Open Gear Lubrication Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433079 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Open Gear Lubrication Market Size

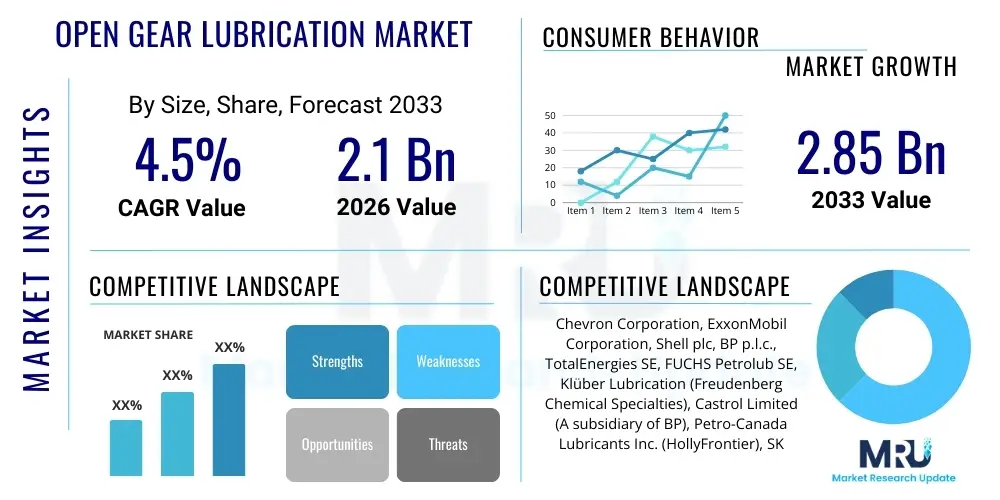

The Open Gear Lubrication Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 2.85 Billion by the end of the forecast period in 2033.

Open Gear Lubrication Market introduction

The Open Gear Lubrication Market encompasses specialized lubricants designed for use in large, slow-moving open gears typically found in heavy machinery across mining, cement, power generation, and marine industries. These gears operate under extreme pressure, high loads, and often in harsh, contaminated environments, requiring lubricants that possess exceptional adhesion, high film strength, and resistance to washout and fling-off. Products range from asphaltic and non-asphaltic compounds to synthetic, semi-synthetic, and biodegradable formulations, all engineered to minimize friction, reduce wear, extend gear life, and enhance operational efficiency.

The primary applications for these high-performance lubricants include ball mills, rotary kilns, draglines, shovels, and various hoisting equipment. The inherent operational challenges of open gears—such as exposed surfaces and high contamination risk—necessitate lubrication systems that provide boundary lubrication and cushion effects under high shock loads. The benefits derived from utilizing optimized open gear lubricants are substantial, including significantly reduced maintenance downtime, decreased power consumption due to lower operating temperatures, and robust protection against premature failure caused by pitting, scoring, and corrosion. The longevity of capital equipment directly correlates with the efficacy of the chosen lubrication solution.

Market growth is predominantly driven by the continuous expansion of infrastructure and heavy industrial sectors globally, particularly in emerging economies where large-scale mining and construction projects are accelerating. Furthermore, stringent environmental regulations are compelling end-users to shift towards cleaner, synthetic, and biodegradable lubricants, propelling innovation in product formulation. The increasing focus on predictive maintenance strategies and total cost of ownership reduction also stimulates demand for premium, long-lasting lubrication products that offer superior performance under severe operating conditions.

Open Gear Lubrication Market Executive Summary

The Open Gear Lubrication Market demonstrates robust growth driven by accelerating industrialization and relentless focus on operational efficiency within heavy industries. Key business trends include the strong shift towards synthetic lubricants offering enhanced thermal stability and extended service intervals, moving away from traditional bitumen-based products due to environmental and application limitations. Furthermore, market consolidation is observed as major global lubricant manufacturers acquire specialized firms to bolster their portfolio of high-performance and environmentally compliant products, aiming for stronger market penetration in Asia Pacific and Latin America.

Regionally, the Asia Pacific dominates the market landscape, primarily fueled by massive investments in mining activities, cement production, and rapidly growing infrastructure projects in China, India, and Southeast Asian nations. North America and Europe, while mature markets, emphasize technological advancements, focusing on automation in lubrication delivery systems (such as automatic spray systems) and the adoption of bio-based lubricants to meet strict regulatory mandates. The Middle East and Africa represent promising growth pockets driven by expanding cement manufacturing capabilities and mineral extraction ventures.

Segment trends reveal that the synthetic oil segment is outpacing conventional mineral oil growth due to superior performance characteristics required by modern, high-intensity machinery. By application, the mining and mineral processing sector holds the largest market share, requiring durable lubricants capable of handling severe shock loads and extreme contamination. The method of application segment highlights the increasing preference for automated spray systems over manual application methods, driven by safety improvements, precise dosing, and significant reduction in lubricant consumption and waste.

AI Impact Analysis on Open Gear Lubrication Market

User queries regarding AI's influence in the Open Gear Lubrication market overwhelmingly center on predictive maintenance capabilities, optimal lubrication scheduling, and formulation science. Key themes involve understanding how AI algorithms can analyze vibration, temperature, and wear particle data collected from open gear systems to precisely forecast lubrication needs, thereby preventing catastrophic failures. Concerns often relate to the integration cost and complexity of deploying Industrial IoT (IIoT) sensors necessary for data collection, alongside expectations for AI-driven software to autonomously adjust lubrication rates based on real-time operational load and environmental changes. Users anticipate that AI will fundamentally transform inventory management and maintenance strategies, moving from time-based schedules to condition-based lubrication practices, demanding lubricants optimized for AI-monitored systems.

- AI enables predictive lubrication scheduling based on real-time machinery condition monitoring, minimizing waste.

- Machine learning algorithms optimize lubricant formulation by analyzing performance data under varied operational stressors.

- AI-powered sensor data interpretation enhances early detection of gear wear, extending equipment lifespan.

- Automation of lubrication systems is integrated with AI controllers for autonomous flow rate adjustments.

- Improved supply chain efficiency through demand forecasting for specific lubricant types using predictive analytics.

DRO & Impact Forces Of Open Gear Lubrication Market

The market dynamics for open gear lubrication are shaped by a complex interplay of industrial growth requirements, regulatory mandates, and technological advancements focusing on operational longevity. Drivers include the global resurgence in mining activities, particularly for essential minerals required in the energy transition, which necessitates reliable performance from massive processing equipment utilizing open gears. Furthermore, the persistent focus across all heavy industries on reducing total ownership cost and minimizing unplanned downtime acts as a significant catalyst, compelling operators to invest in premium, high-adhesion lubricants that deliver extended component life. The rise of sophisticated monitoring technologies, such as IIoT and advanced sensor networks, facilitates the adoption of high-performance lubricants, as operators can accurately measure and quantify performance improvements.

Restraints primarily revolve around the fluctuating prices of base oils, a key component in lubricant manufacturing, which introduces volatility into the final product pricing structure and can impact profit margins. The environmental concerns associated with the disposal of traditional, high-viscosity, asphaltic lubricants pose regulatory and cost barriers, especially in highly regulated regions like Europe and North America, necessitating complex waste management protocols. Moreover, the slow rate of technology adoption in certain low-capital industrial sectors, particularly in developing regions, where conventional and cheaper lubrication methods are still prevalent, hinders the widespread penetration of sophisticated synthetic and bio-based products.

Opportunities for market expansion are vast, centering on the innovation and commercialization of bio-degradable and environmentally friendly lubricants (EALs), particularly those derived from vegetable oils or synthetic esters, aligning with global sustainability goals. Significant opportunities exist in the aftermarket services segment, providing specialized maintenance, lubrication audits, and consultation services to optimize usage efficiency, creating additional revenue streams for lubricant suppliers. The development of advanced, specialized additives that enhance anti-wear properties under extreme conditions, allowing lubricants to perform reliably in previously inaccessible applications or under higher load capacities, also presents a substantial growth avenue. Impact forces are strong, primarily driven by regulatory pressure favoring sustainable solutions and the capital intensity of the end-user industries demanding zero failure tolerance.

Segmentation Analysis

The Open Gear Lubrication Market is systematically segmented based on composition, method of application, application end-user, and geographical region to provide a granular understanding of market dynamics and consumption patterns. Segmentation by composition—mineral, synthetic, and semi-synthetic—highlights the industry's gradual shift towards synthetic options, which offer superior performance characteristics, including high oxidative stability and thermal resistance crucial for high-load, continuous operations. This transition reflects an industry prioritizing long-term asset protection over upfront cost savings.

Segmentation by method of application differentiates between manual application, automated spray systems, and dip/circulation systems. Automated spray systems are rapidly gaining prominence across large-scale industrial sites due to their ability to deliver precise amounts of lubricant consistently, leading to reduced consumption, better coverage, and significant safety enhancements by removing personnel from hazardous application areas. This trend is closely tied to the modernization and digitalization efforts within the heavy industry sector.

Further segmentation by end-user industry—Mining and Mineral Processing, Cement Industry, Marine, Construction, and others—reveals differential demand patterns. The mining sector remains the dominant consumer due to the sheer volume and size of the equipment (e.g., excavators, stackers, reclaimers) relying on open gear drives. The cement industry, with its reliance on large rotary kilns and grinding mills operating under extreme heat and dusty conditions, forms another critical segment demanding highly specialized, high-temperature lubricants.

- By Composition:

- Mineral Oil Based

- Synthetic Oil Based

- Semi-Synthetic Oil Based

- By Method of Application:

- Manual Application

- Automated Spray Systems

- Dip / Circulation Systems

- By Application End-user:

- Mining and Mineral Processing

- Cement Industry

- Power Generation

- Marine and Shipbuilding

- Construction and Heavy Equipment

- Others (e.g., Steel Mills, Pulp and Paper)

Value Chain Analysis For Open Gear Lubrication Market

The value chain for the Open Gear Lubrication Market begins with the upstream raw material suppliers, predominantly base oil manufacturers (Group I, II, III, and synthetic PAOs/Esters) and specialized additive producers (providing anti-wear, extreme pressure, adhesion, and anticorrosion packages). The quality and consistency of these inputs are critical, as they directly determine the performance and lifespan characteristics of the final open gear lubricant. Price volatility in crude oil derivatives significantly impacts the cost structure at this initial stage. Key strategic partnerships at the upstream level often involve long-term supply agreements between major lubricant formulators and large chemical companies to ensure a stable supply of high-grade raw materials, especially for specialized synthetic components required for extreme operating environments.

The core of the value chain involves the blending and formulation stage, where major lubricant manufacturers leverage specialized expertise to combine base oils and complex additive packages to meet stringent industrial specifications (e.g., AGMA specifications, OEM requirements). This stage includes rigorous quality control and performance testing, often involving sophisticated laboratory simulations of real-world stress conditions encountered by large open gears. Manufacturers who invest heavily in R&D to develop proprietary high-adhesion polymers and environmentally compliant chemistries gain a significant competitive advantage, leading to premium pricing capabilities and enhanced brand loyalty among end-users who prioritize reliability.

Distribution channels are multifaceted, categorized into direct and indirect routes. Direct distribution involves supplying large-volume industrial customers (like major mining conglomerates or global cement producers) through captive sales forces or dedicated contracts, ensuring technical support and scheduled deliveries. Indirect channels utilize extensive networks of specialized industrial distributors, regional dealers, and authorized resellers, which are essential for reaching smaller maintenance operators and geographically dispersed end-users. The downstream analysis focuses heavily on after-sales technical support, training for maintenance personnel, and lubrication health monitoring services, as the expertise in application is almost as critical as the quality of the product itself for optimal performance. Effective channel management, coupled with technical proficiency, ensures market reach and customer retention.

Open Gear Lubrication Market Potential Customers

The primary customers for Open Gear Lubrication products are large-scale industrial operators whose core production processes rely on heavy machinery equipped with exposed, high-load gearing. These entities, defined by their massive capital investment and continuous operational requirements, include major global mining corporations extracting coal, iron ore, copper, and precious metals. These mining companies require lubricants capable of withstanding extreme environmental conditions, severe shock loading from material handling, and persistent contamination by dust and water, making them the most critical end-user segment for premium, robust lubrication solutions.

The cement and concrete industry forms another substantial customer base, driven by the indispensable need for rotary kilns and large grinding mills, both of which utilize massive girth gears that operate under extremely high temperatures and severe particulate contamination. For these customers, the lubricant must possess high thermal stability and superior adherence to prevent flinging and maintain film thickness despite intense operating heat. Furthermore, the marine sector, particularly large shipping vessels and offshore drilling platforms utilizing deck machinery and propulsion systems, represents potential customers, demanding specialized, often biodegradable, lubricants to comply with maritime environmental regulations regarding accidental discharge.

Beyond these core sectors, potential customers also include heavy construction companies operating draglines and large excavators, as well as utility companies running large fossil fuel and biomass power generation plants which often incorporate coal mills and stacker/reclaimer equipment. These buyers are typically characterized by centralized procurement processes, high volume consumption, and a strong preference for supply chain partners who offer not only high-quality products but also comprehensive technical support, condition monitoring services, and predictive maintenance software integration to maximize operational uptime and minimize failure risk across their expensive asset base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.85 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chevron Corporation, ExxonMobil Corporation, Shell plc, BP p.l.c., TotalEnergies SE, FUCHS Petrolub SE, Klüber Lubrication (Freudenberg Chemical Specialties), Castrol Limited (A subsidiary of BP), Petro-Canada Lubricants Inc. (HollyFrontier), SK Lubricants Co. Ltd., Quaker Houghton, Bel-Ray Company LLC, Summit Industrial Products Inc., Whitmore Manufacturing, NCH Corporation, Schaeffer Manufacturing Co., Lubrizol Corporation (Additives focus), ENI S.p.A., Caltex (Chevron subsidiary), Lubriplate Lubricants Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Open Gear Lubrication Market Key Technology Landscape

The technological evolution in the Open Gear Lubrication Market is primarily centered on enhancing lubricant adherence, minimizing environmental impact, and enabling precise application. A key development is the widespread integration of polymer chemistry to create highly adhesive, non-fling lubricants that ensure the protective film remains intact even under high peripheral speeds and severe shock loading. Modern formulations increasingly utilize synthetic base oils, such as Polyalphaolefins (PAOs) and synthetic esters, which offer superior high-temperature performance, extended drain intervals, and reduced volatility compared to traditional mineral oil and asphaltic compounds, directly contributing to asset reliability and reduced consumption rates.

Furthermore, the additive technology landscape is rapidly advancing, focusing on complex extreme pressure (EP) and anti-wear (AW) additive packages that include solid lubricants like graphite, molybdenum disulfide, and proprietary ceramic materials. These solid inclusions are crucial for providing sacrificial protection during boundary lubrication conditions—the most common stress state in slow-moving, heavily loaded open gears. The optimization of these solid additive particle sizes and concentrations ensures that they integrate effectively into the base oil matrix without clogging automated spray nozzles, a crucial factor driving the adoption of high-tech lubrication systems.

In terms of application technology, the shift towards sophisticated automated lubrication systems (ALS) is defining the market's future. Modern ALS utilizes precise, computer-controlled spray nozzles and monitoring feedback loops, often integrated with IIoT sensors and centralized control systems, ensuring the 'right amount, at the right time' principle. These systems minimize human error, enhance safety, drastically reduce lubricant consumption (sometimes by 30-50%), and provide real-time performance diagnostics. This technological convergence of advanced fluid formulation with smart, automated delivery mechanisms represents the highest value proposition in the contemporary open gear lubrication market.

Regional Highlights

- Asia Pacific (APAC): Dominates the market share due to rapid industrial growth, particularly robust mining expansion in Australia, Indonesia, and China, coupled with massive infrastructure investments driving cement and construction material demand.

- North America: Characterized by high technological adoption, focusing on premium synthetic lubricants and advanced automated spray systems, driven by strict environmental regulations and high operational safety standards in the US and Canadian mining sectors.

- Europe: Exhibits strong demand for Environmentally Acceptable Lubricants (EALs) and bio-based products due to stringent REACH regulations and significant marine industry requirements; technological innovation focuses on additive packages for extreme cold weather performance.

- Latin America: Expected to show strong growth fueled by extensive mineral extraction projects (iron ore, copper) in Brazil, Chile, and Peru, leading to increased demand for robust, high-performance open gear lubricants capable of enduring corrosive environments.

- Middle East & Africa (MEA): A rapidly emerging market driven by ongoing diversification efforts, large-scale cement manufacturing for construction projects, and expanding energy and port operations requiring reliable, high-temperature lubrication solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Open Gear Lubrication Market.- Chevron Corporation

- ExxonMobil Corporation

- Shell plc

- BP p.l.c.

- TotalEnergies SE

- FUCHS Petrolub SE

- Klüber Lubrication (Freudenberg Chemical Specialties)

- Castrol Limited (A subsidiary of BP)

- Petro-Canada Lubricants Inc. (HollyFrontier)

- SK Lubricants Co. Ltd.

- Quaker Houghton

- Bel-Ray Company LLC

- Summit Industrial Products Inc.

- Whitmore Manufacturing

- NCH Corporation

- Schaeffer Manufacturing Co.

- Lubrizol Corporation (Additives focus)

- ENI S.p.A.

- Caltex (Chevron subsidiary)

Frequently Asked Questions

Analyze common user questions about the Open Gear Lubrication market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of synthetic open gear lubricants over mineral-based products?

Synthetic open gear lubricants offer superior thermal stability, higher oxidative resistance, and better adhesion properties compared to mineral-based options. This translates to extended service life, reduced friction, lower operating temperatures, and enhanced protection under severe load conditions, significantly lowering the total cost of ownership in heavy-duty applications like mining mills.

How does the implementation of automated spray systems impact the consumption of open gear lubrication products?

Automated spray systems significantly reduce lubricant consumption by ensuring precise, measured dosing based on operational parameters, avoiding the excessive application common with manual methods. This optimized delivery minimizes waste, improves coverage uniformity, and leads to verifiable reductions in overall lubricant use and associated disposal costs.

Which end-user segment drives the highest demand for open gear lubrication globally?

The Mining and Mineral Processing segment represents the highest demand globally due to the reliance on extremely large, high-load machinery such as grinding mills, rotary kilns, and shovels, which all utilize massive open gear drives. These operations require durable lubricants that can withstand constant contamination and intense shock loads.

What role do Environmentally Acceptable Lubricants (EALs) play in the future of the Open Gear Lubrication Market?

EALs, including bio-based and synthetic ester formulations, are becoming increasingly crucial, especially in marine and environmentally sensitive industrial regions (like Europe). Driven by stricter regulations and corporate sustainability mandates, EALs offer performance comparable to conventional products while mitigating environmental risk associated with spills and waste disposal, defining a major growth opportunity.

What are the key technical specifications to consider when selecting an open gear lubricant for high-temperature cement kilns?

For high-temperature applications like cement kilns, key specifications include extremely high dropping points, exceptional thermal stability to prevent carbonization, superior adhesion to resist fling-off from heat and rotational forces, and specialized solid lubrication additives to protect gear teeth under high heat and heavy particulate contamination.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager