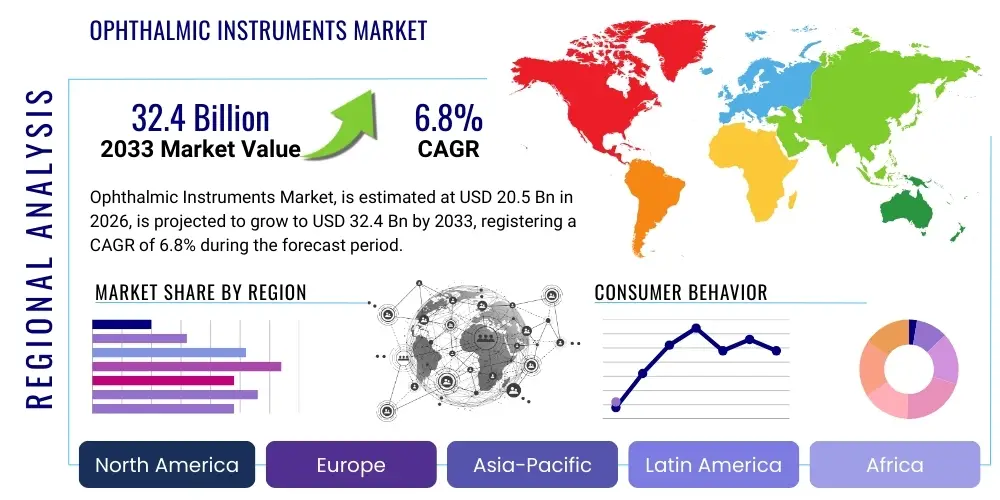

Ophthalmic Instruments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431724 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ophthalmic Instruments Market Size

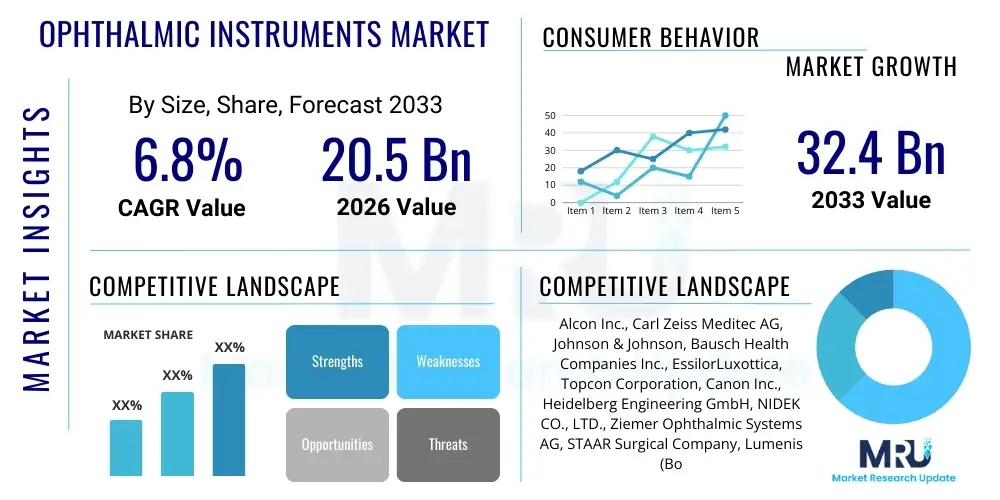

The Ophthalmic Instruments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $20.5 Billion in 2026 and is projected to reach $32.4 Billion by the end of the forecast period in 2033.

Ophthalmic Instruments Market introduction

The Ophthalmic Instruments Market encompasses a diverse range of specialized medical devices utilized for the diagnosis, monitoring, surgical intervention, and correction of various ocular conditions and vision defects. This extensive category includes advanced diagnostic tools such as optical coherence tomography (OCT) systems, fundus cameras, tonometers, and perimeters, alongside sophisticated surgical instruments like femtosecond lasers, phacoemulsification systems, and vitrectomy devices. The primary applications span across general ophthalmology clinics, specialty eye hospitals, ambulatory surgical centers, and research institutions. The inherent need for high-precision, non-invasive or minimally invasive procedures drives continuous innovation in this sector, particularly concerning the early detection of prevalent conditions like glaucoma, cataracts, diabetic retinopathy, and age-related macular degeneration (AMD). The increasing global aging population, coupled with rising prevalence of chronic diseases contributing to vision impairment, fundamentally underpins the market's robust growth trajectory, demanding more efficient and accurate tools for clinical practice.

Products within this market are designed not only to enhance diagnostic accuracy but also to significantly improve patient outcomes and surgical efficacy. For instance, advanced refractive surgery lasers and intraocular lens (IOL) implant tools have revolutionized cataract and vision correction procedures, drastically reducing recovery times and improving post-operative vision quality. The benefits extend beyond clinical settings to public health initiatives, enabling widespread screening programs and improved accessibility to high-quality eye care, especially in emerging economies facing high burdens of preventable blindness. Technological convergence, involving integration of imaging, computing power, and robotics, is defining the next generation of ophthalmic equipment, moving towards automated screening and personalized treatment regimens. Manufacturers are focusing heavily on developing portable, user-friendly devices suitable for telemedicine and remote diagnostics, addressing geographical access barriers.

Driving factors for sustained market expansion include the increasing health expenditure allocated to specialized medical fields, coupled with favorable reimbursement policies in developed nations supporting expensive diagnostic and surgical procedures. Furthermore, continuous research and development efforts resulting in FDA and CE approvals for novel technologies, such as advanced ophthalmic microscopes offering enhanced visualization capabilities and minimally invasive glaucoma surgery (MIGS) devices, contribute substantially to market dynamism. The growing adoption of advanced imaging techniques like angiography and adaptive optics to study retinal microvasculature and photoreceptors is expanding the diagnostic utility of these instruments beyond standard eye exams. The market is characterized by intense competition focused on precision, speed, and data integration capabilities, aiming to provide comprehensive digital solutions for eye care professionals globally, streamlining workflows and reducing diagnostic errors.

Ophthalmic Instruments Market Executive Summary

The Ophthalmic Instruments Market demonstrates significant momentum, primarily propelled by favorable demographic shifts, notably the rapid increase in the geriatric population worldwide, which is highly susceptible to chronic eye diseases such as cataracts and glaucoma. Key business trends indicate a shift towards consolidation, with major industry players acquiring smaller technology specialists to integrate advanced software, artificial intelligence (AI), and sophisticated imaging modalities into their product portfolios. There is a palpable trend towards developing multimodal diagnostic platforms that combine several imaging technologies (e.g., OCT and fundus imaging) into a single, cohesive unit, enhancing efficiency in clinical settings. Furthermore, sustainable growth is observed in the disposable instruments segment, driven by heightened hygiene standards and infection control measures, particularly in surgical environments, influencing procurement strategies among hospitals and ambulatory surgical centers globally. Manufacturers are also prioritizing global expansion into high-growth potential regions, establishing robust distribution networks and focusing on localized regulatory compliance to capture untapped patient pools requiring advanced eye care.

Regionally, North America maintains its dominance due to high adoption rates of cutting-edge ophthalmic technologies, substantial healthcare spending, and the presence of leading research institutions driving innovation. However, the Asia Pacific (APAC) region is forecasted to exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is attributed to improving healthcare infrastructure, increasing disposable incomes enabling access to private healthcare, and aggressive government initiatives aimed at reducing the backlog of treatable blindness, especially in densely populated countries like China and India. European markets remain strong, focusing on standardization and quality control, with a high demand for innovative surgical systems, particularly those related to premium intraocular lenses and minimally invasive surgical techniques. Challenges remain in market penetration across certain regions due to high upfront costs associated with sophisticated equipment and the necessity for specialized training for ophthalmic professionals.

Segmentation trends highlight the diagnostic instruments segment as the largest revenue generator, largely driven by the indispensable role of OCT and fundus cameras in early disease management and monitoring progression. However, the surgical instruments segment, particularly phacoemulsification and femtosecond laser systems, is expected to experience accelerated growth due to the rising volume of cataract and refractive surgeries performed globally. Based on end-user classification, hospitals and ophthalmology clinics represent the largest market share, leveraging these instruments for comprehensive patient care. Technological advancements are notably concentrated in the integration of AI-powered analysis tools into diagnostic devices, allowing for automated segmentation, risk assessment, and decision support, thereby enhancing the productivity and clinical utility of these instruments across all segments. This confluence of technological innovation and demographic demand ensures a dynamic and expanding market landscape for ophthalmic instruments.

AI Impact Analysis on Ophthalmic Instruments Market

Common user inquiries regarding the influence of Artificial Intelligence on the Ophthalmic Instruments Market typically revolve around the speed and accuracy of automated diagnostics, the displacement of human labor, and the integration costs of AI-enabled systems. Users frequently question how AI algorithms can reliably detect subtle signs of retinal diseases (such as diabetic retinopathy or early glaucoma) from imaging scans (OCT, fundus photography) faster than human specialists, and whether these systems are approved for primary screening. There is significant interest in predictive modeling capabilities—how AI can forecast disease progression or surgical success rates, thereby personalizing treatment plans. Concerns often focus on data privacy, the need for vast, high-quality training datasets, and the regulatory pathways necessary for certifying these autonomous or semi-autonomous diagnostic instruments. Expectations are high regarding AI's ability to democratize access to expert-level diagnostics in underserved areas through telemedicine integration, fundamentally shifting the workflow of ophthalmic practices.

The integration of Artificial Intelligence is revolutionizing the Ophthalmic Instruments Market by transforming diagnostic processes from subjective, manual interpretation to objective, rapid, and scalable automated analysis. AI algorithms, particularly deep learning models, are now embedded in next-generation fundus cameras and OCT systems, enabling real-time detection and grading of diseases like age-related macular degeneration (AMD) and diabetic retinopathy with clinically validated accuracy, often surpassing that of general practitioners. This capability significantly reduces the burden on highly specialized ophthalmologists, allowing technicians or non-specialized clinicians to conduct high-quality preliminary screenings, which is crucial for maximizing patient throughput and ensuring timely intervention. The primary advantage of AI integration lies in its ability to process vast amounts of complex imaging data, identifying patterns and biomarkers invisible to the naked eye, leading to earlier and more precise diagnoses.

Furthermore, AI is extending its influence into the surgical domain by optimizing instrument performance and improving intraoperative guidance. AI-powered systems are being developed for surgical planning, determining optimal incision sites, and assisting robotics in maintaining precise instrument alignment during delicate procedures like cataract removal or vitreoretinal surgery. This enhanced precision minimizes human error and shortens surgical times, translating directly into improved patient safety and outcomes. As data sets grow and computational power increases, AI's role will further expand into personalized medicine, leveraging patient history, genetic markers, and imaging data to recommend the most effective treatment pathways and predict the long-term efficacy of various interventions, solidifying AI as a critical component for future ophthalmic instrument design and utility.

- Automated Disease Detection: AI models embedded in OCT and fundus cameras for instantaneous, accurate diagnosis of retinal conditions (e.g., DR, glaucoma, AMD).

- Enhanced Surgical Precision: Utilization of AI for real-time tracking, alignment, and robotic assistance during complex ophthalmic surgeries.

- Workflow Optimization: Automated data analysis, report generation, and electronic health record (EHR) integration to streamline clinical operations.

- Predictive Diagnostics: Algorithms analyzing longitudinal data to forecast disease progression and tailor individualized treatment plans.

- Telemedicine Expansion: Enabling remote, expert-level diagnostics through cloud-based AI analysis of captured images, extending reach to rural populations.

DRO & Impact Forces Of Ophthalmic Instruments Market

The Ophthalmic Instruments Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively define its impact forces and future growth trajectory. The fundamental drivers revolve around global demographics, specifically the surge in the elderly population susceptible to age-related eye conditions, alongside the rising global incidence of systemic diseases like diabetes that lead to ocular complications. Technological innovation acts as a potent accelerator, with continuous advancements in imaging (e.g., swept-source OCT, adaptive optics), minimally invasive surgery (MIGS), and integrated diagnostic platforms making procedures safer and more accessible. Opportunities arise predominantly from expanding healthcare access in emerging economies and the substantial, untapped potential of artificial intelligence and machine learning integration, which promise to revolutionize diagnostics and therapeutic outcomes, driving adoption among next-generation practitioners focused on efficiency and precision.

Conversely, the market faces significant restraints that temper its potential. The most prominent restraint is the exceptionally high cost associated with advanced ophthalmic instruments, such as high-definition surgical microscopes and premium femtosecond lasers, which creates financial barriers for smaller clinics and limits procurement in resource-constrained regions. Furthermore, the specialized nature of these devices necessitates highly skilled operators, and the shortage of trained ophthalmologists and supporting technicians, particularly in developing countries, acts as a crucial bottleneck to widespread adoption. Stringent regulatory hurdles and protracted approval processes, especially for novel AI-powered diagnostic solutions, also impede rapid product commercialization and market entry, demanding extensive clinical validation and evidence generation, adding to the overall development cost and timeline for manufacturers.

The cumulative impact forces resulting from these DRO elements create a dynamic competitive landscape where differentiation is key. The intensifying competitive force drives continuous investment in research and development to achieve technological superiority (e.g., faster scanning speeds, higher resolution imaging, smaller surgical footprints). Opportunities in telemedicine and portable device development mitigate the restraint posed by resource scarcity and geographical access barriers, broadening the market scope. Ultimately, the dominant impact force is the convergence of clinical necessity (driven by demographic change) and technological capability (driven by AI and high-precision optics), ensuring that despite cost restraints, the demand for advanced ophthalmic instruments remains structurally robust and growth-oriented, particularly systems that offer documented clinical utility and strong return on investment for healthcare providers.

Segmentation Analysis

The Ophthalmic Instruments Market is comprehensively segmented based on product type, application, and end-user, reflecting the diversity of devices and their specialized clinical utilities across the eye care spectrum. Product type segmentation is crucial as it differentiates between the diagnostic tools necessary for identifying and monitoring conditions (such as refractometers, slit lamps, and corneal topographers) and the surgical equipment required for intervention (including specialized lasers and cataract devices). Application segmentation helps delineate the devices utilized for specific major disease management areas, such as cataract surgery, glaucoma treatment, or refractive error correction, which are driven by distinct prevalence rates. End-user classification is pivotal for understanding demand patterns and procurement strategies, distinguishing between large volume purchasers (hospitals) and specialized, focused care providers (ophthalmology clinics and ambulatory surgical centers), allowing market stakeholders to tailor their distribution and service models effectively across diverse clinical settings.

- By Product Type:

- Diagnostic Instruments (OCT Scanners, Fundus Cameras, Perimeters, Tonometers, Biometry Systems, Ophthalmic Ultrasound)

- Surgical Instruments (Phacoemulsification Devices, Vitrectomy Devices, Femtosecond Lasers, Excimer Lasers, Ophthalmic Microscopes, Microkeratomes)

- Vision Care (Refractometers, Phoropters, Slit Lamps, Lensmeters)

- By Application:

- Cataract Treatment

- Glaucoma Treatment

- Refractive Surgery

- Retina and Vitreous Disorders Treatment

- General Diagnostics and Monitoring

- By End User:

- Hospitals

- Ophthalmology Clinics

- Ambulatory Surgical Centers (ASCs)

- Research & Academic Institutes

Value Chain Analysis For Ophthalmic Instruments Market

The value chain for the Ophthalmic Instruments Market is highly specialized, beginning with the foundational component manufacturing, which involves the production of precision optical elements, advanced sensors, and high-quality materials required for device construction. This upstream segment is characterized by stringent quality control and reliance on highly skilled, often proprietary, technological expertise in areas like advanced laser technology and complex lens systems. Key upstream activities include R&D focusing on new optical designs, sensor miniaturization, and software development, which lay the groundwork for high-performance instruments. Manufacturers must source globally certified components, ensuring compliance with international medical device standards (e.g., ISO 13485). The efficiency and cost-effectiveness of this upstream activity directly dictate the final product quality and competitiveness in the sophisticated instruments market.

The midstream phase focuses on the assembly, integration, and manufacturing of the final ophthalmic instruments, where major market players integrate outsourced components with proprietary software, robotic mechanisms, and complex mechanical assemblies. This stage involves rigorous testing and calibration to meet clinical accuracy requirements. Following manufacturing, the distribution channel is critical. Sales are predominantly executed through indirect channels, utilizing specialized medical device distributors who possess deep knowledge of ophthalmic clinical needs and regulatory requirements across different geographical markets. Direct sales channels are often reserved for high-value, complex surgical systems (like femtosecond lasers) requiring extensive installation, post-sale training, and ongoing technical support provided directly by the manufacturer's specialized field service engineers. The complexity of these systems necessitates a robust post-sales support infrastructure, often making service contracts a significant revenue stream.

Downstream activities involve the ultimate utilization of the instruments by end-users, primarily hospitals, ophthalmology clinics, and ambulatory surgical centers (ASCs). The key focus downstream is on clinical application, physician training, and maintenance. The purchasing decision is heavily influenced by clinical efficacy data, total cost of ownership (TCO), and favorable reimbursement structures. The relationship between manufacturers and key opinion leaders (KOLs) is paramount in the downstream segment, driving adoption through clinical evidence and educational outreach. Furthermore, the downstream activities are increasingly impacted by digital integration, where data generated by the instruments is analyzed and stored in cloud-based platforms, necessitating strong cybersecurity measures and adherence to patient privacy regulations like HIPAA and GDPR, defining the final clinical utility and data value proposition.

Ophthalmic Instruments Market Potential Customers

The primary potential customers and key end-users of Ophthalmic Instruments are sophisticated clinical institutions specializing in eye care, driven by the need for high-throughput diagnostics and complex surgical intervention capabilities. Hospitals, particularly large tertiary care and university-affiliated medical centers, represent a substantial customer base, acquiring a wide array of instruments—from basic diagnostic tools to high-end surgical equipment like integrated operating room systems and complex vitrectomy machines. These institutions demand durability, multi-functionality, and compatibility with existing hospital IT infrastructure, often purchasing through centralized procurement processes that prioritize long-term service agreements and comprehensive training packages. Their procurement decisions are heavily influenced by the volume of advanced procedures they perform and the desire to maintain a high level of clinical service quality and technological leadership within their geographic area.

Ophthalmology Clinics, ranging from single-physician private practices to multi-specialty group practices, form another critical customer segment. These clinics typically prioritize efficient diagnostic equipment, such as advanced OCTs and visual field analyzers, that enhance workflow and patient throughput in an outpatient setting. Their purchasing focus often leans toward devices offering a high return on investment (ROI) through quick and accurate patient screening, enabling them to handle the rapidly increasing patient volume driven by cataract and refractive surgeries. Ambulatory Surgical Centers (ASCs), which specialize in outpatient procedures, are particularly vital customers for surgical instruments, especially phacoemulsification systems and specialized micro-instruments, as they concentrate on efficient, low-overhead surgical delivery and require robust, reliable equipment optimized for high-volume surgical schedules.

In addition to clinical entities, research and academic institutes constitute a highly valuable, albeit smaller, customer base. These institutions purchase cutting-edge, often prototype or highly specialized instruments, such as adaptive optics systems and high-resolution imaging devices, primarily for basic and translational research into the pathogenesis of ocular diseases and the development of novel therapies. Their demand is driven by research grants and the pursuit of scientific breakthrough, requiring instruments with advanced customization features and data capture capabilities. Therefore, manufacturers often maintain separate product lines or customizable systems tailored to the unique, highly demanding specifications of the research community, further solidifying the diverse end-user landscape of the ophthalmic instruments market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $20.5 Billion |

| Market Forecast in 2033 | $32.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alcon Inc., Carl Zeiss Meditec AG, Johnson & Johnson, Bausch Health Companies Inc., EssilorLuxottica, Topcon Corporation, Canon Inc., Heidelberg Engineering GmbH, NIDEK CO., LTD., Ziemer Ophthalmic Systems AG, STAAR Surgical Company, Lumenis (Boston Scientific), Haag-Streit Group, Glaukos Corporation, Light & Motion, FCI Ophthalmics, Marco Ophthalmic, Inc., Huvitz Co., Ltd., Optovue, Inc., Iridex Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ophthalmic Instruments Market Key Technology Landscape

The Ophthalmic Instruments Market is characterized by a rapidly advancing technological landscape centered around achieving higher resolution, greater speed, and non-invasive diagnosis and treatment. Optical Coherence Tomography (OCT) remains a pivotal technology, continually evolving with the introduction of Swept-Source OCT (SS-OCT) and enhanced-depth imaging (EDI), providing superior visualization of the choroid and vitreoretinal interface with faster scanning capabilities, thereby reducing motion artifacts and improving clinical utility. Furthermore, adaptive optics (AO) technology is gaining traction, allowing clinicians to visualize individual photoreceptor cells and retinal microvasculature with unprecedented detail, moving ophthalmic imaging closer to cellular-level resolution and facilitating the early detection of subtle pathological changes, which is crucial for conditions like inherited retinal dystrophies. These advanced imaging platforms form the technological backbone of modern ophthalmic diagnostics, offering precise quantitative measurements essential for tracking disease progression and treatment efficacy.

In the surgical domain, the technological landscape is dominated by sophisticated laser systems and minimally invasive techniques. Femtosecond laser technology has transitioned from primarily refractive surgery applications to routine use in cataract surgery (FLACS), offering highly precise capsulotomy, lens fragmentation, and corneal incisions, leading to improved standardization and potentially better refractive outcomes post-cataract removal. Concurrently, the rise of Minimally Invasive Glaucoma Surgery (MIGS) devices represents a significant technological shift, offering safer alternatives to traditional filtration surgery by utilizing micro-stents and micro-implants to enhance aqueous humor outflow with minimal tissue manipulation, leading to faster recovery times and reduced complication rates. These surgical innovations are driving significant capital expenditure by hospitals and ASCs seeking to adopt the safest and most advanced procedural standards, reinforcing the demand for high-precision instrumentation that minimizes invasiveness.

Another crucial technological development involves the integration of connectivity and Artificial Intelligence (AI) into nearly all new instruments. Devices are now frequently network-enabled, facilitating seamless data transfer to Electronic Health Records (EHRs) and cloud-based analysis platforms, enhancing interoperability within clinical networks. AI-driven software, utilizing machine learning and deep learning, is increasingly integrated to provide automated segmentation of retinal layers, interpret visual fields, and perform automated screening for conditions like diabetic retinopathy, substantially increasing diagnostic efficiency and reducing the dependency on specialized human resources for primary screening. This digital transformation, coupled with advances in portable and handheld diagnostic devices for point-of-care testing, is expanding the geographic reach and accessibility of advanced eye care, making high-quality diagnostics available outside traditional clinical settings and supporting robust telemedicine models across the globe.

Regional Highlights

- North America: This region holds the largest market share, driven by a high prevalence of chronic eye diseases, advanced healthcare infrastructure, high healthcare spending, and rapid adoption of cutting-edge technologies like AI-powered diagnostics and femtosecond laser systems. Favorable reimbursement policies for complex procedures also bolster market growth, leading to significant capital investment in high-end surgical instruments across the US and Canada. The presence of leading research and manufacturing companies further solidifies the region's dominance and its role as a primary driver of global ophthalmic innovation.

- Europe: Characterized by stringent regulatory standards and a strong focus on high-quality medical equipment, the European market is stable and mature. Growth is supported by the rapid aging population in countries such as Germany, France, and Italy, necessitating continuous replacement and upgrade of diagnostic equipment. Key drivers include the widespread acceptance of premium IOLs and the growing utilization of MIGS devices for glaucoma management, with manufacturers prioritizing instruments that offer superior reliability and CE mark certification for compliance.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally. This exponential growth is fueled by increasing patient awareness, massive untapped patient populations, improving economic conditions leading to greater accessibility to private healthcare, and government initiatives aimed at combating blindness (e.g., controlling cataract backlog). Countries like China, India, and Japan are rapidly adopting advanced equipment, although price sensitivity remains a factor, driving demand for cost-effective, yet highly functional, diagnostic and portable screening devices.

- Latin America (LATAM): The LATAM market is experiencing steady growth, primarily in Brazil and Mexico, due to expanding middle-class populations and investment in specialized eye hospitals. Market expansion is supported by imports of advanced technology, though local economic instability and variability in healthcare expenditure across nations present significant challenges. Demand is typically focused on essential diagnostic tools and moderately priced surgical systems.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, with high growth in Gulf Cooperation Council (GCC) countries driven by robust healthcare tourism and government commitment to modernizing healthcare infrastructure. Conversely, many African nations rely heavily on international aid and government programs for basic eye care, focusing demand on durable, simple diagnostic instruments suitable for outreach programs and portable screening applications to manage common issues like trachoma and cataracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ophthalmic Instruments Market.- Alcon Inc.

- Carl Zeiss Meditec AG

- Johnson & Johnson

- Bausch Health Companies Inc.

- EssilorLuxottica

- Topcon Corporation

- Canon Inc.

- Heidelberg Engineering GmbH

- NIDEK CO., LTD.

- Ziemer Ophthalmic Systems AG

- STAAR Surgical Company

- Lumenis (Boston Scientific)

- Haag-Streit Group

- Glaukos Corporation

- Light & Motion

- FCI Ophthalmics

- Marco Ophthalmic, Inc.

- Huvitz Co., Ltd.

- Optovue, Inc.

- Iridex Corporation

Frequently Asked Questions

Analyze common user questions about the Ophthalmic Instruments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Ophthalmic Instruments Market?

Market growth is primarily driven by the increasing global geriatric population susceptible to chronic eye diseases (like cataracts and AMD), the rising prevalence of diabetes leading to diabetic retinopathy, and continuous technological advancements in diagnostic imaging (OCT) and minimally invasive surgical techniques (MIGS, femtosecond lasers).

How is Artificial Intelligence (AI) being utilized within ophthalmic instruments?

AI is integrated into diagnostic instruments, such as fundus cameras and OCT devices, to provide automated, rapid analysis for early detection and grading of retinal diseases, improving screening efficiency and accuracy. AI also assists in surgical planning and real-time intraoperative guidance.

Which product segment accounts for the largest share in the market?

The Diagnostic Instruments segment, encompassing devices like Optical Coherence Tomography (OCT) systems, fundus cameras, and visual field analyzers, holds the largest market share due to their indispensable role in the initial detection, monitoring, and management of nearly all ocular conditions.

What are the main restraints hindering market growth?

Key restraints include the significantly high initial capital expenditure required for purchasing advanced surgical and diagnostic instruments, coupled with a persistent shortage of highly specialized ophthalmic professionals necessary to operate and interpret the results from these sophisticated technologies, particularly in developing regions.

Which geographical region is expected to exhibit the fastest growth?

The Asia Pacific (APAC) region is projected to register the fastest CAGR, attributable to improving healthcare infrastructure, substantial untapped patient pools, increasing disposable incomes, and proactive government initiatives aimed at expanding access to modern eye care services across populous countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager