Optical Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434844 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Optical Glass Market Size

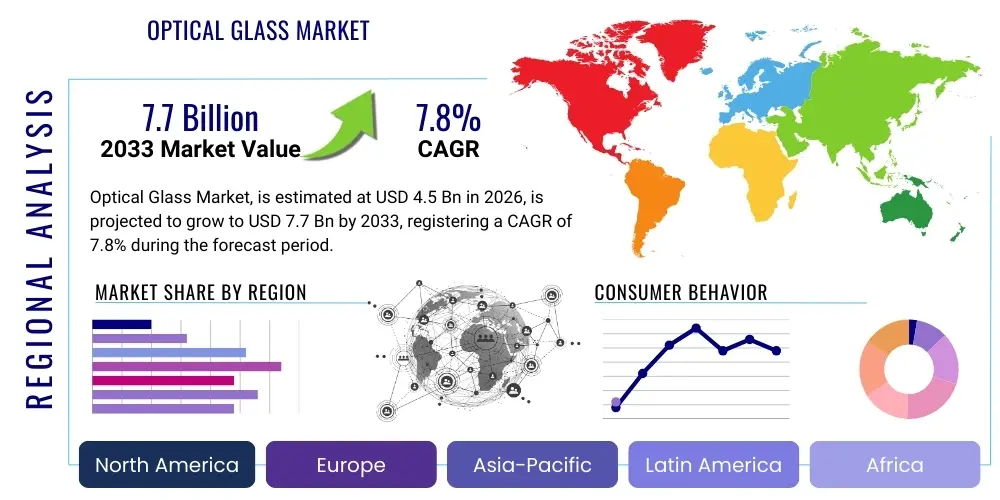

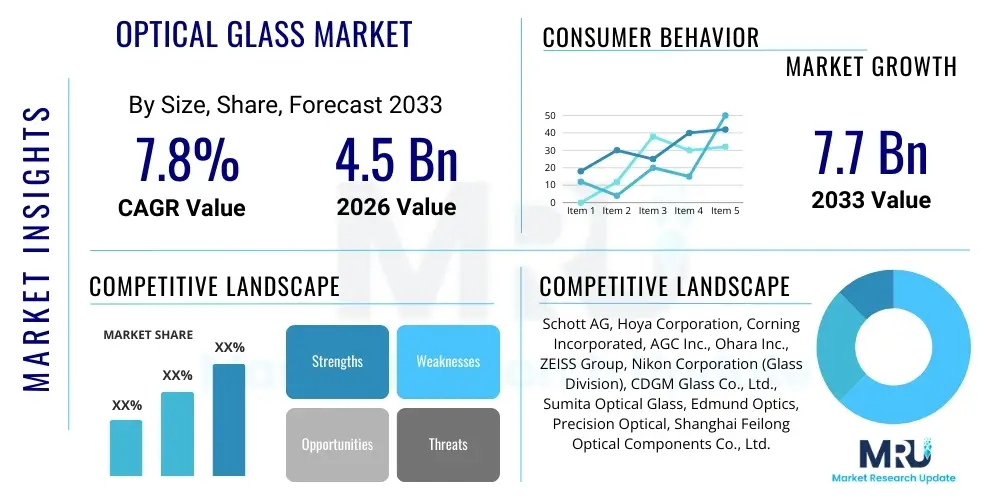

The Optical Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Optical Glass Market introduction

The Optical Glass Market encompasses the production and distribution of specialized glass materials engineered to possess highly specific, controlled optical characteristics, such as precise refractive index, low dispersion, and high transmission across various wavelengths. These materials are distinct from standard commercial glass due to their exceptional homogeneity, purity, and strict control over internal stresses and bubbles, which are critical for maintaining imaging fidelity and performance in precision systems. Optical glass forms the foundational element for lenses, prisms, mirrors, and filters utilized across sophisticated industrial, defense, medical, and consumer electronics applications.

The primary applications driving the demand for high-quality optical glass include advanced camera systems, precision metrology equipment, high-power laser systems, telecommunications infrastructure, and cutting-edge medical devices such as endoscopes and surgical lasers. The benefits inherent to using superior optical glass, such as minimizing chromatic and spherical aberrations, enabling higher numerical apertures, and ensuring reliable performance under extreme environmental conditions, solidify its indispensability in modern technological apparatus. The continuous push toward miniaturization in electronics, coupled with the increasing need for high-resolution imaging and fast data transmission, necessitates the development of novel glass compositions with enhanced thermal and mechanical stability.

Key driving factors accelerating market expansion include the significant investment in military and aerospace surveillance technologies requiring robust optical components, the proliferation of sophisticated sensing technologies in the automotive sector (LiDAR, driver assistance systems), and the rapid expansion of the augmented and virtual reality (AR/VR) landscape. Furthermore, the sustained growth in consumer photography and professional filmmaking, demanding complex lens assemblies, continues to place upward pressure on the demand for advanced optical glass types. Manufacturers are increasingly focusing on specialized optical materials, including molded glass aspheres and chalcogenide glasses, to meet the stringent performance requirements of next-generation optical systems while maintaining cost-effectiveness and manufacturability.

Optical Glass Market Executive Summary

The global Optical Glass Market is poised for substantial growth, driven primarily by technological convergence and massive capital allocation toward advanced imaging and sensing platforms. Current business trends indicate a strong move toward high-refractive-index, low-dispersion glass materials crucial for achieving superior system compactness and performance in devices like smartphones, medical diagnostic tools, and military sighting equipment. Furthermore, the industry is witnessing significant integration of advanced processing techniques, such as precision glass molding (PGM), allowing for the mass production of complex, non-spherical optical components (aspheres) which were previously expensive and labor-intensive to manufacture via traditional grinding and polishing methods. This technological shift is fundamentally altering the supply chain dynamics and enhancing profitability for specialized molders and glass manufacturers.

Regionally, the Asia Pacific (APAC) market is expected to maintain its dominant position, largely due to the concentration of electronics manufacturing hubs, expansive growth in the automotive sector (especially electric vehicles equipped with advanced sensors), and heavy investment in defense optics by countries like China, Japan, and South Korea. North America and Europe remain crucial markets, characterized by high demand for specialized applications in aerospace, defense, and high-end industrial laser machining. Trends across all regions show a shift in demand away from simple crown and flint glasses toward complex, environmentally friendly compositions that exclude harmful elements like lead and arsenic, reflecting stricter regulatory environments and a corporate commitment to sustainability.

Segmentation trends highlight the increasing importance of the high-purity fused silica and specialized glass segments, particularly those optimized for UV and infrared transmission, reflecting surging demand from semiconductor lithography and thermal imaging applications. By application, the consumer electronics segment, particularly smartphone cameras and AR/VR headsets, represents the highest volume driver, while the medical and defense sectors contribute significantly to revenue due to the high-value nature and stringent quality requirements of the optics utilized. Competitive activity is characterized by strategic partnerships between raw material suppliers and downstream system integrators, alongside intense focus on proprietary glass recipes to maintain a competitive edge in performance specifications.

AI Impact Analysis on Optical Glass Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming several facets of the Optical Glass Market, impacting everything from material design to quality assurance and demand patterns. Users frequently inquire about how AI can accelerate the discovery of new glass compositions with specific, optimized properties, such as enhanced resistance to laser damage or ultra-low dispersion for telecommunications. There is significant concern regarding whether AI-driven design tools will diminish the role of traditional optical engineers, though the consensus points toward augmentation rather than replacement, allowing engineers to handle more complex optimization problems. Users are also keenly interested in AI’s ability to perform real-time, non-destructive quality inspection of optical components, addressing the industry's perennial challenge of maintaining zero-defect production for high-precision optics.

The primary influence of AI stems from its capability to process vast datasets related to material chemistry and physical properties, enabling predictive modeling for new glass formulations. This accelerates the R&D cycle for specialized glasses required in emerging fields like deep UV lithography and high-bandwidth fiber optics. Furthermore, AI algorithms are becoming indispensable in optimizing complex lens systems, especially those involving freeform optics and highly precise aspheric designs, reducing the number of physical prototypes required and shortening the overall time-to-market for new optical devices. AI-powered simulation tools allow for the rapid exploration of design space that would be computationally intractable for human engineers, leading to lighter, more compact, and higher-performing systems.

In terms of market demand, AI technologies themselves are major consumers of advanced optical glass. Systems relying on AI—such as autonomous vehicles (LiDAR), facial recognition and structured light sensors (used in consumer devices), and advanced microscopy systems for AI-driven biological analysis—all necessitate high volumes of durable, high-transmission optical components. The expansion of data centers supporting AI computation also fuels the demand for specialized glass components used in high-speed optical switches and interconnects. Thus, AI acts as both an enabler of more efficient manufacturing processes and a significant, high-growth end-user segment for the market.

- AI-driven optimization of complex lens designs, minimizing aberrations and volume.

- Enhanced material discovery via Machine Learning algorithms predicting novel glass compositions.

- Implementation of AI in automated quality control systems for rapid, non-destructive defect detection.

- Increased demand for high-precision optics (lenses, mirrors) for AI hardware components like LiDAR and advanced sensors.

- Optimization of glass manufacturing parameters, leading to higher yields and reduced energy consumption.

- Acceleration of research and development cycles for specialized optical glasses targeting specific spectral ranges (UV/IR).

DRO & Impact Forces Of Optical Glass Market

The Optical Glass Market is propelled by powerful drivers centered on technological advancements in imaging, sensing, and communication, countered by significant restraints related to manufacturing complexity and regulatory compliance, while substantial long-term opportunities remain in untapped high-growth sectors. The main driver is the relentless consumer and industrial demand for high-resolution imaging devices, fueled by the rapid expansion of 5G infrastructure and the subsequent need for faster, higher-capacity optical communication components. Simultaneously, the restraints, particularly the capital-intensive nature of high-purity glass manufacturing and the susceptibility of complex optical systems to thermal and mechanical stresses, pose hurdles to widespread adoption and cost reduction. These forces, when combined, create an environment of intense innovation focused on materials science breakthroughs and scalable production methods.

Opportunities for market stakeholders primarily reside in the development of specialty optical materials tailored for extreme environments, such as space exploration and deep-sea applications, and the burgeoning field of bio-optics, including advanced diagnostic and therapeutic laser systems. Furthermore, the shift towards augmented and virtual reality devices presents a substantial growth avenue, requiring extremely lightweight, high-performance optics that integrate seamlessly into ergonomic form factors. The key impact force observed is technological convergence, where traditional optical engineering intersects deeply with semiconductor manufacturing techniques and digital design tools (including AI), resulting in ultra-precise components like diffractive optical elements (DOEs) and micro-optics arrays which require specialized glass substrates.

Another major impact force is the geopolitical climate, influencing supply chain resilience and material sourcing. Optical glass manufacturing relies on certain rare earth elements and highly controlled processes, making the market vulnerable to trade disputes and regional instability. This vulnerability is pushing manufacturers to diversify their sourcing and invest in vertical integration to secure the supply of critical raw materials. The interplay between demand drivers from the automotive sector (autonomous driving requiring fail-safe LiDAR systems) and the restraints posed by strict automotive safety standards further mandates continuous innovation in glass durability and thermal stability. The market's overall trajectory is thus defined by the balance between unprecedented demand from high-tech sectors and the intrinsic challenges associated with producing ultra-high-quality glass materials.

Segmentation Analysis

The Optical Glass Market segmentation is critical for understanding the diverse applications and technological requirements dictating demand across different industry verticals. The market is primarily dissected based on Glass Type (material composition), Application (end-use sector), and Geography. Segmentation by Glass Type reveals distinct market dynamics between traditional Crown and Flint glasses, high-purity Fused Silica, specialized materials like Borosilicate, and advanced compositions such as Germanium or Sapphire, each addressing unique spectral transmission and durability needs. Fused silica, for instance, dominates applications requiring UV transmission and high thermal stability, such as semiconductor lithography, driving high revenue per unit.

Application-based segmentation provides insight into the major revenue drivers. The Consumer Electronics segment, primarily lenses for high-resolution cameras in smartphones and tablets, commands the largest volume share, although often at lower margins compared to the highly specialized Defense & Aerospace or Medical segments. The Defense segment demands extreme performance, shock resistance, and thermal stability, resulting in higher average selling prices (ASPs) for customized optical components. The Medical sector relies heavily on materials with excellent light transmission and biological inertness for complex imaging and surgical laser delivery systems.

The analysis also reveals significant regional disparities in demand profile. While APAC drives volume in consumer electronics and industrial applications, North America leads in specialized, high-performance optics for space, defense, and advanced R&D. Understanding these segmentation nuances is vital for market players to strategically allocate R&D investment, optimize production lines, and tailor marketing strategies to specific end-user requirements and regional regulatory frameworks.

- By Glass Type:

- Flint Glass

- Crown Glass

- Borosilicate Glass

- Fused Silica/Quartz Glass

- Phosphate Glass

- Specialty Glasses (e.g., Lead-free, Germanium-doped)

- By Application:

- Consumer Electronics (Cameras, AR/VR Headsets)

- Defense & Aerospace (Sighting Systems, Surveillance, Missiles)

- Medical (Endoscopy, Surgical Lasers, Diagnostics)

- Industrial/Metrology (Inspection, Machine Vision)

- Telecommunication (Fiber Optics Components)

- Semiconductor Equipment (Lithography, Inspection)

- Automotive (LiDAR, ADAS Cameras)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Optical Glass Market

The value chain for the Optical Glass Market is intricate and highly specialized, beginning with the procurement and refinement of ultra-pure raw materials and culminating in the integration of finished optical components into complex systems. The upstream analysis focuses on the sourcing of high-purity oxides (like SiO2, B2O3, Na2O, K2O, and specific rare earth oxides) that determine the final optical properties of the glass. Raw material suppliers must meet exceptionally strict purity standards, as minute contaminants can drastically impair the glass’s homogeneity and transmission capabilities. This stage is characterized by high barriers to entry due to the proprietary melting technologies and quality control required to achieve optical grade raw batches.

The midstream segment involves the core manufacturing process: melting, homogenization, annealing, and blank formation. Glass manufacturers utilize specialized platinum crucibles and continuous or batch melting processes under controlled atmospheric conditions to ensure homogeneity and remove microscopic bubbles and inclusions. Post-processing involves annealing—a critical step where the glass is slowly cooled to relieve internal stresses—followed by the cutting of the large glass blocks into precision blanks, which are then distributed through several channels. Direct distribution is common for high-volume standard blanks to large-scale lens fabricators, while specialized, high-value glass often moves through tailored contracts.

The downstream analysis involves the secondary processing (grinding, polishing, coating) performed by specialized optical component fabricators, followed by integration into final systems. Distribution channels are varied: direct sales dominate for high-volume, standard components sold to major OEMs (e.g., smartphone manufacturers). Indirect channels, involving specialized distributors and value-added resellers, are essential for penetrating smaller defense, R&D, and medical equipment manufacturers, who require specific quantities and component designs. The high degree of customization required in the downstream segment necessitates strong collaborative relationships between glass manufacturers, component fabricators, and end-system integrators to ensure optimal performance.

Optical Glass Market Potential Customers

The potential customers for optical glass span a wide array of high-technology industries, fundamentally categorized by their reliance on precise light manipulation, sensing, and imaging capabilities. Primary end-users include major Original Equipment Manufacturers (OEMs) in the consumer electronics sector, particularly those developing advanced cameras, depth sensors, and head-mounted displays (HMDs) for AR/VR applications. These buyers require large volumes of cost-effective, high-quality molded glass and aspheric lenses to meet the demands of miniaturization and high optical performance in mass-market products. The procurement cycles here are often rapid and highly sensitive to pricing, driving innovation in efficient manufacturing techniques like precision glass molding.

Another crucial customer segment is the defense and aerospace industry, including government contractors and defense ministries, which procure customized, ultra-durable optical glass for surveillance satellites, night vision systems, laser rangefinders, and targeting mechanisms. These buyers prioritize reliability, extreme environmental resistance (thermal shock, radiation hardening), and performance specifications over cost. The material requirements are stringent, often necessitating specialized glass compositions like radiation-shielding glass or high-purity fused silica for critical space applications. Procurement in this segment is characterized by long qualification periods and strict regulatory compliance.

Furthermore, medical device manufacturers represent a high-value customer base, purchasing optical glass for surgical instruments, diagnostic equipment (e.g., blood analyzers, microscopes), and therapeutic laser delivery systems. The requirements here involve biological inertness, high transmission uniformity, and the ability to withstand repeated sterilization cycles. Finally, the industrial sector, including semiconductor manufacturers (for lithography optics and inspection systems) and automotive OEMs (for LiDAR systems and ADAS cameras), constitutes a rapidly expanding customer base, driving demand for infrared-transmitting glasses and defect-free, high-homogeneity materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schott AG, Hoya Corporation, Corning Incorporated, AGC Inc., Ohara Inc., ZEISS Group, Nikon Corporation (Glass Division), CDGM Glass Co., Ltd., Sumita Optical Glass, Edmund Optics, Precision Optical, Shanghai Feilong Optical Components Co., Ltd., Viavi Solutions, Heraeus, Kyocera Corporation, Hellma Materials, LightPath Technologies, II-VI Incorporated (Coherent). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Glass Market Key Technology Landscape

The technological landscape of the Optical Glass Market is characterized by continuous refinement in manufacturing processes aimed at improving purity, homogeneity, and surface precision, while simultaneously enabling the cost-effective production of complex geometries. A cornerstone technology is Precision Glass Molding (PGM), which allows for the high-volume manufacturing of aspheric and freeform lenses by pressing heated glass blanks into precision molds. PGM significantly reduces the need for expensive and time-consuming traditional grinding and polishing, making complex optics economically viable for consumer applications like smartphone cameras and AR/VR headsets. Advancements in mold material science and anti-stick coatings are key drivers within PGM, ensuring the durability of molds and the defect-free nature of the finished components.

Another crucial technology involves specialized melting and refining techniques, particularly for high-purity materials like Fused Silica. Vapor Axial Deposition (VAD) and Outside Vapor Deposition (OVD) are essential for manufacturing extremely pure glass used in telecommunication fibers and deep ultraviolet (DUV) lithography, where even trace impurities can cause significant absorption losses. Furthermore, the development of eco-friendly glass compositions is gaining traction. Manufacturers are heavily investing in research to replace traditional, but environmentally hazardous, components such as lead and arsenic with safer alternatives while maintaining equivalent or superior optical properties (e.g., high refractive index and low dispersion). This necessity is driving innovation in specialty phosphate and borate glasses.

Surface technology also plays a vital role. This includes advanced thin-film coating deposition methods, such as ion-assisted deposition (IAD) and plasma-enhanced chemical vapor deposition (PECVD), used to apply anti-reflection coatings, high-reflectivity mirrors, and specialized filters directly onto the optical glass surface. These coatings enhance transmission, control spectral response, and improve durability against abrasion or chemical exposure. Looking forward, the integration of nanoscale fabrication techniques, such as etching for diffractive optical elements (DOEs) directly onto glass substrates, is expanding the functional scope of optical glass beyond simple refraction and reflection.

Regional Highlights

The global Optical Glass Market exhibits distinct growth patterns and maturity levels across key geographical regions, with Asia Pacific (APAC) serving as the undeniable powerhouse for both manufacturing output and end-user demand volume. The region benefits from a robust electronics supply chain ecosystem, led by countries such as China, South Korea, and Japan, which are primary consumers of optical components for consumer devices, display technologies, and high-volume industrial cameras. Massive investments in semiconductor fabrication facilities, coupled with expanding automotive manufacturing for electric and autonomous vehicles, ensure APAC’s market dominance, particularly in the mass production of standard and medium-to-high quality optical blanks and molded components.

North America holds a critical position, characterized by high demand for highly specialized, mission-critical optical systems, particularly within the defense, aerospace, and advanced medical sectors. The presence of major defense contractors, leading research universities, and prominent technological innovators drives the requirement for customized, ultra-precision optics, often requiring complex coatings and highly controlled material specifications. While volume production may not match APAC, the average value per unit in North America is significantly higher due to the stringent performance requirements and specialized nature of the applications, driving innovation in areas like high-power laser optics and radiation-hardened glass.

Europe represents a mature market with strong growth in industrial applications, metrology, and high-end automotive sensor systems, supported by countries like Germany (precision engineering) and France (aerospace). European manufacturers focus heavily on compliance with environmental standards, promoting the use of eco-friendly and lead-free glass compositions. Furthermore, the Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, currently reliant on imports but showing increasing localized demand, particularly in surveillance, infrastructure development, and growing consumer electronics assembly. These emerging regions offer long-term opportunities as industrialization and technological adoption rates accelerate, creating pathways for localized component assembly and system integration.

- Asia Pacific (APAC): Dominates manufacturing and consumer volume; key drivers include consumer electronics, automotive electrification (LiDAR), and semiconductor expansion; major hub for high-volume production.

- North America: Leader in high-value, specialized segments (Defense, Aerospace, Medical); focus on cutting-edge research and ultra-precision optics; high ASPs due to strict performance criteria.

- Europe: Strong base in industrial metrology, machine vision, and advanced automotive applications; strict environmental regulations driving adoption of green glass compositions; highly mature market with stable growth.

- Latin America (LATAM): Emerging market primarily driven by infrastructure projects and imported consumer electronics assembly; growing potential in localized industrial use.

- Middle East and Africa (MEA): Growth tied to defense modernization, surveillance infrastructure, and rising investment in oil and gas inspection technologies; reliance on imported, specialized components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Glass Market.- Schott AG

- Hoya Corporation

- Corning Incorporated

- Ohara Inc.

- AGC Inc. (Asahi Glass Co., Ltd.)

- ZEISS Group

- Nikon Corporation (Glass Division)

- CDGM Glass Co., Ltd.

- Sumita Optical Glass, Inc.

- Edmund Optics

- Precision Optical

- Shanghai Feilong Optical Components Co., Ltd.

- Heraeus

- Kyocera Corporation

- LightPath Technologies

- II-VI Incorporated (Coherent)

- Brewer Science, Inc.

- Saint-Gobain S.A.

- Viavi Solutions

- Mitsui Mining & Smelting Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Optical Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Optical Glass Market?

The market growth is primarily propelled by the exponential expansion of sensor-based technologies in the automotive sector (ADAS and LiDAR), surging demand for high-resolution imaging in consumer electronics (smartphones and AR/VR), and significant governmental investments in defense and aerospace surveillance systems requiring high-performance, durable optical components.

How does Precision Glass Molding (PGM) technology impact the cost and production of optical glass components?

PGM significantly lowers manufacturing costs and increases production speed for complex, non-spherical optics (aspheres). By eliminating extensive grinding and polishing, PGM enables high-volume, cost-effective production of high-performance lenses required for compact consumer devices and sophisticated optical systems.

Which regional market holds the largest share in the Optical Glass industry, and why?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly due to the concentration of global electronics manufacturing hubs, including smartphone and camera assembly lines, coupled with high demand from the rapidly expanding automotive and semiconductor industries across China, Japan, and South Korea.

What are the key technical challenges restraining market expansion for optical glass?

Major restraints include the high capital expenditure required for maintaining ultra-high-purity manufacturing environments, the inherent difficulty and cost associated with producing large-diameter optical components without internal defects, and stringent technical requirements for developing new eco-friendly glass compositions that match the performance of older, lead-containing formulas.

In which application segment is Fused Silica most critical, and what are its key advantages?

Fused Silica is most critical in the semiconductor equipment segment, specifically for deep ultraviolet (DUV) lithography optics. Its primary advantages are exceptional purity, high transparency in the UV spectrum, and extremely low coefficient of thermal expansion, making it resistant to thermal shock and highly stable during high-precision fabrication processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Optical Lenses Market Size Report By Type (Resin Lens, Optical Glass Lens), By Application (Cameras, Automotive, Mobilephone, Surveillance, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Optical Lens Market Size Report By Type (Resin Lens, Optical Glass Lens), By Application (Cameras, Automotive, Mobilephone, Surveillance, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- High Energy Laser Optics Assemblies Market Statistics 2025 Analysis By Application (Communication Industry, Intelligent Manufacturing, Precision Instrument, Physical Experiment), By Type (Fused Quartz Material, Optical Glass Material, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Variable Beam Expanders Market Statistics 2025 Analysis By Application (Optical Instruments, Medical Profession, Oil and Mining, Automation), By Type (Fused Quartz Material, Optical Glass Material), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Endoscope Optics Objective Market Statistics 2025 Analysis By Application (Medical Industry, Construction Industry, Chemical Industry, Security Monitoring, Automobile Industry, Aerospace), By Type (Optical Glass Material, Fused Quartz Material, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager