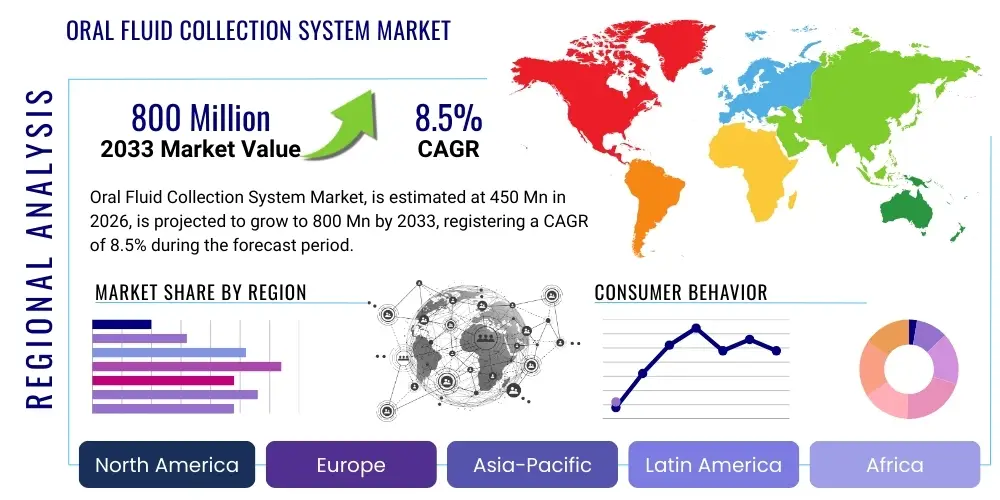

Oral Fluid Collection System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440588 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Oral Fluid Collection System Market Size

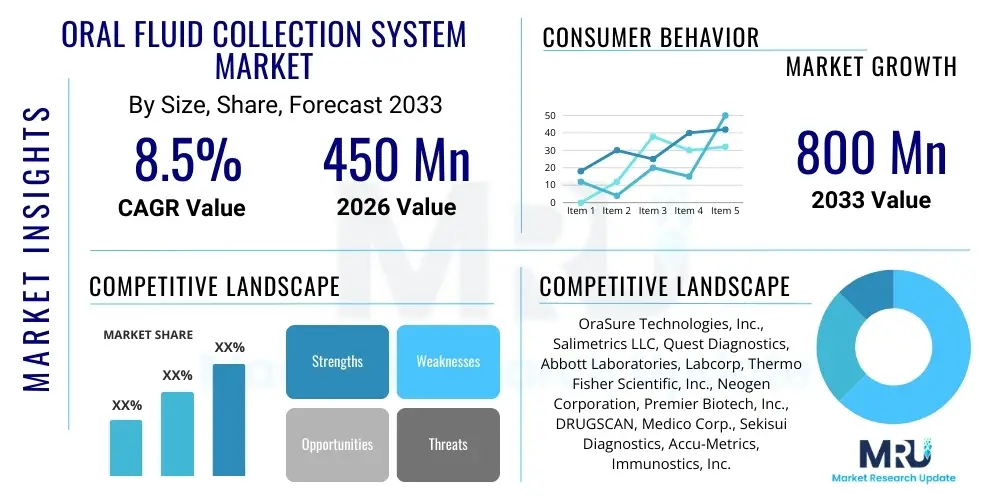

The Oral Fluid Collection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033. This robust growth is primarily driven by an increasing global emphasis on non-invasive diagnostic methods, the rising prevalence of infectious diseases requiring accessible testing, and the expanding applications of oral fluid in drug monitoring and forensic analysis. The market's upward trajectory is further supported by continuous advancements in collection device technologies and assay sensitivities, making oral fluid a more reliable matrix for a broader spectrum of biomarkers.

The inherent advantages of oral fluid collection, such as ease of use, reduced biohazard risk for healthcare workers, and suitability for remote or point-of-care settings, are significant contributors to its market expansion. Furthermore, the societal shift towards less intrusive medical procedures and the growing demand for rapid diagnostic solutions in public health crises are pivotal in shaping market dynamics. As regulatory frameworks evolve to accommodate novel diagnostic approaches, the oral fluid collection system market is poised for substantial penetration across various healthcare and public safety sectors, reflecting a paradigm shift in specimen collection methodologies.

Oral Fluid Collection System Market introduction

The Oral Fluid Collection System Market encompasses a sophisticated range of devices and consumables designed for the non-invasive retrieval of saliva and other oral secretions for diagnostic, screening, and monitoring purposes. These systems facilitate the collection of oral fluid samples, which are then analyzed for various biomarkers, drugs, pathogens, and hormones, offering a less intrusive alternative to traditional blood or urine collection. The product portfolio typically includes absorbent pads, sponges, swabs, specialized collection tubes, and integrated kits that ensure sample integrity and stability from collection to laboratory analysis. Major applications span across critical areas such as drug testing in workplaces and correctional facilities, diagnosis of infectious diseases like HIV, hepatitis, and respiratory viruses, forensic toxicology, and research into biomarkers for stress, endocrine disorders, and various systemic diseases.

The primary benefits of oral fluid collection systems include their non-invasive nature, which enhances patient comfort and compliance, particularly in pediatric or vulnerable populations. They eliminate the risk of needlestick injuries, making them safer for both patients and healthcare professionals. Moreover, these systems simplify sample collection, often allowing for self-collection or collection by non-medical personnel, thereby reducing logistical complexities and costs associated with skilled phlebotomy. This ease of use also makes them ideal for widespread screening programs, point-of-care diagnostics, and settings where immediate results or discreet sampling is required. The driving factors behind the market's growth are multifaceted, including the increasing global burden of infectious diseases, the imperative for comprehensive drug abuse screening programs, technological advancements improving assay sensitivity, and the growing preference for non-invasive diagnostic methodologies in clinical and public health contexts.

Oral Fluid Collection System Market Executive Summary

The Oral Fluid Collection System Market is experiencing dynamic growth, propelled by evolving business trends that prioritize non-invasive, efficient, and cost-effective diagnostic solutions. Key business trends include the shift towards decentralized testing, particularly point-of-care (POC) applications, driven by demand for rapid results and reduced turnaround times. Furthermore, there is a significant push for integrated collection and analysis systems, streamlining workflows and minimizing human error. Strategic collaborations between device manufacturers and diagnostic assay developers are becoming prevalent, aiming to offer comprehensive, end-to-end solutions. The market is also witnessing increasing investment in research and development to enhance the stability of collected analytes and broaden the spectrum of detectable biomarkers, thereby expanding the utility of oral fluid in various medical and forensic fields.

Regionally, North America and Europe currently dominate the market due to established healthcare infrastructures, high awareness of non-invasive testing benefits, and robust regulatory support for diagnostic innovations. However, the Asia Pacific region is projected to exhibit the highest growth rate, fueled by improving healthcare access, increasing healthcare expenditure, and a rising prevalence of target diseases alongside expanding drug testing programs in emerging economies like China and India. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as governments and private organizations invest in public health initiatives and modern diagnostic tools. Segment-wise, drug testing remains a cornerstone application, but disease diagnosis, especially for infectious diseases and increasingly for chronic conditions, is rapidly gaining traction. The market is also seeing robust expansion in forensic toxicology and academic research, indicating a diversification of application areas. Product segments like specialized collection devices and integrated kits are experiencing heightened demand due to their convenience and improved analytical performance.

AI Impact Analysis on Oral Fluid Collection System Market

Users frequently inquire about how artificial intelligence (AI) could revolutionize the oral fluid collection system market, particularly concerning diagnostic accuracy, efficiency, and the development of new applications. Common questions revolve around AI's capability to enhance the sensitivity and specificity of oral fluid-based assays, automate data interpretation, and improve predictive analytics for disease progression or drug metabolism. There is significant interest in AI's role in streamlining laboratory workflows, reducing diagnostic errors, and enabling more personalized diagnostic approaches. Additionally, users are keen to understand AI's potential in identifying novel biomarkers from complex oral fluid matrices and its implications for point-of-care testing by providing immediate, intelligent insights. Concerns also emerge regarding data privacy, algorithmic bias, and the regulatory challenges associated with deploying AI in such critical diagnostic environments.

- AI algorithms can significantly improve the accuracy of oral fluid diagnostic assays by analyzing complex biomarker patterns that might be imperceptible to traditional methods, enhancing sensitivity for early disease detection.

- Integration of AI in automated oral fluid analysis systems can accelerate sample processing, reduce manual intervention, and improve laboratory efficiency, leading to faster turnaround times for results.

- AI-powered predictive analytics can correlate oral fluid biomarker profiles with disease progression, treatment response, or drug abuse patterns, offering valuable insights for personalized medicine and patient management.

- Machine learning models can identify and validate new biomarkers within oral fluid, expanding the diagnostic utility of these systems for a broader range of conditions, including chronic diseases and mental health disorders.

- AI can facilitate real-time data interpretation at the point of care, providing immediate, actionable diagnostic information and supporting rapid decision-making in diverse settings.

- Enhanced quality control and error detection through AI-driven anomaly detection can ensure higher reliability of oral fluid test results, minimizing false positives and negatives.

- AI tools can optimize the design of collection devices by simulating fluid dynamics and absorbent properties, leading to more efficient and standardized sample acquisition.

- Development of AI-enabled remote monitoring platforms utilizing oral fluid data can empower telehealth initiatives, allowing for continuous health tracking and early intervention for patients.

DRO & Impact Forces Of Oral Fluid Collection System Market

The Oral Fluid Collection System Market is shaped by a confluence of influential factors, categorized as Drivers, Restraints, and Opportunities, which collectively constitute the impact forces determining its growth trajectory. Key drivers include the escalating global demand for non-invasive and patient-friendly diagnostic and monitoring solutions, particularly in light of increasing public health awareness and a growing preference for comfort in medical procedures. The rising prevalence of infectious diseases, such as HIV and various respiratory viruses, coupled with the ongoing challenges of substance abuse, significantly fuels the need for convenient and accessible testing methods. Furthermore, continuous technological advancements in collection device design, material science, and assay sensitivities are making oral fluid analysis increasingly reliable and comprehensive, expanding its applications across clinical, forensic, and research domains. The reduced biohazard risks associated with oral fluid collection, compared to blood draws, also acts as a strong driver for adoption in various healthcare settings.

Conversely, several restraints impede the market's full potential. A primary challenge is the typically lower concentration of certain analytes in oral fluid compared to blood, which can sometimes impact assay sensitivity and limit the range of detectable biomarkers. Issues related to sample stability, particularly for delicate molecules, and potential contamination from food particles or oral hygiene products can also pose analytical challenges, requiring stringent collection protocols. Regulatory hurdles and the slow adoption of new diagnostic technologies in some regions, coupled with limitations in reimbursement policies for oral fluid tests, further act as deterrents. Overcoming these technical and operational obstacles is crucial for broader market penetration. However, the market presents significant opportunities for innovation and expansion. These include the development of advanced multiplex assays that can detect multiple biomarkers simultaneously from a single oral fluid sample, the integration of oral fluid collection with digital health platforms for remote patient monitoring, and the penetration into emerging markets with rapidly developing healthcare infrastructures. The expansion of point-of-care testing capabilities and the application of oral fluid in personalized medicine, particularly for therapeutic drug monitoring and pharmacogenomic studies, represent substantial avenues for future growth and innovation.

Segmentation Analysis

The Oral Fluid Collection System Market is comprehensively segmented based on various critical parameters including product type, application, and end-user, allowing for a detailed understanding of market dynamics and targeted strategic planning. This multi-faceted segmentation helps to delineate the specific niches within the market and identify key growth areas. Each segment represents distinct needs and operational environments, dictating the design and functionality of the collection systems. The overarching aim of this segmentation is to provide granular insights into consumer behavior, technological preferences, and market penetration across different verticals, thereby enabling stakeholders to optimize product development and market entry strategies.

- By Product Type:

- Devices

- Absorbent Pads/Sponges

- Saliva Collection Tubes/Vials

- Oral Swabs

- Integrated Collection Kits

- Consumables

- Buffers and Stabilizers

- Transport Media

- Calibration Solutions

- Devices

- By Application:

- Drug Testing

- Workplace Drug Testing

- Clinical Drug Testing

- Criminal Justice Testing

- Disease Diagnosis

- Infectious Diseases (e.g., HIV, Hepatitis, SARS-CoV-2)

- Hormonal Imbalance

- Stress Markers

- Cancer Biomarkers

- Forensic Analysis

- Research and Development

- Drug Testing

- By End-User:

- Diagnostic Laboratories

- Hospitals and Clinics

- Forensic Laboratories

- Academic and Research Institutions

- Workplace Testing Programs

- Public Health Organizations

- Home Care Settings

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Oral Fluid Collection System Market

The value chain for the Oral Fluid Collection System Market encompasses a series of interconnected activities, beginning with upstream raw material sourcing and extending through manufacturing, distribution, and ultimate end-user application. Upstream analysis involves the procurement of specialized materials such as absorbent polymers, medical-grade plastics, and chemical reagents for buffers and stabilizers. Key activities here include research and development for novel material formulations, quality control for component manufacturing, and securing reliable supply chains for critical components. Manufacturers often engage with specialized suppliers to ensure the high purity and biocompatibility of materials, which are crucial for maintaining sample integrity and assay performance. Innovation in materials science, particularly for enhancing sample stability and collection efficiency, is a significant focus at this stage.

Moving downstream, the value chain progresses through the manufacturing of the collection devices and kits, including assembly, sterilization, and packaging. This stage involves stringent quality assurance processes to comply with medical device regulations and ensure product safety and efficacy. Following manufacturing, the products enter various distribution channels, which can be broadly categorized into direct and indirect methods. Direct distribution involves manufacturers selling directly to large diagnostic laboratories, hospital networks, or government public health agencies, often through their own sales forces or dedicated portals. Indirect distribution leverages a network of wholesalers, distributors, and third-party logistics providers who facilitate market penetration across broader geographical areas and diverse customer bases, including smaller clinics, pharmacies, and academic institutions. The choice of distribution channel often depends on the target market, geographical reach, and the scale of the customer base. Effective channel management, including inventory optimization and timely delivery, is paramount to ensuring product availability and customer satisfaction. The efficiency and robustness of this value chain are critical for the timely and widespread adoption of oral fluid collection systems globally.

Oral Fluid Collection System Market Potential Customers

The potential customers and end-users of oral fluid collection systems are diverse and span across multiple sectors, each driven by unique diagnostic and screening needs. Diagnostic laboratories form a significant customer segment, utilizing these systems for a wide array of tests, including infectious disease panels, drug screening, and hormone analysis. These laboratories value the systems for their ability to streamline sample reception, reduce biohazard exposure, and integrate seamlessly with automated analytical platforms. Hospitals and clinics also represent a substantial customer base, where oral fluid collection is increasingly employed for rapid point-of-care testing, particularly in emergency departments, pediatric units, and general practice settings, due to its non-invasiveness and ease of administration, enhancing patient comfort and compliance.

Forensic laboratories are critical end-users, relying on oral fluid collection systems for toxicology screening in impaired driving cases, post-mortem investigations, and criminal justice applications, valuing the direct evidence of recent drug use and the reduced risk of sample tampering compared to urine. Academic and research institutions extensively utilize these systems for biomarker discovery, physiological monitoring studies, and epidemiological research, appreciating the convenience and ethical advantages of non-invasive sample collection. Furthermore, workplace testing programs, particularly in industries requiring stringent drug and alcohol screening, are significant customers, as oral fluid testing offers a less intrusive, more observable, and often quicker alternative to urine tests, improving employee acceptance and program efficiency. Public health organizations and home care settings are emerging as crucial segments, driven by the need for widespread, accessible, and easily deployable testing solutions, especially during public health crises or for chronic disease management, where self-collection or simple administration is highly beneficial.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OraSure Technologies, Inc., Salimetrics LLC, Quest Diagnostics, Abbott Laboratories, Labcorp, Thermo Fisher Scientific, Inc., Neogen Corporation, Premier Biotech, Inc., DRUGSCAN, Medico Corp., Sekisui Diagnostics, Accu-Metrics, Immunostics, Inc., LCMS Limited, Bio-Rad Laboratories, Roche Diagnostics, Siemens Healthineers, F. Hoffmann-La Roche Ltd., Luminex Corporation, BioMerieux SA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oral Fluid Collection System Market Key Technology Landscape

The Oral Fluid Collection System Market is significantly shaped by a dynamic technological landscape, focusing on innovations that enhance sample collection efficiency, preserve analyte integrity, and improve diagnostic accuracy. A primary area of technological advancement involves the development of novel absorbent materials for collection devices, such as specialized polymers and membranes, which offer superior absorption rates and allow for targeted collection of specific analytes while minimizing non-specific binding. These materials are engineered to quickly saturate and release the oral fluid efficiently, ensuring a consistent and representative sample. Furthermore, advancements in integrated collection kits are crucial, combining the collection device with pre-filled stabilizing buffers or transport media that prevent degradation of sensitive biomarkers like nucleic acids, proteins, and hormones, thus extending sample stability from collection to laboratory analysis. This integration reduces handling errors and improves overall sample quality.

Another key technological thrust is the miniaturization and smart integration of collection systems, especially for point-of-care (POC) applications. This includes devices that allow for simpler, user-friendly self-collection in non-clinical settings, often accompanied by color indicators to confirm sufficient sample volume. The evolution also extends to analytical platforms, where oral fluid samples are increasingly compatible with highly sensitive techniques such as mass spectrometry, immunoassays, and polymerase chain reaction (PCR). Innovations in microfluidics are paving the way for advanced oral fluid diagnostics, enabling rapid, multi-analyte testing on small sample volumes. Digital connectivity is also emerging as a pivotal technology, with some systems incorporating features for real-time data logging, tracking, and secure transmission, facilitating integration with electronic health records and telehealth services. These technological advancements collectively drive the market forward by expanding the range of detectable biomarkers, improving test reliability, and making oral fluid collection a more versatile and attractive option across various diagnostic and research applications.

Regional Highlights

- North America: This region stands as a dominant force in the Oral Fluid Collection System Market, primarily driven by a well-established healthcare infrastructure, high awareness and adoption of non-invasive diagnostic technologies, and significant investments in research and development. The United States, in particular, accounts for a large share due to widespread drug testing programs in workplaces and a robust demand for rapid infectious disease diagnostics. Canada also contributes significantly, with increasing governmental focus on public health screening and early disease detection initiatives. The region benefits from strong regulatory support for novel diagnostic devices and a high prevalence of conditions requiring constant monitoring, such as substance abuse and chronic diseases.

- Europe: Europe represents another substantial market for oral fluid collection systems, characterized by advanced healthcare systems, a strong emphasis on patient comfort, and supportive regulatory frameworks from bodies like the European Medicines Agency (EMA). Countries such as Germany, the UK, France, and Italy are key contributors, driven by expanding applications in forensic toxicology, clinical diagnostics for infectious diseases, and an increasing focus on personalized medicine. The region's aging population and the growing demand for home-based diagnostic solutions further stimulate market growth. European research institutions also play a vital role in advancing the scientific understanding and application of oral fluid biomarkers.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for oral fluid collection systems, propelled by rapidly developing healthcare infrastructure, increasing healthcare expenditure, and a vast population base with rising awareness of advanced diagnostic methods. Countries like China, India, Japan, and South Korea are at the forefront of this growth. Factors such as the high burden of infectious diseases, increasing incidence of lifestyle-related disorders, and the expansion of drug enforcement and public health screening programs contribute significantly. Government initiatives aimed at improving healthcare accessibility and adopting cost-effective diagnostic tools are key drivers. The region also presents significant opportunities for market players due to its large patient pool and burgeoning medical tourism sector.

- Latin America: This region is experiencing steady growth in the oral fluid collection system market, driven by improving healthcare access, increasing governmental investments in public health, and a rising demand for non-invasive diagnostic tools. Brazil and Mexico are leading the adoption due to their large populations and efforts to modernize healthcare facilities. The growing prevalence of infectious diseases, coupled with increasing drug abuse challenges, necessitates efficient and accessible testing solutions. While the market is still developing compared to North America and Europe, opportunities exist for manufacturers to cater to unmet diagnostic needs and introduce cost-effective solutions tailored to regional economic conditions.

- Middle East and Africa (MEA): The MEA region shows promising potential for the oral fluid collection system market, albeit from a smaller base. Growth is attributed to increasing healthcare investments, a growing awareness of modern diagnostic techniques, and efforts to combat infectious diseases and substance abuse. Countries like Saudi Arabia, UAE, and South Africa are leading the adoption due to their relatively advanced healthcare sectors and strategic initiatives to enhance public health services. Challenges such as limited healthcare infrastructure in some areas and varying regulatory landscapes exist, but the region's commitment to improving healthcare standards and adopting innovative medical technologies presents significant opportunities for market expansion and penetration in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oral Fluid Collection System Market.- OraSure Technologies, Inc.

- Salimetrics LLC

- Quest Diagnostics

- Abbott Laboratories

- Labcorp

- Thermo Fisher Scientific, Inc.

- Neogen Corporation

- Premier Biotech, Inc.

- DRUGSCAN

- Medico Corp.

- Sekisui Diagnostics

- Accu-Metrics

- Immunostics, Inc.

- LCMS Limited

- Bio-Rad Laboratories

- Roche Diagnostics

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd.

- Luminex Corporation

- BioMerieux SA

Frequently Asked Questions

Analyze common user questions about the Oral Fluid Collection System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using oral fluid collection systems?

Oral fluid collection systems offer several key advantages, including their non-invasive nature which enhances patient comfort and compliance, particularly in sensitive populations. They eliminate the risk of needlestick injuries for healthcare workers, simplify sample collection procedures allowing for self-collection or collection by non-medical personnel, and facilitate rapid diagnostic testing in various settings, including point-of-care and remote locations. These benefits contribute to improved safety, efficiency, and accessibility in diagnostic and screening processes.

For which applications are oral fluid collection systems most commonly used?

Oral fluid collection systems are widely utilized across various applications. Their most common uses include comprehensive drug testing in workplaces, clinical settings, and criminal justice systems to detect illicit substances and prescription drug abuse. They are also crucial for the diagnosis of infectious diseases such as HIV, Hepatitis C, and various respiratory viruses like SARS-CoV-2. Additionally, these systems find significant application in forensic toxicology, monitoring hormonal imbalances, and conducting research and development for new biomarker discovery.

How do oral fluid collection systems compare to traditional blood or urine testing?

Compared to blood testing, oral fluid collection is non-invasive, pain-free, and poses no risk of needlestick injury, making it ideal for patient comfort and safety. While analyte concentrations in oral fluid can sometimes be lower than in blood, advancements in assay sensitivity are bridging this gap. Versus urine testing, oral fluid collection is less susceptible to adulteration or substitution, offers a more immediate detection window for recent drug use, and is often preferred for observed collections. However, urine generally allows for detection over a longer period.

What technological advancements are driving the oral fluid collection system market?

The market is driven by several technological advancements, including the development of advanced absorbent materials that enhance sample collection efficiency and analyte preservation. Innovations in integrated collection kits with stabilizing buffers improve sample integrity and extend stability. Miniaturization and smart integration are facilitating point-of-care applications, while compatibility with highly sensitive analytical techniques like mass spectrometry and PCR is broadening the scope of detectable biomarkers. Digital connectivity features also enable real-time data management and integration with telehealth platforms.

What are the main challenges or restraints faced by the oral fluid collection system market?

Key challenges include the typically lower concentration of certain analytes in oral fluid compared to blood, which can affect assay sensitivity for some tests. Sample stability can also be an issue for delicate biomarkers if not properly preserved. Regulatory hurdles for new device approvals and variations in reimbursement policies across different regions pose additional restraints. Furthermore, potential contamination from food or oral hygiene products can necessitate careful collection protocols, and a general lack of widespread awareness about oral fluid's full diagnostic potential in some areas can slow adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager