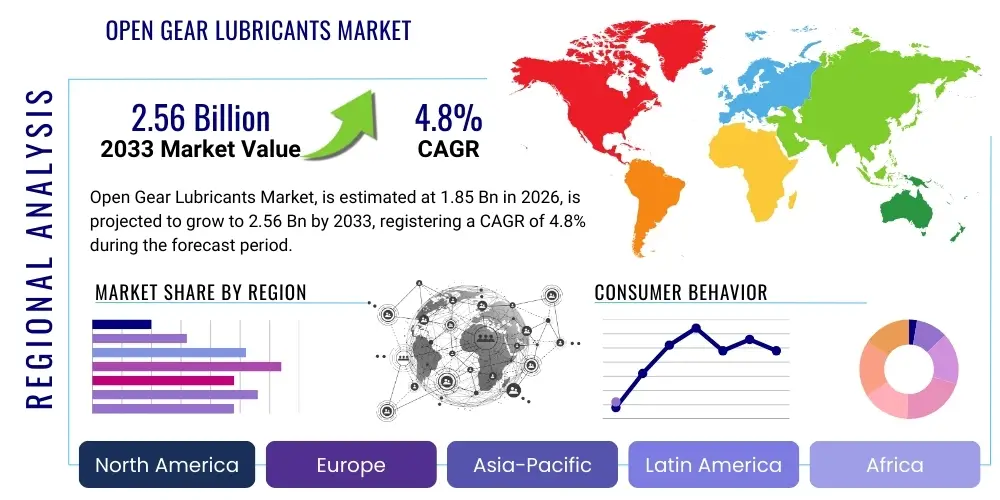

Open Gear Lubricants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439908 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Open Gear Lubricants Market Size

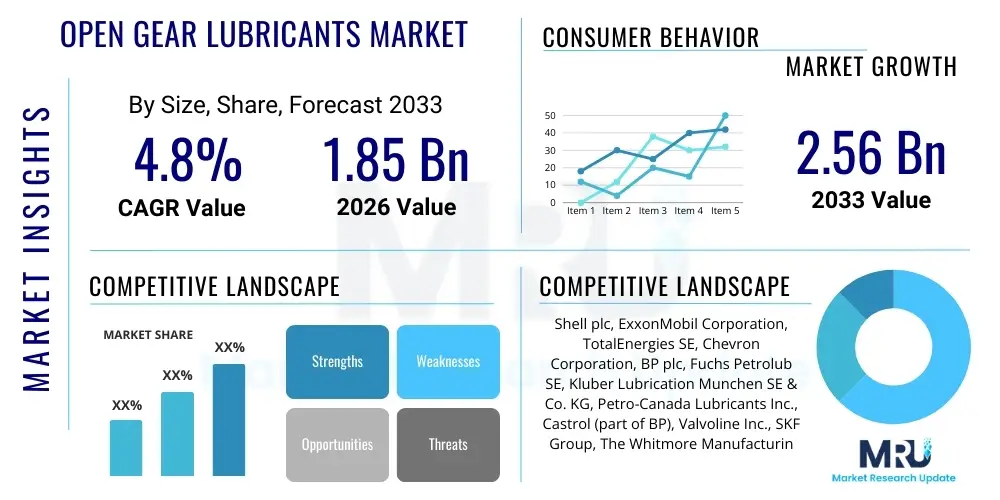

The Open Gear Lubricants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.56 Billion by the end of the forecast period in 2033.

Open Gear Lubricants Market introduction

The Open Gear Lubricants Market encompasses a specialized segment of industrial lubricants designed to protect and enhance the operational efficiency of large, slow-moving gears operating in exposed, heavy-duty environments. These lubricants are critical for machinery in industries such as mining, cement manufacturing, marine operations, and heavy construction, where gears are subjected to extreme pressures, shock loads, and often abrasive contaminants. The product range includes various formulations, such as asphaltic, non-asphaltic, synthetic, and semi-synthetic compounds, each engineered to provide superior adhesion, film strength, and extreme pressure (EP) protection, ensuring minimal wear and extended component life. Key benefits of these lubricants include significant reduction in friction and heat, excellent corrosion resistance, superior load-carrying capacity, and resistance to water wash-off, all contributing to increased machinery uptime and reduced maintenance costs.

The market's continuous evolution is driven by the growing global demand for raw materials, requiring robust and reliable heavy machinery, alongside increasing investments in infrastructure development across developing economies. Furthermore, the focus on enhancing operational efficiency and extending the lifespan of expensive industrial assets pushes manufacturers towards developing more advanced and high-performance lubricant solutions. Environmental regulations are also playing a significant role, prompting innovation towards more sustainable and eco-friendly formulations, while the increasing complexity of industrial applications demands lubricants capable of performing under increasingly challenging conditions. These underlying factors collectively contribute to a robust and dynamic market landscape for open gear lubricants.

Open Gear Lubricants Market Executive Summary

The Open Gear Lubricants Market is characterized by several influential business, regional, and segment trends reflecting its dynamic industrial landscape. Business trends highlight a consolidation among major players, alongside a growing emphasis on R&D for high-performance and environmentally compliant products. Companies are strategically investing in developing lubricants that offer extended service intervals and superior protection under harsh operating conditions, often incorporating advanced additive technologies. The market also observes an increasing demand for comprehensive service packages that include lubrication monitoring and predictive maintenance solutions, moving beyond mere product sales to holistic asset management. Furthermore, supply chain resilience and raw material sourcing strategies are becoming critical competitive differentiators, especially in a globalized yet often volatile economic environment, influencing pricing and product availability.

Regionally, the Asia Pacific continues to be the primary growth engine, fueled by rapid industrialization, significant infrastructure projects, and robust growth in mining and cement sectors in countries like China, India, and Southeast Asia. North America and Europe, while mature markets, demonstrate steady demand driven by stringent maintenance protocols, the need for high-performance lubricants, and a strong pivot towards sustainable and bio-based formulations due to evolving environmental regulations. Emerging markets in Latin America and the Middle East & Africa are also showing considerable potential, buoyed by investments in heavy industries and infrastructure development. Segment trends indicate a rising preference for synthetic and semi-synthetic lubricants due to their superior performance characteristics and longer service life, particularly in applications demanding extreme temperature stability and load-carrying capabilities. Simultaneously, there is a sustained demand for traditional asphaltic and non-asphaltic lubricants in cost-sensitive applications, while bio-based lubricants are gaining traction in niche markets driven by environmental stewardship and regulatory compliance. The mining and metallurgy sector remains the largest application segment, with cement and marine industries also contributing substantially to market demand.

AI Impact Analysis on Open Gear Lubricants Market

User inquiries regarding AI's impact on the Open Gear Lubricants Market frequently revolve around its potential to revolutionize equipment maintenance, optimize lubricant performance, and enhance operational safety and efficiency. Key themes include the application of AI in predictive analytics for gear wear and lubricant degradation, the development of intelligent lubrication systems, and the role of AI in new lubricant formulation and supply chain optimization. There's a strong expectation that AI will lead to more precise lubrication schedules, reduced unscheduled downtime, and the ability to tailor lubricant properties to specific operational demands in real-time. Concerns often relate to the cost of implementing AI solutions, data privacy, and the need for skilled personnel to manage and interpret AI-generated insights, highlighting a balance between technological advancement and practical implementation challenges. Users also anticipate AI contributing to a more sustainable future by minimizing lubricant waste and energy consumption through optimized usage.

- Predictive Maintenance Integration: AI algorithms analyze sensor data from gearboxes (vibration, temperature, oil analysis) to predict potential failures or optimal lubricant change intervals, moving from reactive to proactive maintenance strategies. This significantly reduces downtime and extends equipment lifespan by ensuring lubricants are applied or replaced precisely when needed, based on actual operating conditions rather than fixed schedules.

- Intelligent Lubrication Systems: AI-driven systems can monitor lubricant levels, condition, and consumption in real-time, automatically adjusting dispensing rates or triggering alerts for replenishment or quality checks. These systems optimize lubricant usage, preventing both under-lubrication and over-lubrication, which can lead to waste and environmental concerns.

- Optimized Lubricant Formulation: AI accelerates R&D by simulating molecular interactions and predicting the performance of new lubricant additives or base oil combinations under various stress conditions. This enables faster development of superior, application-specific lubricants that meet stringent performance and environmental criteria, significantly reducing trial-and-error in development.

- Supply Chain and Inventory Optimization: AI improves demand forecasting for open gear lubricants, leading to more efficient inventory management, reduced warehousing costs, and enhanced supply chain resilience. By analyzing historical data, market trends, and operational schedules, AI helps manufacturers and distributors ensure timely availability of products, minimizing stockouts or overstock.

- Enhanced Operational Safety and Environmental Compliance: AI can identify abnormal operational patterns or lubricant degradation that could lead to equipment failure, thus improving workplace safety. Furthermore, by optimizing lubricant consumption and promoting the use of more efficient or bio-degradable formulations through data-driven insights, AI contributes to environmental sustainability by reducing waste and carbon footprint.

DRO & Impact Forces Of Open Gear Lubricants Market

The Open Gear Lubricants Market is influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces that shape its growth trajectory and competitive landscape. Key drivers include the relentless expansion of heavy industries globally, such as mining, cement, and steel, which rely heavily on open gear machinery for critical operations. The increasing focus on extending asset lifespan and reducing maintenance costs in these capital-intensive sectors also fuels demand for high-performance lubricants. Additionally, rapid urbanization and infrastructure development in emerging economies necessitate the extensive use of construction and heavy material handling equipment, further bolstering the market. The advancements in machinery design demanding more sophisticated and robust lubrication solutions, coupled with an escalating awareness among end-users regarding the economic and operational benefits of proper lubrication, are also significant drivers. The implementation of stringent industry standards and safety regulations often mandates the use of specialized, high-quality lubricants, pushing market growth.

However, several restraints pose challenges to market expansion. Volatility in raw material prices, particularly for base oils and specialty additives, directly impacts manufacturing costs and profitability, leading to price fluctuations for end-users. The increasing shift towards sealed gearboxes in certain applications, which require less frequent lubrication or lifetime fills, can marginally reduce the demand for open gear lubricants in those specific niches. Stringent environmental regulations and growing concerns over lubricant biodegradability and toxicity pressure manufacturers to invest heavily in R&D for eco-friendly alternatives, which often come at a higher cost. Furthermore, intense market competition and the presence of numerous regional and international players lead to price wars and compressed profit margins, requiring companies to constantly innovate and differentiate their offerings.

Opportunities within the market largely stem from the development and adoption of bio-based and sustainable lubricant formulations, addressing environmental concerns and catering to niche green industries. The integration of smart lubrication systems and IoT-enabled monitoring solutions presents significant growth avenues, allowing for predictive maintenance and optimized lubricant consumption. Expanding into untapped or rapidly industrializing emerging markets offers substantial potential for market penetration. Furthermore, strategic collaborations and mergers and acquisitions (M&A) activities enable companies to consolidate market share, expand product portfolios, and enhance technological capabilities. The continuous demand for customized lubricant solutions tailored to specific, extreme operating conditions across diverse industries also provides an avenue for specialized product development and market differentiation. These opportunities underscore a dynamic market environment where innovation and strategic adaptation are key to sustained success amidst evolving industrial demands and regulatory landscapes.

Segmentation Analysis

The Open Gear Lubricants Market is comprehensively segmented to provide a detailed understanding of its diverse landscape, identifying key areas of demand and supply dynamics. This segmentation allows for precise market analysis based on various product characteristics, application areas, and end-use industries, reflecting the varied requirements across the global industrial sector. Each segment represents distinct market drivers, competitive forces, and growth opportunities, offering a granular view of where demand is concentrated and how product innovation is tailored to specific needs. Understanding these segments is crucial for manufacturers to optimize their product offerings, marketing strategies, and distribution channels, ensuring alignment with the evolving demands of different industrial applications and geographical regions. This multi-faceted segmentation helps stakeholders identify high-growth niches, assess competitive intensity within sub-markets, and formulate informed business development plans, fostering a more targeted and efficient approach to market participation and expansion.

- By Base Oil:

- Mineral Oil Based: Traditional, cost-effective option for general industrial applications.

- Synthetic Oil Based: Offers superior performance, high thermal stability, and extended service life in extreme conditions.

- Semi-Synthetic Oil Based: Provides a balance of performance and cost-effectiveness.

- Bio-based Oil Based: Environmentally friendly alternatives, gaining traction due to sustainability mandates.

- By Type:

- Asphaltic: Known for excellent adhesion and heavy-duty protection, often dark in color.

- Non-Asphaltic: Clearer formulations, often preferred where cleanliness is important, still offering robust protection.

- Grease: Thicker consistency for specific slow-moving, high-load applications where dripping is a concern.

- By Application:

- Mining and Metallurgy: Crucial for excavators, draglines, ball mills, and crushers.

- Cement Manufacturing: Used in rotary kilns, grinding mills, and raw meal mills.

- Marine: Applied to winches, cranes, and other exposed gear systems on ships and offshore platforms.

- Power Generation: Particularly for wind turbine pitch and yaw gears, and thermal plant conveyors.

- Steel Mills: For various heavy rolling mill gears and handling equipment.

- Heavy Construction: Earthmoving equipment, cranes, and large construction machinery.

- Material Handling: Conveyors, stackers, and reclaimers in various industrial settings.

- Others: Including sugar mills, pulp & paper, and chemical processing.

- By End-Use Industry:

- Heavy Manufacturing: Encompasses steel, cement, and other large-scale production facilities.

- Infrastructure Development: Roads, bridges, ports, and general construction.

- Energy Sector: Traditional and renewable energy production, including wind and thermal power.

- Maritime & Shipping: Commercial vessels, cargo handling, and port operations.

- Mining & Exploration: Extraction and processing of minerals and raw materials.

Value Chain Analysis For Open Gear Lubricants Market

The value chain for the Open Gear Lubricants Market is a complex network involving multiple stages, from raw material sourcing to end-user application, highlighting the critical contributions of various stakeholders. Upstream activities are dominated by the procurement and processing of base oils, which form the bulk of lubricant formulations, alongside the development and manufacturing of sophisticated additive packages. These additives, including extreme pressure (EP) agents, anti-wear compounds, corrosion inhibitors, and tackifiers, are essential for imparting the specific performance characteristics required for open gear applications. Major chemical companies and specialized additive manufacturers play a pivotal role in this segment, investing heavily in research and development to create advanced formulations that meet evolving industrial demands and regulatory standards. The quality and availability of these raw materials directly impact the final product's performance and cost-effectiveness.

Midstream activities primarily involve the lubricant manufacturers, who blend the base oils with various additives in precise ratios to create the final open gear lubricant products. This stage includes stringent quality control, testing, and packaging processes to ensure product consistency, performance, and compliance with industry specifications. Downstream, the distribution channel is crucial for reaching a diverse customer base, ranging from large industrial conglomerates to individual contractors. This typically involves a mix of direct sales to major end-users, where manufacturers engage directly with large mining companies or cement plants, and indirect sales through a network of authorized distributors, agents, and specialized industrial suppliers. These intermediaries often provide additional services such as technical support, inventory management, and localized delivery, acting as a vital link between manufacturers and smaller or geographically dispersed customers. The effectiveness of these distribution channels significantly influences market reach and customer accessibility.

Both direct and indirect distribution channels have distinct advantages and disadvantages within the open gear lubricants market. Direct sales foster stronger customer relationships, allow for customized solutions, and provide manufacturers with direct market feedback, which is invaluable for product development. However, this approach requires significant investment in sales infrastructure and personnel. Indirect channels, on the other hand, offer broader market coverage, particularly in fragmented markets or remote areas, leveraging the existing logistical capabilities and customer relationships of distributors. While indirect channels can involve less control over pricing and customer interaction, they provide a cost-effective way to scale market presence. The optimal strategy often involves a hybrid approach, combining direct engagement with key accounts and utilizing a robust distributor network to serve the wider market. The efficiency and reliability of these distribution channels are paramount for ensuring timely delivery and technical support to industries where lubrication is a critical factor for continuous operation.

Open Gear Lubricants Market Potential Customers

The Open Gear Lubricants Market serves a diverse array of industrial sectors where heavy-duty machinery with exposed gears is fundamental to their operations. The primary potential customers are large-scale industrial entities and their contractors who operate in demanding environments, requiring robust lubrication solutions to ensure equipment longevity and operational continuity. These end-users typically invest heavily in capital equipment and rely on consistent performance to meet production targets and maintain profitability. Their purchasing decisions are often driven by product performance, supplier reliability, technical support, and the total cost of ownership, including factors like extended service intervals and reduced maintenance expenses. The criticality of these lubricants means that customers are often looking for long-term partnerships with suppliers who can offer not just products, but also expertise and tailored solutions. This necessitates a deep understanding of each industry's specific challenges and operational nuances.

Key segments of end-users include mining companies, which utilize open gear lubricants extensively for draglines, shovels, ball mills, and crushers operating under severe conditions involving heavy loads, abrasive dust, and moisture. Cement manufacturing plants are another major consumer, requiring lubricants for massive rotary kilns, raw mills, and grinding mills that operate at high temperatures and pressures. Steel mills rely on these lubricants for various rolling mill gears and material handling systems, where extreme pressure and heat resistance are paramount. The marine industry is a significant segment, with open gear lubricants used on winches, deck cranes, and other exposed gear systems on cargo ships, offshore rigs, and port machinery, where protection against saltwater corrosion and heavy loads is essential. Furthermore, power generation facilities, particularly wind farms, utilize specialized open gear lubricants for the pitch and yaw drive mechanisms of turbines, which are exposed to varying temperatures and require long-term protection. Heavy construction companies also represent a substantial customer base, using these lubricants for large excavators, cranes, and other earthmoving equipment.

Beyond these major industrial players, other potential customers include material handling facilities, sugar mills, pulp and paper manufacturers, and certain chemical processing plants, all of which operate machinery with exposed gear systems. These customers prioritize lubricants that can withstand harsh operating conditions, reduce friction and wear, and protect against environmental contaminants, thereby minimizing unscheduled downtime and optimizing operational efficiency. The long-term performance and reliability of these lubricants are directly linked to the productivity and safety of their industrial processes. Therefore, suppliers must offer products that not only meet technical specifications but also provide robust application support and after-sales service to address the complex operational needs of these diverse industrial clients. This creates a market where strong technical expertise and customer-centric solutions are critical differentiators, allowing suppliers to build enduring relationships with their extensive base of potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.56 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shell plc, ExxonMobil Corporation, TotalEnergies SE, Chevron Corporation, BP plc, Fuchs Petrolub SE, Kluber Lubrication Munchen SE & Co. KG, Petro-Canada Lubricants Inc., Castrol (part of BP), Valvoline Inc., SKF Group, The Whitmore Manufacturing Company, Bel-Ray Company LLC, Molykote (DuPont), Lubrizol Corporation, Croda International Plc, Idemitsu Kosan Co. Ltd., Quaker Houghton, LUBRICATION ENGINEERS, INC., Lubcon GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Open Gear Lubricants Market Key Technology Landscape

The Open Gear Lubricants Market is continuously shaped by advancements in lubrication technology, focusing on enhancing performance, extending equipment life, and meeting increasingly stringent environmental and operational demands. A pivotal area of innovation lies in the development of sophisticated additive packages, which are crucial for imparting specialized properties to the base oils. These include advanced extreme pressure (EP) additives that prevent metal-to-metal contact under heavy loads, anti-wear agents that minimize friction, and tackifiers that ensure superior adhesion of the lubricant to the gear surfaces, preventing sling-off even in high-speed or exposed applications. Furthermore, rust and corrosion inhibitors are essential to protect gears from moisture and chemical attack, especially in marine or high-humidity environments. The continuous research into these additive chemistries allows manufacturers to produce lubricants capable of performing reliably under increasingly harsh and varied operational conditions.

Another significant technological trend involves the formulation of synthetic and semi-synthetic lubricants, which offer superior performance characteristics compared to traditional mineral oil-based products. Synthetic base oils, such as Polyalphaolefins (PAOs) and Esters, provide exceptional thermal stability, wider operating temperature ranges, lower volatility, and extended service intervals, leading to reduced lubricant consumption and maintenance costs. The development of bio-degradable and environmentally acceptable lubricants (EALs) represents a critical technological shift, driven by escalating environmental regulations and corporate sustainability initiatives. These bio-based formulations, often derived from renewable resources like vegetable oils, are designed to minimize environmental impact without compromising critical performance attributes, making them increasingly preferred in sensitive ecosystems like marine and offshore applications. The ongoing refinement of these formulations addresses challenges related to stability and performance, bringing them closer to the efficacy of traditional lubricants.

Beyond the chemical composition, the integration of digital technologies and smart solutions is transforming the application and monitoring of open gear lubricants. IoT (Internet of Things) sensors are increasingly being deployed to monitor critical parameters such as lubricant temperature, pressure, viscosity, and wear particle presence in real-time. This real-time data allows for precise condition monitoring and facilitates predictive maintenance strategies, enabling proactive intervention before catastrophic gear failures occur. Automated lubrication systems, which precisely deliver controlled amounts of lubricant to open gears at optimal intervals, are also gaining traction, ensuring consistent lubrication, reducing human error, and minimizing lubricant waste. Nanotechnology is another emerging area, with ongoing research into incorporating nanoparticles into lubricant formulations to enhance friction reduction, load-carrying capacity, and wear resistance. These technological advancements collectively contribute to greater efficiency, reliability, and sustainability in the maintenance and operation of heavy industrial machinery globally.

Regional Highlights

- North America: This region represents a mature and technologically advanced market for open gear lubricants. Demand is primarily driven by the replacement and maintenance of existing infrastructure in mining, cement, and heavy construction sectors, alongside a strong emphasis on high-performance and environmentally compliant lubricants. Strict environmental regulations and a focus on operational efficiency encourage the adoption of synthetic and bio-based formulations, as well as advanced lubrication monitoring systems. Innovation in lubricant technologies and robust industrial standards are key characteristics of this market.

- Europe: Europe is another mature market characterized by stringent environmental regulations and a strong push towards sustainability. This region exhibits high demand for advanced, eco-friendly, and bio-based open gear lubricants, particularly in marine, wind energy, and heavy industrial applications. Innovation in lubricant chemistry, coupled with a focus on extended service life and reduced environmental footprint, are significant drivers. Countries like Germany, France, and the UK lead in technological adoption and advanced industrial maintenance practices.

- Asia Pacific (APAC): The Asia Pacific region is the fastest-growing market for open gear lubricants, fueled by rapid industrialization, massive infrastructure development projects, and significant growth in the mining, cement, and heavy manufacturing sectors, particularly in China, India, and Southeast Asian countries. The escalating demand for raw materials and energy production necessitates the extensive use of heavy machinery, driving lubricant consumption. While cost-effectiveness remains a key consideration, there's a growing inclination towards performance-enhancing and environmentally conscious solutions.

- Latin America: This region presents a significant market for open gear lubricants, primarily driven by the robust mining industry (e.g., copper in Chile, iron ore in Brazil) and ongoing infrastructure development. Demand is closely tied to commodity prices and investments in heavy industry. The market is characterized by a need for reliable, high-performance lubricants that can withstand challenging operational conditions, with increasing adoption of advanced formulations to optimize asset performance and reduce operational costs.

- Middle East and Africa (MEA): The MEA region is experiencing substantial growth due to significant investments in infrastructure projects, oil & gas exploration, and related industrial development. The demand for open gear lubricants is rising from sectors such as mining, cement, and construction. While cost is an important factor, the need for lubricants that can perform in extreme hot and dusty conditions is paramount, driving the adoption of robust and reliable solutions. Opportunities exist for suppliers offering tailored products and technical support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Open Gear Lubricants Market.- Shell plc

- ExxonMobil Corporation

- TotalEnergies SE

- Chevron Corporation

- BP plc

- Fuchs Petrolub SE

- Kluber Lubrication Munchen SE & Co. KG

- Petro-Canada Lubricants Inc.

- Castrol (part of BP)

- Valvoline Inc.

- SKF Group

- The Whitmore Manufacturing Company

- Bel-Ray Company LLC

- Molykote (DuPont)

- Lubrizol Corporation

- Croda International Plc

- Idemitsu Kosan Co. Ltd.

- Quaker Houghton

- LUBRICATION ENGINEERS, INC.

- Lubcon GmbH

Frequently Asked Questions

What are open gear lubricants and why are they important?

Open gear lubricants are specialized industrial lubricants applied to large, exposed gears that operate in demanding environments, such as those found in mining, cement, and heavy construction machinery. They are crucial for protecting gears from wear, friction, and corrosion under extreme pressures and shock loads. Their importance lies in ensuring the longevity of expensive machinery, reducing unscheduled downtime, and maintaining operational efficiency by forming a robust, adhesive film that withstands harsh conditions and prevents metal-to-metal contact.

What are the key factors driving the Open Gear Lubricants Market?

The Open Gear Lubricants Market is primarily driven by the global growth of heavy industries like mining, cement, and steel, which rely heavily on open gear systems. Increased investments in infrastructure development, a strong focus on extending the operational lifespan of industrial assets, and the need to reduce maintenance costs also significantly contribute to market expansion. Additionally, advancements in machinery design and increasing awareness among end-users regarding the benefits of high-performance lubrication are key growth drivers.

How does AI impact the Open Gear Lubricants Market?

AI impacts the Open Gear Lubricants Market by enabling predictive maintenance, where algorithms analyze sensor data to forecast gear wear and optimal lubricant change intervals, leading to reduced downtime and optimized lubricant consumption. AI also assists in developing new lubricant formulations faster, managing inventory more efficiently, and enhancing operational safety. This technological integration aims to improve overall asset reliability and sustainability within industrial operations.

What are the main types of open gear lubricants?

The main types of open gear lubricants are primarily categorized by their base oil composition and specific formulation characteristics. These include mineral oil-based, synthetic oil-based, semi-synthetic oil-based, and increasingly, bio-based lubricants. Further classification is by type, such as asphaltic (known for strong adhesion and heavy-duty protection), non-asphaltic (often clearer and used where cleanliness is important), and specialized greases for very slow-moving or heavily loaded applications where minimal dripping is desired.

Which industries are the primary consumers of open gear lubricants?

The primary consumers of open gear lubricants are industries that operate heavy-duty machinery with exposed gear systems in challenging environments. These include the mining and metallurgy industry (for excavators, ball mills), cement manufacturing (for rotary kilns and grinding mills), marine industry (for winches and deck cranes), power generation (especially wind turbines), steel mills (for rolling mill gears), and heavy construction (for large earthmoving equipment). These sectors rely on these lubricants for critical equipment protection and continuous operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager