Order & Case Picking Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433823 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Order & Case Picking Machines Market Size

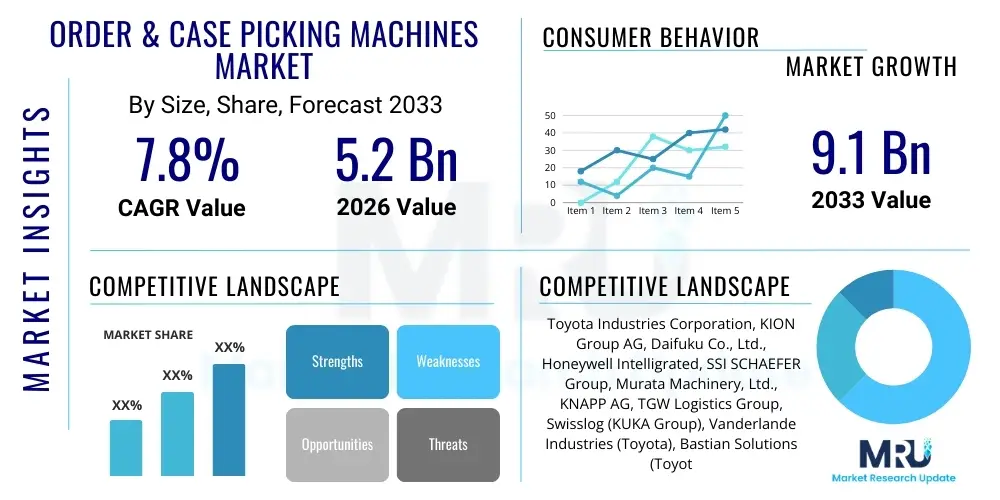

The Order & Case Picking Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 9.1 Billion by the end of the forecast period in 2033.

Order & Case Picking Machines Market introduction

The Order & Case Picking Machines Market encompasses automated and semi-automated systems designed to efficiently retrieve inventory—either individual items (order picking) or full cartons/cases (case picking)—from storage locations within warehouses and distribution centers. These systems are fundamental to modern supply chain operations, driven primarily by the exponential growth of e-commerce, the need for rapid fulfillment, and the increasing complexity of SKU management. The core technology ranges from sophisticated robotic arms and autonomous mobile robots (AMRs) to high-speed conveyor systems and automated storage and retrieval systems (AS/RS), all aimed at reducing labor dependency, minimizing errors, and significantly accelerating throughput.

Product categories within this domain include dedicated case palletizing robots, layer picking solutions, and advanced goods-to-person (G2P) systems that utilize shuttle technologies and vertical lift modules (VLMs). These machines address critical logistical challenges, such as handling diverse product weights and dimensions, managing temperature-controlled environments, and achieving high density storage. The transition from manual processes to automated case and order picking is characterized by substantial capital investment upfront but delivers powerful returns through operational efficiency, scalability, and improved worker safety, positioning the technology as indispensable for businesses striving for competitive advantage in hyper-responsive consumer markets.

Major applications span third-party logistics (3PL), grocery and food & beverage distribution, general merchandise retail, and manufacturing sectors requiring kitting or line-side sequencing. Key benefits include enhanced inventory accuracy, reduced damage rates, optimal utilization of vertical space, and the ability to operate 24/7. Driving factors include persistent labor shortages in warehousing, rising real estate costs necessitating smaller footprints, and the pervasive consumer demand for same-day or next-day delivery, compelling companies globally to invest heavily in advanced material handling automation.

Order & Case Picking Machines Market Executive Summary

The Order & Case Picking Machines Market is experiencing robust expansion, fundamentally transforming global logistics and fulfillment operations. Business trends indicate a definitive pivot towards fully integrated, software-driven solutions, with major investments centered on robotics-as-a-service (RaaS) models to lower initial capital expenditure barriers. Manufacturers are focusing on modular and scalable systems that can adapt quickly to seasonal volume fluctuations and evolving product mix complexity. Furthermore, integration capabilities with existing Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) systems are becoming non-negotiable requirements, driving demand for open architecture and standardized communication protocols across automation equipment.

Regionally, North America and Europe currently dominate the market due to established infrastructure and high labor costs, which accelerate the ROI justification for automation. However, Asia Pacific (APAC), particularly China, Japan, and India, is emerging as the fastest-growing region. This surge is fueled by massive expansion in e-commerce infrastructure, rapid urbanization, and government initiatives promoting smart logistics and manufacturing efficiency. Latin America and MEA are showing steady adoption, primarily focused on incorporating entry-level and semi-automated solutions before transitioning to full robotics integration, driven by multinational logistics providers standardizing global operations.

Segment trends reveal that the Robotic Picking Systems segment, particularly those utilizing AI-powered vision and gripping technologies, is achieving the highest growth rate. Within the operation type, Goods-to-Person (G2P) systems continue to gain significant traction over traditional Person-to-Goods (P2G) methods, as G2P drastically minimizes travel time and maximizes picker productivity. End-user analysis highlights the E-commerce and 3PL sectors as the primary consumers, driven by the intense demands of fulfilling omnichannel retail strategies and managing vast, rapidly changing SKU portfolios efficiently under tight delivery windows.

AI Impact Analysis on Order & Case Picking Machines Market

User queries regarding the impact of Artificial Intelligence (AI) on the Order & Case Picking Machines Market primarily revolve around operational efficiency gains, robot decision-making reliability, and the required infrastructure changes. Users frequently ask how AI-driven vision systems can handle previously difficult items (e.g., polybags, reflective surfaces) and whether AI optimization reduces downtime. A key theme is the expectation that AI should move systems beyond pre-programmed paths to genuine autonomous decision-making in unstructured environments, optimizing complex batch-picking strategies, dynamic task allocation, and predictive maintenance schedules. Concerns often center on the security of cloud-based AI platforms and the availability of skilled technicians capable of servicing these sophisticated intelligent systems.

- Enhanced object recognition and SKU variability handling through advanced machine vision algorithms.

- Real-time path optimization for autonomous mobile robots (AMRs) navigating dynamic warehouse floors.

- Predictive maintenance analytics, reducing unexpected downtime by anticipating component failure.

- Dynamic task assignment and labor orchestration based on immediate order urgency and available machine capacity.

- Improved robotic grasping capabilities for challenging or deformable items (e.g., utilizing deep learning for grip pressure adjustment).

- Optimization of inventory slotting and storage strategies based on historical demand patterns and picker productivity data.

- Autonomous error recovery and self-correction mechanisms in robotic picking operations.

DRO & Impact Forces Of Order & Case Picking Machines Market

The trajectory of the Order & Case Picking Machines Market is shaped by a potent combination of drivers, restraints, and opportunities, culminating in significant impact forces. Key drivers include the overwhelming pressure from e-commerce growth demanding ultra-fast fulfillment cycles and the global shortage of reliable manual warehouse labor, which makes automation a strategic necessity rather than an optional investment. Opportunities lie primarily in the technological advancements of AI-powered vision systems and the increasing feasibility of robotics-as-a-service (RaaS) models, which democratize access to high-end automation for small and medium-sized enterprises (SMEs). However, the market faces restraints such as the substantial initial capital investment required for large-scale deployments, the complexity of integrating new automated systems with legacy IT infrastructure, and the necessity for highly specialized technical support and maintenance personnel.

The impact forces influencing the market are profound. Drivers exert a high, persistent force, compelling rapid technological adoption to meet consumer expectations and operational mandates. The restraint concerning high initial costs acts as a moderating force, slowing adoption in price-sensitive regions or smaller operations, but this is increasingly mitigated by flexible financing models like RaaS. The opportunity arising from AI integration is transformative, shifting the market focus from merely automating tasks to optimizing entire fulfillment strategies in real-time. Overall, the dominant force remains the macroeconomic need for efficiency and speed in logistics, ensuring sustained market growth despite cyclical economic challenges.

The primary impact of these forces manifests as intense competition among technology providers to develop modular, flexible, and affordable solutions. Manufacturers are pushed towards standardization and simplified deployment processes to overcome integration complexity. Furthermore, sustainability requirements are emerging as a subtle but growing impact force, demanding energy-efficient robotic solutions and optimization software that minimizes wasted movement, thereby aligning automation efficiency with corporate environmental goals.

Segmentation Analysis

The Order & Case Picking Machines Market is comprehensively segmented based on the degree of automation, the fundamental operational principle, the product type being handled, and the diverse end-user applications. This segmentation provides stakeholders with a nuanced understanding of market dynamics, revealing which technologies are gaining traction and where investment is being concentrated globally. The core segmentation distinguishes between highly integrated, fixed automation systems and flexible, mobile robotic solutions, allowing market participants to target solutions based on specific warehouse layouts, throughput requirements, and budget constraints.

- By Type:

- Automated Case Picking (ACP) Systems

- Robotic Picking Systems (Articulated Robots, Cartesian Robots)

- Semi-Automated Systems (Pick-to-Light, Voice Picking Integration)

- By Operation:

- Goods-to-Person (G2P) Systems

- Person-to-Goods (P2G) Systems

- By End-User:

- E-commerce and Retail

- 3PL and Logistics

- Food & Beverage (F&B) and Grocery

- Pharmaceutical and Healthcare

- Manufacturing and Automotive

Value Chain Analysis For Order & Case Picking Machines Market

The value chain for Order & Case Picking Machines is complex, starting with upstream component manufacturing and culminating in highly specialized downstream installation and long-term service provision. Upstream analysis involves suppliers of critical components such as advanced sensors (LiDAR, 3D vision systems), motion control components (motors, drives), specialized robotic grippers, and sophisticated software platforms for AI and machine learning. The efficiency and quality of these components, particularly the vision and gripping technology, directly determine the performance and flexibility of the final picking machine. Consolidation among core component suppliers or fluctuations in microchip pricing can significantly impact the final product cost and delivery timelines for automation vendors.

Midstream activities are dominated by system integrators and original equipment manufacturers (OEMs). These entities design, assemble, and integrate the various sub-systems into functional, customized warehouse solutions. Their expertise lies not only in hardware manufacturing but also in proprietary software development for task orchestration and fleet management. Distribution channels play a critical role, involving direct sales teams for large, custom installations and indirect channels (authorized distributors and third-party system integrators) who manage regional sales and provide localized support, particularly beneficial in emerging markets.

Downstream analysis focuses heavily on the end-user deployment, training, maintenance, and optimization phases. Direct involvement is crucial for complex, multi-million dollar projects where OEMs handle installation and commissioning. However, long-term operational success relies on indirect channels—local maintenance providers, software update specialists, and RaaS operators—who ensure system uptime and continuous performance improvement. The shift towards RaaS models means the value derived is increasingly subscription-based, emphasizing long-term service contracts and software enhancement revenue streams rather than purely capital equipment sales.

Order & Case Picking Machines Market Potential Customers

Potential customers for Order & Case Picking Machines are entities requiring high-throughput, accurate, and scalable material handling solutions to meet modern fulfillment demands. The primary buyers are large-scale e-commerce giants and major omnichannel retailers who must manage millions of SKUs and process orders quickly, often under stringent service-level agreements (SLAs). These organizations leverage automation to handle peak demand periods, such as holidays, without compromising accuracy or relying solely on temporary manual labor.

Third-Party Logistics (3PL) providers represent another massive customer base. As 3PLs manage fulfillment for numerous clients across diverse industries, they require flexible, modular automation systems that can be rapidly reconfigured to handle changing client needs, SKU proliferation, and varying order profiles. The investment in automated picking machines allows 3PLs to offer premium, faster services, thereby maintaining competitiveness and increasing margin per transaction.

The food & beverage and grocery sectors are rapidly adopting case picking and layer picking solutions due to the unique challenges of perishable goods, temperature control, and handling heavy, homogenous cases (case picking) as well as managing complex individualized orders (order picking) for online grocery delivery. Furthermore, manufacturing and automotive industries are significant buyers for kitting operations, sequencing parts for assembly lines (just-in-time logistics), and managing large spare parts inventories efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 9.1 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toyota Industries Corporation, KION Group AG, Daifuku Co., Ltd., Honeywell Intelligrated, SSI SCHAEFER Group, Murata Machinery, Ltd., KNAPP AG, TGW Logistics Group, Swisslog (KUKA Group), Vanderlande Industries (Toyota), Bastian Solutions (Toyota), Dematic (KION Group), Locus Robotics, Geek+, Exotec, Berkshire Grey, Symbotic, OPEX Corporation, Cimcorp Oy, Beumer Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Order & Case Picking Machines Market Key Technology Landscape

The technological foundation of the Order & Case Picking Machines Market is rapidly evolving, driven by advancements in robotics, computer vision, and specialized gripping mechanisms. Current dominant technologies include Automated Storage and Retrieval Systems (AS/RS), particularly mini-load and shuttle systems, which serve as the backbone for high-density storage and rapid delivery of cases or totes to picking stations (G2P model). High-speed robotic arms, typically six-axis or delta robots, integrated with sophisticated vision systems, are crucial for item-level picking where speed and precision in handling diverse product shapes are paramount. These systems rely heavily on proprietary software for trajectory planning and collision avoidance.

A major technological shift involves the integration of Autonomous Mobile Robots (AMRs) into picking workflows. Unlike fixed conveyor systems, AMRs provide unprecedented flexibility, transporting cases or totes between zones and integrating seamlessly with manual pickers or other automated systems. The success of AMRs is dependent on high-fidelity sensor fusion (LiDAR, cameras) and AI-driven navigation algorithms that allow them to dynamically adapt to constantly changing warehouse environments and optimize routes in real-time. This flexibility makes them particularly appealing for existing warehouses that cannot justify the costly overhaul required for fixed automation.

Furthermore, the development of sophisticated end-of-arm tooling (EOAT) is a critical technology differentiator. This includes vacuum grippers capable of handling porous or uneven surfaces, magnetic grippers, and multi-faceted mechanical grippers designed specifically for delicate or deformable items like apparel or polybags. The future of the market hinges on perfecting AI-enabled tactile sensing and manipulation, allowing robots to replicate the dexterity and adaptability of human hands, thereby minimizing "no-pick" occurrences and maximizing system throughput across the entire spectrum of consumer goods.

Regional Highlights

- North America (NA): NA is characterized by early and aggressive adoption of high-level automation, driven by extremely high labor costs and the presence of major e-commerce players demanding industry-leading fulfillment speeds. The region focuses heavily on advanced robotic systems, integrated AS/RS solutions, and substantial investment in AI and software optimization to manage complex omnichannel fulfillment strategies. The market here is mature but continues to grow through technology refresh cycles and expansion into secondary markets like grocery fulfillment and cold chain logistics.

- Europe: Europe exhibits strong demand for highly reliable and sustainable automation solutions, influenced by stringent environmental regulations and a focus on operational efficiency. Germany, the UK, and the Benelux countries are major centers for innovation and deployment, often favoring modular G2P systems and specialized layer picking robots for high-volume sectors like food & beverage distribution. The market is also seeing increased demand for integrated logistics execution platforms that unify automated picking systems with broader supply chain visibility tools.

- Asia Pacific (APAC): APAC represents the fastest-growing market, primarily fueled by the massive scale of its population and the explosive penetration of e-commerce, especially in China and India. While initial investments centered on cost-effective, semi-automated systems, the region is now rapidly transitioning to large-scale robotic deployments, driven by the need to manage dense urban logistics and increasingly sophisticated consumer demands. Government support for "smart warehousing" initiatives further accelerates technology adoption across Southeast Asia.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets with significant future potential. Adoption is currently focused on maximizing existing warehouse footprint efficiency through foundational automation, such as conveyor systems and basic semi-automated picking solutions. Growth is tied closely to the expansion of regional 3PLs and international retail chains standardizing their operations globally. Opportunities exist for RaaS providers to penetrate these markets by minimizing upfront capital outlay for local businesses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Order & Case Picking Machines Market.- Toyota Industries Corporation

- KION Group AG

- Daifuku Co., Ltd.

- Honeywell Intelligrated

- SSI SCHAEFER Group

- Murata Machinery, Ltd.

- KNAPP AG

- TGW Logistics Group

- Swisslog (KUKA Group)

- Vanderlande Industries (Toyota)

- Bastian Solutions (Toyota)

- Dematic (KION Group)

- Locus Robotics

- Geek+

- Exotec

- Berkshire Grey

- Symbotic

- OPEX Corporation

- Cimcorp Oy

- Beumer Group

Frequently Asked Questions

Analyze common user questions about the Order & Case Picking Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of case picking machines?

The primary driver is the necessity for operational efficiency and throughput acceleration demanded by high-volume e-commerce and retail fulfillment. Simultaneously, acute labor shortages and rising wage costs make automated systems essential for maintaining profitability and scalability in logistics operations.

What is the difference between Goods-to-Person (G2P) and Person-to-Goods (P2G) systems?

G2P systems use automation (shuttles, robots, conveyors) to bring the requested inventory directly to a stationary human picker, minimizing picker travel time and maximizing efficiency. P2G involves the human picker traveling across the warehouse floor to retrieve items from fixed locations, a less efficient method being phased out by high-volume operations.

How does AI technology improve robotic order picking accuracy?

AI improves accuracy primarily through advanced machine vision systems that utilize deep learning to recognize and differentiate diverse product shapes, sizes, and packaging types (including deformable items like polybags). This enables the robot to autonomously select the optimal gripping strategy and pressure, significantly reducing errors compared to pre-programmed systems.

Are Order and Case Picking Machines suitable for Small and Medium-sized Enterprises (SMEs)?

Yes, increasing modularity and the availability of Robotics-as-a-Service (RaaS) models are making these machines accessible to SMEs. RaaS significantly lowers the high initial capital expenditure, allowing smaller businesses to implement scalable, flexible automation solutions based on subscription or usage fees.

What are the main challenges in integrating new automated picking systems?

Key challenges include ensuring seamless integration between the new physical automation hardware and existing legacy Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) software, as well as overcoming the complexity of system commissioning, customization, and continuous maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager