Ophthalmic Anti-infective Preparations Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432927 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Ophthalmic Anti-infective Preparations Market Size

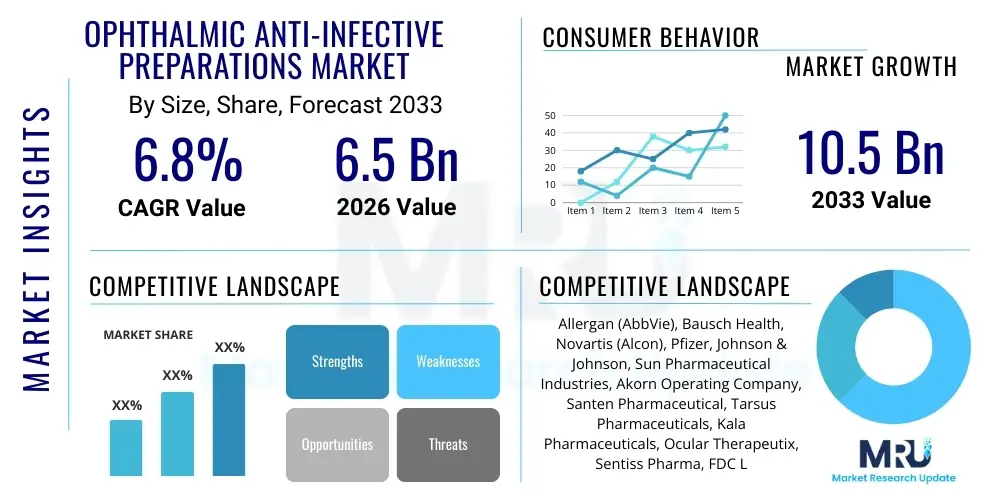

The Ophthalmic Anti-infective Preparations Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033.

Ophthalmic Anti-infective Preparations Market introduction

The Ophthalmic Anti-infective Preparations Market encompasses pharmaceutical formulations specifically designed to treat infections affecting the external and internal structures of the eye, including the conjunctiva, cornea, eyelids, and vitreous humor. These preparations typically contain antimicrobial agents such as antibiotics, antivirals, and antifungals, formulated for topical application (eye drops, ointments) or, in severe cases, for intravitreal or systemic administration. Key products target common conditions like bacterial conjunctivitis, viral keratitis, fungal endophthalmitis, and various forms of uveitis. The primary goal of these treatments is to eradicate the causative pathogen, reduce inflammation, prevent complications, and preserve visual function.

Major applications for ophthalmic anti-infectives include treating ocular surface infections, post-operative infection prophylaxis (especially following cataract or refractive surgery), and managing severe intraocular infections that threaten vision. The increasing prevalence of ocular diseases, coupled with rising awareness about the dangers of untreated eye infections, particularly in geriatric and diabetic populations, significantly drives market demand. Moreover, advancements in drug delivery systems, such as sustained-release inserts and advanced nanoparticle formulations, enhance therapeutic efficacy and patient compliance by reducing dosing frequency.

The benefits derived from effective ophthalmic anti-infective preparations are profound, ranging from rapid symptom resolution and pain relief to the prevention of permanent visual impairment or blindness, which is a critical public health concern globally. Driving factors include continuous research and development into novel broad-spectrum antimicrobial agents to combat increasing drug resistance, improved diagnostic capabilities allowing for earlier and more accurate pathogen identification, and governmental initiatives promoting access to essential medicines in developing regions. Furthermore, the growing adoption of contact lenses, which heightens the risk of microbial keratitis, contributes substantially to the sustained demand for prophylactic and therapeutic anti-infectives.

Ophthalmic Anti-infective Preparations Market Executive Summary

The global Ophthalmic Anti-infective Preparations Market is experiencing robust growth fueled by several converging factors: demographic shifts leading to an aging population more susceptible to ocular infections, the rising incidence of chronic conditions like diabetes which predispose individuals to severe eye infections, and continuous innovation in drug formulation to address antimicrobial resistance. Business trends indicate a strong focus on strategic mergers and acquisitions among large pharmaceutical companies to consolidate their ophthalmic portfolios and acquire pipeline products, especially those utilizing novel drug delivery systems like sustained-release biodegradable inserts or advanced liposomal formulations. Furthermore, there is a distinct commercial shift toward combination therapies that offer both antimicrobial action and anti-inflammatory benefits, maximizing patient outcomes and reducing treatment complexity.

Regional trends highlight that North America and Europe currently dominate the market due to established healthcare infrastructure, high healthcare spending, and rapid uptake of premium branded preparations. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, driven by massive population density, increasing medical tourism, improving access to primary eye care services, and the rising prevalence of infectious eye conditions stemming from poor sanitation and environmental factors. Governments in emerging economies are actively investing in eye health programs, which is expanding the patient pool accessible to anti-infective treatments.

Segmentation trends reveal that the Antibiotics class holds the largest market share, predominantly driven by the high prevalence of bacterial conjunctivitis and post-operative prophylaxis. Within dosage forms, eye drops remain the preferred choice globally due to ease of administration and high patient acceptance. However, the segment focusing on injectables (intravitreal preparations) is expected to grow rapidly, primarily due to the severe nature and complexity associated with treating sight-threatening conditions such as endophthalmitis, requiring direct and high concentration delivery of antibiotics or antivirals to the posterior segment of the eye. The hospital pharmacy distribution channel retains significant importance, particularly for high-value specialty drugs used in acute care settings.

AI Impact Analysis on Ophthalmic Anti-infective Preparations Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ophthalmic Anti-infective Preparations Market predominantly center on how AI can enhance diagnostic accuracy, streamline drug discovery processes, and optimize clinical trial execution for novel antimicrobial agents. Common user concerns revolve around the integration cost of AI-driven diagnostic platforms in low-resource settings, the validation protocols required for AI algorithms used in patient management, and the potential displacement of traditional microscopic or culture-based diagnostics. Users also express strong interest in AI's role in predicting antimicrobial resistance patterns within specific geographic areas, allowing for more targeted and effective empirical treatment strategies, thereby reducing the misuse of broad-spectrum antibiotics and slowing resistance development.

The core theme emerging from these inquiries is the expectation that AI will transition ophthalmic infection management from reactive treatment to proactive, personalized medicine. For instance, AI algorithms, trained on vast datasets of retinal images and patient histories, can potentially detect subtle signs of early infection or inflammation, such as subtle corneal changes or intraocular haze, long before they are clinically evident to the human eye, thus facilitating earlier intervention with anti-infective preparations. Furthermore, AI is anticipated to revolutionize the preclinical phase of drug development by simulating molecular interactions and predicting the efficacy and toxicity profiles of new compounds against specific ocular pathogens, dramatically shortening the time-to-market for effective anti-infective drugs designed to counter newly emerging resistant strains.

In clinical practice, AI tools embedded in telemedicine platforms are expected to democratize access to expert diagnostics, particularly in rural or underserved populations where access to specialist ophthalmologists is limited. This improved diagnostic reach ensures that patients receive the correct anti-infective preparation promptly, improving global treatment outcomes for infectious blindness. However, successful implementation requires overcoming data privacy challenges and ensuring regulatory bodies establish clear guidelines for the use of AI-driven medical devices in infectious disease management. The optimization of dosing regimens based on individual patient characteristics, guided by AI analysis of pharmacokinetics, represents another significant area where AI is expected to maximize the efficacy and safety of current ophthalmic preparations.

- AI-powered image analysis enhances the early and accurate detection of subtle corneal ulcers, keratitis, and other surface infections.

- Accelerated drug discovery through AI simulation of novel antimicrobial compounds targeting multidrug-resistant ocular pathogens.

- Optimization of clinical trial design for anti-infective preparations, including patient recruitment and endpoint prediction.

- Development of predictive models for antimicrobial resistance patterns in local patient populations, guiding empirical therapy choices.

- Teleophthalmology integration, using AI for remote screening and triage of patients presenting with symptoms of infectious eye disease.

- Personalized dosing algorithms based on individual pharmacogenomic and infection severity data to maximize treatment efficacy.

- Automated grading of infection severity and monitoring of treatment response using machine learning applied to slit-lamp images.

DRO & Impact Forces Of Ophthalmic Anti-infective Preparations Market

The market dynamics are significantly shaped by a confluence of influential factors: Drivers primarily include the escalating global prevalence of infectious eye diseases, particularly in fast-growing developing regions, coupled with the increasing surgical volume in ophthalmology necessitating effective infection prophylaxis. Restraints are predominantly centered on the alarming rise of antimicrobial resistance (AMR) across various common ocular pathogens, which renders many established and older generation anti-infective preparations less effective, necessitating costly research and development into new molecules. Opportunities lie in the unmet need for highly effective treatments against drug-resistant strains and the advancement of innovative drug delivery platforms, such as sustained-release preparations and gene therapy techniques, that improve bioavailability and patient compliance, thereby differentiating product offerings and commanding premium pricing.

Key drivers underpinning the robust market expansion include technological advancements in cataract and refractive surgeries, which, while beneficial, inherently increase the risk of post-operative endophthalmitis, driving the demand for advanced prophylactic antibiotics. Furthermore, environmental factors, such as pollution and increasing exposure to allergens, often lead to secondary microbial infections, particularly conjunctivitis. The standardization of eye care protocols globally, advocating for prompt and aggressive treatment of microbial infections to prevent blindness, also acts as a critical market stimulant. Demographic changes, notably the expanding elderly population, contribute substantially to the patient base, as aging individuals are generally more susceptible to chronic and recurring ocular infections due to compromised immune systems.

Conversely, significant restraints hinder growth. Beyond antimicrobial resistance, stringent regulatory pathways required for the approval of new ophthalmic drugs, particularly those intended for intraocular use, often result in long development cycles and high associated costs, limiting the flow of innovative products. Additionally, inadequate patient compliance with long-term topical regimens, which can lead to treatment failure and further resistance development, remains a persistent challenge for healthcare providers. The impact forces indicate a strong positive influence from pharmaceutical innovation and public health awareness campaigns, while simultaneously facing downward pressure from generic competition once patents expire and the complexity of addressing emerging viral and fungal infections for which treatment options are often limited and carry higher toxicity risks.

Segmentation Analysis

The Ophthalmic Anti-infective Preparations Market is extensively segmented based on Drug Class, Indication, Dosage Form, and Distribution Channel, reflecting the diverse clinical needs and varied approaches to managing ocular infections. Analyzing these segments provides strategic insights into consumer preferences and areas of high growth potential. The market structure emphasizes the dominance of broad-spectrum antibiotics due to their utility in empirical therapy before specific pathogen identification, though the focus is gradually shifting toward more targeted preparations to address resistance concerns. Furthermore, the segmentation by indication reflects the differential therapeutic needs for treating external eye diseases (like conjunctivitis) versus internal, sight-threatening diseases (like endophthalmitis), driving innovation in appropriate dosage forms and routes of administration.

The segmentation by Dosage Form is pivotal, as compliance and effectiveness are highly dependent on the method of delivery. While traditional eye drops maintain the largest market share owing to convenience and widespread acceptance for acute, external infections, the fastest-growing segment involves novel delivery systems such as sustained-release ocular inserts and specialized injectable preparations. These newer forms address the limitations of traditional topical drops, namely rapid tear washout and poor penetration into the posterior segment of the eye, which is crucial for treating severe internal infections. Technological advancements in formulations are thus creating distinct sub-markets within the dosage form segment, promising enhanced patient outcomes and market differentiation.

Distribution channel segmentation reflects the varied pathways through which patients access these critical medications. Hospital pharmacies dominate the segment for specialty and high-value anti-infectives, particularly those used for surgical prophylaxis and the treatment of severe, inpatient-managed infections such as endophthalmitis or refractory keratitis. Retail and online pharmacies, conversely, manage the vast volume of prescriptions for common, acute infections like bacterial conjunctivitis, serving the outpatient market. The increasing popularity of online platforms, driven by convenience and competitive pricing, is expected to drive substantial growth in the online pharmacy segment, forcing manufacturers to adapt their supply chain and marketing strategies to leverage digital distribution channels effectively.

- By Drug Class

- Antibiotics (Fluoroquinolones, Aminoglycosides, Macrolides, Others)

- Antivirals (Ganciclovir, Acyclovir, Others)

- Antifungals (Natamycin, Amphotericin B, Others)

- Combination Therapies (Antibiotic/Corticosteroid combinations)

- By Indication

- Conjunctivitis (Bacterial, Viral)

- Keratitis (Microbial Keratitis, Herpes Simplex Keratitis)

- Endophthalmitis

- Blepharitis

- Others (Uveitis, Trachoma)

- By Dosage Form

- Eye Drops (Solutions, Suspensions)

- Ointments

- Gels

- Injections (Intravitreal)

- Ocular Inserts/Implants (Sustained Release)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Ophthalmic Anti-infective Preparations Market

The value chain for Ophthalmic Anti-infective Preparations begins with upstream activities involving the sourcing of active pharmaceutical ingredients (APIs), excipients, and specialized container components (e.g., sterile dropper bottles). Key upstream challenges include maintaining stringent quality control for sterile ingredients and managing the supply risk associated with complex synthesized antimicrobial agents, particularly those required to combat multidrug resistance. Successful companies heavily invest in securing a stable supply of high-purity APIs through vertical integration or establishing robust long-term contracts with specialized chemical manufacturers, ensuring compliance with ophthalmic-specific cGMP requirements which are often more rigorous than those for systemic medications due to the delicate nature of the eye.

The mid-stream component involves formulation, manufacturing, and quality assurance. Manufacturing ophthalmic preparations demands highly sterile environments (aseptic filling) and precision in formulation to ensure the correct pH, osmolarity, and stability, minimizing ocular irritation and maximizing drug bioavailability. Downstream activities focus on the physical distribution of finished products. The distribution channel is crucial, relying heavily on specialized third-party logistics (3PL) providers capable of handling temperature-sensitive and high-value pharmaceuticals while maintaining the integrity of the sterile packaging throughout transit to ensure patient safety and product efficacy. Direct channels are often utilized by major pharmaceutical companies for high-volume sales to large hospital groups or governmental tenders, offering greater control over pricing and inventory.

Indirect distribution is predominant for the outpatient market, utilizing wholesalers and distributors who move products from manufacturers to retail and online pharmacies. This segment relies on efficient inventory management to prevent stock-outs, especially for essential anti-infectives. The interaction between the manufacturer and the healthcare provider (HCP) is paramount, driven by medical science liaisons (MSLs) and sales forces that educate ophthalmologists and optometrists on the proper use, efficacy, and safety profiles of novel preparations, reinforcing the professional recommendation pipeline which significantly influences prescription volume and patient adoption. The effectiveness of the overall value chain determines the speed and affordability with which these essential medicines reach the end-user.

Ophthalmic Anti-infective Preparations Market Potential Customers

The primary customers for Ophthalmic Anti-infective Preparations are healthcare institutions and end-users who require treatment or prophylaxis for ocular infections. The institutional segment, representing the highest purchasing volume, includes tertiary care hospitals, specialized ophthalmic clinics, ambulatory surgical centers (ASCs), and large governmental or non-governmental organizations (NGOs) involved in public health and blindness prevention programs. These customers typically procure in bulk, often through competitive bidding processes, prioritizing products with established efficacy profiles, comprehensive safety data, and cost-effectiveness for managing high-volume conditions like cataract surgery prophylaxis and acute keratitis. The growth in ASCs, which perform a high volume of elective eye surgeries, is a particularly strong customer segment driving demand for prophylactic agents.

Direct end-users, or the patients themselves, access these preparations through retail and online pharmacies based on prescriptions issued by ophthalmologists, optometrists, and general practitioners. Patient compliance is a key factor influencing repeated purchase and successful treatment outcomes; thus, potential customers prioritize preparations that offer convenience, such as reduced dosing frequency (e.g., sustained-release drops or ointments) and minimal ocular side effects. Subsets of the patient population driving specific product demand include contact lens wearers, who require maintenance solutions and prophylactic treatment for microbial keratitis, and diabetic patients, who face an elevated risk of severe, refractory eye infections.

Another increasingly important customer category consists of research institutions and compounding pharmacies. Research facilities purchase specific anti-infective agents for use in clinical trials focusing on resistance mechanisms or new drug development. Compounding pharmacies serve niche patient needs, creating customized, sometimes off-label, concentrations or combinations of anti-infectives tailored for complex or rare ocular infections not addressed by commercially available products. Understanding the specific needs of these varied customer segments—ranging from the cost-sensitive institutional buyer to the compliance-focused individual patient—is essential for manufacturers developing their go-to-market strategies and product portfolio management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allergan (AbbVie), Bausch Health, Novartis (Alcon), Pfizer, Johnson & Johnson, Sun Pharmaceutical Industries, Akorn Operating Company, Santen Pharmaceutical, Tarsus Pharmaceuticals, Kala Pharmaceuticals, Ocular Therapeutix, Sentiss Pharma, FDC Ltd., Greif-Velox, Bristol-Myers Squibb, Mylan (Viatris), Merck & Co., F. Hoffmann-La Roche Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ophthalmic Anti-infective Preparations Market Key Technology Landscape

The technological landscape of the Ophthalmic Anti-infective Preparations Market is characterized by a strong focus on overcoming two critical limitations: the ocular barriers that impede drug penetration (e.g., tear film washout and corneal epithelium) and the growing issue of antibiotic resistance. Key innovations are concentrated in drug delivery systems aimed at improving bioavailability and extending the drug residence time on or within the ocular structure. This includes the widespread adoption of sustained-release technologies such as biodegradable polymer inserts, punctal plugs loaded with anti-infective agents, and specialized hydrogels. These technologies significantly enhance patient compliance by transforming multi-dose daily regimens into weekly or monthly applications, ensuring therapeutic concentrations are maintained consistently over extended periods, which is vital for eradicating stubborn infections like microbial keratitis or chronic blepharitis.

Advanced formulation science plays a crucial role, involving the use of nanoparticles, liposomes, and microemulsions to encapsulate active agents. Nanoparticle delivery systems, for instance, can enhance the penetration of poorly soluble drugs across the corneal barrier and into the posterior segment of the eye, offering a non-invasive alternative to intravitreal injections for certain deep-seated infections. Furthermore, research into novel drug targets is advancing rapidly, utilizing structure-based drug design and high-throughput screening to identify new molecular entities that inhibit bacterial virulence factors or target entirely new pathways, bypassing existing resistance mechanisms. This innovation is critical for developing the next generation of broad-spectrum antibiotics and antivirals specifically optimized for ocular use, minimizing the risk of systemic toxicity.

The manufacturing process itself is undergoing technological refinement, particularly concerning sterile filling and quality control. Automated aseptic manufacturing lines incorporating robotic systems and advanced real-time monitoring sensors ensure the highest levels of sterility and precision in dosing, crucial for patient safety in ophthalmic products. Beyond formulation and delivery, diagnostic technology represents an important adjacent field; rapid point-of-care diagnostics, often utilizing molecular techniques like PCR or advanced microfluidics, are becoming integrated into clinical settings. These tools allow for the quick and accurate identification of the causative pathogen and its specific resistance profile, enabling clinicians to prescribe the most effective, narrow-spectrum anti-infective preparation immediately, thereby improving patient outcomes and contributing to antimicrobial stewardship efforts.

Regional Highlights

- North America: North America, particularly the United States, commands a significant share of the global market due to its highly advanced healthcare infrastructure, high per-capita healthcare expenditure, and the presence of major pharmaceutical companies specializing in ophthalmology. The region benefits from early access and rapid adoption of innovative, high-cost branded drugs, especially in the treatment of severe conditions like endophthalmitis and complex viral infections. Regulatory support for fast-track designation of drugs addressing unmet needs, such as new antibiotics targeting resistant strains, drives continuous innovation. Furthermore, the high volume of elective ophthalmic surgeries contributes significantly to demand for prophylactic anti-infectives. The region focuses heavily on combating hospital-acquired ocular infections and utilizing advanced sustained-release technologies for improved patient adherence.

- Europe: The European market is characterized by robust medical research, strict regulatory standards (European Medicines Agency - EMA), and universal healthcare systems that influence procurement and pricing strategies. Western European countries exhibit high demand for premium anti-infective preparations. The region is actively addressing the challenge of rising AMR through national action plans and surveillance programs, promoting the prudent use of antibiotics. This environment fosters the development of advanced diagnostic tools alongside pharmaceutical innovation. Demand is further supported by the increasing elderly population and established screening programs for eye diseases.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market during the forecast period. This accelerated growth is primarily attributed to the massive population base, increasing disposable incomes, expansion of medical infrastructure, and substantial unmet clinical needs in countries like China and India. High population density and environmental factors contribute to a higher incidence of infectious eye diseases, including conjunctivitis and trachoma. Government initiatives aimed at improving eye health awareness and expanding access to primary eye care services are major growth accelerators. Local manufacturers are rapidly expanding their capacities, often focusing on producing cost-effective generic versions of essential anti-infectives, balancing affordability with growing demand.

- Latin America (LATAM): The LATAM market growth is driven by improving economic conditions, increased healthcare investment, and a growing recognition of the impact of infectious blindness. However, market penetration is often hindered by economic volatility and reliance on imports for advanced medications. Brazil and Mexico are key markets, characterized by efforts to standardize clinical protocols and expand health insurance coverage. The region primarily utilizes established, cost-effective generic anti-infective preparations, although there is a steady uptake of newer branded products in private clinics and major metropolitan centers.

- Middle East and Africa (MEA): The MEA region presents a market of contrasts. The Middle East nations, supported by high oil revenues and advanced private healthcare systems (e.g., UAE, Saudi Arabia), demonstrate demand for sophisticated anti-infective preparations, driven largely by medical tourism and high surgical volumes. Conversely, the African continent is dominated by public health concerns, including high prevalence rates of infectious conditions like trachoma. Market growth here is primarily contingent on governmental procurement, international aid, and NGO programs focused on essential medicine access and widespread public health campaigns targeting infectious eye diseases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ophthalmic Anti-infective Preparations Market.- Allergan (AbbVie)

- Bausch Health Companies Inc.

- Novartis (Alcon)

- Pfizer Inc.

- Johnson & Johnson

- Sun Pharmaceutical Industries Ltd.

- Akorn Operating Company LLC

- Santen Pharmaceutical Co., Ltd.

- Tarsus Pharmaceuticals, Inc.

- Kala Pharmaceuticals, Inc.

- Ocular Therapeutix, Inc.

- Sentiss Pharma Pvt. Ltd.

- FDC Ltd.

- Greif-Velox (Manufacturing solutions)

- Bristol-Myers Squibb Company

- Mylan N.V. (Viatris)

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd.

- Regeneron Pharmaceuticals, Inc.

- Aerie Pharmaceuticals, Inc.

Frequently Asked Questions

Analyze common user questions about the Ophthalmic Anti-infective Preparations market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Ophthalmic Anti-infective Preparations Market?

The primary growth driver is the increasing prevalence of infectious ocular diseases globally, particularly conditions like bacterial conjunctivitis and keratitis, exacerbated by an aging population and rising rates of ophthalmic surgeries which require prophylactic anti-infective agents.

How does antimicrobial resistance (AMR) impact the market?

AMR is the most significant restraint, necessitating intensive research and development into novel compounds and drug delivery systems to replace older, less effective preparations, thereby increasing R&D costs and influencing treatment guidelines towards advanced, targeted therapies.

Which dosage form is projected to experience the highest growth rate?

While traditional eye drops currently dominate, sustained-release ocular inserts and intravitreal injections are projected to exhibit the highest growth rate, driven by the need for enhanced patient compliance and better bioavailability for treating severe, posterior segment infections like endophthalmitis.

What role does AI play in this market?

AI plays a critical role in enhancing diagnostic accuracy for early infection detection, accelerating the drug discovery process for new antimicrobial molecules, and optimizing personalized treatment regimens to counter the challenges posed by multi-drug resistance.

Which geographical region holds the highest growth potential?

The Asia Pacific (APAC) region is projected to hold the highest growth potential (CAGR) due to expanding healthcare access, high population density leading to higher infection incidence, and increasing investment in local pharmaceutical manufacturing capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager