Oral Fluid Drug Test System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435037 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Oral Fluid Drug Test System Market Size

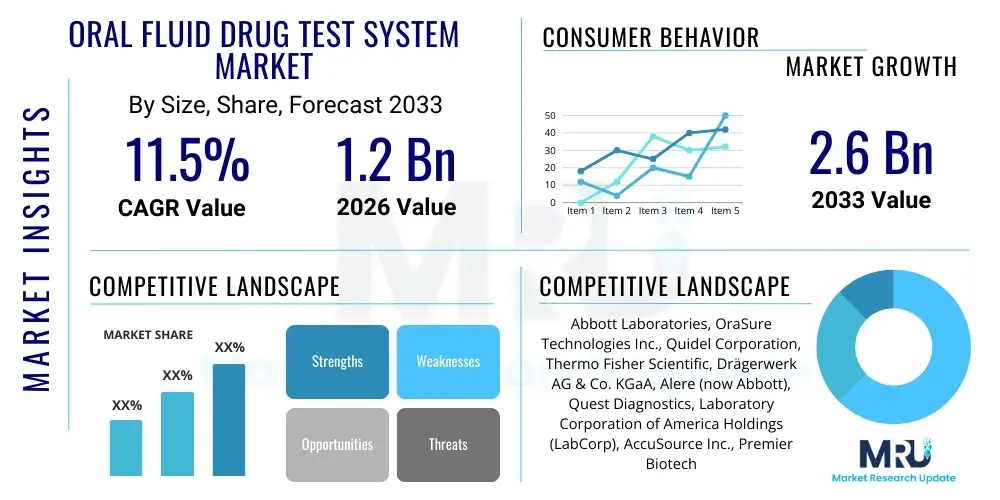

The Oral Fluid Drug Test System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033.

Oral Fluid Drug Test System Market introduction

The Oral Fluid Drug Test System Market encompasses the instruments, consumables, and services utilized for detecting the presence of drugs or their metabolites in saliva or oral fluid. These systems offer a non-invasive, convenient, and tamper-resistant alternative to traditional methods like urine and blood testing, making them increasingly popular in various sectors, particularly for instant and point-of-collection testing (POCT). The primary product categories include rapid screening devices, laboratory-based confirmatory analyzers, and associated collection kits and reagents. These systems are designed to detect substances such as cannabis, opioids, amphetamines, cocaine, and benzodiazepines, providing quick results crucial for time-sensitive decision-making.

Major applications of oral fluid drug test systems span criminal justice, workplace testing, pain management clinics, and roadside enforcement. Their ease of use eliminates the need for specialized facilities or same-sex specimen collection oversight, significantly streamlining the testing process. Furthermore, oral fluid testing primarily indicates recent drug use, which is critical for determining impairment in scenarios like post-accident investigations or traffic stops. This focus on recent use enhances their utility over urine tests, which may detect residual metabolites from past usage.

Key driving factors accelerating market adoption include stricter regulatory mandates regarding workplace safety, the global rise in drug abuse (particularly opioids and synthetic substances), and growing legislative support for non-invasive testing methods. The integration of advanced technologies, such as highly sensitive immunoassay techniques and sophisticated confirmatory chromatography methods, is continually improving the accuracy and reliability of these systems. Benefits derived from these systems include reduced collection costs, enhanced donor comfort, and superior sample integrity due to reduced opportunities for adulteration.

Oral Fluid Drug Test System Market Executive Summary

The Oral Fluid Drug Test System Market is characterized by robust growth, driven by the increasing demand for rapid, non-invasive screening technologies, particularly within employment screening and governmental sectors. Business trends indicate a strong focus on developing highly multiplexed test panels capable of simultaneously detecting a wider range of substances, coupled with enhancing the connectivity of POCT devices for seamless data integration into health management systems. Strategic collaborations between device manufacturers and large diagnostic laboratories are becoming pivotal, aiming to standardize testing protocols and expand geographical reach, particularly in emerging economies where workplace safety regulations are tightening.

Regionally, North America maintains market dominance due to high incidence of drug testing requirements mandated by federal and state regulations, alongside widespread corporate adoption of drug-free workplace policies. However, the Asia Pacific region is demonstrating the highest growth trajectory, spurred by increasing investment in healthcare infrastructure, urbanization, and a growing awareness regarding occupational safety standards in manufacturing and industrial sectors. European markets are driven by roadside impairment testing legislation, demanding highly portable and reliable screening solutions for law enforcement agencies.

Segment trends reveal that the Consumables segment (including collection kits and reagents) commands the largest market share owing to their recurring procurement nature, essential for every test performed. The Workplace Testing application segment is the primary revenue generator, reflecting the consistent need for pre-employment and random employee drug screenings. Technologically, lateral flow assays (LFAs) remain popular for rapid screening, while Liquid Chromatography-Mass Spectrometry (LC-MS) continues to be the gold standard for high-volume, highly accurate confirmatory testing in centralized laboratories, cementing the dual-platform approach characterizing the current market landscape.

AI Impact Analysis on Oral Fluid Drug Test System Market

Common user questions regarding AI’s influence on the Oral Fluid Drug Test System Market primarily revolve around four key areas: enhancing test result accuracy, automating laboratory workflow, improving data security and privacy compliance (HIPAA/GDPR), and facilitating predictive analytics for identifying drug use trends. Users are keen to understand how machine learning algorithms can minimize human error in result interpretation, particularly in complex confirmatory tests like LC-MS/MS, and how AI can aid in the early detection of novel synthetic drugs that current assays may miss. The integration of AI for streamlining the chain of custody documentation and automatically flagging anomalous test patterns is a major expectation, promising to revolutionize efficiency and accountability within high-volume testing environments.

The application of Artificial Intelligence within this market is expected to significantly optimize operational processes, moving beyond simple automation into complex decision support systems. For rapid screening, AI-powered image analysis can interpret lateral flow assay results with greater objectivity and precision than human readers, reducing inter-operator variability and potentially decreasing the false positive or false negative rates associated with visual interpretation. Furthermore, in centralized laboratories, AI algorithms can optimize instrument calibration schedules, predict maintenance needs, and intelligently manage sample queues, thereby maximizing throughput and reducing turnaround times critical for justice and employment decisions. This shift towards smart diagnostic tools is making testing more reliable and scalable.

Moreover, AI is playing a crucial role in big data analysis related to public health and epidemiology. By aggregating anonymized testing data from diverse sources—workplace testing, clinical settings, and law enforcement—AI models can identify emerging substance abuse patterns, regional hotspots for specific drugs, and the efficacy of public health interventions. This level of predictive insight allows policymakers and healthcare providers to anticipate future demand for specific test panels and allocate resources more effectively. The deployment of decentralized, connected POCT devices integrated with AI analytics platforms ensures real-time surveillance capabilities, transforming the market from reactive testing to proactive health monitoring.

- AI enhances the accuracy of rapid test interpretation by utilizing computer vision for objective analysis of assay lines.

- Machine learning algorithms optimize laboratory workflow management, including sample prioritization and instrument maintenance scheduling.

- AI facilitates predictive identification of emerging synthetic drug compounds based on mass spectrometry data patterns.

- Advanced analytics improve data integration, ensuring robust compliance with strict data privacy regulations like HIPAA and GDPR.

- AI-driven tools streamline the chain of custody verification process, minimizing potential tampering and ensuring legal defensibility of results.

- Predictive modeling assists public health officials and employers in tracking regional drug prevalence and tailoring testing strategies accordingly.

DRO & Impact Forces Of Oral Fluid Drug Test System Market

The Oral Fluid Drug Test System Market is strongly influenced by a combination of powerful drivers, structural restraints, and significant emerging opportunities, collectively shaping its growth trajectory and competitive landscape. The principal driver is the non-invasiveness and convenience offered by oral fluid collection, contrasting sharply with the complexities and invasiveness of blood or urine samples, which improves donor compliance and reduces administrative overhead. However, the market faces a persistent restraint related to standardization; specifically, variations in testing cut-off levels across different jurisdictions and the perceived lack of long-term drug detection window compared to hair or urine testing can limit adoption in certain applications. The primary opportunity lies in the rapid technological maturation of Point-of-Care Testing (POCT) systems, offering immediate results outside traditional laboratory settings.

Impact forces stemming from global regulatory environments are particularly acute. Government mandates, especially in the US and Europe, requiring mandatory drug testing for safety-sensitive positions (e.g., transportation, aviation) substantially fuel market demand for reliable screening tools. Conversely, ongoing legal and political shifts surrounding the legalization of recreational cannabis in numerous regions present a challenge; while increasing the need for impairment testing (a driver), it simultaneously forces manufacturers to develop tests that accurately distinguish between recent use leading to impairment and historic consumption (a restraint). This balancing act necessitates continuous innovation in assay specificity and sensitivity to maintain legal and operational relevance.

The competitive intensity within the market is high, with key players focusing on vertical integration and geographical expansion through strategic mergers and acquisitions. Supplier power remains moderate, as the specialized nature of reagents and detection components necessitates reliance on a limited pool of highly technical suppliers. Buyer power is elevated, particularly in large volume contracts originating from federal agencies or major industrial conglomerates, who demand stringent quality assurance, competitive pricing, and comprehensive service agreements. These dynamics enforce a strong emphasis on product differentiation through superior accuracy, faster processing times, and enhanced digital connectivity capabilities to secure major contracts and market share.

Segmentation Analysis

The Oral Fluid Drug Test System Market is strategically segmented based on product type, application, and end-user, providing a granular view of market dynamics and opportunity areas. Product segmentation differentiates between instruments (analyzers, readers) and consumables (collection kits, reagents, assay cartridges), recognizing the high-volume, recurring nature of the consumables segment which dominates revenue generation. Application segmentation highlights the diverse settings where these tests are employed, most notably the workplace, criminal justice systems, and clinical settings such as pain management centers.

The market also segments distinctly by End-User, primarily distinguishing between government agencies (law enforcement, military), private employers, and hospitals/diagnostic laboratories. Private employers, requiring mandatory drug screening for safety and liability management, represent the largest and fastest-growing end-user group. Furthermore, segmentation by technology—specifically Immunoassay Screening vs. Chromatography Confirmation—is vital, reflecting the dual requirement for both fast initial results and legally defensible confirmation of positive findings, driving investment in highly sensitive LC-MS/MS platforms.

Geographically, the market is dissected into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America currently leads due to established regulatory frameworks and high test volumes, but the Asia Pacific region is rapidly expanding its market presence driven by infrastructure development and increasing focus on industrial safety standards. Analyzing these segments helps stakeholders tailor their product portfolios and marketing strategies to meet specific regulatory and operational needs across different geographical and application domains.

- Product:

- Consumables (Collection Kits, Reagents, Assay Cartridges)

- Instruments (Analyzers, Readers, Calibration Devices)

- Application:

- Workplace Testing (Pre-employment, Random, Post-accident)

- Criminal Justice and Law Enforcement (Roadside, Correctional Facilities)

- Clinical Testing (Pain Management, Rehabilitation Centers)

- Public Health Screening

- End-User:

- Diagnostic Laboratories

- Government Agencies

- Private Organizations (Corporations, SMEs)

- Hospitals and Trauma Centers

- Technology:

- Immunoassay Screening (Lateral Flow Assays, ELISA)

- Chromatography Confirmation (LC-MS/MS, GC-MS)

Value Chain Analysis For Oral Fluid Drug Test System Market

The value chain for the Oral Fluid Drug Test System Market begins with the upstream activities centered around raw material sourcing, which involves highly specialized chemical compounds for reagents and advanced plastics for collection devices and instrumentation components. Research and Development (R&D) is a crucial upstream step, focusing on improving the sensitivity, specificity, and shelf-stability of immunoassays and developing innovative collection methods that optimize sample volume and integrity. Key manufacturers heavily invest in R&D to obtain necessary regulatory approvals (e.g., FDA, CE Mark) which acts as a primary barrier to entry and a determinant of market success. Efficient sourcing and high-quality manufacturing of complex diagnostic components are critical differentiators in this initial stage.

Midstream activities involve the primary manufacturing, assembly, and rigorous quality assurance testing of the diagnostic kits and analyzer instruments. Distribution channels play a vital role in connecting manufacturers to diverse end-users. Direct distribution is common for large-scale contracts with government entities or major diagnostic reference laboratories, allowing for specialized service agreements and training. Indirect distribution relies on established networks of specialized medical device distributors and wholesalers, especially for reaching smaller clinics, remote occupational health centers, and international markets. Effective inventory management and cold chain logistics, particularly for temperature-sensitive reagents, are essential throughout this stage.

The downstream segment focuses on the point of consumption, where the tests are administered and results are processed. This involves highly trained personnel in workplace settings, law enforcement, or clinical laboratories. Post-sales service and support, including instrument maintenance, calibration, and provision of supplementary consumables, significantly influence customer retention and market reputation. Regulatory compliance and the seamless integration of testing results into existing health information systems (HIS) or laboratory information management systems (LIMS) represent the final, high-value component of the chain, ensuring the efficiency and legal defensibility of the testing process.

Oral Fluid Drug Test System Market Potential Customers

The potential customer base for the Oral Fluid Drug Test System Market is highly diversified, spanning multiple sectors that prioritize safety, compliance, and rapid decision-making regarding impairment. The largest single group of buyers comprises corporate entities across various industries, particularly those classified as safety-sensitive, such as transportation, manufacturing, mining, construction, and utilities. These private employers utilize the systems primarily for pre-employment screening, random testing mandated by company policies, and post-accident investigations to mitigate legal liability and ensure a drug-free work environment. The ease of collection inherent to oral fluid testing makes it highly attractive for on-site, large-scale employee screening programs.

Another critical customer segment is government agencies, including federal, state, and municipal law enforcement. Police and correctional facilities are key users, relying on rapid oral fluid tests for roadside impairment detection (crucial for drunk and impaired driving enforcement) and probation/parole compliance monitoring. Regulatory bodies, such as the Department of Transportation (DOT) in the US, also drive significant demand by mandating drug testing for workers in safety-critical roles. These government buyers prioritize robust validation, low detection limits, and legally sound, court-admissible results, often leaning towards laboratory confirmation services integrated with collection devices.

Finally, the healthcare sector constitutes a rapidly growing customer base, particularly pain management clinics and addiction treatment centers. Clinicians increasingly use oral fluid systems for routine monitoring of patients prescribed controlled substances to ensure compliance and detect potential substance abuse or diversion. Diagnostic laboratories and reference labs act as high-volume buyers of advanced instruments (LC-MS/MS) and confirmation kits, processing samples collected across all other end-user segments, underscoring their central role as service providers within the overall market ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, OraSure Technologies Inc., Quidel Corporation, Thermo Fisher Scientific, Drägerwerk AG & Co. KGaA, Alere (now Abbott), Quest Diagnostics, Laboratory Corporation of America Holdings (LabCorp), AccuSource Inc., Premier Biotech Inc., Express Diagnostics International Inc., Salimetrics LLC, Instant Technologies Inc., Wondfo Biotech Co. Ltd., Clinical Reference Laboratory (CRL), Lifeloc Technologies Inc., DrugScan Inc., Bio-Rad Laboratories Inc., Randox Laboratories Ltd., and Sentinel Offender Services LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oral Fluid Drug Test System Market Key Technology Landscape

The technological landscape of the Oral Fluid Drug Test System Market is bifurcated into screening and confirmatory methodologies, each serving distinct functional requirements. Screening technologies are dominated by immunochromatographic assays, specifically lateral flow assays (LFAs), which are designed for rapid, qualitative, or semi-quantitative results at the point of collection. Recent advancements in LFA technology focus on improving the sensitivity and increasing the multiplexing capability, allowing a single device to simultaneously test for up to 12 or more different drug classes. Furthermore, the integration of digital readers and smartphone apps for automated result interpretation ensures objective reporting, minimizes human error, and facilitates real-time data transmission compliant with chain-of-custody requirements.

Confirmatory testing relies heavily on advanced analytical chemistry techniques, primarily Liquid Chromatography-Tandem Mass Spectrometry (LC-MS/MS) and Gas Chromatography-Mass Spectrometry (GC-MS). LC-MS/MS is the preferred method, offering extremely high sensitivity, specificity, and the capability to definitively identify and quantify drug metabolites, which is essential for legally defensible results in criminal justice and federal workplace testing. Technological innovation in this area focuses on reducing sample preparation time, automating extraction processes, and developing standardized reference materials to ensure inter-laboratory consistency. The high upfront cost and complex operation of these instruments, however, restrict their deployment mainly to large central reference laboratories.

A critical emerging technological trend is the development of microfluidic and lab-on-a-chip devices for oral fluid analysis. These compact systems aim to bring laboratory-grade accuracy closer to the point of care by integrating sample preparation, separation, and detection into a small, disposable cartridge. Furthermore, sophisticated data management platforms and cloud-based connectivity are essential components of the modern oral fluid testing ecosystem. These digital platforms securely manage patient demographics, track the chain of custody digitally using barcodes or RFID, and automate reporting to comply with stringent regulatory mandates, enhancing both efficiency and auditability across the entire testing lifecycle.

Regional Highlights

The global Oral Fluid Drug Test System Market exhibits diverse regional adoption patterns driven by varying regulatory environments, prevalence of drug abuse, and industrial needs. North America stands as the largest market, largely due to stringent workplace drug testing requirements enforced by federal bodies like the U.S. Department of Transportation (DOT), coupled with widespread voluntary testing programs in the private sector. The mature healthcare infrastructure and high consumer awareness regarding drug testing accuracy also contribute to the region’s dominance. The continuous evolution of cannabis legalization mandates an increased reliance on oral fluid testing to assess recent impairment.

Europe represents the second-largest market, characterized by significant adoption in law enforcement for roadside drug screening, particularly in countries like the UK, Germany, and France. European market growth is further supported by proactive governmental initiatives aimed at reducing drug-related traffic accidents. However, market penetration is fragmented due to diverse national regulations concerning testing cut-offs and acceptable methodologies. Growth is robust in Nordic countries and Western Europe, where investment in sophisticated portable screening devices is prioritized to enhance police operational effectiveness.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion is fueled by developing economies such as China, India, and Southeast Asian nations, which are witnessing rapid industrialization and consequently, the implementation of stricter occupational health and safety standards. Increased foreign direct investment often brings international drug-free workplace policies, driving demand for cost-effective, non-invasive screening solutions. Investments in healthcare infrastructure and rising awareness of public health issues are also significant factors accelerating the adoption of these systems in clinical and governmental settings across APAC.

- North America: Dominant market share attributed to mandatory federal testing, stringent workplace policies, and high demand for confirmation services.

- Europe: High adoption driven by roadside drug testing enforcement, focusing on portable and reliable POCT devices for law enforcement.

- Asia Pacific (APAC): Highest projected CAGR due to rapid industrialization, increasing awareness of occupational safety, and growing healthcare expenditure in emerging economies.

- Latin America: Emerging market characterized by increasing government focus on reducing drug trafficking and associated crime, slowly integrating testing into workforce screening.

- Middle East and Africa (MEA): Growth driven by expatriate workforce screening requirements and governmental efforts to combat illicit drug use in GCC countries, prioritizing high security and accuracy.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oral Fluid Drug Test System Market.- Abbott Laboratories

- OraSure Technologies Inc.

- Quidel Corporation

- Thermo Fisher Scientific

- Drägerwerk AG & Co. KGaA

- Quest Diagnostics

- Laboratory Corporation of America Holdings (LabCorp)

- Premier Biotech Inc.

- Express Diagnostics International Inc.

- Salimetrics LLC

- Wondfo Biotech Co. Ltd.

- Clinical Reference Laboratory (CRL)

- Lifeloc Technologies Inc.

- DrugScan Inc.

- Bio-Rad Laboratories Inc.

- Randox Laboratories Ltd.

- Sentinel Offender Services LLC

- Instant Technologies Inc.

- AccuSource Inc.

- Confirm BioSciences (now part of OraSure Technologies)

Frequently Asked Questions

Analyze common user questions about the Oral Fluid Drug Test System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of oral fluid drug testing over traditional urine testing?

The primary advantage is non-invasiveness and the elimination of privacy concerns during collection, making it easier to administer on-site or at the point of care. Oral fluid also primarily detects recent drug use, which is critical for determining acute impairment, especially relevant for post-accident and roadside testing scenarios.

How accurate are oral fluid drug test systems for common substances like cannabis and opioids?

Oral fluid screening tests (immunoassays) offer high sensitivity for common drugs but require confirmatory testing (typically LC-MS/MS) for legally binding results. Confirmatory oral fluid tests meet extremely high accuracy and specificity standards, comparable to or exceeding those of traditional laboratory methods.

Which industry application contributes the most significantly to the Oral Fluid Drug Test System Market revenue?

Workplace testing, encompassing pre-employment, random, and post-incident screening across safety-sensitive industries (e.g., transportation, manufacturing, energy), generates the largest share of market revenue due to high volume and recurring testing mandates designed to mitigate organizational liability.

What are the main technical limitations currently restraining broader market adoption?

The main limitations include the shorter window of detection for some substances compared to urine or hair analysis, the ongoing challenge of achieving universal standardization of cut-off levels across international borders, and the higher unit cost of specialized collection devices and reagents for some manufacturers.

How is technology, specifically AI, influencing the future development of these testing systems?

AI is being integrated to enhance accuracy in result interpretation (especially in rapid screening devices), automate laboratory workflows for faster turnaround times, and provide advanced predictive analytics for tracking emerging drug trends and improving chain-of-custody documentation security.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager