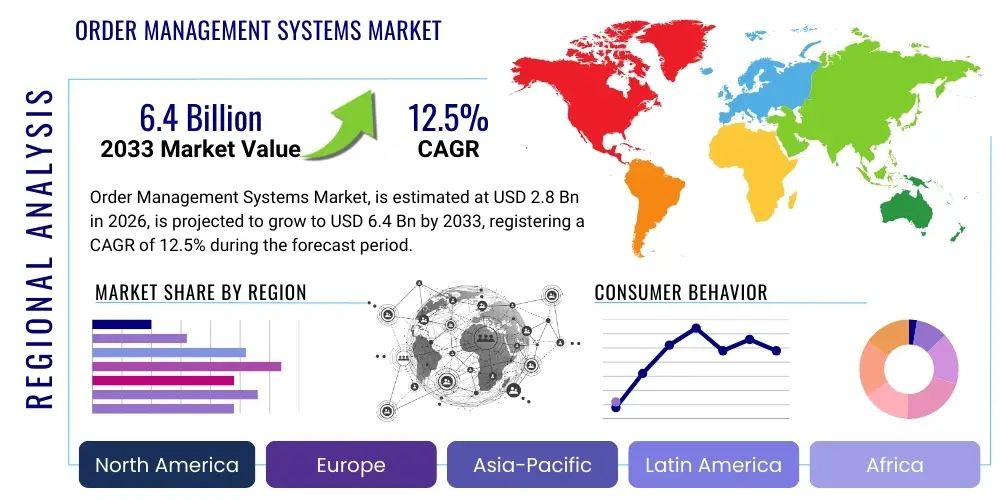

Order Management Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438771 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Order Management Systems Market Size

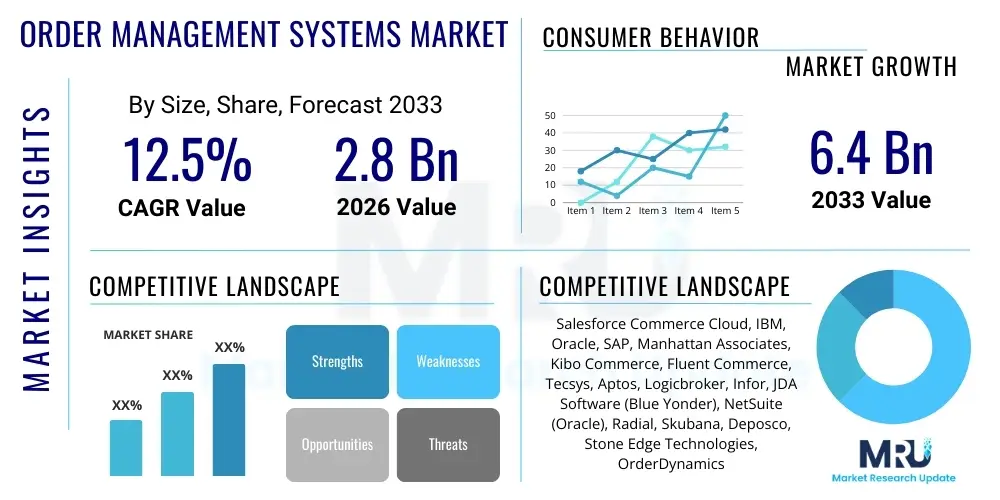

The Order Management Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 6.4 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the exponential growth of e-commerce, the increasing demand for seamless omnichannel experiences, and the necessity for businesses to integrate front-end sales channels with back-end fulfillment capabilities.

Order Management Systems Market introduction

The Order Management Systems (OMS) Market encompasses software solutions designed to manage and track the lifecycle of a customer order, from placement through fulfillment, shipping, and post-sale service. These crucial enterprise solutions provide a centralized hub for inventory visibility, order routing, payment processing, and customer relationship management concerning specific transactions. Major applications span retail (both B2C and B2B), wholesale, and manufacturing sectors where complex fulfillment logistics are paramount. Key benefits derived from adopting robust OMS platforms include enhanced operational efficiency, reduced shipping costs, improved inventory accuracy, and ultimately, superior customer satisfaction achieved through faster and more reliable delivery promises. The primary driving factors fueling market growth are the relentless pressure on retailers to offer unified commerce experiences, the global shift towards direct-to-consumer (DTC) models, and the need for scalable systems capable of handling peak season volumes and intricate global supply chains.

Order Management Systems Market Executive Summary

The global Order Management Systems market is characterized by robust digital transformation initiatives across industries, necessitating systems that support sophisticated cross-channel fulfillment models like Buy Online, Pickup In Store (BOPIS) and Ship From Store (SFS). Business trends indicate a strong move toward cloud-based, composable OMS architectures that allow for flexibility and integration with existing enterprise resource planning (ERP) systems and warehouse management systems (WMS). Segment trends highlight the significant adoption rate within the large enterprise segment due to the complexity of managing global inventory, although Small and Medium Enterprises (SMEs) are increasingly adopting SaaS-based solutions due to lower upfront costs and easier deployment. Regionally, North America maintains market dominance, driven by early technology adoption and a high concentration of large retail and e-commerce companies, while the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapidly expanding digital consumer bases and infrastructural development in emerging economies.

AI Impact Analysis on Order Management Systems Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Order Management Systems predominantly revolve around optimizing complex logistics decisions, predicting demand fluctuations, and automating manual processes currently handled by human operators. Common questions focus on how AI can enhance inventory allocation accuracy across multiple locations, minimize stockouts while maximizing safety stock efficiency, and utilize predictive analytics for proactive fulfillment risk management. Users are concerned with the scalability of AI integration, the complexity of data input required for effective Machine Learning (ML) models, and the potential displacement of legacy decision-making logic. The consensus is that AI is shifting OMS capabilities from reactive transaction processing to proactive, intelligent orchestration, making order fulfillment faster, cheaper, and less susceptible to human error, thereby establishing intelligent OMS platforms as the next evolutionary step in supply chain execution.

- AI enhances predictive inventory allocation by analyzing historical sales, seasonal trends, and real-time market signals to position stock optimally across distribution networks.

- Machine learning algorithms optimize order routing and sourcing decisions, automatically selecting the most cost-effective and fastest fulfillment location based on dynamic shipping rates and inventory levels.

- AI facilitates intelligent fraud detection during order processing, analyzing purchasing patterns and behavioral anomalies in real time, significantly reducing chargebacks and financial risk.

- Natural Language Processing (NLP) integration improves customer service workflows by automating responses to common order status inquiries, reducing the load on support staff.

- Predictive maintenance analytics, driven by AI, ensure high availability of fulfillment infrastructure, anticipating potential equipment failures in automated warehouses linked to the OMS.

- AI-powered demand forecasting integrates directly into the OMS, informing procurement and replenishment cycles for improved working capital management and reduced obsolescence.

DRO & Impact Forces Of Order Management Systems Market

The Order Management Systems market expansion is primarily driven by the mandatory shift toward unified commerce models and the corresponding need for accurate, real-time inventory visibility across all sales channels. Restraints impacting growth include the significant initial capital investment required for implementing sophisticated enterprise-level OMS solutions, particularly for smaller organizations, coupled with the complexity of integrating new OMS platforms with disparate legacy systems like older ERPs or accounting software. Opportunities abound in the development of specialized, low-code, or no-code SaaS OMS platforms tailored for niche markets or specific industry needs, as well as the increasing application of Blockchain technology to enhance transparency and security in cross-border transaction tracking. Impact forces driving market evolution include intensifying consumer expectations for fast, free, and flexible delivery options, which compels businesses to adopt advanced routing and fulfillment optimization capabilities provided exclusively by modern OMS platforms.

Segmentation Analysis

The Order Management Systems market is categorized across several key dimensions including deployment type, component, organization size, and end-user industry, reflecting the diverse requirements of the enterprise landscape. Analyzing segmentation is crucial for understanding specific market dynamics, such as the preference for cloud-based OMS due to its scalability and accessibility, particularly within the growing small and medium-sized enterprise segment. The component breakdown highlights the dual need for core software functionality and critical professional services (implementation, customization, and maintenance) required to maximize system efficacy. Industry-wise, the retail and e-commerce sector remains the dominant consumer, constantly driving innovation in capabilities such as complex returns management and dynamic pricing integration.

- By Component:

- Software (Platform and Solution)

- Services (Professional Services, Managed Services)

- By Deployment Type:

- On-Premise

- Cloud (SaaS, Private Cloud, Public Cloud)

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-User Industry:

- Retail and E-commerce (B2C and B2B)

- Wholesale and Distribution

- Manufacturing

- Healthcare and Pharmaceuticals

- Food and Beverage

Value Chain Analysis For Order Management Systems Market

The value chain for the Order Management Systems market starts with upstream activities focused on the development of core software architecture, encompassing research and development, intellectual property creation, and sourcing crucial supporting technologies such as cloud infrastructure and advanced analytics engines. Key upstream providers include specialized software development firms, cloud service providers (like AWS, Azure, Google Cloud), and data security firms. Successful upstream collaboration dictates the robustness, scalability, and security features of the final OMS product. As vendors transition from traditional monolithic architectures to microservices and composable frameworks, the reliance on advanced API management and third-party data services (e.g., mapping, tax calculation) increases significantly.

Midstream activities involve the actual manufacturing, testing, and deployment of the OMS solution. This stage primarily focuses on customization, integration with existing customer ecosystems (ERPs, WMS, CRM), and quality assurance checks. System integrators and specialized professional services firms play a critical role here, ensuring seamless implementation across diverse client environments. The effectiveness of this stage is measured by deployment speed and the smooth transition of client operations onto the new platform, minimizing operational downtime and ensuring data integrity across interconnected systems.

Downstream activities center on distribution channels, including direct sales from the OMS vendor to the enterprise client, and indirect distribution through channel partners, resellers, and global consulting firms. Direct sales are common for highly customized, large-scale enterprise deployments, while indirect channels often focus on distributing standardized SaaS products to SMEs. Post-implementation, the value chain extends into maintenance, continuous updates, technical support, and value-added services such as advanced analytics consultancy, ensuring clients maximize the return on investment and keep pace with evolving consumer demands and technological advancements.

Order Management Systems Market Potential Customers

The primary potential customers for Order Management Systems are businesses heavily reliant on multi-channel sales and complex inventory logistics across physical and digital storefronts. This spectrum ranges from large multinational retail corporations needing enterprise-grade, highly customized solutions capable of handling millions of transactions daily and managing global fulfillment networks, down to mid-sized B2B distributors requiring robust inventory visibility to service their regional clientele effectively. E-commerce pure-plays and organizations rapidly scaling their Direct-to-Consumer (DTC) operations represent a rapidly expanding customer base, as they require centralized platforms to coordinate sales, inventory, and diverse fulfillment partners, often operating without legacy physical infrastructure.

Beyond traditional retail, sectors such as manufacturing and healthcare are emerging as crucial potential customers. Manufacturing companies utilize OMS to manage complex component orders, track finished goods inventory across different stages of production and distribution, and handle warranties and returns efficiently. Healthcare organizations leverage specialized OMS for managing sensitive supply chain transactions, tracking high-value medical devices, pharmaceuticals, and ensuring regulatory compliance during order processing and distribution. The key differentiating factor for potential customers is the complexity of their fulfillment needs, which often exceeds the capabilities of standard ERP modules, necessitating a dedicated, specialized OMS solution.

SaaS-based OMS models have democratized access for Small and Medium Enterprises (SMEs), which historically lacked the capital for traditional on-premise deployments. SMEs are potential customers seeking solutions that offer rapid deployment, high configurability, and integration capabilities with popular e-commerce platforms (like Shopify or Magento) and third-party logistics providers (3PLs). These customers are primarily interested in operational efficiency gains, reducing shipping errors, and accelerating delivery times to compete effectively with larger market participants, driving significant long-tail growth in the overall market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce Commerce Cloud, IBM, Oracle, SAP, Manhattan Associates, Kibo Commerce, Fluent Commerce, Tecsys, Aptos, Logicbroker, Infor, JDA Software (Blue Yonder), NetSuite (Oracle), Radial, Skubana, Deposco, Stone Edge Technologies, OrderDynamics, Vinculum, G.O.D.A.N. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Order Management Systems Market Key Technology Landscape

The technological landscape of the Order Management Systems market is rapidly transitioning toward highly flexible, scalable, and interconnected architectures, moving away from legacy monolithic systems. Cloud computing, particularly Software as a Service (SaaS), forms the foundational technology, enabling vendors to offer easily deployable solutions with lower maintenance overhead and inherent scalability to manage seasonal peak loads. Modern OMS platforms are increasingly built using microservices architecture, which allows businesses to independently update or swap out specific functionalities—such as inventory lookups or payment processing—without affecting the entire system. This architectural shift facilitates the adoption of "headless" commerce and composable commerce strategies, where the OMS acts as a robust backend fulfillment engine decoupled from the customer-facing presentation layer.

Another critical technology driving evolution is the extensive use of Application Programming Interfaces (APIs). High-performance, well-documented APIs are essential for rapid integration with an increasingly fragmented ecosystem of commerce technologies, including marketplace connectors, payment gateways, tax calculation engines, and numerous last-mile carriers. The ability of an OMS to seamlessly integrate via APIs determines its effectiveness in modern unified commerce environments. Furthermore, advanced data analytics and Machine Learning (ML) capabilities are becoming standard requirements, moving order management beyond simple transactional tracking into sophisticated, predictive orchestration for inventory placement, dynamic order routing, and identifying potential fulfillment bottlenecks before they occur.

Emerging technologies, while not yet mainstream, are beginning to gain traction, particularly Blockchain and Internet of Things (IoT). Blockchain offers a decentralized, transparent ledger for tracking high-value or regulated goods (common in pharmaceutical or luxury retail OMS implementations), enhancing security and accountability throughout the fulfillment chain. IoT integration, primarily through smart warehouse devices and connected packaging, provides real-time contextual data on inventory location and environmental conditions, feeding critical updates back into the OMS for improved accuracy and handling, particularly crucial for cold chain logistics and perishable goods fulfillment. These technological advancements ensure the OMS remains the central nervous system for modern supply chain execution.

Regional Highlights

North America maintains the largest market share in the Order Management Systems market, primarily driven by the region's early adoption of e-commerce, the presence of major retail giants, and a mature technology infrastructure. The intense competition among U.S. and Canadian retailers to offer sophisticated omnichannel experiences, including fast delivery and complex return logistics, necessitates continual investment in advanced OMS solutions. High average consumer digital engagement and strong venture capital funding for tech innovation further solidify North America's position as a key innovation hub, driving demand for AI-integrated, cloud-native OMS platforms capable of handling large-scale, complex fulfillment operations.

Europe represents the second-largest market, characterized by varying regulatory frameworks (such as GDPR) and diverse consumer preferences across countries, mandating OMS solutions with high flexibility for localization, taxation, and compliance. The rapid growth in cross-border e-commerce within the European Union has fueled demand for OMS platforms that efficiently manage multi-currency transactions, complicated VAT calculations, and international shipping documentation. Western European countries, particularly the UK, Germany, and France, lead in technology adoption, focusing heavily on integrating OMS with enterprise sustainability initiatives by optimizing freight and reducing packaging waste.

The Asia Pacific (APAC) region is projected to register the fastest growth over the forecast period, owing to burgeoning e-commerce penetration in economies like China, India, and Southeast Asia. This growth is supported by expanding digital consumer populations, improving logistics infrastructure, and increased government initiatives promoting digitalization in retail and manufacturing. APAC companies often leapfrog older technologies, directly adopting mobile-first, cloud-based OMS solutions suitable for managing high-volume, low-margin transactions and complex regional fulfillment ecosystems that heavily rely on 3PLs and local distribution partners. The Middle East and Africa (MEA) and Latin America (LATAM) markets are also showing strong potential, driven by urbanization and the emergence of strong regional e-commerce players who require foundational OMS tools to scale their nascent digital operations.

- North America: Dominant market share; driven by large retail sectors, mature cloud adoption, and high demand for AI-enhanced fulfillment optimization.

- Europe: Second largest market; focused on cross-border fulfillment capabilities, GDPR compliance, and seamless integration across diverse national markets.

- Asia Pacific (APAC): Fastest growing region; characterized by rapid e-commerce expansion, mobile-first strategies, and mass adoption of scalable cloud solutions.

- Latin America (LATAM): Emerging market; growth fueled by increasing internet penetration, investment in logistics infrastructure, and adoption of specialized solutions for high transaction fraud environments.

- Middle East & Africa (MEA): Growth driven by regional digitization efforts, strong retail market penetration in the GCC countries, and demand for efficient inventory management solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Order Management Systems Market.- Salesforce Commerce Cloud

- IBM

- Oracle

- SAP

- Manhattan Associates

- Kibo Commerce

- Fluent Commerce

- Tecsys

- Aptos

- Logicbroker

- Infor

- Blue Yonder (formerly JDA Software)

- Radial

- NetSuite (Oracle)

- Deposco

- Skubana

- SPS Commerce

- Stone Edge Technologies

- OrderDynamics

- Vinculum Solutions

Frequently Asked Questions

Analyze common user questions about the Order Management Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a traditional OMS and a modern composable OMS?

A traditional OMS is typically a monolithic application, difficult to update or integrate, handling core order flow sequentially. A modern composable OMS utilizes microservices architecture and APIs, allowing businesses to select best-of-breed components (like inventory, payments, or routing engines) from different vendors and assemble them flexibly, offering greater agility and customization for unified commerce.

How does OMS enable true omnichannel retailing?

OMS serves as the single source of truth for inventory availability and order placement across all channels (online, in-store, mobile, marketplaces). By centralizing inventory data and providing intelligent order routing logic, OMS enables complex fulfillment models such as Buy Online, Pickup In Store (BOPIS), Ship From Store (SFS), and easy returns processing, unifying the customer experience regardless of the touchpoint.

Is Cloud deployment mandatory for future-proofing an OMS investment?

While on-premise solutions persist for highly specific, regulated industries, Cloud deployment (SaaS) is strongly preferred for future-proofing. Cloud platforms offer superior scalability, automatic updates, reduced operational expenditure (OpEx), and quicker integration capabilities necessary to support rapid e-commerce growth and incorporate AI and ML functionalities essential for competitive advantage.

What is the role of Artificial Intelligence in optimizing order fulfillment costs?

AI plays a critical role by utilizing predictive analytics for dynamic order sourcing and routing. AI algorithms analyze variables like shipping costs, inventory positioning, labor costs, and delivery speed in real time, determining the optimal fulfillment location (warehouse or store) to minimize overall logistics expenditure while adhering to promised delivery windows.

What are the main integration challenges encountered when implementing a new OMS?

The primary challenges involve integrating the new OMS with disparate legacy systems, specifically older ERPs (Enterprise Resource Planning), WMS (Warehouse Management Systems), and accounting platforms. Data synchronization issues, inconsistent data formats, and the reliance on complex custom APIs often increase implementation time and cost, requiring significant effort in data mapping and cleansing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Order Management Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (On-Premise, Cloud-Based), By Application (BFSI, Retail, Healthcare, Telecom and IT, Manufacturing, Energy and Utilities, Transportation and Logistics, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Retail Distributed Order Management Systems Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud Based, Web Based), By Application (Large Enterprises, SMEs), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager