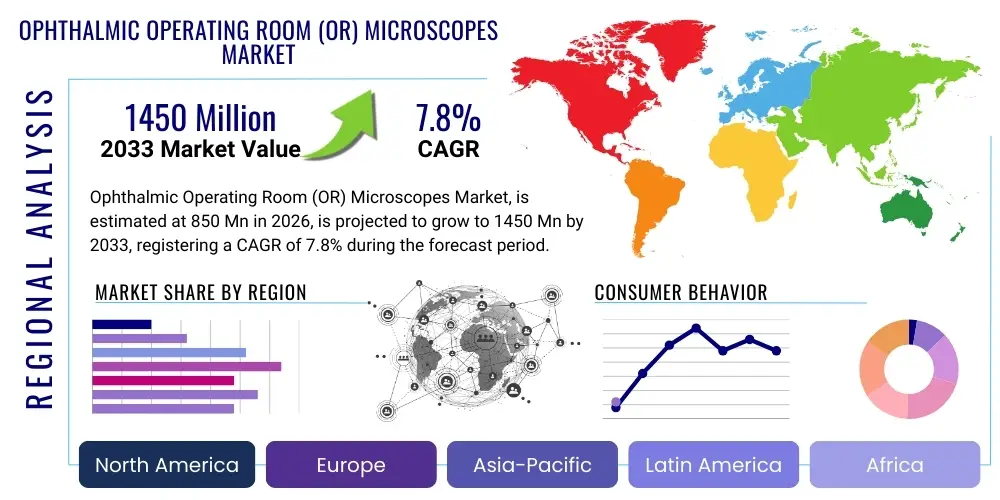

Ophthalmic Operating Room (OR) Microscopes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439260 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Ophthalmic Operating Room (OR) Microscopes Market Size

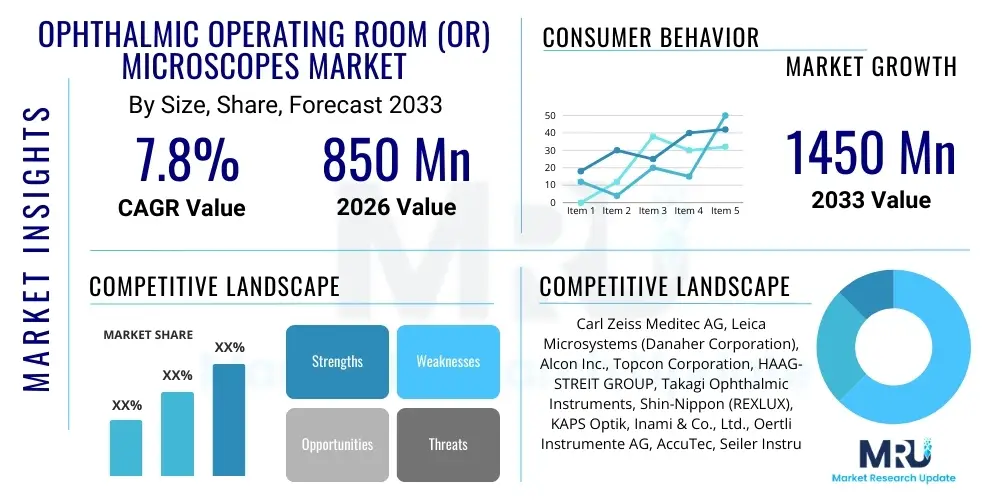

The Ophthalmic Operating Room (OR) Microscopes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1450 million by the end of the forecast period in 2033.

Ophthalmic Operating Room (OR) Microscopes Market introduction

The Ophthalmic Operating Room (OR) Microscopes Market encompasses advanced optical instruments critically designed for the precise visualization required during delicate eye surgeries. These sophisticated microscopes provide surgeons with high-resolution, magnified views of ocular structures, indispensable for procedures ranging from intricate cataract removal to complex retinal interventions. The market's growth is inherently linked to global demographic shifts, particularly the aging population which is more susceptible to age-related eye conditions, and the increasing prevalence of ophthalmic disorders such as cataracts, glaucoma, and diabetic retinopathy. This fundamental need for enhanced visualization and precision in surgical environments underpins the continuous demand for these specialized medical devices.

Product descriptions for modern ophthalmic OR microscopes highlight features such as superior optical clarity, integrated digital imaging capabilities, advanced illumination systems, and ergonomic designs aimed at reducing surgeon fatigue during prolonged procedures. Major applications span a wide spectrum of ophthalmic surgeries including cataract extraction, vitreoretinal surgery, glaucoma surgery, corneal transplants, and refractive error correction procedures. The intrinsic benefits of utilizing these microscopes are manifold: they significantly enhance surgical precision, thereby leading to improved patient outcomes, a substantial reduction in post-operative complications, and an overall increase in the efficacy and safety of ophthalmic surgical interventions. This technological evolution ensures that surgeons have the best possible tools at their disposal.

Driving factors propelling the expansion of this market are multifaceted, primarily centered on the accelerating pace of technological advancements, which include the integration of 3D visualization, heads-up display systems, and intraoperative OCT (Optical Coherence Tomography). Furthermore, the growing global demand for minimally invasive surgical techniques in ophthalmology necessitates instruments capable of providing unparalleled precision and visualization through smaller incisions. Coupled with rising healthcare expenditure in developing economies and increasing awareness regarding the availability of advanced eye care treatments, these factors collectively contribute to a robust and expanding market landscape for ophthalmic OR microscopes.

Ophthalmic Operating Room (OR) Microscopes Market Executive Summary

The Ophthalmic Operating Room (OR) Microscopes Market is currently experiencing dynamic shifts driven by a confluence of evolving business trends, distinct regional market developments, and significant segmentation-specific advancements. Industry consolidation through strategic mergers and acquisitions is a prominent business trend, as major players seek to expand their product portfolios, technological capabilities, and global market reach. There is also a pronounced trend towards offering integrated surgical solutions that combine microscopy with imaging, laser capabilities, and data management systems, reflecting a broader shift towards comprehensive operating room ecosystems. Furthermore, investment in research and development remains robust, particularly in areas like augmented reality and artificial intelligence integration, aiming to further enhance surgical precision and automation, thus shaping the competitive landscape.

From a regional perspective, mature markets such as North America and Europe continue to dominate in terms of adoption of advanced and premium ophthalmic microscopes, characterized by high healthcare spending, sophisticated infrastructure, and a strong preference for cutting-edge technologies. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapidly expanding healthcare sectors, increasing patient populations, rising disposable incomes, and improving access to specialized eye care. Latin America, the Middle East, and Africa are also presenting substantial opportunities, albeit from a lower base, as healthcare infrastructure develops and awareness regarding modern ophthalmic treatments grows, signaling a global expansion trend with localized growth drivers.

Segmentation trends within the market highlight the enduring dominance of microscopes used for cataract surgery, given the high global incidence of cataracts. However, the vitreoretinal surgery segment is exhibiting the most rapid growth, driven by increasing cases of diabetic retinopathy and other complex retinal disorders requiring highly specialized and precise surgical interventions. Technologically, the demand for microscopes featuring advanced optics, integrated digital recording, and 3D visualization is steadily climbing across all application segments, reflecting a strong preference for features that enhance both surgical performance and teaching capabilities. End-user segments, particularly ambulatory surgical centers (ASCs), are showing increased adoption due to their cost-effectiveness and focus on outpatient procedures, influencing design and accessibility requirements for new microscope models.

AI Impact Analysis on Ophthalmic Operating Room (OR) Microscopes Market

The integration of Artificial Intelligence (AI) into Ophthalmic Operating Room (OR) Microscopes is a pivotal development generating significant user curiosity and expectations. Common user questions revolve around how AI can genuinely improve surgical outcomes, what specific tasks it can automate or augment, its potential in real-time diagnostics during surgery, and the implications for surgeon training and workflow efficiency. Users are particularly interested in AI's ability to enhance visualization beyond human perception, provide predictive analytics for complications, and offer precise guidance for micro-movements, while simultaneously raising concerns about data privacy, the validation of AI algorithms, and the initial investment required for such advanced systems. These discussions underscore a collective anticipation for AI to elevate precision and safety in ophthalmic procedures.

AI's influence is anticipated to revolutionize how ophthalmic surgeries are performed, moving beyond mere magnification to active surgical assistance. By leveraging machine learning algorithms, ophthalmic microscopes can incorporate real-time image analysis, providing surgeons with immediate feedback on tissue characteristics, anatomical landmarks, and potential areas of concern that might be imperceptible to the unaided eye. This capability directly addresses the desire for improved diagnostic support during surgery, potentially minimizing the need for multiple pre-operative tests and allowing for dynamic adjustments to the surgical plan based on intraoperative findings. The enhanced data processing power of AI systems can lead to more objective and reproducible measurements, reducing human variability.

Moreover, AI is poised to streamline surgical workflows and reduce surgeon fatigue through automation and intelligent assistance. For instance, AI algorithms can automatically adjust focus, magnification, and illumination settings in response to the surgeon's gaze or detected surgical phase, freeing the surgeon to concentrate solely on the procedure. The development of robotic-assisted micro-movements, guided by AI, promises to extend human dexterity and stability, enabling even more delicate manipulations. As AI continues to evolve, it will likely integrate with surgical training platforms, offering personalized feedback and simulated environments that closely mimic real-world scenarios, thereby accelerating skill acquisition for new surgeons and continuous professional development for experienced practitioners, truly transforming the landscape of ophthalmic surgery.

- Real-time Image Analysis: AI algorithms can provide instantaneous analysis of tissue morphology, identifying critical structures, pathologies, or boundaries during surgery, enhancing decision-making.

- Predictive Analytics for Complications: By processing intraoperative data and correlating it with extensive databases, AI can potentially predict the likelihood of complications, allowing for proactive interventions.

- Automated Focus and Magnification: AI-powered systems can automatically adjust microscope settings based on the surgeon's focal point or predefined surgical steps, optimizing visualization without manual intervention.

- Robotic Assistance for Micro-movements: Integration with robotic platforms allows AI to guide and stabilize ultra-precise surgical instruments, minimizing tremor and enabling superior dexterity for intricate tasks.

- Enhanced Surgical Guidance Systems: AI can overlay vital information, such as surgical plans, pre-operative imaging data, or danger zones, directly into the surgeon's field of view via heads-up displays or augmented reality.

- Optimized Illumination and Ergonomics: AI can intelligently adapt illumination intensity and spectral characteristics to improve contrast and reduce glare, while also suggesting ergonomic adjustments to minimize surgeon strain.

DRO & Impact Forces Of Ophthalmic Operating Room (OR) Microscopes Market

The Ophthalmic Operating Room (OR) Microscopes Market is significantly shaped by a powerful combination of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. Key drivers include the relentless demographic shift towards an aging global population, which is inherently more susceptible to age-related ophthalmic conditions like cataracts, glaucoma, and macular degeneration, thereby fueling the demand for corrective surgeries and, consequently, advanced surgical microscopes. Alongside this demographic impetus, the continuous wave of technological innovation, introducing features such as 3D visualization, integrated OCT (Optical Coherence Tomography), and digital imaging capabilities, elevates surgical precision and efficiency, making new generations of microscopes increasingly indispensable. Furthermore, rising global healthcare expenditures, especially in emerging economies, and greater patient awareness regarding advanced eye care treatments contribute significantly to market expansion, promoting the adoption of sophisticated OR microscope systems across various healthcare settings.

Despite these robust growth drivers, the market faces several inherent restraints that temper its expansion. The high initial capital investment required for acquiring advanced ophthalmic OR microscopes represents a significant barrier for smaller clinics or healthcare facilities with constrained budgets, particularly in developing regions. This substantial cost often necessitates careful financial planning and justification, potentially slowing down adoption rates. Additionally, the complex regulatory approval processes for new medical devices, including ophthalmic microscopes, can prolong market entry and increase development costs for manufacturers, impacting innovation timelines. Another restraint involves the steep learning curve associated with operating highly sophisticated, digitally integrated microscope systems, which requires extensive training for surgical staff and can lead to initial resistance to adoption. Budgetary constraints in public healthcare systems globally also influence purchasing decisions, often favoring more cost-effective solutions over premium, technologically advanced models.

Conversely, numerous opportunities exist to propel the market forward and mitigate existing restraints. Emerging markets, particularly in Asia Pacific, Latin America, and the Middle East & Africa, present vast untapped potential due to their large populations, improving healthcare infrastructure, and increasing disposable incomes. These regions are ripe for growth as access to advanced ophthalmic care expands. The ongoing integration of cutting-edge technologies like Artificial Intelligence (AI) and robotic-assisted surgery offers a significant avenue for product differentiation and enhanced surgical capabilities, promising new levels of precision and automation. Furthermore, the expansion of telemedicine and remote diagnostic capabilities could create new applications or ancillary markets for ophthalmic imaging technologies integrated with microscopes. Lastly, the trend towards customizable microscope systems tailored to specific surgical needs or surgeon preferences offers an opportunity for manufacturers to cater to niche demands and provide more personalized solutions, thereby expanding their market footprint and fostering stronger customer loyalty in a competitive environment.

Segmentation Analysis

The Ophthalmic Operating Room (OR) Microscopes Market is comprehensively segmented based on various critical attributes, including product type, application, and end-user, providing a granular understanding of market dynamics and consumer preferences. This segmentation analysis is crucial for identifying key growth areas, understanding competitive landscapes, and formulating targeted market strategies. The market is broadly categorized to reflect the diversity of surgical needs and technological capabilities, ranging from fundamental optical systems to highly integrated digital platforms, each addressing specific requirements within the ophthalmic surgical spectrum. Understanding these distinct segments helps in dissecting market demand drivers and technological adoption patterns, ensuring that product development and marketing efforts are precisely aligned with specific market niches.

- By Product Type:

- Basic Ophthalmic Microscopes: Primarily offer essential magnification and illumination for standard procedures, often more cost-effective and simpler to operate.

- Advanced Ophthalmic Microscopes: Incorporate features like motorized zoom, finer focus adjustments, ergonomic designs, and improved optical systems, catering to a broader range of complex surgeries.

- Premium/Integrated Ophthalmic Microscopes: Represent the high-end segment, featuring integrated digital imaging (4K, 3D), heads-up display, intraoperative OCT, fluorescence imaging, and AI compatibility, offering unparalleled precision and data capabilities.

- By Application:

- Cataract Surgery: The largest application segment due to the high global prevalence of cataracts, driving demand for microscopes optimized for lens extraction and intraocular lens implantation.

- Vitreoretinal Surgery: A rapidly growing segment requiring highly specialized microscopes with wide-angle visualization and stable illumination for delicate procedures on the retina and vitreous.

- Glaucoma Surgery: Microscopes providing precise visualization for procedures such as trabeculectomy and shunt implantation to manage intraocular pressure.

- Corneal Surgery: Used for procedures like corneal transplants (e.g., DSAEK, DMEK) and other surface reconstructions, demanding high resolution and depth perception.

- Refractive Surgery: Though less dependent on OR microscopes than other segments, some procedures benefit from magnified views, especially for intricate lamellar cuts or stromal manipulations.

- Other Ophthalmic Surgeries: Includes oculoplastic surgery, pediatric ophthalmology, and various diagnostic procedures requiring magnified views.

- By End-User:

- Hospitals: Major end-users, especially large multi-specialty hospitals and university medical centers, due to their comprehensive ophthalmic departments and high surgical volumes.

- Specialty Eye Clinics: Dedicated eye care centers focusing exclusively on ophthalmology, often investing in advanced microscopes for specialized procedures.

- Ambulatory Surgical Centers (ASCs): A growing end-user segment, favored for their efficiency and cost-effectiveness for outpatient ophthalmic surgeries, driving demand for compact and efficient microscopes.

Value Chain Analysis For Ophthalmic Operating Room (OR) Microscopes Market

The value chain for the Ophthalmic Operating Room (OR) Microscopes Market is a complex and integrated network, commencing with upstream activities focused on the sourcing and manufacturing of highly specialized components, extending through the meticulous assembly and quality control of the final product, and culminating in downstream distribution and end-user adoption. Upstream analysis reveals a critical dependency on a specialized supplier base for precision optics, advanced electronic components, and high-quality mechanical parts. These suppliers are often global and require stringent quality control measures to ensure the performance and longevity of the final microscope system. The manufacturing phase involves sophisticated engineering, assembly, and rigorous testing to meet stringent medical device standards and certifications, reflecting the high technical complexity and precision required for ophthalmic instruments. This initial phase dictates the quality, innovation, and cost structure of the subsequent stages.

The downstream segment of the value chain is primarily focused on bringing the finished ophthalmic OR microscopes to the end-users. This involves a multi-layered distribution channel that includes both direct and indirect sales approaches. Direct sales involve manufacturers engaging directly with large hospitals, university medical centers, or key opinion leaders to facilitate sales, installation, training, and ongoing service support. This approach allows for strong customer relationships and direct feedback loops, essential for product improvement and market responsiveness. Conversely, indirect distribution channels leverage a network of authorized dealers, distributors, and agents, particularly effective for reaching smaller clinics, ambulatory surgical centers, and diverse geographical markets where direct presence may be less feasible or cost-effective. These intermediaries often handle local marketing, sales, logistics, and first-line technical support, extending the manufacturer's reach and providing localized expertise.

Both direct and indirect distribution strategies are crucial for market penetration and maintaining a competitive edge. The choice of channel often depends on the specific market characteristics, regulatory landscape, and the manufacturer's strategic objectives. Effective channel management, including robust training for sales and technical teams, inventory management, and responsive customer service, is paramount for ensuring product availability, maximizing sales efficiency, and building strong brand reputation. Additionally, after-sales services, including maintenance, repairs, and software updates, form a critical part of the downstream value chain, providing ongoing value to customers and generating recurring revenue streams for manufacturers. The seamless integration and optimization of these upstream and downstream activities are fundamental to the overall success and profitability within the highly specialized Ophthalmic Operating Room (OR) Microscopes Market.

Ophthalmic Operating Room (OR) Microscopes Market Potential Customers

The Ophthalmic Operating Room (OR) Microscopes Market primarily targets a highly specialized and discerning customer base that includes professional medical institutions and individual ophthalmic surgeons globally. The core segment of potential customers comprises large multi-specialty hospitals, particularly those with dedicated ophthalmology departments, and university medical centers that serve as significant hubs for both advanced surgical procedures and medical education. These institutions typically possess substantial budgets for capital equipment, a high volume of complex surgical cases, and a continuous need for cutting-edge technology to maintain their leadership in patient care and research. They often seek premium, integrated microscope systems offering the latest features in imaging, data management, and surgical assistance to support a wide range of ophthalmic sub-specialties.

Another crucial customer segment consists of specialty eye clinics and private ophthalmic practices. These facilities, while potentially smaller in scale than large hospitals, are often highly specialized and may perform a significant volume of specific ophthalmic procedures, such as cataract surgery or refractive error correction. They prioritize efficiency, ergonomic design, and a strong return on investment, often seeking advanced or basic microscope models that align with their operational needs and patient demographics. The increasing establishment of ambulatory surgical centers (ASCs) focused on outpatient procedures also represents a rapidly growing customer base. ASCs are attracted to ophthalmic microscopes that are reliable, user-friendly, and cost-effective, allowing them to provide high-quality care in an efficient and streamlined environment, often with quicker patient turnaround times.

Beyond these primary clinical settings, other potential customers include government healthcare programs and non-profit organizations that procure ophthalmic equipment for public health initiatives or humanitarian missions, particularly in underserved regions. Furthermore, military hospitals and research institutions also represent niche customer segments that require advanced ophthalmic microscopes for specialized surgical needs, trauma care, or ongoing research into new diagnostic and surgical techniques. The decision-making process for these various customer groups is influenced by factors such as clinical efficacy, technological sophistication, service support, brand reputation, and the overall cost of ownership, including consumables and maintenance, making a multifaceted marketing and sales approach essential for manufacturers in this highly competitive market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 million |

| Market Forecast in 2033 | USD 1450 million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss Meditec AG, Leica Microsystems (Danaher Corporation), Alcon Inc., Topcon Corporation, HAAG-STREIT GROUP, Takagi Ophthalmic Instruments, Shin-Nippon (REXLUX), KAPS Optik, Inami & Co., Ltd., Oertli Instrumente AG, AccuTec, Seiler Instrument Inc., Chongqing Vision Star Optical Co., Ltd., Eickhorst Vision GmbH, Zumax Medical Co., Ltd., Suzhou Longy Optics Technology Co., Ltd., A.R.C. Laser GmbH, MOLLER-WEDEL GmbH, Appasamy Associates, STERIS (Allen Medical Systems) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ophthalmic Operating Room (OR) Microscopes Market Key Technology Landscape

The Ophthalmic Operating Room (OR) Microscopes Market is characterized by a rapidly evolving technological landscape, where innovation is paramount to enhancing surgical precision, improving patient outcomes, and increasing operational efficiency. One of the most significant advancements is the integration of high-definition 3D visualization systems, which provide surgeons with an immersive, true-to-life perception of depth and anatomy, critical for intricate microsurgical tasks. These 3D systems often come with heads-up displays, allowing surgeons to operate while viewing the surgical field on a large screen rather than through eyepieces, thereby reducing neck and back strain and improving ergonomic comfort during lengthy procedures. This shift towards digital visualization also facilitates easier collaboration and teaching, as the entire surgical team can view the procedure simultaneously with exceptional clarity, fostering a more engaging and effective learning environment within the operating theatre.

Another transformative technology is the incorporation of intraoperative Optical Coherence Tomography (OCT) directly into the microscope system. This feature enables real-time, cross-sectional imaging of ocular tissues during surgery, providing invaluable anatomical information and allowing surgeons to monitor tissue interactions, assess fluid levels, and verify surgical manipulations with unparalleled precision. Similarly, fluorescence imaging capabilities, utilizing specific dyes, enhance the visualization of structures like the retinal vasculature or tumor margins, which might not be visible under standard white light. These advanced imaging modalities provide critical diagnostic and guidance tools at the point of care, significantly reducing uncertainty and optimizing surgical decision-making, leading to superior clinical results and reduced complication rates in complex cases such as vitreoretinal surgery or glaucoma drainage device placement.

Furthermore, the market is witnessing a strong trend towards digitally assisted surgical guidance systems and advanced illumination technologies. Digital guidance systems leverage pre-operative planning data and real-time intraoperative imaging to project critical information, such as incision lines, target zones, or toric IOL alignment guides, directly into the surgeon's field of view. This minimizes manual errors and improves precision for procedures like cataract surgery and corneal transplants. Alongside this, the evolution of illumination systems, utilizing advanced LED or xenon sources, provides brighter, more stable, and color-accurate light with adjustable filters to minimize phototoxicity and enhance contrast without compromising patient safety. These technological convergences are not only improving existing surgical techniques but also enabling the development of entirely new procedures, cementing the role of ophthalmic OR microscopes as central to the future of eye surgery.

Regional Highlights

- North America: This region maintains a leading position in the Ophthalmic OR Microscopes Market, characterized by its advanced healthcare infrastructure, high prevalence of age-related eye diseases, and significant adoption of cutting-edge technologies. The presence of major market players, substantial R&D investments, and favorable reimbursement policies for ophthalmic procedures further solidify its dominance, particularly for premium and integrated microscope systems.

- Europe: A mature and technologically sophisticated market, Europe demonstrates consistent demand driven by its aging population, robust healthcare spending, and a strong emphasis on clinical excellence and innovation. Countries like Germany, France, and the UK are key contributors, known for adopting advanced surgical techniques and investing in high-quality optical and digital microscopy solutions, often influenced by rigorous quality standards.

- Asia Pacific (APAC): Emerging as the fastest-growing region, APAC offers immense market potential due to its vast population base, rapidly improving healthcare infrastructure, and increasing disposable incomes. Countries such as China, India, and Japan are experiencing a surge in demand for ophthalmic surgeries, fueling the adoption of both basic and advanced microscopes, with a growing focus on expanding access to modern eye care.

- Latin America: This region represents a developing market with significant growth prospects, propelled by improving healthcare access, increasing awareness about eye health, and rising medical tourism in some countries. Investments in public and private healthcare facilities are driving the demand for ophthalmic OR microscopes, particularly models that offer a balance between advanced features and cost-effectiveness.

- Middle East and Africa (MEA): The MEA region is characterized by varied levels of healthcare development, but significant investments in medical infrastructure and a rising incidence of eye disorders are spurring market growth. Countries in the Gulf Cooperation Council (GCC) are leading the adoption of advanced ophthalmic technologies, driven by government initiatives to enhance medical tourism and provide world-class healthcare services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ophthalmic Operating Room (OR) Microscopes Market.- Carl Zeiss Meditec AG

- Leica Microsystems (Danaher Corporation)

- Alcon Inc.

- Topcon Corporation

- HAAG-STREIT GROUP

- Takagi Ophthalmic Instruments

- Shin-Nippon (REXLUX)

- KAPS Optik

- Inami & Co., Ltd.

- Oertli Instrumente AG

- AccuTec

- Seiler Instrument Inc.

- Chongqing Vision Star Optical Co., Ltd.

- Eickhorst Vision GmbH

- Zumax Medical Co., Ltd.

- Suzhou Longy Optics Technology Co., Ltd.

- A.R.C. Laser GmbH

- MOLLER-WEDEL GmbH

- Appasamy Associates

- STERIS (Allen Medical Systems)

Frequently Asked Questions

What are the primary drivers for the Ophthalmic OR Microscopes market growth?

The market is primarily driven by the globally aging population, which increases the prevalence of age-related eye diseases such as cataracts and glaucoma. Additionally, continuous technological advancements, including 3D visualization, integrated OCT, and digital imaging, coupled with a rising demand for minimally invasive ophthalmic surgeries and increasing healthcare expenditures worldwide, significantly contribute to market expansion.

How is AI transforming ophthalmic surgical microscopes?

AI is set to revolutionize ophthalmic surgical microscopes by enabling real-time image analysis, offering predictive analytics for potential complications, and automating critical functions like focus and magnification. It facilitates robotic assistance for micro-movements and integrates enhanced surgical guidance systems, ultimately boosting precision, reducing surgeon fatigue, and improving patient outcomes in complex procedures.

Which regions offer the most significant growth opportunities for ophthalmic OR microscopes?

The Asia Pacific (APAC) region stands out as the area with the most significant growth opportunities, driven by its large and underserved population, rapidly developing healthcare infrastructure, and increasing healthcare spending. Emerging markets in Latin America and the Middle East & Africa also present considerable growth potential as their healthcare systems evolve and access to advanced eye care expands.

What are the key technological advancements in ophthalmic OR microscopes?

Key technological advancements include high-definition 3D visualization with heads-up displays, integrated intraoperative Optical Coherence Tomography (OCT) for real-time tissue imaging, and advanced fluorescence imaging. Furthermore, digitally assisted surgical guidance systems and sophisticated illumination technologies (LED, xenon) are crucial for enhancing precision, safety, and ergonomic comfort during ophthalmic surgeries.

What challenges do manufacturers face in the Ophthalmic OR Microscopes market?

Manufacturers encounter challenges such as the high initial capital investment required for developing and acquiring advanced microscope systems, which can limit adoption, particularly in budget-constrained settings. Stringent regulatory approval processes, the steep learning curve associated with complex new technologies, and intense market competition also pose significant hurdles that must be effectively navigated.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager