that creates the opacity—to ensure uniformity of bubble size and density throughout the quartz component. Achieving precise opacity levels is crucial for thermal management applications, as it directly impacts the material's insulating performance and thermal gradient control within diffusion furnaces.

Purity enhancement technologies represent another critical area of innovation. Manufacturers are utilizing advanced chemical leaching and washing protocols on raw silica sand to reduce metallic impurities to levels below 10 ppb, which is essential for components used in sensitive processes like atomic layer deposition (ALD) and high-K gate dielectric formation. Furthermore, post-fusion technologies, specifically ultra-precision machining and surface treatment, are vital. The finished quartzware must possess extremely smooth surfaces and tight dimensional tolerances to prevent particle generation and ensure compatibility with automated wafer handling systems. New machining techniques, including advanced CNC milling and laser-assisted shaping, are being employed to fabricate complex, large-format components required for 300mm and future 450mm wafer processing.

A recent technological push involves developing doped opaque fused quartz materials. By intentionally introducing small amounts of specific elements, manufacturers can tailor the material's properties, such as improving resistance to devitrification (crystallization) at sustained high temperatures or altering the thermal expansion coefficient for better integration with other furnace materials. Moreover, the integration of advanced sensor technology into the manufacturing workflow allows for real-time monitoring of thermal profiles during the fusion process, ensuring batch-to-batch consistency and minimizing structural flaws. This technological drive towards material customization and process control is crucial for maintaining performance competitiveness in the high-stakes, technologically demanding end-user markets.

Regional Highlights

The Opaque Fused Quartz Market displays significant regional variation in terms of consumption, manufacturing concentration, and growth trajectory, largely mirroring the global distribution of advanced manufacturing capabilities, particularly in semiconductors and solar energy. Asia Pacific (APAC) stands out as the undisputed leader in both market size and forecasted growth rate. This dominance is directly attributable to the overwhelming presence of semiconductor fabrication plants (fabs) in countries like China, Taiwan, South Korea, and Japan, which are aggressively expanding their production capacities to meet global demand for consumer electronics, 5G technology, and AI hardware. China, in particular, is witnessing massive governmental and private investment in its domestic semiconductor supply chain, ensuring sustained, high-volume demand for quartzware.

North America and Europe represent mature, high-value markets, characterized by demand for ultra-high-purity quartz essential for specialized applications, R&D, and defense technologies. North America’s growth is receiving a boost from federal initiatives aimed at revitalizing domestic chip manufacturing (e.g., the CHIPS and Science Act), fostering the construction of new mega-fabs that require substantial initial and recurring supplies of opaque fused quartz. European consumption, while stable, focuses heavily on advanced industrial applications, precision optics, and maintaining existing semiconductor facilities. Manufacturers in these regions often emphasize material customization and technical superiority over high-volume cost efficiency, catering to niche markets with highly specific material requirements.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but are exhibiting promising growth potential. The MEA region’s expansion is tied to nascent but growing renewable energy projects, particularly solar power installations, which indirectly drive demand for photovoltaic equipment requiring quartz components. Latin America’s market growth is slower but steady, supported by general industrial maintenance and specialized manufacturing sectors. Overall, global market trends indicate a geographic shift in production and consumption towards APAC, necessitating that key global quartz manufacturers establish robust regional operational footprints to service this high-growth area effectively while maintaining established supply chains in Western markets.

- Highlight key countries or regions and their market relevance:

- Asia Pacific (APAC): Dominant market share due to semiconductor manufacturing hubs (Taiwan, South Korea, China) and large-scale photovoltaic production. Highest CAGR forecasted.

- North America: Significant demand driven by federal investment (CHIPS Act), R&D, aerospace, and specialized, ultra-high-purity quartz requirements.

- Europe: Stable, mature market focusing on high-precision industrial applications, established semiconductor foundries, and advanced lighting systems.

- China: Major driver of regional growth due to massive domestic semiconductor capacity expansion and solar industry scaling.

- South Korea & Taiwan: Critical hubs for leading-edge semiconductor node fabrication, demanding the most advanced quartz materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Opaque Fused Quartz Market.- Heraeus

- Momentive Technologies

- TOSOH Corporation

- Shin-Etsu Quartz Products Co., Ltd.

- Saint-Gobain Quartz

- Quartz Scientific, Inc.

- Technical Glass Products, Inc.

- Atlantic Ultraviolet Corporation

- Litetec

- Jelight Company, Inc.

- Guidinger Quartz

- Ohara Corporation

- CCTY

- Feilihua Quartz Glass Co., Ltd.

- PGO GmbH

- Raesch Quarz (Germany) GmbH

- Jiangsu Pacific Quartz Co., Ltd.

- Russia Quartz

- Q Silicium

- Cotronics Corporation

Frequently Asked Questions

Analyze common user questions about the Opaque Fused Quartz market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Opaque Fused Quartz and Transparent Fused Quartz?

The primary difference lies in the microstructure and optical properties. Transparent fused quartz is clear and homogenous, used when light transmission is necessary. Opaque fused quartz contains millions of microscopic air bubbles trapped during the melting process, giving it a milky, non-transparent appearance. This structure significantly lowers its thermal conductivity, making it an excellent thermal insulator preferred for high-temperature furnace lining and thermal shielding in semiconductor and solar applications.

Which application segment drives the largest demand for Opaque Fused Quartz?

The Semiconductor Manufacturing segment currently drives the largest demand for Opaque Fused Quartz. It is critical for the thermal processing steps (diffusion, oxidation, annealing) required in wafer fabrication. As semiconductor technology scales down and requires larger wafer sizes (300mm), the demand for high-purity opaque quartz furnace tubes, end caps, and boat carriers continues to escalate rapidly due to its unparalleled thermal stability and chemical inertness under extreme operating conditions.

What are the key purity concerns regarding Opaque Fused Quartz in high-tech manufacturing?

Key purity concerns revolve around minimizing trace metallic impurities (such as alkali metals, iron, and aluminum) which can leach onto silicon wafers during high-temperature processing, leading to device defects and reduced chip yield. Semiconductor-grade opaque quartz must maintain purity levels often below 10 parts per billion (ppb). Manufacturers continuously invest in advanced purification techniques and non-contaminating fabrication processes to meet the stringent cleanliness standards of leading-edge technology nodes.

How do global energy prices impact the production cost of Opaque Fused Quartz?

Global energy prices have a significant impact because the production of Opaque Fused Quartz is extremely energy-intensive, requiring sustained high temperatures (over 1700°C) for the fusion of silica sand. Energy costs, particularly electricity or specialized gases used in arc or flame fusion, constitute a substantial portion of the overall manufacturing expenditure. Volatility in energy markets can directly translate into fluctuations in the final price of quartzware, impacting profitability and supply chain stability.

Which geographic region is expected to experience the fastest growth in the Opaque Fused Quartz Market?

Asia Pacific (APAC) is projected to experience the fastest growth in the Opaque Fused Quartz Market through 2033. This acceleration is driven by aggressive capital expenditure on new semiconductor fabrication plants, particularly in China, Taiwan, and South Korea, coupled with the exponential growth in the region's solar cell production capacity, collectively creating a massive, localized requirement for high-temperature quartz components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager