Operational Technology (OT) Cybersecurity Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437075 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Operational Technology (OT) Cybersecurity Market Size

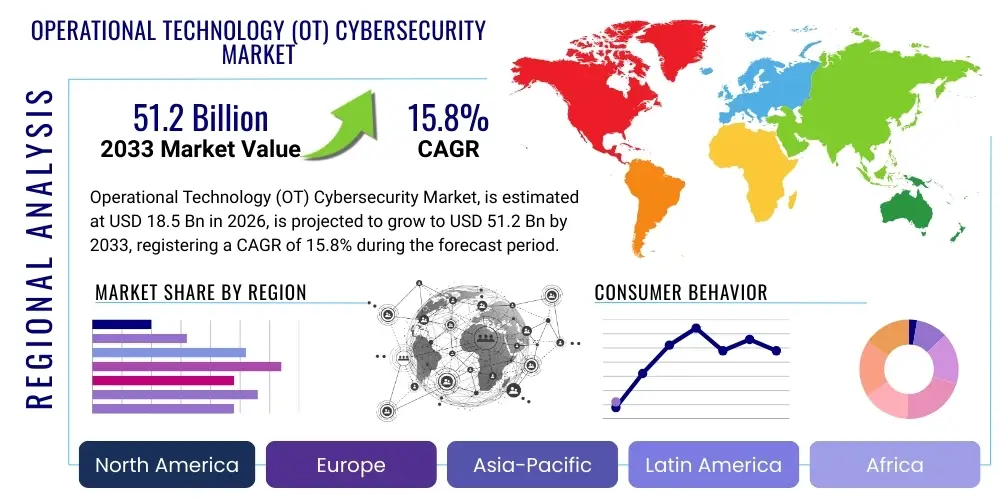

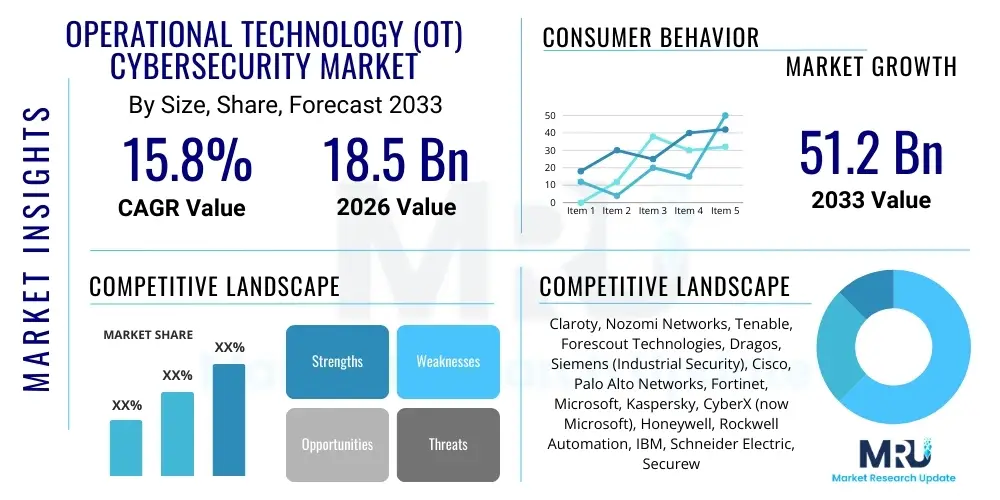

The Operational Technology (OT) Cybersecurity Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $51.2 Billion by the end of the forecast period in 2033.

Operational Technology (OT) Cybersecurity Market introduction

The Operational Technology (OT) Cybersecurity market encompasses the suite of hardware, software, and services specifically designed to protect industrial control systems (ICS), including Supervisory Control and Data Acquisition (SCADA) systems, Distributed Control Systems (DCS), and other vital industrial assets from cyber threats. OT environments, historically isolated (air-gapped), are increasingly interconnected with enterprise IT networks due to digital transformation initiatives such as Industry 4.0 and the Industrial Internet of Things (IIoT). This convergence exposes critical infrastructure—spanning energy, manufacturing, utilities, and transportation—to sophisticated malware, ransomware, and state-sponsored attacks, necessitating robust, purpose-built cybersecurity solutions that prioritize operational uptime and safety over traditional confidentiality measures.

Key product offerings in this domain include network monitoring and visibility platforms, asset inventory management tools customized for industrial devices, specialized threat detection systems utilizing deep packet inspection tailored for proprietary industrial protocols (e.g., Modbus, DNP3, Profinet), and secure remote access solutions. The inherent architectural differences between IT and OT, particularly concerning real-time latency requirements, device longevity, and proprietary communication standards, mandate that OT cybersecurity solutions are non-intrusive and highly resilient. These specialized solutions ensure the integrity and availability of physical processes, preventing catastrophic failures, environmental damage, and production losses that result from successful breaches.

The market is predominantly driven by the escalating frequency and sophistication of attacks targeting critical infrastructure, often facilitated by the blurring of boundaries between IT and OT networks. Regulatory mandates across various geographies, particularly those focused on utility and energy sector resilience (like NERC CIP in North America and NIS Directive in Europe), also enforce minimum security standards, compelling organizations to invest substantially in advanced detection and response capabilities. Furthermore, the tangible benefits of enhanced operational resilience, reduced downtime costs associated with cyber incidents, and comprehensive risk management contribute significantly to the sustained high growth trajectory observed across this critical security segment.

Operational Technology (OT) Cybersecurity Market Executive Summary

The Operational Technology Cybersecurity market is experiencing profound growth, fundamentally shaped by global business trends pivoting toward pervasive digital operational models and the adoption of the Industrial Internet of Things (IIoT). Key business trends highlight a shift from passive monitoring to active defense mechanisms, characterized by increased adoption of security orchestration, automation, and response (SOAR) platforms specifically tailored for industrial environments. Enterprises are increasingly moving beyond perimeter defense, focusing on micro-segmentation and Zero Trust architectures within the OT domain to limit lateral movement of threats. The strong demand for managed security services (MSS) in the OT space is notable, driven by the significant shortage of personnel skilled in industrial cyber risk management, allowing organizations to outsource complex monitoring and incident response functions to specialized third-party providers.

Regional dynamics illustrate varied maturity levels and regulatory catalysts; North America remains the dominant market due to early implementation of stringent regulatory frameworks and high technology adoption rates across the energy and manufacturing sectors, particularly in the United States. Europe is accelerating rapidly, primarily influenced by the implementation of directives such as NIS2, which broadens the scope of regulated entities and mandates stricter incident reporting requirements, spurring investments in compliance-driven security solutions. Meanwhile, the Asia Pacific region presents the highest growth opportunities, propelled by massive industrialization efforts, widespread smart factory deployment in countries like China and India, and subsequent recognition of cyber risks associated with rapidly deployed, interconnected manufacturing systems.

Segment-wise, the Services component, including professional services like risk assessment, penetration testing, and incident response, holds a substantial and growing market share due to the complex, unique nature of OT environments requiring specialized expertise for deployment and maintenance. In terms of end-use sectors, the Energy and Power sector consistently leads market consumption, given the high criticality and systemic impact of potential failures in these facilities. Furthermore, there is a distinct trend towards solutions that facilitate deep integration between IT Security Operations Centers (SOCs) and OT monitoring systems, enabling unified visibility and coordinated threat response capabilities, thereby improving overall organizational resilience against hybrid cyber-physical attacks.

AI Impact Analysis on Operational Technology (OT) Cybersecurity Market

User queries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on OT cybersecurity commonly focus on three core themes: the feasibility and accuracy of automated threat detection in noisy industrial environments, the use of AI to analyze massive datasets generated by IIoT devices for behavioral anomaly detection, and the potential for AI-driven response systems to autonomously stop threats without compromising operational safety. Users are highly concerned about AI's role in identifying zero-day threats that bypass signature-based systems, and they seek clarification on how AI can effectively manage the unique operational protocols and latency constraints inherent to OT networks. Key expectations revolve around leveraging AI for predictive security, moving beyond reactive measures, and addressing the persistent skills gap through intelligent automation of security monitoring and incident prioritization in mission-critical facilities.

- AI-driven anomaly detection analyzes baseline network traffic and process behavior within ICS, rapidly identifying deviations indicative of malware infection or unauthorized configuration changes that traditional signature-based methods often miss.

- Machine Learning algorithms significantly enhance the accuracy and speed of industrial asset inventory creation and maintenance by automatically classifying devices based on observed network metadata, vastly improving asset management efficiency.

- AI assists in threat hunting by correlating disparate event data from both IT and OT environments, providing a unified risk posture and enabling security analysts to prioritize threats based on potential impact to physical processes.

- Predictive maintenance security models leverage ML to forecast the likelihood of component failure or security vulnerability exploitation based on continuous operational data monitoring, facilitating proactive patching and repair schedules.

- Natural Language Processing (NLP) is used in security information and event management (SIEM) systems tailored for OT, helping to process and interpret unstructured incident reports and vendor advisories for faster situational awareness.

- Autonomous incident response capabilities, powered by AI, can isolate compromised industrial endpoints or execute controlled network segmentation changes instantly upon confirmed detection, minimizing downtime duration and potential process disruption.

- AI models are trained on large volumes of proprietary industrial protocol data to ensure that deep packet inspection is optimized for accuracy, preventing false positives that could lead to unnecessary shutdowns or operational instability.

- The use of generative AI (GenAI) is emerging in simulating complex cyber-physical attacks for resilience testing, allowing organizations to train their defense systems against highly sophisticated, custom-engineered attack vectors in a safe environment.

- AI-enabled risk scoring automatically calculates the aggregated vulnerability and threat exposure level for specific critical assets, guiding resource allocation towards the highest-priority security gaps in real time.

- Enhanced security automation through AI minimizes the reliance on human intervention for routine tasks, effectively mitigating the market challenge presented by the acute global shortage of specialized OT security professionals.

DRO & Impact Forces Of Operational Technology (OT) Cybersecurity Market

The dynamics of the Operational Technology Cybersecurity market are driven by the urgent necessity to protect essential services and production capabilities against sophisticated digital adversaries, countered by structural challenges related to legacy infrastructure and high integration costs. Key drivers include the exponential increase in highly damaging ransomware attacks targeting manufacturing and utilities, the accelerated IT/OT convergence due to digital transformation initiatives (IIoT adoption), and increasingly stringent regulatory mandates across critical infrastructure sectors globally, forcing adherence to minimum security standards and resilience testing. Restraints primarily involve the long lifespan and proprietary nature of legacy OT equipment that resists easy patching or integration with modern security controls, the inherent risk of implementing security measures that might induce downtime or instability in sensitive industrial processes, and the substantial capital investment required for comprehensive, cross-domain security architecture implementation.

Opportunities for market expansion are significant, particularly through the proliferation of 5G networks, which enable massive connectivity for industrial devices, necessitating secure remote access and edge computing security solutions to protect distributed assets. The burgeoning demand for specialized Managed Security Service Providers (MSSPs) focused solely on OT environments presents a major avenue for growth, especially for small and mid-sized industrial organizations lacking internal expertise. Furthermore, the push towards standardized, verifiable compliance across multinational corporations offers vendors opportunities to provide comprehensive governance, risk, and compliance (GRC) platforms integrated with real-time operational security data, addressing both IT and OT compliance requirements simultaneously.

The impact forces shaping the market are complex, intertwining technological advancement with geopolitical risk. Geopolitical tensions are elevating state-sponsored cyber-physical attacks as a key risk vector, accelerating government and private sector collaboration on critical infrastructure protection (CIP). The transition towards cloud-based security services, while offering scalability, introduces new attack surfaces that require hybrid defense models, pushing innovation in securing the interface between centralized cloud management and distributed industrial assets. The cumulative effect of these forces ensures sustained investment, particularly in advanced detection technologies and industrial intrusion prevention systems, positioning OT cybersecurity as a non-negotiable component of modern industrial operations.

Segmentation Analysis

The Operational Technology Cybersecurity market is comprehensively segmented based on the type of components, deployment model, type of service offered, and the diverse end-use verticals, providing granular insights into investment patterns and evolving technological preferences across the industrial landscape. The segmentation by component clearly distinguishes between specialized hardware, industrial security software applications, and supporting services, with software increasingly focusing on network visibility, threat intelligence, and behavioral monitoring optimized for control systems. Deployment models span on-premise solutions, which currently dominate due to latency and control requirements in critical environments, and cloud/hybrid models, which are gaining momentum for non-critical assets and centralized management functions. The varying security needs and regulatory pressures across industries like power generation versus manufacturing necessitate dedicated sector-specific segmentation analysis.

- By Component:

- Hardware (e.g., Secure Industrial Gateways, Firewalls, Intrusion Prevention Systems tailored for OT)

- Software (e.g., Asset Inventory & Configuration Management, Threat Detection Platforms, Vulnerability Management Solutions, Industrial Endpoint Protection)

- Services (e.g., Consulting, Implementation, Managed Security Services, Training and Education, Risk and Vulnerability Assessments)

- By Deployment Model:

- On-Premise (Dominant for highly sensitive, air-gapped or low-latency OT environments)

- Cloud/Hybrid (Growing for centralized management, remote access, and non-real-time data analysis)

- By Service Type:

- Professional Services (Consulting, Integration, Auditing)

- Managed Services (Managed Detection and Response, 24/7 Monitoring, Incident Handling)

- By End-Use Industry:

- Energy & Power (Electricity, Oil & Gas, Nuclear Facilities)

- Manufacturing (Discrete and Process Manufacturing, Automotive, Pharmaceuticals)

- Utilities (Water and Wastewater Treatment, Public Works)

- Transportation (Railways, Airports, Ports, Logistics)

- Chemicals & Petrochemicals

- Mining and Metals

Value Chain Analysis For Operational Technology (OT) Cybersecurity Market

The value chain for the Operational Technology Cybersecurity market begins with core technology providers, who are responsible for the foundational research and development of specialized hardware and software capable of interfacing securely with industrial communication protocols and aging control systems. These providers innovate in areas such as industrial deep packet inspection, non-intrusive asset discovery, and threat intelligence specifically tailored to industrial vulnerabilities. Following this stage are systems integrators and engineering firms, which play a crucial role in adapting these generic solutions to the unique operational constraints and network architectures of specific end-user environments, often involving complex integration with legacy equipment and existing IT infrastructure to create a unified security fabric.

The distribution channel involves both direct sales, particularly for large critical infrastructure projects where bespoke solutions and long-term contracts are common, and indirect channels dominated by specialized Managed Security Service Providers (MSSPs) and value-added resellers (VARs). MSSPs are becoming increasingly important, acting as the primary delivery mechanism for ongoing security monitoring and specialized incident response, bridging the gap created by the shortage of highly skilled OT security staff within end-user organizations. Downstream activities involve the continuous maintenance, vulnerability patching, and security operations management performed by the end-user or outsourced to the MSSP, ensuring the sustained integrity and availability of the protected physical processes.

Operational Technology (OT) Cybersecurity Market Potential Customers

Potential customers for Operational Technology Cybersecurity solutions are entities that own and operate mission-critical physical systems whose disruption could result in significant economic, environmental, or public safety consequences. These end-users are characterized by having complex, multi-layered industrial control systems (ICS) that necessitate specialized security protocols different from traditional IT environments, prioritizing safety and system availability above all else. The primary buyers are typically large corporations and governmental agencies managing critical national infrastructure, including Chief Information Security Officers (CISOs), Directors of Operational Technology (DOT), and plant managers who are directly responsible for maintaining operational uptime and regulatory compliance within their production or service delivery environments.

The buying decision is generally highly complex, involving multiple stakeholders from IT, OT, and safety compliance departments, focused on finding solutions that offer deep, non-intrusive visibility into proprietary industrial networks without causing system interruptions during implementation or operation. Key purchasing industries include those subject to strict governmental regulation, such as electricity transmission and distribution companies, natural gas pipeline operators, and large-scale pharmaceutical manufacturing facilities. These customers seek vendor partners who not only provide advanced technology but also possess deep domain expertise in industrial processes to ensure seamless integration and rapid, safe incident remediation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $51.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Claroty, Nozomi Networks, Tenable, Forescout Technologies, Dragos, Siemens (Industrial Security), Cisco, Palo Alto Networks, Fortinet, Microsoft, Kaspersky, CyberX (now Microsoft), Honeywell, Rockwell Automation, IBM, Schneider Electric, Secureworks, Radiflow, Verve Industrial Protection, Check Point Software. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Operational Technology (OT) Cybersecurity Market Key Technology Landscape

The contemporary OT Cybersecurity technology landscape is defined by the necessity for deep industrial visibility coupled with adaptive, non-intrusive defense mechanisms designed to uphold system integrity and availability in real-time control environments. A foundational shift involves the widespread adoption of specialized Industrial Intrusion Detection Systems (I-IDS) that utilize deep packet inspection (DPI) technology, enabling them to decipher and analyze proprietary industrial protocols (like OPC UA, Ethernet/IP, and Modbus TCP) for malicious commands or unauthorized activity, providing far greater context than generic network monitoring tools. Furthermore, technology development is heavily concentrated on comprehensive asset inventory and vulnerability management platforms specifically optimized for OT environments, which can identify and profile every connected device—including those that cannot host traditional agents—and assess vulnerabilities without relying on disruptive, active network scanning techniques, a critical requirement for live production systems.

Another major technological trend driving the market is the implementation of Zero Trust Architecture (ZTA) principles adapted for Operational Technology networks. ZTA, in the OT context, translates to stringent network segmentation, micro-segmentation, and rigorous access verification for all users and devices attempting to interact with critical industrial controllers or endpoints, treating every connection as potentially hostile regardless of its network location. This move away from traditional flat OT networks significantly reduces the attack surface and limits the lateral movement of threats that manage to breach the perimeter. Secure remote access solutions, often employing multi-factor authentication and granular session recording, are vital components of this landscape, ensuring external maintenance personnel or vendors can only access specific necessary assets for limited durations under continuous surveillance, thereby mitigating inherent supply chain risks.

Advanced security analytics and threat intelligence sharing platforms constitute the cutting edge of OT defense, leveraging machine learning to establish comprehensive behavioral baselines of industrial processes and device interactions. This behavioral analysis enables the detection of anomalous activity, such as unusual controller reprogramming attempts or abnormal sensor readings, often before a traditional security alert is generated. Coupled with industry-specific threat intelligence feeds, which disseminate timely information on new exploits targeting SCADA systems and specific vendor equipment, organizations can proactively patch vulnerabilities and configure network defenses. The integration capabilities of these new technologies with existing enterprise Security Operations Centers (SOCs) are paramount, facilitating unified threat visibility and streamlined incident response workflows between IT and OT teams, moving toward converged security operations.

Regional Highlights

- North America: This region maintains its dominant position in the global market, driven by the presence of major technology providers, stringent regulatory compliance requirements (particularly NERC CIP for the power sector and sector-specific NIST guidelines), and a heightened awareness of high-profile cyber-physical risks targeting energy infrastructure and critical manufacturing bases. The region exhibits high adoption rates for advanced solutions such as managed detection and response (MDR) services specialized for OT environments and actively pursues large-scale pilot projects integrating AI-driven monitoring systems into legacy ICS architectures across federal and state critical assets.

- Europe: The European market is experiencing robust, accelerated growth, primarily fueled by the comprehensive regulatory landscape defined by the Network and Information Security (NIS) Directive and the forthcoming NIS2 update, which mandates heightened cybersecurity requirements across expanded sectors including digital infrastructure providers and critical supply chains. Investment is strongly focused on achieving verifiable compliance, enhancing national resilience capabilities, and prioritizing cross-border information sharing regarding industrial threats, leading to significant expenditure on vulnerability assessment, risk management consulting, and security integration services.

- Asia Pacific (APAC): APAC is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, reflecting massive government investments in digitalization, widespread rollout of smart manufacturing facilities (Industry 4.0), and the rapid expansion of critical infrastructure in developing economies like India, China, and Southeast Asia. The region’s growth is characterized by the need for scalable and often cost-effective solutions to protect newly deployed, often heterogeneous, IIoT devices, leading to strong demand for cloud-based or hybrid OT security solutions and local MSSP partnerships.

- Latin America (LATAM): This market demonstrates gradual but consistent growth, mainly concentrated within the energy, mining, and oil and gas sectors, which form the economic backbone of many countries in the region. Growth drivers include increasing foreign investment that necessitates international security standards adherence and regional governmental initiatives aiming to modernize outdated infrastructure, spurring investments in passive asset discovery and network visibility solutions to establish fundamental security hygiene and compliance frameworks.

- Middle East and Africa (MEA): Growth in the MEA region is intrinsically linked to substantial government-led strategic initiatives aimed at securing vital national assets, particularly in the large-scale oil and gas processing facilities, water desalination plants, and developing smart city projects across the Gulf Cooperation Council (GCC) states. These nations prioritize vendor relationships that provide comprehensive, turn-key industrial security solutions, often leveraging high-specification hardware and advanced physical security integration alongside digital defenses to address elevated geopolitical threat levels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Operational Technology (OT) Cybersecurity Market.- Claroty

- Nozomi Networks

- Tenable

- Dragos

- Forescout Technologies

- Siemens AG (Industrial Security Solutions)

- Cisco Systems, Inc.

- Palo Alto Networks

- Fortinet, Inc.

- Microsoft Corporation (including CyberX capabilities)

- Honeywell International Inc.

- Rockwell Automation, Inc.

- IBM Corporation

- Schneider Electric SE

- Kaspersky Lab

- Radiflow

- Verve Industrial Protection

- Check Point Software Technologies Ltd.

- Secureworks

- CyberArk Software Ltd.

Frequently Asked Questions

Analyze common user questions about the Operational Technology (OT) Cybersecurity market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between IT and OT cybersecurity approaches?

The primary distinction lies in prioritization. IT security prioritizes Confidentiality, Integrity, and Availability (CIA), whereas OT security strictly enforces Availability, Integrity, and then Confidentiality (AIC). OT systems focus on maintaining continuous operational uptime and safety of physical processes, meaning security measures must be non-intrusive and adhere to strict real-time performance constraints incompatible with traditional IT patching or active scanning methodologies.

How is the increasing convergence of IT and OT networks impacting industrial security strategies?

IT/OT convergence requires organizations to adopt a unified, holistic security framework, moving away from air-gapped assumptions toward segmented networks secured by industrial demilitarized zones (IDMZs). The impact necessitates shared visibility platforms, centralized threat intelligence, and harmonized incident response protocols to effectively manage cyber risks that can now traverse both enterprise and industrial domains, requiring expertise in both spheres.

Which industrial sector is currently investing the most in OT cybersecurity solutions globally?

The Energy and Power sector consistently demonstrates the highest investment levels in OT cybersecurity, driven by the critical national importance of electricity grids, gas pipelines, and power generation facilities, coupled with stringent, federally mandated regulations such as North American Electric Reliability Corporation Critical Infrastructure Protection (NERC CIP) standards, which enforce mandatory security controls and continuous compliance auditing.

What role does Zero Trust Architecture play in securing Operational Technology environments?

Zero Trust Architecture (ZTA) in OT focuses on minimizing the inherent trust previously granted to internal network devices. It enforces micro-segmentation, robust identity and access management (IAM) for both humans and devices, and continuous verification of access privileges to critical controllers. This approach significantly limits the potential for lateral movement by an adversary within the highly sensitive industrial network, enhancing resilience against insider and external threats.

What are the greatest technological challenges limiting the widespread adoption of modern OT security solutions?

The primary challenges include the long operational lifecycles of legacy industrial equipment, which often cannot be patched or updated without high risks to operational stability; the proprietary nature of many industrial communication protocols, which limits interoperability; and the need to deploy security measures without introducing latency or jitter that could interfere with time-sensitive control loops within the physical processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager