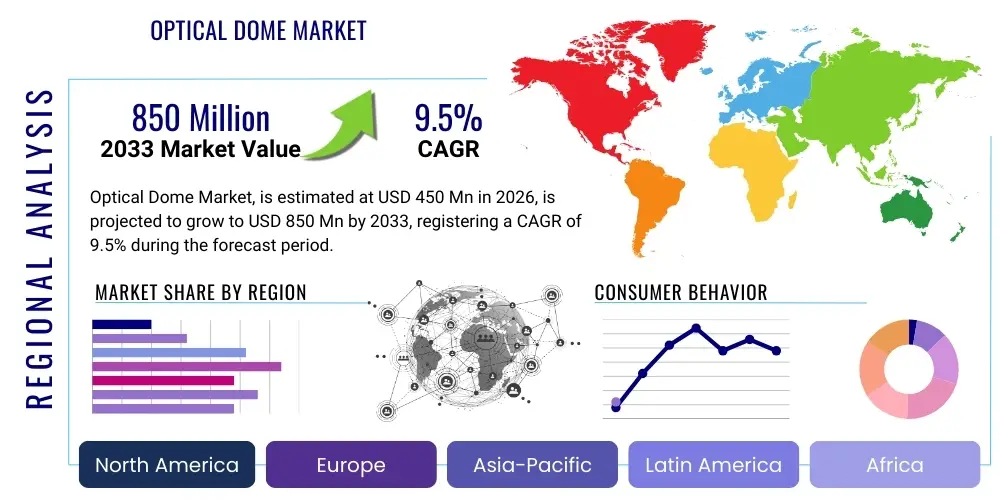

Optical Dome Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436219 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Optical Dome Market Size

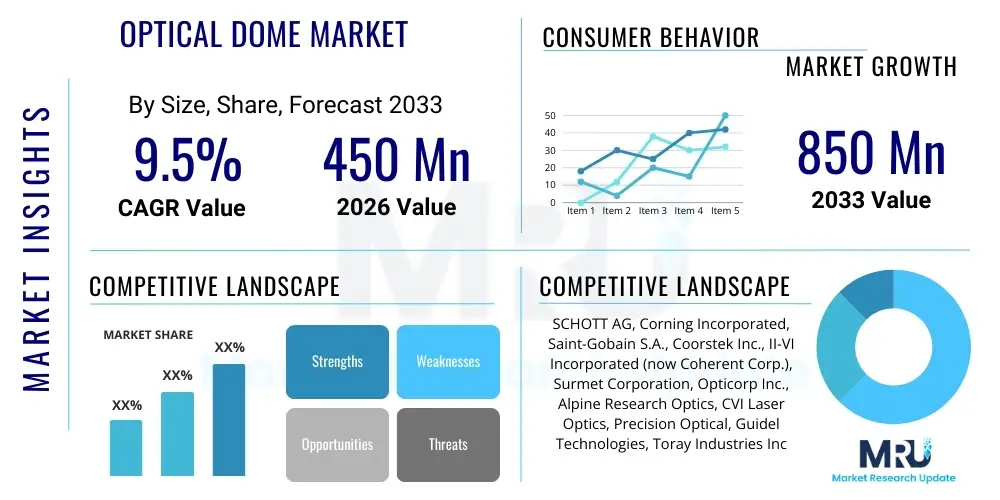

The Optical Dome Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 850 Million by the end of the forecast period in 2033.

Optical Dome Market introduction

Optical domes are highly specialized hemispherical windows designed to protect sensitive optical sensors, cameras, and infrared detectors from harsh environmental conditions while maintaining maximum optical clarity and transmission efficiency. These components are critical in applications requiring ruggedness combined with precision optics, such as aerospace imaging, underwater surveillance, advanced missile guidance systems, and high-end security cameras. The primary function of an optical dome is to act as a protective enclosure against elements like high pressure, extreme temperatures, sand, dust, and corrosive chemicals, all while ensuring minimal distortion of the transmitted light signals. The precise geometry and material composition—often utilizing sapphire, fused silica, specialized glasses, or zinc sulfide—are crucial determinants of their performance across various electromagnetic spectra, including visible, infrared (IR), and ultraviolet (UV).

The product description of an optical dome involves materials engineered for specific spectral ranges and mechanical resilience. Sapphire domes, known for their exceptional hardness and resistance to thermal shock, dominate the high-performance military and aerospace sectors, particularly where supersonic speeds generate intense aerodynamic heating. Conversely, fused silica and specialized borosilicate glasses are preferred for high-volume commercial applications and deep-sea environments where stability and pressure resistance are paramount. Manufacturing processes, including precision grinding, polishing, and specialized anti-reflective (AR) coatings, are highly complex, contributing significantly to the final cost and performance characteristics of the product. The demand for these sophisticated enclosures is directly tied to the escalating deployment of high-resolution surveillance and monitoring technologies globally.

Major applications span critical infrastructure, defense, and scientific research. In defense, they are integral to seeker heads for missiles and reconnaissance aircraft sensor payloads. In the commercial sector, they are vital for high-resolution underwater remotely operated vehicles (ROVs), professional-grade broadcasting cameras, and advanced meteorological equipment. The core benefits driving market growth include enhanced system reliability under extreme conditions, improved longevity of expensive internal optics, and superior transmission performance enabled by custom optical coatings. Key driving factors encompass rapid technological advancements in sensor miniaturization, increased global military spending focusing on sophisticated targeting systems, and the proliferation of deep-sea exploration and 5G network infrastructure requiring robust sensor protection.

Optical Dome Market Executive Summary

The Optical Dome Market is experiencing robust growth driven primarily by escalating defense modernization programs across North America and Asia Pacific, coupled with burgeoning demand from high-resolution commercial imaging systems. Current business trends indicate a significant shift toward next-generation materials like ceramic matrix composites and advanced polycrystalline materials, offering superior performance in high-speed, high-temperature environments compared to traditional sapphire. Furthermore, strategic alliances and vertical integration between dome manufacturers and specialized coating providers are becoming essential to maintain competitive edges, as performance differentiation increasingly relies on proprietary anti-reflection and durability coatings. Investment flows are concentrated in automated precision manufacturing technologies, such as advanced Computer Numerical Control (CNC) grinding and diamond turning, aimed at reducing production cycle times and achieving micro-level surface tolerances necessary for complex applications like hypersonic vehicle domes.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, largely fueled by aggressive expansion in marine exploration, large-scale infrastructure surveillance projects, and the establishment of local manufacturing hubs in countries like China, India, and South Korea, challenging the historical dominance of Western manufacturers. North America continues to be the largest revenue generator, underpinned by substantial long-term procurement contracts from the Department of Defense (DoD) for advanced reconnaissance and target acquisition systems. Europe maintains a strong presence, focusing heavily on research and development, particularly in developing domes compatible with next-generation LiDAR and sophisticated autonomous vehicle sensors, emphasizing thermal stability and wide-band transmission capabilities suitable for European regulatory standards and environmental monitoring efforts.

Segment trends underscore the Material type segment, specifically Sapphire, retaining the highest value share due to its irreplaceable role in military-grade applications demanding unparalleled strength and spectral purity. However, the emerging material sub-segment, including specialized ceramics, is projected to witness the highest CAGR, reflecting market adoption in niche, high-stress environments. By Application, the Defense and Aerospace segment dominates, driven by ongoing geopolitical tensions necessitating constant upgrades to existing platforms. The Commercial and Industrial application segment, encompassing environmental monitoring, oil and gas inspection, and underwater imaging, is rapidly expanding, fueled by increasing automation and the need for reliable, maintenance-free sensor protection across diverse operational domains. This segmentation shift necessitates manufacturers to diversify their product portfolios, balancing high-margin, low-volume defense contracts with standardized, higher-volume commercial solutions.

AI Impact Analysis on Optical Dome Market

The integration of Artificial Intelligence (AI) is fundamentally reshaping the ecosystem surrounding the Optical Dome Market, moving beyond simple sensor protection toward enhanced functionality and optimized manufacturing processes. Common user questions often revolve around how AI-driven vision systems influence dome specifications, whether AI can improve the quality control of highly precise components, and if the increased demand for AI-enabled surveillance (requiring high-data-rate optics) will mandate new material properties. The analysis reveals that AI primarily influences the market by driving demand for extreme precision in optical components, as machine learning algorithms require exceptionally clean and distortion-free data inputs, increasing the pressure on manufacturers to minimize wavefront errors and achieve near-perfect surface finish. Furthermore, AI is crucial in optimizing the complex grinding and polishing stages of dome manufacturing, predicting material failures, and enhancing the throughput of inspection processes, thereby potentially lowering manufacturing costs for ultra-high-quality units.

- AI-enabled quality control systems utilize image recognition to detect sub-micron flaws and imperfections on dome surfaces, dramatically improving yield rates and consistency in mass production.

- Increased proliferation of AI in aerial imaging (drones, satellites) and autonomous vehicles (LiDAR systems) drives the specific need for wider field-of-view and multi-spectral optical domes that maintain high fidelity across various light sources.

- Predictive maintenance algorithms, leveraging sensor data from operational environments, inform manufacturers about common failure modes, guiding the development of more durable and application-specific protective coatings and materials.

- AI algorithms applied to computational optics allow for the optimization of dome geometry, potentially enabling lighter or thinner designs that still meet stringent performance requirements by compensating digitally for minor optical aberrations.

- Supply chain optimization using AI tools improves the sourcing of specialized raw materials (e.g., optical sapphire boules), managing inventory, and predicting demand spikes based on evolving defense and aerospace procurement cycles.

DRO & Impact Forces Of Optical Dome Market

The dynamics of the Optical Dome Market are heavily influenced by a confluence of accelerating drivers, stringent restraints, and high-potential opportunities, which together define the impact forces shaping its trajectory. The primary driver is the pervasive and sustained increase in global defense expenditure, particularly focused on upgrading intelligence, surveillance, and reconnaissance (ISR) platforms, which rely extensively on high-performance optical domes for seeker heads and sensor protection. Complementing this is the rapid expansion of commercial sectors such as deep-sea exploration, offshore energy infrastructure monitoring, and advanced meteorological observation, all demanding reliable sensor enclosures capable of withstanding extreme environmental pressures and temperatures. Furthermore, the miniaturization and increased sensitivity of modern optical sensors necessitate protective domes that offer better signal transmission and reduced absorption, pushing innovation in anti-reflective coating technology, thereby generating consistent market traction.

However, significant restraints temper the market growth rate. The foremost challenge is the extremely high cost and complexity associated with manufacturing large, monolithic optical domes from materials like single-crystal sapphire or specialized ceramics. Achieving the necessary geometrical accuracy and surface finish (measured in Angstroms) requires specialized, high-capital machinery and highly skilled technicians, creating steep barriers to entry for new players. Furthermore, stringent export control regulations, particularly the International Traffic in Arms Regulations (ITAR) in the U.S. and equivalent controls elsewhere, severely restrict the global trade and technological transfer of high-performance defense-grade domes, limiting market expansion and fostering regional fragmentation in the supply chain. Raw material scarcity and volatility in pricing, particularly for high-purity crystalline materials, also pose recurring operational risks for manufacturers.

Despite these restraints, substantial opportunities exist, primarily through the exploitation of advanced material science and application diversification. The development and commercialization of next-generation optical materials, such as specific chalcogenide glasses for mid-wave infrared (MWIR) applications or diamond-like carbon (DLC) coatings for superior hardness, present avenues for product differentiation and performance gains. Moreover, the increasing adoption of 5G infrastructure and the subsequent need for high-frequency telecommunication components and associated robust environmental sensors open up new, high-volume commercial applications for optical domes. Addressing the impact forces, market players must strategically invest in automation to mitigate labor costs and complexity (a positive force), while actively lobbying for streamlined regulatory processes to facilitate cross-border technical collaboration (mitigating a negative force). The overall net impact remains highly positive, contingent on continuous innovation in manufacturing yield and material performance stability.

Segmentation Analysis

The Optical Dome Market is systematically segmented based on Material, Application, and Spectral Range, providing a granular view of market dynamics and tailored product needs across different end-user industries. This structured approach allows manufacturers to align their production capabilities with specific market demands, ranging from the extremely robust requirements of defense systems to the cost-sensitive specifications of commercial surveillance. The segmentation by material, encompassing high-strength crystals like sapphire and specialty glasses, highlights the trade-offs between performance, durability, and manufacturing cost. Application segmentation clearly delineates the high-value, stringent defense sector from the rapidly growing, volume-driven commercial sector, reflecting different sales channels and procurement cycles. Spectral range segmentation is critical as it dictates the required material purity and coating specifications, essential for maximizing transmission efficiency in specific bands such as infrared for thermal imaging or UV for specialized scientific instruments.

- By Material:

- Sapphire Optical Domes

- Fused Silica Optical Domes

- Quartz Optical Domes

- Specialized Glass (e.g., Borosilicate)

- Advanced Ceramics and Composites (e.g., Aluminum Oxynitride (ALON))

- By Application:

- Defense and Aerospace (Missile Domes, Reconnaissance Pods)

- Underwater Systems (ROVs, Submarines)

- Commercial Surveillance and Security

- Meteorology and Scientific Research

- Industrial Monitoring and Sensing

- By Spectral Range:

- Visible Spectrum Domes

- Infrared (IR) Domes (SWIR, MWIR, LWIR)

- Ultraviolet (UV) Domes

- Multi-Spectral Domes

Value Chain Analysis For Optical Dome Market

The value chain for the Optical Dome Market is characterized by high specialization and capital intensity, beginning with the upstream sourcing of extremely high-purity raw materials. Upstream activities involve the acquisition and processing of bulk crystalline materials, such as synthetic sapphire boules, high-purity quartz, or specialized zinc sulfide ingots. This stage requires significant investment in material synthesis technologies (e.g., Czochralski or edge-defined film-fed growth (EFG) methods for sapphire) to ensure the optical purity and structural integrity necessary for final product performance. Since the raw material quality directly impacts the spectral transmission and physical strength of the dome, supplier qualification and long-term partnerships with specialized crystal growth companies are crucial, often involving proprietary processes to minimize defects and internal stress.

The midstream phase, involving specialized manufacturing, represents the highest value-addition point. This stage encompasses highly precise operations like rough grinding, sub-surface damage removal, precision CNC machining, and, most critically, ultra-precision polishing to achieve nano-scale surface finish. Following polishing, the component moves to the deposition stage for proprietary anti-reflection (AR) and hard coatings, which require cleanroom environments and sophisticated vacuum coating equipment. Downstream activities focus on rigorous quality assurance, including interferometric testing, environmental stress testing, and integration verification. The efficiency and yield rate at this stage are critical determinants of profitability, given the extremely high cost of material wastage and rework associated with precision optics.

The distribution channel is predominantly B2B (Business-to-Business) and B2G (Business-to-Government), reflecting the highly specialized nature of the product. Direct distribution is common for defense and aerospace contracts, where manufacturers often engage directly with prime contractors (e.g., Lockheed Martin, Northrop Grumman) or government agencies to ensure compliance with stringent security and technical specifications. Indirect channels utilize specialized distributors or system integrators primarily for the commercial and industrial segments (e.g., marine technology or security surveillance system providers). The channel choice heavily influences pricing, delivery logistics, and technical support requirements, with defense contracts demanding robust post-sales support and documentation for certification, while commercial sales prioritize volume discounts and faster turnaround times. Furthermore, the specialized nature often mandates direct technical consultation between the dome manufacturer and the end-user system designer to ensure perfect integration and optimal system performance.

Optical Dome Market Potential Customers

The primary end-users and buyers of optical domes are institutions and organizations requiring sensor protection in extreme, high-stress, or operationally critical environments. The most significant customer base resides within the global Defense and Aerospace sectors, specifically military procurement divisions, national defense ministries, and prime defense contractors responsible for manufacturing missiles, sophisticated aircraft, unmanned aerial vehicles (UAVs), and satellite-based surveillance systems. These customers prioritize domes offering superior resistance to aerodynamic heating (high Mach numbers), thermal shock, erosion, and wide-band spectral transmission, often demanding custom, low-volume, high-specification products governed by strict security protocols and government oversight.

Beyond the defense sector, potential customers include commercial entities operating in harsh environments. This includes major players in the Oil and Gas industry utilizing deep-sea remotely operated vehicles (ROVs) for pipeline inspection and infrastructure integrity checks, where domes must withstand intense hydrostatic pressure. Furthermore, specialized scientific research institutions and meteorological organizations utilize optical domes for atmospheric monitoring and space observation telescopes. The expanding market for high-end professional security and broadcasting equipment also serves as a crucial customer segment, seeking domes that offer superior clarity and scratch resistance for long-term outdoor deployment, ensuring continuous, high-definition image quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 850 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCHOTT AG, Corning Incorporated, Saint-Gobain S.A., Coorstek Inc., II-VI Incorporated (now Coherent Corp.), Surmet Corporation, Opticorp Inc., Alpine Research Optics, CVI Laser Optics, Precision Optical, Guidel Technologies, Toray Industries Inc., Materion Corporation, Trelleborg AB, Hellma Materials GmbH, Dynasil Corporation, Heraeus Holding, Meller Optics Inc., Janos Technology LLC, Rhynergy Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Dome Market Key Technology Landscape

The technological landscape of the Optical Dome Market is defined by continuous advancements in material science, ultra-precision machining, and coating deposition techniques, all aimed at achieving higher optical performance under increasingly severe operational demands. Material technology remains foundational, with single-crystal sapphire dominating the high-end sector due to its superior mechanical strength, wide spectral transmission (from UV to near-IR), and exceptional resistance to high temperatures and abrasion. However, next-generation materials like Advanced Aluminum Oxynitride (ALON) ceramic are gaining traction, offering high visible and infrared transparency coupled with poly-crystalline resilience, making them easier to manufacture into large, complex shapes compared to single-crystal growth methods. Fused silica and specialized glasses continue to serve cost-sensitive or unique spectral applications, benefiting from improved material doping processes to enhance specific wavelength transmission characteristics.

In terms of manufacturing technology, the market relies heavily on advanced abrasive processes. Ultra-precision diamond turning and high-speed CNC grinding are essential for initial shaping and achieving the precise hemispherical or hyper-hemispherical geometry required, often maintaining tolerances in the range of a few microns. The subsequent polishing stage employs sophisticated Magneto-Rheological Finishing (MRF) or Computer-Controlled Optical Surfacing (CCOS) techniques to minimize sub-surface damage and achieve nanometer-level surface roughness (measured in Ångstroms), critical for minimizing scattered light and maximizing image clarity, particularly in high-magnification or long-range systems. Process automation, often leveraging integrated robotics and AI-driven feedback loops, is critical for scaling production while maintaining these rigorous quality standards, addressing the historic challenges of low yield rates in precision optics manufacturing.

Coating technology provides the final layer of performance enhancement and protection. State-of-the-art optical domes require complex multi-layer anti-reflective (AR) coatings, specifically tailored to the operating spectral band (e.g., 3-5 µm for MWIR systems or broad-band coatings for multi-sensor platforms). These coatings are applied using advanced vacuum deposition techniques such as Ion-Assisted Deposition (IAD) or Plasma-Enhanced Chemical Vapor Deposition (PECVD) to ensure high adhesion, durability, and resistance to environmental degradation, including salt fog and humidity. Furthermore, specialized hard coatings, such as Diamond-Like Carbon (DLC), are frequently applied to the outer surface of defense and aerospace domes operating in erosive environments (e.g., sand, rain impact at high velocity), ensuring the longevity and sustained performance of the expensive underlying optical system.

Regional Highlights

Regional dynamics play a crucial role in shaping the Optical Dome Market, with distinct drivers and demand patterns observed across different geographical areas. North America, specifically the United States, represents the largest and most technologically mature market segment. This dominance is attributable to massive, sustained investment in military modernization, research and development programs related to hypersonic flight and advanced sensor technology, and the presence of major defense prime contractors. Demand here is typically focused on high-specification, low-volume products utilizing cutting-edge materials like ALON and high-purity sapphire, often requiring compliance with stringent ITAR regulations and complex procurement processes. The region leads in developing domes for advanced surveillance systems, drone technology, and next-generation missile guidance.

Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate during the forecast period. This rapid expansion is driven by escalating geopolitical tensions leading to increased naval and air defense spending by nations like China, India, and Japan, alongside a booming commercial sector. The region serves as a major manufacturing hub, fostering local production capabilities for consumer electronics, industrial sensors, and underwater exploration equipment, creating high volume demand for fused silica and specialized glass domes. Government initiatives supporting marine infrastructure and environmental monitoring also contribute significantly, demanding cost-effective and reliable sensor protection solutions for large-scale deployment.

Europe holds a strong position, driven primarily by high standards in scientific research, advanced automotive sensing (LiDAR protection), and established military alliances focusing on interoperability and advanced defense systems. Countries such as Germany, the UK, and France are key contributors, specializing in precision optics R&D and manufacturing highly complex, customized domes for niche scientific and aerospace projects. The focus in Europe is often placed on developing multi-spectral domes and specialized coatings for harsh environments, meeting strict EU regulations concerning environmental impact and material traceability. The Middle East and Africa (MEA) and Latin America (LATAM) markets are nascent but show potential, driven by oil and gas infrastructure monitoring (MEA) and border surveillance and natural resource exploration (LATAM), relying heavily on imports from established North American and European manufacturers.

- North America (Dominant Market): Strong government R&D funding, large defense procurement contracts, technical leadership in materials science (e.g., ALON), stringent quality demands for space and military applications.

- Asia Pacific (Fastest Growing): Rapid growth in defense expenditure, expansion of local manufacturing capabilities, high volume demand from commercial surveillance and marine exploration, significant investment in 5G related sensor infrastructure.

- Europe: Focus on R&D for LiDAR and autonomous vehicle sensors, high standards for scientific and environmental monitoring domes, key expertise in ultra-precision optical fabrication and advanced coating technologies.

- Latin America & MEA: Emerging markets driven by infrastructure security, natural resource management (mining, oil & gas), and reliance on imported high-performance systems for specific national security needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Dome Market.- SCHOTT AG

- Corning Incorporated

- Saint-Gobain S.A.

- Coorstek Inc.

- II-VI Incorporated (now Coherent Corp.)

- Surmet Corporation

- Opticorp Inc.

- Alpine Research Optics

- CVI Laser Optics

- Precision Optical

- Guidel Technologies

- Toray Industries Inc.

- Materion Corporation

- Trelleborg AB

- Hellma Materials GmbH

- Dynasil Corporation

- Heraeus Holding

- Meller Optics Inc.

- Janos Technology LLC

- Rhynergy Corporation

Frequently Asked Questions

Analyze common user questions about the Optical Dome market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary material choices for high-performance optical domes and why?

The primary choices are Sapphire, Fused Silica, and Advanced Ceramics (like ALON). Sapphire is preferred for demanding defense and aerospace applications due to its extreme hardness, resistance to thermal shock, and wide spectral transmission. Fused silica offers excellent UV transmission and high resistance to pressure for underwater applications, while ALON provides ruggedness and flexibility for manufacturing large, complex geometries suitable for military platforms.

How do anti-reflective (AR) coatings impact the overall performance of an optical dome?

AR coatings are crucial as they minimize surface reflection and maximize light transmission into the sensor, improving signal clarity and efficiency. Custom multi-layer coatings are engineered specifically for the target spectral range (e.g., IR or Visible) and are vital for preventing ghosting, flare, and energy loss, ensuring the dome's high optical fidelity even in challenging environments.

Which application segment holds the largest market share in the Optical Dome Market?

The Defense and Aerospace application segment currently holds the largest market share. This dominance is driven by high-value, stringent requirements for missile seeker heads, reconnaissance aircraft sensors, and satellite imaging systems, which necessitate bespoke, high-cost optical domes made from premium materials like sapphire or ALON with specialized environmental resilience.

What key technological restraints exist in the manufacturing of large optical domes?

Key restraints include the difficulty and cost associated with achieving ultra-high precision (nanometer-level surface finish) across large curvatures, material waste during grinding and polishing, and the complex, time-consuming process of growing flawless, large-diameter crystalline materials (such as sapphire boules) without internal stress or defects that compromise optical performance.

How is the rise of autonomous systems influencing the demand for optical domes?

Autonomous systems, particularly in defense (UAVs) and commercial sectors (LiDAR for vehicles), are significantly increasing demand. These systems rely on robust, multi-spectral sensor arrays requiring protective domes that offer broad spectral clarity and high durability against environmental abrasion and vibration, pushing manufacturers toward lighter, tougher composite materials and multi-functionality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager