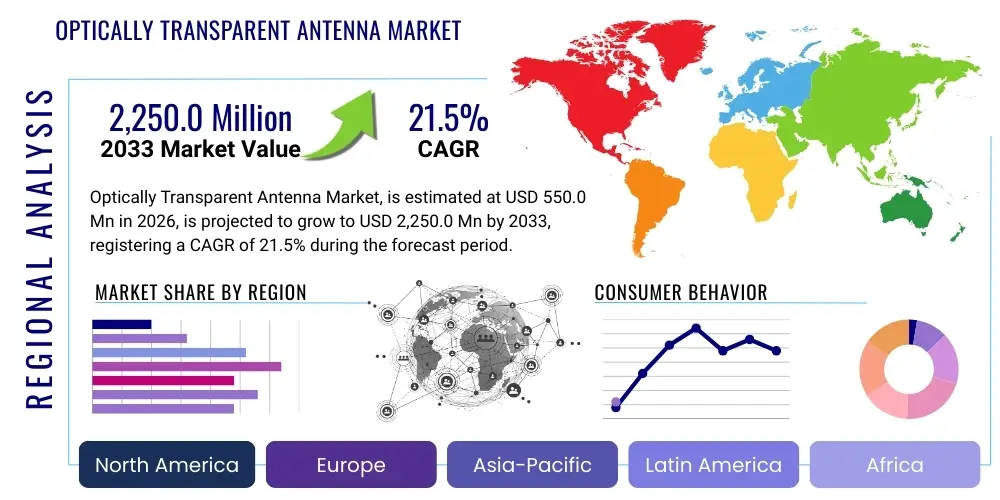

Optically Transparent Antenna Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438128 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Optically Transparent Antenna Market Size

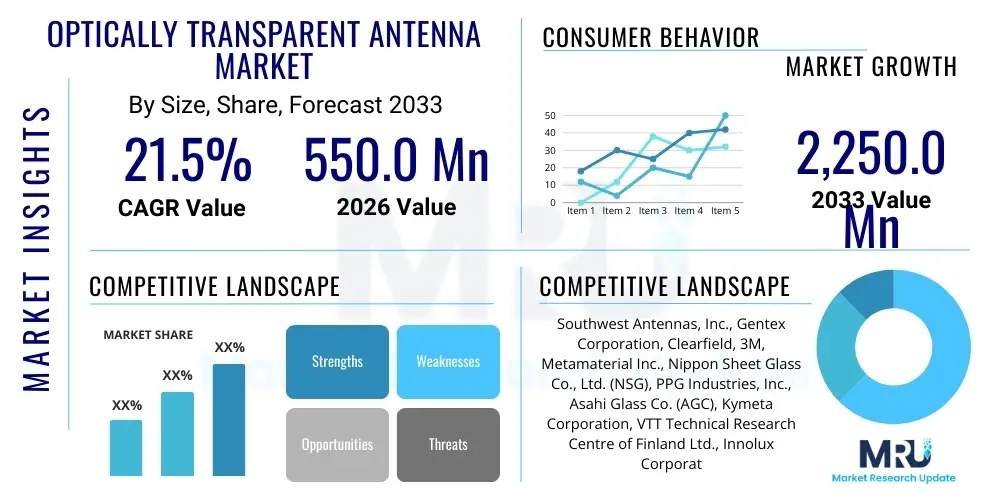

The Optically Transparent Antenna Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 550.0 Million in 2026 and is projected to reach USD 2,250.0 Million by the end of the forecast period in 2033.

Optically Transparent Antenna Market introduction

The Optically Transparent Antenna (OTA) Market encompasses advanced components designed to transmit and receive radio frequency (RF) signals while maintaining high levels of optical transparency. These antennas leverage specialized transparent conductive materials, such as silver nanowires, carbon nanotubes (CNTs), and highly doped semiconductors (like Indium Tin Oxide, ITO), deposited on clear substrates. This technological advancement allows for seamless integration into surfaces like windows, displays, and vehicle windshields without obstructing visibility, thereby revolutionizing product design in consumer electronics, automotive, and architecture.

Major applications of OTAs span across smart consumer devices, where they enable bezel-less displays and integrated connectivity; the automotive sector, facilitating vehicle-to-everything (V2X) communications and sophisticated infotainment systems embedded within the glass; and infrastructural uses, including smart windows and building integrated photovoltaics (BIPV). The primary benefit is the convergence of high-performance wireless functionality with aesthetic and ergonomic demands for invisibility. This integration minimizes visual clutter and maximizes available space for connectivity solutions, especially critical in dense urban environments and miniaturized electronics.

Key driving factors accelerating market adoption include the ubiquitous deployment of 5G and 6G networks requiring dense antenna placements, the escalating demand for connected vehicles (autonomous driving features rely heavily on seamless connectivity through OTAs), and the rapid proliferation of the Internet of Things (IoT), necessitating discreet yet powerful communication nodes. Furthermore, advancements in materials science, particularly the development of high-transparency, low-resistivity conductive films that offer superior RF performance compared to traditional ITO, are overcoming past limitations related to efficiency and cost, making OTAs a viable solution for mass-market integration.

Optically Transparent Antenna Market Executive Summary

The Optically Transparent Antenna Market is experiencing robust growth driven primarily by structural shifts in the consumer electronics and automotive industries. Business trends indicate a strong focus on miniaturization and aesthetic design, compelling manufacturers to substitute traditional opaque antennas with transparent alternatives. Strategic partnerships between material science companies and Tier 1 automotive suppliers are vital for developing robust, weatherproof, and thermally stable OTAs suitable for integration into vehicle exteriors and glass surfaces. Furthermore, the push towards utilizing higher frequency bands (mmWave) in 5G is increasing the need for highly efficient, small-form-factor antennas, perfectly aligning with the core capabilities of transparent designs. Investment is heavily concentrated in developing non-ITO transparent conductors that offer superior flexibility and lower sheet resistance, such as silver nanowires (AgNWs) and metal mesh films, to enhance performance and reduce manufacturing complexity.

Regional trends highlight North America and Asia Pacific as the dominant growth regions. North America leads in research and development and early adoption, driven by stringent safety regulations promoting V2X communication in the automotive sector and a massive presence of major consumer electronics OEMs. The Asia Pacific region, particularly China, South Korea, and Japan, is crucial due to its high-volume manufacturing capabilities for smartphones and displays, coupled with aggressive 5G infrastructure rollout. These regions are competitive hubs for both technology innovation and high-volume commercialization, fostering rapid price declines and standardization necessary for broader market penetration. Europe is also showing strong adoption, particularly in high-end automotive manufacturing and smart building applications.

Segmentation trends reveal that the Indium Tin Oxide (ITO) segment, while mature, is rapidly losing market share to advanced materials like Silver Nanowires (AgNWs) and Metal Mesh, which provide better trade-offs between optical transparency and RF conductivity. Application-wise, consumer electronics currently hold the largest share, driven by smartphones and augmented reality (AR) devices. However, the automotive segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the increasing adoption of connected, autonomous, shared, and electric (CASE) vehicle technologies. The OTA integration in automotive glass for GPS, Wi-Fi, 5G connectivity, and potentially LIDAR/RADAR sensor communication is transforming vehicle architecture, positioning the automotive sector as the primary growth engine through 2033.

AI Impact Analysis on Optically Transparent Antenna Market

User queries regarding AI's influence on the Optically Transparent Antenna Market primarily revolve around optimizing antenna design, enhancing real-time performance management, and facilitating autonomous driving integration. Users frequently ask if AI can accelerate the modeling of new transparent materials, how machine learning can compensate for signal degradation inherent in high-transparency films, and the role of AI in managing the complex network of OTAs integrated across a smart surface or a connected vehicle. The key themes summarized from user concerns focus on AI’s ability to refine the trade-off between transparency and efficiency, predict material failure under stress, and dynamically adjust beamforming strategies in dense OTA arrays to minimize interference and maximize throughput in real-world, highly mobile environments.

AI’s influence is profound, primarily streamlining the complex design cycle. Traditional antenna design relies on iterative simulation and fabrication, a process that is significantly complicated when balancing electromagnetic performance with optical properties. Machine learning algorithms are now being used to rapidly explore the vast parameter space of transparent conductive materials, predicting the optimal geometries, thicknesses, and deposition patterns required to meet stringent multi-criteria requirements for both RF efficiency and light transmission. This computational approach drastically cuts down R&D time, enabling faster commercialization of novel, high-performing transparent antennas tailored for specific frequency bands, such as 5G mmWave applications, which require extremely precise geometrical tolerances.

In operational settings, particularly within the autonomous vehicle ecosystem, AI plays a critical role in optimizing the performance of integrated OTA arrays. As vehicles move, the network environment changes rapidly, demanding dynamic signal management. AI-driven systems utilize real-time environmental data (e.g., proximity to towers, weather conditions, obstruction data) to adjust beamforming and signal processing, ensuring robust and continuous connectivity for V2X communications and sensor data transfer. Furthermore, predictive maintenance using ML models can analyze minor degradations in antenna performance or material characteristics over time, allowing for proactive component replacement, thereby enhancing the long-term reliability and safety of connected systems where OTAs are mission-critical components.

- AI optimizes transparent material selection and antenna geometry through predictive modeling, balancing optical clarity and RF efficiency.

- Machine learning algorithms enhance beamforming and array management in dense OTA networks, crucial for 5G and V2X stability.

- AI accelerates R&D by simulating complex electromagnetic and optical interactions, reducing prototyping costs and time-to-market.

- Predictive maintenance driven by AI monitors performance degradation and material aging in integrated vehicle antennas.

- AI enables dynamic compensation for signal loss introduced by transparent conductive films, maximizing data throughput and reliability.

DRO & Impact Forces Of Optically Transparent Antenna Market

The Optically Transparent Antenna Market is characterized by a strong interplay of technological drivers and material science restraints, balanced by immense growth opportunities in emerging connectivity ecosystems. The primary driver is the pervasive demand for visually unobtrusive connectivity solutions across consumer and industrial applications, directly supported by global mandates for advanced 5G/6G infrastructure deployment. However, the market faces significant material and performance constraints, primarily the fundamental trade-off between achieving high optical transparency (high visible light transmission, VLT) and achieving low electrical resistance necessary for efficient RF performance. Overcoming this trade-off requires continuous innovation in advanced transparent conductors, a process that often entails high manufacturing costs and scalability challenges, impacting widespread adoption in cost-sensitive segments. The competitive intensity is moderate, driven by specialized material suppliers and established RF component manufacturers vying for integration into high-value platforms like premium vehicles and high-end consumer devices.

The market impact is significantly amplified by the shift toward integrated smart surfaces, moving OTAs from niche components to fundamental elements of system design. Opportunities abound in new segments, particularly in infrastructure (smart cities, solar panels) and specialized defense applications, where signature reduction and stealth are prioritized. The regulatory environment, favoring autonomous driving safety standards and V2X mandates, acts as a powerful external force compelling automotive integration. Conversely, a major restraining force is the susceptibility of some transparent materials (like ITO) to mechanical stress and environmental degradation, requiring robust encapsulation and advanced deposition techniques which further add to the production complexity and capital expenditure requirements for mass production. These forces collectively dictate the pace of market penetration, favoring materials that can offer durability and scalability.

The core innovation trajectory focuses on mitigating the inherent signal loss and improving impedance matching across various substrates. Impact forces center around technological convergence—the synergy between advancements in flexible electronics, advanced deposition techniques (like roll-to-roll processing for AgNWs), and high-frequency RF engineering. Successful market players are those who can achieve large-area uniformity and high yield rates while maintaining a near-invisible profile. The necessity for these antennas to operate effectively in complex electromagnetic environments, such as densely packed urban areas, means performance validation and compliance with stringent industry standards act as secondary market restraints that innovators must continuously address to ensure market viability and trust among system integrators.

Segmentation Analysis

The Optically Transparent Antenna Market is systematically segmented based on the type of conductive material used, the integration method, the specific frequency of operation, and its diverse application across major industries. The material segmentation is critical as it directly impacts both the optical transparency and the resulting electrical performance, defining suitability for different end-use environments. Current dominant materials, such as Silver Nanowires and Indium Tin Oxide, determine the cost structure and physical characteristics (e.g., flexibility, durability). Application segmentation, particularly separating consumer electronics from high-value automotive and infrastructural uses, highlights divergent growth trajectories and demands for reliability and longevity, driving differentiated product development strategies across the market.

Further segmentation by integration method distinguishes between surface integration (used primarily for displays and simple windows) and laminated integration (critical for vehicle windshields and structural glass requiring enhanced protection and durability). Frequency band segmentation, ranging from lower frequency bands (sub-6 GHz) common in Wi-Fi and legacy cellular systems to the high-frequency mmWave bands essential for next-generation 5G connectivity, influences the geometric design and material requirements. The consumer electronics sector remains the volume leader, utilizing OTAs for smartphones, tablets, and AR/VR headsets where aesthetic design is paramount, while the automotive sector, demanding high reliability for V2X communication and autonomous systems, provides the highest value growth opportunity due to strict performance mandates.

- By Material:

- Indium Tin Oxide (ITO)

- Silver Nanowires (AgNWs)

- Metal Mesh

- Carbon Nanotubes (CNTs)

- Conductive Polymers

- By Integration Type:

- On-Glass Integration (Laminated)

- On-Surface Integration (Film/Coating)

- By Frequency Band:

- Sub-6 GHz

- mmWave (Above 24 GHz)

- Dual/Multi-Band Antennas

- By Application:

- Consumer Electronics (Smartphones, Tablets, AR/VR)

- Automotive (V2X, GPS, Infotainment)

- Aerospace and Defense

- Smart Infrastructure and Buildings (Smart Windows)

- Industrial IoT Devices

Value Chain Analysis For Optically Transparent Antenna Market

The value chain for the Optically Transparent Antenna Market begins with the upstream procurement and synthesis of specialized raw materials, primarily focusing on high-purity transparent conductive materials such as silver ink precursors for nanowire synthesis, specialized sputtering targets for ITO deposition, and high-quality optical substrates (glass or polymers). This highly specialized upstream segment is dominated by material science companies and chemical producers who ensure the consistent quality, high conductivity, and optical clarity required for subsequent manufacturing stages. Control over patented transparent conductor technologies grants significant competitive advantage at this stage, setting the performance baseline for the final product. Material cost volatility, particularly for silver and rare earth elements used in ITO, poses a consistent risk in this foundational segment.

The midstream involves complex manufacturing processes, including precision deposition techniques like sputtering, wet coating (for AgNWs/CNTs), laser patterning, and etching, transforming the raw materials into functional antenna films or integrated substrates. Specialized antenna manufacturers and flexible electronics fabricators handle the design, integration, and testing of the antenna structure, ensuring compliance with strict RF and optical performance specifications. The integration complexity is often high, requiring cleanroom environments and expertise in handling large-area, high-precision film deposition. Direct distribution occurs when these finished antenna components are sold directly to Original Equipment Manufacturers (OEMs), such as smartphone or automotive Tier 1 suppliers, who embed the OTA into their final product assembly, necessitating stringent quality control and customized solutions.

The downstream market is driven by end-product manufacturers, including major consumer electronics brands, global automotive companies, and smart infrastructure developers. Distribution channels are predominantly indirect, flowing from specialized antenna component manufacturers through system integrators and Tier 1 suppliers before reaching the final product assembly line. However, for specialized, high-value applications like aerospace or defense, direct distribution channels and collaborative R&D contracts are common. The effectiveness of the overall supply chain relies heavily on the collaboration between material innovators and system integrators to ensure seamless physical and electronic integration, moving beyond component supply to full solution provision where antenna performance is tested within the end-use environment.

Optically Transparent Antenna Market Potential Customers

Potential customers for Optically Transparent Antennas are diverse, spanning multiple high-tech industries that prioritize aesthetic integration, space conservation, and enhanced connectivity. The primary buyers are major global consumer electronics manufacturers (OEMs) who seek to incorporate seamless connectivity into their latest generation of smartphones, tablets, and wearable technologies, aiming for maximal screen-to-body ratios and advanced AR/VR capabilities. These customers demand high-volume production capabilities, stringent quality checks, and cost-effective solutions to maintain competitive pricing in the mass market. The requirement for OTAs here is often for dual-band or multi-band operation in conjunction with highly flexible substrates to conform to unique device geometries.

Another major segment comprises automotive Tier 1 suppliers and vehicle manufacturers. These buyers integrate OTAs into windshields, side windows, and sunroofs to facilitate crucial functions like GPS, dedicated short-range communications (DSRC), V2X connectivity, and 5G mobile hotspots required for autonomous driving and sophisticated infotainment systems. Automotive buyers prioritize durability, resistance to extreme temperatures and UV exposure, adherence to safety standards, and long-term operational reliability, often requiring integrated manufacturing solutions that match the vehicle's production cycle and structural requirements. The shift towards electric and highly connected vehicles intensifies the purchasing power of this customer base.

Furthermore, smart infrastructure developers, particularly those focused on commercial and residential building technology, represent a significant growth area. These customers purchase OTAs for integration into smart windows and façade materials, enabling localized IoT network hubs and enhancing cellular coverage within energy-efficient buildings. Defense and aerospace contractors also constitute high-value, albeit lower volume, buyers, seeking OTAs for stealth applications, drone communication, and advanced sensor integration where maintaining visual clarity or minimizing radar cross-section is paramount. These specialized buyers demand custom solutions, exceptionally high performance metrics, and adherence to rigorous military specifications, often leading to proprietary technology development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Million |

| Market Forecast in 2033 | USD 2,250.0 Million |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Southwest Antennas, Inc., Gentex Corporation, Clearfield, 3M, Metamaterial Inc., Nippon Sheet Glass Co., Ltd. (NSG), PPG Industries, Inc., Asahi Glass Co. (AGC), Kymeta Corporation, VTT Technical Research Centre of Finland Ltd., Innolux Corporation, Gauzy Ltd., Saint-Gobain, TAIYO YUDEN CO., LTD., Corning Incorporated, E Ink Holdings, Inc., CIMA NanoTech, TDK Corporation, Murata Manufacturing Co., Ltd., Sumitomo Metal Mining Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optically Transparent Antenna Market Key Technology Landscape

The technological landscape of the Optically Transparent Antenna Market is fundamentally driven by advancements in materials science and thin-film deposition techniques, aiming to maximize conductivity while minimizing light scattering and absorption. Indium Tin Oxide (ITO), historically the dominant transparent conductor, faces limitations due to its relatively high resistivity and mechanical brittleness, particularly when applied to flexible substrates or high-frequency antenna designs (like mmWave, which require lower loss tangents). Consequently, research has shifted significantly towards next-generation materials like Silver Nanowires (AgNWs) and Copper/Silver Metal Mesh structures. AgNWs offer superior conductivity and flexibility compared to ITO, making them ideal for integration into curved surfaces and flexible displays, while Metal Mesh utilizes photolithography or etching to create highly conductive, nearly invisible metallic grid patterns, optimizing performance for large-area applications such as smart windows and automotive glass.

A crucial technological area is the development of optimized patterning and integration methodologies. Techniques such as roll-to-roll processing for flexible substrates coated with AgNWs are essential for achieving high throughput and reducing manufacturing costs, facilitating mass market adoption in consumer electronics. Furthermore, advanced laser ablation and printing technologies are being utilized to create precise antenna patterns on these transparent conductors, ensuring accurate impedance matching and required radiation characteristics specific to cellular, Wi-Fi, or GPS bands. The integration method also involves sophisticated lamination processes, especially in the automotive sector, where OTAs must be protected within the vehicle glass layers, requiring materials that withstand high-pressure, high-temperature lamination cycles without performance degradation or discoloration.

The emerging landscape also includes innovations in metamaterials and conductive polymers. Metamaterial-based antenna designs, which rely on sub-wavelength structures to control electromagnetic waves, offer potential for highly miniaturized, efficient, and broadband transparent antennas. Although still nascent, conductive polymers and carbon nanotube (CNT) films are being explored as cost-effective, durable alternatives to metallic conductors, particularly in applications where some trade-off in conductivity for increased flexibility and environmental stability is acceptable. Overall, the technology trajectory is focused on overcoming the inherent physical limits of transparency versus conductivity, enabling transparent antennas to handle the high data rates and complex multi-band requirements of future 5G Advanced and 6G communications.

Regional Highlights

- North America: This region is a primary innovation hub and early adopter, driven by aggressive deployment of 5G mmWave technology and stringent regulatory pushes for V2X safety features in the automotive sector. Major technology companies and defense contractors are heavily investing in OTA R&D for applications in aerospace, autonomous vehicles, and high-end consumer electronics. The presence of leading R&D institutions and a robust venture capital ecosystem supports the growth of specialized material startups focusing on AgNWs and Metal Mesh technologies.

- Asia Pacific (APAC): APAC represents the largest market by volume, fueled by its dominance in global manufacturing for consumer electronics (smartphones, displays) and rapid infrastructure development, particularly in China, South Korea, and Japan. Governments are prioritizing 5G rollout, creating immense demand for discreet, high-performance antenna solutions. Competitive manufacturing environments lead to faster technology commercialization and price optimization, making APAC a critical region for both production and consumption of OTAs.

- Europe: The European market is characterized by high adoption in the luxury and high-performance automotive sector, driven by key German manufacturers and strict environmental standards promoting smart building technologies. Focus areas include advanced integration techniques for smart windows and solar facades, and collaborative research projects aimed at developing durable, integrated OTAs compliant with rigorous European safety and quality certifications, maintaining a steady, high-value growth rate.

- Latin America (LATAM): Growth in LATAM is currently moderate but accelerating, primarily driven by increasing penetration of connected devices and improving regional telecommunication infrastructure. The market demand centers around cost-effective OTA solutions for smartphones and entry-level connected vehicles. Investment is generally focused on integrating established technologies like ITO and cost-optimized AgNW films.

- Middle East and Africa (MEA): MEA is an emerging market with potential driven by smart city initiatives in the Gulf Cooperation Council (GCC) countries and ongoing urbanization efforts. High-value projects related to luxury infrastructure and defense applications are key demand drivers. The focus is on large-area transparent antennas for architectural applications and high-security communication systems, requiring durable, high-performance materials suitable for harsh environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optically Transparent Antenna Market.- Southwest Antennas, Inc.

- Gentex Corporation

- Clearfield

- 3M

- Metamaterial Inc.

- Nippon Sheet Glass Co., Ltd. (NSG)

- PPG Industries, Inc.

- Asahi Glass Co. (AGC)

- Kymeta Corporation

- VTT Technical Research Centre of Finland Ltd.

- Innolux Corporation

- Gauzy Ltd.

- Saint-Gobain

- TAIYO YUDEN CO., LTD.

- Corning Incorporated

- E Ink Holdings, Inc.

- CIMA NanoTech

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Rogers Corporation

- Avery Dennison Corporation

Frequently Asked Questions

Analyze common user questions about the Optically Transparent Antenna market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary transparent conductive materials used in Optically Transparent Antennas (OTAs)?

The primary materials are Silver Nanowires (AgNWs), which offer high flexibility and conductivity; Metal Mesh, used for large area applications; and Indium Tin Oxide (ITO), which is cost-effective but generally less conductive for high-frequency applications.

How does the integration of OTAs impact vehicle safety and V2X communication?

OTAs enable seamless V2X (Vehicle-to-Everything) communication by providing reliable, embedded connectivity through vehicle glass without obstructing the driver's view, crucial for enhanced safety systems and autonomous driving functionalities.

What major challenge limits the widespread adoption of transparent antennas?

The fundamental challenge is the trade-off between maximizing optical transparency (visibility) and minimizing electrical resistance (conductivity), which directly affects the RF efficiency and overall antenna performance, especially at higher frequencies like mmWave.

Which application segment is projected to show the fastest market growth?

The Automotive segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by the accelerating demand for connected, electric, and autonomous vehicles requiring integrated 5G and V2X connectivity solutions embedded in vehicle glass.

Are Optically Transparent Antennas compatible with 5G mmWave technology?

Yes, while challenging, advanced OTA designs utilizing low-loss materials like optimized Metal Mesh or high-density Silver Nanowires are being developed specifically to meet the high precision and performance requirements necessary for 5G mmWave spectrum bands.

The Optically Transparent Antenna (OTA) Market is experiencing a rapid technological evolution, shifting the paradigm of wireless communication integration. The market's foundational strength lies in its ability to address the pervasive need for connectivity without visual interference, making it indispensable for modern design aesthetics in consumer devices and sophisticated functionality in connected vehicles. The complexity introduced by balancing optical clarity and high RF performance necessitates continuous material innovation, with Silver Nanowires and Metal Mesh technologies rapidly displacing traditional Indium Tin Oxide (ITO). This strategic transition is crucial for meeting the demands of high-frequency applications, particularly the widespread rollout of 5G and future 6G networks, which require densely packed, high-efficiency antenna arrays that are visually unobtrusive.

Geographically, market dynamics are bifurcated: North America leads in high-value R&D and specialized integration, particularly in aerospace and autonomous technology, while the Asia Pacific region dominates in volume manufacturing and mass consumer device integration. European growth remains robust, driven by the high-end automotive sector and stringent smart building mandates. The influence of Artificial Intelligence (AI) is becoming a critical accelerant, primarily by optimizing the intricate design process and enabling dynamic, real-time management of OTA arrays to ensure signal stability and robust beamforming in mobile and complex electromagnetic environments. This integration of AI supports the feasibility of deploying OTAs in mission-critical applications where reliability cannot be compromised, such as V2X communication necessary for autonomous driving safety protocols.

The core segments—by material, application, and frequency band—reflect highly differentiated market needs. While consumer electronics currently drive market volume, the automotive segment offers the highest growth potential, underpinned by global regulatory pushes and massive investment in CASE (Connected, Autonomous, Shared, Electric) vehicle architecture. The value chain underscores the importance of highly specialized material science companies upstream, whose innovations dictate the performance ceiling for the final product. Downstream, successful market penetration relies on strong strategic partnerships between antenna component manufacturers and Tier 1 system integrators, ensuring that these complex transparent components are seamlessly integrated and perform reliably under real-world operational stress, validating the market's trajectory towards ubiquitous, invisible connectivity solutions.

Market restraints, primarily centered around cost, scalability, and the technical challenge of achieving perfect conductivity and transparency simultaneously, necessitate continued high investment in research and advanced manufacturing equipment. Nevertheless, the compelling drivers—ubiquitous 5G connectivity, the rise of smart infrastructure, and the non-negotiable aesthetic demands of modern consumer technology—far outweigh these constraints. The long-term outlook for the Optically Transparent Antenna Market is exceptionally strong, positioning it as a foundational technology enabling the next generation of smart surfaces and integrated digital ecosystems across multiple high-growth industries globally. This ongoing technological maturation is poised to unlock vast potential applications previously constrained by the physical limitations of traditional, opaque antenna designs, driving substantial market value through 2033.

Further analysis of competitive positioning reveals that established materials companies are strategically acquiring or partnering with specialized transparent conductor innovators to gain a foothold in the high-growth segments like AgNWs and Metal Mesh. Patent portfolios concerning deposition uniformity and pattern accuracy are becoming vital competitive assets, particularly for automotive integration where large-area manufacturing precision is non-negotiable. Furthermore, market participants are increasingly focusing on developing multi-functional transparent films that not only act as antennas but also incorporate features like heating elements, UV filtering, or self-cleaning capabilities, offering enhanced value proposition to system integrators and strengthening market differentiation against commodity suppliers.

The future technology roadmap for OTAs is leaning heavily towards integrated photonics and advanced semiconductor processing to potentially overcome the limitations of current conductive films. Research into ultra-thin flexible glass substrates and next-generation transparent transistors could further reduce weight and increase the robustness of transparent antenna components, making them suitable for ultra-wearable technology and highly dynamic aerospace environments. Successful market penetration hinges on continuous improvement in deposition yield rates and reducing the unit cost of advanced transparent conductors, moving these technologies from premium components into standardized, cost-effective solutions capable of high-volume adoption in mid-range consumer products and entry-level connected vehicles, ensuring the forecasted exponential growth is realized across all geographical regions.

Regulatory harmonization is another key factor influencing growth, especially regarding wireless spectrum utilization and mandated connectivity standards for vehicular safety. As global standards bodies define requirements for V2X reliability and 5G network performance, manufacturers of transparent antennas must adhere to these evolving specifications, often requiring significant testing and certification phases. This regulatory environment acts as a quality filter, favoring established players with robust testing capabilities and deep integration expertise. The emphasis on sustainability also favors OTAs, as their seamless integration reduces the need for external, often plastic-based, antenna housings, aligning with broader industry goals for reduced material usage and cleaner design aesthetics.

In summary, the Optically Transparent Antenna Market is characterized by a high degree of technical sophistication, rapid innovation in material science, and strong, pervasive demand across the automotive and consumer electronics sectors. The convergence of 5G deployment, AI-driven design optimization, and the irreversible trend towards aesthetically pleasing, integrated connectivity ensures that OTAs will be a foundational technology supporting the next generation of smart, connected devices and infrastructure. Strategic investments in advanced conductive materials and scalable manufacturing processes will be the determining factors for market leadership over the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager