Optical Modulators Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438045 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Optical Modulators Materials Market Size

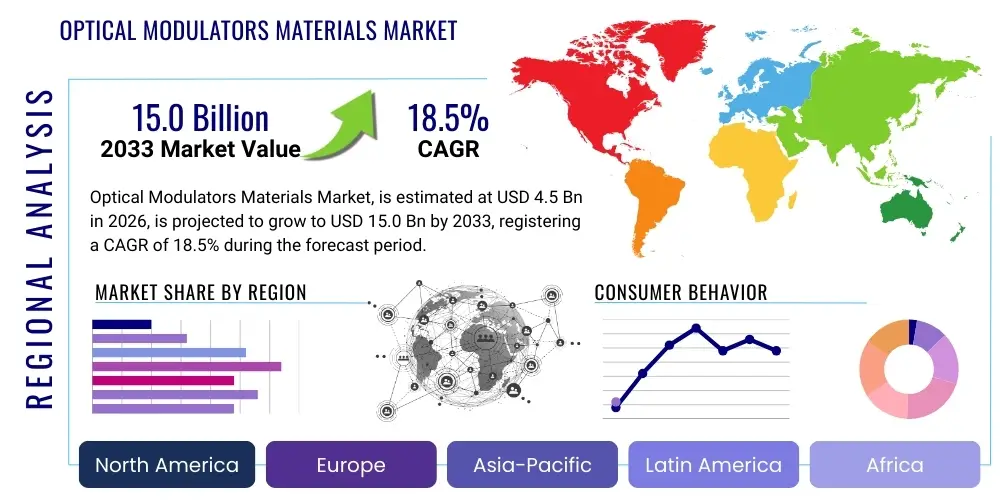

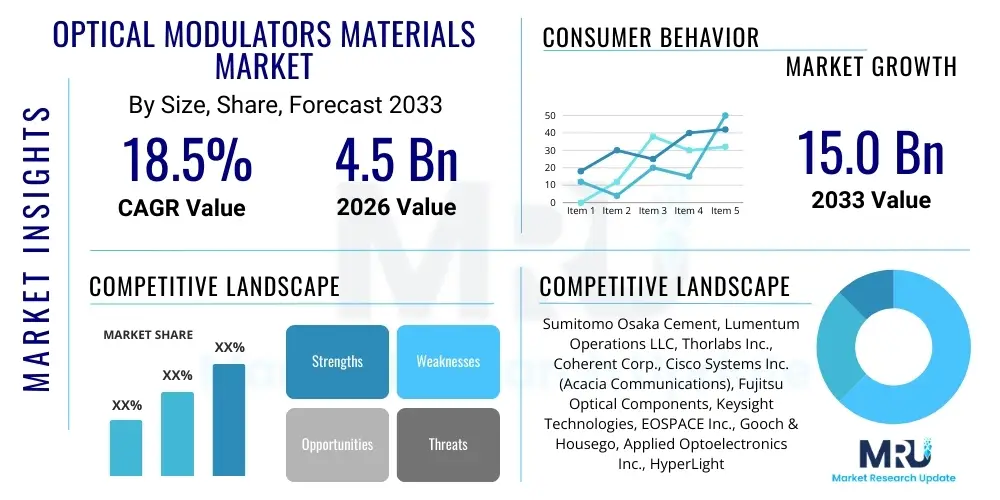

The Optical Modulators Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 15.0 Billion by the end of the forecast period in 2033.

Optical Modulators Materials Market introduction

Optical modulators are critical components in modern high-speed communication systems, serving the function of converting electrical signals into modulated optical signals. The performance of these modulators, which determines data transmission capacity and energy efficiency, is fundamentally dependent on the underlying material utilized. Key materials include Lithium Niobate (LiNbO3), which offers excellent stability and low chirp; Indium Phosphide (InP), primarily used for integration with lasers; Gallium Arsenide (GaAs); electro-optic polymers; and increasingly, Silicon and Thin-Film Lithium Niobate (TFLN), driven by the requirement for higher integration density and lower power consumption in mass-produced photonic integrated circuits (PICs). The relentless increase in global data traffic, fueled by video streaming, cloud computing, and the proliferation of 5G networks, necessitates modulators capable of operating at 400G and 800G speeds, placing significant pressure on material science innovations to deliver required bandwidths while minimizing signal loss.

The core product in this market encompasses the specialized substrates, waveguides, and active layers essential for creating the electro-optic or thermo-optic effect required for modulation. These materials must exhibit high Pockels coefficients, low absorption loss at telecommunication wavelengths (1310 nm and 1550 nm), and compatibility with existing semiconductor manufacturing processes. Major applications span hyperscale data centers, long-haul terrestrial and submarine telecommunications, and high-performance computing (HPC). The benefits of advanced modulator materials include dramatically increased data rates (measured in Gbps), reduced energy consumption per bit transmitted, smaller form factors enabling higher integration (critical for co-packaged optics), and enhanced thermal stability for reliable deployment in demanding environments.

The primary driving factors propelling this market include the aggressive global rollout of 5G infrastructure requiring massive backhaul capacity, the exponential growth in demand for bandwidth from hyperscale data center operators (such as Google, Amazon, Microsoft, and Meta), and the escalating deployment of Artificial Intelligence and Machine Learning workloads which demand ultra-low latency and high throughput interconnects. Furthermore, the push towards achieving net-zero emissions has intensified research into highly energy-efficient materials, bolstering the uptake of newer platforms like Silicon Photonics and TFLN, which promise integration at scale and lower operational expenditure compared to traditional bulk optic solutions. This symbiotic relationship between high-speed connectivity demands and material innovation defines the current trajectory of the Optical Modulators Materials Market, positioning it as a pivotal segment within the broader photonics industry landscape.

Optical Modulators Materials Market Executive Summary

The Optical Modulators Materials Market is entering a transformative phase characterized by the rapid transition from traditional bulk crystalline materials to highly integrated thin-film and semiconductor platforms. Business trends indicate a significant increase in strategic partnerships between traditional compound semiconductor providers and pure-play Silicon Photonics foundries, aiming to optimize fabrication processes and achieve high-volume scalability necessary to meet the burgeoning demand from the data center and telecommunications sectors. Key market players are heavily investing in research and development focusing on Thin-Film Lithium Niobate (TFLN) technology, recognized for its superior electro-optic efficiency and compatibility with compact integration, challenging the dominance of older bulk LiNbO3 devices in high-performance applications, particularly those exceeding 100 GHz modulation rates. Furthermore, the cost reduction associated with large-scale wafer processing of Silicon-based materials is driving commercial viability and mass adoption, creating intense pricing competition in high-volume transceiver markets.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, primarily fueled by extensive investments in 5G network deployment across China, South Korea, and Japan, coupled with its established dominance in global photonics component manufacturing and assembly. North America remains a leading region in terms of technology adoption and innovation, driven by hyperscale data center deployment and continuous R&D expenditure by major tech firms pushing the envelope for 800G and 1.6T interconnects. Europe is exhibiting steady growth, largely driven by investments in fiber-to-the-home (FTTH) infrastructure and strategic initiatives focusing on European self-sufficiency in semiconductor and photonics technologies. These regional dynamics underline a global race to secure supply chains for advanced electro-optic materials capable of supporting future data architectures.

In terms of segment trends, the Material Type segment is experiencing the most dynamic shift, with Silicon and TFLN materials projected to capture substantial market share from traditional III-V semiconductors and bulk LiNbO3. Silicon Photonics, due to its CMOS compatibility, dominates the volume segments, especially within short-reach data center interconnects (up to 2 km). However, TFLN is proving crucial for ultra-high-speed and long-haul applications where low insertion loss and low V-pi are paramount. The Application segment is dominated by Data Center Interconnects and Telecommunications, which together account for the vast majority of revenue, reflecting the core necessity of high-capacity modulators in managing global internet traffic. This structural shift toward integrated platforms dictates that future market growth will be intrinsically linked to success in reducing the cost and complexity of hybrid integration techniques.

AI Impact Analysis on Optical Modulators Materials Market

Common user questions regarding AI's impact on the Optical Modulators Materials Market revolve around how the computational intensity of AI/ML training and inference affects demand for specialized materials, whether AI can optimize material design, and how AI-driven data centers influence transceiver specifications. Users frequently express concerns about the power consumption requirements of AI clusters and seek materials that can deliver extreme bandwidth (e.g., 200G per lane) while maintaining low energy consumption per bit. Key themes emerging from this analysis include the recognition that AI is not just a consumer of data transmission capacity but also a catalyst forcing radical innovation in electro-optic material properties. The requirements for instantaneous, high-density interconnection within AI clusters (requiring co-packaged optics or on-chip optical I/O) are pushing the limits of current material stability and efficiency, specifically driving interest in ultra-low V-pi materials like TFLN and advanced polymeric solutions. AI is fundamentally reshaping the performance metrics that drive material selection.

The massive computational workloads associated with large language models (LLMs) and advanced deep learning necessitate vast, tightly coupled GPU clusters, demanding interconnectivity solutions that exceed the capabilities of copper cables in terms of reach, density, and bandwidth. This surge directly translates into increased demand for optical modulators operating at speeds of 400G, 800G, and potentially 1.6T for inter-rack and intra-data center links. Consequently, the materials market benefits directly, as these high-speed links require superior performance from active materials. Furthermore, the constraints imposed by power consumption in AI data centers amplify the need for energy-efficient modulation techniques (such as Mach-Zehnder or Ring Resonator architectures) implemented using low-loss materials. The materials that can deliver high extinction ratios with minimal drive voltage (low V-pi) are strategically positioned for rapid adoption in the AI infrastructure buildout, making material efficiency a strategic differentiator.

Beyond driving demand, Artificial Intelligence is increasingly being leveraged in the research and development pipeline for discovering novel electro-optic materials and optimizing photonic device design. AI algorithms, particularly machine learning models, are utilized for high-throughput screening of material properties, predicting performance characteristics, and simulating waveguide geometries to minimize insertion loss and maximize bandwidth. This analytical capability accelerates the transition from laboratory discovery to commercial readiness, reducing the time required to bring new materials like next-generation electro-optic polymers or optimized hybrid Silicon-based platforms to market. Thus, AI acts as both a primary demand generator, requiring immense quantities of high-performance optical modulators, and an enabling technology, accelerating the innovation and characterization of the specialized materials needed to fulfill that demand.

- AI workload acceleration drives demand for 800G and 1.6T optical transceivers.

- Increased energy efficiency requirements necessitate ultra-low V-pi materials (e.g., TFLN) for AI data centers.

- AI demands are pushing the adoption of co-packaged optics (CPO), favoring highly integrated silicon and hybrid platforms.

- Machine learning models are employed to accelerate the discovery and characterization of new electro-optic materials.

- Focus shifts to materials offering high-density integration required for inter-chip and intra-rack connectivity in GPU clusters.

DRO & Impact Forces Of Optical Modulators Materials Market

The dynamics of the Optical Modulators Materials Market are shaped by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which together constitute the primary Impact Forces determining market direction. The dominant driver is the unprecedented growth in global data traffic, primarily stemming from cloud services, video streaming, and the massive deployment of 5G networks, necessitating continuous bandwidth upgrades from 400G to 800G interfaces in core networks and data centers. Coupled with this is the technological imperative for miniaturization and integration, favoring materials compatible with Silicon Photonics platforms. Key restraints include the high manufacturing complexity and cost associated with advanced material fabrication, particularly the stringent quality control required for thin-film deposition and hybrid integration processes. Furthermore, material reliability and stability issues, especially concerning temperature fluctuations and long-term performance degradation in high-power environments, pose technical hurdles that limit faster widespread adoption of newer platforms. Opportunities are primarily centered around the emergence of quantum computing and integrated sensing applications, which require highly specialized, stable electro-optic materials for control and measurement, and the potential for new electro-optic polymers that offer superior speed-power ratios at lower manufacturing costs compared to crystalline materials.

Impact forces currently favoring market growth stem from the macro-economic and technological alignment globally. The global focus on digital transformation, accelerated by remote work and digital consumption trends, ensures sustained capital expenditure by telecommunication carriers and hyperscalers into network upgrades. This sustained demand provides the necessary revenue stream for continued material innovation. However, geopolitical factors impacting semiconductor supply chains introduce volatility, serving as a critical restraint. The market is also heavily influenced by standardization bodies (like the OIF), whose specifications for next-generation optical interfaces dictate which material platforms will be commercially viable, thereby accelerating the adoption of materials that meet strict power, footprint, and performance requirements, such as TFLN for high-speed coherent optics. The interplay between relentless speed demands and economic viability dictates material selection and market share distribution.

Specifically addressing the forces, the market is positively driven by the decreasing cost per bit facilitated by integrated photonics, making optical solutions more appealing than electrical interconnects at higher data rates. Conversely, a major restraint is the technological challenge of achieving optimal thermal management in highly integrated photonic circuits, as material properties (especially refractive index) are sensitive to temperature, affecting modulation performance. The most significant long-term opportunity lies in hybrid integration technologies, combining the scalability of silicon with the superior electro-optic performance of materials like LiNbO3 or specialized polymers onto a single chip, which promises to unlock tera-scale transmission rates within a compact, power-efficient form factor. The market’s future profitability rests on overcoming the manufacturing bottlenecks inherent in scaling these complex hybrid material systems.

Segmentation Analysis

The Optical Modulators Materials Market is segmented based on the type of active material used, the specific application or system in which the modulator is deployed, and the end-user vertical consuming the technology. Segmentation provides a structured view of the market dynamics, identifying specific high-growth niches and technological shifts. The material type segmentation is crucial, differentiating between traditional crystalline materials, semiconductor platforms designed for high integration, and newer polymer-based solutions. Application segmentation highlights the primary market drivers—telecommunications (long-haul) versus data centers (short-reach)—each having distinct requirements regarding power budget, insertion loss, and required bandwidth. Analyzing these segments helps stakeholders understand the competitive landscape and target high-value R&D efforts towards materials meeting specific performance criteria required by critical end-use applications like high-capacity data transmission or advanced sensing.

- By Material Type:

- Lithium Niobate (LiNbO3) (Bulk and Thin-Film)

- Silicon/Silicon Photonics

- Electro-Optic Polymers

- III-V Semiconductors (InP, GaAs)

- Others (e.g., AlN, Hybrid materials)

- By Application:

- Data Center Interconnects

- Telecommunications (Long-Haul, Metro, Access)

- High-Performance Computing (HPC)

- Defense and Aerospace

- Sensing and Instrumentation

- By End-User:

- Telecommunication Service Providers

- Cloud and Hyperscale Data Center Operators

- Enterprise Network Operators

- Government and Defense Agencies

- Component Manufacturers and Foundries

Value Chain Analysis For Optical Modulators Materials Market

The value chain for the Optical Modulators Materials Market begins with the upstream sourcing and refinement of highly pure raw materials, which is crucial as the quality of the starting substrate significantly dictates the final device performance. Key upstream activities involve the growth of single crystals (such as LiNbO3 or InP) or the production of high-quality silicon wafers suitable for photonic integration. This stage requires specialized chemical and metallurgical expertise and significant capital investment in purification and crystal growth facilities. Companies involved in this initial phase focus on achieving high material purity, minimizing crystal defects, and ensuring uniform substrate thickness, which are paramount for high-yield device manufacturing. The ability to produce high-quality thin-film substrates, particularly TFLN wafers, is a critical bottleneck in the current value chain, heavily influencing the final cost and availability of advanced modulators.

The midstream segment involves the highly technical process of component manufacturing, including specialized material processing, lithography, etching, and waveguide fabrication. Foundries and integrated device manufacturers (IDMs) transform the raw substrate into functional optical modulator chips. This stage encompasses the deposition of active layers, electrode patterning, and subsequent assembly into packaged devices (transceivers). Distribution channels play a vital role here, linking component manufacturers to system integrators and equipment vendors. Direct distribution typically involves large-scale, customized contracts with major hyperscalers or tier-one telecom vendors, ensuring a secure supply of high-volume, performance-specific components. Indirect distribution relies on specialized distributors and value-added resellers (VARs) to cater to smaller enterprise clients, research institutions, and diverse industrial applications.

Downstream activities involve the integration of the optical modulator components into larger communication systems, such as network equipment (routers, switches), data center switches, and optical transmission terminals. End-users, comprising telecom operators, cloud providers, and government entities, are at the end of the value chain, driving demand specifications. The rapid evolution of communication standards (e.g., OIF specifications for 800G) means system integrators must quickly adapt to new material platforms and modulator designs. Success in the downstream market depends on robust integration expertise and the ability to provide reliable, scalable, and interoperable systems. Overall, the value chain emphasizes stringent quality control at the upstream material level, high-precision manufacturing in the midstream, and sophisticated system integration capabilities in the downstream to ensure seamless data transmission.

Optical Modulators Materials Market Potential Customers

The primary customers for the advanced materials utilized in optical modulators are organizations that require ultra-high-speed, high-density data transmission capabilities, where the performance and energy efficiency of the interconnects are crucial competitive factors. Hyperscale cloud providers, such as Meta, Amazon Web Services (AWS), Google Cloud Platform, and Microsoft Azure, represent the largest and most rapidly growing customer segment. Their relentless need to expand data center capacity and upgrade internal network infrastructure to support services like AI, video streaming, and storage drives massive volume purchases of transceivers incorporating the latest low-loss, high-bandwidth materials. These customers prioritize long-term reliability, power efficiency (measured in pJ/bit), and scalable manufacturing processes (CMOS compatibility), making Silicon Photonics and TFLN the preferred material platforms for their intra-data center requirements.

Telecommunication Service Providers (TSPs), including major global carriers like AT&T, Vodafone, China Mobile, and NTT, constitute the second major customer group. TSPs require high-performance modulators for long-haul and metro networks to manage backbone traffic and support fiber-to-the-home (FTTH) deployments. For long-distance coherent transmission, the demand is heavily tilted towards materials like high-purity LiNbO3 and Thin-Film LiNbO3, which offer superior linearity, low chirp, and high power handling capabilities essential for robust transmission over thousands of kilometers. Their purchasing decisions are driven by total cost of ownership (TCO) over the lifespan of the equipment, regulatory requirements regarding universal access, and the necessity to deploy 5G and future 6G backhaul infrastructure.

Beyond the core telecom and data center sectors, specialized customers include Defense and Aerospace contractors who utilize these materials for applications requiring high precision, such as microwave photonics, radar systems, and secure high-bandwidth communication links in harsh environments. Additionally, specialized technology companies involved in High-Performance Computing (HPC) and advanced integrated sensing (e.g., LiDAR systems) are key purchasers. Component Manufacturers and Foundries, while acting as immediate buyers of raw wafers, also represent a significant customer group, purchasing high-quality substrates to supply the entire ecosystem. The diversity in customer requirements—from volume and cost sensitivity (data centers) to extreme performance and reliability (defense/long-haul)—necessitates a segmented material strategy from suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 15.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Osaka Cement, Lumentum Operations LLC, Thorlabs Inc., Coherent Corp., Cisco Systems Inc. (Acacia Communications), Fujitsu Optical Components, Keysight Technologies, EOSPACE Inc., Gooch & Housego, Applied Optoelectronics Inc., HyperLight Corporation, OE Solutions America, Mellanox (Nvidia), MACOM Technology Solutions, Shin-Etsu Chemical Co. Ltd., CETC, II-VI Incorporated (now Coherent), NTT Advanced Technology Corporation, Advantest Corporation, Ciena Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Modulators Materials Market Key Technology Landscape

The technological landscape of the Optical Modulators Materials Market is primarily defined by the ongoing transition from mature bulk optic components to highly scalable integrated photonic platforms. Silicon Photonics (SiPh) remains a dominant technology due to its compatibility with high-volume CMOS manufacturing processes, enabling the production of small, cost-effective modulators, particularly Mach-Zehnder and ring resonators, suitable for short-reach data center applications (up to 2km). The core material challenge in SiPh is the inherently weak electro-optic effect of silicon itself, which necessitates techniques like carrier depletion or hybrid integration with other materials (e.g., Germanium or specific polymers) to achieve efficient modulation. Research efforts are heavily focused on reducing the footprint of these modulators and improving thermal stability to handle high-density integration required for co-packaged optics (CPO) architectures.

A transformative technology rapidly gaining traction is Thin-Film Lithium Niobate (TFLN). TFLN leverages the superior electro-optic coefficient of Lithium Niobate while drastically reducing the device size and driving voltage (V-pi) compared to its bulk counterpart. By utilizing a thin layer of LiNbO3 bonded onto a silicon or silica substrate, TFLN modulators offer unparalleled bandwidth (up to 100 GHz and beyond) and extremely low insertion loss, making them ideal for high-speed coherent communications, long-haul transmission, and advanced RF photonics applications. The technological challenge here revolves around scaling the manufacturing yield of high-quality TFLN wafers and developing reliable, low-loss coupling mechanisms between the LiNbO3 waveguides and external optical fibers or other chips. The superior performance metrics of TFLN are challenging the traditional dominance of Indium Phosphide in certain high-end applications.

Furthermore, Hybrid Integration is becoming a crucial technological approach, seeking to combine the best properties of different materials on a single platform. For instance, combining the light-emitting capabilities of III-V materials (like InP) with the efficient modulation and routing capabilities of Silicon or TFLN is central to achieving fully integrated transceiver solutions. Advanced polymer materials, while less mature, offer the potential for extremely fast modulation speeds (femtosecond scale) and low power consumption due to high electro-optic coefficients. The complexity lies in ensuring their long-term stability and reliability under various operational temperatures and humidity levels. The overarching technological trend is towards heterogeneous integration, where material expertise—whether in silicon processing, III-V deposition, or thin-film bonding—determines competitive advantage, pushing the theoretical limits of optical communication speed and density.

Regional Highlights

The global Optical Modulators Materials Market exhibits distinct regional strengths and growth trajectories, fundamentally driven by infrastructure investments and technological maturity. North America, particularly the United States, represents a powerhouse of innovation and early technology adoption. This region benefits from the presence of major hyperscale cloud providers who are the earliest and largest deployers of next-generation optical interconnects (800G and 1.6T). Significant R&D expenditure in Silicon Photonics and TFLN technologies, supported by government initiatives and private sector investment in advanced manufacturing, solidifies North America's leadership in high-end, high-performance modulator materials and integrated devices. The demand here is centered on sophisticated, energy-efficient components for massive data center expansion and advanced military photonics applications.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by unparalleled government-backed investments in digital infrastructure, particularly in China and South Korea. The aggressive rollout of 5G networks and subsequent commercialization of 5.5G and 6G concepts require vast quantities of optical modulators for fronthaul, mid-haul, and backhaul transmission. Furthermore, APAC is the global manufacturing hub for electronic and photonics components, leading to high production volumes and competitive pricing for both traditional and emerging material solutions. While APAC is strong in mass production, particularly for components based on Indium Phosphide and entry-level Silicon Photonics, countries like Japan and South Korea also maintain strong positions in high-quality specialized material production, especially for long-haul telecom applications.

Europe demonstrates steady growth, primarily concentrated in countries like Germany and the UK, driven by long-term strategic goals for network upgrade and self-reliance in key semiconductor technologies. European initiatives focus heavily on promoting Silicon Photonics integration and supporting fundamental research into new electro-optic materials and integration methods. The Middle East and Africa (MEA) and Latin America (LATAM) currently hold smaller market shares but are expected to experience accelerated growth as large-scale fiber optic infrastructure projects mature and local data center ecosystems expand, creating demand for cost-effective, reliable optical connectivity solutions suitable for regional telecom networks.

- North America: Leading in R&D, primary consumer of high-end SiPh and TFLN due to hyperscale data center dominance and advanced military applications.

- Asia Pacific (APAC): Highest volume manufacturing, fastest growth driven by extensive 5G/5.5G deployment and robust telecom investment in China and Southeast Asia.

- Europe: Steady adoption focusing on SiPh for metro networks and strategic investment in indigenous photonics technology development.

- Latin America (LATAM) & MEA: Emerging markets showing increasing demand driven by growing internet penetration and new subsea cable deployments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Modulators Materials Market.- Sumitomo Osaka Cement

- Lumentum Operations LLC

- Thorlabs Inc.

- Coherent Corp.

- Cisco Systems Inc. (Acacia Communications)

- Fujitsu Optical Components

- Keysight Technologies

- EOSPACE Inc.

- Gooch & Housego

- Applied Optoelectronics Inc.

- HyperLight Corporation

- OE Solutions America

- Mellanox (Nvidia)

- MACOM Technology Solutions

- Shin-Etsu Chemical Co. Ltd.

- CETC

- NTT Advanced Technology Corporation

- Advantest Corporation

- Ciena Corporation

- Rockley Photonics

Frequently Asked Questions

Analyze common user questions about the Optical Modulators Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material is currently dominating the high-speed optical modulator market?

The high-speed optical modulator market is undergoing a transition. While Indium Phosphide (InP) and traditional Lithium Niobate (LiNbO3) have been dominant for long-haul coherent systems, Thin-Film Lithium Niobate (TFLN) is rapidly emerging due to its superior electro-optic efficiency, ultra-low V-pi, and ability to support modulation speeds exceeding 100 GHz, making it critical for next-generation 800G and 1.6T applications.

How is Silicon Photonics influencing the demand for specialized modulator materials?

Silicon Photonics (SiPh) drives demand for highly specialized integration materials. Although silicon itself is the substrate, SiPh relies on hybrid integration with materials like Germanium or electro-optic polymers to achieve efficient modulation because silicon has a weak Pockels effect. SiPh’s primary influence is pushing the market toward high-volume, low-cost CMOS-compatible materials for data center short-reach interconnects.

What are the primary factors restraining the growth of advanced electro-optic materials?

The main restraints include the high capital expenditure and manufacturing complexity associated with producing high-quality thin-film substrates, such as TFLN wafers, which directly impact scalability and cost efficiency. Additionally, issues related to long-term material reliability, especially thermal stability and integration loss in hybrid systems, pose significant technical challenges for widespread commercial adoption.

Which application segment holds the largest potential for material demand in the forecast period?

Data Center Interconnects (DCI), particularly within hyperscale cloud environments, hold the largest potential. The shift toward co-packaged optics (CPO) and the need for ultra-high-density 800G and 1.6T transceivers, primarily driven by AI and machine learning workloads, create immense volume demand for low-power, integrated material platforms like Silicon Photonics and hybrid TFLN-on-Silicon solutions.

What is the significance of the V-pi metric in selecting optical modulator materials?

V-pi (the voltage required to switch the modulator from minimum to maximum transmission) is highly significant as it directly relates to power consumption and energy efficiency. Lower V-pi materials, such as TFLN, are highly preferred, particularly in energy-sensitive hyperscale data centers, as they reduce the overall operational expenditure and thermal management challenges of high-density optical systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager