Open Cup Flash Point Testers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434968 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Open Cup Flash Point Testers Market Size

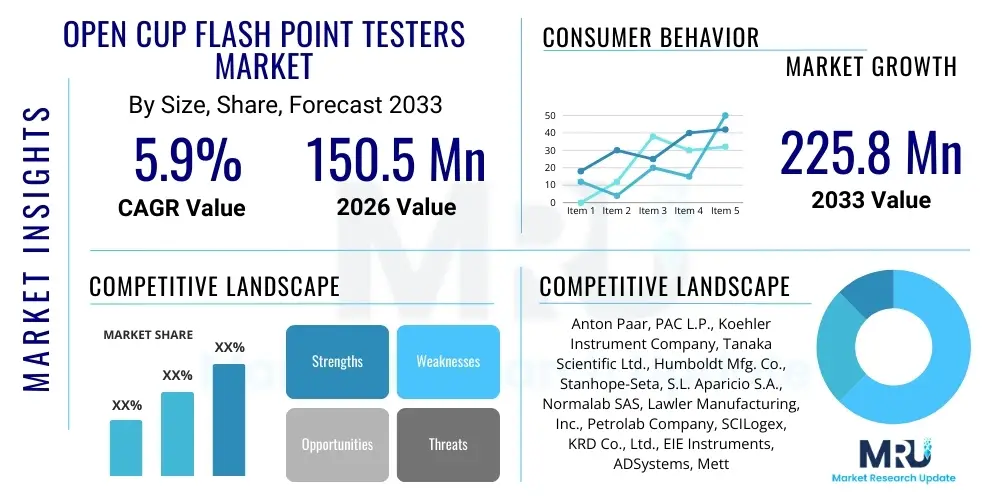

The Open Cup Flash Point Testers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.9% between 2026 and 2033. The market is estimated at USD 150.5 Million in 2026 and is projected to reach USD 225.8 Million by the end of the forecast period in 2033.

Open Cup Flash Point Testers Market introduction

The Open Cup Flash Point Testers Market encompasses devices used to determine the lowest temperature at which a volatile material’s vapor ignites when exposed to an open flame under specified conditions. This critical safety parameter, typically measured using methods like the Cleveland Open Cup (COC) standard (ASTM D92/ISO 2592), is indispensable across various industrial sectors dealing with flammable liquids, including lubricants, heavy oils, bitumen, and certain solvents. These testers are crucial for ensuring compliance with international safety and transportation regulations, verifying product quality, and assessing the fire hazard potential of substances. The market growth is inherently tied to stringent global safety mandates and the continuous expansion of petrochemical refining and lubricant manufacturing industries.

Open Cup Flash Point Testers are categorized generally into manual and automated systems. Manual testers require operator interaction for heating, ignition, and observation, offering a cost-effective solution often used in smaller labs or educational settings. Conversely, automated testers utilize microprocessors, electric heating, and automated dipping devices, providing enhanced precision, repeatability, and safety, while minimizing human error and reducing operator exposure to hazardous vapors. The shift towards automated systems, driven by demands for higher throughput and data integrity in sophisticated R&D and quality control laboratories, is a major trend shaping market dynamics. These instruments play a vital role in preventing catastrophic industrial accidents and maintaining supply chain stability by certifying material safety specifications.

Major applications of Open Cup Flash Point Testers include quality control in the production of engine oils, hydraulic fluids, and insulating oils, where maintaining a specific flash point is crucial for operational safety and regulatory adherence. Furthermore, the testers are heavily utilized in the transportation sector to classify materials for shipping, ensuring that liquids with dangerous volatility levels are handled appropriately. Benefits derived from using reliable open cup testers include enhanced workplace safety, precise regulatory compliance, reduced product liability risks, and optimized manufacturing processes through accurate material characterization. The inherent driving factors include increasing complexity in industrial formulations, stricter environmental, health, and safety (EHS) regulations globally, and the consistent need for preventative maintenance in critical infrastructure.

Open Cup Flash Point Testers Market Executive Summary

The Open Cup Flash Point Testers Market is positioned for stable growth, underpinned by escalating global safety regulations and the sustained demand for high-performance lubricants and petroleum products, particularly in emerging economies. Key business trends indicate a strong market shift towards fully automated, ruggedized testing systems that offer digital data logging, remote monitoring capabilities, and compliance with multiple international standards (ASTM, ISO, IP). Manufacturers are focusing heavily on developing software integration and calibration routines that simplify validation processes and enhance operational efficiency, addressing the perennial industry challenge of inter-laboratory result variability. The competitive landscape is characterized by innovation in sensor technology and cooling systems, designed to improve the speed and accuracy of high-temperature flash point determinations typical of heavy fuels and asphalt binders, thereby cementing their utility in critical sectors.

Regional trends reveal that North America and Europe currently represent mature markets, dominating in terms of technology adoption, driven by rigorous established safety standards (such as OSHA and REACH) and high levels of industrial automation across their chemical and energy sectors. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate throughout the forecast period. This acceleration is fueled by massive infrastructure development, rapid industrialization, burgeoning automotive manufacturing, and subsequent rising demand for quality lubricants in countries like China, India, and Southeast Asia. Regulatory harmonization efforts across these rapidly industrializing nations are compelling local manufacturers to adopt certified testing equipment, boosting market penetration for advanced testers. Latin America and MEA are seeing steady, moderate growth, primarily driven by investments in oil and gas exploration and refining capacities.

Segmentation trends highlight the increasing dominance of the Automated Open Cup Testers segment due to their superior efficiency, safety features, and reliability compared to traditional manual methods. While manual testers retain relevance in specific segments focused on cost sensitivity or infrequent testing, the overall market trajectory points toward automation as the standard for critical quality control and research applications. Application-wise, the Petrochemicals segment maintains the largest market share, given the sheer volume and diversity of volatile petroleum products requiring flash point determination. However, the Solvents and Paints & Coatings sectors are showing significant uptake, driven by regulatory efforts to manage volatile organic compounds (VOCs) and ensure the safe handling of industrial chemicals and consumer products.

AI Impact Analysis on Open Cup Flash Point Testers Market

Common user questions regarding AI’s impact on Open Cup Flash Point Testers center on whether artificial intelligence can replace physical testing, how AI can improve the accuracy and speed of results, and the feasibility of using AI to predict flash points based on chemical composition. Users are keen to understand if machine learning (ML) models can analyze vast historical testing data and chemical structure databases to flag potential testing anomalies or optimize equipment maintenance schedules. There is also significant curiosity about integrating AI-driven predictive modeling into product formulation and R&D processes, potentially reducing the reliance on time-consuming, repetitive physical measurements for routine samples. Concerns often revolve around data security, the high initial investment required for AI integration, and the validation of AI-derived predictions against established regulatory standards, such as those set by ASTM and ISO, which currently mandate physical measurements for compliance.

The primary impact of AI currently lies not in replacing the physical open cup test itself, but in enhancing the ecosystem surrounding the testing process. AI and ML algorithms are being deployed for advanced data analysis, improving the reliability of automated systems by identifying subtle trends in raw sensor data that might indicate equipment drift or sample contamination. This leads to predictive maintenance capabilities, reducing unexpected downtime and improving the overall utilization rate of expensive automated testers. Furthermore, AI is crucial in quality assurance by correlating flash point results with other measured properties (e.g., viscosity, density) across different batches, providing a holistic view of product consistency and immediately alerting operators to statistically improbable or out-of-spec results before product release.

Looking ahead, AI’s predictive modeling capabilities are poised to revolutionize the R&D phase, particularly in the blending and formulation of complex mixtures like biofuels and custom lubricants. While regulatory approval will continue to require physical testing, AI can drastically cut down the number of experimental blends needed to achieve a target flash point, accelerating innovation cycles. By learning from millions of data points on chemical inputs and corresponding test outputs, AI models can offer instant, highly accurate estimations of flash points for novel compositions, guiding chemists efficiently. This transition enhances data utility, moves the process from reactive quality control to proactive predictive formulation, and fundamentally shifts how volatility specifications are managed in large industrial enterprises.

- AI enhances predictive maintenance for automated testers, minimizing downtime and optimizing calibration schedules.

- Machine learning algorithms improve data analysis by identifying subtle anomalies in test results and sensor feedback.

- AI-driven predictive modeling accelerates product formulation and R&D by estimating flash points for novel chemical mixtures.

- Integration of AI with Laboratory Information Management Systems (LIMS) automates compliance reporting and audit trail generation.

- AI supports quality control by correlating flash point data with other physical properties across production batches for consistency checks.

DRO & Impact Forces Of Open Cup Flash Point Testers Market

The market for Open Cup Flash Point Testers is primarily driven by stringent global regulatory frameworks mandating the determination of flash points for safety classification, storage, and transportation of flammable materials, particularly within the petrochemical and chemical industries. Restraints include the high initial capital cost associated with purchasing and maintaining advanced automated systems, alongside the technical complexity requiring specialized operator training. Opportunities arise from the increasing market demand for biofuels and sustainable lubricants, which necessitates new and often higher-temperature testing procedures, stimulating innovation in automated equipment design. The core impact forces influencing the market trajectory are the continuous evolution of industrial safety standards, the push for greater automation in laboratory environments, and fluctuations in raw material pricing that affect the operational expenditure of end-user industries.

A primary driver is the pervasive and non-negotiable requirement for safety compliance across all jurisdictions, dictating that manufacturers must adhere to internationally recognized standards like ASTM D92 (Cleveland Open Cup method). This ensures that products such as heavy fuel oils, asphalt, and transformer oils are tested rigorously for thermal stability and fire risk. The growing emphasis on quality assurance in high-stakes applications, such as aerospace and power generation, further elevates the importance of reliable flash point determination. Conversely, the market faces restraints due to the inherent trade-off between speed and accuracy; while manual methods are cheap, they are prone to significant operator error, and sophisticated automated systems, while highly accurate, present a substantial procurement barrier for smaller or budget-constrained testing facilities and emerging market entrants. Furthermore, the regulatory inertia associated with revising decades-old testing standards can sometimes impede the rapid adoption of potentially superior, but non-standardized, rapid testing technologies.

Significant opportunities are emerging from the shift towards cleaner energy sources and specialized chemical manufacturing. The formulation of new generation lubricants designed for extreme operating conditions (e.g., electric vehicle fluids or advanced wind turbine gear oils) often requires testing at higher temperature ranges, pushing manufacturers to develop more robust and precise instrumentation. Moreover, the integration of IoT (Internet of Things) capabilities into testers offers an opportunity for remote diagnostics, real-time data streaming, and seamless integration with LIMS, enhancing global service capabilities and reducing reliance on localized technical expertise. The impact forces are continually being shaped by competitive pressures favoring manufacturers who can demonstrate superior test repeatability (low standard deviation), fast cooling cycles for high-throughput environments, and comprehensive software solutions that streamline compliance documentation, positioning reliability and ease of use as paramount market differentiators.

- Drivers:

- Strict international safety and environmental regulations (ASTM, ISO, REACH) mandating flash point determination.

- Increasing demand for quality control and assurance in the petrochemical and lubricant manufacturing sectors.

- Expansion of critical industrial applications requiring high-performance, thermally stable fluids (e.g., aerospace, power).

- Restraints:

- High initial capital investment required for sophisticated automated flash point testing equipment.

- Need for specialized technical training and skill maintenance for operating and calibrating advanced testers.

- Potential for regulatory lag in adopting novel, non-standardized rapid testing methodologies.

- Opportunities:

- Growing market for high-temperature testing of new generation biofuels, asphalt, and specialized synthetic lubricants.

- Integration of IoT and digitalization (remote monitoring, LIMS integration) for enhanced operational efficiency.

- Development of portable, robust testers suitable for field testing and remote quality assurance applications.

- Impact Forces:

- Regulatory compliance mandates.

- Technological advancements in automation and sensor sensitivity.

- Industry focus on minimizing operator exposure to volatile organic compounds (VOCs).

Segmentation Analysis

The Open Cup Flash Point Testers market is fundamentally segmented based on the degree of automation (Type) and the primary industrial end-user (Application), with geography providing the critical regional context. The Type segmentation divides the market into Manual and Automated Open Cup Testers, reflecting different budgetary constraints, throughput needs, and labor efficiencies required by various users. Automated testers are capturing market share rapidly due to their safety, precision, and ease of compliance documentation, driving innovation in sensor technology and software integration. Manual testers, while declining in relative market volume, remain vital in educational settings and in industrial processes where testing frequency is low or specific non-automated methods are required by legacy standards.

Segmentation by Application reveals the significant reliance of key industries on flash point testing. The Petrochemicals sector, encompassing refining, blending, and distribution of fuels and heavy oils, is the largest consumer. The reliable measurement of flash points is a non-negotiable step in certifying product batches before they enter the supply chain. Other crucial segments include Pharmaceuticals and Solvents, where volatility control is crucial for both product efficacy and manufacturing safety. The Paints and Coatings industry relies heavily on open cup methods to classify industrial thinners and paint components to meet transportation and safety data sheet (SDS) requirements, ensuring that materials comply with global standards for flammability hazard assessment.

Understanding these segment dynamics is paramount for market participants. Manufacturers are increasingly tailoring their product lines to specific application needs, such as ruggedized, high-temperature automated testers explicitly designed for bitumen and asphalt applications, or smaller, portable units targeted at field testing for environmental compliance. The trend toward customized solutions reflects the diverse regulatory and operational environments faced by end-users. As new formulations, particularly in the realm of sustainable fuels and specialized industrial lubricants, gain prominence, the demand for adaptable, high-precision automated testers capable of handling complex matrices will continue to grow across all key application segments.

- By Type:

- Manual Open Cup Testers

- Automated Open Cup Testers

- By Application:

- Petrochemicals

- Pharmaceuticals

- Paints and Coatings

- Solvents

- Food and Beverages

- Others (e.g., Environmental Testing, Specialty Chemicals)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Open Cup Flash Point Testers Market

The value chain for Open Cup Flash Point Testers begins with upstream activities, primarily involving the sourcing and processing of high-precision electronic components, sophisticated sensor technologies (especially for automated temperature sensing and flame detection), and specialized materials resistant to high heat and chemical corrosion, such as stainless steel and ceramic parts. Key upstream suppliers include manufacturers of platinum resistance thermometers (PRTs), microprocessors, and specialized heating elements. Maintaining robust quality control at this stage is crucial, as the performance and longevity of the final testing equipment heavily depend on the reliability and accuracy of these core components. Furthermore, software development, particularly for automated models, forms a significant upstream intellectual component, ensuring compliance with evolving digital standards like LIMS connectivity and data security protocols.

The midstream segment involves the core manufacturing, assembly, and rigorous calibration of the flash point testers. Leading market players engage in proprietary research and development to enhance test methodology, speed, and safety features. Manufacturing processes emphasize precision engineering to meet stringent measurement tolerances required by standards organizations. Distribution channels are typically a mix of direct sales to large, integrated oil and gas companies or national testing laboratories, and indirect sales through a network of specialized technical distributors. These distributors often provide localized sales support, installation, and essential after-sales calibration and maintenance services, which are critical components of the total cost of ownership for end-users, especially in geographically dispersed markets.

Downstream analysis focuses on the final end-users and their consumption patterns. The largest consumers are large-scale petrochemical refineries and independent testing laboratories (ITLs). Procurement decisions are often driven by regulatory requirements, brand reputation (due to the need for traceable calibration and service), and the throughput demands of their quality control operations. After-market services, including routine calibration checks, certified spare parts, and software updates, constitute a significant portion of the downstream value. The overall efficiency and profitability of the value chain are increasingly impacted by the necessity of swift, high-quality technical support, which ensures minimal operational disruption for continuous industrial processes. The indirect distribution network provides essential localized expertise for highly regulated industries.

Open Cup Flash Point Testers Market Potential Customers

The primary consumers and end-users of Open Cup Flash Point Testers are entities that manufacture, process, store, or transport volatile and flammable liquids, requiring mandatory testing for safety and classification purposes. Integrated oil and gas companies (IOCs and NOCs) represent the largest customer base, using these testers extensively at refineries, blending plants, and research facilities for quality control of heavy fuels, lubricants, and asphalt products. Independent testing laboratories (ITLs) and commercial contract laboratories also form a major customer segment, servicing smaller manufacturers, facilitating third-party verification for trade, and conducting regulatory compliance testing on behalf of various clients across multiple industries, including environmental and consumer product safety.

Beyond the core energy sector, significant procurement comes from the specialty chemicals and manufacturing sectors. This includes paint and coatings manufacturers who must accurately determine the flash point of solvents, thinners, and finished products to ensure compliance with volatile organic compound (VOC) regulations and transportation safety standards. Similarly, pharmaceutical manufacturers utilize flash point testing, especially for volatile ingredients, cleaning solvents, and reagents used in production processes, ensuring workplace safety and product purity. The chemical industry’s constant development of new formulations, such as specialized hydraulic fluids, heat transfer oils, and industrial cleaning agents, maintains a steady demand for precise and reliable testing apparatus.

An emerging customer segment includes academic and research institutions, and governmental agencies focused on standards development and public safety. These entities use open cup testers for basic material research, forensic analysis, fire investigations, and training future industry professionals. Furthermore, organizations involved in the burgeoning biofuels and sustainable energy sectors represent a growing customer base, as these novel fuels often require rigorous and sometimes customized high-temperature flash point testing to ensure their safe integration into existing infrastructure. Ultimately, any organization whose operational safety, insurance liability, or legal standing depends on certifying the flammability characteristics of its raw materials or finished goods is a potential customer for these testing instruments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.5 Million |

| Market Forecast in 2033 | USD 225.8 Million |

| Growth Rate | 5.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Anton Paar, PAC L.P., Koehler Instrument Company, Tanaka Scientific Ltd., Humboldt Mfg. Co., Stanhope-Seta, S.L. Aparicio S.A., Normalab SAS, Lawler Manufacturing, Inc., Petrolab Company, SCILogex, KRD Co., Ltd., EIE Instruments, ADSystems, Mettler Toledo, Julabo GmbH, Laboquest, Atlas Material Testing Technology, Linetronic Technologies SA, Wilmad-LabGlass |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Open Cup Flash Point Testers Market Key Technology Landscape

The technology landscape for Open Cup Flash Point Testers is defined by a progressive shift from basic manual apparatus toward highly integrated, automated systems designed for high precision and operator safety. The core technological advancement revolves around precise temperature control systems, utilizing advanced PID (Proportional-Integral-Derivative) controllers and highly accurate platinum resistance thermometers (PRTs) to ensure the heating rate adheres strictly to international standards like ASTM D92. Modern automated testers incorporate electric igniters (often resistance wire or gas-fed) that are automatically positioned and dipped at defined temperature intervals, eliminating the subjectivity and variability inherent in manual flame application and observation, which has historically been a major source of error.

A significant trend involves enhanced safety features and digitalization. Automated systems now routinely include advanced vapor detection sensors, automatic fire suppression capabilities (for accidental ignition beyond the standard test), and sophisticated cooling systems (often forced air or Peltier technology) to expedite the return to ambient temperature, thereby increasing sample throughput. Digitalization is manifested through high-resolution touch screens for intuitive operation, onboard memory for storing hundreds of test results, and robust connectivity features (Ethernet, USB, RS-232). This connectivity facilitates seamless integration with Laboratory Information Management Systems (LIMS), enabling automated data logging, audit trail generation, and compliance reporting, which are critical for regulated industries such as pharmaceuticals and petrochemicals.

Furthermore, the development of robust, specialized accessories designed for unique sample matrices is crucial. This includes customized cups and accessories for testing highly viscous materials like asphalt and bitumen, ensuring proper sample homogeneity and heat transfer during the test cycle. Manufacturers are also focusing on portable and ruggedized versions that maintain ASTM precision but are suitable for field verification and remote site testing, supporting pipeline operations and remote quality assurance needs in the logistics sector. The competitive technological edge increasingly lies in the development of proprietary algorithms for enhanced test result stability and software features that guide the operator through complex, multi-stage testing protocols with minimal input, reducing the reliance on highly skilled labor.

Regional Highlights

North America holds a substantial share of the Open Cup Flash Point Testers Market, driven by the presence of a mature petrochemical industry, extensive manufacturing capacity, and the earliest and strictest adoption of regulatory standards enforced by entities such as OSHA and EPA. The demand here is concentrated heavily in automated, high-end testers, reflecting the region's emphasis on high throughput, zero-tolerance for operational errors, and widespread use of advanced LIMS integration. The U.S. and Canada, with their significant oil refining and chemical processing operations, are key consumption centers, continually investing in replacing older manual equipment with state-of-the-art automated testing facilities to maintain global competitiveness and safety mandates.

Europe represents another key region, characterized by robust regulatory oversight (especially under EU directives like REACH) and a strong focus on quality in specialized chemical manufacturing and automotive fluids. Germany, France, and the UK are major consumers, particularly within the development of synthetic lubricants and complex specialty chemical formulations. The European market exhibits a high demand for instruments offering certified calibration traceability and compliance with both ISO and national standards. The trend in Europe is toward environmentally friendly, low-solvent cleaning processes, which still require precise flash point determination for new, often specialized, cleaning agents and industrial fluids, driving demand for technologically sophisticated instruments.

Asia Pacific (APAC) is anticipated to be the fastest-growing market globally. This exponential growth is attributed to rapid industrialization, massive investments in infrastructure (roads, energy), and the exponential growth of the automotive sector, particularly in China and India. The expanding middle class in APAC drives demand for petroleum products and coatings, necessitating massive scaling of quality control capabilities. While price sensitivity remains a factor, increasing regulatory enforcement and harmonization of standards within countries like China and South Korea are rapidly pushing local manufacturers to upgrade from manual or basic equipment to certified automated open cup testers. The growing production and use of bitumen and asphalt for extensive road networks make the COC method particularly vital in this region.

Latin America (LATAM) and the Middle East and Africa (MEA) offer moderate but steady growth opportunities. LATAM’s demand is largely driven by national oil companies and infrastructure projects, requiring quality assessment of locally refined and imported fuels. MEA, especially the Gulf Cooperation Council (GCC) countries, is critical due to its central role in global crude oil production and refining. These regions demand robust, reliable testers for continuous quality control in high-volume export operations. The investment is often concentrated in high-temperature testing equipment suitable for heavy crude derivatives and specialized bunker fuels, reflecting the regions' focus on deep-sea shipping and high-volume refining activities.

- North America: Dominates high-end automated tester adoption due to strict environmental and workplace safety regulations (OSHA, EPA) and advanced LIMS integration requirements in the petrochemical sector.

- Europe: Focuses on highly certified, traceable equipment driven by rigorous EU regulations (REACH) and demand from specialty chemical and automotive lubricant R&D.

- Asia Pacific (APAC): Fastest growing region, fueled by massive infrastructure development, rapid industrialization in China and India, and rising regulatory compliance pressure on local manufacturers.

- Middle East and Africa (MEA): Steady growth linked to large-scale crude oil refining, export operations, and quality control for heavy fuel oils and asphalt production.

- Latin America (LATAM): Moderate growth supported by national oil company investments and expanding transportation fuel requirements, focusing on essential quality assurance measures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Open Cup Flash Point Testers Market.- Anton Paar

- PAC L.P.

- Koehler Instrument Company

- Tanaka Scientific Ltd.

- Humboldt Mfg. Co.

- Stanhope-Seta

- S.L. Aparicio S.A.

- Normalab SAS

- Lawler Manufacturing, Inc.

- Petrolab Company

- SCILogex

- KRD Co., Ltd.

- EIE Instruments

- ADSystems

- Mettler Toledo

- Julabo GmbH

- Laboquest

- Atlas Material Testing Technology

- Linetronic Technologies SA

- Wilmad-LabGlass

Frequently Asked Questions

Analyze common user questions about the Open Cup Flash Point Testers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Open Cup and Closed Cup Flash Point Testers?

Open cup testers, like the Cleveland Open Cup (COC), determine the flash point when the vapor is exposed to the ambient atmosphere, typically used for higher flash point products like lubricating oils and heavy fuels. Closed cup testers, such as Pensky-Martens, measure flash point in a sealed environment, providing a more conservative (lower) result and are used for volatile fuels and solvents.

Which industry accounts for the largest demand for Open Cup Flash Point Testers?

The Petrochemical industry, encompassing oil refining, fuel blending, asphalt manufacturing, and lubricant production, is the largest consumer of Open Cup Flash Point Testers due to the strict regulatory necessity of determining the fire hazard and thermal stability of heavy petroleum derivatives.

Are automated flash point testers more reliable than manual units?

Automated flash point testers offer significantly higher reliability and repeatability because they eliminate human factors such as subjective observation, inconsistent flame application, and variability in heating rates, ensuring strict adherence to the defined ASTM or ISO standards.

How does the adoption of new sustainable fuels impact the market for these testers?

The adoption of new sustainable fuels (like biofuels and advanced synthetic lubricants) drives demand for Open Cup Testers that can handle complex matrices and often require higher testing temperatures, pushing manufacturers toward advanced, precise, and high-temperature automated equipment.

What key safety features are mandatory in modern Open Cup Flash Point Testers?

Modern automated testers incorporate critical safety features including automated ignition systems, built-in fire suppression mechanisms, automatic shut-off functionalities in case of abnormal operation, and enclosed hoods or ventilation connections to manage hazardous volatile organic compounds (VOCs) released during testing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager