Optical Grade TAC Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438349 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Optical Grade TAC Film Market Size

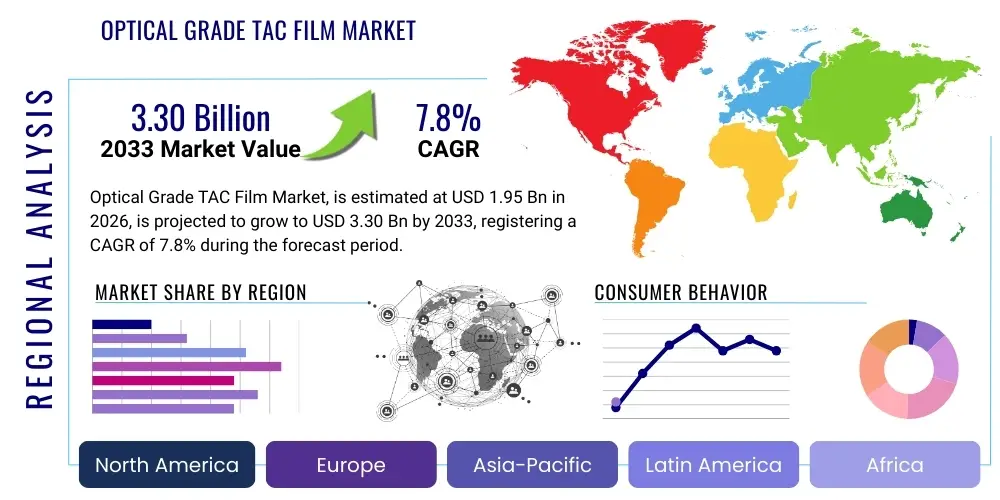

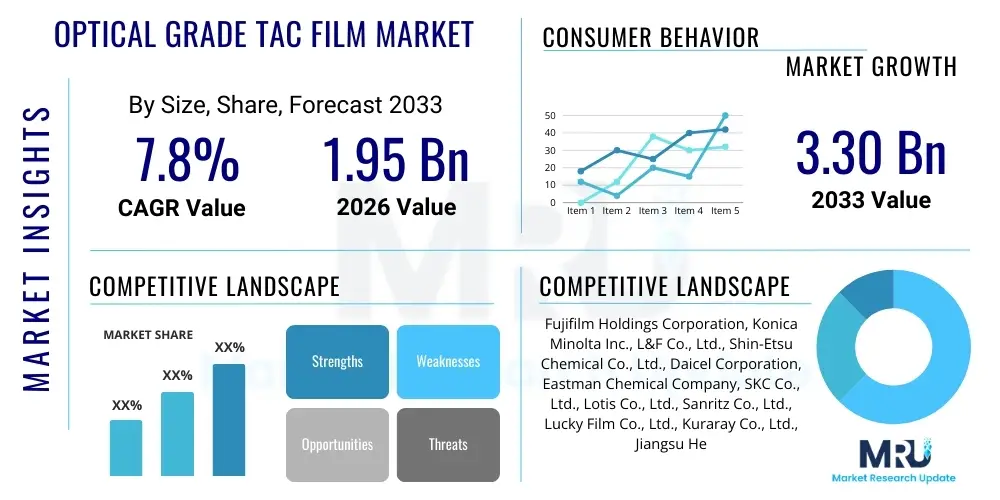

The Optical Grade TAC Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.95 Billion USD in 2026 and is projected to reach $3.30 Billion USD by the end of the forecast period in 2033.

Optical Grade TAC Film Market introduction

Optical Grade Triacetylcellulose (TAC) film is a critical component in the manufacturing of polarized light filters, serving primarily as a protective and supporting layer for the iodine-based polarizer core within liquid crystal displays (LCDs) and increasingly, in advanced OLED screens. TAC film, derived from cellulose acetate, offers high transparency, excellent birefringence properties, and superior dimensional stability, which are essential prerequisites for maintaining optimal contrast ratios and viewing angles in high-resolution displays. Its primary function is to shield the delicate polarizer layer from moisture, heat, and mechanical stress, thereby enhancing the overall durability and longevity of the display module. The material's inherent optical clarity and minimal yellowing characteristics over time make it irreplaceable in applications demanding high visual fidelity, such as smartphones, large-format televisions, and automotive displays.

The core application of optical grade TAC film resides in the polarizer assemblies used across various electronic display technologies. As the demand for larger, thinner, and more energy-efficient displays accelerates globally, the consumption of high-specification TAC film expands correlatively. Key benefits driving its adoption include its cost-effectiveness compared to alternative protective films, superior adhesion capabilities to polarizer materials, and relatively straightforward processing via the solution casting method. Furthermore, continuous advancements in material science are leading to ultra-thin TAC films that support the development of sleeker device form factors, particularly crucial in the fiercely competitive mobile device and wearable technology segments. Its role as the functional substrate in polarizing films dictates its necessity in nearly every LCD manufactured today, cementing its foundational position in the display supply chain.

Major driving factors influencing market expansion include the massive global penetration of smart televisions, the ongoing transition to 4K and 8K display resolutions requiring enhanced optical components, and the burgeoning demand for large-area industrial and commercial displays. The increasing adoption of in-cell and on-cell touch panel architectures also relies on stable, optically pure materials like TAC film to maintain touch sensitivity and display performance. However, emerging substitutes and the push toward thinner films necessitate ongoing research and development into new polymerization and casting techniques to preserve market relevance. The material properties of TAC—specifically its ability to reliably minimize light leakage and maximize light transmission—underscore its continued importance despite technological shifts in display backlighting (e.g., Mini LED).

Optical Grade TAC Film Market Executive Summary

The Optical Grade TAC Film Market is characterized by intense technological competition and a supply chain heavily centralized in the Asia Pacific region, specifically dominated by Japanese manufacturers renowned for high-purity cellulose acetate feedstock and advanced casting technology. Business trends indicate a strategic focus on developing thinner, multi-functional TAC films that integrate anti-glare (AG) or anti-reflective (AR) properties directly into the substrate, streamlining the display assembly process and reducing material stack thickness. Manufacturers are also exploring biodegradable and sustainable cellulose sources to address mounting environmental regulatory pressures and corporate sustainability goals. The market structure features strong backward integration among key players, securing consistent supply of high-purity cellulose pulp, which is critical for maintaining optical quality and reducing manufacturing variance across batches. Pricing pressures remain consistent due to the commoditization of standard-thickness films, driving innovation toward premium, specialized grades.

Regional trends reveal that Asia Pacific (APAC) remains the undisputed epicenter of demand and production, driven by the massive concentration of display panel fabrication plants (Fabs) in countries such as China, South Korea, and Taiwan. China, in particular, has seen explosive growth in local display production capacity, shifting the geographical demand balance. While North America and Europe primarily represent end-markets for consumer electronics, their influence is felt through demand for advanced display features and high-specification polarization solutions used in premium monitors and specialized medical equipment. Segment trends highlight the dominant position of films used in Large-Format TV applications, followed by Mobile Devices, where the push for thinner components is most pronounced. Furthermore, the segmentation by thickness indicates a steady migration towards ultra-thin films (below 40 µm) to support modern display requirements for reduced weight and flexible designs, necessitating substantial investment in specialized casting equipment.

Overall, the market dynamic is poised between the stable, high-volume requirement from the mature LCD sector and the volatile, high-specification demand emanating from advanced display applications like high-end OLEDs and flexible displays. The profitability of the market hinges on scale efficiency in manufacturing and the ability to consistently supply films with extremely low optical defects. Key challenges summarized in this summary include managing the vulnerability of the supply chain to cellulose price volatility and the persistent threat from alternative protective polymers such as cyclic olefin polymers (COP) and polycarbonate (PC) films, although TAC maintains advantages in cost and established processing infrastructure. Strategic alliances between film producers and major display panel manufacturers are increasingly common, ensuring co-development of next-generation polarization materials tailored for emerging display technologies.

AI Impact Analysis on Optical Grade TAC Film Market

Users frequently inquire about AI's role in optimizing the production process of high-ppurity optical materials, particularly concerning defect detection, quality control, and predictive maintenance within the highly complex and sensitive solution casting process for TAC film. Key concerns center on whether AI-driven quality assurance systems can dramatically reduce the yield loss associated with microscopic optical defects, a major cost driver for manufacturers. Users also express interest in AI's capacity to model and optimize the chemical reaction parameters during acetylation and the subsequent casting and drying phases to achieve ultra-uniform thickness and superior birefringence stability. The summarized theme suggests that users expect AI implementation to lead to a significant uplift in manufacturing efficiency, driving down operational costs and enabling the production of more specialized, defect-free TAC films necessary for 8K and high dynamic range (HDR) displays.

- AI-enhanced Automated Optical Inspection (AOI) dramatically reduces defect rates by identifying microscopic flaws undetectable by traditional human or basic machine vision systems, improving manufacturing yields.

- Predictive Maintenance algorithms utilize sensor data from casting lines (temperature, solvent concentration, flow rates) to anticipate equipment failure, minimizing costly unplanned downtime and maximizing throughput.

- Machine Learning (ML) models optimize polymerization and casting parameters, ensuring precise control over film thickness uniformity (critical for optical performance) and minimizing variations across large production rolls.

- Supply Chain optimization powered by AI forecasts raw material demand (cellulose pulp and acetic anhydride) more accurately, mitigating risks associated with feedstock price volatility and ensuring inventory efficiency.

- AI algorithms accelerate the R&D cycle for new film formulations by simulating the impact of chemical additives on birefringence, thermal stability, and mechanical strength, speeding up the introduction of next-generation products.

DRO & Impact Forces Of Optical Grade TAC Film Market

The market dynamics are primarily fueled by the relentless global growth in high-definition display consumption, particularly in Asian manufacturing hubs, establishing a powerful baseline demand for TAC film. Simultaneously, the market faces significant structural constraints tied to the chemical complexity and capital intensity of the manufacturing process, alongside environmental pressures regarding solvent use. Opportunities emerge from advanced applications such as flexible displays and specialized automotive electronics, demanding higher-performance films. These factors collectively exert critical impact forces, dictating pricing stability, investment in purification technology, and strategic regionalization of the supply chain, forcing established players to innovate continuously while maintaining strict cost control.

Segmentation Analysis

The Optical Grade TAC Film Market is extensively segmented based on factors including thickness, end-user application, and functionality, reflecting the diverse and stringent requirements of the modern display industry. The segmentation by thickness—categorized into films above 60 µm, between 40-60 µm, and below 40 µm—is particularly critical, as thinner films are increasingly necessary for slim display designs in mobile devices, driving innovation in casting technology. Application segmentation highlights the dominance of large-format consumer electronics, but the fastest growth is observed in specialized segments like augmented reality (AR) devices and complex automotive dashboards requiring films capable of enduring extreme environmental conditions. Functional segmentation further distinguishes standard protective films from those featuring integrated performance characteristics, such as specialized UV blocking or anti-scratch coatings, offering higher margin opportunities for manufacturers.

- By Application:

- Television (Large-Format Displays)

- Smartphones and Tablets (Mobile Devices)

- Monitors and Notebooks (IT Displays)

- Automotive Displays

- Wearables and Specialized Displays (AR/VR)

- By Thickness:

- Below 40 µm (Ultra-Thin Films)

- 40 µm – 60 µm (Standard Films)

- Above 60 µm (Thick Films for specialized uses)

- By Functionality:

- Standard Protective Film

- Compensator Film (Used in advanced polarization structures)

- Anti-Glare (AG) and Anti-Reflection (AR) Films

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Optical Grade TAC Film Market

The value chain for Optical Grade TAC film is highly intricate and starts with the highly specific sourcing of raw materials, primarily high-purity cellulose pulp derived from wood or cotton linters. Upstream activities are dominated by specialized chemical companies that manage the acetylation process—reacting cellulose with acetic anhydride to produce cellulose triacetate. This stage requires rigorous control to ensure the high degree of substitution necessary for optical grade performance, eliminating impurities that could cause haze or light scattering. The midstream involves the core manufacturing process: solution casting, where the TAC resin is dissolved in volatile solvents (historically Dichloromethane, but increasingly less toxic alternatives) and cast onto specialized metal belts. This capital-intensive step determines the final film thickness, uniformity, and optical characteristics. The scarcity of expertise and high cost associated with high-speed, high-precision casting lines represents a significant barrier to entry.

Downstream activities involve converting the bulk TAC film into finished products for display assembly. This includes slitting the jumbo rolls into precise widths, often subjecting the film to surface treatments (such as saponification for enhanced adhesion), and integration into polarizer assemblies by specialized polarizer manufacturers. The distribution channel is relatively concentrated; due to the film's sensitive nature and required just-in-time delivery to display Fabs, direct sales models between film producers and major display makers are prevalent, minimizing intermediary handling. Indirect channels are utilized mainly for smaller, specialized converters or regional distributors serving niche industrial applications. The efficiency of this downstream segment relies heavily on maintaining a cold chain and contamination-free environment to preserve the pristine optical quality of the film until it is integrated into the final display panel.

The power within the value chain is disproportionately held by the few global suppliers who control the proprietary casting technology and maintain strong relationships with the handful of high-purity cellulose pulp suppliers. Any disruption at the upstream feedstock level—be it quality issues or price volatility—cascades rapidly through the entire chain. Simultaneously, large downstream display panel manufacturers (such as Samsung Display, LG Display, and BOE) possess substantial negotiating leverage due to their massive procurement volumes. Film producers are thus constantly squeezed between the high input costs of raw materials and the demanding price and quality requirements set by the major display integrators, emphasizing the necessity for continuous process optimization and vertical integration to secure stable margins and competitive advantage in this sophisticated market.

Optical Grade TAC Film Market Potential Customers

The primary customers for Optical Grade TAC Film are large-scale display panel manufacturers and specialized polarizer component integrators who utilize the film as the fundamental protective substrate in polarizing filters. These customers operate high-volume, automated production lines where material consistency and defect-free supply are non-negotiable requirements. Key buyers include global leaders in liquid crystal display (LCD) and organic light-emitting diode (OLED) production, who source film based on precise specifications regarding thickness, surface treatment, and optical purity necessary for specific display resolutions and panel sizes. The procurement decisions are typically driven by engineering teams focused on yield management, material cost efficiency, and long-term supply stability. Given the high reliance on just-in-time inventory, proximity to major film production sites is a critical factor for these end-users.

A significant secondary customer segment includes manufacturers of specialized optical components for niche high-technology sectors. This incorporates companies producing high-performance lenses, augmented reality (AR) and virtual reality (VR) headsets, and sophisticated automotive head-up display (HUD) systems. These customers often demand TAC film with specialized coatings or unique mechanical properties to withstand extreme temperature cycling or high light intensity, leading to tailored supply contracts. Furthermore, research institutions and advanced material developers frequently purchase small volumes for testing and prototyping new display architectures, representing a leading indicator of future demand trends. The focus for these specialized buyers is less on volume price and more on technical performance and collaboration for custom film development.

The purchasing cycle is often long-term and contractual, reflecting the high capital investment required in qualifying a new material supplier for display fabrication. Once a TAC film supplier is qualified by a major display manufacturer, the relationship typically spans several years, making initial market penetration difficult but offering significant revenue stability to established players. The shift in demand towards thinner, more complex films (like compensating films used in specific viewing angle correction) means that procurement criteria are constantly evolving, requiring film manufacturers to maintain rapid response capabilities to changing display specifications. The end-users are thus highly sophisticated buyers, focused on Total Cost of Ownership (TCO) which includes factors such as yield impact and long-term durability, not merely the unit price of the film itself.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion USD |

| Market Forecast in 2033 | $3.30 Billion USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fujifilm Holdings Corporation, Konica Minolta Inc., L&F Co., Ltd., Shin-Etsu Chemical Co., Ltd., Daicel Corporation, Eastman Chemical Company, SKC Co., Ltd., Lotis Co., Ltd., Sanritz Co., Ltd., Lucky Film Co., Ltd., Kuraray Co., Ltd., Jiangsu Hengli Chemical Fiber Co., Ltd., Mitsubishi Chemical Corporation, Teijin Limited, Nippon Paper Industries Co., Ltd., Kureha Corporation, Polyplastics Co., Ltd., Toray Industries, Inc., Toyobo Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Grade TAC Film Market Key Technology Landscape

The foundational technology underpinning the Optical Grade TAC Film market is the high-precision solution casting method, often referred to as the dope process. This method involves dissolving cellulose triacetate pellets in a solvent mixture (dope), followed by precisely extruding this viscous solution onto a highly polished, endless metal belt or drum. The technological challenge lies in ensuring ultra-uniformity during the drying process, where the solvent is evaporated and recycled. Minor fluctuations in temperature, air flow, or casting speed can introduce optical non-uniformities or thickness variations, severely impacting the film's performance. Significant advancements in casting technology have focused on achieving higher processing speeds while simultaneously reducing film thickness, with leading manufacturers now capable of consistently producing films well below 40 µm required for modern mobile devices. Furthermore, the development of solvent recovery systems that minimize environmental impact and maximize resource efficiency represents a critical technological frontier, shifting away from highly toxic solvents like Dichloromethane (DCM) towards more environmentally benign alternatives such as methyl acetate, although this necessitates re-engineering the casting formulation.

A second crucial area of technological focus involves the chemical synthesis and modification of the cellulose triacetate itself, particularly in the development of specialized compensating films. While standard TAC film primarily serves a protective function, compensating films are chemically or structurally engineered to control and optimize light transmission by intentionally manipulating the film's birefringence (the difference between refractive indices). This requires precise control over the degree of acetylation, post-processing stretching (uniaxial or biaxial orientation), and the addition of specific retarders. Advanced compensation technologies, such as those employing discotic liquid crystals combined with TAC substrates, are essential for achieving the wide viewing angles and high contrast ratios required by high-end IPS and VA LCD panels, as well as complex OLED structures. Innovators are heavily investing in proprietary polymerization techniques that stabilize the optical properties across varying temperatures and humidity levels, crucial for automotive and outdoor display applications where environmental stress is high.

The manufacturing process is further enhanced by sophisticated integration technologies applied during or immediately after casting. These include in-line plasma treatments and chemical saponification processes applied to the film surface. Saponification, which converts the hydrophobic TAC surface into a hydrophilic layer, is essential for enabling strong, reliable adhesion with the iodine-based polarizer core. Furthermore, modern TAC production lines integrate high-speed, high-resolution Automated Optical Inspection (AOI) systems utilizing advanced machine vision and spectral analysis to detect even sub-micron level defects or contaminants in real-time. This stringent quality control technology ensures that the film meets the demanding optical purity standards of 8K displays. The competition in the technological landscape is thus defined by the seamless integration of chemical expertise (for materials), mechanical engineering precision (for casting and orientation), and advanced computer vision (for quality assurance), collectively driving the incremental improvements necessary for continued market relevance against competitive materials like COP films.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant region in the Optical Grade TAC Film Market, accounting for the largest share of both consumption and production. This supremacy is directly attributable to the overwhelming concentration of global display panel manufacturing infrastructure (LCD and OLED Fabs) located in China, South Korea, Taiwan, and Japan. Japan holds a unique position, housing the major film manufacturers known for proprietary high-purity TAC synthesis and advanced casting technologies. China's rapid expansion in display production capacity, particularly in large-area TV panels and mobile devices, drives massive volume demand, creating a highly localized and competitive supply chain dynamic. Regional growth is further amplified by government incentives supporting the localization of advanced materials production and the continuous investment in next-generation display technologies.

- North America: North America represents a mature, high-value end-market characterized by demand for specialized and premium optical components, particularly in medical displays, aerospace instruments, and high-specification IT monitors. While minimal manufacturing of bulk TAC film occurs here, the region drives innovation in end-user application specifications, often demanding advanced functionalities such as extreme durability and specific compensation films for specialized viewing environments. The demand is stable, focusing on quality and performance rather than sheer volume, and is significantly influenced by military and industrial standards for optical clarity and ruggedness.

- Europe: The European market demonstrates steady growth, primarily driven by the automotive sector, which utilizes TAC film in complex cockpit display systems and advanced navigation interfaces requiring high performance under varying light conditions and temperatures. Furthermore, the region has a robust focus on industrial automation and high-end professional equipment, demanding films that integrate anti-reflective and anti-glare properties. European manufacturers are also pioneers in adopting sustainable and bio-based material alternatives, pressuring TAC producers to accelerate the shift away from harmful solvents and toward eco-friendly cellulose sources in line with stricter EU regulations.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets primarily driven by the increasing penetration of affordable consumer electronics, particularly televisions and smartphones, reliant on imported polarized display modules. While local production infrastructure for TAC film is negligible, the growing consumer base represents a consistent source of underlying demand. Market growth is generally correlated with macroeconomic factors and the expansion of domestic assembly plants for consumer electronics, making them significant areas for finished goods consumption but secondary to APAC in terms of raw material demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Grade TAC Film Market.- Fujifilm Holdings Corporation

- Konica Minolta Inc.

- Daicel Corporation

- Eastman Chemical Company

- SKC Co., Ltd.

- L&F Co., Ltd.

- Sanritz Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Mitsubishi Chemical Corporation

- Kuraray Co., Ltd.

- Teijin Limited

- Nippon Paper Industries Co., Ltd.

- Lucky Film Co., Ltd.

- Kureha Corporation

- Polyplastics Co., Ltd.

- Toray Industries, Inc.

- Toyobo Co., Ltd.

- Jiangsu Hengli Chemical Fiber Co., Ltd.

- DIC Corporation

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Optical Grade TAC Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Optical Grade TAC Film in a display panel?

Optical Grade Triacetylcellulose (TAC) film serves as the vital protective layer for the iodine-based core of the polarizing film, shielding it from moisture, heat, and mechanical damage, thereby ensuring the stability and longevity of the display’s contrast and color performance.

Which factors are restraining the market growth for TAC Film?

Key restraints include the extremely high capital investment required for establishing solution casting facilities, fluctuating costs and supply chain sensitivity related to high-purity cellulose pulp feedstock, and persistent environmental concerns regarding the industrial use of halogenated solvents like DCM.

How is the move towards flexible displays impacting TAC Film production?

The transition to flexible displays requires ultra-thin TAC films (below 40 µm) or alternative flexible substrates; while standard TAC faces challenges in extreme bending, advanced TAC films are being modified to offer enhanced mechanical resilience and dimensional stability to remain relevant in specific flexible applications.

Which geographical region dominates the global supply and demand for TAC Film?

Asia Pacific (APAC), particularly Japan, China, and South Korea, dominates the market due to the high concentration of global LCD and OLED panel manufacturing facilities, coupled with the presence of key Japanese manufacturers controlling advanced film casting technology and proprietary processes.

What is the key technological differentiation among major TAC film manufacturers?

Differentiation is achieved primarily through proprietary solution casting technology that ensures superior thickness uniformity and minimizes optical defects, and the ability to chemically modify the film to produce high-performance compensating films necessary for wide viewing angles and advanced display structures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager