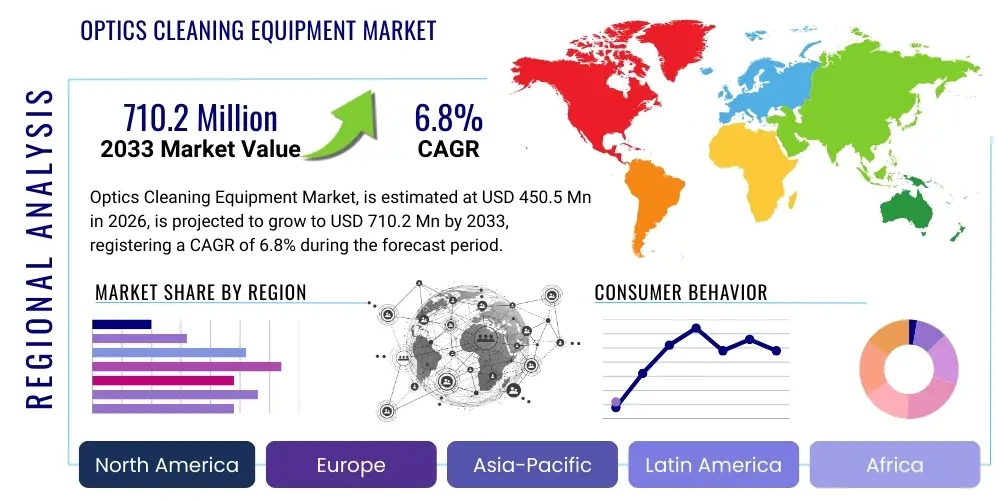

Optics Cleaning Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437345 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Optics Cleaning Equipment Market Size

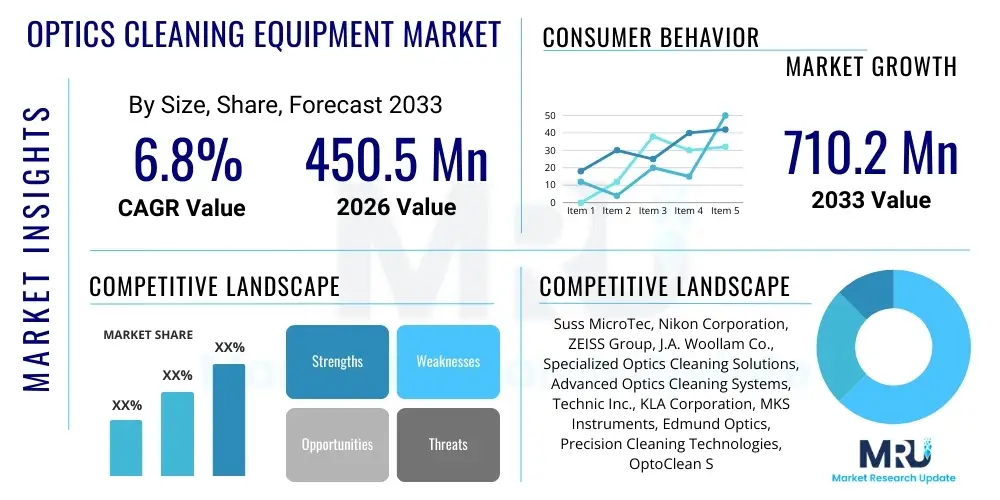

The Optics Cleaning Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.2 Million by the end of the forecast period in 2033.

Optics Cleaning Equipment Market introduction

The Optics Cleaning Equipment Market encompasses specialized tools, systems, and consumables designed to meticulously remove contaminants—such as dust, fingerprints, oils, manufacturing residues, and organic films—from high-precision optical components. These components are critical across various high-technology sectors, including semiconductor lithography, advanced medical imaging, defense and aerospace surveillance systems, high-power laser facilities, and scientific research instrumentation. Maintaining pristine optical surfaces is paramount because even microscopic particles or films can drastically degrade system performance, leading to light scattering, reduced transmission, or, critically, damage to expensive optics, especially in high-energy laser environments. The demand for increasingly smaller features in microelectronics and higher resolutions in imaging drives the necessity for zero-defect cleaning solutions.

The product description spans a wide range of technologies, from manual methods utilizing specialized swabs, tissues, and solvents to highly automated, non-contact systems such as CO2 snow cleaning, plasma cleaning, and ultrasonic baths specifically tuned for delicate optics. Major applications reside prominently within the manufacturing processes of advanced semiconductors, where cleanliness directly impacts yield and chip performance. Other key applications include maintaining telescope mirrors and lenses, ensuring the accuracy of medical diagnostic equipment like endoscopes and microscopes, and preserving the integrity of sensors used in space exploration and tactical defense systems. The market is defined by the requirement for ultra-high purity and damage prevention, necessitating specialized equipment that goes far beyond general industrial cleaning standards.

The core benefits derived from utilizing specialized optics cleaning equipment include enhanced system performance, extended lifespan of costly optical components, and reduced operational downtime caused by maintenance or component failure due to contamination. Driving factors for market growth include the escalating global investment in semiconductor fabrication facilities (fabs), the increasing prevalence of complex optical systems in consumer electronics (e.g., advanced camera modules), and the continuous advancements in laser technology that demand extremely resilient and contaminant-free optics to handle high fluence levels. Furthermore, stringent quality control standards in industries like aerospace and defense necessitate the consistent adoption of verifiable, professional-grade cleaning protocols, thereby sustaining market momentum.

Optics Cleaning Equipment Market Executive Summary

The Optics Cleaning Equipment Market is experiencing robust growth fueled by irreversible trends toward miniaturization and high-performance requirements across critical technological industries. Business trends indicate a significant shift toward automated and non-contact cleaning methodologies, driven by the need to minimize human error and physical damage during the cleaning process. Key players are investing heavily in research and development to create equipment that utilizes ultra-pure cleaning agents and advanced techniques like supercritical fluid cleaning and plasma etching, specifically targeting sub-micron particulate removal, which is essential for EUV lithography optics. The competitive landscape is characterized by specialization, where niche providers offer tailored solutions for specific types of optics, such as mirrors used in fusion research or lenses in metrology tools, rather than relying solely on generalized cleaning solutions.

Regionally, the Asia Pacific (APAC) stands out as the dominant and fastest-growing market, primarily due to the massive concentration of semiconductor manufacturing foundries, especially in countries like Taiwan, South Korea, and China. These regions are at the forefront of adopting advanced cleaning equipment to support cutting-edge wafer fabrication. North America and Europe, while mature, maintain strong market positions driven by high-value applications in aerospace, defense, and advanced scientific research (e.g., national laboratories and advanced optics R&D centers). Regional trends are also influenced by environmental regulations concerning the use of harsh cleaning solvents, prompting a shift towards eco-friendly alternatives like specialized aqueous solutions and dry cleaning techniques, such as CO2 snow cleaning.

Segment trends reveal that the non-contact cleaning equipment segment, particularly those leveraging precision gas and specialized light sources, is projected to show the highest CAGR. In terms of application, the semiconductor and electronics segment remains the largest consumer, driven by ever-increasing requirements for defect-free optical systems used in photolithography and inspection. The consumables segment, including ultra-low lint wipes, specialized solvents, and pre-saturated cleaning tools, continues to provide a stable, recurring revenue stream, supported by strict maintenance protocols mandated by OEM specifications. Furthermore, there is a rising trend in providing integrated cleaning solutions combined with real-time monitoring and inspection capabilities, moving cleaning from a reactive maintenance task to a proactive quality control measure within the manufacturing workflow.

AI Impact Analysis on Optics Cleaning Equipment Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can enhance the precision, automation, and predictive maintenance aspects of optics cleaning operations. Common questions revolve around the use of AI in defect detection prior to and post-cleaning, optimizing cleaning parameters based on contaminant type, and integrating autonomous robotic systems for handling delicate optics. The key theme is the expectation that AI integration will revolutionize cleaning by moving beyond fixed protocols to dynamic, adaptive processes. Users are concerned about whether AI can truly differentiate between minute surface defects and actual contamination, and how ML algorithms can optimize non-contact methods like plasma or laser ablation for maximum effectiveness without damaging the underlying substrate or coatings.

The integration of AI is primarily focused on enhancing the precision and efficiency of automated cleaning systems, which is critical for handling large volumes of optics in high-throughput manufacturing environments. AI algorithms are currently being utilized in advanced optical metrology tools that precede and follow the cleaning process. These algorithms rapidly analyze high-resolution images of the optic surface to classify, quantify, and map defects (such as haze, pits, or particulate matter) with greater accuracy and speed than human operators. This data-driven approach allows the cleaning equipment to apply targeted, localized treatments, significantly reducing the required cleaning time and minimizing the exposure of the optic to potentially damaging processes or harsh chemicals.

Furthermore, Machine Learning models are being deployed to optimize the operational parameters of highly specialized cleaning equipment, such as varying the flow rate, pressure, or temperature in CO2 snow jet systems, or adjusting the power intensity in laser cleaning based on the identified contaminant profile and the specific optic material. This predictive capability allows maintenance schedules to be optimized, predicting when an optic will require cleaning based on environmental data and usage cycles, rather than relying on time-based schedules. AI-powered robotics also enhances the handling and transport of delicate optics within the cleaning chamber, ensuring precise positioning and manipulation, thereby mitigating the risk of mechanical damage.

- AI enhances defect classification and mapping using high-resolution image processing algorithms.

- Machine learning optimizes cleaning parameters (e.g., pressure, temperature, energy flux) for specific contaminant types and coating sensitivities.

- Predictive maintenance models forecast required cleaning intervals, reducing reactive downtime.

- Robotic systems leverage AI for autonomous, high-precision handling and manipulation of fragile optical components.

- Integration of real-time monitoring and feedback loops ensures cleaning effectiveness is verified instantly.

DRO & Impact Forces Of Optics Cleaning Equipment Market

The Optics Cleaning Equipment Market is fundamentally driven by the escalating demand for ultra-clean optical surfaces in high-technology applications, particularly within the semiconductor, defense, and laser industries. A primary driver is the ongoing push towards miniaturization and higher performance standards, which translates directly into zero-tolerance for contamination. Restraints typically involve the high initial capital investment required for specialized, automated cleaning systems and the difficulty in developing universally effective cleaning agents that are both environmentally compliant and safe for highly sensitive coatings, such as anti-reflective or polarizing films. Opportunities emerge from the growing adoption of new, non-contact cleaning technologies like specialized UV ozone treatment and plasma cleaning, especially as traditional solvent-based methods face increasing regulatory scrutiny. The market dynamics are highly influenced by the technological sophistication required, making specialized knowledge a significant barrier to entry, while high R&D expenditures serve as a major impact force shaping the competitive landscape.

Key drivers include the massive global expansion of semiconductor fabrication, particularly the transition to Extreme Ultraviolet (EUV) lithography, which requires optics cleaning processes that can remove particles down to the single nanometer scale without inducing subsurface damage. The continuous development of high-power laser systems, used in industrial processing and scientific research, also necessitates flawless optics to prevent laser-induced damage (LID) and ensure beam quality. These critical demands compel end-users to invest in the most advanced, often proprietary, cleaning solutions. Furthermore, increasing quality standards in medical device manufacturing and aerospace surveillance systems place continuous pressure on suppliers to deliver highly verifiable and repeatable cleaning results, favoring sophisticated equipment over manual processes.

However, market growth faces notable restraints, including the significant operational cost associated with maintaining ultra-clean environments (cleanrooms) necessary for the cleaning procedures, and the inherent risk of damaging highly expensive optics during the cleaning process if protocols are not meticulously followed. The specialized nature of equipment also leads to long replacement cycles and limited supplier options for certain proprietary components. Conversely, substantial opportunities arise from the increasing integration of Internet of Things (IoT) sensors and digital tracking into cleaning equipment, enabling real-time process control and data logging critical for regulatory compliance. The shift towards dry cleaning methods, driven by environmental concerns and the high cost of disposal of hazardous solvents, also presents a lucrative pathway for innovation and market expansion.

The impact forces are driven by the confluence of technological advancement and strict regulatory requirements. The rapid evolution of materials science, particularly the development of new optical coatings and substrate materials (like fused silica or specialized crystals), constantly challenges cleaning technology developers to innovate. Additionally, the dominant position of a few major semiconductor manufacturers dictates specific cleaning standards and procurement decisions, exerting strong influence on smaller component suppliers. The necessity for highly customized cleaning systems, tailored for unique geometries or specific contamination types, ensures that specialization remains a powerful market force, rewarding companies capable of providing bespoke solutions.

Segmentation Analysis

The Optics Cleaning Equipment Market is primarily segmented based on the Type of Cleaning Technology, the Type of Product, the Application/End-User industry, and Geographic Region. The segmentation highlights the diverse technical needs across industries, ranging from highly automated, large-scale systems utilized in semiconductor manufacturing to portable, precision tools required for field maintenance in aerospace. Understanding these segments is crucial for manufacturers to tailor their R&D efforts toward specific performance metrics, such as cleaning throughput, particle removal efficiency, and compatibility with sensitive optical coatings.

The technology segment differentiates between contact (manual/mechanical) and non-contact (dry/chemical) methods. Non-contact methods are increasingly dominant in high-value applications due to their minimized risk of causing physical abrasion or micro-scratching. The product type segment splits the market into equipment (machines like CO2 cleaners, ultrasonic systems) and consumables (wipes, solvents, specialized pads). Consumables represent a necessary, recurring expenditure that sustains market stability, while equipment sales are characterized by large, periodic capital outlays.

Application segmentation reveals the highest demand originating from electronics and semiconductors, followed by defense and aerospace, and then medical and life sciences. Each end-user sector imposes unique constraints; for instance, medical optics require sterile, biocompatible cleaning solutions, whereas high-power laser optics prioritize the removal of organic residues that cause laser damage. This intricate segmentation underscores the necessity for specialized product lines capable of meeting the stringent requirements of their respective operational environments.

- By Product Type:

- Equipment (Automated Systems, Manual Devices)

- Consumables (Wipes, Swabs, Solvents, Cleaning Kits)

- By Cleaning Technology:

- Contact Cleaning (Solvent-based, Mechanical Wipes)

- Non-Contact Cleaning (CO2 Snow Cleaning, Plasma Cleaning, Ultrasonic Cleaning, Laser Ablation)

- By Application/End-User:

- Semiconductors and Electronics

- Defense and Aerospace

- Medical and Life Sciences (Imaging, Diagnostics, Endoscopy)

- High-Power Lasers and Scientific Research

- Metrology and Inspection

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Optics Cleaning Equipment Market

The value chain for the Optics Cleaning Equipment Market begins with the upstream raw material suppliers, which primarily include manufacturers of ultra-high purity chemical solvents (e.g., isopropyl alcohol, acetone, proprietary blends), specialized micro-fiber and polyester materials for wipes and swabs, and high-precision component providers for machinery (e.g., cryogenic nozzles, ultrasonic transducers, vacuum components). The quality and purity of these upstream materials are critically important, as any impurity introduced during the cleaning process would defeat the purpose of the equipment. Suppliers must adhere to strict cleanroom manufacturing standards (e.g., ISO Class 4 or better) to ensure the integrity of the end product.

The central segment involves the Original Equipment Manufacturers (OEMs) and specialized system integrators who design, manufacture, and assemble the actual cleaning machinery and proprietary consumables. This stage is characterized by high intellectual property value, focusing on the engineering of precise fluid dynamics, non-damaging material compatibility, and automated handling robotics. Distribution channels are varied, including direct sales for large, customized, or integrated automated systems sold directly to major semiconductor fabs or defense contractors. Indirect distribution involves specialized technical distributors and representatives who provide localized installation, support, and recurring supply of consumables to smaller research facilities or specialized industrial users.

Downstream analysis focuses on the end-users—ranging from high-volume manufacturers (e.g., consumer electronics assembly lines) to highly regulated entities (e.g., aerospace repair depots). The primary value realized downstream is the enhancement of manufacturing yield, reduction of component damage, and overall improvement in optical system performance and reliability. Effective post-sales support, including calibration, maintenance, and training on complex equipment, is a major factor determining customer loyalty and repeat consumable purchases. The necessity of maintaining cleanliness standards ensures continuous demand for maintenance services and periodic equipment upgrades, completing the high-value feedback loop within the ecosystem.

Optics Cleaning Equipment Market Potential Customers

The core clientele for the Optics Cleaning Equipment Market consists of organizations whose operational success is inextricably linked to the performance and longevity of sensitive optical components. The largest and most demanding customer segment is the semiconductor industry, specifically wafer fabrication plants (fabs) and integrated device manufacturers (IDMs), which require cleaning solutions for photolithography lenses, photomasks, and wafer inspection optics. This segment demands the highest level of cleanliness (nanometer scale) and highly automated, high-throughput systems to maintain operational efficiency and yield integrity.

Another significant customer base includes defense and aerospace contractors and governmental research facilities. These entities rely on pristine optics for sensitive applications such as satellite surveillance systems, advanced targeting systems, missile guidance, and high-energy directed energy weapons. For these customers, reliability and performance in extreme conditions are paramount, favoring highly ruggedized equipment and strict protocol-based consumables. Furthermore, major scientific research institutions, including universities and national laboratories operating large telescopes, particle accelerators, and high-intensity laser facilities (like those focused on fusion research), constitute a specialized, high-value customer group requiring bespoke cleaning solutions for exceptionally large or custom-shaped optics.

The medical device sector represents a growing segment, particularly manufacturers and servicing companies involved with advanced diagnostic imaging equipment (CT scanners, MRI machines, OCT systems) and surgical tools (endoscopes, laparoscopes). These customers require cleaning solutions that meet stringent sterilization and biocompatibility standards, often favoring aqueous or vapor-based cleaning technologies over volatile organic solvents. Ultimately, any industry utilizing precision optics in its core process—from display panel manufacturing to advanced photography and cinematography—is a potential buyer of either specialized equipment or premium consumables.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Suss MicroTec, Nikon Corporation, ZEISS Group, J.A. Woollam Co., Specialized Optics Cleaning Solutions, Advanced Optics Cleaning Systems, Technic Inc., KLA Corporation, MKS Instruments, Edmund Optics, Precision Cleaning Technologies, OptoClean Solutions, Angstrom Engineering, Ushio America, Inc., Applied Materials |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Optics Cleaning Equipment Market Key Technology Landscape

The technological landscape of the Optics Cleaning Equipment Market is characterized by a constant pursuit of lower damage thresholds and higher cleanliness levels, particularly focusing on non-contact methods. One of the cornerstone technologies is CO2 Snow Cleaning (or Cryogenic Cleaning), which utilizes expanding liquid or solid CO2 to form microscopic snow particles that physically impact and lift contaminants from the surface. This technique is highly effective for removing particulate matter without introducing mechanical stress, chemical residues, or electrostatic discharge (ESD). Advancements in this area focus on optimizing the nozzle design and flow characteristics to achieve better uniformity across large or complex optical surfaces, making it a staple in high-precision manufacturing environments where solvent use must be minimized.

Another crucial technology involves Plasma Cleaning systems, which use low-pressure or atmospheric pressure plasma generated from gases like Argon, Oxygen, or specialized mixtures. Plasma systems effectively remove organic contaminants and hydrocarbon films by chemically reacting with them, converting them into volatile byproducts that are then vacuumed away. This method is highly favored for preparing surfaces before coating or bonding processes and for restoring transmission properties of UV optics. The ongoing innovation in plasma cleaning centers around achieving higher throughput while maintaining temperature stability, ensuring no thermal deformation or damage to temperature-sensitive coatings. Furthermore, proprietary advancements in ultrasonic and megasonic cleaning systems, using optimized frequencies and specialized aqueous solutions, continue to dominate the cleaning of multi-lens assemblies and bulk components where immersion is feasible and high volume processing is required.

The integration of advanced metrology and inspection technology is now inseparable from the cleaning process. Modern cleaning equipment often incorporates integrated scatterometers, dark-field imaging, and high-magnification microscopy (sometimes utilizing AI for automated defect analysis) to verify cleanliness immediately after the process cycle. This real-time feedback loop allows for immediate process adjustment and quality assurance, which is a major technological differentiator. Laser ablation cleaning, though highly specialized and demanding precise control, is also gaining traction for removing tough, adhered residues or localized damage spots on robust substrates, offering extremely focused and chemical-free remediation for highly expensive, damaged optics.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and is projected to exhibit the fastest growth globally. This region serves as the global hub for semiconductor manufacturing (Taiwan, South Korea, China) and advanced electronics assembly (Japan, Southeast Asia). The massive investment in new fabrication plants, particularly those adopting cutting-edge EUV lithography (which demands unparalleled optics cleanliness), directly fuels the demand for high-end, automated cleaning equipment. Government incentives supporting domestic high-tech manufacturing further accelerate market penetration.

- North America: North America holds a substantial market share, driven primarily by high-value, highly regulated sectors such as defense, aerospace, and advanced scientific research (NASA, Department of Energy labs). The demand here centers on highly reliable, specialized cleaning systems for exotic materials and large, custom optics. The presence of major optics R&D centers and key laser technology developers ensures continuous demand for state-of-the-art cleaning consumables and integrated metrology solutions.

- Europe: The European market is mature and characterized by strong demand from advanced automotive manufacturing (LiDAR sensors), medical device production, and significant investment in research institutions (e.g., CERN). European regulations, particularly environmental directives concerning industrial solvents, are a strong regional driver, pushing the adoption of eco-friendly, non-contact cleaning technologies like CO2 snow and specialized aqueous systems. Germany and France are key market contributors due to their strong industrial optics bases.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently represent smaller market shares but offer emerging opportunities. Growth is typically concentrated in specific areas, such as astronomical research centers in Chile (LATAM) or oil and gas exploration (MEA) requiring specialized optical sensors and thermal imaging equipment. Market maturity is lower, often relying on imported equipment, but expanding infrastructure projects and increasing adoption of modern medical diagnostics drive gradual growth, particularly in the consumables segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Optics Cleaning Equipment Market.- Suss MicroTec SE

- Nikon Corporation

- ZEISS Group

- J.A. Woollam Co. Inc.

- Advanced Optics Cleaning Systems (AOCS)

- KLA Corporation

- MKS Instruments Inc.

- Edmund Optics

- Precision Cleaning Technologies (PCT)

- Technic Inc.

- Applied Materials Inc.

- Ushio America, Inc.

- OptoClean Solutions

- Angstrom Engineering Inc.

- Specialized Optics Cleaning Solutions (SOCS)

- TOPTICA Photonics AG

- FemtoTools AG

- BOC Sciences

- Clean Systems Co., Ltd.

- Cyberoptics Corporation (now Nordson)

Frequently Asked Questions

Analyze common user questions about the Optics Cleaning Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between contact and non-contact optics cleaning technologies?

Contact cleaning involves physical interaction using specialized wipes or swabs and solvents, offering precise manual control but carrying a risk of micro-scratching or residue transfer. Non-contact methods, such as CO2 snow, plasma, or ultrasonic cleaning, use physical forces or chemical reactions without mechanical abrasion, minimizing damage and achieving superior cleanliness levels, especially for highly sensitive or coated optics required in semiconductor lithography.

Why is the semiconductor industry the largest consumer of high-end optics cleaning equipment?

The semiconductor industry relies heavily on complex optical systems, especially in photolithography (EUV and DUV), where feature sizes are reaching the nanometer scale. Even microscopic contamination on the optics severely degrades chip yield and performance. High-end cleaning equipment ensures the ultra-purity and integrity of these expensive components, which is directly tied to manufacturing efficiency and financial returns, driving continuous investment in the most advanced automated cleaning solutions.

What role does automation play in the future of the optics cleaning market?

Automation, increasingly supported by AI and robotics, is critical for reducing human error, ensuring process repeatability, and handling large, delicate optics without damage. Automated systems allow for precise control of parameters (temperature, pressure, duration) and integrate metrology for immediate quality verification, shifting cleaning from a manual maintenance task to a standardized, proactive manufacturing step, particularly valuable in cleanroom environments.

What are the main restraints impacting market growth for optics cleaning equipment?

The primary restraints include the significant initial capital expenditure required for sophisticated automated machinery, the technical challenge of cleaning complex optical coatings without damage, and the ongoing regulatory pressure to phase out certain effective but environmentally harmful cleaning solvents, necessitating costly R&D into alternative dry or green chemical cleaning methods.

Which regional market is expected to dominate growth in optics cleaning equipment?

The Asia Pacific (APAC) region is expected to dominate market growth. This rapid expansion is fundamentally driven by the enormous concentration of advanced semiconductor fabrication facilities (fabs) across Taiwan, South Korea, and China, coupled with massive regional investment in high-tech manufacturing and consumer electronics production, creating unparalleled demand for ultra-precise cleaning equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager