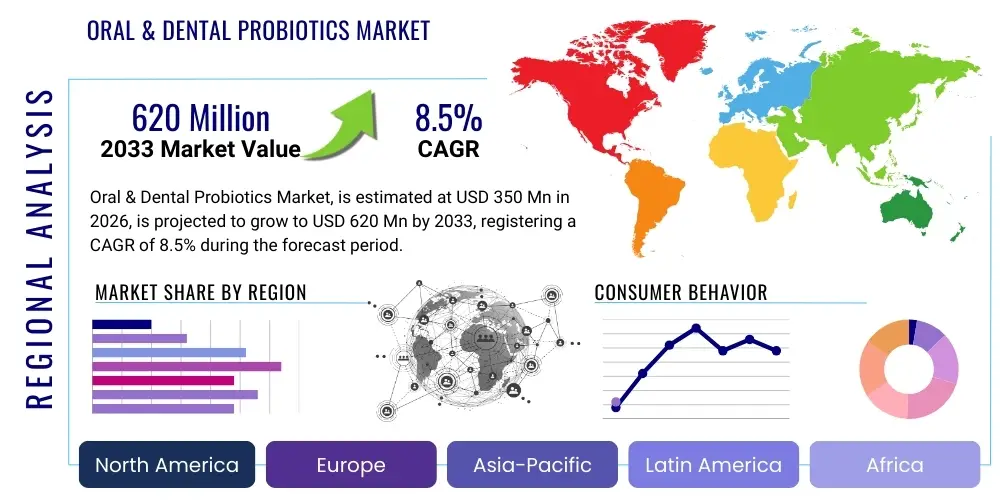

Oral & Dental Probiotics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434764 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Oral & Dental Probiotics Market Size

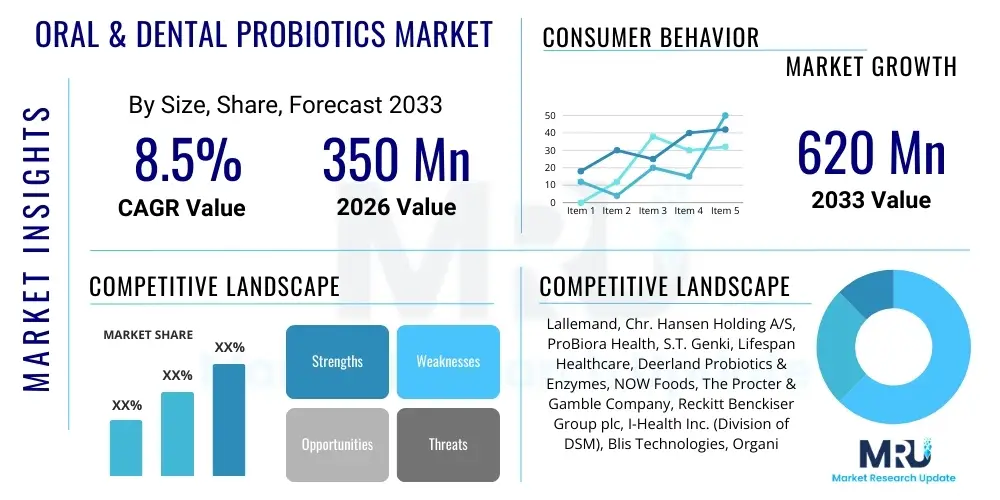

The Oral & Dental Probiotics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $350 million USD in 2026 and is projected to reach $620 million USD by the end of the forecast period in 2033.

Oral & Dental Probiotics Market introduction

The Oral & Dental Probiotics Market encompasses functional food and dietary supplement products designed to introduce beneficial microorganisms into the oral cavity to establish a balanced microflora. These products aim to combat pathogenic bacteria responsible for common dental issues such as dental caries, periodontal disease, and halitosis (bad breath). The central mechanism involves competitive exclusion, where probiotic strains colonize the oral environment, inhibiting the growth and adhesion of harmful pathogens like Streptococcus mutans and volatile sulfur compound (VSC) producing bacteria. Increasing consumer awareness regarding preventive healthcare and the limitations of traditional chemical-based oral hygiene products are propelling market expansion globally.

Products available in this market primarily utilize well-researched strains such as Lactobacillus reuteri, Bifidobacterium lactis, and, most notably, strains of Streptococcus salivarius (K12 and M18), which have demonstrated clinical efficacy in improving gingival health and reducing plaque formation. Major applications span prophylactic dental care, adjunctive therapy for treating periodontal issues, and maintenance of overall oral mucosal immunity. The product forms are diverse, including lozenges, chewable tablets, and specialized mouthwashes, catering to different consumer preferences and maximizing the duration of contact between the probiotic organism and the oral surface.

Driving factors include extensive clinical research validating the effectiveness of specific strains, rising incidence of dental diseases worldwide despite improved hygiene standards, and a shift toward natural, bio-therapeutic alternatives over antibiotics. Furthermore, the integration of oral probiotics into pediatric dental care, focusing on preventing early childhood caries, represents a significant growth trajectory. The perceived safety profile and the general wellness trend emphasizing the microbiome connection further solidify the market's robust outlook.

Oral & Dental Probiotics Market Executive Summary

The Oral & Dental Probiotics Market is characterized by strong innovation in delivery mechanisms and formulation, driven by robust clinical evidence supporting specific strains capable of modulating the oral microbiome. Key business trends indicate a strategic focus on expanding distribution channels beyond traditional pharmacies, emphasizing e-commerce platforms and professional dental clinic recommendations. Mergers and acquisitions are frequent among ingredient suppliers and supplement manufacturers seeking to secure proprietary strain technology and accelerate geographical reach. The market is increasingly segmented by targeted application, moving beyond general oral health into specialized areas like addressing oral mucositis associated with chemotherapy or managing specific halitosis causes.

Regionally, North America maintains market dominance due to high consumer spending on dietary supplements, established regulatory frameworks supporting probiotic labeling, and significant investment in R&D by major pharmaceutical and nutraceutical companies. The Asia Pacific region, however, is emerging as the fastest-growing market, propelled by rapidly increasing middle-class populations, improving access to dental care, and heightened adoption of functional food products in countries like China, Japan, and India. European markets exhibit maturity, emphasizing regulatory compliance (EFSA) and capitalizing on health claims related to immune function linked through the oral cavity.

Segment trends reveal that lozenges and chewable tablets dominate the product form category due to their optimal residence time in the mouth, crucial for successful colonization. The application segment sees general oral hygiene maintenance as the largest category, but preventive care for periodontitis and gingivitis is showing the highest growth rate, reflecting the growing awareness of the systemic link between oral health and cardiovascular well-being. Furthermore, the increasing availability of third-party clinical validation is enhancing consumer trust and driving adoption across various demographic segments, particularly among adults seeking natural alternatives for chronic oral issues.

AI Impact Analysis on Oral & Dental Probiotics Market

User inquiries regarding AI's influence on the Oral & Dental Probiotics Market frequently center on personalized strain selection, optimizing manufacturing processes, and utilizing machine learning for predictive oral health diagnostics. Consumers and professionals are keen on understanding how AI can facilitate the development of 'precision probiotics' tailored to an individual’s unique oral microbiome composition, moving away from generalized solutions. Concerns also revolve around AI's ability to analyze vast clinical trial data to identify synergistic probiotic combinations and its role in accelerating the discovery of novel strains with superior colonization potential or specific antagonistic properties against drug-resistant oral pathogens. The consensus expectation is that AI will dramatically shorten the R&D cycle and refine marketing strategies by pinpointing effective intervention points.

Artificial intelligence is being deployed in research laboratories to analyze genomic and metagenomic data derived from large-scale population studies of the oral cavity. This analysis helps identify keystone species and complex microbial interactions that influence disease progression. Machine learning algorithms can process clinical outcomes data alongside patient genetic predispositions and lifestyle factors to predict the efficacy of specific probiotic regimens, offering personalized preventive plans. This high-throughput screening and predictive modeling significantly enhances the reliability and targeted nature of future oral probiotic products.

Furthermore, AI-driven digital dentistry and telemedicine platforms are beginning to integrate oral microbiome analysis and probiotic recommendations directly into patient care pathways. For instance, AI can analyze images or sensor data from the mouth to detect early signs of dysbiosis, automatically triggering a recommendation for a specific oral probiotic product known to counteract the identified microbial imbalance. This integration streamlines diagnosis-to-treatment time and improves patient compliance by linking product usage directly to measurable health outcomes, thereby supporting higher market penetration.

- AI-powered metagenomic analysis accelerates the identification of novel, efficacious probiotic strains.

- Machine learning optimizes fermentation processes, ensuring high viability and stability of active cultures.

- Predictive modeling enables personalized probiotic formulations based on individual oral microbiome profiles.

- AI algorithms enhance clinical trial design and data interpretation for faster regulatory approval.

- Integration of AI diagnostics into dental telemedicine platforms drives direct consumer recommendations.

DRO & Impact Forces Of Oral & Dental Probiotics Market

The Oral & Dental Probiotics Market growth is fundamentally driven by the escalating global prevalence of periodontal diseases and caries, coupled with increasing consumer preference for natural, non-pharmacological therapeutic options. Restraints primarily include regulatory hurdles related to making specific health claims, the complexity of maintaining the viability and shelf life of live bacterial cultures, and the variability in efficacy observed across different individuals due to unique baseline microbiome compositions. Opportunities lie in the synergistic development of combined oral care products (e.g., probiotic toothpaste) and leveraging advancements in microencapsulation technology to improve strain stability. Impact forces underscore the high dependence on scientific validation (clinical trials) and the strong influence of dental professional recommendations shaping consumer purchasing decisions, often outweighing mass-market advertising.

Drivers prominently include substantial evidence linking oral health to systemic conditions (like diabetes and cardiovascular issues), prompting greater focus on preventive oral care, and a rising discomfort with antibiotic resistance, making probiotics an appealing, natural alternative. Innovations in product formats, such as slow-release lozenges that maximize bacterial colonization time, also provide significant market momentum. However, the relatively high cost compared to conventional oral hygiene products and the fragmented regulatory landscape regarding whether these products should be classified as supplements, functional foods, or medical foods pose substantial barriers to universal market adoption, particularly in price-sensitive regions.

The greatest opportunity remains the educational outreach aimed at both consumers and dental practitioners, establishing oral probiotics as a standard component of daily preventive care rather than merely a niche supplement. Furthermore, technological breakthroughs in strain genomics allow manufacturers to develop highly targeted, genetically optimized strains resistant to gastric acid and environmental stresses, overcoming historical instability constraints. The ongoing shift toward preventative and personalized medicine ensures that products addressing specific microbiome imbalances will capture premium market positioning and drive long-term growth.

Segmentation Analysis

The Oral & Dental Probiotics Market is extensively segmented based on product type, application, distribution channel, and end-user, reflecting a diverse landscape tailored to various consumer needs and consumption habits. Segmentation ensures manufacturers can target specific demographics (e.g., children with caries risk or adults with chronic halitosis) with specialized formulations optimized for delivery and efficacy. Analyzing these segments provides critical insights into purchasing patterns, identifying high-growth areas such as specialized applications and direct-to-consumer (DTC) distribution models, which are leveraging health personalization trends.

The primary segment drivers include the formulation complexity, with lozenges being popular due to efficacy, and the application focus, with prophylactic dental health constituting the largest volume but specialized treatments driving value growth. Geographically, segmentation highlights varying regulatory acceptance and cultural preferences regarding probiotic consumption, dictating product availability and market entry strategies for key players.

- Product Type:

- Tablets/Capsules

- Lozenges/Pastilles

- Chewable Forms

- Powders

- Rinses/Gels

- Application:

- Preventive Dental Care (General Oral Health)

- Halitosis Treatment

- Gingivitis and Periodontitis Management

- Dental Caries Prevention

- Other Specific Oral Issues (e.g., Oral Thrush, Oral Mucositis)

- Distribution Channel:

- Online Stores (E-commerce, Company Websites)

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Dental Clinics and Hospitals

- End-User:

- Adults

- Children (Pediatric Population)

- Strain Type:

- Streptococcus salivarius (K12, M18)

- Lactobacillus strains (L. reuteri, L. rhamnosus)

- Bifidobacterium strains

- Other Proprietary Blends

Value Chain Analysis For Oral & Dental Probiotics Market

The value chain for the Oral & Dental Probiotics Market begins with extensive upstream activities centered on microbial strain selection, genetic sequencing, and high-purity fermentation processes. Raw material providers, often highly specialized biotechnology companies, focus on optimizing bacterial viability, stability, and mass production yield under stringent quality controls. Critical factors at this stage include sourcing proprietary, patented strains and developing advanced delivery technologies, such as microencapsulation, which significantly influence the final product’s shelf life and efficacy. This upstream phase requires heavy investment in R&D and intellectual property protection.

The midstream focuses on manufacturing and formulation, where bulk probiotic powders are integrated into consumer-ready formats like lozenges, tablets, or powders, requiring specialized pharmaceutical-grade facilities to prevent contamination and ensure accurate dosing. Packaging plays a crucial role in maintaining viability, often utilizing airtight, moisture-resistant materials. Downstream distribution involves both direct and indirect channels. Indirect channels, such as pharmacies and supermarkets, rely on established logistics networks, while direct channels, particularly e-commerce and professional recommendations (via dental clinics), offer manufacturers higher margins and direct consumer interaction, which is vital for building brand loyalty in a health-focused niche.

Dental professionals often act as crucial gatekeepers, providing endorsements that lend credibility and drive indirect sales. Direct-to-consumer online sales are growing rapidly, benefiting from detailed digital marketing campaigns focused on educational content and personalized health solutions. The effectiveness of the overall value chain is highly dependent on rigorous quality assurance and transparent clinical documentation that supports product claims, ensuring consumer trust from the point of strain origin to final consumption.

Oral & Dental Probiotics Market Potential Customers

The primary customer base for Oral & Dental Probiotics is highly diversified, encompassing individuals actively seeking preventive healthcare solutions, patients suffering from chronic oral conditions like halitosis or persistent gingivitis, and parents focused on reducing the risk of dental caries in children. Customers typically exhibit high health literacy and are often already users of general digestive probiotics, leading to easier adoption of targeted oral solutions. The typical buyer prioritizes long-term, natural solutions over short-term pharmacological interventions, valuing clinical validation and strain specificity highly in their purchasing decisions.

A significant segment includes adults aged 35-65 who are concerned about periodontal health, often influenced by dental hygienist or periodontist recommendations. This group frequently uses the products as adjunctive therapy to maintain the benefits of professional cleanings. Another fast-growing segment is the pediatric market, where parents are seeking alternatives to fluoride-only treatments to protect children's developing dentition against S. mutans colonization, especially in high-risk groups or those undergoing orthodontic treatment.

Furthermore, patients with underlying systemic conditions (e.g., diabetics, immunocompromised individuals, or those undergoing specific medical treatments like chemotherapy) who are prone to secondary oral infections and dysbiosis represent a high-value niche market. Dental clinics themselves are increasingly becoming key buyers and distributors, integrating these products into their standard post-treatment care packages to enhance patient outcomes and compliance, thereby solidifying the professional endorsement channel as critical to market success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 million USD |

| Market Forecast in 2033 | $620 million USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lallemand, Chr. Hansen Holding A/S, ProBiora Health, S.T. Genki, Lifespan Healthcare, Deerland Probiotics & Enzymes, NOW Foods, The Procter & Gamble Company, Reckitt Benckiser Group plc, I-Health Inc. (Division of DSM), Blis Technologies, Organika Health Products, Straumann Group, BioGaia AB, Sunstar Suisse S.A., AOBiome Therapeutics, Kemin Industries, Inc., Pure Encapsulations, General Mills, DuPont Nutrition & Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oral & Dental Probiotics Market Key Technology Landscape

The technological landscape of the Oral & Dental Probiotics Market is dominated by advancements in strain isolation and stabilization techniques crucial for ensuring product efficacy. High-throughput screening using genomic analysis is the foundational technology employed to identify probiotic strains that exhibit strong antagonistic activity against key oral pathogens, such as Streptococcus mutans and Porphyromonas gingivalis, while also demonstrating robust adhesion capabilities to oral mucosal surfaces. Specialized techniques are employed to ensure the strains are not only effective but also safe for ingestion and capable of surviving manufacturing processes.

A major technological focus is the optimization of fermentation and downstream processing, specifically lyophilization (freeze-drying) and spray-drying, to achieve high cell concentration and long-term shelf stability at ambient temperatures. Furthermore, microencapsulation technology is pivotal. This involves coating the live bacteria cells with protective matrices (often polysaccharide or protein-based) to shield them from environmental stressors like moisture, oxygen, and fluctuating temperatures during storage and distribution. This protective layer is essential for maximizing the number of viable bacteria delivered to the target site—the oral cavity—at the point of consumption.

Delivery mechanism innovation also forms a key part of the technology landscape. Development efforts concentrate on matrices that allow slow release or extended dissolution in the mouth, such as specialized lozenges or melts, ensuring the probiotic cells have adequate contact time to colonize the dental plaque and mucosal surfaces effectively. These technological advancements collectively address the primary industry challenge: maintaining the high viability and targeted activity of the living biological ingredients until they achieve their therapeutic function.

Regional Highlights

- North America: This region holds the largest market share, driven by high consumer acceptance of dietary supplements, substantial healthcare expenditure, and a well-developed infrastructure for clinical research supporting product validation. The US and Canada are major consumers, benefiting from proactive marketing by large nutraceutical companies and strong adoption within professional dental channels. High awareness regarding the link between oral health and systemic diseases further fuels demand for premium, clinically proven oral probiotic products.

- Europe: Europe represents a mature market characterized by stringent regulatory environments, particularly the European Food Safety Authority (EFSA), which heavily influences health claim substantiation. Countries like Germany, the UK, and Scandinavia show high penetration, emphasizing research into specific strains like S. salivarius K12 and M18. Growth is steady, focused on innovation in functional food applications and leveraging consumer demand for immune health benefits stemming from the oral microbiome.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, stimulated by rising disposable incomes, rapid urbanization, and an expanding awareness of preventive healthcare among large populations, particularly in China and India. Government initiatives to improve oral health literacy and the strong cultural acceptance of traditional functional foods accelerate the adoption of oral probiotic supplements. The market is highly sensitive to price, favoring accessible formats and local strain development.

- Latin America (LATAM): Growth in LATAM is moderate but steady, centered in major economies like Brazil and Mexico. The market often lags in regulatory clarity but shows increasing consumer interest in natural health products. Distribution largely relies on pharmacy networks, and market expansion is heavily dependent on professional dental recommendations and educational campaigns.

- Middle East and Africa (MEA): This region is an emerging market with potential, though currently constrained by lower penetration rates and fragmented healthcare systems. Demand is predominantly concentrated in the Gulf Cooperation Council (GCC) countries, driven by expatriate populations and growing wellness trends. Market development requires localized product formulations and addressing challenges related to high heat distribution logistics affecting product stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oral & Dental Probiotics Market.- Lallemand

- Chr. Hansen Holding A/S

- ProBiora Health

- S.T. Genki

- Lifespan Healthcare

- Deerland Probiotics & Enzymes

- NOW Foods

- The Procter & Gamble Company

- Reckitt Benckiser Group plc

- I-Health Inc. (Division of DSM)

- Blis Technologies

- Organika Health Products

- Straumann Group

- BioGaia AB

- Sunstar Suisse S.A.

- AOBiome Therapeutics

- Kemin Industries, Inc.

- Pure Encapsulations

- General Mills

- DuPont Nutrition & Health

Frequently Asked Questions

Analyze common user questions about the Oral & Dental Probiotics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Oral & Dental Probiotics and how do they function?

Oral and Dental Probiotics are supplements containing beneficial bacteria, such as Streptococcus salivarius, designed to colonize the mouth. They function by competitively inhibiting the growth of harmful pathogens responsible for dental decay, gum disease, and bad breath, thus restoring a healthy balance (eubiosis) to the oral microbiome.

What specific conditions can Oral Probiotics help manage?

Oral Probiotics are primarily used to prevent dental caries (cavities), reduce plaque formation, mitigate the symptoms of gingivitis (gum inflammation), and effectively treat halitosis (chronic bad breath) by neutralizing volatile sulfur compounds produced by undesirable bacteria.

Which probiotic strains are most effective for oral health?

Highly effective and clinically studied strains include Streptococcus salivarius K12 and M18, and specific strains of Lactobacillus reuteri. These strains are selected for their ability to adhere to oral tissues, produce bacteriocins (natural antimicrobial substances), and outcompete pathogenic species.

What are the primary factors driving the growth of the Oral Probiotics Market?

Market growth is driven by the increasing global prevalence of dental diseases, rising consumer preference for natural preventive healthcare alternatives over antibiotics, and growing scientific validation linking oral health to systemic health, encouraging proactive use of specialized supplements.

How should Oral Probiotics be consumed for maximum effectiveness?

For maximum effectiveness, oral probiotics are typically consumed in lozenge or chewable tablet form, allowing the beneficial bacteria to dissolve slowly in the mouth, maximizing contact time with the mucosal surfaces and ensuring successful colonization before being swallowed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager