Oral Rehydration Salts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433036 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Oral Rehydration Salts Market Size

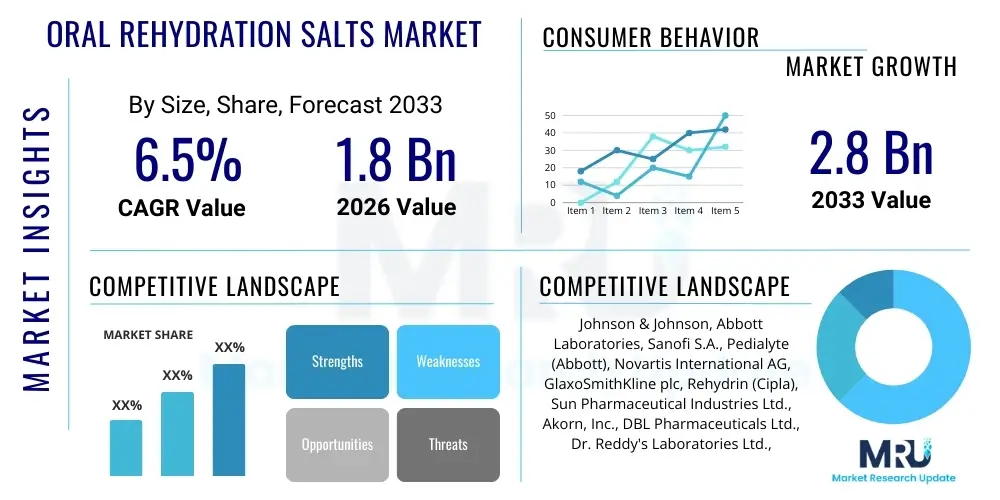

The Oral Rehydration Salts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Oral Rehydration Salts Market introduction

The Oral Rehydration Salts (ORS) Market encompasses the production, distribution, and sale of specific salt, sugar, and mineral formulations designed to prevent or reverse dehydration caused primarily by diarrhea, vomiting, or excessive perspiration. ORS solutions function by leveraging the sodium-glucose co-transport mechanism in the small intestine, facilitating the absorption of water and electrolytes, which are critical for restoring fluid balance. This simple yet profound medical innovation, often referred to as the most significant medical advance of the 20th century in pediatric care, continues to be the cornerstone treatment recommended by organizations such as the World Health Organization (WHO) and UNICEF for acute watery diarrhea.

ORS products are highly versatile, finding major applications not only in managing diarrheal diseases, especially among children in developing nations, but also increasingly in managing dehydration related to intense athletic activity, heat exhaustion, and travel-related illnesses. The standard ORS formulation contains sodium chloride, glucose, potassium chloride, and trisodium citrate, balanced precisely according to WHO guidelines (low osmolarity formulation) to ensure maximum efficacy and rapid fluid absorption with minimal side effects. The inherent benefits of ORS are manifold: it is extremely cost-effective, easily administered, non-invasive, and remarkably effective at reducing mortality rates associated with severe dehydration, making it a critical public health tool.

Market growth is substantially driven by the high global incidence of diarrheal diseases, particularly in Asia Pacific and Sub-Saharan Africa, coupled with intensive public health campaigns promoting ORS use. Furthermore, the increasing consumer awareness regarding wellness, coupled with the rising popularity of sports and fitness activities, has catalyzed the demand for advanced, flavored ORS and electrolyte solutions tailored for adult consumption. Product innovation, including the development of better-tasting formulations and ready-to-drink options, is continuously expanding the consumer base beyond traditional medical settings into the general wellness and recovery sectors.

Oral Rehydration Salts Market Executive Summary

The Oral Rehydration Salts market is undergoing a structural shift characterized by robust business trends focusing on convenience, palatability, and diversified product forms. Key business trends include the strong adoption of specialized formulations for pediatric use, featuring natural flavorings and lower sugar content, addressing historical restraints related to taste compliance. Furthermore, pharmaceutical and nutraceutical companies are aggressively expanding their distribution networks, utilizing both traditional pharmacy channels and modern e-commerce platforms, enhancing accessibility, particularly in urban and semi-urban areas. Strategic collaborations between market players and non-governmental organizations (NGOs) continue to be pivotal in facilitating large-scale procurement and distribution in endemic regions, sustaining baseline market demand.

Regionally, the market demonstrates significant variations in maturity and growth trajectory. The Asia Pacific (APAC) region currently dominates the market share due to high population density, prevalent enteric diseases, and sustained government-led initiatives supporting ORS usage. However, high-growth potential is increasingly concentrated in the Middle East & Africa (MEA) region, where improvements in healthcare infrastructure combined with high burdens of infectious diseases and vulnerability to climate change-induced heat stress are driving rapid volume expansion. North America and Europe, while having lower incidences of life-threatening diarrheal disease, show steady growth driven by the adoption of sophisticated ORS products positioned as advanced recovery and hydration solutions for athletes and frequent travelers, moving the product beyond purely medicinal applications.

Segmentation trends highlight a noticeable pivot towards innovative delivery mechanisms. While traditional powder packets (sachets) remain the dominant segment due to their low cost and logistical simplicity, the ready-to-drink (RTD) liquid segment is exhibiting the fastest growth rate, fueled by demand for immediate use and superior convenience among adult consumers and in developed markets. Based on application, the clinical segment (treating acute diarrhea and dehydration) remains the volume leader, but the wellness and sports hydration segment is capturing increasing investment, reflecting the market’s evolution from an essential medicine to a mainstream functional health product. This dual market dynamic requires manufacturers to maintain dual production strategies targeting both mass public health markets and premium consumer markets simultaneously.

AI Impact Analysis on Oral Rehydration Salts Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Oral Rehydration Salts market frequently center on three critical themes: optimizing supply chain logistics to ensure prompt delivery during outbreaks, utilizing predictive analytics for preemptive inventory management in high-risk areas, and enhancing personalized hydration recommendations. Consumers and healthcare professionals are particularly interested in how AI can solve the historical challenge of timely distribution in remote or disaster-stricken regions, reducing the significant lag time between disease outbreak and adequate ORS availability. Furthermore, there is growing expectation that AI-driven diagnostic tools, coupled with geospatial data, could forecast localized dehydration risks based on climate patterns, sanitation data, and infectious disease surveillance, allowing for hyper-targeted public health interventions and minimizing waste in distribution. These advanced capabilities represent a major step toward maximizing the public health utility of ORS solutions globally.

- AI-Powered Demand Forecasting: Utilizing machine learning algorithms to predict regional disease outbreaks and severe weather events, ensuring proactive stocking and minimizing stock-outs of ORS, especially in low-resource settings.

- Optimized Supply Chain Logistics: AI engines can dynamically reroute and manage cold chain requirements for liquid ORS formulations, improving efficiency and reducing transportation costs across complex international supply chains.

- Personalized Hydration Recommendations: Development of AI models that analyze individual patient parameters (age, weight, severity of dehydration) to recommend slightly adjusted ORS dosage or type (e.g., standard vs. low osmolarity), particularly in hospital settings.

- Enhanced Quality Control: Application of AI-driven image recognition and sensor data within manufacturing facilities to monitor the consistency and purity of salt and sugar ingredients, ensuring compliance with strict WHO guidelines.

- Improved Public Health Outreach: AI models analyze social media chatter and localized public health data to identify communities with low ORS usage awareness, enabling highly tailored and culturally relevant educational campaigns.

DRO & Impact Forces Of Oral Rehydration Salts Market

The dynamics of the Oral Rehydration Salts market are shaped by a strong set of driving, restraining, and opportunity forces, collectively defining the impact landscape. The primary driver is the pervasive global burden of diarrheal diseases, particularly rotavirus and cholera, which necessitate prompt and effective hydration solutions to prevent mortality, especially among children under five. This persistent epidemiological threat, coupled with sustained financial and logistical support from international bodies like the WHO, UNICEF, and the Gates Foundation, ensures a stable, high-volume market base in endemic regions. Secondary drivers include increasing global temperatures and climate change effects, leading to higher instances of heatstroke and necessitating electrolyte replacement for general populations and occupational workers.

Conversely, market growth faces significant restraints. A long-standing impediment is the poor palatability and often medicinal taste associated with standard ORS formulations, which results in low compliance, particularly among children and adults in markets where flavored beverages are the norm. Furthermore, cultural resistance and reliance on traditional, less effective home remedies in certain developing regions pose substantial behavioral barriers to widespread adoption. Logistical constraints, particularly in maintaining optimal storage conditions and ensuring last-mile delivery of the product in remote, rural areas, also restrict market reach and impact effectiveness, particularly for ready-to-use liquid formats which are heavier and more sensitive to temperature fluctuations than powder sachets.

The most compelling opportunities lie in product innovation and market diversification. The development of next-generation ORS featuring microencapsulation technologies, superior flavoring agents, and natural sweeteners addresses the palatability issue, opening avenues into premium consumer markets focused on health and fitness recovery. Furthermore, targeting specific vulnerable populations, such as military personnel, endurance athletes, and the elderly population prone to dehydration, allows companies to diversify revenue streams beyond traditional public health procurement. Strategic focus on establishing local manufacturing hubs in high-demand regions (e.g., Sub-Saharan Africa and South Asia) will also mitigate supply chain volatility and reduce end-user costs, significantly expanding market accessibility and penetration.

Segmentation Analysis

The Oral Rehydration Salts market is meticulously segmented across product type, formulation, age group, application, distribution channel, and geography, allowing for granular analysis of demand patterns and strategic planning. The segmentation reflects the dual nature of the market, catering simultaneously to essential public health needs through low-cost powder forms and premium consumer recovery needs through higher-priced liquid or specialty forms. Understanding these segmentation nuances is crucial for manufacturers designing targeted marketing campaigns and optimizing their portfolio mix, balancing social responsibility with commercial viability. The evolving consumer preference for convenient, easy-to-use solutions is noticeably driving the revenue shift within the formulation-based segments, although volume sales still heavily favor cost-effective packaging options.

- By Product Type:

- Oral Rehydration Salts Powder (Sachets)

- Ready-to-Drink (RTD) Solutions

- ORS Tablets (Effervescent and Chewable)

- By Formulation:

- Standard WHO Formulation

- Low Osmolarity Formulation

- Specialty ORS (e.g., with added zinc or probiotics)

- By Age Group:

- Pediatric ORS

- Adult ORS

- By Application:

- Acute Diarrhea Management

- Traveler's Diarrhea Treatment

- Sports and Fitness Recovery

- General Heat Exhaustion and Illness

- By Distribution Channel:

- Retail Pharmacies and Drug Stores

- Hospital and Clinical Procurement

- Online Pharmacies and E-commerce

- Government and NGO Procurement (Public Health Programs)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Oral Rehydration Salts Market

The value chain for the Oral Rehydration Salts market begins with upstream activities involving the sourcing and purification of key raw materials, primarily pharmaceutical-grade glucose (dextrose), sodium chloride, potassium chloride, and trisodium citrate. Quality control at this stage is paramount, as the precise balance of these components dictates the efficacy and safety of the final product, especially considering the low-osmolarity requirements set by international standards. Manufacturers often establish long-term relationships with certified chemical suppliers to ensure consistent quality and avoid supply shocks. Manufacturing processes involve sophisticated blending, granulating, and packaging operations, requiring stringent regulatory adherence to GMP (Good Manufacturing Practice) standards, particularly for sterile liquid preparations.

The midstream segment involves packaging and warehousing. Powder ORS is typically packaged in unit-dose foil sachets, offering maximum shelf stability and low logistical cost, making this format ideal for large-scale public health procurement. Ready-to-drink solutions require specialized aseptic bottling or packaging, incurring higher costs but offering enhanced convenience. Distribution forms the critical downstream component. Direct distribution often occurs through tender processes where governments, UN agencies, or NGOs procure vast quantities directly from large manufacturers, ensuring subsidized availability in regions with high disease burden. This public health channel accounts for a major volume share globally.

Indirect distribution involves commercial channels, where products move through national distributors, wholesalers, and finally to retail outlets such as pharmacies, supermarkets, and increasingly, online e-commerce platforms. This channel is dominant for premium, branded, and flavored ORS products targeting the consumer wellness and sports recovery segments in developed markets. The complexity arises from managing dual channels—one focused on cost minimization (public health) and the other focused on margin optimization and consumer brand building (retail). Effective management of both direct and indirect channels is essential for achieving broad market coverage and ensuring that the life-saving product reaches all segments of the population efficiently.

Oral Rehydration Salts Market Potential Customers

The potential customer base for the Oral Rehydration Salts market is exceptionally broad, spanning from vulnerable populations requiring life-saving treatment to healthy individuals seeking performance enhancement and rapid recovery. The primary and largest segment of end-users are infants and children under the age of five in developing countries, who are disproportionately affected by acute gastroenteritis and represent the highest priority for public health interventions. This demographic relies heavily on ORS procured via government subsidies, UNICEF, and NGO programs. Clinical settings, including hospitals, pediatric clinics, and emergency rooms globally, constitute another major buying group, procuring ORS for professional medical treatment of dehydration stemming from various causes, including infectious diseases and chemotherapy side effects.

A rapidly expanding segment involves the adult consumer market, which includes travelers, particularly those visiting regions with high risks of waterborne illnesses, and individuals seeking rapid relief from hangover symptoms or general dehydration associated with heat exposure. Furthermore, the athletic community represents a significant potential customer base for specialty ORS. Endurance athletes, including marathon runners, triathletes, and cyclists, utilize low-osmolarity electrolyte solutions that are technically a form of ORS but marketed specifically for optimal physiological hydration and recovery post-intense exercise, demanding better taste profiles and innovative packaging. Manufacturers are increasingly tailoring products—with added vitamins, zinc, and natural flavors—to appeal directly to these demanding consumer segments, shifting ORS perception from solely medicine to advanced nutritional support.

Lastly, governmental organizations and military bodies are consistent bulk buyers. Governments procure for national public health stock reserves, disaster relief efforts, and continuous sanitation/health awareness programs. Military forces and peacekeeping operations require large quantities of shelf-stable ORS to manage dehydration among troops operating in extreme climates or austere environments. This diverse user landscape necessitates a tiered product strategy, ensuring that basic, affordable sachets are available for critical public health use, while premium, consumer-facing products are developed for the lucrative wellness and athletic markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Abbott Laboratories, Sanofi S.A., Pedialyte (Abbott), Novartis International AG, GlaxoSmithKline plc, Rehydrin (Cipla), Sun Pharmaceutical Industries Ltd., Akorn, Inc., DBL Pharmaceuticals Ltd., Dr. Reddy's Laboratories Ltd., ORSL (Johnson & Johnson), Otsuka Pharmaceutical Co., Ltd., Unilever (Select Brands), Takeda Pharmaceutical Company Limited, Premier Medical Corporation, Prestige Brands Holdings, Inc., Halewood Laboratories Pvt. Ltd., Cipla Health Ltd., Wallace Pharmaceuticals Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Oral Rehydration Salts Market Key Technology Landscape

The technology landscape within the Oral Rehydration Salts market is continually evolving, driven primarily by the need to improve stability, enhance palatability, and optimize delivery mechanisms. A significant area of focus is on formulation technology, moving beyond simple dry mixing. Techniques such as spray drying and co-processing are utilized to ensure highly uniform particle size distribution in powder formulations, which is critical for consistent dissolution and absorption rates. Furthermore, advanced encapsulation technologies are being employed to mask the inherently salty taste of the salts. Microencapsulation involves coating salt particles with non-reactive, food-grade materials that dissolve only upon ingestion, significantly improving the taste profile and thereby boosting patient compliance, especially in pediatric applications where taste is a major barrier.

Another crucial technological advancement involves the shift toward ready-to-drink (RTD) solutions. This segment relies heavily on aseptic processing and specialized packaging materials, such as multi-layer barrier plastics or Tetra Pak systems, to ensure long shelf life without the need for refrigeration, a critical factor for distribution in tropical climates. The development of effervescent ORS tablets represents a key innovation in delivery technology. These tablets contain bicarbonates or citric acid along with the ORS components, allowing the user to create a carbonated, more palatable solution instantly upon mixing with water. This method improves the user experience and is particularly popular in developed markets targeting sports hydration and convenience-focused consumers.

Finally, technology integration extends into the manufacturing process itself, emphasizing precision dosage and quality assurance. High-speed sachet-filling machines utilize sophisticated sensors and weight checks to guarantee that each unit dose contains the exact proportion of electrolytes and glucose specified by the WHO guidelines. This level of automation and quality control is non-negotiable, given that the efficacy of ORS is highly dependent on its precise osmolarity. Future technological focus will likely center on incorporating functional ingredients like specific strains of probiotics or high-absorption trace elements, requiring complex formulation science to maintain the stability of these delicate components alongside the standard salts.

Regional Highlights

- Asia Pacific (APAC) stands as the dominant market in terms of volume consumption, driven by its immense population base, sanitation challenges in rural areas, and a persistently high burden of diarrheal diseases in nations like India, Indonesia, and Pakistan. Government intervention through mass distribution programs and subsidized sales ensures widespread access to basic ORS powder formulations. The region is also witnessing fast-paced growth in the premium segment, particularly in China and South Korea, where sophisticated liquid electrolyte drinks are gaining traction among fitness enthusiasts and the urban consumer base.

- Middle East and Africa (MEA) is poised to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to poor water quality, climate change leading to increased heat-related illnesses, and high endemicity of cholera and rotavirus. International aid organizations and local health ministries prioritize ORS procurement as a fundamental tool for reducing infant mortality, making public sector tender results crucial for market performance in this region. Local production capacity expansion is a key trend addressing logistics challenges.

- North America and Europe represent mature markets characterized by low medicinal ORS use but high demand for specialized, premium electrolyte solutions. These regions focus heavily on ORS products marketed for sports recovery, travel wellness, and the management of minor illnesses. Key drivers here include high disposable income, strong health and fitness trends, and preference for ready-to-drink or effervescent tablet formats that prioritize taste and convenience over minimal cost. Regulatory frameworks are extremely stringent regarding purity and labeling claims.

- Latin America (LATAM) shows consistent growth fueled by a mixture of public health needs and burgeoning consumer awareness. Countries such as Brazil and Mexico have integrated ORS into their essential medicine lists, ensuring accessibility. Simultaneously, growing middle-class populations are driving demand for commercially available flavored ORS products, blurring the lines between medicinal ORS and general sports beverages. The market structure is highly fragmented with a mix of multinational players and strong local pharmaceutical companies competing fiercely.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Oral Rehydration Salts Market.- Johnson & Johnson

- Abbott Laboratories

- Sanofi S.A.

- Novartis International AG

- GlaxoSmithKline plc

- Cipla Health Ltd.

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Takeda Pharmaceutical Company Limited

- Prestige Brands Holdings, Inc.

- Akorn, Inc.

- DBL Pharmaceuticals Ltd.

- Halewood Laboratories Pvt. Ltd.

- Premier Medical Corporation

- Wallace Pharmaceuticals Pvt. Ltd.

- Electrolyte Labs Inc.

- Perrigo Company plc

- Baxter International Inc.

- Himalaya Wellness Company

Frequently Asked Questions

Analyze common user questions about the Oral Rehydration Salts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Oral Rehydration Salts globally?

The primary driver is the persistent, high global incidence of acute watery diarrheal diseases, particularly among pediatric populations in developing nations, coupled with continuous strategic procurement and distribution efforts by major international health organizations like UNICEF and the WHO.

Which product segment, powder or ready-to-drink (RTD), is experiencing faster growth?

While the powder segment currently holds the largest volume share due to its low cost and shelf stability, the ready-to-drink (RTD) liquid segment is exhibiting the fastest revenue growth, driven by consumer demand for convenience, better palatability, and market penetration in developed economies for sports and wellness hydration.

What major challenge restrains the widespread use and compliance with ORS?

The most significant restraint is the historically poor palatability of standard ORS formulations. This metallic or salty taste often leads to refusal, particularly among children, necessitating ongoing innovation in flavoring and formulation technology to improve patient compliance across all age groups.

How is the market for ORS adapting to wellness and sports hydration trends?

Manufacturers are adapting by developing specialty low-osmolarity formulations, often enhanced with zinc or specific vitamins, and marketing them in convenient forms (RTD, effervescent tablets) with natural flavors, positioning them as advanced recovery solutions rather than strictly medicinal treatments, thereby expanding their consumer base significantly.

Which geographic region currently holds the largest market share for Oral Rehydration Salts?

The Asia Pacific (APAC) region currently holds the largest market share for Oral Rehydration Salts, primarily due to its high population density, high prevalence of infectious diseases, and substantial government-backed public health programs focused on preventing dehydration-related fatalities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Oral Rehydration Salts (ORS) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Oral Rehydration Salts (ORS) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Tablets, Powder, Capsules, Others), By Application (Infants, Children, Adults), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager