Opioid Induced Constipation (OIC) Drug Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438847 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Opioid Induced Constipation (OIC) Drug Market Size

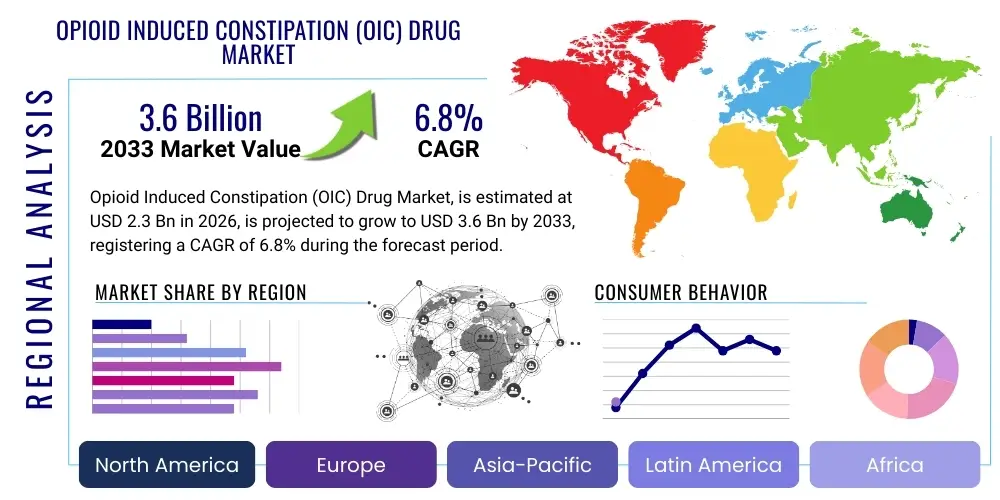

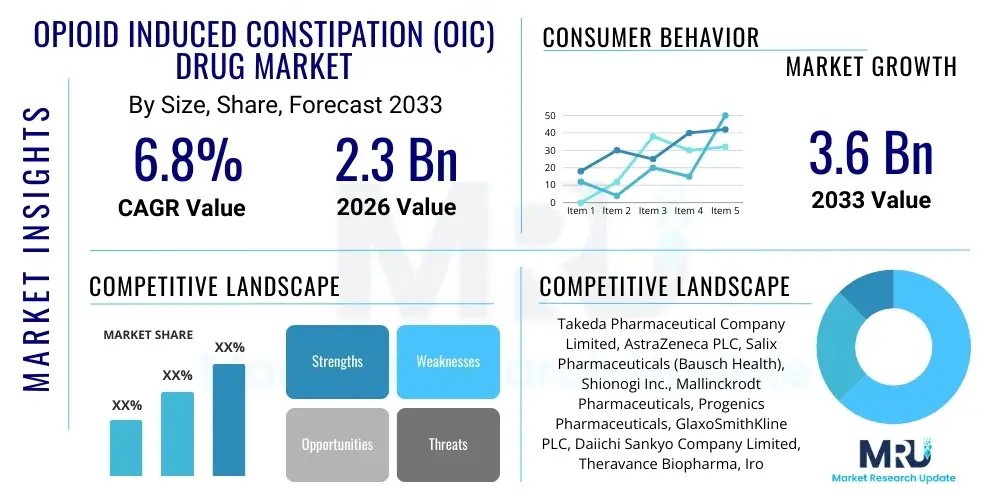

The Opioid Induced Constipation (OIC) Drug Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.3 Billion in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033.

Opioid Induced Constipation (OIC) Drug Market introduction

The Opioid Induced Constipation (OIC) Drug Market encompasses pharmaceutical agents specifically developed to treat constipation caused by the use of opioid analgesics. Opioids, while effective for chronic and acute pain management, frequently induce significant gastrointestinal side effects, predominantly constipation, by binding to peripheral mu-opioid receptors in the enteric nervous system, reducing peristalsis and increasing fluid absorption. The increasing prevalence of chronic pain conditions, particularly those requiring long-term opioid therapy, such as cancer pain and chronic non-cancer pain, acts as the primary catalyst for market expansion. The core market drivers involve the need for effective, targeted treatments that do not compromise the central analgesic effects of opioids, leading to the development of highly specific pharmaceutical classes.

Products within this market are broadly categorized, with peripherally acting mu-opioid receptor antagonists (PAMORAs) representing the most significant therapeutic innovation. PAMORAs, such as methylnaltrexone, naloxegol, and naldemedine, selectively block opioid binding in the gut without crossing the blood-brain barrier in substantial amounts, thus reversing the constipating effects while maintaining systemic pain relief. These drugs offer a substantial clinical advantage over traditional over-the-counter laxatives, which often provide insufficient relief for moderate-to-severe OIC. The applications of these drugs are focused on patients requiring long-term opioid therapy for chronic pain management, where OIC significantly diminishes quality of life and adherence to pain protocols.

The structural growth of the OIC drug market is underpinned by several critical factors, including heightened clinician awareness regarding the impact of OIC on patient outcomes, rising prescriptions of potent opioids globally, and continuous research into novel drug delivery systems that enhance bioavailability and patient compliance. Furthermore, demographic shifts, specifically the aging global population, contribute to a larger pool of patients suffering from chronic pain and subsequently, OIC. The development pipeline remains robust, focusing on maximizing efficacy, minimizing adverse effects, and addressing specific patient populations, such as those in palliative care settings or those with specific comorbidities, ensuring sustained market vibrancy throughout the forecast period.

Opioid Induced Constipation (OIC) Drug Market Executive Summary

The OIC drug market is characterized by robust business trends driven by the adoption of prescription-strength PAMORAs and specialized laxatives that offer superior efficacy compared to traditional treatments. Key market players are heavily invested in securing favorable reimbursement policies, expanding indications for existing PAMORA products, and developing fixed-dose combinations to improve patient convenience and compliance. Strategic mergers and acquisitions, particularly focused on securing proprietary drug formulations and expanding regional distribution networks, are prominent strategies shaping the competitive landscape. The market exhibits a clear trend toward personalized medicine approaches, aiming to match the severity of OIC and specific patient characteristics to the most appropriate therapeutic intervention, thereby optimizing treatment success rates.

Regionally, North America maintains market dominance due to high opioid prescription rates, sophisticated healthcare infrastructure, and favorable market access for premium-priced branded PAMORAs. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rising healthcare expenditures, increasing urbanization leading to better access to chronic pain clinics, and the gradual liberalization of drug approval processes in emerging economies like China and India. European growth is steady, driven by increasing awareness and the successful penetration of approved PAMORAs, although pricing pressures and heterogeneous reimbursement across member states present unique challenges compared to the U.S. market.

Segment trends highlight the continued supremacy of the PAMORA class due to its targeted mechanism of action, offering symptom relief without impacting central analgesia. Within distribution channels, retail pharmacies and hospital pharmacies remain the primary points of dispensing, reflecting the prescription-only nature of most advanced OIC treatments. The segment dedicated to chronic non-cancer pain patients accounts for the largest share of drug utilization, reflecting the long-term nature of treatment required in this demographic. Further innovation is expected in the injectable segment, catering primarily to patients in acute care or hospice settings requiring rapid relief, although the oral route remains preferred for long-term chronic management.

AI Impact Analysis on Opioid Induced Constipation (OIC) Drug Market

User inquiries regarding the impact of Artificial Intelligence (AI) in the OIC drug market frequently revolve around its potential to optimize clinical trial design, personalize treatment protocols, and enhance pharmacovigilance related to opioid usage and subsequent OIC development. Common questions ask whether AI can predict which patients are most likely to suffer from severe OIC based on genetic markers or concomitant medications, thereby allowing for prophylactic treatment strategies. There is significant interest in using machine learning algorithms to analyze Electronic Health Record (EHR) data to identify patterns of inadequate OIC management, leading to improved prescribing practices and better clinical guidance for pain specialists. Furthermore, users are keen to understand how AI-driven drug discovery platforms can accelerate the identification of novel therapeutic targets or refine existing drug candidates, potentially leading to OIC drugs with improved safety profiles and reduced cost of development.

AI's influence is transforming the market from a reactive treatment model to a predictive and preventative care model. Predictive modeling using AI can analyze complex patient datasets, including demographic information, opioid dose, duration of use, and existing gastrointestinal comorbidities, to forecast OIC risk levels with high accuracy. This capability is crucial for implementing targeted interventions early, significantly reducing the burden of disease and potentially decreasing the need for rescue therapies. For clinical researchers, AI accelerates the identification of optimal inclusion/exclusion criteria for OIC clinical trials, streamlines patient recruitment, and enables real-time monitoring of adverse events related to both the opioid therapy and the OIC treatment itself, enhancing the overall efficiency and cost-effectiveness of research and development.

The adoption of AI in pharmacovigilance is particularly impactful, allowing regulatory bodies and pharmaceutical companies to continuously monitor real-world evidence (RWE) concerning the efficacy and safety of approved OIC drugs. Natural Language Processing (NLP) tools can rapidly process vast amounts of unstructured data from patient reports, social media, and medical literature, uncovering subtle adverse drug reactions or efficacy variations across different patient subgroups that might be missed by traditional methods. This ensures timely updates to drug labels and safer use of potent OIC medications, thereby solidifying stakeholder confidence and supporting market maturity. AI is effectively bridging the gap between clinical data collection and actionable insights for both prescribers and developers in the OIC therapeutic space.

- AI-driven personalized risk assessment models predict OIC susceptibility based on patient profiles.

- Machine learning optimizes clinical trial recruitment and site selection for new OIC therapies.

- Natural Language Processing (NLP) enhances pharmacovigilance by analyzing RWE for adverse events.

- AI accelerates the identification of novel therapeutic targets for chronic constipation mechanisms.

- Algorithmic analysis of EHR data improves clinical pathway adherence for OIC management.

DRO & Impact Forces Of Opioid Induced Constipation (OIC) Drug Market

The Opioid Induced Constipation drug market is subjected to a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively dictate its growth trajectory and competitive dynamics. A primary driver is the undeniable necessity for effective treatment solutions driven by the global opioid crisis and the resultant increase in patients receiving chronic opioid therapy, especially in developed economies. The superiority of targeted therapies like PAMORAs over traditional over-the-counter laxatives in terms of efficacy and patient tolerability provides a strong foundation for market expansion, pushing prescribing physicians towards premium, specialized pharmaceutical solutions. Furthermore, increasing awareness among both healthcare professionals and patients about the debilitating impact of OIC on quality of life encourages proactive diagnosis and treatment, translating directly into higher prescription volumes for branded products.

However, significant restraints temper the market’s potential. The high cost of branded prescription OIC drugs, particularly PAMORAs, often leads to restricted formulary coverage by payers, creating access barriers for patients. This pricing challenge frequently forces patients to initiate therapy with low-cost, less-effective osmotic or stimulant laxatives, delaying the use of advanced targeted treatments. Moreover, the increasing regulatory scrutiny and public health campaigns aimed at reducing opioid over-prescription, particularly in North America, represent a long-term restraint, as a decrease in the overall opioid-using population would naturally shrink the target demographic for OIC treatments. The complexity surrounding the diagnosis and differentiation of OIC from general chronic constipation also sometimes leads to misdiagnosis or delayed initiation of specialized OIC treatment protocols.

Opportunities for sustained growth are manifold, centering on market penetration in under-served geographical regions, particularly emerging markets where chronic pain management is evolving. The development of novel drug classes beyond current PAMORAs, focusing on alternative mechanisms of action or better patient convenience (e.g., once-weekly dosing or non-oral formulations), presents significant revenue potential. Furthermore, integrating OIC treatment into comprehensive pain management programs and demonstrating the long-term cost-effectiveness of early PAMORA intervention through robust health economics and outcomes research (HEOR) studies can overcome current payer restrictions. The trend towards developing drugs that treat opioid side effects without compromising analgesia remains a highly attractive field for pharmaceutical investment and pipeline development.

Impact Forces Analysis

The market is critically influenced by the shifting regulatory landscape surrounding opioid use and pain management guidelines. Stricter prescribing guidelines imposed by governmental bodies and medical societies in response to the opioid epidemic directly impacts the patient pool susceptible to OIC. Conversely, regulatory fast-track designations for novel, targeted OIC therapies incentivize innovation and quicker market entry, strengthening the product availability. Technological advances in drug formulation, such particularly prodrugs or site-specific delivery systems designed to enhance gut specificity and minimize systemic exposure, are major positive impact forces, improving the therapeutic index of new entrants.

The competitive environment acts as a strong impact force, where the presence of multiple branded PAMORAs and the potential for generics (post-patent expiry) drives innovation in formulation and aggressive marketing strategies. Pricing and reimbursement decisions by major payers, especially in the U.S. and key European markets, exert immense pressure on profitability and patient access; restrictive policies force manufacturers to justify premium pricing with compelling clinical and economic evidence. Finally, patient advocacy and increasing physician education regarding the chronic nature and serious complications of inadequately treated OIC fuel demand, pushing healthcare systems towards adopting specialized OIC management protocols as a standard of care, thus creating a strong underlying force for market adoption.

Segmentation Analysis

The Opioid Induced Constipation (OIC) Drug Market is meticulously segmented based on Product Type, Route of Administration, and Distribution Channel, allowing for detailed analysis of market dynamics across diverse therapeutic options and commercial pathways. Segmentation by product type reveals the division between specialized, prescription-only targeted therapies, primarily PAMORAs, and traditional laxatives, including osmotic, stimulant, and bulk-forming agents, many of which are available over the counter but are increasingly used in combination or as initial failed therapy before advancing to prescription options. This structure highlights the shift towards higher-value, targeted pharmacological solutions that address the root cause of OIC more effectively than legacy treatments, thereby commanding higher market share value.

Analysis of the Route of Administration segments the market into Oral and Injectable formulations. Oral drugs are the dominant segment due to their convenience and preference for chronic, long-term patient self-administration in non-hospital settings. The injectable segment, while smaller, plays a vital role in acute care settings, such as hospital admissions or palliative care units, where rapid onset of action is critical, or for patients unable to tolerate oral medications. Understanding the dynamics across these routes is essential for manufacturers developing patient-centric formulations that improve adherence and overall treatment experience.

Furthermore, segmentation by Distribution Channel, encompassing Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies, reflects how patients access these treatments. Given that most high-value OIC drugs are prescription-only specialty medications, retail pharmacies and specialized mail-order pharmacies often manage the highest volume of long-term prescriptions. Hospital pharmacies primarily cater to the injectable forms and initiation of oral therapy during an inpatient stay. The growing penetration of online pharmacies, particularly for chronic medications, offers an increasingly convenient channel, impacting logistics and patient adherence, although regulatory constraints surrounding specialty drug distribution must be carefully navigated.

- Product Type

- Peripherally Acting Mu-Opioid Receptor Antagonists (PAMORAs)

- Traditional Laxatives (Osmotic, Stimulant, Bulk-forming, and Stool Softeners)

- Route of Administration

- Oral

- Injectable/Subcutaneous

- Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies/Mail Order

- Application/Indication

- Chronic Non-Cancer Pain (CNCP)

- Cancer Pain and Palliative Care

Value Chain Analysis For Opioid Induced Constipation (OIC) Drug Market

The value chain for the Opioid Induced Constipation drug market begins with the Upstream activities centered around active pharmaceutical ingredient (API) manufacturing and initial drug discovery, heavily relying on complex organic synthesis processes, particularly for novel compounds like PAMORAs. This initial phase involves rigorous R&D, clinical trials, and securing intellectual property. Key relationships exist between large pharmaceutical companies, which typically manage the overall drug development and commercialization, and specialized contract research organizations (CROs) and contract manufacturing organizations (CMOs) that provide expertise in trial execution and scalable API production. Regulatory approval by bodies such as the FDA and EMA is a critical intermediary step that validates the product and allows entry into the commercial phases.

The midstream involves secondary manufacturing, formulation, packaging, and quality assurance. This stage ensures that the finished dosage forms (tablets, injections) meet stringent quality standards and are packaged appropriately for distribution. Distribution Channel management forms the crucial link between manufacturers and end-users. The distribution is highly regulated, often involving a mix of direct sales to large hospital systems and indirect distribution through third-party logistics (3PL) providers, wholesalers, and specialized drug distributors. Given the high cost and specialty nature of some OIC drugs, stringent control over the cold chain and inventory management is often necessary, especially for injectable biological products, though PAMORAs are generally small molecules.

Downstream activities focus on reaching the patient, primarily through retail pharmacies, hospital pharmacies, and specialized mail-order services. Direct distribution strategies are sometimes employed for high-value specialty drugs to maintain tighter control over pricing and patient support programs. Indirect channels rely on strong commercial relationships with pharmaceutical wholesalers who manage logistics and inventory for thousands of retail outlets. Sales and marketing efforts, including direct-to-consumer (DTC) advertising and direct engagement with pain specialists, gastroenterologists, and primary care physicians, drive prescription volume. The final stage involves the patient consuming the drug, monitored by healthcare providers, forming the feedback loop necessary for pharmacovigilance and future product enhancements, thereby completing the cycle of the value chain.

Opioid Induced Constipation (OIC) Drug Market Potential Customers

The primary customer base for the Opioid Induced Constipation (OIC) Drug Market consists of individuals receiving chronic opioid therapy for extended periods, necessitating ongoing relief from gastrointestinal side effects. This demographic is predominantly segmented into patients suffering from Chronic Non-Cancer Pain (CNCP), such as severe lower back pain, fibromyalgia, and neuropathy, where opioid use often spans years. These customers seek effective, orally administered drugs that provide reliable and sustained constipation relief without interfering with their central pain management regimen. Their purchasing decision is heavily influenced by prescription recommendations from pain management specialists, rheumatologists, and primary care providers, as well as their insurance coverage and co-payment obligations for branded therapies.

A second major customer segment includes patients undergoing palliative care or receiving treatment for cancer-related pain. This group often requires higher opioid dosages and more immediate, potent relief, sometimes favoring injectable formulations administered in institutional or hospice settings. Healthcare institutions, including large hospitals and specialized cancer centers, act as key buyers for these products, purchasing them in bulk through institutional contracts and formulary agreements. In this segment, the speed of action and reliable efficacy, particularly in compromised or frail patients, are paramount decision criteria, often prioritizing specialized therapies over standard laxatives.

Finally, governmental health agencies and private insurance payers are indirect yet highly influential customers. While they do not consume the product, their decisions regarding drug listing and reimbursement policies dictate patient access and market volume. Manufacturers must therefore demonstrate the clinical superiority and favorable pharmacoeconomic value of their OIC drugs to secure favorable coverage, thereby making the payers essential stakeholders in the entire commercial process. The increasing emphasis on quality of life metrics and reduced complication rates (e.g., fewer emergency room visits due to impaction) further solidifies the role of payers in driving the market's adoption of advanced OIC therapies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Takeda Pharmaceutical Company Limited, AstraZeneca PLC, Salix Pharmaceuticals (Bausch Health), Shionogi Inc., Mallinckrodt Pharmaceuticals, Progenics Pharmaceuticals, GlaxoSmithKline PLC, Daiichi Sankyo Company Limited, Theravance Biopharma, Ironwood Pharmaceuticals, Pfizer Inc., Sanofi S.A., Purdue Pharma L.P., Vertex Pharmaceuticals, Synergy Pharmaceuticals, RedHill Biopharma, Biogen Inc., Johnson & Johnson, Sun Pharmaceutical Industries Ltd., Allergan plc (AbbVie) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Opioid Induced Constipation (OIC) Drug Market Key Technology Landscape

The technological landscape of the OIC drug market is defined primarily by advanced pharmacological development focusing on specificity and targeted delivery. The core technology involves the engineering of peripherally acting mu-opioid receptor antagonists (PAMORAs). These compounds are specifically designed to be substrates for P-glycoprotein efflux pumps or possess structural features that limit their ability to cross the blood-brain barrier. This technological constraint ensures that they selectively antagonize mu-opioid receptors located in the enteric nervous system, reversing the constipating effects without significantly impacting the analgesic effects mediated by receptors in the central nervous system (CNS), which is a crucial technological distinction setting them apart from non-specific laxatives or general opioid antagonists.

Recent technological advancements are also concentrating on optimizing existing drugs through enhanced formulation technologies. This includes developing prodrugs, which are inactive forms that become active only upon absorption or metabolism, potentially leading to improved bioavailability or reduced systemic side effects. Furthermore, specialized drug delivery systems, such as sustained-release oral matrices or subcutaneous auto-injectors, aim to improve patient adherence and convenience. These formulation innovations address market needs for less frequent dosing and easier administration, particularly for elderly populations or those with swallowing difficulties, thereby expanding the applicability of current therapeutic agents.

Beyond PAMORAs, the technology pipeline explores alternative mechanisms, including compounds targeting novel neurotransmitter pathways in the gut or utilizing selective ion channel modulators designed to stimulate colonic transit. For example, some researchers are investigating agents that modulate gut motility through non-opioid mechanisms but specifically address the bowel dysfunction associated with chronic opioid use. This diversity in therapeutic approach represents a continuous technological effort to find solutions for patients who do not respond adequately to PAMORAs or who experience specific adverse events related to the current generation of targeted drugs, ensuring the ongoing innovation and long-term viability of the OIC drug development sector.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the United States. The market here is characterized by high prescription rates of both chronic pain opioids and corresponding premium-priced branded OIC treatments, specifically PAMORAs. Extensive insurance coverage and a well-developed network of pain management clinics contribute to strong adoption. Regulatory changes aiming to curb opioid misuse, paradoxically, drive demand for specialized OIC drugs as part of comprehensive risk management strategies when opioids are prescribed.

- Europe: Western European countries represent a mature market with steady growth. Growth is constrained somewhat by price controls and variation in reimbursement policies across countries like Germany, France, and the UK, which often mandate the use of generic, cheaper laxatives before approving specialized OIC drugs. However, increasing awareness among gastroenterologists and palliative care specialists is steadily increasing the prescribing of drugs like naloxegol and methylnaltrexone.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising healthcare investment, expanding access to advanced pain management techniques, and a large, aging population base. Countries like Japan, China, and Australia are seeing increased market penetration of branded OIC drugs. Market growth is heavily dependent on overcoming regulatory hurdles and establishing efficient drug distribution networks in high-density urban areas.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets for OIC drugs. Growth is modest but accelerating, primarily concentrated in major economies (e.g., Brazil, Saudi Arabia). Market access is challenged by lower average healthcare expenditure and dependence on imported pharmaceuticals, but increasing international collaborations and governmental focus on improving palliative care infrastructure are creating foundational opportunities for future market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Opioid Induced Constipation (OIC) Drug Market.- Takeda Pharmaceutical Company Limited

- AstraZeneca PLC

- Salix Pharmaceuticals (Bausch Health)

- Shionogi Inc.

- Mallinckrodt Pharmaceuticals

- Progenics Pharmaceuticals

- GlaxoSmithKline PLC

- Daiichi Sankyo Company Limited

- Theravance Biopharma

- Ironwood Pharmaceuticals

- Pfizer Inc.

- Sanofi S.A.

- Purdue Pharma L.P.

- Vertex Pharmaceuticals

- Synergy Pharmaceuticals

- RedHill Biopharma

- Biogen Inc.

- Johnson & Johnson

- Sun Pharmaceutical Industries Ltd.

- Allergan plc (AbbVie)

Frequently Asked Questions

Analyze common user questions about the Opioid Induced Constipation (OIC) Drug market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between PAMORAs and traditional laxatives for OIC treatment?

PAMORAs (Peripherally Acting Mu-Opioid Receptor Antagonists) are specialized prescription drugs that block the constipating effects of opioids selectively in the gut without crossing the blood-brain barrier, thus maintaining central pain relief. Traditional laxatives, conversely, work non-specifically by increasing fluid content or stimulating bowel movement and often fail to adequately treat moderate-to-severe OIC.

Which geographic region currently dominates the global OIC drug market?

North America, particularly the United States, dominates the OIC drug market due to the high volume of chronic opioid prescriptions, established market access for premium branded therapies like PAMORAs, and comprehensive clinical guidelines recommending targeted OIC management.

How does the increasing regulatory scrutiny on opioid prescribing affect the OIC drug market?

Increased regulatory scrutiny on opioid prescribing creates a mixed impact: while it aims to reduce the overall population receiving opioids (a market restraint), it simultaneously necessitates that providers who do prescribe opioids adopt rigorous OIC risk mitigation strategies, driving the demand for specialized, effective prescription OIC drugs as a required standard of care (a market driver).

What is the forecasted Compound Annual Growth Rate (CAGR) for the OIC Drug Market?

The Opioid Induced Constipation Drug Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between the forecast period of 2026 and 2033, driven by innovation in targeted therapies and rising global prevalence of chronic pain requiring long-term opioid use.

What role does Artificial Intelligence (AI) play in the future of OIC treatment?

AI is increasingly used to optimize OIC treatment by employing predictive modeling to identify high-risk patients for proactive management, enhancing pharmacovigilance by analyzing real-world evidence, and accelerating the discovery and clinical development of novel, safer therapeutic compounds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager