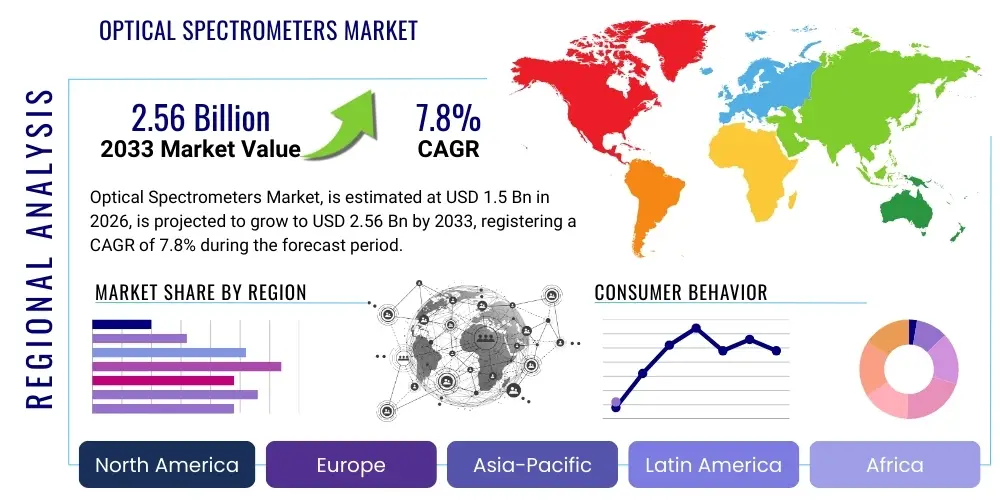

Optical Spectrometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438442 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Optical Spectrometers Market Size

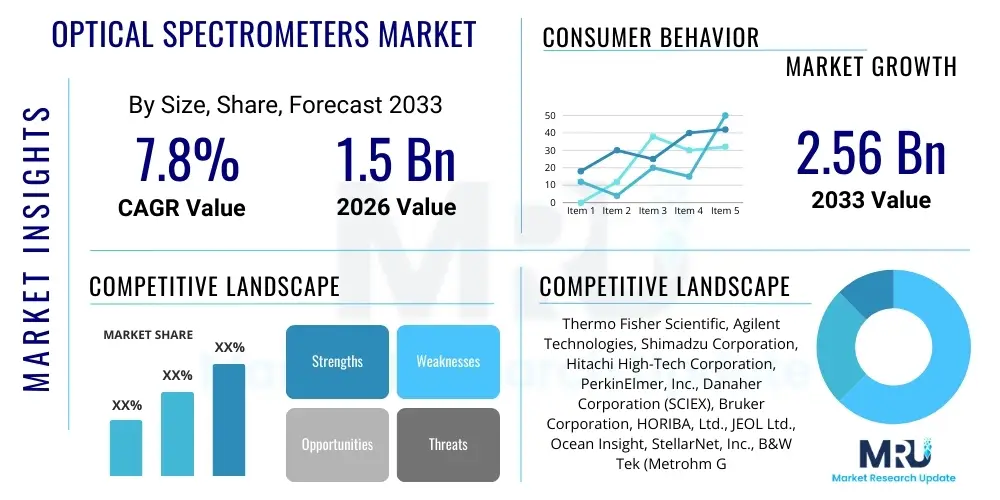

The Optical Spectrometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.56 Billion by the end of the forecast period in 2033.

Optical Spectrometers Market introduction

The Optical Spectrometers Market encompasses instruments designed to measure specific properties of light over a defined portion of the electromagnetic spectrum, typically used to analyze material composition, concentration, and structure. These devices operate on the principle of spectroscopy, dividing light into its constituent wavelengths to interpret the interaction between matter and light. Key products include Atomic Absorption Spectrometers (AAS), UV-Visible Spectrometers, Infrared (IR) Spectrometers, Raman Spectrometers, and Mass Spectrometers, catering to diverse needs ranging from fundamental research to rigorous industrial quality control and environmental monitoring.

Major applications of optical spectrometers span across critical sectors such as life sciences (drug discovery, clinical diagnostics), chemical and petrochemical industries (process monitoring, quality assurance), food and beverage testing (safety and authenticity), and semiconductor manufacturing (thin-film analysis). The primary benefits derived from these instruments include high precision, non-destructive analysis capabilities, rapid data acquisition, and the ability to handle complex sample matrices. Modern spectrometers are increasingly characterized by miniaturization and enhanced portability, allowing for deployment outside traditional laboratory settings, which is a significant factor contributing to market expansion.

The driving forces behind the robust market growth are multifaceted, centering on the escalating demand for high-throughput screening technologies, stringent regulatory mandates regarding environmental pollution and product safety, and increasing global investments in pharmaceutical and biotechnology R&D. Furthermore, the continuous integration of advanced data processing techniques, specifically chemometrics and machine learning algorithms, enhances the utility and analytical power of these instruments, making them indispensable tools in modern analytical chemistry and material science.

Optical Spectrometers Market Executive Summary

The global Optical Spectrometers Market is experiencing dynamic shifts, driven primarily by technological advancements focused on portability, increased sensitivity, and data integration. Business trends indicate a strong focus on strategic mergers and acquisitions among key players aimed at consolidating technological niches, particularly in the fields of handheld spectroscopy and high-resolution Fourier Transform Infrared (FTIR) instrumentation. The competitive landscape is characterized by innovation in detector technology and software solutions, moving beyond hardware sales to offering comprehensive analytical platforms, thereby creating higher barriers to entry for new competitors and fostering stronger long-term customer relationships.

Regionally, the market exhibits sustained growth in established markets like North America and Europe, attributed to substantial governmental and private funding in biomedical research and adherence to strict quality control standards across manufacturing sectors. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid industrialization, expansion of the manufacturing and electronics sectors, and increasing regulatory emphasis on environmental monitoring and food safety, particularly in China and India. This regional diversification necessitates tailored distribution strategies and product localizations to meet varied regulatory and operational demands.

Segment trends highlight the growing dominance of UV-Visible and Raman spectroscopy techniques, favored for their versatility and application in material characterization and drug analysis. There is a notable segment shift towards portable and handheld spectrometers (micro-spectrometers), allowing for real-time analysis in field operations, reducing reliance on centralized laboratories, and accelerating quality decision-making processes. The life sciences and pharmaceutical end-user segment remains the largest revenue contributor, underpinned by continuous drug development pipelines and the necessity for precise quality control throughout the production lifecycle, demanding instruments capable of high precision and scalability.

AI Impact Analysis on Optical Spectrometers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Optical Spectrometers Market frequently revolve around how AI can enhance spectral data interpretation, automate calibration processes, and facilitate the transition from qualitative to predictive analysis. Users are keenly interested in machine learning (ML) models that can process vast datasets generated by high-throughput spectrometers, especially concerning complex mixtures in industrial quality control or clinical diagnostics. The primary concern is often related to the reliability and explainability of AI-driven analytical results, ensuring that regulatory standards are maintained even with automated decision-making processes. Users anticipate AI will minimize operator error and dramatically shorten analysis times.

The integration of AI, specifically machine learning and deep learning, is fundamentally transforming the value proposition of optical spectrometers by moving beyond simple data acquisition towards sophisticated data interpretation. AI algorithms significantly improve signal-to-noise ratios, optimize baseline correction, and enable the rapid identification and quantification of analytes in highly complex matrices, tasks that were historically time-consuming and required expert intervention. This enhancement facilitates the use of spectroscopy in non-traditional fields by lowering the required technical expertise of the end-user.

Furthermore, AI drives automation in instrument maintenance and workflow management. Predictive maintenance models analyze operational data from the spectrometer (such as lamp output or detector temperature) to forecast potential component failures, thereby minimizing downtime and maximizing instrument lifespan. In application workflows, AI-driven software enables automated spectral library matching, complex multivariate analysis (chemometrics), and real-time process control (e.g., in pharmaceutical continuous manufacturing), ensuring consistent quality and maximizing yield.

- AI-driven Chemometrics: Enhanced multivariate analysis for complex mixture separation and quantification.

- Predictive Modeling: Forecasting material properties or reaction outcomes based on spectral input data.

- Automated Calibration: Self-adjusting algorithms reduce the need for manual recalibration, improving stability.

- Real-Time Quality Control: Instantaneous defect detection and process adjustment in continuous manufacturing.

- Spectral Library Enhancement: Machine learning improves pattern recognition for faster, more accurate identification of unknown compounds.

- Fault Detection: Predictive maintenance schedules are optimized based on operational sensor data analysis.

DRO & Impact Forces Of Optical Spectrometers Market

The dynamics of the Optical Spectrometers Market are profoundly shaped by a combination of positive catalysts (Drivers), structural impediments (Restraints), emerging avenues for expansion (Opportunities), and external pressures (Impact Forces). The dominant driver is the increasing global emphasis on product quality and environmental safety, which necessitates high-precision analytical instruments across all major industrial sectors. This regulatory environment, particularly the stringent standards enforced by bodies like the FDA and EPA, compels industries to invest in sophisticated spectroscopic equipment for compliance and verification purposes, directly fueling market demand.

However, the market growth is constrained primarily by the significant capital expenditure required for high-end, research-grade spectrometers, making them prohibitive for smaller laboratories or emerging market enterprises. Additionally, the complexity of data analysis and the need for highly specialized personnel trained in chemometrics and spectroscopy interpretation present a substantial restraint. The long replacement cycles for certain durable benchtop models also temper consistent year-over-year revenue growth in established market segments, pushing manufacturers toward service contracts and software subscriptions to ensure recurring revenue streams.

Opportunities for market penetration lie significantly in the accelerating trend of miniaturization and the development of cost-effective, portable devices. These micro-spectrometers are opening new application areas in point-of-care diagnostics, agriculture, and drone-based remote sensing. Furthermore, the integration of cloud computing and IoT capabilities is enabling distributed analytical networks and big data generation, offering substantial opportunities for platform differentiation and value-added service provision. The primary impact forces affecting the market include the threat of substitution from alternative analytical techniques (e.g., chromatography or mass spectrometry in certain applications) and the volatility in the global supply chain for high-precision components, such as specialized detectors and optical gratings.

Segmentation Analysis

The Optical Spectrometers Market is structurally segmented based on crucial dimensions, including the type of spectroscopy employed, the portability of the instrument, the specific application area, and the target end-user industry. Analyzing these segments is critical for understanding market penetration rates and identifying areas of highest growth potential. The Type segmentation reveals a mature but constantly evolving landscape, with UV-Visible spectroscopy holding a significant share due to its established methodology and broad utility, while highly advanced techniques like Raman and Mass Spectroscopy are witnessing accelerated adoption due to their specificity and non-destructive capabilities in complex analyses.

The segmentation by portability illustrates a strategic market shift; while benchtop instruments remain essential for high-resolution research and regulated environments, the fastest growth is observed in the portable and handheld segment. This trend caters to the demand for rapid, on-site testing in diverse settings, including logistics, defense, and emergency response. End-user analysis consistently places the Life Sciences sector (including pharmaceutical and biotechnology) at the forefront of expenditure, primarily due to rigorous R&D pipelines and stringent regulatory requirements for quality assurance and control throughout the entire drug development and manufacturing processes.

- By Type:

- Atomic Absorption Spectrometers (AAS)

- Molecular Spectrometers

- UV-Visible Spectrometers

- Infrared (IR) Spectrometers (FTIR, NIR)

- Raman Spectrometers

- Fluorescence Spectrometers

- Mass Spectrometers (MS)

- Atomic Emission Spectrometers (AES)

- By Portability:

- Benchtop Spectrometers

- Portable Spectrometers

- Handheld/Micro Spectrometers

- By Application:

- Quality Control and Assurance

- Research and Development

- Material Science and Characterization

- Environmental Monitoring and Testing

- Process Analytical Technology (PAT)

- By End-User Industry:

- Life Sciences and Biotechnology (Pharmaceuticals, Clinical Diagnostics)

- Chemical and Petrochemical

- Food and Beverage Testing

- Semiconductor and Electronics

- Academic and Government Institutions

- Mining and Metallurgy

Value Chain Analysis For Optical Spectrometers Market

The value chain for the Optical Spectrometers Market is intricate, beginning with highly specialized upstream component suppliers. The core components, such as diffraction gratings, specialized mirrors, detectors (e.g., Charged Coupled Devices or InGaAs), and proprietary light sources (lasers or Deuterium lamps), require high precision and constitute a major portion of the instrument's cost and performance capabilities. Suppliers in this segment often operate under long-term contracts with major instrument manufacturers, and the performance of these upstream players is critical to the final product's quality and innovation cycle. Manufacturers must ensure secure sourcing of these highly sensitive, often patented, optical components to maintain competitive advantage and avoid supply bottlenecks, especially given the global nature of the component supply chain.

The midstream focuses on the instrument manufacturing, assembly, and integration phase, where R&D and intellectual property surrounding software, user interface design, and proprietary analytical algorithms are paramount. Leading players focus on integrating hardware with advanced chemometrics software and ensuring compliance with regulated standards (like FDA 21 CFR Part 11). Distribution channels are highly segmented; complex benchtop and mass spectrometers typically utilize a direct sales model, often requiring specialized field application scientists for pre-sales consultation, installation, and extensive post-sales technical support. This direct engagement is essential for managing the high acquisition cost and technical complexity associated with advanced instruments.

Conversely, simpler or more commoditized instruments, particularly portable UV-Vis units or basic quality control analyzers, often leverage indirect distribution channels, utilizing regional distributors, value-added resellers (VARs), and e-commerce platforms. The downstream segment involves the end-user R&D labs, quality control departments, and field operations, which rely heavily on efficient service contracts, timely consumables supply (cuvettes, calibration standards), and specialized training. The transition to cloud-based data management and subscription models for software access is increasingly influencing the downstream service relationship, focusing on long-term customer retention rather than solely on initial instrument sale profitability.

Optical Spectrometers Market Potential Customers

The potential customer base for the Optical Spectrometers Market is exceptionally broad, spanning nearly all industrial and research sectors that require precise quantitative and qualitative analysis of materials. The primary and most lucrative customer segment remains the Life Sciences industry, including major pharmaceutical companies, specialized Contract Research Organizations (CROs), and biotechnology firms. These entities utilize spectrometers throughout the entire drug lifecycle, from initial compound screening and formulation development to final product quality control and stability testing, demanding instruments with high resolution and excellent linearity.

Another significant customer segment includes chemical and petrochemical manufacturers, who rely on process analytical technology (PAT) utilizing spectrometers (especially NIR and Raman) for real-time monitoring and optimization of continuous chemical reactions, ensuring product consistency and process safety. Academic institutions and government research labs constitute a stable, foundational customer group, frequently purchasing cutting-edge instruments for fundamental research in physics, chemistry, and environmental science, often driven by government grant funding cycles. Emerging customers include the specialized fields of precision agriculture, where handheld spectrometers are used for soil and crop health analysis, and the electronics sector, where they are critical for characterizing thin films and semiconductor materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.56 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Agilent Technologies, Shimadzu Corporation, Hitachi High-Tech Corporation, PerkinElmer, Inc., Danaher Corporation (SCIEX), Bruker Corporation, HORIBA, Ltd., JEOL Ltd., Ocean Insight, StellarNet, Inc., B&W Tek (Metrohm Group), GBC Scientific Equipment, BaySpec, Inc., Oxford Instruments, FOSS Analytical, Analytik Jena (Endress+Hauser), Teledyne Technologies, JASCO Corporation, Rigaku Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optical Spectrometers Market Key Technology Landscape

The technological landscape of the Optical Spectrometers Market is defined by innovation aimed at enhancing sensitivity, reducing physical size, and improving data handling capacity. A pivotal trend is the move toward advanced detector technologies, shifting from traditional photodetectors to high-performance, low-noise detectors such as InGaAs (Indium Gallium Arsenide) for Near-Infrared (NIR) applications and highly sensitive Electron Multiplying CCDs (EMCCDs) and Scientific CMOS (sCMOS) sensors for low-light level detection, which dramatically improves the limits of detection, particularly crucial in trace analysis and complex biological samples. Furthermore, integrated photonics, utilizing micro-electro-mechanical systems (MEMS) technology, is a key enabler for miniaturizing components like gratings and light sources, directly facilitating the development of the rapidly expanding handheld spectrometer segment, offering laboratory-grade performance in a portable format.

Another major technological development focuses on spectroscopic system optimization through computational enhancements. Chemometrics, the application of statistical methods to chemical data, is now deeply integrated into the operating software of modern spectrometers. This allows for complex multivariate analysis, such as Principal Component Analysis (PCA) and Partial Least Squares (PLS), enabling users to extract meaningful data from highly overlapped spectral features, crucial for quality control in complex matrices like polymer blends or food products. Manufacturers are also heavily investing in improving light source stability and efficiency, leveraging high-intensity LEDs, quantum cascade lasers (QCLs), and advanced fiber optics to maintain signal quality while reducing power consumption and instrument footprint.

The future technology roadmap points toward further integration and connectivity. The rise of sophisticated Internet of Things (IoT) platforms allows for remote diagnostics, centralized data collection, and real-time monitoring of geographically dispersed instruments, supporting decentralized testing models. This connectivity, combined with edge computing capabilities, ensures that rapid data processing and decision-making can occur directly at the point of analysis, minimizing latency and maximizing operational efficiency, especially vital for Process Analytical Technology (PAT) implementations in continuous manufacturing environments. Spectroscopy is increasingly moving toward multi-modal integration, combining techniques like Raman and fluorescence spectroscopy into single instruments to provide more comprehensive material characterization from a single sample.

Regional Highlights

The regional dynamics of the Optical Spectrometers Market reflect differences in industrial maturity, R&D investment levels, and regulatory environments. North America, specifically the United States, commands a dominant share of the global market, primarily driven by substantial and consistent funding into life sciences research, strong presence of leading pharmaceutical and biotechnology companies, and the early adoption of advanced analytical instruments, including high-end Mass Spectrometry and advanced Raman systems. High regulatory compliance standards set by the FDA necessitate rigorous quality control, ensuring sustained demand for high-precision, validated spectroscopic equipment across manufacturing and research sectors. Furthermore, significant governmental and private sector investments in defense, homeland security, and environmental protection further solidify North America's leadership position.

Europe represents another mature and technologically advanced market, characterized by stringent environmental monitoring regulations (e.g., REACH) and a strong automotive and chemical manufacturing base, particularly in Germany and France. The market growth in Europe is steady, supported by collaborative academic and industrial research programs and a focused transition toward green technologies, increasing the demand for spectrometers used in material recycling and hazardous substance analysis. The introduction of advanced pharmaceutical manufacturing techniques requires sophisticated Process Analytical Technology (PAT), which heavily relies on integrated spectroscopic solutions, maintaining Europe's role as a major consumption hub for high-value benchtop and integrated systems.

The Asia Pacific (APAC) region is projected to be the engine of future market expansion, exhibiting the highest growth rate during the forecast period. This rapid growth is attributable to massive industrial expansion, increasing foreign direct investment in manufacturing and healthcare sectors, particularly in China, Japan, South Korea, and India. Rising concerns over food security and environmental pollution in densely populated urban and industrial areas necessitate significant investment in analytical infrastructure. Local governments are rapidly upgrading testing and monitoring capabilities, driving demand for cost-effective, high-throughput instruments. While price sensitivity remains higher than in Western markets, the sheer volume of industrial activity and expanding middle-class consumption drives considerable market volume.

- North America: Market leader, driven by robust biotech R&D, strict FDA regulations, and high defense sector demand. Focus on high-resolution MS and advanced hyphenated techniques.

- Europe: Stable growth fueled by stringent environmental directives (REACH) and high adoption rates in academic research and automotive manufacturing. Emphasis on FTIR and integrated PAT solutions.

- Asia Pacific (APAC): Fastest growing region, propelled by rapid industrialization, expansion of domestic pharmaceutical manufacturing, and increasing need for environmental and food safety testing infrastructure in emerging economies.

- Latin America (LATAM): Emerging market with fragmented adoption, primarily driven by mining/metallurgy and agricultural sectors, seeking cost-effective and portable analytical solutions.

- Middle East and Africa (MEA): Growth concentrated in petrochemicals and oil & gas analysis, along with increasing healthcare infrastructure development in wealthy Gulf Cooperation Council (GCC) states, requiring specialized laboratory equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optical Spectrometers Market.- Thermo Fisher Scientific

- Agilent Technologies

- Shimadzu Corporation

- Hitachi High-Tech Corporation

- PerkinElmer, Inc.

- Danaher Corporation (SCIEX)

- Bruker Corporation

- HORIBA, Ltd.

- JEOL Ltd.

- Ocean Insight

- StellarNet, Inc.

- B&W Tek (Metrohm Group)

- GBC Scientific Equipment

- BaySpec, Inc.

- Oxford Instruments

- FOSS Analytical

- Analytik Jena (Endress+Hauser)

- Teledyne Technologies

- JASCO Corporation

- Rigaku Corporation

Frequently Asked Questions

Analyze common user questions about the Optical Spectrometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Optical Spectrometers Market?

The primary driver is the increasing necessity for stringent quality control (QC) and product safety measures across critical industries like pharmaceuticals and food and beverage. Regulatory mandates demanding detailed material analysis and rapid, non-destructive testing are compelling industries globally to upgrade their analytical infrastructure using advanced spectroscopy.

How is miniaturization impacting the adoption of optical spectrometers?

Miniaturization is significantly expanding market access by enabling the development of portable and handheld spectrometers. This allows for analytical capabilities to move outside centralized laboratories to field applications, reducing analysis time and supporting real-time process monitoring and point-of-care diagnostics, thereby lowering operational costs and improving decision speed.

Which end-user segment contributes the most revenue to the market?

The Life Sciences and Biotechnology segment, including pharmaceutical companies and clinical diagnostics labs, is the highest revenue contributor. This dominance is due to continuous investment in drug discovery, development, and the mandatory use of high-precision spectrometers for comprehensive quality assurance testing required by global regulatory bodies.

What role does Artificial Intelligence play in modern spectroscopy?

AI, specifically machine learning and chemometrics, is utilized to process complex spectral data, significantly enhancing interpretation accuracy, automating multivariate analysis of mixtures, and improving baseline correction. AI integration reduces operator subjectivity and enables sophisticated predictive modeling for material characterization and process optimization.

Which spectroscopic technique is experiencing the fastest technological advancement?

Raman Spectroscopy is experiencing rapid technological advancement, particularly in surface-enhanced Raman scattering (SERS) and the development of integrated, compact Raman systems. These innovations are enhancing sensitivity for trace analysis and making the technique highly effective for non-destructive analysis and real-time quality control in manufacturing environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager