Ophiopogon Japonicus Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435566 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Ophiopogon Japonicus Market Size

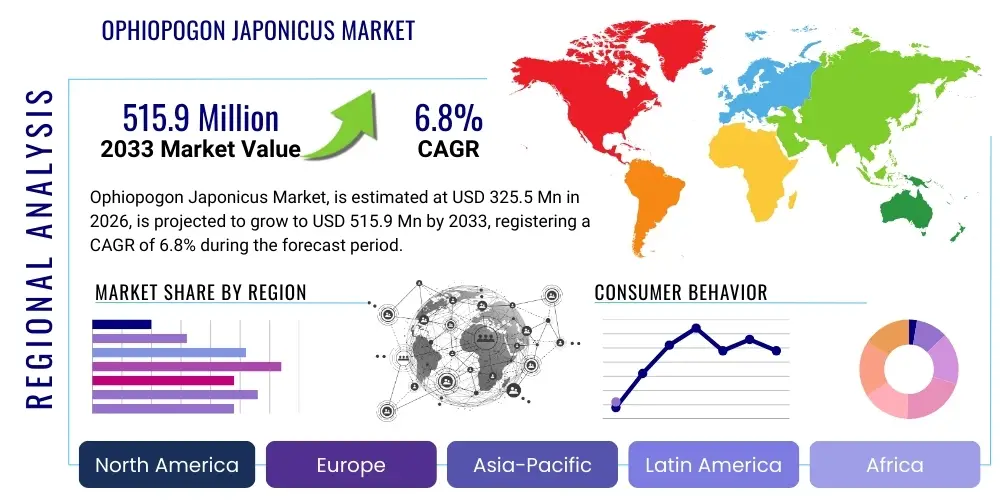

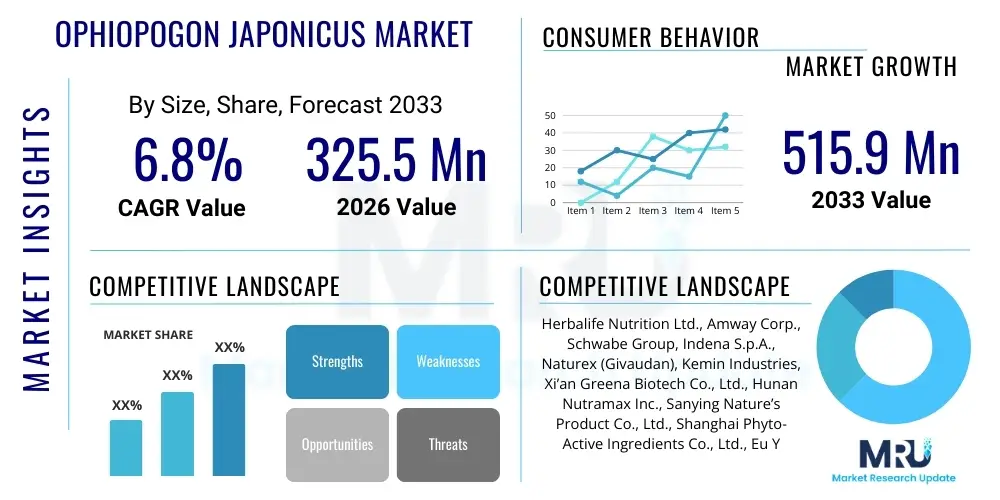

The Ophiopogon Japonicus Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 325.5 Million in 2026 and is projected to reach USD 515.9 Million by the end of the forecast period in 2033.

Ophiopogon Japonicus Market introduction

The Ophiopogon Japonicus market encompasses the global trade, cultivation, processing, and application of the tuberous root of the plant, commonly known as Mai Men Dong in Traditional Chinese Medicine (TCM). This botanical ingredient is highly valued for its medicinal properties, particularly its ability to nourish Yin, moisten the lungs, and strengthen the stomach. The core product forms include raw dried roots, granulated extracts, and purified compounds, primarily used in dietary supplements, functional foods, and pharmaceutical formulations targeting chronic respiratory conditions, cardiovascular health, and immune system support. The market growth is fundamentally driven by the escalating consumer shift toward natural and plant-based remedies globally, particularly in developed economies where interest in preventive healthcare is surging.

Major applications of Ophiopogon Japonicus extract revolve around its inclusion in traditional formulations and modern nutraceuticals. In pharmaceuticals, its components, such as Ophiopogonins and polysaccharides, are researched for potential anti-inflammatory, antioxidant, and immunomodulatory effects. Traditional applications prominently feature its use in tonics and herbal decoctions for treating dry coughs, thirst, and heart palpitations. Furthermore, the cosmetic industry utilizes extracts for skin moisturizing and anti-aging properties. This broad range of applicability, spanning health, wellness, and personal care, significantly enhances its market penetration and long-term viability.

The principal benefits driving the commercial demand for Ophiopogon Japonicus include its recognized efficacy in lung health maintenance, particularly relevant in regions affected by high pollution levels or increasing prevalence of chronic obstructive pulmonary disease (COPD). Regulatory environments, particularly in Asian countries, support the commercialization of TCM ingredients, providing a strong foundational market. Western markets are gradually adopting these ingredients as scientific validation for their efficacy increases, bolstered by ongoing research into their bioactive components, thereby reinforcing Ophiopogon Japonicus’s position as a premium ingredient in the global herbal extracts market.

Ophiopogon Japonicus Market Executive Summary

The global Ophiopogon Japonicus market is characterized by robust growth, primarily propelled by the integration of traditional herbal remedies into mainstream healthcare and the rising demand for natural ingredients in the nutraceutical and cosmetic sectors. Business trends show a strong emphasis on standardization and quality assurance, driven by stricter international regulations concerning herbal product purity and efficacy. Key players are focusing on vertical integration, controlling the supply chain from cultivation to extraction, to mitigate issues related to raw material sourcing volatility and ensuring batch-to-batch consistency. Furthermore, strategic partnerships between primary producers in Asia and Western pharmaceutical companies are defining the global distribution landscape, aiming to capitalize on both established TCM usage and burgeoning Western supplement interest.

Regional trends indicate that Asia Pacific (APAC), particularly China and South Korea, remains the dominant market owing to deeply rooted traditional usage and large-scale domestic cultivation infrastructure. However, North America and Europe are exhibiting the highest growth rates (CAGR), fueled by consumer health consciousness, increased accessibility of specialty herbal ingredients, and robust marketing campaigns highlighting the clinical benefits of adaptogenic and restorative herbs. Regulatory harmonization efforts, such as those undertaken by the European Medicines Agency (EMA) concerning traditional herbal medicinal products, are facilitating smoother market entry in Western jurisdictions. Investment in sustainable cultivation practices is becoming a critical regional trend, especially in areas facing environmental challenges or land-use competition.

Segmentation trends highlight the increasing prominence of standardized extracts over raw herb forms, driven by industrial buyers seeking predictable potency for mass production of capsules and tablets. Application-wise, the nutraceutical segment, specifically functional beverages and dietary supplements focused on respiratory and cardiovascular support, commands the largest market share and is expected to sustain high growth. The pharmaceutical segment, though smaller, is gaining traction due to ongoing clinical trials investigating specific Ophiopogonin derivatives for drug development. Distribution trends show a powerful shift towards e-commerce platforms and specialized health food stores, bypassing traditional retail pharmacy channels, especially for supplements targeting younger, digitally native consumers.

AI Impact Analysis on Ophiopogon Japonicus Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ophiopogon Japonicus market predominantly center on optimizing the supply chain, enhancing quality control, and accelerating pharmacological research. Common questions involve how AI can predict crop yields under changing climatic conditions, verify the authenticity of raw materials to combat counterfeiting, and identify novel therapeutic applications for Ophiopogonin compounds through deep learning models. Consumers and businesses alike are concerned about maintaining traditional knowledge integrity while leveraging AI for modernization and scalability. Key expectations revolve around using machine learning for personalized dosage recommendations in traditional herbal formulations and ensuring sustainable sourcing through predictive ecological modeling.

AI’s most immediate impact is visible in optimizing the agricultural phase. Machine learning algorithms analyze geospatial and climatic data to determine ideal planting schedules, irrigation needs, and disease prevention strategies, leading to higher yields and reduced resource wastage. Furthermore, advanced vision systems powered by AI are being deployed during harvesting and sorting processes to ensure that only roots meeting stringent physical quality parameters (size, color, weight) enter the processing stream. This application significantly reduces manual quality control errors and enhances raw material consistency, which is crucial for producing standardized extracts required by pharmaceutical companies.

In the downstream value chain, AI is transforming research and development (R&D) efforts. Drug discovery platforms utilize AI to screen existing literature and chemical databases, predicting the interaction of Ophiopogon Japonicus compounds with human biological targets (e.g., receptors related to inflammation or cardiac function). This substantially reduces the time and cost associated with identifying lead compounds and understanding their mechanism of action. Moreover, AI-driven personalized nutrition tools may soon recommend specific Ophiopogon formulations based on individual genomic data, microbiome profile, and health goals, creating new high-value market niches for customized herbal products.

- AI-powered predictive modeling for optimizing Ophiopogon Japonicus cultivation yields.

- Implementation of deep learning algorithms for chemical fingerprinting and authentication of standardized extracts.

- Enhanced supply chain transparency and traceability using AI integrated with blockchain technology.

- Accelerated research into Ophiopogonin therapeutic applications via computational drug discovery platforms.

- Automated quality control systems (vision inspection) to ensure purity and physical integrity of harvested roots.

- Development of personalized herbal formulation recommendations based on individual health data analysis.

- Optimization of extraction processes (temperature, solvent ratio) using AI-driven process control for maximum active compound yield.

DRO & Impact Forces Of Ophiopogon Japonicus Market

The Ophiopogon Japonicus market dynamics are shaped by a complex interplay of drivers, restraints, and opportunities. The primary Driver is the increasing global consumer preference for natural, preventative health solutions, particularly traditional medicines with established historical safety records. This trend is amplified by scientific research validating the cardioprotective, antioxidant, and anti-inflammatory benefits of the plant's constituents, stimulating demand from both the supplement and pharmaceutical sectors. However, significant Restraints include the challenges associated with sourcing inconsistency, mainly due to reliance on wild harvesting in some regions and the vulnerability of cultivation to climate change. Regulatory hurdles, especially the stringent requirements for New Dietary Ingredient (NDI) status or drug approval in Western markets, also limit rapid market expansion. Opportunities (Opportunity) lie in developing highly purified, standardized extracts tailored for specific health indications and exploiting emerging markets in Latin America and the Middle East where herbal medicine interest is rapidly growing.

The Impact Forces influencing this market are multifaceted, encompassing macroeconomic trends, technological advancements, competitive intensity, and stringent regulatory environments. Macroeconomically, rising disposable incomes in emerging Asian economies enhance affordability and usage of premium TCM ingredients. Technologically, advancements in extraction techniques, such as supercritical fluid extraction (SFE) and membrane filtration, allow for higher purity and concentration of active compounds (e.g., polysaccharides and homoisoflavonoids), thereby increasing the ingredient's value proposition. Competitive forces are intensifying as major global ingredient suppliers seek to acquire or partner with specialized Asian cultivators and processors to secure reliable supply lines, driving consolidation and greater emphasis on certified organic or sustainable sourcing.

Furthermore, external factors like public health crises (e.g., respiratory pandemics) significantly increase the demand for natural ingredients traditionally used for lung health, such as Ophiopogon Japonicus, acting as a powerful, albeit unpredictable, driver. Regulatory changes, particularly the streamlining of acceptance for traditional medicinal products in jurisdictions like the EU and the US, represent a key opportunity to move these products from niche health food stores into mainstream pharmaceutical distribution channels, fundamentally changing the market structure and accessibility for a broader consumer base.

Segmentation Analysis

The Ophiopogon Japonicus market is segmented primarily based on Product Form, Application, and Distribution Channel. This segmentation allows market participants to tailor their strategies to specific end-user needs and regulatory requirements. The distinction between raw materials and processed extracts is crucial, as the latter commands a premium due to required R&D and manufacturing sophistication. The dominant application remains in dietary supplements, driven by consumer self-medication trends, followed by the relatively smaller but highly regulated pharmaceutical sector. Geographic distribution heavily influences the preferred product form and application, with Asia prioritizing traditional raw or mildly processed forms, while Western markets favor standardized, encapsulated extracts.

Segmentation by Product Form includes raw dried root, standardized extract powder, and essential oils derived from the plant. Standardized extracts, which guarantee a minimum percentage of key active components like total Ophiopogonins, are witnessing the fastest growth due to high demand from the nutraceutical and functional food industries requiring consistency for formulation integrity. Raw roots continue to dominate in traditional medicine markets where decoctions are standard practice. The trend towards liquid extracts and specialized delivery systems, such as liposomal encapsulation, is emerging, focusing on improving bioavailability and consumer compliance.

Analyzing the market by Application reveals the significant contribution of the respiratory health segment, addressing chronic conditions like asthma and persistent coughs. Cardiovascular health, leveraging Ophiopogon Japonicus’s ability to reduce inflammation and oxidative stress, is the second major application area. The cosmetics and personal care segment, though smaller, is growing rapidly, incorporating extracts into high-end moisturizing and anti-aging creams due to their hydration properties. This diversification across multiple application sectors shields the market from volatility within any single end-user industry, ensuring steady, long-term growth.

- By Product Form:

- Raw Dried Roots

- Standardized Extracts (Powder/Granules)

- Liquid Tinctures and Essential Oils

- By Application:

- Dietary Supplements and Nutraceuticals

- Traditional Medicine and Pharmaceuticals

- Functional Foods and Beverages

- Cosmetics and Personal Care

- By Distribution Channel:

- Online Retail (E-commerce)

- Specialty Health Stores and Pharmacies

- Direct Sales (Business-to-Business)

Value Chain Analysis For Ophiopogon Japonicus Market

The value chain for the Ophiopogon Japonicus market begins with the upstream analysis, encompassing the cultivation and initial harvesting of the roots. This phase is critical as the quality of the final product is heavily dependent on agricultural practices, soil quality, and harvesting timing. Primary producers, largely small to medium-sized farms in China, Japan, and Vietnam, manage the labor-intensive planting and harvesting. The immediate subsequent step involves basic processing—washing, drying, and preliminary sorting—which prepares the raw material for commercial trade. Ensuring sustainable and ethical sourcing at this stage is a growing requirement, driven by demands from downstream manufacturers seeking certifications like organic or Fair Trade equivalent.

The midstream stage involves processing and manufacturing. This is where raw dried roots are converted into high-value standardized extracts. Specialized processing companies utilize complex techniques, including solvent extraction, fractionation, and purification, to concentrate the active Ophiopogonins and polysaccharides. Quality testing and standardization are paramount here, involving advanced analytical chemistry (HPLC, mass spectrometry) to verify potency and screen for contaminants such as heavy metals or pesticides. Companies that invest in proprietary extraction technologies and robust quality systems achieve significant competitive advantages, offering higher purity ingredients to pharmaceutical and premium nutraceutical clients.

The downstream analysis focuses on formulation, branding, and distribution. Formulators integrate the extracts into final consumer products—capsules, tablets, functional beverages, or topical creams. Distribution channels are varied: large ingredient suppliers use Direct (Business-to-Business) channels to sell bulk extracts to major nutraceutical and pharmaceutical corporations. For finished consumer products, Indirect distribution channels dominate, utilizing online retail, specialized health food stores, and conventional pharmacies. The rise of e-commerce has democratized market access, allowing smaller, niche brands to compete effectively by focusing on direct-to-consumer marketing, leveraging AEO and GEO strategies to connect directly with consumers searching for specific herbal remedies and benefits.

Ophiopogon Japonicus Market Potential Customers

The primary customers for Ophiopogon Japonicus ingredients are categorized into three major segments: the Nutraceutical Industry, the Traditional Medicine and Pharmaceutical Sector, and the Cosmetics and Personal Care Market. The Nutraceutical Industry, comprising companies producing dietary supplements and functional foods, represents the largest immediate consumer base. These buyers require standardized, safe, and easily incorporable ingredients to formulate products targeting respiratory health, immune boosting, and general vitality. Their buying decisions are heavily influenced by clinical efficacy data, ease of formulation, and regulatory compliance (e.g., GRAS status in the US).

The Traditional Medicine and Pharmaceutical Sector includes TCM practitioners, hospitals utilizing herbal remedies, and large pharmaceutical companies conducting R&D on botanical drugs. These customers demand the highest levels of purity, consistency, and rigorous documentation, often preferring active pharmaceutical ingredients (APIs) isolated from the root. They are focused on specific clinical outcomes and often require Good Manufacturing Practice (GMP) certified ingredients, driving up the required quality standards and pricing structure for this segment.

A rapidly emerging customer segment is the Cosmetics and Personal Care Market, particularly manufacturers of high-end, natural beauty products. These buyers value the moisturizing and anti-inflammatory properties of the extracts, incorporating them into skin serums, lotions, and hair care products. Their purchasing criteria often revolve around sustainability credentials, organic certifications, and compelling marketing narratives based on the botanical origin and traditional uses of Ophiopogon Japonicus. Targeting brands focused on holistic wellness and clean beauty provides significant growth opportunities for suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 325.5 Million |

| Market Forecast in 2033 | USD 515.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Herbalife Nutrition Ltd., Amway Corp., Schwabe Group, Indena S.p.A., Naturex (Givaudan), Kemin Industries, Xi’an Greena Biotech Co., Ltd., Hunan Nutramax Inc., Sanying Nature’s Product Co., Ltd., Shanghai Phyto-Active Ingredients Co., Ltd., Eu Yan Sang International, Tsumura & Co., Gaia Herbs, Inc., NOW Foods, Mountain Rose Herbs, Inc., Gencor Botanical, Inc., Sabinsa Corporation, B&B Health Care Co., Ltd., Sinopharm Group Co., Ltd., DSM Nutritional Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ophiopogon Japonicus Market Key Technology Landscape

The technology landscape governing the Ophiopogon Japonicus market is concentrated on two critical areas: advanced agricultural practices and sophisticated extraction and purification methodologies. In cultivation, the shift is moving towards Controlled Environment Agriculture (CEA) and precision farming, leveraging sensor technology and IoT devices to monitor soil moisture, nutrient levels, and light exposure in real-time. This minimizes resource use while maximizing the concentration of medicinally active compounds within the roots. Hydroponics and aeroponics are being explored by leading cultivators to establish sustainable, indoor production systems, mitigating reliance on inconsistent field-based sourcing and ensuring year-round supply continuity essential for large-scale manufacturers.

In the processing stage, technological innovation is centered around maximizing the yield and purity of standardized extracts. Traditional methods often utilize simple hydro-alcoholic extraction, which can result in low concentration and variability. Modern manufacturers are adopting advanced solvent technologies, particularly Supercritical Fluid Extraction (SFE) using CO2, which allows for selective extraction of specific lipophilic compounds like homoisoflavonoids without the use of harsh chemical solvents. Furthermore, membrane separation technologies (microfiltration, ultrafiltration) are employed to refine crude extracts, removing unwanted waxes, fiber, and pigments, resulting in high-purity powders required for pharmaceutical-grade applications.

Analytical technology is also critical for market credibility. High-Performance Liquid Chromatography (HPLC) and Liquid Chromatography-Mass Spectrometry (LC-MS) are standard tools used for chemical fingerprinting, verifying the species identity, and quantifying specific marker compounds (Ophiopogonins A, B, C, D). This technological sophistication ensures compliance with global regulatory standards (e.g., USP, European Pharmacopoeia) and supports the claims of standardization necessary for premium pricing and consumer trust. The continuous advancement in these analytical and processing technologies directly underpins the shift from raw herbal material trade to value-added extract manufacturing, defining the competitive edge in the global market.

Regional Highlights

Asia Pacific (APAC) is the undisputed leader in the Ophiopogon Japonicus market, both in terms of consumption and production. China, as the origin and primary cultivator, dominates the supply chain, accounting for the vast majority of global production. The market here is deeply integrated into traditional healthcare systems, driving high volume demand for raw and minimally processed forms. The high prevalence of proprietary Traditional Chinese Medicine (TCM) formulas utilizing Mai Men Dong ensures consistent institutional demand. South Korea and Japan also maintain strong usage, particularly in Kampo medicine and functional food products. The regional growth is characterized by heavy investment in large-scale, standardized commercial cultivation projects designed to meet increasing export demand while battling issues related to counterfeit products and soil exhaustion. Regulatory frameworks in China and Japan are highly supportive of domestic herbal medicine industries, creating a favorable environment for regional market expansion and innovation.

North America (NA) represents the fastest-growing market region due to a significant shift in consumer attitude toward preventive health and natural supplements. Demand is driven by health-conscious consumers seeking botanical solutions for inflammation, immune support, and respiratory health, often influenced by clean label and adaptogen trends. Unlike APAC, the North American market almost exclusively favors highly processed, standardized extracts sold as dietary supplements (capsules, powders). Regulatory compliance, particularly with the U.S. Food and Drug Administration (FDA) guidelines for New Dietary Ingredients (NDI), dictates market entry and product success. Key market drivers include the proliferation of specialized health retailers and the effective marketing of Ophiopogon Japonicus’s traditional benefits within the modern wellness context. High average consumer spending power allows for premium pricing on certified organic or third-party tested extracts.

Europe is a significant market, balancing traditional herbal use with stringent pharmaceutical regulations. Countries like Germany and France have established regulatory pathways for traditional herbal medicinal products, facilitating market acceptance. The European market demands exceptional quality assurance, focusing heavily on traceability, pesticide residue testing, and adherence to European Pharmacopoeia standards. The primary application is in specialized supplements, often blended with other herbs (e.g., ginseng, astragalus) targeting general vitality and mild respiratory ailments. Growth is sustained by increasing interest in vegan and plant-based medicinal ingredients, alongside academic research into the cardioprotective effects of the root's compounds. However, the regulatory complexity and cultural diversity across European Union member states present ongoing challenges for uniform market penetration.

Latin America (LA) and the Middle East and Africa (MEA) currently hold smaller shares but present substantial long-term growth opportunities. In LA, urbanization, increasing disposable income, and emerging health trends are fostering openness to new botanical ingredients, primarily through the dietary supplement channel imported from the US or Europe. Distribution networks are still developing, but e-commerce is rapidly bridging the gap. The MEA region’s growth is nascent, focused largely on high-value imports catering to affluent consumers seeking premium wellness products. As regulatory bodies in these regions begin to formalize pathways for botanical ingredients and as consumer awareness increases regarding TCM benefits, both LA and MEA are projected to exhibit accelerated market growth toward the end of the forecast period, transitioning from being primarily import-reliant to potentially exploring localized processing partnerships.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ophiopogon Japonicus Market.- Herbalife Nutrition Ltd.

- Amway Corp.

- Schwabe Group

- Indena S.p.A.

- Naturex (Givaudan)

- Kemin Industries

- Xi’an Greena Biotech Co., Ltd.

- Hunan Nutramax Inc.

- Sanying Nature’s Product Co., Ltd.

- Shanghai Phyto-Active Ingredients Co., Ltd.

- Eu Yan Sang International

- Tsumura & Co.

- Gaia Herbs, Inc.

- NOW Foods

- Mountain Rose Herbs, Inc.

- Gencor Botanical, Inc.

- Sabinsa Corporation

- B&B Health Care Co., Ltd.

- Sinopharm Group Co., Ltd.

- DSM Nutritional Products

Frequently Asked Questions

Analyze common user questions about the Ophiopogon Japonicus market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ophiopogon Japonicus primarily used for in modern supplements?

Ophiopogon Japonicus, often marketed as Mai Men Dong, is primarily incorporated into modern dietary supplements for supporting respiratory health, particularly moisturizing the lungs and alleviating persistent dry coughs. It is also valued for its cardiovascular benefits and potent antioxidant and anti-inflammatory properties, making it a key ingredient in tonics for overall vitality and hydration.

What are the key active compounds in Ophiopogon Japonicus extracts?

The key active compounds driving the market value are Ophiopogonins (steroidal saponins) and various polysaccharides. Ophiopogonins, such as Ophiopogonin D, are extensively studied for their pharmacological effects, including cardioprotection and anti-arrhythmic activity. Polysaccharides contribute significantly to the plant's immune-modulating and moisturizing characteristics, crucial for respiratory formulations.

How does the quality of Ophiopogon Japonicus raw material affect the global market?

Raw material quality profoundly impacts market dynamics, as inconsistencies in sourcing (e.g., wild harvesting vs. standardized cultivation) lead to variability in active compound concentration. High demand for standardized extracts requires high-purity roots, driving processors to implement rigorous testing protocols (HPLC) to ensure batches meet global regulatory standards for both potency and freedom from contaminants like heavy metals or pesticides.

Which geographical region dominates the supply and consumption of Ophiopogon Japonicus?

Asia Pacific (APAC), particularly China, dominates both the cultivation (supply) and consumption of Ophiopogon Japonicus due to its foundational role in Traditional Chinese Medicine (TCM). While Western markets drive the demand for high-value standardized extracts, APAC dictates raw material pricing and volume, acting as the global hub for production and traditional application.

What technological advancements are driving growth in the extract segment?

The growth in the high-value extract segment is fueled by advanced processing technologies such as Supercritical Fluid Extraction (SFE) and sophisticated membrane separation. These technologies enable manufacturers to produce highly purified, solvent-free extracts with guaranteed concentrations of Ophiopogonins, meeting the stringent quality requirements of pharmaceutical and premium nutraceutical buyers globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager