Optical Gas Imaging (OGI) Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431647 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Optical Gas Imaging (OGI) Camera Market Size

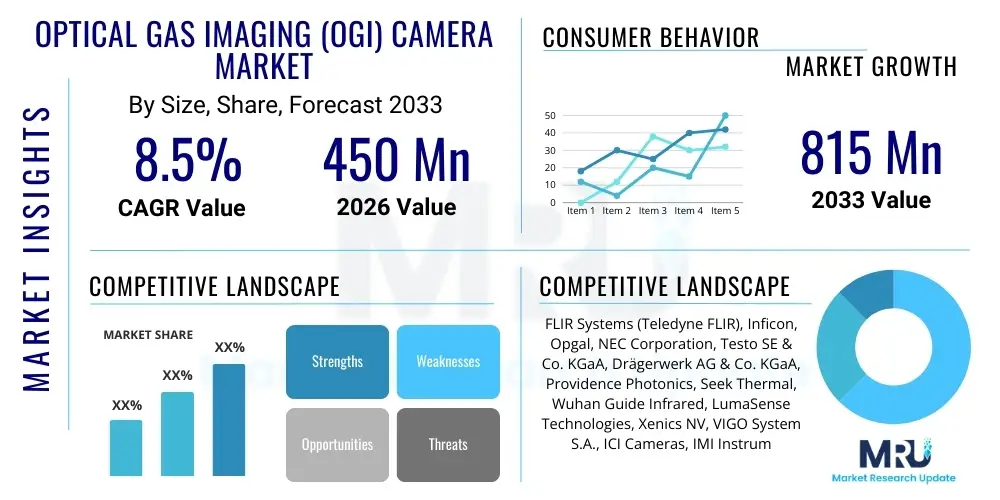

The Optical Gas Imaging (OGI) Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 815 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by increasingly stringent environmental regulations targeting methane and Volatile Organic Compound (VOC) emissions across critical industrial sectors globally, compelling operators to adopt advanced leak detection and repair (LDAR) methodologies to ensure compliance and enhance operational safety.

Optical Gas Imaging (OGI) Camera Market introduction

The Optical Gas Imaging (OGI) Camera Market encompasses specialized infrared cameras designed to visualize gases that are invisible to the naked eye, such as methane, sulfur hexafluoride (SF6), carbon dioxide, and various refrigerants. These devices operate by utilizing spectral filtering technology in combination with infrared detectors, which allows the camera to detect minute absorptions of energy by the target gas molecules, thus rendering gas plumes visible in real-time. The technology is instrumental in non-contact, rapid detection of gas leaks, serving as a critical tool for preventative maintenance, safety assurance, and environmental compliance, particularly in industries where fugitive emissions pose significant economic and ecological risks.

Major applications for OGI cameras span the oil and gas sector (upstream, midstream, and downstream), chemical processing, power generation, and utilities, with a rising presence in landfill and wastewater management for methane emission monitoring. The primary benefit of adopting OGI technology lies in its efficiency; it enables surveyors to rapidly scan large areas and complex infrastructures from a safe distance, significantly reducing the time and cost associated with traditional leak detection methods like 'sniffer' instruments or soap bubble tests. Furthermore, OGI facilitates immediate visual verification of leaks, streamlining the repair process and ensuring persistent operational integrity.

Key driving factors accelerating market adoption include the global push for decarbonization and stricter governmental mandates, such as the U.S. EPA's Leak Detection and Repair (LDAR) requirements and the European Union’s Methane Strategy, which necessitate continuous monitoring and quantifiable emission reduction strategies. The declining cost of uncooled infrared detectors, coupled with advancements in camera portability and integration capabilities (especially with Unmanned Aerial Vehicles or UAVs), further expands the addressable market by making OGI solutions more accessible to a broader range of industrial operators focused on improving safety, reducing product loss, and demonstrating corporate environmental responsibility.

Optical Gas Imaging (OGI) Camera Market Executive Summary

The Optical Gas Imaging (OGI) Camera Market is experiencing robust growth fueled by mandatory global environmental standards and escalating industrial demand for highly efficient, non-invasive leak detection technologies. Business trends indicate a pivot toward smaller, more rugged, and highly sensitive uncooled camera systems, which offer a lower total cost of ownership compared to traditional cooled systems, thereby democratizing access to this advanced monitoring technology. Strategic partnerships between OGI manufacturers and drone service providers are creating new operational paradigms, allowing for safer, faster, and more comprehensive infrastructure inspections, particularly in remote or hazardous environments, positioning OGI as a pivotal component of modern predictive maintenance protocols.

Regionally, North America maintains market leadership, heavily influenced by expansive pipeline networks, massive oil and gas exploration activities, and the foundational regulatory framework established by the EPA regarding methane emissions. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion in APAC is attributable to accelerated industrialization, the proliferation of chemical and petrochemical facilities, and the increasing governmental implementation of pollution control measures, driving significant new demand for OGI cameras in emerging economies like China, India, and Southeast Asian nations. Europe also contributes significantly, driven by the Green Deal initiatives and strict industrial emissions directives.

Segment trends highlight the dominance of the oil and gas application segment due to the critical need for continuous monitoring of natural gas (methane) leaks, which represent both significant safety hazards and financial losses. Technology-wise, while cooled OGI cameras still command premium applications requiring extreme sensitivity (e.g., research or high-precision industrial processes), the uncooled segment is witnessing faster volume growth. This shift is primarily due to the improving performance of uncooled microbolometers, making them sufficiently sensitive for routine industrial LDAR programs, alongside their inherent advantages related to lower maintenance requirements and superior portability, catering effectively to the burgeoning demand for handheld and drone-mounted solutions.

AI Impact Analysis on Optical Gas Imaging (OGI) Camera Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can automate the interpretation of complex OGI data, minimize human error, and integrate OGI feeds into centralized asset management systems. Key concerns center on the reliability of AI algorithms in distinguishing actual gas plumes from environmental noise (such as heat signatures, steam, or smoke), the feasibility of real-time leak quantification, and the capability of AI systems to prioritize maintenance alerts based on leak severity and environmental impact. There is a high expectation that AI will transform OGI from a qualitative detection tool into a quantitative, predictive asset management solution, significantly enhancing the efficiency and accuracy of LDAR programs and compliance reporting.

AI’s influence is shifting OGI usage from simple detection to automated classification and quantification. Traditional OGI relied heavily on trained human operators to visually analyze thermal videos, a process susceptible to fatigue and subjective interpretation. AI algorithms can now be trained on vast datasets of gas plume imagery under diverse environmental conditions (wind, temperature, background clutter) to automatically identify, classify, and even estimate the volume of fugitive emissions. This automation dramatically reduces false positive rates, ensures consistent reporting standards across multiple sites, and facilitates proactive decision-making without constant human oversight, especially when cameras are fixed or drone-mounted.

Furthermore, the integration of ML models with OGI data facilitates predictive maintenance scheduling. By correlating detected gas leaks (type, size, location) with operational data from other sensors (pressure, temperature, flow rates) and historical maintenance logs, AI systems can pinpoint assets at the highest risk of failure. This capability moves the industry beyond reactive or time-based inspections toward condition-based monitoring, optimizing resource allocation, minimizing downtime, and ensuring regulatory compliance through automated documentation and auditable evidence of effective LDAR practices. This transition positions OGI cameras as smart sensors within a broader industrial internet of things (IIoT) ecosystem.

- AI enables automated real-time identification and classification of specific gas leaks, reducing dependence on human interpretation.

- Machine Learning algorithms enhance the quantification capabilities of OGI, providing estimates of leak rates for improved regulatory reporting.

- Integration with computer vision allows OGI data streams from fixed or drone-mounted cameras to automatically trigger maintenance alerts based on defined severity thresholds.

- Predictive analytics correlates OGI findings with operational data to forecast equipment failure and optimize preventative maintenance cycles.

- AI minimizes false positive detections by intelligently filtering out non-gas visual clutter like steam or thermal anomalies.

DRO & Impact Forces Of Optical Gas Imaging (OGI) Camera Market

The OGI Camera Market is fundamentally shaped by powerful regulatory drivers mandating environmental safety and leak reduction, coupled with significant technological opportunities arising from portability and sensor advancements. However, the market faces constraints related to high initial hardware investment and complexities associated with adopting highly sensitive thermal technology. The primary drivers include global regulatory pressure (e.g., methane mandates) and industrial demand for operational efficiency and verifiable safety improvements. Restraints encompass the substantial initial capital expenditure required, particularly for high-performance cooled systems, and the necessity for specialized training for effective data interpretation. Opportunities lie predominantly in integrating OGI with autonomous inspection platforms (drones and robotics) and expanding into non-traditional industrial sectors such as wastewater treatment and agriculture.

The overall impact forces are strongly positive, exerting an upward pull on market adoption. The environmental impact force is particularly compelling; as nations commit to net-zero targets and methane reduction pledges, OGI cameras become indispensable tools for measurement, reporting, and verification (MRV) of emissions. Simultaneously, the economic impact force, driven by the desire to reduce product loss (e.g., lost natural gas) and avoid hefty regulatory fines, strongly incentivizes companies to invest in this technology. Technological maturity, specifically the performance improvement and cost reduction of uncooled microbolometers, has lowered the entry barrier, allowing smaller companies to participate in advanced LDAR programs.

The convergence of technological advancement (high-resolution sensors, AI integration) and market necessity (zero-tolerance safety and emissions standards) creates a strong impetus for growth. The high cost remains a mitigating factor, slowing adoption in price-sensitive markets, but this is being offset by the increasing availability of camera-as-a-service models and rental options. The long-term trajectory indicates that the drivers, specifically environmental legislation and the operational benefits derived from proactive monitoring, will continue to overpower the restraints, solidifying OGI technology as a critical and standardized component of industrial infrastructure management worldwide, moving toward mandatory, rather than optional, use across high-emission industries.

Segmentation Analysis

The Optical Gas Imaging (OGI) Camera Market is structurally segmented primarily based on the underlying detector technology, the portability of the device, and the target end-use application. Analysis across these segments reveals distinct adoption rates and value propositions. The technology segmentation (Cooled vs. Uncooled) determines sensitivity and price, while portability (Handheld vs. Fixed vs. Drone-based) dictates operational flexibility and deployment scenarios. The application segment remains the most crucial driver, with the Oil and Gas sector dominating demand, followed by chemical processing and power generation, each utilizing OGI for tailored gas monitoring needs, such as methane, SF6, or CO2 detection.

- By Technology

- Cooled OGI Cameras

- Uncooled OGI Cameras

- By Spectrum Type

- Short-Wave Infrared (SWIR)

- Mid-Wave Infrared (MWIR)

- Long-Wave Infrared (LWIR)

- By Portability/Format

- Handheld Cameras

- Fixed/Mounted Cameras

- Drone-based/UAV Integrated Systems

- By Target Gas

- Methane (CH4) & Hydrocarbons

- Sulfur Hexafluoride (SF6)

- Carbon Dioxide (CO2)

- Refrigerants (e.g., R-134a, R-410A)

- Carbon Monoxide (CO)

- By End-Use Application

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical Industry

- Power Generation and Utilities (Electrical substations, Power Plants)

- Industrial Manufacturing and Processing

- Environmental Monitoring and Waste Management

- Research and Development

Value Chain Analysis For Optical Gas Imaging (OGI) Camera Market

The value chain for the OGI camera market begins with the upstream suppliers responsible for core components, including highly specialized infrared detector arrays (microbolometers for uncooled and cryocoolers/detectors for cooled systems), optical elements (lenses, spectral filters), and sophisticated processing electronics. Detector manufacturing, particularly for cooled systems, requires significant investment and highly controlled fabrication processes, often resulting in a concentrated supply base. The quality and sensitivity of these upstream components directly dictate the final performance and cost structure of the OGI camera system, positioning these suppliers as critical gatekeepers of technological feasibility.

The midstream phase involves the core OGI camera manufacturers, who procure these components and integrate them with proprietary software and specialized calibration routines to create the final product. This stage is dominated by established thermal imaging companies known for their expertise in infrared physics and software development. Manufacturing activities involve precision assembly, rigorous environmental testing, and configuring the device for specific gas detection spectral bands. Competitive differentiation at this stage hinges on software sophistication, thermal stability, ruggedness for industrial environments, and the ability to integrate advanced features like on-board analytics and cloud connectivity. Manufacturers also focus heavily on maintaining compliance with global standards, ensuring their products meet the strict performance criteria demanded by regulatory bodies.

The downstream distribution channels are multifaceted, employing both direct sales teams for large, strategic accounts (e.g., major oil companies or national utility providers) and a robust network of indirect specialized distributors and value-added resellers (VARs). VARs often provide localized technical support, integration services, and training, especially for complex fixed installations or drone integration projects. Direct channels ensure high profit margins and direct customer feedback, while indirect channels provide market penetration and localized logistical support. End-users often rely on these channels for ongoing calibration, maintenance, and system upgrades, making post-sale service a crucial element of the downstream value proposition and customer retention strategy, particularly given the specialized nature of OGI operation and maintenance.

Optical Gas Imaging (OGI) Camera Market Potential Customers

Potential customers for Optical Gas Imaging (OGI) cameras are fundamentally characterized by their involvement in processes that utilize or produce substantial volumes of valuable or environmentally hazardous gases, making leak detection mandatory for economic, safety, and regulatory reasons. The largest segment of end-users are major players across the entire oil and gas supply chain—from offshore drilling platforms (upstream) to liquefied natural gas (LNG) terminals (midstream) and refineries (downstream). These entities rely on OGI for mandated Leak Detection and Repair (LDAR) programs targeting methane and VOCs, aimed at preventing catastrophic failures and reducing significant revenue losses associated with fugitive emissions, positioning them as the anchor buyers in the market.

Beyond the hydrocarbon sector, major utilities, particularly those managing electrical transmission and distribution, represent a substantial and growing customer base due to the critical need to monitor sulfur hexafluoride (SF6) gas. SF6 is an extremely potent greenhouse gas used widely as an electrical insulator in switchgear. OGI cameras capable of detecting SF6 leaks are indispensable tools for utility companies seeking to minimize their environmental footprint and maintain the reliability of high-voltage equipment. Similarly, industrial facilities that utilize refrigerants (e.g., large data centers, cold storage, industrial HVAC systems) are increasingly adopting OGI to manage compliance with F-gas regulations and prevent costly refrigerant loss.

The expanding scope of OGI usage includes the environmental monitoring sector, encompassing customers such as waste management facilities, landfills, and biogas production plants. These customers use OGI to detect fugitive methane emissions emanating from decomposition processes, aiding in compliance with air quality regulations and optimizing methane capture systems. Furthermore, chemical and petrochemical manufacturers utilize OGI to ensure worker safety and prevent the release of toxic or flammable process gases. The breadth of application across these high-stakes industries confirms the OGI camera's role as a versatile, cross-sector industrial safety and environmental compliance tool.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 815 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLIR Systems (Teledyne FLIR), Inficon, Opgal, NEC Corporation, Testo SE & Co. KGaA, Drägerwerk AG & Co. KGaA, Providence Photonics, Seek Thermal, Wuhan Guide Infrared, LumaSense Technologies, Xenics NV, VIGO System S.A., ICI Cameras, IMI Instrumentation, KJT Associates, Sierra Olympic Technologies, Spectroradiometer Inc., TASI Group, SenseAir AB, Teledyne FLIR. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Gas Imaging (OGI) Camera Market Key Technology Landscape

The Optical Gas Imaging (OGI) Camera Market technology landscape is primarily defined by the detector type: cooled and uncooled infrared detectors. Cooled OGI cameras utilize highly sensitive detectors that require cryogenic cooling (often to temperatures below 77 Kelvin) to minimize noise and maximize spectral sensitivity. This technology provides superior thermal resolution and the capacity to detect extremely small gas leaks, making them the standard choice for regulated gases with low concentration requirements and complex monitoring tasks, particularly where precise leak quantification is necessary. While providing high performance, cooled systems are characterized by high purchase costs, greater maintenance complexity due to the cryocooler, and limited battery life, constraining their widespread use in routine, high-volume inspections.

Conversely, uncooled OGI cameras rely on microbolometer technology, which operates at ambient temperatures, eliminating the need for cryocoolers. Recent technological advancements have dramatically improved the sensitivity and resolution of uncooled detectors, enabling them to meet the performance threshold for detecting common industrial gases like methane, particularly in scenarios where moderate leak rates are common. The key advantages of uncooled technology are lower manufacturing costs, superior portability, enhanced durability, and minimal maintenance, making them ideal for handheld and drone-mounted applications, thereby accelerating their adoption for mass market LDAR programs and expanding the overall accessibility of OGI technology across smaller enterprises and remote inspection services.

Beyond the core detector technology, crucial innovation is occurring in spectral filtering and software processing. Highly optimized spectral filters are essential for isolating the specific infrared absorption fingerprint of the target gas, ensuring high selectivity and minimizing interference from other atmospheric components or thermal sources. Furthermore, advanced software analytics, increasingly incorporating AI and Machine Learning, are being deployed directly onto the cameras. These on-board processing capabilities enable real-time image stabilization, environmental compensation, automated leak flagging, and, crucially, the move toward quantitative OGI (QOGI). QOGI uses sophisticated algorithms to translate visual gas plumes into estimated leak rate data (e.g., mass per unit time), providing the essential quantitative metrics required for robust regulatory reporting and economic loss analysis.

Regional Highlights

- North America: Dominates the global OGI market due to its mature oil and gas infrastructure, significant regulatory impetus from the U.S. EPA (especially OOOOa and OOOOb rules targeting methane), and a high adoption rate of advanced safety and compliance technologies. The large presence of key market players and extensive integration of OGI with UAV inspection services solidify this region's leadership.

- Europe: Exhibits robust growth driven by stringent European Union environmental policies, including the Green Deal and efforts to curtail SF6 emissions from electrical infrastructure. Regulatory focus on industrial emissions and strong investment in renewable energy infrastructure, which requires continuous monitoring, ensures sustained demand.

- Asia Pacific (APAC): Expected to show the fastest growth CAGR, spurred by rapid industrial expansion, increasing investment in petrochemical complexes, and the implementation of initial air quality and environmental protection legislation in countries like China and India. The demand is heavily concentrated in low-cost, uncooled, handheld devices for large-scale, cost-sensitive industrial facility monitoring.

- Middle East and Africa (MEA): Growth is primarily confined to the major oil-producing nations (GCC countries). Investment is concentrated in safeguarding critical national hydrocarbon assets, focusing on large-scale fixed installations and specialized high-performance cooled cameras to manage extensive gas processing facilities.

- Latin America (LATAM): Represents an emerging market, driven by foreign direct investment in oil and gas exploration (e.g., Brazil, Mexico) and associated regulatory modernization efforts aimed at aligning national standards with international environmental compliance benchmarks, fostering gradual adoption of OGI technology in large projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Gas Imaging (OGI) Camera Market.- FLIR Systems (Teledyne FLIR)

- Inficon

- Opgal

- NEC Corporation

- Testo SE & Co. KGaA

- Drägerwerk AG & Co. KGaA

- Providence Photonics

- Seek Thermal

- Wuhan Guide Infrared

- LumaSense Technologies

- Xenics NV

- VIGO System S.A.

- ICI Cameras

- IMI Instrumentation

- KJT Associates

- Sierra Olympic Technologies

- Spectroradiometer Inc.

- TASI Group

- SenseAir AB

- Teledyne FLIR

Frequently Asked Questions

Analyze common user questions about the Optical Gas Imaging (OGI) Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between cooled and uncooled OGI cameras?

Cooled OGI cameras offer superior thermal sensitivity and resolution, crucial for detecting minimal leaks or gases with weak infrared absorption, but they are significantly more expensive and require complex maintenance. Uncooled OGI cameras are more affordable, portable, and rugged, making them the preferred choice for routine industrial methane leak detection and drone integration applications.

Which regulatory frameworks are driving the adoption of OGI technology?

The primary drivers are environmental regulations focused on reducing greenhouse gas emissions, particularly methane (CH4) and sulfur hexafluoride (SF6). Key frameworks include the U.S. EPA's New Source Performance Standards (NSPS) 40 CFR Part 60, Subpart OOOOa, and the European Union's Methane Strategy, which mandate robust leak detection and repair (LDAR) practices utilizing OGI as a Best Available Technology (BAT).

How is drone integration impacting the OGI Camera Market?

Drone integration significantly expands the operational scope of OGI cameras by enabling the inspection of inaccessible, elevated, or hazardous infrastructure (e.g., flares, vertical stacks, large pipelines) safely and efficiently. This synergy reduces inspection time, lowers labor costs, and provides comprehensive coverage, driving demand for lighter, high-performance uncooled systems optimized for UAV platforms.

Can OGI cameras be used for quantitative measurement of gas leaks?

Traditionally, OGI was primarily qualitative (visual detection). However, advancements in proprietary algorithms and software analytics have led to Quantitative Optical Gas Imaging (QOGI). QOGI utilizes advanced image processing and AI to provide estimated leak rates (mass flow per unit time), moving the technology beyond detection to actionable, quantifiable measurement necessary for regulatory reporting and emission accountability.

What industries are the fastest growing segments for OGI adoption?

While Oil and Gas remains the largest application segment, the fastest growing areas include Power Generation and Utilities, driven by the need to monitor SF6 leaks from electrical equipment, and Environmental Monitoring, particularly for large landfill sites and wastewater treatment plants focused on quantifying and mitigating methane releases to ensure public health and regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager