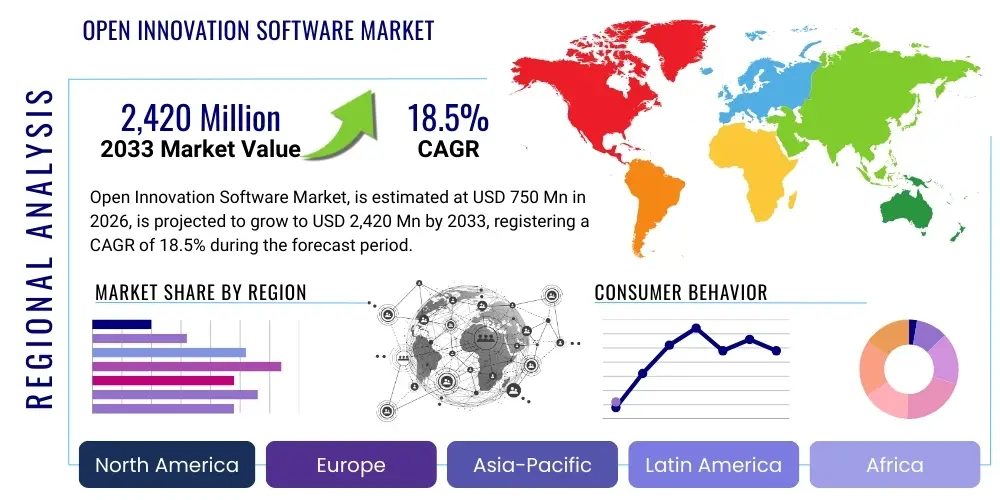

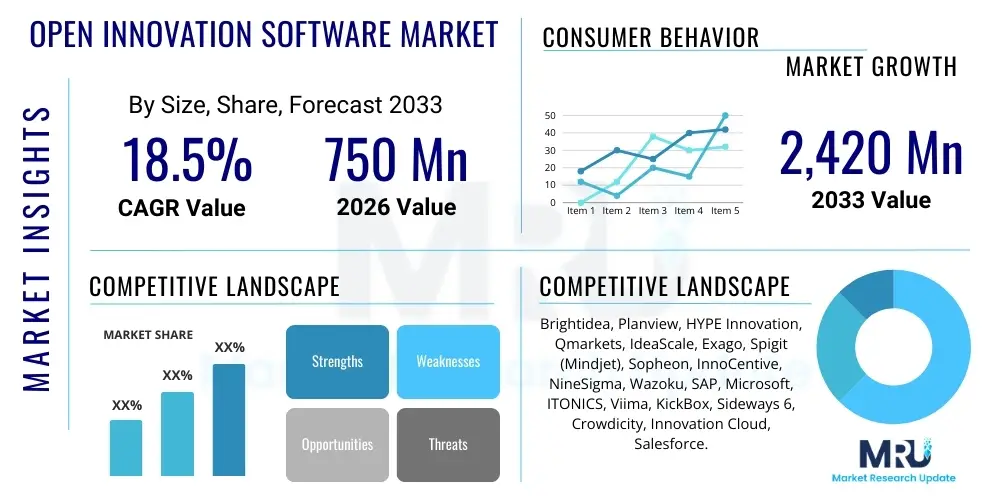

Open Innovation Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437717 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Open Innovation Software Market Size

The Open Innovation Software Market is experiencing robust expansion driven by the global imperative for accelerated digital transformation and the recognition that innovation often requires leveraging external expertise and technological capabilities. This market encompasses platforms and tools designed to facilitate the structured collection, evaluation, and implementation of ideas and solutions sourced from customers, partners, academia, and the broader public. The increasing complexity of technological landscapes mandates a shift away from purely internal R&D models toward collaborative ecosystems, positioning open innovation software as a critical investment for enterprises seeking competitive advantage and accelerated time-to-market.

The strategic value derived from these platforms—including enhanced employee engagement, faster prototyping cycles, and improved market validation—contributes directly to sustained market growth. Furthermore, the accessibility offered by Software-as-a-Service (SaaS) deployment models is significantly lowering barriers to entry, enabling small and medium-sized enterprises (SMEs) to adopt sophisticated innovation management tools previously exclusive to large corporations. Regulatory support for cross-industry collaboration, particularly in sectors like healthcare and sustainability, further catalyzes the adoption of formal open innovation methodologies and associated software infrastructure.

The Open Innovation Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $750 million in 2026 and is projected to reach $2,420 million by the end of the forecast period in 2033. This substantial growth trajectory reflects the critical role these solutions play in maintaining organizational agility and ensuring continuous, scalable innovation across diverse industrial verticals globally.

Open Innovation Software Market introduction

The Open Innovation Software Market provides specialized digital platforms that enable organizations to systematically manage the entire innovation lifecycle by sourcing ideas and solutions from external stakeholders and internal teams through structured challenges, campaigns, and ideation portals. These solutions facilitate collaboration, streamline the evaluation process using analytical tools, manage intellectual property (IP) disclosures, and track the development of selected concepts through to commercialization. Key applications span product development, process optimization, corporate strategy formulation, and sustainability initiatives, offering benefits such as reduced R&D costs, improved solution quality, and diversified knowledge acquisition. The market's expansion is fundamentally driven by the rising need for digital tools to manage complex external ecosystems, the widespread adoption of cloud computing for scalability, and the strategic recognition that innovation performance is directly linked to an organization's ability to absorb external knowledge effectively.

Open Innovation Software solutions are broadly categorized into Idea Management Platforms, Crowdsourcing Software, and Ecosystem Management Systems. Idea Management focuses internally or on known external communities (e.g., suppliers), ensuring structured submission and refinement workflows. Crowdsourcing extends this reach to the public or specialized problem solvers (e.g., through platforms like NineSigma or InnoCentive) to tackle specific, defined technical challenges. Ecosystem Management, conversely, handles the broader network of partners, start-ups, and academic institutions, facilitating co-creation and joint venture management. These products typically feature robust analytical engines, customizable workflow automation, secure communication channels, and strong integration capabilities with enterprise resource planning (ERP) and product lifecycle management (PLM) systems, cementing their role as central hubs for corporate creativity and problem-solving.

The central benefit driving market adoption is the enhancement of organizational resilience and adaptive capability in fast-changing technological landscapes. By transforming sporadic, ad-hoc external engagement into repeatable, measurable processes, organizations ensure a constant influx of diverse, validated ideas. Furthermore, these platforms provide necessary governance structures to navigate legal and intellectual property complexities associated with external contributions. Major driving factors include the global shift towards distributed workforces and digital collaboration models, the necessity for rapid response to competitive threats, and the technological maturity of AI and machine learning tools now integrated within these platforms to improve idea filtering, duplicate detection, and expert matching, thereby maximizing operational efficiency within the innovation funnel.

Open Innovation Software Market Executive Summary

The Open Innovation Software Market Executive Summary highlights a pronounced shift towards highly integrated, AI-enhanced platforms capable of managing end-to-end innovation portfolios. Current business trends indicate a strong preference for cloud-based SaaS models, particularly among SMEs, due to lower operational expenditure and faster deployment cycles, propelling the overall market toward service-centric revenue streams. Large enterprises are increasingly prioritizing robust ecosystem management tools that facilitate deep collaboration with technology partners and start-ups, moving beyond simple idea collection to complex co-development projects. This demand is fostering merger and acquisition activities, as established enterprise software vendors seek to incorporate specialized open innovation capabilities to offer holistic digital transformation suites, focusing heavily on enhancing interoperability with existing PLM and CRM systems.

Geographically, North America currently holds the largest market share, driven by a mature ecosystem of early technology adopters, high R&D spending, and a concentration of key market vendors and large technology companies that mandate formalized innovation processes. Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by rapid industrialization, increasing governmental focus on fostering domestic innovation (particularly in China and India), and growing investments in digitalization across the manufacturing and IT sectors. European growth remains steady, anchored by strong regulatory emphasis on collaborative research (e.g., through EU funding programs) and deep engagement from established industries such as automotive and pharmaceuticals, which are leveraging open innovation to address sustainability and circular economy mandates.

Segment trends reveal that the Idea Management Software segment retains the largest share due to its foundational role in internal and closed-loop innovation processes, while the Crowdsourcing Software segment is exhibiting the fastest growth, reflective of the expanding use of global solvers to address highly technical or intractable problems. In terms of end-users, the IT & Telecom sector, characterized by rapid technological cycles, remains the largest adopter, utilizing platforms extensively for product feature enhancement and technological scouting. However, the Manufacturing sector is rapidly catching up, employing open innovation software to optimize supply chain processes, develop smart factory solutions, and integrate customer feedback directly into product iterations, thereby significantly expanding the serviceable market and driving demand for industry-specific templates and integration capabilities.

AI Impact Analysis on Open Innovation Software Market

User inquiries regarding the impact of Artificial Intelligence on Open Innovation Software predominantly center on its ability to automate traditionally manual and time-consuming tasks within the innovation lifecycle, specifically focusing on how AI can enhance the quality and velocity of idea evaluation. Common questions include: 'How can AI screen thousands of ideas efficiently?', 'Can AI predict the commercial viability of a submitted concept?', 'How does machine learning ensure fair evaluation and reduce human bias?', and 'What is the role of Natural Language Processing (NLP) in clustering similar ideas and identifying emerging trends?' Based on this analysis, the key themes summarize a high expectation for AI to transform these platforms from passive collection tools into proactive, intelligent decision-support systems. Users anticipate that AI will maximize the return on innovation investment by automating idea normalization, expert matching, trend analysis, and plagiarism detection, thereby enabling organizations to focus human resources solely on strategic refinement and implementation, while simultaneously mitigating the overwhelming challenge of idea volume management.

- AI-driven automated idea scoring and ranking based on predefined strategic criteria, resource availability, and technical feasibility, significantly reducing initial review time.

- Advanced Natural Language Processing (NLP) capabilities to analyze vast amounts of unstructured idea data, enabling automatic theme clustering, duplicate detection, and sentiment analysis derived from feedback.

- Predictive analytics modules employing machine learning to forecast the potential market success or failure rates of proposed innovations by benchmarking against historical project data and external market indicators.

- Intelligent expert matching algorithms that automatically route specific technical challenges or submitted ideas to the most relevant internal or external subject matter experts for specialized evaluation and mentorship.

- Enhanced search and knowledge retrieval functions that use contextual understanding to identify prior attempts or existing solutions within the organization's knowledge base or public patent registries, reducing redundant efforts.

- Implementation of generative AI models to assist in rapid prototyping or generating alternative visualizations and business cases based on initial conceptual input, accelerating the refinement stage.

- Improved fraud and intellectual property risk detection through machine learning algorithms monitoring submission patterns and content similarity against proprietary data sets and public domain information.

DRO & Impact Forces Of Open Innovation Software Market

The Open Innovation Software Market is governed by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces (I) that collectively shape its trajectory. The primary driver is the pervasive digital transformation requiring rapid adaptability and decentralized problem-solving, pushing enterprises to leverage global intellectual capital. Conversely, significant restraints include the complex process of integrating these platforms with legacy enterprise systems (ERP, PLM), leading to costly implementation cycles, and persistent concerns regarding data security, confidentiality, and managing the legal complexities associated with externally generated intellectual property. The fundamental opportunities lie in the integration of Artificial Intelligence for automated idea validation and the expansion of vertical-specific applications, moving beyond general ideation platforms to tailored solutions for complex regulatory environments like pharmaceuticals or finance. These factors create powerful impact forces, most notably the pressure for vendors to provide highly secure, API-first platforms that guarantee seamless interoperability and robust IP protection, thereby addressing core corporate governance concerns while enabling necessary organizational agility.

Key drivers further elaborate on the necessity for cost reduction in traditional R&D, where open innovation offers a budget-efficient alternative by accessing global talent pools without permanent hiring overhead. The rapid obsolescence cycles in technology-intensive industries (e.g., semiconductors, software) demand continuous, rapid, and externally informed innovation inputs, making structured open innovation software indispensable for maintaining product relevance. Moreover, the increasing trend of customer-centric development and co-creation—where companies actively solicit consumer feedback and ideas throughout the product lifecycle—is driving demand for user-friendly, highly scalable crowdsourcing and idea management modules that can handle high volumes of submissions and provide robust feedback loops back to the community.

The principal restraints often involve cultural and organizational inertia, where resistance to external input or internal siloed thinking undermines the adoption and successful utilization of open innovation strategies, irrespective of the software quality. Furthermore, ensuring a consistent, high-quality flow of participation requires significant community management and internal marketing efforts, representing an ongoing operational cost that can deter smaller organizations. However, these challenges are being mitigated by opportunities presented through advanced analytics, which help organizations quantify the return on innovation investment (ROI), thereby justifying the platform expenditure. The shift towards ecosystem-as-a-service models, offering pre-configured vertical solutions and managed services for community engagement, presents significant growth avenues, particularly in emerging markets where expertise may be scarcer, further amplifying the positive impact forces on market expansion and penetration across diverse geographical landscapes.

Segmentation Analysis

The Open Innovation Software Market is segmented based on deployment model, enterprise size, end-user industry, and software type, each reflecting distinct organizational needs and buying behaviors. The analysis highlights that deployment flexibility—specifically the choice between secure on-premise solutions favored by highly regulated industries like BFSI and government, versus scalable cloud-based SaaS models dominating the IT and Retail sectors—is a major determinant of market penetration. Furthermore, software typology is crucial, distinguishing solutions optimized for massive, undefined crowdsourcing challenges from those focused on structured, internal knowledge capture and management. This segmentation allows vendors to tailor their offerings, focusing on specialized features such as compliance frameworks for regulated sectors or enhanced API integration capabilities for large multinational corporations operating complex IT architectures, ensuring maximum market relevance and addressing specific innovation pain points across the economic spectrum.

- Deployment Model

- Cloud (SaaS): Favored by SMEs and organizations needing rapid deployment, scalability, and reduced infrastructure maintenance.

- On-Premise: Preferred by large enterprises and highly regulated industries requiring stringent data security, customization, and full control over IT infrastructure.

- Enterprise Size

- Small and Medium-sized Enterprises (SMEs): Characterized by the adoption of subscription-based, user-friendly, lightweight cloud platforms.

- Large Enterprises: Dominate the market revenue, demanding highly integrated, robust, customized solutions with extensive workflow automation and governance features.

- End-User Industry

- IT & Telecom: High-volume adoption for rapid feature development, technological scouting, and product lifecycle management (PLM).

- Banking, Financial Services, and Insurance (BFSI): Focus on regulatory technology (RegTech) and customer experience innovation.

- Healthcare and Life Sciences: Utilizes platforms for drug discovery, clinical trial optimization, and medical device innovation, subject to rigorous compliance standards.

- Manufacturing and Automotive: Employed for supply chain optimization, smart factory initiatives, and sustainable product development.

- Retail and Consumer Goods: Used primarily for consumer co-creation, trend spotting, and marketing innovation.

- Education and Government: Focused on policy development, service delivery improvement, and administrative process optimization.

- Software Type

- Idea Management Software: Core platform for internal and closed-loop community ideation, submission, and validation.

- Crowdsourcing Software: Tools designed for launching public challenges to a broad, often anonymous, global solver base for specific technical problems.

- Ecosystem Management Platforms: Specialized software for managing complex external relationships with start-ups, accelerators, universities, and corporate venture partners.

Value Chain Analysis For Open Innovation Software Market

The value chain for the Open Innovation Software Market begins with upstream activities focused on platform development and core technology provision, which includes foundational elements such as robust security architecture, high-performance data processing capabilities, advanced analytics engines, and the integration of specialized AI/ML models for intelligent idea sorting. Core providers invest heavily in research to ensure their platforms offer superior user experience (UX) and interoperability standards, often relying on third-party specialized service vendors for niche technologies like advanced cryptography or specialized predictive modeling. Key activities at this stage involve software architecture design, intellectual property portfolio development for proprietary algorithms, and ensuring compliance with international data privacy regulations such as GDPR, establishing the foundational quality and functional breadth of the solutions offered to the market.

Moving downstream, the value chain focuses heavily on implementation, integration, distribution, and post-sales support, which are critical components given the complexity of deploying these systems within diverse enterprise environments. Distribution channels primarily involve direct sales teams catering to large accounts requiring bespoke solutions, alongside an expanding reliance on indirect channels such as certified Value-Added Resellers (VARs) and system integrators (SIs) who offer regional expertise and facilitate the integration of open innovation platforms with clients' existing ERP, CRM, and PLM infrastructure. The role of these indirect partners is vital for market penetration, particularly in regions where local market knowledge and tailored professional services are paramount, ensuring successful deployment, user training, and cultural alignment necessary for maximizing platform utilization and realizing measurable innovation outcomes.

The final phase involves ongoing customer success management, including technical support, platform maintenance, and consultative services focused on innovation strategy optimization. Direct sales maintain a high level of engagement with strategic clients, offering continuous software updates, specialized training, and consultation on structuring effective innovation challenges. Indirect distribution channels, often through partnerships with management consultancies and digital transformation firms, provide strategic advisory services, helping organizations define their open innovation mandates, manage external communities, and measure the long-term impact of the software on business performance. The emphasis across all channels is moving towards outcome-based engagement, where vendors and partners share responsibility for the client's innovation success, cementing the long-term, sticky nature of the Open Innovation Software subscription model and creating high customer lifetime value.

Open Innovation Software Market Potential Customers

The primary potential customers for Open Innovation Software are large, globally operating enterprises across technology-intensive and consumer-facing sectors that face relentless pressure for rapid product cycles and disruptive business model creation. These end-users, typically Chief Innovation Officers (CIOs), Heads of R&D, and C-suite executives driving corporate strategy, seek centralized platforms to manage complex, multi-stakeholder ideation processes and systematically scout for external technologies. Industries with high regulatory burdens, such as Pharmaceuticals and BFSI, are increasingly critical buyers, utilizing the software to manage compliance-driven challenges and harness expert knowledge while maintaining secure, auditable records of innovation governance. The common characteristic among these customers is the necessity to externalize R&D risk, accelerate solution finding, and institutionalize a culture of collaborative problem-solving across geographical and organizational boundaries, making the software a strategic asset rather than a mere IT tool.

Beyond the traditional corporate sector, a rapidly growing segment includes governmental and non-profit organizations that leverage open innovation software to address significant societal challenges, such as urban planning, public policy formation, and service delivery improvement. These public sector buyers prioritize platforms with strong community engagement tools, multilingual support, and robust anonymity features to encourage broad citizen participation while ensuring data integrity and transparent governance. Furthermore, academic institutions and research consortia utilize these platforms to manage joint research projects, administer grants, and facilitate the commercialization of intellectual property developed within their networks. The diversity of these end-users underscores the broad applicability of the software, extending its value proposition far beyond traditional corporate R&D to encompass virtually any organization that needs a scalable, structured mechanism for collective intelligence gathering and execution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 million |

| Market Forecast in 2033 | $2,420 million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brightidea, Planview, HYPE Innovation, Qmarkets, IdeaScale, Exago, Spigit (Mindjet), Sopheon, InnoCentive, NineSigma, Wazoku, SAP, Microsoft, ITONICS, Viima, KickBox, Sideways 6, Crowdicity, Innovation Cloud, Salesforce. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Open Innovation Software Market Key Technology Landscape

The technology landscape of the Open Innovation Software Market is defined by the integration of advanced analytical tools and scalable, cloud-native architectures designed to process massive volumes of qualitative data. Core technologies include sophisticated workflow automation engines that map complex innovation processes, from initial idea submission and refinement to business case approval and project initiation, often utilizing API-first methodologies to ensure seamless connection with external tools like communication platforms (Slack, Teams) and project management suites. Furthermore, the reliance on robust relational and non-relational databases is essential for efficiently storing, retrieving, and cross-referencing idea histories, expert profiles, and intellectual property documentation across global operations, thereby providing a singular source of truth for all innovation assets and maintaining necessary audit trails for governance purposes. The shift towards microservices architecture enables vendors to rapidly deploy new features and scale specific platform components (such as the evaluation module or the community engagement portal) independently of the core system, enhancing overall system resilience and performance.

A major technological differentiator is the increasing incorporation of Artificial Intelligence and Machine Learning (AI/ML) algorithms, forming the foundation of intelligent innovation management. This includes leveraging Natural Language Processing (NLP) for semantic analysis of submitted text, which allows the software to automatically categorize ideas, detect emerging trends from unstructured data, and summarize complex proposals for reviewers. Computer vision technologies are also being subtly integrated to process diagrams, mockups, and visual prototypes submitted by users. Crucially, proprietary scoring models and predictive analytics are used to assess an idea's novelty and potential business impact, significantly reducing the manual overhead traditionally associated with idea triage. These AI layers are paramount for managing "idea overflow" and transforming the platform into a strategic foresight instrument capable of identifying white spaces and potential competitive disruptions within the market landscape.

Finally, security and interoperability form the critical backbone of the software stack, especially given the sensitive nature of pre-commercialized IP and partner data residing on these platforms. Open Innovation Software utilizes advanced encryption protocols (both at rest and in transit), multi-factor authentication, and stringent access controls based on zero-trust principles to secure proprietary information. Technological infrastructure relies heavily on secure cloud environments (AWS, Azure, Google Cloud) that offer global scaling and compliance certifications (ISO 27001, SOC 2). The widespread adoption of open standards, such as REST APIs and webhook integrations, is non-negotiable, ensuring that the innovation platform does not become another silo but acts as a synergistic component within the broader digital ecosystem of the organization, facilitating data exchange with R&D, marketing, and finance systems seamlessly.

Regional Highlights

Geographical market analysis reveals distinct maturity levels and growth drivers across major global regions, reflecting variations in technological adoption rates, R&D investment levels, and industrial concentration. North America leads the Open Innovation Software Market, characterized by a highly mature technology ecosystem, a dominant presence of major platform vendors, and a corporate culture that aggressively embraces digital tools for competitive advantage. The region’s strength is rooted in significant spending by technology, media, and pharmaceutical companies, which utilize these platforms for global crowdsourcing and managing extensive IP portfolios. The demand here is driven by advanced feature sets, high-level AI integration, and robust security requirements, making it the benchmark for new solution deployment and innovation pilot programs, sustained by high corporate VC activity and a robust start-up culture that fuels the external knowledge ecosystem.

Europe represents a stable and high-value market, primarily driven by long-established manufacturing (especially automotive and industrial goods) and financial services sectors. European adoption is motivated by regulatory pushes towards sustainability, circular economy models, and cross-border collaboration funded by the European Union’s R&D frameworks. Countries like Germany, the UK, and the Nordics show particularly high usage, focusing on platforms that facilitate complex co-creation with suppliers and manage specific intellectual property agreements related to joint technology development. The market trend in Europe emphasizes localized support, compliance with strict data protection laws (GDPR), and platforms capable of handling multi-lingual innovation campaigns across diverse markets, supporting both internal corporate innovation and external collaborative research efforts effectively.

Asia Pacific (APAC) is slated to be the fastest-growing region during the forecast period. This rapid expansion is primarily fueled by accelerated digitalization efforts in rapidly developing economies like China, India, and Southeast Asian nations, coupled with increasing governmental investments aimed at boosting domestic innovation capacity and technological self-sufficiency. The large manufacturing base and burgeoning IT sector in APAC are driving significant demand for scalable, cloud-based idea management systems to optimize process efficiency and integrate customer feedback into high-volume product lines. While price sensitivity remains a factor, the sheer scale of enterprises and the push toward establishing regional innovation hubs ensure that APAC will contribute disproportionately to the global market volume growth, necessitating vendors to develop regional partner ecosystems and offer flexible, highly localized deployment solutions to meet the varying regulatory and operational demands across the diverse sub-regions.

- North America: Dominates the market due to high R&D expenditures, early technology adoption, strong vendor presence, and high demand for AI-enabled intelligent platforms across technology and pharmaceutical sectors.

- Europe: Characterized by steady growth, driven by manufacturing and automotive industries and strong governmental support for collaborative, cross-border innovation projects, with a focus on GDPR compliance and sustainability-related challenges.

- Asia Pacific (APAC): Expected to show the highest CAGR, propelled by rapid industrialization, digitalization initiatives in large economies (China, India), and strong demand for scalable cloud solutions in the manufacturing and IT sectors.

- Latin America (LATAM): Emerging market showing increased adoption in financial services and resource-based industries, focusing on operational efficiency improvements and addressing local social challenges through open innovation initiatives.

- Middle East and Africa (MEA): Growth is tied to ambitious national vision projects (e.g., Vision 2030 in Saudi Arabia) aiming to diversify economies and establish knowledge-based industries, driving niche adoption in government, energy, and telecom sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Open Innovation Software Market.- Brightidea

- Planview

- HYPE Innovation

- Qmarkets

- IdeaScale

- Exago

- Spigit (Mindjet)

- Sopheon

- InnoCentive

- NineSigma

- Wazoku

- SAP

- Microsoft

- ITONICS

- Viima

- KickBox

- Sideways 6

- Crowdicity

- Innovation Cloud

- Salesforce

Frequently Asked Questions

Analyze common user questions about the Open Innovation Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Idea Management Software and Crowdsourcing Software?

Idea Management Software primarily focuses on structured, internal or closed-community innovation (employee suggestions, known partner feedback), offering comprehensive workflow and governance tools. Crowdsourcing Software focuses on leveraging external, often large, anonymous global solver communities to solve specific, defined technical or creative challenges.

Which industry vertical is driving the highest demand for open innovation platforms?

The IT and Telecom sector currently drives the highest volume and demand due to rapid technological obsolescence cycles and the constant need for software feature enhancements and technological scouting. However, the Manufacturing sector is exhibiting the fastest growth in adoption for process optimization and supply chain resilience.

How does the integration of AI benefit organizations using open innovation tools?

AI significantly enhances platform efficiency by automating idea triage, duplicate detection, and sentiment analysis via NLP. It also utilizes predictive analytics to score ideas based on potential commercial viability and automates expert matching, ensuring relevant human resources focus only on high-potential concepts.

What are the main security concerns associated with adopting cloud-based Open Innovation Software?

The primary concerns revolve around intellectual property (IP) protection, data confidentiality, and compliance with regional data privacy regulations (like GDPR). Vendors address this through stringent encryption, robust access controls, and adherence to international security standards (e.g., ISO 27001).

Is the Open Innovation Software Market dominated by SaaS or On-Premise deployment models?

The market is increasingly dominated by the Software-as-a-Service (SaaS) model, particularly favored by SMEs and fast-growing enterprises seeking scalability and lower total cost of ownership (TCO). On-Premise solutions remain critical for large, highly regulated enterprises requiring maximum customization and complete control over sensitive data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager