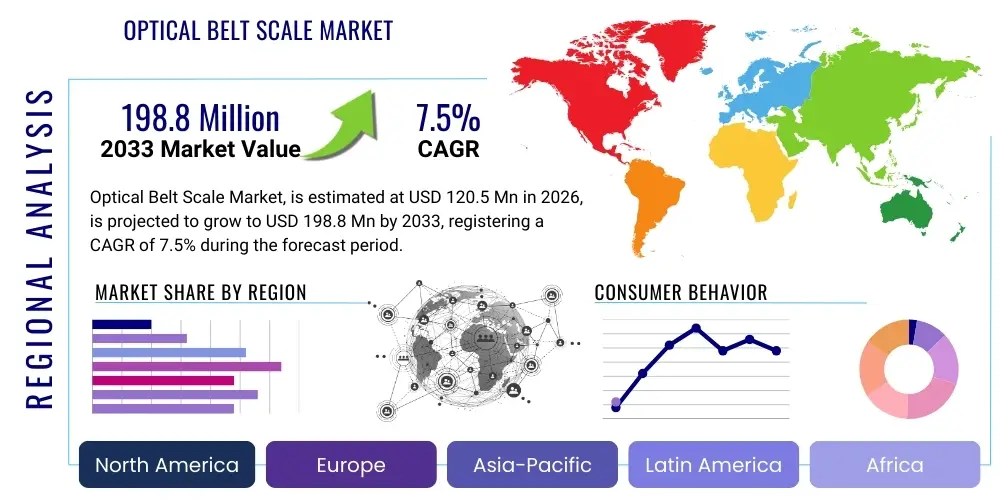

Optical Belt Scale Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436384 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Optical Belt Scale Market Size

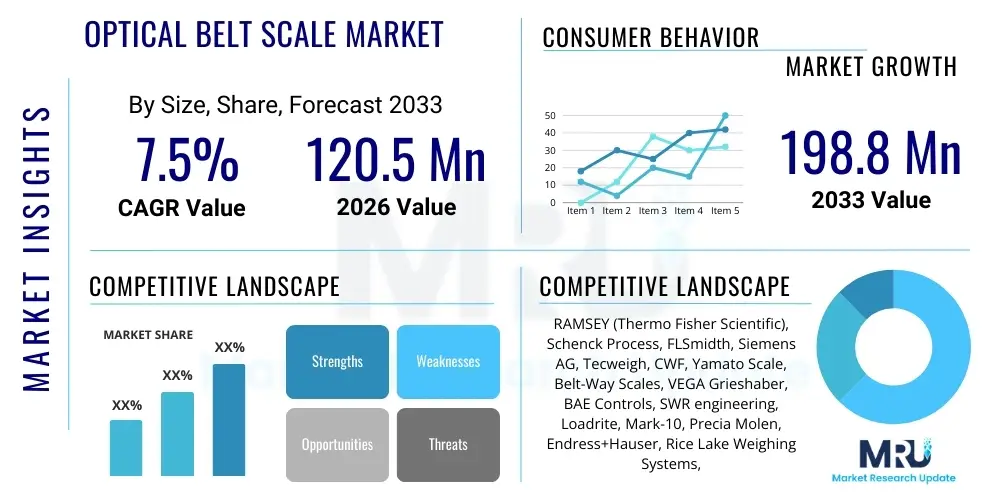

The Optical Belt Scale Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 120.5 Million in 2026 and is projected to reach USD 198.8 Million by the end of the forecast period in 2033.

Optical Belt Scale Market introduction

Optical belt scales represent a significant advancement in bulk material flow measurement technology, offering non-contact, highly accurate, and continuous monitoring of conveyed materials. Unlike traditional mechanical belt scales that rely on load cells and susceptible moving parts, optical systems utilize advanced laser or camera technology combined with sophisticated signal processing to determine the volume and speed of material passing over a conveyor belt. This technology is critical in industries where precise inventory tracking, process control, and regulatory compliance regarding material throughput are paramount, thereby ensuring operational efficiency and reducing measurement uncertainties associated with environmental factors like dust or belt vibration.

The core components of an optical belt scale system typically include a light source (often laser or LED array), high-resolution sensing devices, and a processing unit integrated with compensation algorithms. These systems calculate mass flow rate by accurately measuring the material cross-sectional area and the belt speed. Major applications span high-volume industries such as mining, aggregates, ports and terminals, cement production, and power generation (coal handling). The inherent benefits of these systems—including minimal maintenance requirements due to the lack of moving parts, resilience in harsh operational environments, and superior long-term accuracy—are driving rapid adoption globally, positioning them as essential tools for modern automated facilities.

Driving factors for this market include the global push for industrial automation, the stringent requirement for higher measurement accuracy in high-value bulk commodities, and the decreasing cost and increased robustness of optical sensing technology. Furthermore, the integration capabilities of these scales with modern Industrial Internet of Things (IIoT) platforms allow for real-time data analysis and seamless integration into plant-wide control systems, further bolstering their appeal in the context of Industry 4.0 initiatives across developed and rapidly industrializing economies.

Optical Belt Scale Market Executive Summary

The Optical Belt Scale Market is characterized by robust growth driven fundamentally by the necessity for enhanced operational precision in bulk material handling sectors, notably mining and port operations. Business trends indicate a strong shift toward integrated solutions that combine high-accuracy optical measurement with advanced data analytics and cloud connectivity, favoring manufacturers who can provide comprehensive software and calibration services alongside hardware. Key players are heavily investing in multi-beam and laser profiling technologies to overcome challenges posed by uneven material loading and fluctuating belt conditions, thereby solidifying market stability.

Regional trends highlight the Asia Pacific (APAC) region as the dominant growth engine, propelled by massive infrastructure development and intense mining activities in countries like China, India, and Australia, demanding high-throughput weighing solutions. North America and Europe maintain significant market shares, characterized by early adoption of automation and a focus on replacing legacy mechanical systems with superior optical alternatives to achieve higher regulatory compliance standards. The Middle East and Africa (MEA) are emerging due to significant investments in port development and expansion of raw material extraction activities.

Segmentation trends reveal that Multi-Beam Optical Scales are gaining traction due to their ability to provide superior accuracy across varying load profiles compared to simpler Single-Beam designs. Application-wise, the Mining sector remains the largest consumer, although the Cement and Aggregate industry is projected to exhibit the fastest CAGR, reflecting the global construction boom. The market remains competitive, with focus shifting from basic product features to total cost of ownership (TCO) and seamless integration capabilities within complex industrial environments.

AI Impact Analysis on Optical Belt Scale Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is profoundly transforming the functionality and reliability of Optical Belt Scales. User questions frequently revolve around how AI can eliminate manual calibration requirements, improve accuracy in adverse conditions (like high moisture or varying particle size), and provide predictive maintenance alerts for the conveyor system itself. Stakeholders are keen to understand how ML algorithms can process the vast amounts of optical data generated (e.g., laser profiles and imaging data) to discern true material flow from noise caused by belt irregularities, slippage, or environmental dust accumulation, which are traditional limitations for high-accuracy weighing.

AI is primarily leveraged for real-time data interpretation and anomaly detection. By training ML models on historical data covering varying operational states, material characteristics, and environmental conditions, optical belt scales can automatically compensate for inherent measurement deviations that would otherwise require manual intervention or system downtime. This enhancement ensures unprecedented levels of long-term stability and accuracy, dramatically reducing the operational expenditure associated with calibration audits and measurement disputes. Furthermore, predictive modeling enables the scale system to forecast wear on the conveyor components (e.g., idlers, pulleys) based on observed belt movement patterns, moving the technology beyond mere weight measurement into comprehensive conveyor health monitoring.

- AI-driven automated calibration and drift correction increase long-term measurement accuracy.

- Machine Learning algorithms analyze optical profiles to compensate for belt wear and material heterogeneity (e.g., uneven loading).

- Predictive maintenance analytics for both the belt scale components and the associated conveyor system.

- Enhanced data interpretation allows for real-time volumetric and density estimations, moving beyond simple mass measurement.

- Improved noise filtering and signal processing for reliable performance in dusty or high-vibration environments.

DRO & Impact Forces Of Optical Belt Scale Market

The dynamics of the Optical Belt Scale Market are shaped by a complex interplay of high-demand drivers, technical and economic restraints, and significant modernization opportunities, all contributing to powerful market impact forces. The core driver is the increasing global demand for mineral resources and construction materials, necessitating high-volume, reliable throughput monitoring in large-scale operations. Restraints include the high initial capital expenditure required for installing these sophisticated systems compared to conventional mechanical scales, along with the requirement for specialized technical personnel for initial setup and advanced diagnostics. Opportunities lie in integrating these scales into holistic IIoT ecosystems, offering cloud connectivity and advanced data services, allowing manufacturers to capture higher-value recurring revenue streams through software subscriptions and remote monitoring.

Impact forces are centered around regulatory pressure for accurate reporting and industry competition. The stringent environmental and fiscal reporting requirements in the mining and bulk commodity sectors enforce the need for the highest accuracy class scales, directly benefiting non-contact optical technology. Furthermore, the rising labor costs and safety concerns associated with maintenance in hazardous industrial environments accelerate the shift towards non-contact systems that require minimal physical intervention. This environment pushes industry participants to continuously innovate on sensor robustness and data processing capabilities to maintain a competitive edge.

The market also experiences strong influence from technology standardization and integration challenges. While optical technology offers high precision, ensuring interoperability with diverse legacy plant management systems (DCS/SCADA) is a constant challenge that vendors must address. However, the substantial reduction in total cost of ownership (TCO) over the scale’s lifecycle, driven by minimized downtime and eliminated need for mechanical component replacement, acts as a powerful long-term economic driver mitigating the initial high investment barrier, thereby sustaining the market’s positive growth trajectory.

Segmentation Analysis

The Optical Belt Scale Market is comprehensively segmented based on technology type, material application, and specific end-use industry. This granular segmentation provides a detailed understanding of the diverse technological demands across various operational environments. The fundamental division lies between Single-Beam and Multi-Beam designs, reflecting the accuracy requirements and complexity of the material handling operation. Furthermore, application segmentation reveals the dominant sectors driving demand, ranging from heavy industrial processing (mining, cement) to lighter processes (food and chemical handling), each requiring specialized calibration and sensor configurations to optimize performance under distinct material flow characteristics.

- By Type:

- Single-Beam Optical Scales

- Multi-Beam Optical Scales

- Laser Profiling Scales

- By Technology:

- Laser-based

- Camera/Vision-based (Photogrammetry)

- By Application:

- Volumetric Measurement

- Mass Flow Measurement

- By End-Use Industry:

- Mining and Quarrying

- Ports and Terminals

- Cement and Aggregates

- Power Generation (Coal/Biomass)

- Food Processing and Agriculture

- Chemical and Fertilizer

- By Component:

- Sensors and Optics

- Processing Units and Controllers

- Software and Analytics Platforms

- By Conveyor Belt Width:

- Narrow Belt (< 1000 mm)

- Medium Belt (1000 mm – 1800 mm)

- Wide Belt (> 1800 mm)

Value Chain Analysis For Optical Belt Scale Market

The value chain for the Optical Belt Scale Market begins with the highly specialized upstream segment, which involves the sourcing and development of core technological components, primarily sophisticated optical sensors (lasers, high-speed cameras) and high-performance microprocessors required for complex data processing. Key activities at this stage include R&D focusing on sensor robustness, spectral analysis capabilities, and computational efficiency. Component suppliers, often semiconductor or specialized optics manufacturers, exert significant influence on the final product’s cost structure and technical specifications, requiring manufacturers to establish robust supply chain relationships to manage quality and cost effectively.

The middle segment of the value chain involves the design, manufacturing, assembly, and rigorous testing of the complete belt scale system. Original Equipment Manufacturers (OEMs) focus on system integration, embedding proprietary algorithms for measurement compensation, and developing industrial-grade enclosures suitable for extremely harsh operating environments (e.g., high dust, moisture, extreme temperatures). Distribution channels are critical here; sales are primarily conducted through direct sales teams for complex, large-scale projects (direct channel), and via specialized industrial distributors or system integrators (indirect channel) who possess local market knowledge and installation expertise, particularly in fragmented markets like aggregates and smaller ports.

The downstream segment is defined by installation, commissioning, after-sales service, and software support. Given the complexity and criticality of accurate weighing, services like on-site calibration, training, remote monitoring, and software updates are high-value elements that contribute substantially to vendor differentiation and profitability. End-users in mining and large terminals require continuous operational support and often purchase long-term maintenance contracts, solidifying the importance of a reliable global service network. Direct engagement with end-users provides valuable feedback for continuous product refinement, particularly concerning integration with plant operational technology (OT) systems.

Optical Belt Scale Market Potential Customers

The primary customers for Optical Belt Scale technology are large industrial entities that rely heavily on the efficient, accurate, and continuous transportation of bulk materials. The dominant purchasing entities are high-volume operators in the mining and quarrying sector, including major iron ore, coal, and copper producers, who require precise reconciliation of extracted materials and shipments to maximize profitability and adhere to stringent contract specifications. These customers prioritize system longevity, high accuracy (often demanding 0.25% error tolerance or better), and robust integration with complex SCADA or MES systems.

Secondary, yet rapidly growing, customer segments include global port and terminal operators that handle large volumes of imported and exported commodities such as grains, fertilizers, and bulk minerals. For these customers, optical belt scales are crucial for billing accuracy, regulatory compliance, and managing vessel loading efficiency. Furthermore, infrastructure-intensive industries like cement manufacturing and power generation (coal-fired or biomass plants) represent consistent end-users, requiring precise feed rate control for optimal combustion efficiency and product quality standardization. These customers value the scale’s ability to operate reliably with minimal maintenance in dusty, corrosive atmospheres.

The purchasing decision across these segments is highly technical, often involving cross-functional teams comprising procurement managers, instrumentation engineers, and operational technology (OT) specialists. The focus is increasingly shifting toward Total Cost of Ownership (TCO), where the higher initial investment in an optical scale is justified by significant long-term savings realized through reduced maintenance labor, eliminated calibration expenses, and minimized revenue loss due to measurement inaccuracies. Solution providers must tailor their proposals to address the specific throughput, material type (e.g., sticky, abrasive), and environmental challenges faced by each distinct industrial segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 120.5 Million |

| Market Forecast in 2033 | USD 198.8 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RAMSEY (Thermo Fisher Scientific), Schenck Process, FLSmidth, Siemens AG, Tecweigh, CWF, Yamato Scale, Belt-Way Scales, VEGA Grieshaber, BAE Controls, SWR engineering, Loadrite, Mark-10, Precia Molen, Endress+Hauser, Rice Lake Weighing Systems, Ashworth, EADEC, Saimo Electric, Belt-Tech Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Belt Scale Market Key Technology Landscape

The technological landscape of the Optical Belt Scale Market is rapidly evolving, driven primarily by advancements in non-contact sensing and high-speed data processing. The dominant technology remains laser-based profiling, where single or multiple fixed laser beams create a precise topographical profile of the material on the conveyor belt. These lasers utilize triangulation methods or time-of-flight measurements to determine the cross-sectional area with high resolution. The integration of multi-beam arrays significantly improves accuracy by averaging measurements across the belt width, compensating for material segregation and uneven loading, which is a key technical differentiator from single-beam systems.

A burgeoning technological segment involves vision-based or photogrammetry techniques, utilizing high-resolution industrial cameras and advanced image processing algorithms. These systems capture 3D images of the material surface, offering superior density estimation capabilities and better visualization of the material profile. However, vision-based systems require more computational power and are often more susceptible to performance degradation from extreme dust or condensation unless specialized cleaning and air-purge systems are implemented. The continuous development of robust, high-power LEDs and improved camera sensitivity is making photogrammetry a viable, high-accuracy option, particularly in challenging environments.

Crucially, the effectiveness of both laser and vision technologies hinges on the sophistication of the embedded software and processing unit. Modern optical belt scales rely on powerful microprocessors capable of executing complex proprietary algorithms in real-time. These algorithms perform tasks such as belt speed compensation (often using non-contact radar or encoder feedback), temperature correction, and filtering out noise caused by belt movement or atmospheric interference. The focus is shifting toward implementing edge computing capabilities to handle data locally before transmission, enhancing speed and security while facilitating seamless integration into the broader Industrial Internet of Things (IIoT) infrastructure using standard industrial communication protocols like PROFINET, Ethernet/IP, and Modbus TCP.

Regional Highlights

The global Optical Belt Scale Market exhibits distinct regional characteristics influenced by industrial activity, regulatory environments, and investment in automation technology.

- Asia Pacific (APAC): APAC is anticipated to hold the largest market share and register the highest growth rate during the forecast period. This dominance is primarily attributed to unprecedented investment in infrastructure development, massive scale mining operations in Australia and Southeast Asia, and rapid industrialization in China and India. The expansion and modernization of port facilities, particularly those handling coal, iron ore, and aggregates, create sustained high demand for accurate throughput measurement solutions. Favorable governmental policies promoting industrial automation further fuel market expansion in this region.

- North America: North America represents a mature yet highly demanding market characterized by high regulatory requirements (e.g., MSHA standards) and a strong focus on maximizing operational efficiency through advanced digitalization (Industry 4.0). The region shows high adoption rates for premium, multi-beam, and AI-enhanced optical scales, particularly in the Canadian and US mining and aggregates industries, where replacing aging mechanical systems with non-contact alternatives is a priority to minimize maintenance costs and ensure reliable compliance reporting.

- Europe: The European market is defined by stringent quality control and environmental regulations, driving demand for the highest class of measurement accuracy. While the growth rate may be slower compared to APAC, the high value of industrial output and the emphasis on smart factory implementations ensure stable demand. Key areas include complex manufacturing, cement production, and handling of fine chemicals. European vendors often lead in developing modular, easily integrated systems and software platforms that comply with regional machinery directives.

- Latin America (LATAM): LATAM is a significant market due to its abundant mineral resources and large-scale mining operations (e.g., Chile, Brazil, Peru). Market growth is volatile but strong, heavily tied to global commodity prices. There is substantial opportunity for technology adoption as mining companies seek to optimize logistics and material handling efficiency to compete globally, often jumping directly to advanced optical technologies over traditional methods.

- Middle East and Africa (MEA): The MEA region is emerging rapidly, driven by significant investments in port expansion projects (e.g., in the GCC countries) and the development of new extraction industries in Sub-Saharan Africa. While challenges related to infrastructure and harsh desert environments exist, the requirement for high-throughput, low-maintenance technology makes optical belt scales an ideal solution for new facility construction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Belt Scale Market.- RAMSEY (Thermo Fisher Scientific)

- Schenck Process

- FLSmidth

- Siemens AG

- Tecweigh

- CWF

- Yamato Scale

- Belt-Way Scales

- VEGA Grieshaber

- BAE Controls

- SWR engineering

- Loadrite

- Mark-10

- Precia Molen

- Endress+Hauser

- Rice Lake Weighing Systems

- Ashworth

- EADEC

- Saimo Electric

- Belt-Tech Systems

Frequently Asked Questions

Analyze common user questions about the Optical Belt Scale market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes optical belt scales from traditional mechanical belt scales?

Optical belt scales utilize non-contact sensors (lasers or cameras) to measure material volume and belt speed, eliminating moving parts, friction, and load cells. This results in superior long-term accuracy, minimal maintenance requirements, and higher resilience to environmental factors like vibration or dust compared to traditional mechanical systems.

In which industries are optical belt scales most commonly applied?

Optical belt scales are predominantly utilized in high-volume bulk material handling operations, with the Mining and Quarrying sector being the largest consumer. Other key applications include Ports and Terminals, Cement and Aggregates production, and Power Generation facilities handling biomass or coal.

How does temperature and belt speed fluctuation affect the accuracy of optical belt scales?

Modern optical scales incorporate sophisticated embedded processors and algorithms that automatically compensate for temperature variations (thermal drift) and continuously integrate real-time belt speed measurements (often via encoders or radar) into the calculation. This ensures stable and precise mass flow measurement despite environmental or operational fluctuations.

What is the primary benefit of using Multi-Beam Optical Scales over Single-Beam units?

Multi-Beam systems use several measurement points across the width of the conveyor belt. This configuration provides a more accurate average cross-sectional profile, significantly compensating for inaccuracies caused by uneven material loading, material segregation, or inconsistent belt alignment, making them suitable for regulatory custody transfer applications.

Is the initial investment cost for optical belt scales justified by long-term operational savings?

Yes. While the upfront cost is higher than mechanical scales, the long-term Total Cost of Ownership (TCO) is lower. This reduction is achieved through minimal maintenance needs, elimination of continuous manual calibration expenses, and avoidance of revenue loss resulting from measurement inaccuracies inherent in friction-dependent mechanical systems.

The Optical Belt Scale Market is poised for sustained expansion, fueled by the relentless demand for automation and precision in global logistics and material processing. The convergence of advanced sensor technology, robust industrial computing, and the transformative power of Artificial Intelligence is redefining the benchmarks for throughput measurement accuracy and operational reliability in harsh industrial environments. Key market participants are focused on delivering IIoT-ready solutions that not only measure material flow but also provide holistic conveyor system health monitoring, further cementing the scale’s role as a mission-critical asset.

The technological advancement trajectory indicates a clear shift towards self-diagnostic, self-calibrating systems that minimize human intervention. This trend, coupled with ongoing infrastructure investments, particularly in emerging economies where high-throughput facilities are being rapidly deployed, ensures a resilient and high-growth environment for non-contact optical weighing technologies. Strategic regional focus remains on the Asia Pacific, where industrial output and commodity handling volumes dictate the pace of technological adoption and market scale.

Future competitive advantages will hinge on software integration capabilities, particularly the ability to seamlessly link optical measurement data into enterprise resource planning (ERP) systems and optimize supply chain logistics. Companies that successfully combine cutting-edge optical hardware with powerful cloud-based analytics platforms will capture the largest share of the rapidly digitalizing bulk material handling market, ensuring operational excellence for their industrial clientele.

In summary, the market's trajectory is definitively upward, reflecting a fundamental industry shift away from mechanically constrained measurement toward digitally enabled, high-precision optical solutions, offering superior performance and lower lifetime ownership costs. This dynamic is reinforced by stringent environmental standards and the imperative for meticulous inventory control in high-value commodity flows worldwide.

The rigorous demand for traceable and certifiable measurement data, particularly in sectors where the measured volume translates directly into financial transactions (custody transfer), mandates the use of technology offering the lowest uncertainty. Optical belt scales, especially multi-beam configurations utilizing AI-enhanced processing, meet these rigorous requirements, establishing them as the gold standard for high-accuracy bulk material weighing. Continuous innovation in laser robustness and photogrammetric processing promises to further extend the application range of these scales into previously challenging environments.

Furthermore, vendor differentiation is increasingly reliant on providing comprehensive data packages. Beyond simple tonnage counts, customers seek integrated solutions that offer material profiling, density estimates, and predictive alerts related to belt loading efficiency and potential spillage. This added intelligence transforms the scale from a simple weighing device into a strategic sensor component of the overall plant control system, generating significant long-term value for end-users across mining, port, and manufacturing verticals.

The competitive landscape is characterized by established automation giants leveraging their broad industrial presence and specialized niche players focusing exclusively on optical sensing innovation. Collaboration and strategic partnerships between these two groups are becoming common, allowing specialized sensor manufacturers to access global distribution channels and larger players to rapidly integrate leading-edge optical technology into their extensive product portfolios, thereby accelerating market penetration and stabilizing technological standards.

Environmental compliance is also a significant, albeit indirect, driver. As companies face increasing scrutiny regarding dust emissions and resource utilization, accurate monitoring provided by non-contact optical systems aids in optimizing material handling processes, reducing waste, and demonstrating verifiable adherence to environmental regulations. The precision offered by optical systems supports efforts toward sustainable resource management, aligning market growth with global sustainability goals.

The evolution towards modular and easily deployable systems is crucial for tapping into the retrofit market, where older conveyor systems require upgraded weighing capabilities without extensive structural modifications. Manufacturers are responding by designing compact, lightweight optical units that minimize installation complexity and downtime, making the transition from legacy mechanical scales more economically viable for a wider range of facility sizes and operational budgets worldwide.

The market faces minor headwinds from global economic volatility, which can temporarily impact large capital expenditure projects in the mining and infrastructure sectors. However, the fundamental efficiency gains offered by optical technology ensure that demand remains stable, as high-accuracy measurement is often prioritized even during periods of commodity price fluctuation to safeguard financial reconciliation and operational integrity across the value chain.

Technological advancement is also focusing on enhancing the robustness of the optical components themselves. Operating in dusty, wet, or extremely hot conditions requires sensors with high Ingress Protection (IP) ratings and advanced self-cleaning mechanisms. Investments in material science for protective casings and lens technology are vital areas of R&D, ensuring sustained measurement quality irrespective of the surrounding industrial chaos, thereby expanding the applicability of these scales globally.

The integration challenge remains a key area of focus. While the hardware is highly precise, ensuring seamless data exchange with varied industrial control systems (DCS, PLC platforms) across different manufacturers is paramount. Standardization efforts in industrial communication protocols and the development of open APIs are facilitating faster and less custom integration, reducing project commissioning times and lowering the overall barrier to adoption for new customers.

In conclusion, the Optical Belt Scale Market is transitioning from a specialized niche to a mainstream requirement for precision bulk material flow. Driven by economic benefits (reduced TCO, improved inventory control) and technological maturity (AI, advanced optics), the market is set for exceptional growth, redefining accuracy standards across the global commodity value chain.

The increasing prevalence of specialized material types, such as biomass or recycled aggregates, which exhibit highly inconsistent densities and moisture content, necessitates the sophisticated profiling capabilities of optical systems. Unlike mechanical scales that assume uniform density distribution, the volumetric measurement combined with potential correlation to material analysis data allows optical scales to deliver a more representative mass flow reading, which is increasingly critical for process optimization.

Vendor strategies are heavily influenced by geographic proximity to major industrial clusters. Companies with established sales and service networks in high-growth regions like Western Australia (mining) and Southeast Asia (ports) are strongly positioned. Establishing local calibration and service centers is non-negotiable, as the sensitivity of the instruments requires expert handling and regulatory certification to ensure legal acceptance of the measured data for commercial purposes.

The role of software as a service (SaaS) is gaining prominence. Manufacturers are migrating towards offering subscription-based access to their advanced analytical software, which provides continuous system diagnostics, remote calibration checks, and performance benchmarking against industry best practices. This model not only stabilizes recurring revenue for vendors but also ensures that customers always benefit from the latest algorithmic improvements and security patches, enhancing the long-term value proposition of the optical scale investment.

Furthermore, educational initiatives aimed at training plant personnel on the unique features and maintenance requirements of optical scales are essential for sustainable market growth. As the technology is complex, user acceptance and proper utilization depend heavily on effective training programs provided by the manufacturers, reducing the reliance on specialized external technicians for routine operation and minor troubleshooting.

The regulatory environment in many developed nations mandates periodic verification of weighing instruments used for commerce. Optical scale manufacturers are therefore focusing R&D on features that streamline the verification process, often incorporating internal diagnostic routines that can generate traceable data demonstrating accuracy compliance, thus simplifying audits and reducing regulatory burden for the end-user.

Ultimately, the long-term success of the optical belt scale technology lies in its ability to deliver superior accuracy consistently under the most demanding industrial conditions. This reliability, combined with the integration into automated control loops for process optimization, makes it an indispensable component of modern, high-efficiency bulk handling operations globally, securing its robust growth trajectory through the forecast period and beyond.

The focus on predictive modeling extends beyond the conveyor belt to the material itself. AI integrated optical systems can potentially detect anomalies in material composition or size distribution based on the 3D profile data, alerting operators to potential upstream processing issues before they impact final product quality or operational efficiency, thus creating additional value beyond simple mass measurement.

Competition among manufacturers drives continuous cost reduction in sensor components and processing hardware, making optical belt scales increasingly accessible to medium-sized operations that previously relied solely on lower-cost, less accurate mechanical solutions. This expanding affordability is a critical factor broadening the market reach into smaller quarrying, aggregate, and regional port facilities, increasing the overall global installed base.

Finally, the movement towards modularity in scale design allows for customization tailored to specific conveyor geometries and environmental constraints. Whether dealing with steep incline conveyors, extremely wide belts, or high-speed systems, vendors are offering flexible deployment options, ensuring that the benefits of optical measurement technology can be realized across virtually all types of bulk material conveyance systems worldwide.

The evolution of wireless connectivity standards (e.g., 5G industrial networks) further enhances the utility of optical belt scales by enabling high-bandwidth, real-time data transmission from remote and mobile handling equipment, such as stackers and reclaimers. This capability supports centralized monitoring and control across vast industrial sites, drastically improving coordination and data synchronization across the entire logistics chain.

Investment in cybersecurity for these connected devices is becoming increasingly important. As optical scales become vital nodes in the Industrial Internet of Things (IIoT), manufacturers are embedding advanced security features to protect measurement data integrity and prevent unauthorized access or manipulation of the weighing system, particularly crucial in high-value custody transfer applications where data tampering could result in significant financial loss.

The synergy between optical measurement and other non-contact sensing modalities, such as nuclear density gauges, is creating hybrid systems offering enhanced information. While the optical scale measures volume accurately, density gauges provide real-time material density, allowing for highly accurate mass calculation irrespective of material characteristics like moisture content. This synergistic approach represents the pinnacle of current bulk material weighing technology.

Market growth is also indirectly supported by global efforts to improve worker safety. By reducing the need for frequent physical calibration and maintenance interventions on active conveyor belts—a high-risk activity—optical belt scales contribute significantly to enhanced site safety records, appealing strongly to large international corporations with stringent EHS policies.

The focus on green technology also benefits the optical scale market. By optimizing material usage and improving process efficiency, these scales help industries minimize energy consumption related to over-processing or inaccurate blending, aligning operational improvements with corporate sustainability mandates and contributing positively to the overall market narrative.

In conclusion, the Optical Belt Scale Market is a dynamic sector characterized by relentless innovation, strong economic drivers stemming from efficiency needs, and expanding application across critical industrial sectors globally. The robust growth projected is sustainable, underpinned by the intrinsic advantages of non-contact, highly accurate measurement technology in the age of industrial digitalization.

The strategic differentiation among vendors often lies in the quality of the proprietary software used for signal processing. Since raw optical data can be noisy due to dust and vibration, the algorithms that efficiently filter, compensate, and convert 3D profile data into reliable mass flow figures are highly guarded intellectual property, representing a significant competitive barrier to entry for new market participants.

Furthermore, the development of standardized test procedures and verification protocols specifically tailored for optical technology is crucial for gaining universal acceptance, especially among trade and regulatory bodies. Industry collaborations focused on defining these standards help build confidence in the technology’s accuracy and reliability across various jurisdictions.

The market for retrofit solutions is substantial, especially in older industrial regions. Offering scalable and customizable optical solutions that can be easily mounted on existing conveyor infrastructure without extensive modifications allows manufacturers to tap into this large installed base, providing a cost-effective pathway to modernization for customers seeking compliance and efficiency improvements.

Finally, emerging market demands are shifting towards portable or semi-mobile optical scales used in temporary extraction sites or construction projects. Designing systems that are easy to deploy, calibrate quickly, and dismantle enhances the versatility of optical technology, expanding its scope beyond fixed plant installations and further driving market volume growth.

The competitive rivalry in the market is healthy, driving continuous improvements in sensor resolution, processing speed, and environmental resistance. Major players leverage their global service presence, while smaller innovators focus on specialized algorithmic precision or unique mounting designs, ensuring a constant flow of advanced products entering the market ecosystem.

The adoption rate is strongly correlated with the average value of the bulk material being handled. Industries dealing with high-value commodities (e.g., specialized ores, precious minerals) show the highest willingness to invest in top-tier optical scales, as the cost of even a marginal measurement error can quickly exceed the system's capital expenditure, reinforcing the value proposition of high precision.

The long-term outlook for the Optical Belt Scale Market remains highly optimistic, supported by global urbanization, sustained infrastructure spending, and the overarching industrial imperative to achieve maximal operational efficiency through the adoption of cutting-edge digitalization technologies. Optical scales are essential components in achieving this future state of automated and precise material flow management.

The development of augmented reality (AR) interfaces for maintenance and diagnostics is another emerging trend. AR tools can overlay real-time data and component identification onto the physical scale, enabling non-specialized technicians to perform complex troubleshooting or calibration checks accurately and efficiently, further reducing operational reliance on highly skilled specialists and decreasing system downtime.

In regions facing significant skilled labor shortages, the autonomous operation and diagnostic capabilities provided by optical scales integrated with AI become particularly attractive. The reduction in manual intervention translates directly into lower operational risk and more predictable performance, which is a major purchasing criterion for large multinational corporations operating globally.

Therefore, the strategic emphasis for market players moving forward will be centered on developing end-to-end solutions that offer not only best-in-class hardware accuracy but also robust, user-friendly software ecosystems capable of generating actionable business intelligence from the stream of measurement data, thereby maximizing customer ROI.

This comprehensive digitalization approach ensures that the optical belt scale remains at the forefront of industrial measurement technology, maintaining its competitive superiority over legacy alternatives and securing its position as a foundational element of the smart factory and intelligent mining operations globally.

The ability of optical scales to function effectively in environments where traditional scales fail—such as those with frequent belt misalignment or severe fouling—further solidifies their market position. Their independence from mechanical linkages and gravitational forces allows them to provide robust data where other systems would experience catastrophic failure or unacceptable levels of drift.

The market analysis confirms that strategic investments in R&D focusing on sensor longevity, thermal stability, and embedded processing power will be the critical determinants of vendor success over the forecast period, ensuring sustained high performance and reliability across the diverse and challenging applications of bulk material handling worldwide.

The overall market growth narrative is fundamentally tied to the global push for transparency and verifiable metrics in commercial transactions involving commodities. Optical scales provide the necessary high-integrity data to support these requirements, making them a strategic investment rather than a mere operational expense for leading industrial entities.

Furthermore, the expanding capabilities of optical systems to analyze material characteristics beyond mass, such as moisture content estimations (using near-infrared spectroscopy integration), opens up new market segments in agriculture and chemical processing where traditional scales offered limited utility, broadening the potential customer base significantly.

This evolution into multi-functional measurement devices ensures that optical belt scales will continue to capture market share from simpler weighing systems and position themselves as central data acquisition points within modern smart industrial plants globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager