Oral Biological Barrier Membrane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440276 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Oral Biological Barrier Membrane Market Size

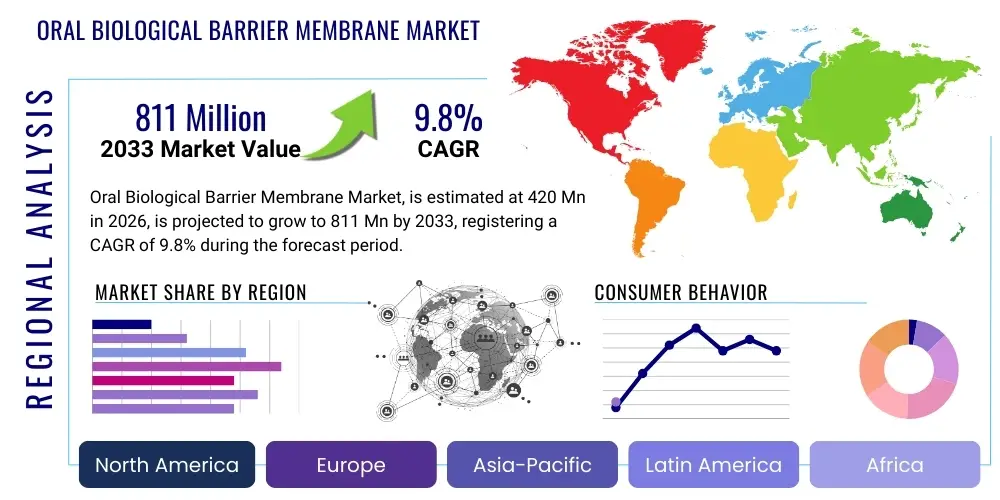

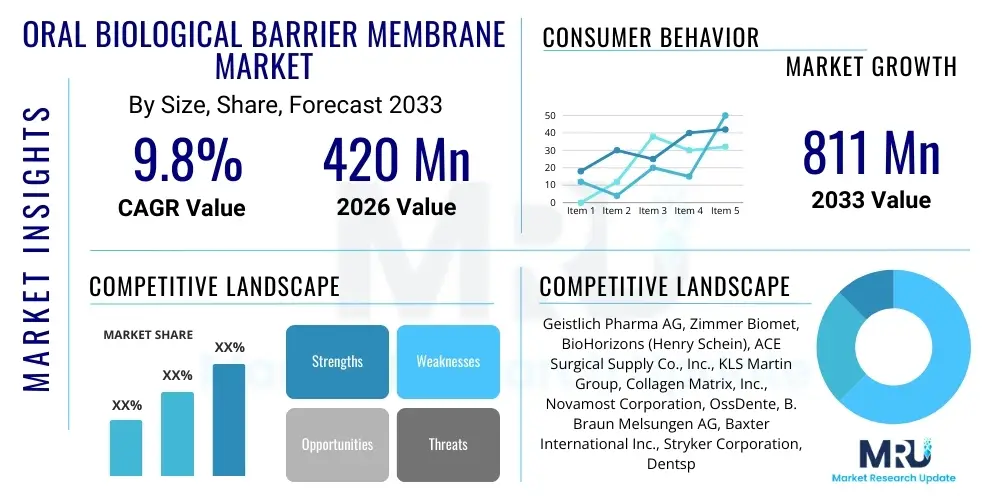

The Oral Biological Barrier Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 420 million in 2026 and is projected to reach USD 811 million by the end of the forecast period in 2033.

Oral Biological Barrier Membrane Market introduction

The Oral Biological Barrier Membrane Market encompasses a specialized segment within dental and oral healthcare, focusing on the development, manufacturing, and distribution of membranes used in guided bone regeneration (GBR) and guided tissue regeneration (GTR) procedures. These membranes serve as crucial tools in reconstructive dentistry and oral surgery, designed to prevent the ingrowth of unwanted soft tissue into bone defects, thereby creating a protected space for bone regeneration. The primary objective is to facilitate predictable healing and integration of bone grafts or natural bone formation around dental implants, periodontal defects, or other oral surgical sites. The market is characterized by a diverse range of materials, including resorbable membranes derived from collagen or synthetic polymers, and non-resorbable membranes typically made from polytetrafluoroethylene (PTFE) or titanium-reinforced materials, each offering distinct advantages in terms of biocompatibility, mechanical properties, and degradation profiles tailored to specific clinical requirements.

Product descriptions within this market highlight the membranes' key characteristics such as porosity, tensile strength, degradation rate, and cellular occlusion properties. Major applications span a broad spectrum of dental procedures, predominantly involving dental implantology for site preservation and augmentation, periodontal surgery to treat gum diseases and regenerate lost supporting tissues, and maxillofacial surgery for larger reconstructive efforts. The benefits of utilizing oral biological barrier membranes are substantial, including enhanced bone regeneration outcomes, reduced post-operative complications, improved predictability of dental implant success, and superior aesthetic results. These advantages contribute significantly to patient quality of life and the long-term stability of dental restorations. The continuous evolution of biomaterials and surgical techniques further propels the adoption of these innovative solutions in clinical practice, addressing critical needs in restorative and regenerative dentistry.

Driving factors for the growth of the oral biological barrier membrane market are multifaceted and interconnected. A primary driver is the increasing global prevalence of periodontal diseases, which often necessitate regenerative procedures to preserve natural dentition or prepare sites for implants. Concurrently, the rising incidence of tooth loss due to age, trauma, or disease, coupled with a growing elderly population globally, fuels the demand for dental implants, thereby increasing the need for bone augmentation procedures where barrier membranes are indispensable. Furthermore, heightened awareness among patients and dental professionals regarding advanced regenerative treatments, alongside continuous technological advancements leading to more sophisticated and user-friendly membrane products, significantly contributes to market expansion. Economic development and improving healthcare infrastructure in emerging economies also play a pivotal role, making these advanced dental treatments more accessible to a wider demographic and fostering market penetration.

Oral Biological Barrier Membrane Market Executive Summary

The Oral Biological Barrier Membrane Market is witnessing robust expansion driven by evolving business trends, significant regional dynamics, and intricate segmentation shifts. Business trends indicate a strong inclination towards consolidation among market players, with strategic partnerships and mergers and acquisitions becoming common strategies to broaden product portfolios and expand geographical reach. Innovation remains a cornerstone, with companies heavily investing in research and development to introduce next-generation membranes that offer enhanced biocompatibility, superior handling characteristics, and tailored degradation profiles. There is also a growing emphasis on evidence-based dentistry, compelling manufacturers to conduct extensive clinical trials to substantiate product efficacy and gain physician trust. Furthermore, the shift towards digital dentistry, including CAD/CAM technologies for customized solutions, is slowly influencing manufacturing processes and material design, promising more precise and patient-specific regenerative outcomes in the near future.

Regional trends reveal North America and Europe as historically dominant markets, largely due to high healthcare expenditure, advanced dental infrastructure, and a strong culture of adopting innovative medical technologies. These regions continue to be key revenue generators, fueled by a high volume of dental implant procedures and a well-established network of specialized dental clinics and hospitals. However, the Asia Pacific region is rapidly emerging as the fastest-growing market, propelled by increasing disposable incomes, improving access to dental care, a vast and aging population, and a burgeoning medical tourism sector. Latin America and the Middle East and Africa also present significant growth opportunities, albeit from a smaller base, as dental awareness rises and healthcare investments increase. Regulatory landscapes vary across these regions, impacting market entry and product commercialization strategies, requiring manufacturers to adapt to diverse compliance requirements and market access pathways.

Segmentation trends highlight the increasing preference for resorbable membranes, particularly collagen-based and synthetic polymer membranes, due to their ease of use and elimination of a second surgical procedure for removal. However, non-resorbable membranes continue to hold a niche for specific clinical indications requiring longer barrier function or superior space maintenance. The application segment is dominated by dental implantology and periodontal regeneration, which together account for the majority of market share, reflecting the high prevalence of related oral health issues. End-user segmentation shows dental clinics as the primary consumers, although hospitals and ambulatory surgical centers also represent crucial segments, especially for complex oral and maxillofacial surgeries. The market is also seeing a trend towards combination products, integrating membranes with growth factors or antibiotics to enhance regenerative outcomes and minimize complications, indicating a move towards more comprehensive and sophisticated treatment solutions.

AI Impact Analysis on Oral Biological Barrier Membrane Market

Common user questions regarding the impact of AI on the Oral Biological Barrier Membrane Market frequently revolve around how artificial intelligence can revolutionize treatment planning, enhance product development, and improve surgical precision. Users are keen to understand if AI can personalize membrane selection for individual patient anatomies and regenerative needs, optimize manufacturing processes for greater efficiency and cost-effectiveness, and potentially lead to the discovery of novel biomaterials with superior properties. Concerns often include the reliability and validation of AI-driven recommendations, the potential for job displacement among dental professionals, and the ethical implications of using autonomous systems in complex surgical procedures. Overall, there is a strong expectation that AI will bring about a new era of predictive analytics, enhanced diagnostic capabilities, and precision dentistry, leading to more predictable and successful outcomes for patients requiring oral regenerative therapies.

The integration of AI technologies across various stages of the oral biological barrier membrane market lifecycle promises transformative changes, from preclinical research to post-operative care. In research and development, AI algorithms can significantly accelerate the identification and screening of potential biomaterials, predicting their biocompatibility, degradation rates, and mechanical properties based on vast datasets of material science and biological interactions. This data-driven approach allows for the rapid prototyping and testing of new membrane formulations, reducing the time and cost associated with traditional experimental methods. Furthermore, AI can aid in simulating complex biological environments, predicting how different membrane designs will interact with host tissues, and optimizing structural characteristics to achieve desired regenerative effects. This level of predictive modeling is crucial for developing innovative membranes that offer improved regenerative potential and reduced complication rates.

Within clinical practice, AI holds immense potential to enhance precision and personalization. AI-powered diagnostic tools can analyze high-resolution imaging data, such as CBCT scans, to accurately assess bone defect morphology, quantify bone volume, and identify critical anatomical structures with unparalleled precision. This analysis can then inform AI algorithms to recommend the most suitable type and size of barrier membrane for a specific patient, considering factors like bone density, defect size, and desired regenerative outcome. During surgical procedures, AI-assisted navigation systems could provide real-time guidance for precise membrane placement, minimizing invasiveness and improving the accuracy of the procedure. Post-operatively, AI can monitor healing progress by analyzing follow-up imaging and patient data, identifying early signs of complications or deviations from expected regeneration, thus allowing for timely interventions and more predictable long-term results.

- AI-enhanced diagnostic imaging for precise defect assessment and personalized treatment planning.

- Predictive analytics for optimal barrier membrane selection based on patient-specific biological factors.

- Accelerated biomaterial discovery and development through AI-driven molecular modeling and simulation.

- Automated quality control and precision manufacturing of membranes, including 3D printing of customized designs.

- Real-time AI-guided assistance during surgical placement of membranes for improved accuracy.

- Optimization of membrane degradation rates and functional properties using machine learning algorithms.

- AI-powered post-operative monitoring for early detection of complications and tracking regeneration progress.

DRO & Impact Forces Of Oral Biological Barrier Membrane Market

The Oral Biological Barrier Membrane Market is shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside significant impact forces that dictate its trajectory. A primary driver for market growth is the escalating global burden of periodontal diseases and increasing prevalence of tooth loss, which necessitate advanced regenerative solutions. The aging population worldwide, coupled with rising aesthetic consciousness, propels the demand for dental implants and associated bone augmentation procedures where barrier membranes are indispensable. Furthermore, continuous advancements in biomaterial science, leading to the development of more biocompatible, biodegradable, and functionally superior membranes, along with growing awareness and adoption of these sophisticated techniques among dental professionals, significantly fuel market expansion. These factors create a fertile ground for sustained growth, underscoring the critical role of these membranes in modern restorative and regenerative dentistry.

Despite the robust growth drivers, the market faces several notable restraints. The high cost associated with advanced barrier membranes and the complex surgical procedures required for their placement can be a significant deterrent, particularly in price-sensitive markets or for patients with limited insurance coverage. Stringent regulatory approval processes across various geographies, which demand extensive clinical data and rigorous testing, can delay product launches and increase development costs, thus posing a barrier to entry for new innovations. Moreover, the need for highly skilled and trained dental surgeons to perform these intricate procedures effectively limits adoption in regions with inadequate specialized professional training. Potential post-operative complications, though rare, such as membrane exposure, infection, or insufficient regeneration, can also impact patient and clinician confidence, necessitating continuous product improvement and refined surgical protocols.

Opportunities for market players are abundant, particularly in emerging economies where dental healthcare infrastructure is improving and disposable incomes are rising, fostering a growing patient base willing to invest in advanced treatments. The advent of personalized medicine opens avenues for customized barrier membranes, potentially fabricated using 3D printing technologies, to perfectly match individual patient anatomies and defect configurations. Research into combination therapies, such as integrating membranes with growth factors, stem cells, or antimicrobial agents, offers promising avenues to enhance regenerative outcomes and mitigate complications. Furthermore, continued innovation in synthetic and composite materials, aiming for ideal degradation kinetics and mechanical properties, presents significant development opportunities. The competitive landscape is also influenced by forces such as the bargaining power of buyers (dental clinics and hospitals), the bargaining power of suppliers (raw material providers), the threat of new entrants (innovative startups), the threat of substitute products (alternative regenerative therapies), and the intensity of rivalry among existing market players, all of which mandate continuous differentiation and strategic agility.

Segmentation Analysis

The Oral Biological Barrier Membrane Market is meticulously segmented across various dimensions to provide a comprehensive understanding of its structure, dynamics, and growth potential. These segments are crucial for market players to identify specific niches, tailor product development, and formulate targeted marketing strategies. The primary segmentation categories typically include product type, material, application, and end-user, each revealing distinct patterns of adoption and demand. Product types differentiate between resorbable and non-resorbable membranes, reflecting the balance between ease of use and sustained barrier function requirements in clinical scenarios. Material segmentation highlights the diverse biomaterials employed, from natural collagen to advanced synthetic polymers, each offering unique biochemical and mechanical properties. Application-based segmentation underscores the specific dental procedures where these membranes are predominantly utilized, while end-user segmentation pinpoints the primary purchasers and clinical settings. This detailed analysis allows for a granular view of market behavior and facilitates strategic decision-making in a highly specialized medical device sector.

- By Product Type:

- Resorbable Membranes

- Non-Resorbable Membranes

- By Material:

- Collagen

- PTFE (Polytetrafluoroethylene)

- Synthetic Polymers (e.g., PLA, PLGA)

- Titanium-Reinforced

- Others (e.g., Chitosan, Hyaluronic Acid)

- By Application:

- Guided Bone Regeneration (GBR)

- Guided Tissue Regeneration (GTR)

- Periodontal Regeneration

- Dental Implant Surgery

- Oral and Maxillofacial Surgery

- Ridge Augmentation

- By End-User:

- Dental Clinics

- Hospitals

- Ambulatory Surgical Centers

- Academic & Research Institutes

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Oral Biological Barrier Membrane Market

A comprehensive value chain analysis for the Oral Biological Barrier Membrane Market begins with the upstream activities, which are critical for the quality and cost-effectiveness of the final product. This stage primarily involves the sourcing and processing of raw materials. For collagen-based membranes, this entails acquiring high-purity collagen from bovine, porcine, or other animal sources, followed by extensive purification and sterilization processes to ensure biocompatibility and minimize immunogenicity. For synthetic polymer membranes, the upstream activities focus on the synthesis of specialized biocompatible polymers like PLA (polylactic acid) or PLGA (poly(lactic-co-glycolic acid)) by chemical manufacturers. Titanium or PTFE used in non-resorbable membranes also involves specialized material suppliers. The quality and consistency of these raw materials directly impact the performance, safety, and regulatory approval of the barrier membranes, making strong supplier relationships and stringent quality control protocols essential at this foundational stage of the value chain.

The midstream segment of the value chain is dedicated to the manufacturing and production of the barrier membranes. This involves sophisticated processes such as electrospinning for fibrous membranes, casting for film-like structures, or weaving for PTFE membranes, often performed in highly controlled cleanroom environments to meet medical device standards. Manufacturers must adhere to Good Manufacturing Practices (GMP) and ISO certifications to ensure product quality, sterility, and efficacy. Research and development activities are deeply embedded in this stage, focusing on material science innovations, improving membrane properties (e.g., porosity, degradation rate, tensile strength), and developing new fabrication techniques. Packaging, sterilization, and labeling are also crucial midstream activities, ensuring products are safe, identifiable, and ready for clinical use, aligning with global regulatory requirements for medical devices. Efficiency in manufacturing and scale-up capabilities are key competitive advantages for market participants at this stage.

The downstream activities involve the distribution channel, direct and indirect sales, and ultimately reaching the end-users. Direct distribution typically involves manufacturers selling directly to large hospital groups, academic institutions, or key opinion leaders, often supported by dedicated sales teams providing product training and technical support. Indirect distribution, which is more common, utilizes a network of distributors, wholesalers, and specialized dental supply companies that manage inventory, logistics, and sales to a broader base of dental clinics and individual practitioners. The choice between direct and indirect channels often depends on market penetration strategy, regional regulations, and the specific target audience. Effective distribution ensures product availability and timely delivery, which are critical in the healthcare sector. Post-sales support, including handling product inquiries, managing complaints, and providing clinical education, further strengthens the value proposition and builds long-term relationships with end-users, ultimately influencing market share and brand loyalty within the Oral Biological Barrier Membrane Market.

Oral Biological Barrier Membrane Market Potential Customers

The primary potential customers, or end-users/buyers, of products within the Oral Biological Barrier Membrane Market are diverse, yet concentrated within the dental and oral healthcare ecosystem. Dental clinics, ranging from general practices to specialized periodontics and oral surgery clinics, represent the largest customer segment. These clinics regularly perform procedures such as dental implant placements, guided bone regeneration for ridge augmentation, and periodontal surgeries to treat advanced gum disease. The increasing demand for aesthetic dentistry and reconstructive procedures directly translates into higher consumption of barrier membranes by these practitioners. Their purchasing decisions are often influenced by product efficacy, ease of use, cost-effectiveness, and the availability of clinical evidence supporting superior patient outcomes. Building strong relationships with individual practitioners and group practices is paramount for manufacturers seeking sustained market penetration.

Hospitals, particularly those with departments of oral and maxillofacial surgery, plastic surgery, or trauma centers, constitute another significant customer segment. These institutions often handle more complex and extensive cases, such as reconstructive surgery following trauma, tumor resection, or congenital defects, which frequently require substantial bone regeneration. The procurement processes in hospitals are typically more structured, involving committees and tendering systems, where factors like regulatory compliance, bulk purchasing discounts, and comprehensive technical support play a crucial role. Furthermore, academic and university-affiliated hospitals, which are often at the forefront of medical research and education, also serve as early adopters of innovative membrane technologies and often contribute to clinical studies, influencing broader market acceptance and professional recommendations.

Ambulatory surgical centers (ASCs) are emerging as increasingly important potential customers. These facilities provide a cost-effective alternative to traditional hospital settings for various outpatient surgical procedures, including a growing number of dental and oral surgeries requiring barrier membranes. The efficiency, specialized focus, and convenience offered by ASCs appeal to both patients and healthcare providers, driving their proliferation and increasing their demand for specialized dental products. Beyond direct clinical use, dental laboratories, particularly those involved in implantology and prosthetics, may also influence product selection by recommending specific membrane types to their referring clinicians. Lastly, research institutions and universities involved in biomaterials science and regenerative medicine serve as key indirect customers, utilizing these membranes for experimental studies and contributing to future product development, thereby indirectly influencing the market's long-term trajectory.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 420 Million |

| Market Forecast in 2033 | USD 811 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Geistlich Pharma AG, Zimmer Biomet, BioHorizons (Henry Schein), ACE Surgical Supply Co., Inc., KLS Martin Group, Collagen Matrix, Inc., Novamost Corporation, OssDente, B. Braun Melsungen AG, Baxter International Inc., Stryker Corporation, Dentsply Sirona, Integra LifeSciences, Nobel Biocare (Envista Holdings Corporation), MIS Implants Technologies Ltd., Botiss Biomaterials GmbH, Meisinger GmbH, Osteogenics Biomedical, Curasan AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oral Biological Barrier Membrane Market Key Technology Landscape

The key technology landscape of the Oral Biological Barrier Membrane Market is continually evolving, driven by advancements in biomaterials science, manufacturing techniques, and tissue engineering principles. One of the foundational technologies involves the sophisticated processing of natural materials, particularly collagen, sourced primarily from porcine or bovine tissues. Technologies in this area focus on highly controlled purification, cross-linking, and lyophilization methods to create membranes with desired structural integrity, degradation rates, and biocompatibility, minimizing immunogenicity while optimizing cellular attachment and nutrient permeability. Innovations in collagen processing aim to enhance barrier function and mechanical strength without compromising the natural bioactivity that supports tissue regeneration. The development of layered or composite collagen membranes, sometimes incorporating growth factors or antibiotics, represents a significant technological stride towards multifunctional regenerative solutions.

Another crucial technological area is the development and refinement of synthetic polymer membranes. This includes the use of biocompatible and biodegradable polymers such as polylactic acid (PLA), polyglycolic acid (PGA), and their copolymers like PLGA. Advanced manufacturing techniques, such as electrospinning, are central to creating fibrous, porous structures that mimic the extracellular matrix, offering controlled degradation kinetics and tailored porosity for selective cell migration. These technologies allow for precise control over the membrane's architecture, enabling customization of features like pore size, fiber alignment, and overall thickness to optimize guided bone and tissue regeneration. Furthermore, advancements in 3D printing and additive manufacturing are opening doors for creating patient-specific, anatomically contoured membranes, promising unparalleled precision and fit for complex defect morphologies, thereby enhancing regenerative outcomes.

Beyond material composition and fabrication, the technology landscape also encompasses surface modification and integration strategies. Technologies are being developed to functionalize membrane surfaces with bioactive molecules, such as growth factors (e.g., PDGF, BMPs), peptides, or antimicrobial agents, to actively promote angiogenesis, osteogenesis, or reduce infection risk. These advanced coatings or integrated components aim to transform passive barriers into active scaffolds that guide and accelerate the healing process. Furthermore, research into smart membranes that can respond to the local physiological environment or release therapeutic agents in a controlled manner represents the cutting edge of innovation. Quality control technologies, including advanced imaging for structural analysis and in vitro/in vivo biocompatibility testing methods, are also critical, ensuring that these high-tech membranes meet stringent safety and efficacy standards required for clinical applications and maintain their competitive edge in the evolving oral regenerative market.

Regional Highlights

- North America: This region is a dominant market due to a highly developed healthcare infrastructure, substantial R&D investments, high prevalence of dental diseases, and a strong adoption rate of advanced dental procedures. The presence of major market players and increasing awareness among both clinicians and patients about advanced regenerative treatments further solidifies its leading position. The United States, in particular, drives significant demand with its large dental implant market.

- Europe: Europe represents another significant market, characterized by sophisticated dental care systems, favorable reimbursement policies in many countries, and a growing aging population demanding restorative dental treatments. Germany, France, the UK, and Italy are key contributors, benefiting from robust research initiatives and the presence of innovative biomaterials companies. Strict regulatory standards ensure high product quality and safety within the European market.

- Asia Pacific (APAC): This region is projected to exhibit the highest growth rate, primarily driven by rapidly improving healthcare infrastructure, increasing disposable incomes, and a vast patient pool in countries like China, India, and Japan. The burgeoning medical tourism industry, coupled with increasing dental awareness and the adoption of Western dental practices, provides significant growth opportunities for manufacturers looking to expand their footprint.

- Latin America: The Latin American market is experiencing steady growth, fueled by increasing investments in healthcare, rising awareness of oral health, and a growing middle class capable of affording advanced dental treatments. Countries such as Brazil, Mexico, and Argentina are key markets, showing expanding opportunities for barrier membrane adoption as dental professionals seek modern regenerative solutions to meet patient needs.

- Middle East and Africa (MEA): This region is an emerging market with substantial untapped potential. Growth is attributed to improving healthcare expenditure, increasing dental tourism in certain countries, and a rising prevalence of dental issues. While challenges like healthcare access and affordability persist, ongoing economic development and increasing foreign investment in healthcare infrastructure are expected to drive market growth for oral biological barrier membranes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oral Biological Barrier Membrane Market.- Geistlich Pharma AG

- Zimmer Biomet Holdings, Inc.

- BioHorizons IPH, Inc. (Henry Schein, Inc.)

- ACE Surgical Supply Co., Inc.

- KLS Martin Group

- Collagen Matrix, Inc.

- Novamost Corporation

- OssDente Biomaterials (Grafton Dental LLC)

- B. Braun Melsungen AG

- Baxter International Inc.

- Stryker Corporation

- Dentsply Sirona Inc.

- Integra LifeSciences Corporation

- Nobel Biocare Services AG (Envista Holdings Corporation)

- MIS Implants Technologies Ltd.

- Botiss Biomaterials GmbH

- Meisinger GmbH

- Osteogenics Biomedical, Inc.

- Curasan AG

- Sunstar Americas, Inc.

Frequently Asked Questions

What are oral biological barrier membranes used for?

Oral biological barrier membranes are specialized devices used in guided bone regeneration (GBR) and guided tissue regeneration (GTR) procedures in dentistry. They create a physical barrier to prevent the ingrowth of fast-growing soft tissue cells into bone defects, thereby allowing slower-growing bone cells to proliferate and regenerate lost bone or periodontal tissues, crucial for dental implant success and treating gum disease.

What is the difference between resorbable and non-resorbable membranes?

Resorbable membranes, typically made from collagen or synthetic polymers, gradually degrade and are absorbed by the body over time, eliminating the need for a second surgical procedure for removal. Non-resorbable membranes, often made from PTFE or reinforced with titanium, maintain their structural integrity for longer periods and generally require a second surgery for removal once regeneration is complete, offering superior space maintenance for larger defects.

What materials are commonly used to make these membranes?

Common materials include natural collagen (derived from bovine or porcine sources) for resorbable membranes, and synthetic polymers like PLA, PGA, or PLGA for other resorbable options. For non-resorbable membranes, polytetrafluoroethylene (PTFE) and titanium-reinforced PTFE are widely used due to their biocompatibility and mechanical strength.

What factors drive the growth of the Oral Biological Barrier Membrane Market?

Key drivers include the rising global prevalence of periodontal diseases and tooth loss, increasing demand for dental implants due to an aging population and aesthetic concerns, continuous advancements in biomaterials technology, and growing awareness among dental professionals and patients about advanced regenerative treatment options.

How is AI expected to impact the future of oral biological barrier membranes?

AI is anticipated to revolutionize the market by enhancing diagnostic precision for defect assessment, enabling personalized membrane selection and design through predictive analytics, accelerating the discovery and development of new biomaterials, and improving surgical accuracy with AI-guided systems, ultimately leading to more predictable and successful regenerative outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager