Optically Transparent Polyimide Films Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435126 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Optically Transparent Polyimide Films Market Size

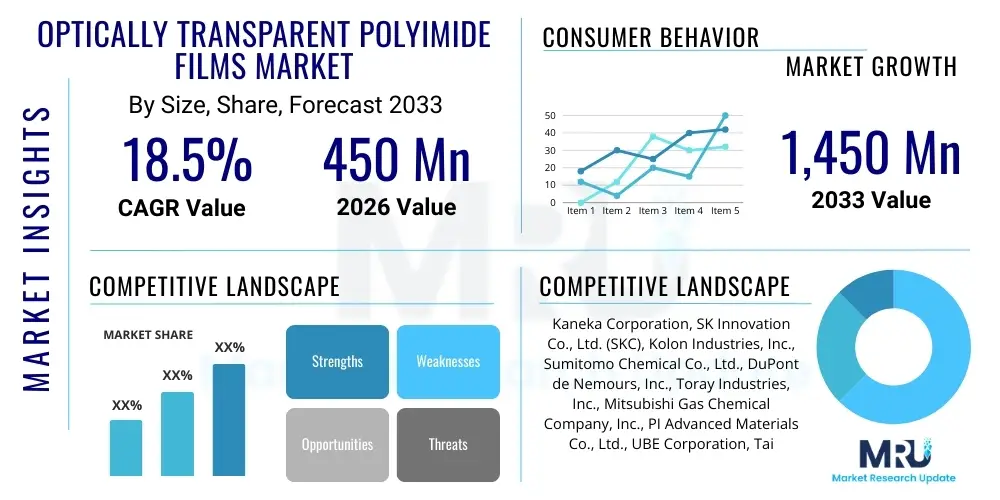

The Optically Transparent Polyimide Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,450 Million by the end of the forecast period in 2033.

Optically Transparent Polyimide Films Market introduction

Optically Transparent Polyimide (OTPI) Films represent a cutting-edge class of high-performance polymer materials critical for next-generation flexible electronics and display technologies. Traditional polyimide films are known for their exceptional thermal stability, mechanical strength, and excellent dielectric properties, characteristics that make them indispensable in harsh operating environments. However, their inherent deep yellow or amber coloration due to charge-transfer complex (CTC) formation between polymer chains limits their use in applications requiring high optical clarity. OTPI films overcome this limitation through advanced molecular engineering, primarily involving fluorination or structural modification of the polyimide backbone, resulting in films that combine traditional polyimide strength with superior transparency (often above 85% transmittance in the visible spectrum).

The primary applications of these highly specialized films span across foldable smartphones, flexible AMOLED (Active-Matrix Organic Light-Emitting Diode) displays, flexible printed circuit boards (FPCBs), high-efficiency solar cells, and transparent conductive films. These materials serve as substrates or coverlays, replacing traditional, heavier, and brittle materials like glass. The unique combination of properties—thermal resistance exceeding 300°C, low coefficient of thermal expansion (CTE), and superior mechanical flexibility—positions OTPI films as essential enablers for the miniaturization and flexibility trend sweeping the consumer electronics and automotive sectors. Their ability to withstand high temperatures required for thin-film transistor (TFT) processing is particularly crucial for display fabrication.

The market growth is overwhelmingly driven by the escalating global demand for flexible and foldable electronic devices. As major technology firms invest heavily in flexible display infrastructure, the dependency on high-quality, durable, and transparent polymer substrates intensifies. Furthermore, advancements in 5G technology and the proliferation of the Internet of Things (IoT) are creating new avenues for OTPI films in smart wearables and flexible sensor technology, where durability and lightweight structure are paramount. The shift from rigid to flexible electronics across various industrial and consumer applications solidifies the long-term positive trajectory of the optically transparent polyimide films market.

Optically Transparent Polyimide Films Market Executive Summary

The global Optically Transparent Polyimide Films market is undergoing rapid expansion, primarily fueled by breakthrough innovations in flexible display technology and escalating investment in high-density flexible circuits. Market dynamics are characterized by intense competition among established chemical manufacturers and emerging specialty polymer producers, focusing on optimizing film properties such as scratch resistance, haze minimization, and cost-efficient production methods like continuous roll-to-roll processing. Business trends show a strategic shift toward developing fully colorless polyimides and leveraging hybrid materials (e.g., incorporating inorganic nanoparticles) to further enhance mechanical and barrier performance, positioning the material as a premium alternative to conventional flexible substrates.

Regionally, Asia Pacific (APAC) dominates the market, largely due to the concentration of major display panel manufacturing hubs and consumer electronics giants in South Korea, China, and Japan. These countries are the primary consumers and innovators in foldable device technology, driving significant demand for OTPI substrates. North America and Europe, while smaller in volume, represent critical markets for high-value applications, particularly in advanced aerospace, medical devices, and high-reliability automotive components, emphasizing stringent quality control and specialized material formulations. Future growth is anticipated to be most robust in emerging APAC economies as local manufacturing capabilities scale up.

Segment-wise, the Flexible Display segment holds the largest market share and is expected to exhibit the highest CAGR throughout the forecast period, directly correlating with the penetration rate of foldable and rollable devices. Based on film type, the colorless polyimide (CPI) film segment is rapidly gaining traction over traditional transparent PI films, driven by consumer preference for display materials with true color fidelity and lower haze. Key players are heavily focused on horizontal integration, securing raw material supply chains (specialty monomers like 6FDA or BDAF) and vertically integrating into lamination and coating services to capture greater value across the sophisticated manufacturing process.

AI Impact Analysis on Optically Transparent Polyimide Films Market

User queries regarding the impact of Artificial Intelligence on the Optically Transparent Polyimide Films market frequently revolve around how AI can accelerate materials discovery, optimize complex manufacturing processes, and improve quality control in high-volume production. Key themes include the application of Materials Informatics to predict novel polymer structures that yield superior optical transparency and thermal performance without compromising mechanical integrity. Users are also concerned with how machine learning (ML) algorithms can be deployed to manage the critical variables in the solution casting and curing stages of film production, aiming to reduce defects, minimize haze, and achieve greater batch-to-batch consistency. Furthermore, questions address the potential of AI-driven supply chain management to anticipate monomer shortages and optimize inventory, mitigating risks associated with specialized chemical precursors.

The primary influence of AI lies in its ability to handle the multivariate complexity inherent in advanced polymer synthesis and processing. Developing an OTPI film involves balancing factors such as molecular weight, chemical composition, curing temperature profiles, and solvent evaporation rates—all of which drastically affect the final film quality, including transparency and coefficient of thermal expansion (CTE). AI algorithms, particularly deep learning models, can analyze vast datasets generated from simulation and experimental runs (e.g., spectroscopic data, thermal analysis data) far faster than traditional methodologies, identifying optimal synthesis pathways and processing windows. This significantly reduces the R&D cycle time needed to commercialize next-generation colorless polyimides.

In manufacturing, AI and machine learning are revolutionizing quality assurance. High-speed, high-resolution visual inspection systems powered by computer vision are being implemented to detect minute flaws, such as micro-scratches, pinholes, or localized haze variations, in continuous roll-to-roll production lines. ML models trained on defect libraries ensure near-perfect quality control necessary for display applications. Moreover, predictive maintenance driven by AI minimizes costly downtime in high-temperature processing equipment, ensuring continuous operation, which is crucial for maintaining competitive manufacturing costs in this capital-intensive sector.

- AI-driven Materials Informatics accelerates the discovery and optimization of novel polyimide chemical structures (e.g., fluorinated or cyclic aliphatic monomers) for enhanced transparency and reduced yellowing.

- Machine learning models optimize solution casting and thermal curing processes, leading to tighter control over film thickness uniformity, reduced haze, and lower defect rates.

- Predictive quality control systems utilizing computer vision analyze high-speed, continuous film production, ensuring immediate detection and classification of surface and subsurface imperfections.

- AI enhances supply chain resilience by forecasting demand for specialty monomers (Dianhydrides and Diamines) and optimizing procurement strategies.

- Simulation and modeling using AI tools predict the long-term performance and durability of OTPI films under flexible stress, reducing the need for extensive physical prototyping.

DRO & Impact Forces Of Optically Transparent Polyimide Films Market

The Optically Transparent Polyimide Films market is powerfully shaped by strong market drivers related to consumer electronics trends, yet it faces significant technological and economic restraints, offering substantial opportunities for innovation. The key driver is the explosive demand for foldable and rollable devices, where OTPI films are superior to glass in terms of flexibility, durability, and weight. Complementary drivers include the growing adoption of 5G technology, which necessitates flexible antenna substrates with excellent dielectric properties, and the expansion of the electric vehicle (EV) market, which requires lightweight, thermally stable display interfaces. These factors create high demand elasticity for advanced polymer substrates, compelling manufacturers to increase production capacity and improve material specifications.

However, the market faces considerable restraints, primarily the high cost associated with raw material synthesis and specialized manufacturing techniques. The high purity monomers required to achieve optical clarity (such as fluorinated dianhydrides like 6FDA) are expensive and involve complex, multi-step synthesis. Furthermore, the film manufacturing process, often involving demanding solvent purification and controlled high-temperature curing, requires significant capital investment and energy consumption, leading to higher end-product pricing compared to commodity films. Another technical restraint is the inherent challenge of ensuring perfect scratch resistance and effective moisture barrier properties comparable to ultra-thin glass, necessitating multi-layer hybrid film structures which further complicate manufacturing.

Despite these challenges, substantial opportunities exist, particularly in emerging applications beyond mainstream consumer electronics. The shift toward organic photovoltaics (OPV) and flexible solar cells offers a robust growth avenue, requiring durable, transparent, and UV-resistant substrates. Furthermore, the integration of OTPI films into advanced wearable health monitors, electronic textiles, and flexible lighting solutions (OLED lighting) represents untapped potential. Strategic investments in continuous production methods, coupled with R&D focused on cheaper, non-fluorinated routes to transparency (e.g., rigid rod polyimides or non-coplanar molecular design), will be crucial for capitalizing on these future opportunities and overcoming current cost restraints, thereby maintaining high impact forces.

Segmentation Analysis

The Optically Transparent Polyimide Films market is meticulously segmented based on key differentiators including the type of film composition, the primary application where it is utilized, and the specific end-use industry driving demand. This segmentation is critical for understanding market dynamics, as performance requirements vary significantly; for instance, a flexible display application demands high clarity and scratch resistance, while a flexible circuit board application emphasizes thermal stability and dielectric performance. The Colorless Polyimide (CPI) films sub-segment is rapidly dominating due to their superior optical performance over standard transparent PI films, establishing themselves as the material of choice for premium display cover windows.

Application segmentation reveals that consumer electronics, specifically flexible and foldable screens, constitute the most significant revenue stream, owing to massive production volumes and continuous product lifecycle updates. However, emerging segments like solar energy and automotive displays are demonstrating faster year-on-year growth, signifying diversification in demand. Geographically, the market analysis shows a profound concentration of consumption and manufacturing capacity within the Asia Pacific region, though technological leadership often emanates from the specialized chemical research institutions in North America and Europe that focus on novel monomer synthesis and processing methodologies.

- By Type:

- Colorless Polyimide (CPI) Film

- Transparent Polyimide (TPI) Film (Slightly colored/Low Haze)

- Fluorinated Polyimide Film (FPI)

- By Application:

- Flexible Displays (Foldable Smartphones, Tablets, Laptops)

- Flexible Printed Circuit Boards (FPCBs)

- Solar Cells and Photovoltaics (Flexible PV Modules)

- Transparent Conductive Films (TCF)

- Flexible Sensors and Wearables

- Other Applications (Lighting, Aerospace Components)

- By End-Use Industry:

- Consumer Electronics

- Automotive

- Energy (Solar)

- Aerospace and Defense

- Healthcare and Medical Devices

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Optically Transparent Polyimide Films Market

The value chain for the Optically Transparent Polyimide Films market is characterized by high levels of specialization, beginning with the complex synthesis of high-purity specialty monomers in the upstream segment. Upstream analysis focuses on the production of key precursors, primarily Dianhydrides (such as 6FDA, BPDA) and Diamines (such as BDAF, APB), which must be synthesized with exceptionally high purity to ensure minimal coloration and defect formation in the final film. These chemical companies often operate in a highly regulated and capital-intensive environment, possessing the core intellectual property regarding molecular modification needed to achieve optical transparency.

The midstream stage involves the critical process of polymerization and film fabrication, where monomer precursors are reacted to form polyamic acid solutions. This solution is then cast onto highly smooth carriers (like stainless steel belts or glass plates) and thermally cured in high-temperature ovens to form the finished polyimide film. This stage is extremely sensitive, requiring precision control over temperature, atmosphere, and curing speed to manage internal stress and prevent haze formation. Distribution channels are typically indirect, relying on specialized polymer distributors and material science agents who handle the sensitive transport and supply of these high-value films to panel manufacturers and circuit fabricators.

Downstream analysis centers on the integration of OTPI films into final products, predominantly carried out by large display manufacturers (like Samsung Display or LG Display) and FPCB assemblers. These firms utilize the films as flexible substrates or cover windows, requiring additional processing steps like coating with hard coats for scratch resistance, etching, and lamination with other functional layers (e.g., transparent conductive materials). Direct sales often occur between film manufacturers and tier-one display makers for high-volume orders, while smaller end-users in specialized sectors (like medical or aerospace) may purchase through indirect distribution channels offering tailored conversion and cutting services.

Optically Transparent Polyimide Films Market Potential Customers

The primary consumers and buyers of Optically Transparent Polyimide Films are large-scale manufacturers operating within the consumer electronics ecosystem, particularly those specializing in advanced display and circuit technology. The most significant customers include global smartphone and tablet manufacturers who require substrates for their foldable and flexible display product lines, often purchasing vast quantities directly from film producers through long-term supply agreements. These customers value the combination of high thermal stability, enabling sophisticated manufacturing processes, and the optical clarity necessary for consumer-facing screens.

Another crucial segment of potential customers comprises flexible printed circuit board (FPCB) fabricators. These companies utilize OTPI films as the flexible dielectric layer, demanding superior dimensional stability and robust dielectric properties for high-density, multi-layer flexible circuits used in complex electronic assemblies. Furthermore, manufacturers of flexible solar panels and specialized aerospace components are growing potential customers, valuing the material’s lightweight nature and resistance to extreme temperatures and radiation, surpassing the limitations of conventional PET or glass alternatives in these demanding environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,450 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kaneka Corporation, SK Innovation Co., Ltd. (SKC), Kolon Industries, Inc., Sumitomo Chemical Co., Ltd., DuPont de Nemours, Inc., Toray Industries, Inc., Mitsubishi Gas Chemical Company, Inc., PI Advanced Materials Co., Ltd., UBE Corporation, Taimide Technology Inc., Thin Film Devices, Inc., Wuxi Wei Da Technology Co., Ltd., Shinwha Tech, Rayoung, NeXene |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optically Transparent Polyimide Films Market Key Technology Landscape

The technological landscape of the Optically Transparent Polyimide Films market is characterized by continuous innovation focused on eliminating color formation (yellowing) while maintaining the superior thermo-mechanical properties inherent to polyimides. The leading technology involves the incorporation of bulky, symmetric, and often fluorinated functional groups into the polyimide backbone. The use of highly transparent monomers like 2,2-Bis(3,4-dicarboxyphenyl)hexafluoropropane dianhydride (6FDA) or 2,2-Bis(4-aminophenyl)hexafluoropropane (BDAF) successfully disrupts the formation of inter-chain charge-transfer complexes (CTCs), which are the primary cause of yellow coloration, thereby significantly enhancing visible light transmittance (often >90%).

Beyond chemical modification, the processing technology is equally critical. Advanced solution casting and curing techniques, including continuous roll-to-roll (R2R) processing, are essential for mass production scalability and achieving the necessary uniformity in film thickness and low coefficient of thermal expansion (CTE). Manufacturers are investing heavily in specialized curing ovens that utilize inert atmospheres and controlled ramp rates to manage solvent removal and imidization precisely, minimizing defects and internal stress which could lead to birefringence or haze. Furthermore, surface treatment technologies, such as plasma etching or hard-coat deposition (using materials like scratch-resistant acrylates or silica nanoparticles), are necessary post-processing steps to meet the demanding durability requirements for display cover windows.

A burgeoning technological trend is the development of composite or hybrid films. These incorporate inorganic nanoparticles (e.g., SiO2, TiO2) into the polyimide matrix to simultaneously enhance barrier properties against moisture and oxygen—a known weakness of pure polyimides—while improving mechanical stiffness and scratch resistance without compromising optical clarity. Furthermore, research is focused on low-temperature processing methods to make OTPI films compatible with existing display manufacturing lines, which traditionally operate at lower thermal budgets than required for conventional high-performance polyimides. Success in these areas will broaden the applicability of OTPI films in cost-sensitive flexible electronic devices.

Regional Highlights

The Optically Transparent Polyimide Films market exhibits distinct regional dynamics driven by manufacturing concentration, technological maturity, and local consumer demand for advanced electronics.

- Asia Pacific (APAC): APAC is the epicenter of the global market, dominating both production and consumption. Countries like South Korea, China, and Japan house the world’s largest display panel manufacturers (OLED and AMOLED) and the primary assembly hubs for foldable devices and FPCBs. South Korea, in particular, has been at the forefront of commercializing colorless polyimide (CPI) films, driven by giants like SKC and Kolon Industries. Government support for advanced manufacturing and the massive regional consumer electronics market solidify APAC’s leading position and projected high growth rate.

- North America: North America represents a mature, high-value market focused heavily on R&D, specialized applications, and materials innovation. Demand is strong from aerospace, defense, and high-tech medical device manufacturers, where stringent performance requirements (e.g., radiation resistance, extreme thermal cycling) justify the premium price of OTPI films. Key players like DuPont drive significant innovation in monomer chemistry and process technologies, though actual film production volume is lower than in APAC.

- Europe: Europe maintains a significant role in developing advanced polymer chemistry and high-performance industrial applications. The demand for OTPI films is primarily driven by the automotive sector, focusing on flexible in-car displays and sensor applications, as well as specialized industrial electronics requiring high reliability and thermal stability. Environmental regulations also push innovation toward sustainable synthesis routes and solvent recovery technologies within the European manufacturing base.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets characterized primarily by the consumption of finished electronic goods imported from APAC. While local manufacturing of high-end OTPI films is limited, increased investment in regional electronics assembly and renewable energy projects (especially flexible solar power generation) suggests future growth in demand for both FPCBs and durable substrates. Growth here is dependent on increased local industrialization and technology transfer.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optically Transparent Polyimide Films Market.- Kaneka Corporation

- SK Innovation Co., Ltd. (SKC)

- Kolon Industries, Inc.

- Sumitomo Chemical Co., Ltd.

- DuPont de Nemours, Inc.

- Toray Industries, Inc.

- Mitsubishi Gas Chemical Company, Inc.

- PI Advanced Materials Co., Ltd.

- UBE Corporation

- Taimide Technology Inc.

- Thin Film Devices, Inc.

- Wuxi Wei Da Technology Co., Ltd.

- Shinwha Tech

- Rayoung

- NeXene

- Changzhou Hongfeng Polymer Materials Co., Ltd.

- Mitsui Chemicals, Inc.

- Teijin Limited

- Kwang Chun Electronic Co., Ltd.

- Industrial Summit Technology Corp.

Frequently Asked Questions

Analyze common user questions about the Optically Transparent Polyimide Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard Polyimide (PI) and Optically Transparent Polyimide (OTPI) films?

Standard PI films are intrinsically yellowish due to the formation of charge-transfer complexes (CTCs) between polymer chains, limiting optical clarity. OTPI films, achieved through molecular structure modification, primarily fluorination or the use of specific bulky diamines/dianhydrides, disrupt these CTCs, resulting in high visible light transmittance (typically >85%) while retaining the superior thermal and mechanical stability characteristic of polyimides.

Why are Colorless Polyimide (CPI) films preferred over glass for foldable electronic displays?

CPI films are favored because they offer exceptional flexibility, allowing for repeated folding cycles (up to 200,000 cycles or more), coupled with high thermal resistance crucial for display processing (over 300°C). Unlike ultra-thin glass, CPI is inherently lightweight and durable, making the final device significantly lighter and less prone to catastrophic failure upon impact, despite potential lower scratch resistance that is mitigated by hard-coatings.

Which monomers are essential for achieving high optical transparency in polyimide films?

The most essential precursors are fluorinated monomers, specifically 2,2-Bis(3,4-dicarboxyphenyl)hexafluoropropane dianhydride (6FDA) and 2,2-Bis(4-aminophenyl)hexafluoropropane (BDAF). The bulky hexafluoroisopropylidene groups within these monomers increase the free volume between polymer chains and reduce electron affinity, effectively preventing the formation of color-causing charge-transfer complexes.

What major challenges restrict the widespread adoption of Optically Transparent Polyimide Films?

The primary restriction is the high cost of production, driven by the specialized and expensive high-purity fluorinated monomers and the capital-intensive, controlled processing required for casting and curing. Additionally, achieving comparable levels of scratch resistance and effective moisture/oxygen barrier properties to glass often necessitates complex, multi-layer hybrid structures, adding to the total material cost and manufacturing complexity.

In which emerging applications are OTPI films expected to see the most significant growth outside of consumer electronics?

Significant growth is anticipated in the Flexible Photovoltaics (OPV) sector, where OTPI films serve as durable, lightweight, and UV-resistant substrates for solar cells. Furthermore, the Automotive sector is increasingly adopting OTPI films for complex, flexible dashboard displays and interior lighting solutions that demand high thermal stability and structural durability within harsh vehicle environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Optically Transparent Polyimide Films Market Statistics 2025 Analysis By Application (.), By Type (Thickness>25 m, 15 m), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Optically Transparent Polyimide Films Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thickness>25μm, 15μm

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager