Ophthalmic Lens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437180 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ophthalmic Lens Market Size

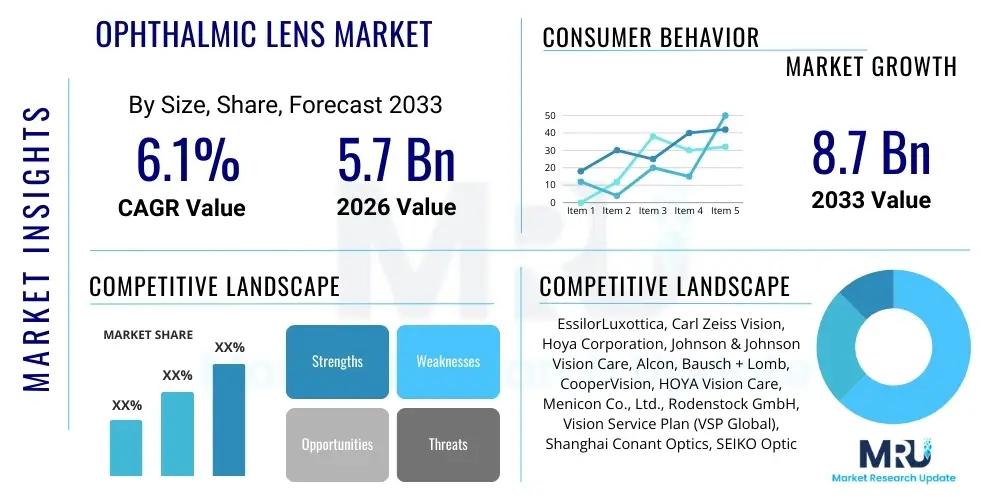

The Ophthalmic Lens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 5.7 billion in 2026 and is projected to reach USD 8.7 billion by the end of the forecast period in 2033.

Ophthalmic Lens Market introduction

The Ophthalmic Lens Market encompasses the global production and distribution of specialized lenses designed to correct, protect, or enhance visual function, serving as critical components in spectacles, contact lenses, and sophisticated intraocular lenses (IOLs). These products address prevalent visual impairments, including myopia, hyperopia, astigmatism, and presbyopia, which are increasingly widespread globally due to demographic aging and intense visual demands associated with modern digital lifestyles. Continuous innovation in materials science, particularly the development of high-index plastics and hydrogels, has enabled the manufacturing of thinner, lighter, and more cosmetically appealing lenses while simultaneously improving optical clarity and durability. The market is defined by a dichotomy of high-volume commodity products and specialized, high-margin items like customized progressive lenses and advanced toric and multifocal IOLs, all contributing to the overarching goal of maximizing patient quality of life through optimized vision correction.

Major applications span routine vision correction, therapeutic interventions, and elective cosmetic enhancements. Corrective applications are dominated by spectacle lenses utilizing advanced surfacing technologies, such as digital free-form production, which customizes the lens surface point-by-point to minimize aberrations and enhance peripheral vision, particularly beneficial for complex prescriptions and progressive designs. Therapeutic applications include specialized contact lenses used for corneal reshaping (orthokeratology) or wound protection (bandage lenses), alongside IOLs implanted during cataract surgery, which remains one of the most frequently performed surgical procedures globally. The inherent benefits of these products—restoring lost visual function, mitigating the risk of visual impairment progression, and facilitating better integration into daily activities—are fundamental driving factors ensuring resilient market demand despite cyclical economic fluctuations across various international jurisdictions.

Driving factors for sustained market growth are multifaceted, anchored by the rapid increase in the geriatric population, which inherently fuels the demand for cataract surgery and presbyopia correction. Furthermore, the global epidemic of childhood myopia, particularly prominent in Asian economies, is propelling significant investment and commercialization efforts in novel myopia management lenses and therapeutic devices designed to slow progression. Regulatory support for advancements in medical devices, coupled with improving reimbursement policies in key mature markets, accelerates the adoption of premium technologies. The synergistic effect of consumer demand for aesthetic improvements (thin lenses, specialized coatings) and clinical mandates for superior optical performance ensures that technological leadership and robust research and development expenditures remain core determinants of competitive success within the highly specialized domain of ophthalmic optics.

Ophthalmic Lens Market Executive Summary

The global Ophthalmic Lens Market exhibits strong strategic momentum characterized by aggressive business trends focused on vertical integration, digitalization of the entire patient journey, and significant cross-sector innovation between optical retail and surgical ophthalmology. Key manufacturers are increasingly consolidating their value chains, merging lens production capabilities with large-scale retail distribution networks, exemplified by major market movements aimed at controlling product flow from raw material to final dispensing. This trend ensures better control over pricing, quality assurance, and the implementation of sophisticated marketing strategies targeting specific consumer segments, such as those seeking advanced protective coatings (blue light, UV) or aesthetically superior high-index lenses, thereby capturing a higher percentage of the consumer surplus across the optical value chain.

Regionally, the market dynamics are highly differentiated. North America and Europe retain their strong positions by dominating the revenue stream for premium products, supported by high insurance coverage, significant technological penetration in clinical practices, and high consumer willingness to pay for customized, technologically advanced solutions. Conversely, the Asia Pacific (APAC) region is projected to register the most robust Compound Annual Growth Rate (CAGR), driven by the sheer scale of the population requiring vision correction, rapidly improving access to formalized eye care, and the urgent clinical need to address the rising prevalence of school-aged myopia. Investment and manufacturing capacity are increasingly shifting towards APAC to capitalize on this demographic dividend and meet the burgeoning demand for both standard and specialized products in emerging economies like India, China, and Southeast Asian nations.

Segmentation trends indicate a pronounced shift towards customized and specialty products. Within the Spectacle Lenses segment, digital progressive lenses designed using patient-specific parameters are rapidly replacing conventional designs, reflecting the demand for flawless visual performance in complex, multitasking environments. The Intraocular Lens (IOL) segment is witnessing exponential growth in premium categories—specifically Multifocal, Toric, and Extended Depth of Focus (EDoF) IOLs—as advancements enable surgeons to provide superior outcomes in cataract and presbyopia correction, significantly reducing post-operative spectacle dependence. Furthermore, specialized therapeutic contact lenses, including those explicitly developed for myopia management in pediatric populations, represent an accelerating, high-value sub-segment that is attracting substantial R&D funding and strategic commercial focus globally, capitalizing on public health concerns regarding long-term vision impairment.

AI Impact Analysis on Ophthalmic Lens Market

User queries regarding AI’s impact on the Ophthalmic Lens Market consistently highlight the themes of diagnostic automation, prescription personalization, and manufacturing efficiency. Users are keenly interested in AI’s capability to analyze voluminous diagnostic data, such as corneal topography maps and retinal scans, to derive refractive error corrections that are far more accurate and nuanced than traditional manual methods. Concerns frequently center on the necessary infrastructure investment for adopting sophisticated AI diagnostic tools within smaller optometric practices and the regulatory framework surrounding the use of machine learning-derived inputs for medical device manufacturing, particularly regarding accountability for prescription errors. However, there is widespread expectation that AI integration will fundamentally shorten the prescription-to-delivery cycle, allowing for highly individualized lenses that precisely match a patient’s unique physiological and lifestyle demands, optimizing the first-time fit success rate and reducing patient dissatisfaction related to adaptation and visual comfort.

The integration of Artificial Intelligence (AI) and deep learning algorithms is profoundly reshaping the operational and product development landscape across the ophthalmic sector. In clinical settings, AI-powered diagnostic tools are enhancing the speed and accuracy of identifying subtle ocular pathologies and complex refractive conditions, providing practitioners with highly detailed and data-driven inputs for lens prescription generation. This precision allows for the design of lenses that account for dynamic visual behaviors, head and eye movements, and specific viewing distances unique to the user’s occupation and hobbies. For instance, AI algorithms can refine the geometry of personalized progressive lenses (PPLs) by simulating thousands of potential visual scenarios and identifying the optimal curvature parameters, thus ensuring maximum comfort and minimal peripheral distortion, moving beyond generalized design paradigms toward true biometric customization.

In the manufacturing and supply chain domain, AI is instrumental in achieving operational excellence in the high-volume production of highly individualized lenses. Machine learning models optimize surfacing machinery, minimizing material waste and energy consumption during the complex digital free-form process by predicting the optimal cutting paths. Furthermore, AI systems are deployed in real-time quality control checks, using high-resolution imaging to detect microscopic flaws or coating inconsistencies that would be impossible to identify reliably through manual inspection, significantly improving outgoing product quality. Predictive analytics also governs inventory management and order fulfillment, especially critical for contact lenses and IOLs, ensuring just-in-time delivery for surgical procedures and mitigating stock shortages for common prescription strengths, thereby streamlining the entire market ecosystem and substantially boosting overall manufacturing throughput.

- AI-driven automated analysis of OCT and topography data for superior diagnostic insights.

- Precision optimization of complex progressive lens designs through proprietary machine learning software.

- Enhanced manufacturing throughput and reduced material waste via AI-optimized production scheduling and surfacing paths.

- Real-time automated quality assurance systems detecting microscopic defects in lens coatings and materials.

- Personalized IOL power calculations incorporating patient biometry and surgical history for cataract procedure planning.

- Streamlined distribution logistics and predictive inventory management for highly customized product portfolios.

DRO & Impact Forces Of Ophthalmic Lens Market

The core dynamics of the Ophthalmic Lens Market are governed by a robust confluence of accelerating drivers, persistent restraining factors, and significant technological opportunities that collectively shape its trajectory. The demographic imperative, specifically the rapid expansion of the global elderly population and the corresponding rise in age-related conditions like cataracts and presbyopia, provides a foundational driver for continuous demand, particularly for sophisticated progressive spectacle lenses and premium intraocular implants. This is synergistically supported by technological advancements, such as the commercialization of lightweight, high-refractive-index materials and durable, multi-functional lens coatings, which enhance product performance and drive consumer preference for frequent upgrades. The increased awareness campaigns promoting the necessity of early eye examination and refractive correction further propel the demand curve across all socioeconomic market tiers globally.

Notwithstanding these powerful drivers, the market faces structural restraints primarily related to cost and accessibility. The manufacturing of state-of-the-art ophthalmic lenses, requiring substantial capital investment in digital surfacing equipment, advanced cleanrooms, and proprietary software, results in high retail costs for premium products, restricting their widespread adoption in price-sensitive developing markets and among lower-income demographics. Additionally, complex and often inconsistent global reimbursement policies, particularly concerning premium IOLs and customized contact lenses, act as a barrier to entry and slow the market penetration of innovative solutions. The challenge posed by the unregulated proliferation of low-quality or counterfeit lenses, especially through online channels, also undermines established pricing structures and poses significant risks to patient visual health, necessitating constant vigilance and regulatory intervention by industry bodies.

Opportunities for strategic growth are concentrated in the development of highly specialized therapeutic and preventative lens technologies. The burgeoning pediatric myopia management segment, involving lens designs scientifically proven to slow axial length growth, represents a colossal untapped market opportunity fueled by clinical urgency in APAC and North America. Furthermore, the integration of smart functionalities into eyewear, such as embedded sensors for health monitoring or auto-focusing capabilities, offers transformative potential beyond simple correction. Geographically, enhancing distribution networks and product accessibility in underserved emerging markets through scalable, localized manufacturing and optimized digital consultation platforms represents a critical pathway for long-term sustainable expansion and revenue diversification for leading international manufacturers seeking to offset saturation in mature economies.

The market is dynamically influenced by the interplay between consumer health demands and material science breakthroughs. The increasing incidence of vision problems tied to extensive digital screen usage demands innovative blue light and fatigue-reducing lens solutions. Conversely, strict regulatory requirements for medical devices, particularly IOLs, necessitate prolonged R&D cycles and high compliance costs, which act as a key impact force shaping competitive strategy. Overall, the collective impact forces compel the market toward specialization and personalization, prioritizing lenses that offer not just correction but also prevention and lifestyle enhancement, simultaneously driving innovation in manufacturing efficiency and patient-centric dispensing protocols to maintain profitability and market share.

Segmentation Analysis

The meticulous segmentation of the Ophthalmic Lens Market is essential for understanding the diverse supply and demand dynamics across the global vision care ecosystem, distinguishing between mass-market commodity items and high-value niche solutions. Market breakdown by product type reveals Spectacle Lenses as the volumetric leader, catering to the vast majority of corrective needs, followed by Contact Lenses and the technologically advanced Intraocular Lenses (IOLs). Design segmentation, particularly the differentiation between single-vision and complex progressive lenses, reflects the demographic progression and the shift toward addressing age-related vision loss effectively. The continuous evolution of materials, coatings, and specialized applications, such as the focus on therapeutic myopia control or cosmetic enhancement, underscores the highly specialized nature of the industry and directs investment toward areas yielding superior clinical outcomes and higher profit margins, making detailed segmentation analysis indispensable for strategic market positioning.

Further analysis by material demonstrates a strong migration away from traditional glass toward high-performance plastics (e.g., polycarbonate, high-index resin), which offer superior impact resistance, UV protection, and lightweight comfort, especially critical for high-power prescriptions. Coating segmentation, encompassing anti-reflective (AR), anti-scratch, and blue light filters, showcases the industry's response to modern environmental and lifestyle stressors, adding significant perceived value and margin to standard lens products. The distribution channel segmentation, now heavily influenced by the rise of specialized e-commerce platforms for contact lenses and accessories, requires manufacturers to manage complex omnichannel strategies to balance traditional brick-and-mortar optical retail relationships with the efficiency and reach of direct-to-consumer digital sales models, ultimately necessitating adaptability in pricing and logistics structures.

- By Product Type: Spectacle Lenses (Single Vision Lenses, Progressive Lenses, Bifocal Lenses, Trifocal Lenses), Contact Lenses (Soft Contact Lenses (Daily Disposables, Monthly Disposables, Extended Wear), Rigid Gas Permeable (RGP) Lenses, Hybrid Contact Lenses), Intraocular Lenses (Monofocal IOLs, Multifocal IOLs, Toric IOLs, Extended Depth of Focus (EDoF) IOLs, Accommodating IOLs).

- By Material: Plastic/Resin (CR-39, Polycarbonate, Trivex, High-Index 1.60, 1.67, 1.74), Glass, Silicone Hydrogel (for Contact Lenses), Specialized PMMA/Acrylic (for IOLs).

- By Coating: Anti-Reflective Coating (A/R), Anti-Scratch Coating, UV Protection Coating, Hydrophobic/Oleophobic Coatings, Blue Light Filtering Coating, Photochromic Coatings (Transition Lenses), Polarized Coatings, Mirror Coatings.

- By Design: Spherical Lenses, Aspherical Lenses, Atoric Lenses, Free-Form Lenses (Digital Surfacing Technology).

- By Application: Corrective Lenses (Myopia, Hyperopia, Astigmatism, Presbyopia), Therapeutic Lenses (Myopia Management, Orthokeratology, Bandage Contact Lenses), Cosmetic Lenses.

- By Distribution Channel: Retail Stores (Independent Opticians, Large Optical Chains), E-commerce (Online Retailers and Subscription Services), Hospitals and Clinics (Primarily for IOLs and advanced surgical products).

Value Chain Analysis For Ophthalmic Lens Market

The Ophthalmic Lens Value Chain commences with upstream activities centered on highly specialized chemical synthesis and material sourcing. This segment involves major chemical corporations supplying precise optical-grade monomers (like high-index resin components and specific hydrogels for contact lenses) that determine the final physical and optical properties of the lens blanks. Quality control and proprietary formulation are paramount here, as minor variations in material purity or composition directly affect lens clarity, weight, and light transmission characteristics. Manufacturers often engage in long-term, exclusive agreements with these specialized raw material suppliers to secure access to cutting-edge polymers necessary for developing premium products, such as next-generation photochromic lenses or high-oxygen-permeability contact lenses, maintaining a crucial competitive barrier to entry for smaller market players.

The midstream stage, encompassing manufacturing and processing, is characterized by high capital intensity and sophisticated engineering. This involves the transformation of raw materials into semi-finished lens blanks, followed by precision surfacing, predominantly utilizing Computer Numerical Control (CNC) digital surfacing techniques (free-form technology) to generate the precise prescription geometry. This stage also includes the highly technical application of multi-layer coatings via vacuum deposition, adding functionalities like anti-reflection, scratch resistance, and hydrophobic properties. Effective midstream operation requires vertical integration and mastery of complex software algorithms to ensure that the customized design prescribed by the eye care professional is flawlessly transferred onto the lens surface, a process that is increasingly being automated and optimized using machine learning to enhance yield rates and minimize product lead times globally.

Downstream activities focus on distribution and dispensing, representing the direct interface with the end-user. Distribution channels are varied, involving direct sales to large optical chains, independent retail partnerships, and dedicated wholesale laboratories that perform final edging and mounting services before delivery to the consumer. The rising influence of e-commerce has significantly disrupted the distribution of standardized products, particularly contact lenses, shifting power towards online subscription models that prioritize convenience and competitive pricing. For high-value, customized products like IOLs and premium progressive lenses, the dispensing process relies heavily on the expertise of skilled ophthalmologists and optometrists who ensure accurate fitting and provide necessary post-fitting adjustments, maintaining the crucial link between advanced manufacturing and personalized professional care, thereby justifying the higher cost structure inherent in specialty ophthalmic solutions.

Ophthalmic Lens Market Potential Customers

The diverse clientele base for the Ophthalmic Lens Market can be segmented into primary consumers, who are individuals requiring vision correction or protection, and institutional buyers, which include professional healthcare facilities and large retail organizations. The largest segment, individual consumers, spans all ages and is categorized by the specific refractive error being addressed: children and adolescents primarily driving demand for myopia management lenses, working adults seeking single-vision correction and advanced protective coatings for digital screen use, and the rapidly growing geriatric demographic heavily demanding presbyopia correction (progressive lenses) and surgical solutions (IOLs). Purchasing decisions for this segment are highly sensitive to product comfort, aesthetic appeal (thinness, frame compatibility), clinical effectiveness, and financial considerations, including the extent of vision insurance coverage for premium features.

Institutional customers form a high-volume, professional purchasing segment critical to market revenue, particularly in the IOL category. This includes hospitals, ambulatory surgical centers (ASCs), and private ophthalmic clinics that purchase high volumes of surgical implants and related equipment. Their procurement process is driven by clinical data, regulatory compliance (FDA/CE approval), vendor reliability, bulk pricing, and specialized training/support provided by manufacturers for complex surgical procedures. Another influential institutional buyer is the large optical retail chain and vertically integrated eye care providers, which acquire vast inventories of spectacle lens blanks, contact lens boxes, and equipment for in-house finishing, often negotiating exclusive supplier contracts to secure favorable terms for high-quality, high-volume products used across their extensive network of dispensing locations.

Emerging potential customer groups include government health initiatives and non-governmental organizations (NGOs) focused on public health outreach and reducing preventable blindness in low-resource settings. These organizations primarily seek durable, cost-effective solutions for widespread distribution, driving demand for standard, high-volume spectacle lenses and affordable cataract solutions. Furthermore, specialized niches are attracting focused customer investment, such as military and industrial organizations requiring ultra-durable, ballistic-grade protective lenses and highly technical coatings for extreme environments. Targeting these diverse customer groups requires manufacturers to maintain a comprehensive product portfolio that ranges from economically accessible commodity items to the cutting edge of customized, medically approved therapeutic and preventative optical solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.7 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EssilorLuxottica, Carl Zeiss Vision, Hoya Corporation, Johnson & Johnson Vision Care, Alcon, Bausch + Lomb, CooperVision, HOYA Vision Care, Menicon Co., Ltd., Rodenstock GmbH, Vision Service Plan (VSP Global), Shanghai Conant Optics, SEIKO Optical Europe GmbH, UltraVision CLPL, ClearLab. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ophthalmic Lens Market Key Technology Landscape

The Ophthalmic Lens Market is undergoing a rapid technological transformation, fundamentally driven by the maturity and sophistication of Digital Free-Form Surfacing technology. This process, also known as digital high-definition surfacing, utilizes highly precise diamond-tipped lathes and computer numerical control (CNC) to individually carve the prescription onto the back surface of the lens with micrometric accuracy. This capability enables manufacturers to optimize lens power and geometry for the specific wearer, taking into account parameters such as the patient's unique frame fit, pupillary distance, and visual angle through the lens—a critical advancement for progressive lenses where precision significantly impacts adaptation ease and overall visual comfort. The continuous refinement of this technology, often paired with proprietary software utilizing complex algorithms, ensures that the industry can deliver truly personalized vision correction solutions far superior to conventional, semi-finished lens casting methods, commanding higher market prices and accelerating technology differentiation among key competitors globally.

Material science remains central to innovation, with major developments focusing on enhanced safety, comfort, and protection. The widespread adoption of high-index plastic materials (such as 1.67 and 1.74) allows for the production of lenses that are up to 50% thinner than standard CR-39, crucial for patients with strong prescriptions who demand aesthetic improvements. Furthermore, the integration of specialized functional materials, including photochromic dyes that react rapidly to UV and High-Energy Visible (HEV) light, and light absorption additives designed to filter harmful blue light directly within the lens matrix, significantly enhances the protective capabilities of standard eyewear. For contact lenses, the technological focus is on Silicone Hydrogel materials, which dramatically increase oxygen permeability to the cornea, allowing for safer, more comfortable extended-wear schedules and supporting the development of therapeutic lenses for conditions like corneal irregularities and chronic dry eye, marking a crucial crossover between optics and materials engineering.

In the Intraocular Lens (IOL) segment, the technological frontier is dominated by micro-optics and diffraction engineering aimed at maximizing post-surgical visual independence. Extended Depth of Focus (EDoF) IOLs leverage advanced optical profiles to provide a continuous, high-quality range of vision from distance to intermediate, bridging the gap between traditional monofocal and complex multifocal designs and reducing halo and glare effects often associated with the latter. Simultaneously, specialized coatings and surface treatments are paramount across all lens categories. Advanced multi-layer Anti-Reflective (AR) coatings, applied via sophisticated vacuum vapor deposition processes, are essential for reducing glare and improving night vision, while specialized anti-scratch and anti-smudge hydrophobic coatings increase lens durability and ease of maintenance, directly addressing key points of consumer dissatisfaction and solidifying the value proposition of high-end ophthalmic products.

Regional Highlights

- North America: The North American market, dominated by the United States, is characterized by high adoption rates of premium Ophthalmic Lenses and advanced surgical solutions, including Multifocal and EDoF IOLs. This leadership position is sustained by substantial consumer purchasing power, extensive insurance coverage for vision care, and a mature regulatory environment that encourages technological innovation and ensures high product standards. The region serves as a crucial hub for the early commercialization of new lens materials and digital dispensing technologies, reflecting a strong market propensity for aesthetic excellence and superior optical performance, particularly driving demand for high-index, customized progressive lenses and contact lens subscription services.

- Europe: Western Europe represents a technologically mature and highly regulated market, driven predominantly by the persistent demand stemming from an aging demographic necessitating correction for presbyopia and cataracts. Countries like Germany, France, and Italy exhibit high per-capita expenditure on optical products and maintain strict quality standards, promoting the use of locally manufactured, precision-engineered lenses. The region is a significant adopter of advanced free-form progressive designs and is increasingly focusing on environmentally sustainable manufacturing processes and materials in lens production, responding to strong regional consumer preference for eco-conscious products and ethical supply chains.

- Asia Pacific (APAC): APAC is undeniably the engine of future market growth, expected to record the highest CAGR over the forecast period. This rapid expansion is underpinned by the unprecedented incidence of myopia, especially in East Asia, creating a massive, urgent demand for myopia control lenses and standard correction. The market is fueled by rapidly improving economic conditions, expanding middle-class access to modern eye care services, and government initiatives focused on reducing the burden of refractive errors. While price sensitivity influences purchasing in large segments, major urban centers show a growing inclination toward adopting international premium brands and advanced vision technologies.

- Latin America (LATAM): This region is an emerging market characterized by significant variability in economic conditions and healthcare infrastructure. Growth is primarily driven by urbanization and the expansion of private healthcare facilities, leading to increased access to and affordability of corrective lenses. The market shows steady growth in basic spectacle lens and contact lens sales, although the adoption of high-end premium IOLs and customized progressive lenses remains constrained compared to North America due to less developed reimbursement systems and varying levels of disposable income.

- Middle East and Africa (MEA): The MEA region offers specialized growth opportunities, heavily concentrated in the Gulf Cooperation Council (GCC) countries where high levels of disposable income and advanced private healthcare facilities ensure high-end IOL and luxury eyewear adoption. The African segment, while vast, is constrained by infrastructure challenges; however, focused public-private partnerships aimed at combating cataracts and standard refractive errors are opening up long-term potential for basic and standardized lens products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ophthalmic Lens Market.- EssilorLuxottica SA

- Carl Zeiss Vision International GmbH

- Hoya Corporation

- Johnson & Johnson Vision Care, Inc.

- Alcon Inc.

- Bausch + Lomb

- CooperVision, Inc.

- HOYA Vision Care

- Menicon Co., Ltd.

- Rodenstock GmbH

- Vision Service Plan (VSP Global)

- Shanghai Conant Optics Co., Ltd.

- SEIKO Optical Europe GmbH

- UltraVision CLPL

- ClearLab Group

- Nikon and Shamir Optical Industry Ltd.

- Contamac Ltd.

- Mitsui Chemicals, Inc.

- Safilens S.r.l.

- Precision Vision

Frequently Asked Questions

Analyze common user questions about the Ophthalmic Lens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Ophthalmic Lens Market?

Market growth is primarily driven by the increasing global prevalence of refractive errors (myopia and presbyopia), aging demographics requiring vision correction, and rapid technological advancements in personalized free-form lens designs and premium intraocular lenses (IOLs) offering superior visual outcomes. Additionally, rising consumer awareness regarding eye protection and preventative care contributes significantly to overall market expansion and the adoption of high-margin products like blue light filters and photochromic lenses across all age groups globally.

Which segment holds the largest share in the Ophthalmic Lens Market?

The Spectacle Lenses segment currently holds the largest market share by volume and value. Within this category, advanced progressive lenses are experiencing the highest revenue growth, driven by the increasing number of presbyopic patients globally seeking multifocal correction without visible lines. The continued development of lighter, thinner, high-index materials ensures this segment maintains its dominance in overall market contribution and revenue generation.

How is digital surfacing technology impacting lens manufacturing?

Digital free-form surfacing allows for point-by-point optimization of lens geometry, enabling highly customized prescriptions that significantly reduce peripheral distortion and improve the wearer’s adaptation time, particularly important for complex progressive and high-power lenses. This precision manufacturing process ensures optimal optical clarity and allows for the seamless integration of highly specialized design parameters directly onto the lens surface, enhancing overall patient satisfaction and product performance.

What are the key technological trends in intraocular lenses (IOLs)?

The key trend is the shift towards premium IOLs, including Multifocal, Toric, and Extended Depth of Focus (EDoF) lenses. These innovations aim to correct astigmatism and provide a wider, more continuous range of clear vision post-cataract surgery, reducing the patient's reliance on secondary corrective eyewear, thereby offering enhanced quality of life and greater visual independence compared to standard monofocal options.

Which geographical region offers the most significant growth opportunities?

Asia Pacific (APAC) represents the most significant growth opportunity, fueled by large, underserved populations, rapidly increasing incidence of myopia (especially in children), rising disposable incomes, and continuous improvements in the regional healthcare infrastructure and optical retail network. Governments and private entities are heavily investing in this region to address the massive demand for both basic and advanced ophthalmic lens solutions effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager