Open Source Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438387 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Open Source Software Market Size

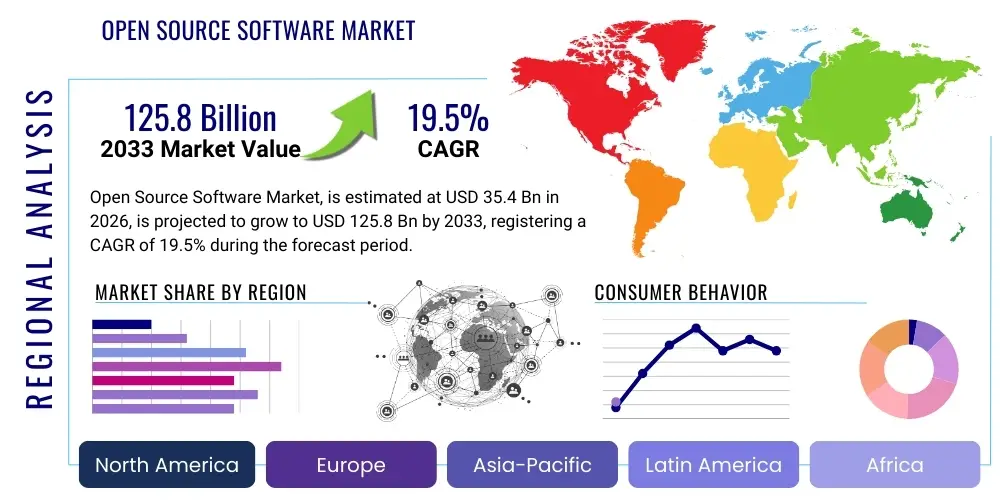

The Open Source Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at $35.4 Billion USD in 2026 and is projected to reach $125.8 Billion USD by the end of the forecast period in 2033.

Open Source Software Market introduction

The Open Source Software (OSS) market encompasses commercially supported and community-driven platforms, tools, and applications where the source code is freely available for inspection, modification, and enhancement. This market is fundamentally shifting the technological landscape by fostering rapid innovation, reducing vendor lock-in, and providing cost-effective alternatives to proprietary solutions. OSS spans critical technology stacks, including operating systems (like Linux), databases (PostgreSQL, MongoDB), cloud infrastructure (Kubernetes, OpenStack), development tools (Git), and emerging fields like machine learning frameworks (TensorFlow, PyTorch). The inherent collaborative nature of open source development accelerates patching, feature deployment, and security auditing, driving its adoption across small and medium enterprises (SMEs) and large global corporations alike.

Major applications of OSS include core enterprise infrastructure management, cloud-native application development, big data analytics, and decentralized network operations. The pervasive adoption of digital transformation initiatives globally, coupled with the necessity for highly customizable and scalable technological ecosystems, positions OSS as a foundational element of modern IT strategy. Its application extends deeply into highly regulated sectors such as BFSI and Healthcare, which leverage the transparency of source code for compliance and enhanced security standards. The modularity and interoperability provided by OSS also facilitate complex hybrid and multi-cloud deployments, critical for optimizing resource utilization in contemporary IT environments.

Key benefits driving market growth include significantly lower total cost of ownership (TCO) compared to licensed software, exceptional flexibility in customization, and access to a vast global community of developers who contribute to continuous improvement and bug resolution. Furthermore, major technology vendors, recognizing the strategic importance of OSS, are increasingly contributing to and monetizing open source projects through premium services, professional support, and integrated enterprise versions. This formalized commercial support minimizes perceived risks associated with community-driven projects, cementing OSS as a viable, long-term strategic investment for mission-critical operations worldwide.

Open Source Software Market Executive Summary

The Open Source Software market is characterized by robust business trends driven primarily by the transition towards cloud-native architectures, containerization, and DevOps methodologies, all heavily reliant on open source tools such as Kubernetes, Docker, and Ansible. Major enterprises are increasing their contribution to open source foundations, viewing participation not merely as consumption but as a mechanism for setting industry standards and accelerating innovation velocity. The shift from selling proprietary licenses to offering subscription-based support, consulting, and managed services around OSS distributions represents the dominant monetization model. Furthermore, mergers and acquisitions involving established proprietary vendors acquiring key open source contributors illustrate the strategic urgency to internalize open source capabilities and integrate them into commercial portfolios, enhancing market consolidation and strategic capability.

Regionally, North America maintains the largest market share due to the high concentration of technology innovation hubs, significant early adoption of cloud computing, and the presence of leading open source contributors and major technology corporations. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid digital transformation in emerging economies, increasing government mandates promoting technology self-sufficiency through open source adoption, and massive investments in IT infrastructure, particularly in countries like China and India. Europe exhibits strong growth, underpinned by regulatory environments emphasizing data sovereignty and security, where open source transparency is highly valued, particularly in the public sector and government IT systems.

Segment trends indicate that the Services component segment, encompassing professional services, consulting, training, and maintenance support, is expanding rapidly as organizations require specialized expertise to implement and manage complex open source stacks effectively. Cloud deployment models are overwhelmingly favored over on-premise solutions, reflecting the seamless integration of OSS tools with major public cloud platforms (AWS, Azure, GCP). Geographically, the adoption rate among Large Enterprises remains dominant in terms of revenue contribution, yet the Small and Medium Enterprises (SMEs) segment is accelerating its uptake, driven by the cost-effectiveness and scalability that OSS solutions afford, democratizing access to enterprise-grade technology.

AI Impact Analysis on Open Source Software Market

User inquiries regarding AI's influence on the Open Source Software Market predominantly revolve around three critical themes: the future of AI development frameworks, the implications of AI-assisted coding tools on developer productivity, and the ethical/licensing complexity introduced by large language models (LLMs) trained on publicly available source code. Users frequently ask about which open source AI frameworks (like PyTorch or TensorFlow) will dominate, how tools like GitHub Copilot affect traditional developer roles, and whether companies are liable for copyright infringement when using code generated or recommended by AI trained on varied OSS licenses. These questions underscore a transition period where AI is seen as both the largest consumer and the greatest accelerator of open source technologies, demanding new governance and contribution standards.

The impact of Artificial Intelligence is profoundly accelerating the Open Source Software market by making sophisticated algorithms and machine learning tools accessible to a broader developer base. AI models require massive computational resources and extensive datasets, and the foundational software supporting this ecosystem—ranging from data handling platforms to model training environments—is overwhelmingly open source. This reliance establishes OSS as the de facto standard for AI research and commercial deployment, ensuring that innovation in AI is inherently collaborative and community-driven. Furthermore, the need for transparency, interpretability, and auditability in AI systems, especially those deployed in sensitive sectors, mandates the use of open source components, allowing for rigorous scrutiny of underlying logic and mitigating concerns regarding algorithmic bias.

Conversely, the rise of AI-powered code generation tools, trained on billions of lines of public open source code, presents unprecedented legal and ethical challenges regarding licensing compliance. Developers benefit from increased productivity, but organizations must navigate the complexities of ensuring that AI-generated code snippets comply with the varied licenses (e.g., GPL, MIT, Apache) of the original training data. This challenge is spurring the development of new governance models, stricter license scanning tools, and potentially new types of permissive AI-specific licenses aimed at standardizing usage. Ultimately, AI acts as a powerful catalyst, driving both the demand for and the complexity of managing open source assets, necessitating sophisticated tools for tracking provenance and ensuring compliance.

- AI mandates Open Source as the core infrastructure layer for Machine Learning Operations (MLOps) and model deployment.

- Increased demand for open source frameworks (e.g., PyTorch, Hugging Face, Scikit-learn) drives adoption across enterprises for research and production AI.

- AI-assisted coding tools (e.g., Copilot) significantly boost developer productivity but raise critical licensing and provenance challenges for organizations.

- The need for explainable AI (XAI) promotes the use of transparent, open source algorithms for auditability and regulatory compliance.

- Open source communities are actively developing ethical AI standards and governance tools to manage datasets and model biases effectively.

- AI is automating infrastructure management tasks, relying heavily on open source tools like Kubernetes and Terraform for self-healing and scaling capabilities.

- New AI-specific licenses and policies are being debated within major foundations to address liability issues arising from generative model training data.

DRO & Impact Forces Of Open Source Software Market

The dynamics of the Open Source Software market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive and adoption landscape. Key drivers include the overwhelming industry preference for cloud-native development and containerization technologies, which are intrinsically tied to open source projects like Kubernetes and Docker. Furthermore, the lower initial cost and the flexibility of customization inherent to OSS drive massive adoption, especially among startups and SMEs seeking to compete with minimal capital expenditure. The continuous, rapid innovation cycle provided by the global developer community ensures that OSS often outpaces proprietary alternatives in terms of feature richness and security patching velocity. This high rate of technological advancement acts as a powerful magnet for technologically mature organizations.

Significant restraints challenging market growth involve the perception of complexity regarding implementation and maintenance, particularly for organizations lacking in-house open source expertise. Although OSS is "free," the cost of specialized support, integration, and training can be substantial, leading to a high total cost of ownership if not managed correctly. Moreover, the fragmentation of licenses and the inherent challenges in ensuring consistent governance and compliance across diverse projects pose considerable legal and security risks. Enterprise decision-makers often cite security vulnerabilities and the lack of guaranteed vendor support, especially for smaller or community-driven projects, as critical barriers to the adoption of OSS for mission-critical applications, necessitating reliance on commercially supported distributions.

Opportunities for exponential growth are concentrated in the rapid monetization of managed cloud services built around open source stacks, where vendors offer operational simplicity atop complex core technologies. The expansion of the Internet of Things (IoT) and Edge Computing represents a massive opportunity, as these distributed environments require lightweight, highly customizable, and standards-based operating systems and protocols predominantly provided by open source solutions. Additionally, the increasing focus on blockchain technology and decentralized finance (DeFi), almost entirely built on open source foundations, offers new avenues for market penetration. Strategic partnerships between traditional proprietary vendors and open source foundations, alongside specialized training programs to bridge the skill gap, are pivotal for unlocking the market's full potential.

Segmentation Analysis

The Open Source Software market is extensively segmented based on the type of offering, deployment method, organizational scale, and the specific industries leveraging the technology. Analyzing these segments provides a nuanced view of where investment is concentrated and which technological solutions are achieving the highest adoption rates. The component segmentation highlights the growing shift in revenue generation from core software solutions towards specialized services, reflecting the maturity of the market. Deployment models confirm the industry's irreversible move towards cloud environments, optimizing scalability and operational efficiency. Furthermore, industry vertical analysis reveals targeted growth in sectors undergoing intensive digital transformation, particularly IT and BFSI, where open source solutions provide essential security, resilience, and regulatory compliance features.

- Component:

- Solution (Operating Systems, Databases, Middleware, Tools, Application Software)

- Service (Support, Maintenance, Consulting, Training, Integration Services)

- Deployment Mode:

- On-Premise

- Cloud (Public, Private, Hybrid)

- Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecommunication

- Healthcare and Life Sciences

- Retail and E-commerce

- Manufacturing and Automotive

- Government and Public Sector

- Others (Education, Media & Entertainment)

Value Chain Analysis For Open Source Software Market

The Open Source Software value chain begins with the Upstream Analysis, which is centered on the core innovation ecosystem: individual developers, commercial contributors, and non-profit foundations (e.g., Linux Foundation, Apache Software Foundation). The primary activities in this stage involve project initiation, collaborative coding, code review, bug fixing, and ensuring adherence to specific OSS licenses. Innovation at this stage is highly decentralized and rapid, driven by necessity and shared technical interest rather than purely commercial motives. This upstream efficiency in creating and maintaining high-quality code is the foundational strength of the entire OSS market, minimizing the high R&D costs typically borne by proprietary vendors.

The value then flows through the Midstream and Downstream analyses. The midstream involves commercialization by major vendors (such as Red Hat, SUSE, IBM, Microsoft) who take the community code, stabilize it, add enterprise features, ensure security hardening, and package it into commercially supported distributions. This step adds significant value by mitigating the risk associated with raw community code and guaranteeing enterprise-level SLAs. Downstream analysis focuses on Distribution Channels, which are primarily Direct (selling subscription services and support directly to end-users) and Indirect (leveraging VARs, system integrators, and strategic cloud partners like AWS, Azure, and Google Cloud, which embed open source components into their platform services). The indirect channel has become increasingly dominant as cloud providers manage the infrastructure complexity for the end-user, often monetizing the OSS through consumption models.

The final stage is the implementation and end-user consumption. Value realization for the end-user is achieved through customization, systems integration, and ongoing operational support, typically facilitated by specialized consultants or the commercial vendor's service division. The shift in profitability focuses away from the software itself and towards the expertise required to implement, secure, and scale these complex systems. The overall structure emphasizes services over solutions, validating the model where the software is used to drive consulting and long-term support revenue streams, thereby cementing the commercial viability and sustainability of the open source ecosystem.

Open Source Software Market Potential Customers

Potential customers for Open Source Software span a broad spectrum of industries and organizational scales, primarily categorized as technology-intensive enterprises seeking cost efficiency, operational agility, and architectural flexibility. Large Enterprises across BFSI, IT, and Telecommunications are major consumers, utilizing OSS for mission-critical infrastructure, including operating systems, virtualization platforms, and core application development tools. These organizations leverage the transparency of OSS for enhanced security auditing and compliance with strict industry regulations (e.g., GDPR, HIPAA), making source code visibility a non-negotiable requirement. Their purchasing decisions are heavily influenced by the availability of commercially backed support and the demonstrated scalability of the solutions.

Small and Medium Enterprises (SMEs) represent a rapidly expanding customer segment. For SMEs, the immediate benefit of reducing initial software licensing costs is paramount. They primarily adopt OSS for standardized business functions such as web servers, productivity tools, and basic database management. Their adoption strategy often involves utilizing readily available community-supported versions or low-cost cloud services built on open source stacks, prioritizing simplicity and ease of deployment over highly specialized customization. The rapid proliferation of cloud platforms has made enterprise-grade open source tools accessible to these smaller entities without requiring massive in-house IT teams.

Additionally, the Government and Public Sector worldwide are becoming significant consumers, often mandated by policy to use open source solutions to promote vendor independence, secure long-term digital sovereignty, and reduce reliance on single foreign proprietary vendors. Educational institutions and Research Organizations are also core potential customers, as they rely on the collaborative, non-proprietary nature of OSS for scientific computation, data analysis, and pedagogical purposes. This demographic utilizes the open nature of the software to train future professionals and advance research without prohibitive licensing barriers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $35.4 Billion USD |

| Market Forecast in 2033 | $125.8 Billion USD |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Red Hat (IBM), SUSE, Canonical, Microsoft, Google (Android/Chromium), AWS, VMware, HPE, Oracle, SAP, GitHub (Microsoft), GitLab, Elastic, MongoDB, Linux Foundation, Apache Software Foundation, HashiCorp, JFrog, Automattic, Talend. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Open Source Software Market Key Technology Landscape

The technological landscape of the Open Source Software market is dominated by advancements in cloud infrastructure, container orchestration, and sophisticated data management systems. Kubernetes, as the leading open source container orchestrator, is foundational, driving the shift towards microservices and hybrid cloud environments. This technology enables portability and scalability critical for modern enterprise applications. Complementary technologies such as Docker for containerization and Prometheus and Grafana for monitoring and observability are crucial components of this technology stack, allowing organizations to manage complex, distributed systems efficiently. The rapid evolution and standardization around these technologies, maintained by foundations like the Cloud Native Computing Foundation (CNCF), underscore the market's trajectory towards highly automated, cloud-agnostic infrastructure management.

Furthermore, the data management segment relies heavily on open source databases, both relational (PostgreSQL, MariaDB) and NoSQL (MongoDB, Cassandra). These databases offer performance, flexibility, and cost advantages over legacy proprietary systems, positioning them as primary choices for big data analytics, real-time processing, and high-volume transaction systems. The tools surrounding the development lifecycle are also overwhelmingly open source, including Git for version control, Jenkins and GitLab for Continuous Integration/Continuous Deployment (CI/CD) pipelines, and various infrastructure-as-Code (IaC) tools like Terraform and Ansible. This comprehensive open source tooling allows development teams to implement DevOps practices rapidly and maintain highly secure, traceable, and iterative software releases.

A critical emerging area is the integration of open source into the security technology stack. Tools for vulnerability scanning (e.g., OWASP ZAP), firewall management (e.g., pfSense), and security information and event management (SIEM) solutions utilize open source models to benefit from community-driven security audits and faster response times to zero-day exploits. The ongoing commitment by major technology companies to contribute security enhancements back to foundational projects like the Linux kernel and various cryptography libraries ensures a continually improving baseline level of security across the digital ecosystem. This robust, decentralized security effort is a key competitive differentiator for open source technologies, increasing trust among risk-averse enterprises.

Regional Highlights

- North America: This region holds the largest market share, driven by a mature cloud computing infrastructure, high adoption rates in key industry verticals (especially technology and financial services), and the headquarters of major open source contributing companies (e.g., IBM/Red Hat, Google, Microsoft). Extensive investment in AI, cloud-native development, and sophisticated DevOps tooling ensures continuous demand. The presence of significant venture capital funding supports numerous open source startups, maintaining the region's lead in innovation and commercialization of new OSS technologies.

- Europe: The European market is growing strongly, characterized by high regulatory scrutiny and a strong emphasis on digital sovereignty, particularly within the public sector and government IT systems. Open source solutions are favored due to their inherent transparency, which facilitates compliance with data protection laws like GDPR. Countries like Germany and the UK are heavy adopters of open source for core infrastructure and application development. The region sees specialized growth in open source solutions focused on cybersecurity and industrial IoT applications.

- Asia Pacific (APAC): APAC is projected to experience the fastest growth globally, propelled by massive digital transformation initiatives, particularly in emerging economies like India, China, and Southeast Asia. Governments in these regions are actively promoting open source mandates to reduce reliance on foreign technology vendors and build local technology ecosystems. Rapid urbanization and subsequent investment in telecommunication infrastructure (5G) create significant demand for scalable, open network management and cloud solutions. The influx of IT talent and increasing enterprise IT spending fuels exponential OSS adoption.

- Latin America (LATAM): Growth in LATAM is primarily driven by the need for cost-effective enterprise solutions among SMEs and public sector organizations facing budget constraints. Countries like Brazil and Mexico are witnessing increased adoption of open source operating systems and databases to modernize legacy infrastructure efficiently. Challenges related to localized IT skill shortages are often mitigated by relying on global managed services providers specializing in OSS.

- Middle East and Africa (MEA): Adoption is accelerating in the MEA region, particularly in the Gulf Cooperation Council (GCC) countries, focusing on large-scale smart city and national digital transformation projects. Open source provides the necessary flexibility and security for these foundational government initiatives. Economic diversification away from oil dependence is driving significant investment in technology infrastructure, increasing the demand for scalable open source cloud and data analytics platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Open Source Software Market.- Red Hat (IBM)

- SUSE

- Canonical

- Microsoft

- Google (Android/Chromium)

- Amazon Web Services (AWS)

- VMware

- Hewlett Packard Enterprise (HPE)

- Oracle

- SAP

- GitHub (Microsoft)

- GitLab

- Elastic

- MongoDB

- The Linux Foundation

- Apache Software Foundation

- HashiCorp

- JFrog

- Automattic

- Talend

Frequently Asked Questions

Analyze common user questions about the Open Source Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary commercialization strategy for Open Source Software vendors?

The primary commercialization strategy for OSS vendors is moving away from selling licenses toward offering subscription-based services, professional support, training, and certified enterprise distributions. This model monetizes expertise and guaranteed service levels (SLAs), managing the complexity inherent in deploying and maintaining community-driven software at scale, ensuring long-term profitability and sustainable development for core projects.

How does open source software compare to proprietary software regarding security and compliance?

OSS offers superior transparency, allowing global security experts to continuously audit the code, leading to rapid vulnerability identification and patching—often faster than proprietary vendors. For regulatory compliance (e.g., GDPR, HIPAA), the ability to inspect the entire source code base minimizes risk and satisfies governance requirements, making it a preferred choice for high-compliance environments where transparency is paramount.

Which specific open source technologies are essential for cloud-native application development?

Key open source technologies for cloud-native development are Kubernetes (for container orchestration and management), Docker (for containerization), Prometheus and Grafana (for monitoring and observability), and tools like Envoy and Istio (for service mesh architectures). These components, governed by organizations like the CNCF, form the foundational stack enabling scalable, distributed, and portable applications across public and private clouds.

What are the greatest risks or restraints associated with adopting Open Source Software in large enterprises?

The greatest restraints include navigating the legal complexities of diverse and potentially conflicting open source licenses (license proliferation), mitigating the lack of guaranteed immediate vendor support for highly customized or community-driven solutions, and addressing the severe shortage of in-house IT expertise required to implement and manage complex open source stacks effectively. Enterprises mitigate this by engaging with specialized commercial vendors.

What is the anticipated impact of AI-powered coding on the future of the open source developer community?

AI-powered coding tools, such as GitHub Copilot, will significantly augment developer productivity by automating boilerplate code and assisting with debugging. However, their reliance on training data sourced from vast repositories of open source code introduces complex licensing provenance challenges. The community must establish new ethical guidelines and tools to track and attribute AI-generated code snippets to ensure compliance with underlying open source licenses while capitalizing on productivity gains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager