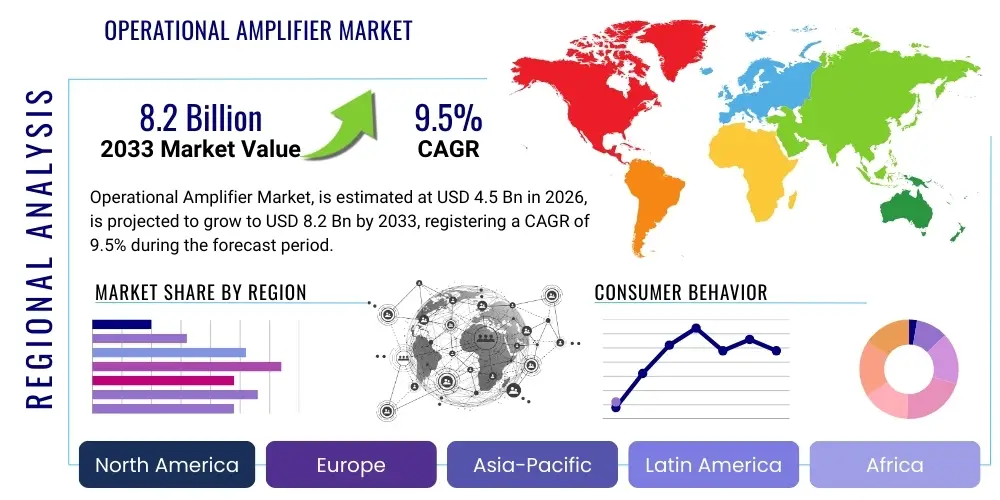

Operational Amplifier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435985 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Operational Amplifier Market Size

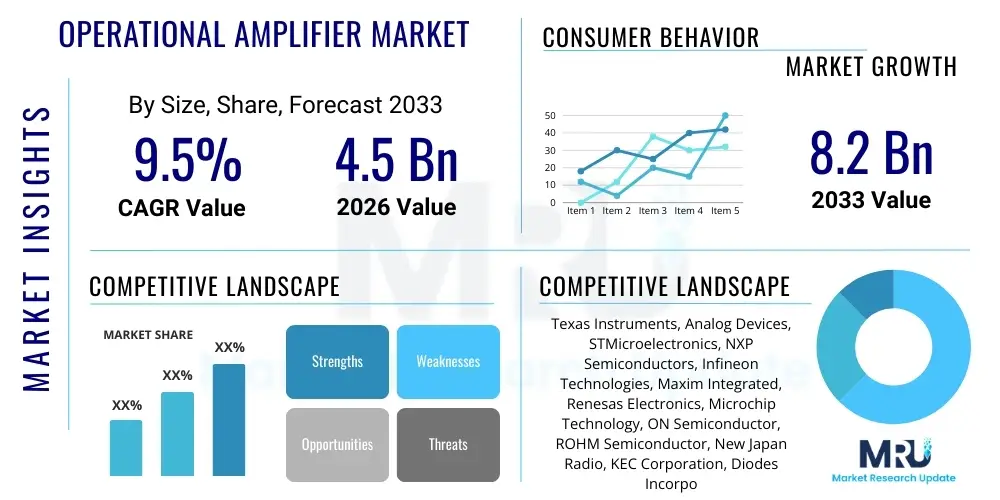

The Operational Amplifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.2 Billion by the end of the forecast period in 2033.

Operational Amplifier Market introduction

Operational Amplifiers (Op-Amps) are fundamental building blocks in analog circuit design, serving as high-gain electronic voltage amplifiers with differential inputs. These versatile integrated circuits are critical components across virtually all electronic sectors, facilitating signal conditioning, filtering, instrumentation, and control systems. The market encompasses a wide array of op-amp types, including precision, high-speed, low-power, and specialty devices designed to meet stringent requirements in terms of noise, offset voltage, bandwidth, and power consumption. The inherent reliability and continuous technological refinement, particularly in semiconductor manufacturing processes, ensure their perpetual relevance in modern electronics.

The primary applications driving market growth include advanced sensor interfacing in Industrial Internet of Things (IIoT) ecosystems, high-resolution data acquisition systems in medical diagnostics, sophisticated power management circuits in electric vehicles (EVs), and robust signal integrity maintenance in 5G communication infrastructure. Op-amps offer substantial benefits such as enabling precise signal manipulation, simplifying complex circuit designs, and allowing for high linearity and stability across varying temperatures and operating conditions. Their flexibility makes them indispensable for translating real-world analog signals into usable digital data, a core requirement for nearly all intelligent systems.

Key driving factors accelerating the adoption of operational amplifiers include the rapid proliferation of connected devices requiring specialized signal chains, the escalating demand for high-performance analog components in automotive safety systems (ADAS), and the persistent shift towards miniaturization and power efficiency in consumer electronics. Furthermore, increasing investment in industrial automation and the necessity for highly accurate measurement equipment in scientific research and manufacturing processes solidify the continuous trajectory of market expansion. Innovation focusing on reducing quiescent current and improving output drive capabilities remains central to manufacturer strategies.

Operational Amplifier Market Executive Summary

The global Operational Amplifier Market is characterized by robust growth, fueled predominantly by the secular trends of digitization and automation across major industries. Business trends indicate a strong focus on developing specialized op-amps, such as zero-drift amplifiers for high-precision measurement and high-voltage amplifiers for industrial control, moving away from general-purpose devices. Major semiconductor manufacturers are heavily investing in integrating passive components and advanced protection features directly onto the op-amp die to enhance reliability and reduce overall board space in end-user applications. Strategic mergers and acquisitions among key players are common, aimed at consolidating intellectual property in high-speed and low-power technologies, thereby securing supply chain resilience and expanding product portfolios.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by its massive manufacturing base in consumer electronics and the rapid adoption of electric vehicle technology in countries like China, Japan, and South Korea. North America and Europe maintain significant market shares, characterized by high demand for premium, specialized op-amps used in aerospace, defense, and stringent healthcare instrumentation. Regional trends are also influenced by evolving regulatory standards, particularly concerning electromagnetic compatibility (EMC) in industrial and automotive sectors, mandating the use of highly stable and noise-resistant op-amps.

Segmentation trends highlight the increasing importance of the Precision Operational Amplifier segment, primarily due to the stringent accuracy requirements in sophisticated sensing and medical applications. In terms of end-use, the Automotive sector is exhibiting the fastest growth, propelled by the transition towards fully autonomous driving (Level 4 and 5) which requires hundreds of specialized op-amps for sensor fusion, LIDAR/RADAR systems, and battery management systems (BMS). Furthermore, the packaging segment sees a continuous shift towards smaller surface mount devices (SMD), optimizing space utilization while maintaining thermal and electrical performance, a crucial trend in portable and compact devices.

AI Impact Analysis on Operational Amplifier Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Operational Amplifier Market often center on whether AI processing chips will supersede analog components, or, conversely, how AI systems will drive increased demand for specialized op-amps. Users frequently ask about the role of op-amps in the complex signal conditioning required for AI sensor inputs (e.g., high-resolution image sensors, acoustic arrays), the power demands imposed by integrating these components in AI edge devices, and the need for extremely low latency analog-to-digital conversion chains facilitated by high-speed op-amps. The consensus theme derived from user concern is the critical interdependency between advanced AI computation and pristine analog signal input; without highly accurate, low-noise signal conditioning provided by modern operational amplifiers, the effectiveness and reliability of AI algorithms are fundamentally compromised.

AI processing workloads, whether running on centralized servers or localized edge devices, are fundamentally reliant on input data acquired from the physical world. Operational amplifiers play a pivotal role in the analog front-end (AFE) of these systems, amplifying minute sensor outputs, filtering out ambient noise, and buffering signals before digitization. The drive towards advanced AI applications, such as predictive maintenance in IIoT or real-time object detection in ADAS, necessitates op-amps with superior performance metrics—ultra-low noise density, extremely high slew rates, and minimal temperature drift—to ensure the integrity of the data fed into the neural networks. This elevated requirement for quality input data directly translates into sustained, high-value demand for specialized, high-performance operational amplifiers.

Consequently, the market is witnessing innovation specifically targeting AI integration. Manufacturers are developing rail-to-rail op-amps optimized for low-voltage, battery-powered AI edge devices, ensuring minimal power consumption without sacrificing bandwidth. The trend towards integrating sensing and processing closer together demands smaller form factors and robust electromagnetic interference (EMI) immunity, which op-amp designers are addressing through advanced packaging and internal shielding techniques. Far from being threatened by digital AI chips, the operational amplifier market is experiencing accelerated growth and specialization, acting as the indispensable link between the physical analog world and the digital AI computational environment.

- AI systems necessitate high-fidelity analog front-ends (AFEs), driving demand for ultra-low noise and high-speed op-amps.

- Increased implementation of AI at the Edge demands op-amps optimized for low power consumption (quiescent current) and rail-to-rail operation.

- Op-amps are critical components in sensor fusion and data acquisition for autonomous vehicles (LIDAR, RADAR processing), integral to AI decision-making.

- The growth of industrial AI (IIoT predictive maintenance) relies on zero-drift op-amps for precise, long-term sensor accuracy and stability.

- AI-driven optimization of manufacturing processes increases the need for high-bandwidth op-amps in advanced test and measurement equipment.

- Integration of machine learning algorithms into signal processing chains requires op-amps capable of handling complex, high-frequency filtering tasks.

DRO & Impact Forces Of Operational Amplifier Market

The Operational Amplifier Market is shaped by a powerful interplay of technological advancements and industrial necessities. Key drivers include the exponential growth in global data generation and consumption, necessitating sophisticated signal processing chains; the rigorous safety and performance requirements of the automotive electrification and autonomy movement; and the expansion of the Industrial IoT, demanding rugged, high-reliability components for harsh environments. Restraints primarily involve the high complexity and cost associated with producing ultra-high-precision, specialty op-amps, coupled with challenges related to semiconductor manufacturing capacity constraints and the lengthy design-in cycles required for safety-critical applications. Opportunities lie in developing integrated system-on-chip (SoC) solutions incorporating multiple analog functions alongside op-amps, addressing emerging needs in quantum computing interfacing, and leveraging 5G infrastructure build-out which mandates high-frequency amplification.

The impact forces within this market are significant. Technological momentum forces favor continuous innovation in reducing noise floors and offset voltages, pushing the boundaries of analog performance necessary for new generations of high-resolution ADCs (Analog-to-Digital Converters). Economic forces dictate that while high-precision op-amps command premium pricing, mass-market consumer electronics require cost-effective, high-volume production, creating a bifurcation in market strategy between specialization and volume optimization. Regulatory and environmental forces, particularly in the European Union and China, push manufacturers towards developing low-voltage, energy-efficient designs, aligning with global sustainability initiatives and stricter power consumption mandates for electronic devices.

Competitive forces remain intense, with established market leaders focusing on ecosystem integration—offering complete signal chain solutions rather than standalone components—to lock in customers. New entrants often specialize in niche areas, such as radiation-hardened or extreme temperature op-amps, challenging the incumbents in specific, high-margin sectors. Overall, the market resilience is high due to the fundamental role of op-amps in converting physical phenomena into actionable electrical signals, ensuring that demand correlates directly with global technological advancement and the proliferation of electronic intelligence across all industrial and consumer domains.

Segmentation Analysis

The Operational Amplifier Market is extensively segmented based on type, application, and packaging technology, reflecting the vast range of performance requirements demanded by diverse end-user industries. Segmentation by type—encompassing Precision, High-Speed, and Low-Power Op-Amps—is crucial as it delineates the primary performance metrics optimized for specific tasks, whether it be sub-microvolt accuracy (Precision) or multi-GHz bandwidth (High-Speed). The application segmentation provides insight into end-user spending priorities, with Automotive, Industrial, and Communication sectors being the key growth engines, each requiring unique characteristics in terms of robustness, temperature range, and noise immunity. This multilayered segmentation allows market participants to tailor their product development and marketing strategies to address highly specific and complex design challenges globally.

The dominance of specific segments is closely tied to broader macroeconomic trends. For instance, the rapid expansion of IIoT initiatives is bolstering the Precision Op-Amp segment, necessary for accurate remote sensing and control, while the rollout of 5G networks drives intense demand for High-Speed Op-Amps utilized in base station and optical networking equipment. Packaging segmentation, though seemingly functional, has significant strategic implications, with surface-mount devices (SMD) dominating volumes due to the universal industry requirement for miniaturization and automated assembly. Through-hole devices persist only in specialized, high-power or legacy systems where robust physical connections are paramount or thermal management demands larger footprints.

Analyzing these segments reveals critical shifts in technological investment. Manufacturers are increasingly focusing R&D on achieving combined attributes, such as "low-power precision" or "high-speed, low-noise" hybrid devices, recognizing that modern applications often require conflicting performance parameters simultaneously. This synthesis of capabilities dictates future market positioning and competitive advantage. The ability to offer a comprehensive portfolio covering high-volume, low-cost op-amps alongside niche, high-performance variants is essential for maintaining a strong overall market presence.

- By Type:

- Precision Operational Amplifiers (Low Offset, Low Drift)

- High-Speed Operational Amplifiers (High Slew Rate, Wide Bandwidth)

- Low-Power Operational Amplifiers (Low Quiescent Current)

- High-Voltage Operational Amplifiers

- Current Feedback Operational Amplifiers

- By Application:

- Industrial Automation and Control (Test & Measurement, Process Control)

- Automotive Electronics (ADAS, Battery Management Systems, Infotainment)

- Consumer Electronics (Portable Devices, Audio Equipment)

- Healthcare and Medical Devices (Patient Monitoring, Imaging Systems)

- Communication Systems (5G Infrastructure, Fiber Optics)

- Aerospace and Defense

- By Packaging Technology:

- Surface Mount Devices (SMD)

- Through-Hole Devices

- Chip Scale Packages (CSP)

Value Chain Analysis For Operational Amplifier Market

The value chain for the Operational Amplifier Market commences with the upstream segment, dominated by highly sophisticated silicon foundries (fabs) and specialized materials suppliers providing essential components such as high-purity silicon wafers and complex chemical processes. Success in the upstream segment hinges on achieving ultra-tight process control necessary for fabricating sensitive analog circuits with minimal variation in parameters like offset voltage and noise. Key activities here include wafer fabrication, photolithography, and process engineering tailored specifically for Bipolar, CMOS, or BiCMOS technologies, which define the final operational performance characteristics of the amplifier.

The distribution channel represents the midstream, acting as the critical link between semiconductor manufacturers and a highly diversified customer base. This channel is bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) who integrate massive volumes of op-amps (e.g., automotive Tier 1 suppliers or major industrial equipment manufacturers) and indirect distribution via global and regional electronic component distributors. The distributors play a vital role in servicing smaller enterprises, managing inventory, providing technical support, and offering short lead times for lower-volume and specialized orders. Efficiency in the indirect channel often determines market penetration success across fragmented industrial and research sectors.

The downstream segment primarily consists of the diverse array of end-users—ranging from automotive system builders and industrial controls manufacturers to medical device designers and consumer electronics assemblers. Success in the downstream market is measured by how effectively the op-amps integrate into complex systems, often requiring extensive technical collaboration between the op-amp vendor and the end-user design team. Factors such as application-specific reference designs, comprehensive technical documentation, and rapid technical support are paramount. The long-term profitability of the market relies heavily on this downstream integration, ensuring the amplifier meets the exact performance envelope required by the final application.

Operational Amplifier Market Potential Customers

The potential customer base for the Operational Amplifier Market is exceptionally broad, spanning nearly all sectors that utilize electronic circuits for signal measurement, conditioning, and control. Primary end-users fall within the industrial and automotive sectors due to the sheer volume and mission-critical nature of their applications. Industrial buyers, including manufacturers of automated test equipment (ATE), factory automation systems (PLCs, motor controls), and high-resolution instrumentation (oscilloscopes, power meters), require op-amps characterized by extreme precision, temperature stability, and robust protection against electrical transients common in factory settings.

Automotive manufacturers and their Tier 1 suppliers constitute another massive and rapidly growing segment. These customers purchase op-amps for critical safety applications such as Advanced Driver Assistance Systems (ADAS), including signal processing for RADAR and ultrasonic sensors; powertrain control, particularly in complex Battery Management Systems (BMS) for electric vehicles which demand high accuracy current sensing; and general vehicle infotainment and networking systems. The strict quality standards (e.g., AEC-Q100 certification) demanded by this sector create high barriers to entry, making certified suppliers highly valued partners.

Beyond these major segments, the healthcare industry represents a high-value customer base, seeking ultra-low noise op-amps for sensitive medical imaging (MRI, ultrasound) and diagnostic equipment (ECG, blood analyzers) where signal integrity is non-negotiable for patient safety and diagnostic accuracy. Furthermore, telecommunications companies and their equipment suppliers (OEMs) are significant buyers, especially those building 5G base stations and fiber optic network components, needing high-speed and wide-bandwidth op-amps to ensure reliable, high-throughput data transmission.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Texas Instruments, Analog Devices, STMicroelectronics, NXP Semiconductors, Infineon Technologies, Maxim Integrated, Renesas Electronics, Microchip Technology, ON Semiconductor, ROHM Semiconductor, New Japan Radio, KEC Corporation, Diodes Incorporated, Semtech Corporation, Skyworks Solutions, Broadcom, Monolithic Power Systems, Qorvo, Cirrus Logic, Advanced Micro Devices (AMD) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Operational Amplifier Market Key Technology Landscape

The technological landscape of the Operational Amplifier Market is defined by continuous innovation aimed at enhancing performance parameters while simultaneously improving power efficiency and integration density. A pivotal development is the widespread adoption of complementary metal-oxide-semiconductor (CMOS) fabrication processes, which allows for extremely low quiescent currents necessary for portable and battery-powered applications, particularly in the low-power op-amp segment. However, for applications requiring the highest speed and lowest noise, specialized processes such as Bipolar, Junction Field-Effect Transistor (JFET), and Silicon-Germanium (SiGe) BiCMOS technologies remain crucial, particularly for high-end data acquisition systems and 5G transceiver front-ends. The choice of manufacturing process dictates the trade-offs between speed, noise, and power consumption.

Key architectural innovations are driving the precision segment, most notably the implementation of zero-drift (or auto-zero) techniques, which utilize internal switching and calibration mechanisms—such as chopping or auto-correction—to continuously measure and eliminate the input offset voltage and its drift over temperature and time. This technology is critical for high-accuracy sensing in temperature measurement (thermocouples) and strain gauges, minimizing the need for complex, costly external calibration cycles. Furthermore, significant progress is being made in rail-to-rail input and output designs, allowing op-amps to operate effectively using the full dynamic range provided by low-voltage power supplies, a fundamental requirement for modern integrated systems.

Advanced packaging technologies, including Chip Scale Packages (CSP) and Wafer Level Chip Scale Packages (WLCSP), are becoming standard, reducing the physical size of the op-amp footprint dramatically, which is essential for compact consumer and medical devices. Furthermore, technological focus is being placed on robust internal protection circuits, including integrated electrostatic discharge (ESD) protection and thermal shutdown features, to enhance the reliability of the devices in harsh industrial environments. The trend is moving towards higher functional integration, where op-amps are combined with other analog functions like multiplexers, comparators, and gain stages into highly optimized, single-chip Analog Front Ends (AFEs).

Regional Highlights

Regional dynamics significantly influence the Operational Amplifier Market, reflecting varying levels of industrialization, technological adoption rates, and governmental investment priorities across different geographies. Asia Pacific (APAC) dominates the global market, largely driven by its comprehensive electronic manufacturing ecosystem in countries such as China, Taiwan, South Korea, and Japan. The region's stronghold in consumer electronics production, coupled with massive government and private sector investments in electric vehicle manufacturing and 5G infrastructure rollout, ensures sustained, high-volume demand for op-amps across all performance levels. Furthermore, the rapid growth of the industrial automation sector in Southeast Asian economies contributes substantially to the demand for rugged, high-reliability op-amps.

North America is characterized by high demand for specialty and high-performance operational amplifiers, particularly within the aerospace, defense, medical, and advanced test and measurement sectors. The United States, being a global hub for technological innovation, drives significant revenue for high-margin, precision-grade components. Investment here is focused on supporting complex R&D initiatives, requiring op-amps with cutting-edge specifications in terms of noise performance and bandwidth. Similarly, Europe maintains a strong presence, spearheaded by Germany's robust industrial machinery sector and the region's pioneering efforts in automotive electrification. European customers demand certified, long-lifecycle components that adhere to stringent quality and functional safety standards (e.g., ISO 26262 for automotive applications).

The Latin America, Middle East, and Africa (LAMEA) regions currently represent emerging markets, although they are exhibiting strong potential growth. This growth is predominantly linked to infrastructure development, telecommunications expansion, and increasing adoption of smart grid technologies and industrial automation. While the average selling prices (ASPs) for op-amps in these regions may be lower, the increasing pace of digitization suggests a long-term trajectory toward higher-volume purchasing. Market players are strategically expanding their distribution and technical support networks in these regions to capitalize on future growth opportunities driven by industrial modernization efforts.

- Asia Pacific (APAC): Dominant market share fueled by mass manufacturing, consumer electronics volume, and rapid expansion of 5G and EV production. Key countries include China, Japan, and South Korea.

- North America: Leader in high-value, specialized segments (Aerospace, Defense, Advanced Medical Instrumentation). Focus on high-performance, ultra-low noise, and bandwidth op-amps.

- Europe: Strong demand from the Automotive (EVs, ADAS) and Industrial Automation sectors (Industry 4.0). Emphasis on certified components meeting strict quality and functional safety standards.

- Latin America, Middle East, and Africa (LAMEA): Emerging high-growth markets driven by infrastructure upgrades, smart grid initiatives, and increasing penetration of industrial IoT technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Operational Amplifier Market.- Texas Instruments

- Analog Devices

- STMicroelectronics

- NXP Semiconductors

- Infineon Technologies

- Maxim Integrated

- Renesas Electronics

- Microchip Technology

- ON Semiconductor

- ROHM Semiconductor

- New Japan Radio

- KEC Corporation

- Diodes Incorporated

- Semtech Corporation

- Skyworks Solutions

- Broadcom

- Monolithic Power Systems

- Qorvo

- Cirrus Logic

- Advanced Micro Devices (AMD)

Frequently Asked Questions

Analyze common user questions about the Operational Amplifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Operational Amplifier Market?

Market growth is primarily driven by the exponential adoption of electronic content in the Automotive sector (ADAS, EVs), the proliferation of Industrial IoT (IIoT) sensors requiring precision signal conditioning, and the continuous need for high-speed components in 5G communication infrastructure.

How do Precision Op-Amps differ technologically from High-Speed Op-Amps, and where are they used?

Precision Op-Amps prioritize extremely low input offset voltage and minimal temperature drift, often utilizing zero-drift technology for stability in sensor measurement (e.g., medical devices). High-Speed Op-Amps focus on high slew rates and wide bandwidth for rapid data transmission and filtering in communications and video processing.

Which geographical region dominates the Operational Amplifier Market?

Asia Pacific (APAC) currently dominates the market share due to its vast electronic manufacturing base, significant investments in electric vehicle production, and rapid build-out of 5G infrastructure, generating the highest volume demand globally.

What is the impact of low-voltage electronics on Op-Amp design?

The shift towards low-voltage, battery-powered devices (AI edge computing, portable medical devices) mandates the development of rail-to-rail input/output op-amps characterized by ultra-low quiescent current (power consumption) to maximize battery life without compromising performance.

What role do operational amplifiers play in electric vehicle Battery Management Systems (BMS)?

Operational amplifiers are critical in BMS for high-precision current sensing and voltage monitoring across battery cells. Zero-drift and high common-mode rejection ratio (CMRR) op-amps ensure accurate, reliable measurement of cell conditions necessary for optimizing charge cycles, monitoring battery health, and ensuring functional safety.

What technological advancements are enhancing the reliability of Op-Amps in harsh industrial environments?

Reliability enhancements include the integration of robust on-chip ESD protection, overvoltage protection circuits, and thermal shutdown features. Furthermore, specialized manufacturing processes (e.g., Silicon on Insulator, SOI) improve resilience to extreme temperatures and electromagnetic interference (EMI) prevalent in industrial settings.

How does the segmentation by packaging technology influence market trends?

The segmentation reflects a strong market trend toward miniaturization. Surface Mount Devices (SMD) and Chip Scale Packages (CSP) dominate due to requirements for higher circuit density, automated assembly, and smaller device footprints in modern electronics, while traditional Through-Hole packages are reserved for high-power or legacy systems.

What are the key restraint factors affecting market expansion?

Major restraints include the extensive investment required for new fabrication facilities capable of producing cutting-edge analog components, the increasingly complex design requirements for ultra-low noise op-amps, and the prolonged qualification and design-in cycles, particularly for safety-critical applications like aerospace and automotive systems.

How are mergers and acquisitions influencing the competitive landscape?

Mergers and acquisitions allow dominant market players to consolidate crucial analog intellectual property (IP), broaden their product portfolios to offer complete signal chain solutions, and secure access to specialized process technologies, thereby increasing market concentration and competition based on comprehensive system offerings.

Why is the development of ultra-low noise op-amps important for the healthcare sector?

In healthcare, particularly in diagnostic imaging (MRI, ultrasound) and patient monitoring (ECG, EEG), the signals measured are often extremely small. Ultra-low noise op-amps are essential to amplify these minute biological signals with high fidelity, ensuring accurate data capture and reliable clinical results.

What role do Op-Amps play in advanced sensor fusion for autonomous vehicles?

Op-Amps serve as the Analog Front-End (AFE) for diverse sensors (LIDAR, RADAR, camera). They are responsible for amplifying, filtering, and conditioning the raw analog data from these sensors before digitization, ensuring the high integrity and synchronization required for the vehicle’s central processing unit to merge data reliably.

Define the concept of "rail-to-rail" operation in operational amplifiers.

Rail-to-rail operation refers to the ability of an operational amplifier's input and/or output voltage to span the entire range between the positive and negative power supply voltage rails. This is critical in low-voltage systems to maximize the dynamic range and avoid clipping of the signal.

How does the value chain analysis differentiate between direct and indirect distribution?

Direct distribution involves high-volume sales and custom contracts between the op-amp manufacturer and large OEMs (e.g., Apple, Tesla). Indirect distribution utilizes global and regional channel partners (distributors) to handle low-to-medium volume sales, inventory management, and technical support for smaller businesses and specialized industrial customers.

What is the significance of BiCMOS technology in the Op-Amp market?

BiCMOS (Bipolar-CMOS) technology combines the high input impedance and low power characteristics of CMOS with the high speed and low noise of Bipolar transistors. This hybrid approach allows manufacturers to create op-amps that offer superior overall performance, particularly in high-speed precision applications.

Explain the relationship between the IIoT market and the demand for zero-drift op-amps.

The Industrial Internet of Things (IIoT) requires sensor data (temperature, pressure, vibration) to be accurate over long periods in harsh factory conditions. Zero-drift op-amps, due to their ability to virtually eliminate input offset voltage drift over time and temperature, are essential for maintaining the long-term calibration and accuracy required for effective predictive maintenance and process control.

Which application segment is forecasted to exhibit the highest CAGR?

The Automotive Electronics application segment is forecasted to register the highest Compound Annual Growth Rate (CAGR), driven by the widespread global adoption of electric vehicles and the escalating deployment of complex ADAS features, both demanding vast quantities of certified analog components.

How do Op-Amps contribute to the precision required in automated test equipment (ATE)?

ATE systems require highly accurate signal generation and measurement capabilities. Op-Amps with extremely low distortion, high linearity, and wide bandwidth are utilized in the AFE stages of ATE to precisely condition test signals and accurately measure the minute responses from the device under test (DUT).

What are the primary opportunities in the Op-Amp market related to 5G technology?

5G infrastructure demands high linearity and high-frequency analog components. Opportunities exist in supplying high-speed, high-bandwidth op-amps for active antenna systems, optical transceivers, and baseband signal conditioning required to manage the massive data throughput and high frequency operation of 5G networks.

What is the distinction between Op-Amps used in consumer audio devices versus industrial sensors?

Consumer audio op-amps prioritize high fidelity, low distortion, and low voltage operation. Industrial sensor op-amps prioritize ruggedness, wide operating temperature range, high Common-Mode Rejection Ratio (CMRR), and superior precision (low offset voltage) to withstand electrical noise and harsh physical environments.

Describe the current trend regarding functional integration in operational amplifiers.

The current trend is towards integrating the op-amp with supplementary functions, creating highly optimized System-in-Package (SiP) or Analog Front-End (AFE) solutions. This integration includes combining op-amps with voltage references, digital potentiometers, or Analog-to-Digital Converters (ADCs) to simplify system design and reduce component count for end-users.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Transient Voltage Suppressor Tvs Diode Market Size Report By Type (Uni-polar TVS, Bi-polar TVS, Arrays, Ultra Low Capacitance (Less than 5pF), Low Capacitance (5 to 100pF), Standard Capacitance (Less than 100 pF)), By Application (DC Supply Protection, DC Load Protection, AC Supply Protection, Electro-Magnetic Interference Limiting, Operational Amplifier Protection, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Operational Amplifier Market Size Report By Type (OpenLoop Amplifier, ClosedLoop Amplifier), By Application (OpenLoop Amplifier, ClosedLoop Amplifier), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Transient Voltage Suppressor Market Size Report By Type (Uni-polar TVS, Bi-polar TVS), By Application (DC Supply Protection, DC Load Protection, AC Supply Protection, Electro-Magnetic Interference Limiting, Operational Amplifier Protection, Others, By End User, Automotive, Industrial Power Supplies, Military/Aerospace, Telecommunication, Computing, Consumer Goods, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Operational Amplifier Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Generic, Current Class, Voltage Class, Others), By Application (Active Filter, Oscillator, Voltage Comparator, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager