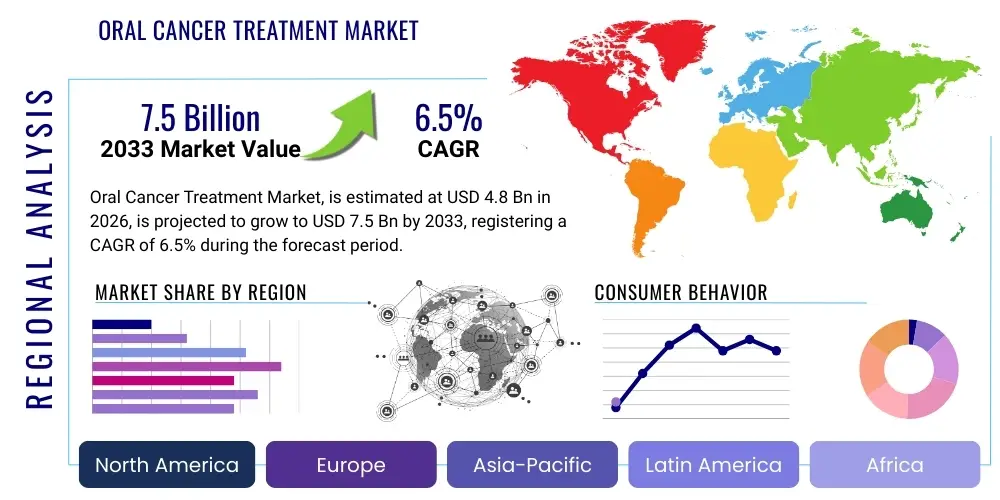

Oral Cancer Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437955 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Oral Cancer Treatment Market Size

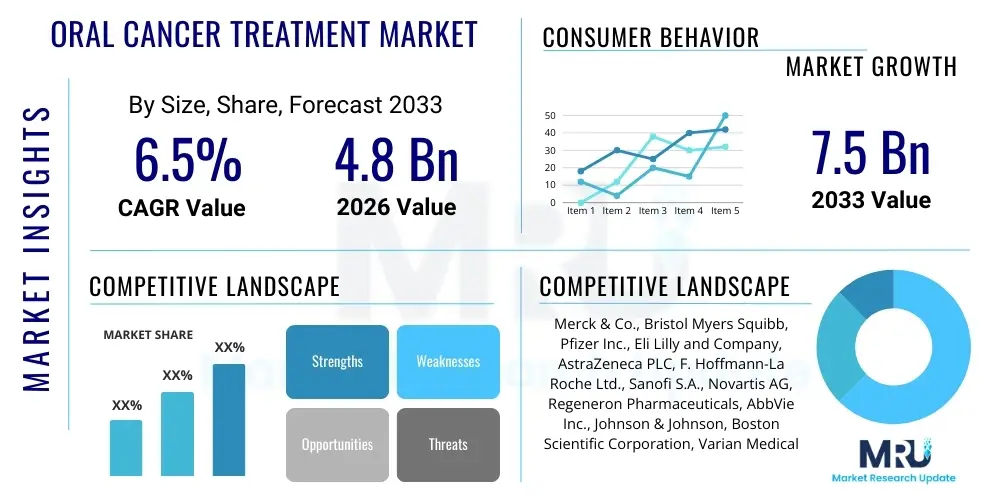

The Oral Cancer Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Oral Cancer Treatment Market introduction

The Oral Cancer Treatment Market encompasses the entire spectrum of therapeutic and diagnostic interventions aimed at managing malignant neoplasms originating in the oral cavity and pharynx. This complex domain involves highly specialized medical procedures ranging from radical surgical resections and reconstruction to advanced systemic pharmaceutical agents and high-precision radiation delivery technologies. Oral cancer, predominantly Squamous Cell Carcinoma (OSCC), represents a significant global health burden, particularly in Southeast Asia and parts of Europe, directly correlating with persistent high rates of tobacco chewing, heavy alcohol consumption, and, increasingly, infection with high-risk Human Papillomavirus (HPV). The urgency for effective treatment is amplified by the aggressive nature of the disease, often diagnosed at late stages, which necessitates comprehensive, multimodal therapeutic strategies to maximize patient survival and functional quality of life post-treatment.

The product portfolio within this therapeutic area is diverse and constantly evolving. Core pharmaceuticals include cytotoxic chemotherapy agents such as Cisplatin, Carboplatin, and 5-Fluorouracil, which remain critical components of induction and concurrent chemoradiation protocols. However, the market shift is heavily leaning towards biologics, particularly targeted therapies like Cetuximab (an EGFR inhibitor) and immune checkpoint inhibitors (e.g., Pembrolizumab and Nivolumab), which harness the body’s immune system to attack cancer cells. These advanced drugs represent a significant leap forward in managing recurrent and metastatic oral cancer, offering superior response rates and more manageable side effect profiles compared to conventional high-dose chemotherapy. Furthermore, the development of sophisticated diagnostic tools, including molecular biomarker testing for HPV status and PD-L1 expression, is crucial as these markers guide the selection of appropriate systemic therapies, enabling a true personalized medicine approach.

Driving factors for the market's robust expansion include a global increase in HPV-related oropharyngeal cancers among younger, non-smoking populations, necessitating new therapeutic approaches tailored to this distinct etiology. Concurrently, public health campaigns and improved dental screening are leading to earlier diagnosis, shifting the treatment focus toward less invasive, curative interventions like Transoral Robotic Surgery (TORS) and high-precision radiation. The introduction of combination therapies, integrating novel immunotherapies with standard radiation or chemotherapy, has demonstrated enhanced overall survival in clinical trials, thereby fueling market demand. Continuous investment by governmental bodies and venture capital in oncology R&D, aimed at reducing therapeutic toxicity and improving long-term survivorship care, provides sustained momentum for growth across all segments of the oral cancer treatment ecosystem, emphasizing the shift towards durable, functionally sparing clinical outcomes.

Oral Cancer Treatment Market Executive Summary

The global Oral Cancer Treatment Market is characterized by a high degree of technological dynamism, with current business trends indicating intense competition centered on therapeutic innovation, particularly in the systemic therapy and surgical technology segments. Pharmaceutical firms are heavily focused on expanding the indications for existing checkpoint inhibitors and developing next-generation cancer vaccines or adoptive T-cell therapies specifically tailored for head and neck squamous cell carcinoma (HNSCC). Strategically, companies are forging alliances with diagnostic developers to co-develop companion diagnostics, ensuring optimal patient selection for high-value biological drugs, thereby securing market leadership. The push towards value-based care is also driving demand for treatments that offer demonstrable quality-of-life improvements and cost-effectiveness over the entire treatment trajectory, influencing purchasing decisions by large healthcare organizations and payers prioritizing long-term patient value.

Regional dynamics highlight a complex market structure. North America maintains the primary revenue generator status due to the highest per capita healthcare spending and widespread availability of advanced treatments, including institutional access to expensive proton therapy centers and widespread reimbursement for complex surgeries and cutting-edge drug regimens. However, regulatory pressures regarding drug pricing, particularly in the US, present ongoing commercial challenges related to accessibility and affordability. The Asia Pacific region, while lagging in infrastructure quality overall, is experiencing explosive growth driven by sheer market volume, rapid urbanization, and increasing health insurance penetration. This region presents substantial opportunity for manufacturers of essential and moderately priced medical devices and generic chemotherapeutics, alongside a burgeoning, highly sophisticated market for premium biologics in developed pockets like South Korea and Australia.

Segmentation analysis clearly reveals the prominence of the Drug Therapy segment, propelled by the high commercial value and repeated dosing required for immunotherapies. Within the Drug Therapy segment, Monoclonal Antibodies specifically targeting immune checkpoints or growth factor receptors command premium pricing and lead revenue growth, redefining the standard of care for recurrent disease. In contrast, the Surgery segment is being redefined by the growth in minimally invasive techniques, such as TORS, enhancing the viability of outpatient treatment settings and driving demand for high-precision surgical instruments. The End-User segmentation shows a consolidation of care toward specialized cancer centers, which are uniquely equipped to manage the multidisciplinary complexity of oral cancer cases, requiring coordinated efforts and integrated technological platforms from suppliers.

AI Impact Analysis on Oral Cancer Treatment Market

User inquiries regarding AI’s integration into oral cancer treatment frequently explore its potential to enhance early detection accuracy, particularly in routine dental settings, and its role in customizing the highly complex planning process for radiation therapy. A major theme is the concern over data privacy and the robustness of AI model validation across diverse patient demographics and tumor heterogeneity. Users expect AI tools to significantly reduce diagnostic turnaround times and provide quantitative prognostic indicators far surpassing current methodologies. There is substantial interest in AI's capacity to analyze multi-omics data—genomic, proteomic, and clinical information—to predict individual patient response to high-cost immunotherapies and chemoradiation, thus minimizing therapeutic failure and optimizing resource allocation, a critical economic consideration in modern oncology.

Artificial Intelligence is swiftly becoming an indispensable tool across the continuum of oral cancer care, moving beyond simple image processing to complex predictive modeling. In the diagnostic phase, deep learning algorithms are trained on vast datasets of histopathological images, allowing for automated, high-throughput screening of biopsy slides. This not only speeds up the workload for pathologists but dramatically improves consistency in grading cellular differentiation and identifying tumor margins, which are vital for surgical planning and determining the extent of resection. Furthermore, AI systems are now integrated into advanced dental practices to flag suspicious mucosal changes or bone resorption patterns visible on panoramic radiographs, enabling referral for specialized investigation much earlier than traditional methods, ultimately improving detection at highly salvageable stages and reducing overall treatment complexity.

On the therapeutic front, AI systems are revolutionizing radiation oncology by providing sophisticated tools for treatment planning. Machine learning models automate the process of organ-at-risk (OAR) contouring—a laborious and expert-dependent task—reducing planning time from days to hours, ensuring faster initiation of treatment. Moreover, AI is being deployed for dose calculation optimization, generating highly conformal radiation plans that meet complex clinical objectives while maximizing healthy tissue sparing, significantly contributing to the market for advanced linear accelerators and treatment planning software. Beyond radiation, predictive analytics powered by AI assist medical oncologists by correlating genomic signatures with clinical outcomes, optimizing the sequencing and combination of systemic drugs, particularly crucial in metastatic or relapsed settings where minimizing toxicity and maximizing efficacy is paramount, making treatment delivery more precise and evidence-based.

The economic impact of AI integration is profound, driving efficiency and personalization across the market sectors. By reducing diagnostic errors and accelerating staging accuracy, AI minimizes unnecessary downstream procedures and optimizes the utilization of expensive hospital resources, leading to substantial cost savings. For pharmaceutical companies, AI accelerates the early stages of drug discovery by analyzing high-throughput screening data to identify potential therapeutic candidates and optimize clinical trial design, decreasing R&D timelines and expenditures. Furthermore, AI-driven prognostication tools enable payers and providers to strategically justify the use of high-cost targeted therapies only in patients with the highest probability of response, thereby promoting a more sustainable, value-driven healthcare model within the oral cancer treatment domain globally.

- AI-driven early detection through automated analysis of dental radiographs and optical biopsy images, achieving expert-level sensitivity and specificity.

- Enhanced pathological diagnosis via machine learning for rapid assessment of surgical margins and objective tumor classification (e.g., differentiation and invasion depth).

- Optimization of radiation therapy planning (auto-contouring, real-time adaptive radiotherapy, dose calculation optimization) reducing planning time and treatment toxicity.

- Predictive modeling for treatment response, aiding selection between surgery, chemotherapy, and high-cost immunotherapy based on integrated genomic and clinical markers.

- Drug discovery acceleration by identifying novel molecular targets, facilitating drug repurposing, and optimizing compound screening processes.

- Personalized risk stratification and recurrence monitoring based on longitudinal patient data analysis and predictive biomarkers derived from liquid biopsy techniques.

- Integration into robotic surgery platforms for enhanced precision, providing real-time tumor feedback, and creating comprehensive virtual training simulations for complex surgical procedures.

- Streamlining clinical trials management, including patient identification, outcome prediction, and data quality assurance, reducing R&D timelines and operational costs for clinical studies.

DRO & Impact Forces Of Oral Cancer Treatment Market

The Oral Cancer Treatment Market is significantly influenced by a powerful combination of drivers, restraints, and opportunities, underpinned by fundamental impact forces that dictate investment and innovation. The primary driver is the alarming increase in the global incidence of oral cavity and pharyngeal cancers, directly necessitating increased allocation of resources for screening, diagnosis, and treatment infrastructure worldwide. Technological advancements, particularly the successful clinical integration of checkpoint inhibitors and the refinement of minimally invasive surgical techniques, offer substantial opportunity for market growth by shifting the standard of care away from highly toxic cytotoxic agents towards biologically targeted approaches. However, these advancements are curtailed by major restraints, including the extremely high cost of these novel therapies and the complexity of accessing multidisciplinary care, particularly in resource-limited settings where the disease burden is often highest, creating critical market access challenges for manufacturers.

Specific market drivers include favorable shifts in diagnostic technologies, such as non-invasive molecular testing (liquid biopsies) for circulating tumor DNA (ctDNA), which promise to revolutionize early recurrence detection and surveillance protocols, reducing the need for repeated invasive procedures. The opportunity landscape is further broadened by emerging gene therapy and personalized cancer vaccine approaches currently in late-stage clinical trials, offering the potential for long-term durable remissions and new revenue streams. Conversely, the market faces significant restraints from regulatory bodies that impose rigorous clinical trial requirements for novel oncology products, leading to protracted and costly development cycles. Additionally, challenges related to the inadequate awareness and low adoption rates of preventative measures, such as comprehensive HPV vaccination programs and rigorous tobacco cessation strategies in high-risk regions, continue to feed the patient pipeline, increasing the sustained demand for complex late-stage treatments.

The impact forces within the market are predominantly centered around the pressure exerted by clinical guidelines and patient advocacy groups to improve overall survival and quality of life while simultaneously managing spiraling healthcare costs associated with chronic disease management. The rising patient demand for less toxic, more personalized treatments compels manufacturers to invest heavily in targeted research and combination therapy development that minimizes long-term morbidity. Reimbursement policies, controlled by governmental and private payers, exert a strong influence, favoring treatments with rigorously demonstrated clinical effectiveness and superior pharmacoeconomic profiles validated through real-world evidence. Ultimately, the successful navigation of this market depends on bridging the gap between high-cost innovative therapies available in developed economies and the critical need for accessible, cost-effective, and scalable solutions required to effectively address the massive patient volumes projected in emerging markets where resource constraints dominate clinical decision-making.

Segmentation Analysis

Detailed segmentation of the Oral Cancer Treatment Market provides granular insights into the expenditure patterns and technological preferences across various therapeutic areas. The market is structured around four primary pillars: treatment modality, the anatomical site of the cancer, the specific drug class utilized, and the end-user setting where the care is delivered. This multifaceted segmentation is essential because oral cancer care is inherently personalized; the optimal treatment strategy changes drastically based on the stage, location (e.g., primary tongue tumor versus tonsil tumor), and underlying biological drivers (e.g., HPV-positive or negative status) of the tumor. Analysts use these segments to track crucial shifts in standard protocols, such as the increasing role of immunotherapy in metastatic disease, or the replacement of traditional open surgical methods by sophisticated robotic techniques for organ preservation.

Segmentation by Treatment Modality highlights the sustained dominance of the Drug Therapy segment, driven primarily by the high per-patient cost and long duration of treatment involving Monoclonal Antibodies (immunotherapy and targeted therapy). This financial weight ensures continuous, high-value revenue streams for pharmaceutical companies, making it the most lucrative market segment. Radiation Therapy, while a mature segment, is experiencing high-value growth through technological upgrades, such as the adoption of expensive Proton Beam Therapy centers over conventional photon-based systems, specifically designed to minimize collateral damage in the sensitive head and neck region. Conversely, the Surgery segment, while foundational for early-stage disease control, is driven by continuous innovation in medical devices like high-definition visualization systems and robotic arms, focusing intensely on functional preservation and reduced invasiveness to meet patient demands for better quality of life.

Analyzing the market by Cancer Site reveals distinct epidemiological and therapeutic trends that inform strategic market decisions. Oropharyngeal cancers, largely driven by HPV infection in Western countries, often favor non-surgical treatments (chemo-radiation) that prioritize organ preservation, thereby boosting the Drug and Radiation segments. In contrast, Oral Cavity cancers (involving the tongue, floor of the mouth), traditionally linked to tobacco and alcohol, often necessitate complex surgery followed by adjuvant therapy, sustaining the demand for advanced surgical devices and extensive reconstructive expertise. The End-User segment reflects the complexity of care, with Specialized Cancer Centers continuing to consolidate market share. These centers not only house the necessary complex capital machinery but also employ the multidisciplinary teams required to coordinate simultaneous modalities, making them key purchasing decision-makers for high-capital equipment and premium biologics.

- By Treatment Modality:

- Surgery (Transoral Robotic Surgery (TORS), Transoral Laser Microsurgery (TOLM), Radical Neck Dissection, Microvascular Reconstructive Surgery)

- Radiation Therapy (Intensity-Modulated Radiation Therapy (IMRT), Volumetric Modulated Arc Therapy (VMAT), Stereotactic Body Radiation Therapy (SBRT), Proton Beam Therapy, Brachytherapy)

- Drug Therapy (Cytotoxic Chemotherapy, Immunotherapy (Checkpoint Inhibitors), Targeted Therapy (EGFR Inhibitors), Adjuvant and Neoadjuvant Therapy, Combination Regimens)

- Palliative Care and Symptom Management Treatments

- By Cancer Site:

- Oral Cavity (Tongue, Floor of Mouth, Gum/Alveolar Ridge, Hard Palate, Buccal Mucosa)

- Oropharynx (Tonsils, Base of Tongue, Soft Palate)

- Hypopharynx

- Larynx

- By End-User:

- Hospitals and Specialized Oncology Centers (Primary purchasers of capital equipment and biologics for inpatient and outpatient care)

- Ambulatory Surgical Centers (Growing segment for less invasive procedures, diagnostics, and outpatient infusions)

- Academic Research Institutes and University Hospitals (Key centers for clinical trials, early adoption of novel therapies, and complex reconstructions)

- By Drug Class (within Drug Therapy):

- Monoclonal Antibodies (Anti-EGFR, Anti-PD-1/PD-L1 inhibitors)

- Alkylating Agents (e.g., Cisplatin, Carboplatin)

- Antimetabolites (e.g., 5-Fluorouracil, Methotrexate)

- Tyrosine Kinase Inhibitors (TKIs) and other Small Molecule Targeted Agents

- Immunomodulators and Cancer Vaccines (Emerging)

Value Chain Analysis For Oral Cancer Treatment Market

The upstream segment of the Oral Cancer Treatment value chain is dominated by intense intellectual property creation and high-risk R&D, essential for generating market-leading products. This phase involves basic scientific discovery, preclinical testing of novel molecular entities (NMEs), and the development of specialized hardware and software for high-precision radiation and robotic surgery. Key activities include genomic sequencing to identify new therapeutic targets specific to HNSCC, the complex synthesis of biological drugs (monoclonal antibodies), and the meticulous engineering of precision surgical robotics. Companies operating here require vast capital, highly specialized scientific talent, and effective navigation of rigorous regulatory approval processes (e.g., FDA and EMA). Strategic partnerships between academic research centers and pharmaceutical giants are essential for translating preclinical findings into viable drug candidates, establishing the foundation of the market’s premium offerings and defining future standard of care.

The midstream phase focuses on scalable manufacturing, quality assurance, and complex logistical distribution. Manufacturing processes must adhere to stringent Good Manufacturing Practices (GMP), especially for high-value biologics requiring aseptic conditions and secure cold chain management from production site to point of use. For medical devices like linear accelerators and robotic systems, manufacturing involves precision engineering, software integration, and extensive quality control checks. The distribution channel is bifurcated: capital equipment sales often proceed directly from manufacturer to specialized hospital procurement departments, necessitating extensive installation and long-term maintenance contracts. Conversely, pharmaceutical distribution is primarily indirect, moving through specialized oncology wholesalers and Group Purchasing Organizations (GPOs) before reaching hospital pharmacies or outpatient infusion centers, demanding meticulous supply chain management due to the critical nature and high value of oncology drugs.

Downstream activities involve the delivery and administration of treatment, which is highly localized, skill-dependent, and patient-centric. This stage is carried out by specialized oncology teams in hospitals and dedicated cancer centers. The value delivered here is clinical efficacy and functional preservation, which depends not only on the quality of the upstream products but crucially on the skilled application of these treatments, including accurate staging, meticulous surgical tumor resection, and the precise delivery of radiation and systemic therapies. Furthermore, the downstream value extends to post-treatment survivorship programs and palliative care, utilizing follow-up diagnostics and specialized psychological support. This phase generates essential real-world data (RWD) on efficacy and toxicity, which is fed back upstream to research departments to refine drug development and optimize existing treatment protocols, thereby closing the iterative value cycle and driving continuous quality improvement across the entire therapeutic spectrum.

Oral Cancer Treatment Market Potential Customers

The most significant and consistent customers in the Oral Cancer Treatment Market are tertiary care hospitals and comprehensive cancer centers. These institutions serve as primary treatment delivery hubs for complex, multidisciplinary oncology care, handling the majority of high-stage cases requiring coordinated surgical, radiation, and medical oncology interventions. They represent massive purchasing power, acquiring high-capital equipment—including robotic surgical systems, advanced diagnostic scanners (PET-CT), and linear accelerators for radiotherapy. They also account for the largest volume purchases of therapeutic drugs—both patented biologics (immunotherapy) and generic chemotherapeutic agents—often negotiating substantial discounts through centralized procurement bodies or Group Purchasing Organizations (GPOs). Their purchasing decisions are critically influenced by clinical trial data demonstrating superior efficacy, the ability to integrate new technologies with existing infrastructure, and the necessity of specialized staff training to operate advanced equipment, ensuring continuity of high-quality care delivery.

Secondary but highly influential potential customers are governmental health systems and private health insurance payers, including national health services (e.g., NHS in the UK) and major private insurers (e.g., UnitedHealth Group, Anthem in the US). Although they do not consume the product, their role as financial gatekeepers determines market access, profitability, and patient utilization rates. They drive demand for evidence-based treatments and cost-effective solutions through formal Health Technology Assessments (HTAs), strict formulary inclusion criteria, and rigorous coverage determinations. Manufacturers must invest heavily in pharmacoeconomic studies to satisfy these payers, demonstrating that the often high initial cost of a novel therapy is justified by reduced recurrence rates, lower long-term morbidity, and improved overall patient survival. Payer acceptance is thus a necessary and crucial prerequisite for achieving widespread commercial success and market penetration for premium products.

A third crucial customer group comprises independent specialized oncology clinics and ambulatory surgical centers (ASCs). These customers are increasingly relevant for the delivery of diagnostic procedures, minor surgical resections (especially biopsies), and routine outpatient chemotherapy/immunotherapy infusions, driven by the desire for cost containment and patient convenience. They seek cost-effective, portable diagnostic devices, essential monitoring equipment, and generic or biosimilar drugs to manage standard patient care efficiently outside the high-overhead hospital setting. Their purchasing focus is on operational efficiency, ease of use, and quick patient turnaround times, representing a key channel for high-volume drug distribution. Finally, global academic and pharmaceutical research institutions are significant customers who purchase specialized laboratory equipment, reagents, and services (such as genomic sequencing and outsourced clinical trial management) to fuel the discovery pipeline for future oral cancer therapies, acting as foundational customers for diagnostic technology firms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck & Co., Bristol Myers Squibb, Pfizer Inc., Eli Lilly and Company, AstraZeneca PLC, F. Hoffmann-La Roche Ltd., Sanofi S.A., Novartis AG, Regeneron Pharmaceuticals, AbbVie Inc., Johnson & Johnson, Boston Scientific Corporation, Varian Medical Systems (Siemens Healthineers), Accuray Incorporated, Elekta AB, Teleflex Incorporated, Becton, Dickinson and Company (BD), CureVac, BeiGene, Exelixis, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Intuitive Surgical, Photofrin Medical, Daiichi Sankyo Company, Limited, Roche Diagnostics, OncoCyte Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oral Cancer Treatment Market Key Technology Landscape

The technological landscape driving the Oral Cancer Treatment Market is characterized by highly specialized, capital-intensive innovations aimed at maximizing cure rates while minimizing functional and cosmetic impairment, a critical objective in head and neck oncology. In surgical oncology, the deployment of robotic platforms, such such as Transoral Robotic Surgery (TORS), has established itself as a critical technology for access to difficult-to-reach oropharyngeal tumors, offering enhanced 3D high-definition visualization and superior instrument dexterity, thereby avoiding large external incisions and reducing recovery time. This focus on minimal invasiveness directly improves post-operative functional outcomes like swallowing and speech. Furthermore, the integration of advanced intraoperative imaging technologies, such as fluorescence-guided surgery utilizing specific tumor-targeting agents, is becoming standard practice to provide surgeons with real-time feedback, ensuring microscopic tumor margins are accurately identified and completely resected, significantly reducing the probability of local recurrence.

In radiation therapy, technological progress is intensely focused on achieving unprecedented precision and accelerating treatment delivery speed. The continuous global transition from older 3D conformal radiotherapy to advanced modalities like Intensity-Modulated Radiation Therapy (IMRT) and Volumetric Modulated Arc Therapy (VMAT) has profoundly improved dose conformity, allowing highly concentrated doses to target the tumor while meticulously sparing surrounding critical structures such as the salivary glands, pharyngeal constrictors, and spinal cord, thereby mitigating severe long-term side effects like xerostomia and dysphagia. The cutting-edge technology, Proton Beam Therapy, which offers unique physical properties enabling precise radiation dose delivery with minimal exit dose, is increasingly utilized for complex head and neck cases, although its broader market adoption remains limited by the extremely high capital investment required for facility construction and specialized operation. Current research is heavily focused on developing adaptive radiotherapy techniques that leverage AI and real-time imaging to adjust the treatment plan daily based on anatomical changes.

The pharmaceutical sector is dominated by technological breakthroughs in immunological agents and molecularly targeted drug delivery systems. The immense clinical success of immune checkpoint inhibitors, specifically those targeting the PD-1/PD-L1 axis, represents the most significant technological leap in systemic therapy for advanced HNSCC in recent history. These large molecule drugs require sophisticated, complex biotechnology manufacturing processes (bioreactors and purification). Complementing drug development is the rapid proliferation of molecular diagnostic technology, particularly Next-Generation Sequencing (NGS) and Liquid Biopsy platforms. These technologies enable the comprehensive genomic and proteomic profiling of tumor characteristics from minimal tissue or simple blood draws, identifying actionable mutations and predicting patient response to specific targeted drugs or eligibility for immunotherapy. This seamless technological integration of advanced diagnostics and targeted therapeutics is defining the future of personalized medicine in the oral cancer treatment market.

Regional Highlights

North America maintains its unchallenged position as the dominant region in the Oral Cancer Treatment Market, largely driven by the high incidence of HPV-associated oropharyngeal cancer and a highly capitalized healthcare system that mandates the rapid adoption of technological innovations. The United States market benefits significantly from robust pharmaceutical and medical device R&D investment, strong intellectual property protections, and a dynamic ecosystem of specialized cancer research centers. Furthermore, favorable, though complex, reimbursement policies established by private insurers and federal programs ensure broad patient access to high-cost treatment modalities like cutting-edge immunotherapies, personalized medicine diagnostics, and sophisticated robotic surgical systems. This regional market sets the global benchmark for clinical protocols and technology adoption, strongly influencing treatment guidelines and subsequent investment strategies worldwide.

Europe represents a mature and substantial market share, primarily supported by well-established national health services and statutory health insurance systems across Western and Northern Europe. Growth in Europe is steady, buoyed by aging populations and consistent governmental funding directed towards improving cancer outcomes as a major public health priority. Leading European economies like Germany, the U.K., and France exhibit high penetration of precision radiation technologies (IMRT, VMAT) and utilize biological agents extensively, guided by evidence-based recommendations from pan-European oncology bodies. However, market access for novel, expensive drugs is closely scrutinized by national health technology assessment (HTA) agencies, leading to stringent price negotiations and sometimes delayed clinical availability compared to the U.S. This regional focus on long-term cost-effectiveness and economic viability means that manufacturers must provide compelling real-world evidence of survival benefit and quality of life improvements to secure widespread commercial success across the continent.

The Asia Pacific (APAC) region stands out as the highest-growth potential market, reflecting a complex mix of economic and epidemiological factors. The region carries the largest global burden of oral cancer, largely attributable to high rates of tobacco chewing and smoking practices prevalent in many countries. While established markets like Japan and Australia demonstrate technological parity with Western nations, incorporating advanced robotics and immunotherapies, the vast emerging markets of India and China are characterized by high volume but significantly lower per-patient expenditure capacity. The critical market need here is for affordable and accessible foundational care, encompassing essential surgical instruments, generic chemotherapy, and scalable screening programs. Investment in local infrastructure, coupled with the manufacture of high-quality biosimilars and generic cytotoxic drugs, represents the primary commercial opportunities driving this rapid market expansion across the economically diverse APAC landscape.

Latin America and the Middle East & Africa (MEA) together form a smaller but increasingly relevant segment. In LATAM, key economic centers like Brazil and Mexico exhibit growing private healthcare sectors that are increasingly adopting advanced Western technologies, though public health systems struggle with resource constraints, leading to significant inequality in access to high-cost biologics. In the MEA region, the market is highly fragmented. Growth is concentrated in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) which are making substantial investments in state-of-the-art specialized cancer centers and are significant importers of advanced equipment and high-value pharmaceuticals. Conversely, large parts of the African continent face immense challenges regarding infrastructure, trained personnel, and basic access to cancer treatment, limiting market revenue primarily to essential drug distribution and basic surgical services, demanding innovative low-cost solutions.

- North America: Dominates the market due to leading R&D investment, highest adoption rates of immunotherapy and TORS, and favorable, though costly, reimbursement policies supporting advanced treatment protocols.

- Europe: Exhibits steady growth driven by sophisticated, centralized cancer care guidelines, high expenditure on advanced radiation therapy (IMRT, Proton Therapy), and a strong regulatory environment focused on cost-effectiveness and clinical evidence.

- Asia Pacific (APAC): Fastest growing region, fueled by the largest patient population, rapidly improving healthcare infrastructure, high prevalence of risk factors, and significant demand for both affordable generics and cutting-edge biopharma products in developed sub-regions.

- Latin America (LATAM): Moderate growth, driven by expansion of private healthcare and increasing awareness; characterized by significant disparity in technology access between private and under-funded public health sectors.

- Middle East & Africa (MEA): Emerging market concentrated in the GCC nations through heavy government investment in specialized oncology centers; market revenue relies heavily on imported technology and pharmaceuticals for elite patient segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oral Cancer Treatment Market.- Merck & Co.

- Bristol Myers Squibb

- Pfizer Inc.

- Eli Lilly and Company

- AstraZeneca PLC

- F. Hoffmann-La Roche Ltd.

- Sanofi S.A.

- Novartis AG

- Regeneron Pharmaceuticals

- AbbVie Inc.

- Johnson & Johnson

- Boston Scientific Corporation

- Varian Medical Systems (Siemens Healthineers)

- Accuray Incorporated

- Elekta AB

- Teleflex Incorporated

- Becton, Dickinson and Company (BD)

- CureVac

- BeiGene

- Exelixis

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Intuitive Surgical

- Photofrin Medical

- Daiichi Sankyo Company, Limited

- Roche Diagnostics

- OncoCyte Corporation

- Illumina, Inc.

Frequently Asked Questions

Analyze common user questions about the Oral Cancer Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Oral Cancer Treatment Market?

The Oral Cancer Treatment Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period from 2026 to 2033, driven fundamentally by the expanding application of advanced immunotherapy agents and rising global incidence rates of head and neck cancers, particularly those linked to HPV infection.

Which treatment modality holds the largest share and what is driving its growth?

Drug Therapy commands the largest market share, predominantly propelled by the introduction and rapid clinical adoption of high-value Monoclonal Antibodies, such as PD-1 inhibitors (immunotherapies), which are increasingly used in complex combination regimens for advanced and recurrent disease, commanding premium pricing and necessitating extensive, long-term treatment cycles.

How is Artificial Intelligence (AI) influencing oral cancer diagnosis and treatment planning?

AI significantly impacts the market by enhancing the speed and accuracy of early diagnosis through automated analysis of dental and pathological slides, while also critically optimizing complex radiation therapy planning (IMRT/Proton Therapy) by ensuring precise dose delivery and meticulous organ sparing, leading to superior functional patient outcomes.

What are the primary drivers accelerating the Oral Cancer Treatment Market, beyond incidence?

Key accelerators include continuous technological innovation in targeted biological agents and cancer vaccines, the rising prevalence of HPV-associated oropharyngeal cancers requiring specialized therapeutic approaches, and the increasing utilization of minimally invasive surgical techniques like Transoral Robotic Surgery (TORS) to prioritize functional preservation.

What challenges restrain the growth of the Oral Cancer Treatment Market globally?

Major restraints include the exorbitant and often prohibitive cost of novel treatments (specifically immunotherapies and proton therapy), which creates significant patient access barriers in emerging economies, alongside the persistent challenges related to inadequate public awareness, late-stage diagnosis, and the severe toxicity profiles associated with traditional treatment regimens.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager