Order Picker Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434561 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Order Picker Machines Market Size

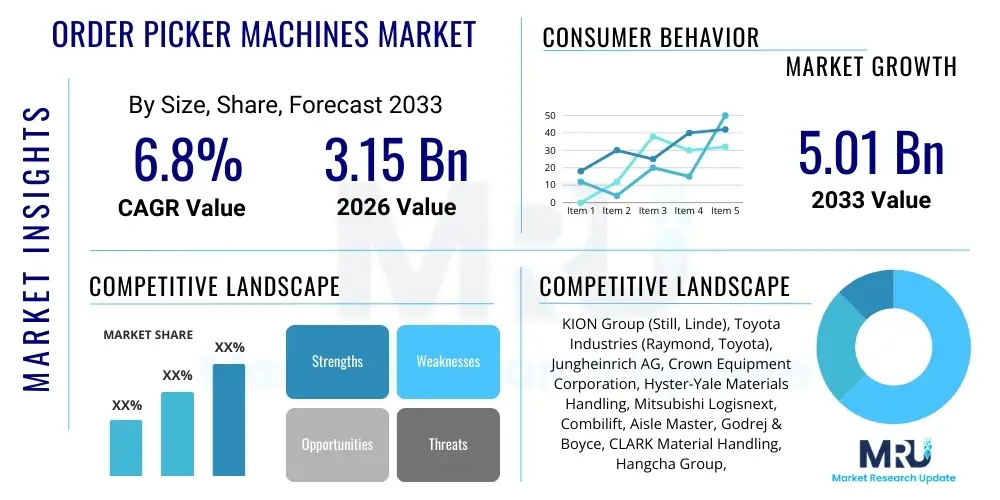

The Order Picker Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.15 Billion in 2026 and is projected to reach USD 5.01 Billion by the end of the forecast period in 2033.

Order Picker Machines Market introduction

The Order Picker Machines Market encompasses specialized material handling equipment designed to efficiently lift operators and accompanying loads to elevated storage levels, primarily for piece-picking operations within warehouses, distribution centers, and high-bay facilities. These machines, essential components of modern intralogistics, are categorized based on lifting height into low-level (up to 20 feet), mid-level, and high-level (above 30 feet) pickers, fulfilling crucial roles in inventory management and order fulfillment, especially in sectors characterized by high stock keeping unit (SKU) diversity and rapid turnaround times.

The core function of an order picker is to optimize the manual component of the picking process, significantly reducing travel time and improving safety compared to static ladders or manual carts. Product descriptions range from simple walk-along models to advanced turret trucks capable of aisle guidance and integrated inventory systems. Major applications are concentrated in third-party logistics (3PL), e-commerce fulfillment centers, automotive parts distribution, and large-scale manufacturing facilities where component parts need to be retrieved from vertical shelving structures.

Key benefits derived from adopting modern order picker machines include substantial improvements in operational efficiency, enhanced worker ergonomics and safety compliance, and maximum utilization of vertical warehouse space. Driving factors propelling this market growth involve the relentless expansion of global e-commerce necessitating faster and more accurate order fulfillment, the persistent scarcity of skilled warehouse labor, and technological advancements such as lithium-ion battery integration and advanced fleet management telematics that improve machine uptime and productivity.

Order Picker Machines Market Executive Summary

The Order Picker Machines Market is experiencing robust growth fueled by transformative business trends centered on automation adoption and optimizing supply chain responsiveness. Current business trends indicate a strong pivot towards integrating order pickers with Warehouse Management Systems (WMS) and utilizing sophisticated fleet telematics to monitor performance, predict maintenance needs, and manage battery life efficiently. Furthermore, there is a distinct trend towards narrower aisle operation capability (VNA, Very Narrow Aisle) models, maximizing storage density and consequently driving demand for high-level articulating or turret-style order pickers in mega-warehouses supporting global retail operations.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, predominantly due to the monumental expansion of e-commerce markets in China, India, and Southeast Asia, coupled with massive investments in new logistics infrastructure. North America and Europe remain mature markets, focusing less on new facility build-out and more on retrofitting existing distribution centers with advanced, energy-efficient machines and integrating automation features like semi-autonomous navigation aids to address escalating labor costs and operational bottlenecks. Regulatory pressures regarding worker safety also push European companies toward newer, compliant equipment.

Segment trends reveal that the Electric/Battery-powered segment dominates the market, largely replacing traditional IC engine models due to environmental mandates and suitability for indoor operations. Low-level order pickers maintain significant volume due to high utilization rates in fast-moving consumer goods (FMCG) and parcel handling, while the high-level segment commands higher average selling prices (ASPs) due to their complex hydraulic systems and integration requirements. The adoption of custom-built machines tailored for specific load capacities and ergonomic requirements is also rising across specialized end-user industries such as cold storage and hazardous materials handling.

AI Impact Analysis on Order Picker Machines Market

User inquiries regarding the impact of Artificial Intelligence (AI) on order picker machines frequently center on three critical themes: the transition to full autonomy, optimization of human-machine interaction, and the effectiveness of predictive maintenance schedules. Users are keen to understand if AI will eliminate the need for human operators entirely, or if it will primarily serve to guide and assist existing human operators through complex picking routes. Significant concern is also expressed regarding the cost-effectiveness and scalability of integrating deep learning algorithms into traditional material handling fleets, especially considering the varied operational environments and existing legacy infrastructure.

The implementation of AI is expected to revolutionize order picker operations by shifting from reactive decision-making to predictive operational planning. AI algorithms analyze vast datasets—including WMS instructions, traffic patterns, equipment usage history, and ambient conditions—to dynamically assign picking routes, minimizing empty travel time and reducing congestion within aisles. This optimization capability directly translates into substantial productivity gains and decreased energy consumption per pick cycle, addressing the primary concerns of efficiency and operational expenditure that drive user interest.

Furthermore, AI significantly enhances safety and maintenance protocols. Machine vision coupled with AI enables real-time hazard detection, collision avoidance, and ensuring proper load stability. In terms of asset management, AI-driven predictive maintenance analyzes sensor data from motors, hydraulics, and batteries to forecast component failures before they occur, drastically reducing unexpected downtime and prolonging the useful life of the machinery. This technological integration transforms the order picker from a simple mechanical lift into an intelligent, networked asset critical for high-throughput logistics.

- AI-powered dynamic route optimization reduces travel distance and time by 15-20%.

- Predictive maintenance analytics lowers unscheduled downtime and operational costs.

- Machine vision systems enhance collision avoidance and operator safety compliance.

- Integration with WMS through machine learning improves inventory accuracy and sequencing.

- Facilitation of semi-autonomous navigation assists operators in high-density storage environments.

DRO & Impact Forces Of Order Picker Machines Market

The dynamics of the Order Picker Machines Market are primarily shaped by the rapid expansion of global e-commerce and the subsequent need for high-density storage solutions, which serves as a major Driver (D). This driver is compounded by persistent labor shortages in logistics sectors globally, compelling companies to invest in equipment that maximizes individual worker productivity and offers improved ergonomic features, thereby attracting and retaining talent. However, the market faces significant Restraints (R), notably the substantial initial capital expenditure required for sophisticated, high-level order pickers and the complexity associated with integrating these advanced machines into legacy warehouse management and operational systems, particularly for Small and Medium Enterprises (SMEs).

Numerous Opportunities (O) exist, particularly in the rapid development and commercialization of next-generation power sources, such as solid-state and high-density lithium-ion batteries, which extend operational run times and reduce charging infrastructure requirements. Furthermore, the trend toward full warehouse automation and the integration of IoT devices into order picker fleets present avenues for manufacturers to offer high-margin service contracts and data-driven optimization solutions. This blend of technological advancement and evolving logistical demands creates a potent framework for market expansion and innovation in the short to medium term.

Impact Forces are predominantly high, driven by the intense competition within the material handling equipment sector and the critical reliance of key end-user segments (e.g., e-commerce, 3PL) on efficient picking processes. Economic volatility, particularly rising material and component costs (steel, microchips), exerts upward pressure on manufacturing costs, which is partially offset by the imperative for operational efficiency gains in customer sectors. Regulatory forces, particularly concerning workplace safety and carbon emissions, also significantly influence product design and procurement decisions globally, favoring electric, ergonomic, and safety-compliant models.

Segmentation Analysis

The Order Picker Machines Market segmentation provides a crucial framework for understanding the diverse product offerings and their specialized applications across various industrial landscapes. Segmentation is primarily based on Product Type, Lift Height/Capacity, Power Source, and the End-User Industry, allowing manufacturers and buyers to align machine specifications precisely with operational requirements. This detailed classification highlights where capital investments are concentrated and which technologies are currently achieving maximum market penetration across different logistical environments.

The segmentation by Product Type (low-level, mid-level, high-level) is essential because it directly dictates the machine’s deployment environment. Low-level pickers are volume movers, focusing on fast retrieval of items stored close to the ground, while high-level pickers are critical for maximizing storage cube utilization in VNA settings. Segmentation by Power Source demonstrates the shift towards sustainability, with battery-electric models dominating due to their zero-emission profile and operational efficiency indoors, increasingly featuring advanced Li-ion battery technology over traditional lead-acid alternatives.

Further analysis of the End-User Industry reveals that E-commerce and Retail distribution centers are the most significant consumers, driven by the need for multi-shift operations and high throughput rates. The 3PL segment is also growing rapidly, often requiring highly versatile machines capable of handling different clients' SKU profiles and packaging requirements. Understanding these granular segment behaviors is vital for forecasting demand, optimizing production lines, and strategizing market entry or expansion initiatives for equipment manufacturers globally.

- By Product Type:

- Low-Level Order Pickers

- Mid-Level Order Pickers

- High-Level Order Pickers (including Turret Trucks/VNA)

- By Power Source:

- Electric/Battery-Powered (Lead-Acid, Lithium-Ion)

- Internal Combustion (IC) Engine (Limited Application)

- By Capacity:

- Less than 1,500 lbs

- 1,500 lbs to 3,000 lbs

- Above 3,000 lbs

- By End-User Industry:

- E-commerce and Retail

- 3rd Party Logistics (3PL)

- Manufacturing and Automotive

- Food and Beverages (including Cold Storage)

- Pharmaceutical and Healthcare

Value Chain Analysis For Order Picker Machines Market

The value chain for the Order Picker Machines Market begins with the Upstream Analysis, which involves the sourcing of critical raw materials and specialized components. Key upstream activities include the procurement of high-grade steel and aluminum for chassis construction, sophisticated hydraulic systems, electric motors, and, increasingly, advanced battery systems (Li-ion cells). The reliance on complex electronics, sensors, and microprocessors for control systems means manufacturers are highly dependent on global semiconductor supply chains, which introduces significant risk and cost variability.

Midstream activities encompass the core manufacturing, assembly, and quality assurance processes. Leading Original Equipment Manufacturers (OEMs) focus on lean manufacturing techniques, modular design, and customization capabilities to meet diverse client specifications, particularly regarding lift height and load capacity. This stage involves substantial investment in automated welding, painting, and precision assembly lines. The efficiency and quality control implemented here are crucial determinants of the final product's reliability and total cost of ownership (TCO).

Downstream analysis focuses on Distribution Channels, which are critical for market penetration and after-sales support. Sales primarily occur through a mix of Direct Sales (for major global accounts requiring customized fleet solutions) and Indirect Sales via authorized regional dealers and distributors. Dealers provide localized sales expertise, rental services, and, most importantly, critical maintenance and spare parts supply, ensuring high equipment uptime. The profitability of the value chain is significantly influenced by the efficacy of the after-market service segment, including parts supply and advanced telematics subscription services.

Order Picker Machines Market Potential Customers

The primary end-users or buyers of Order Picker Machines are institutions heavily engaged in warehousing, distribution, and logistics operations where accurate, piece-part picking from elevated shelving is mandatory. The rapid evolution of omnichannel retail means that companies previously relying on bulk handling now require flexible equipment to manage high volumes of individual orders. This group includes massive multinational e-commerce giants, who operate some of the largest, most technologically advanced distribution centers globally, often requiring bespoke VNA systems and high-throughput order picking solutions.

Another major customer segment is the Third-Party Logistics (3PL) provider industry. 3PLs manage inventory and fulfillment for multiple clients, necessitating a highly versatile fleet of order pickers that can adapt quickly to changing SKU profiles and operational requirements. Their purchasing decisions are strongly influenced by the total cost of ownership, reliability, and the ability of the equipment to integrate seamlessly with various client WMS platforms. The demand from 3PLs is often cyclic, peaking during holiday seasons, leading to significant interest in rental and leasing options for order picker fleets.

Beyond logistics specialists, the Manufacturing and Automotive sectors represent substantial potential customers, particularly for spare parts distribution and internal component handling operations. Automobile manufacturers and their suppliers utilize order pickers extensively in service parts warehouses to ensure rapid availability of components required for maintenance and repair. Furthermore, specialized industries like Pharmaceuticals and Cold Storage facilities are increasingly investing in highly specialized, often corrosion-resistant or temperature-optimized order picker models to comply with stringent regulatory requirements and preserve product integrity during storage and retrieval processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.15 Billion |

| Market Forecast in 2033 | USD 5.01 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KION Group (Still, Linde), Toyota Industries (Raymond, Toyota), Jungheinrich AG, Crown Equipment Corporation, Hyster-Yale Materials Handling, Mitsubishi Logisnext, Combilift, Aisle Master, Godrej & Boyce, CLARK Material Handling, Hangcha Group, TVH Parts, Hubtex, Bendi, EP Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Order Picker Machines Market Key Technology Landscape

The technological evolution within the Order Picker Machines Market is heavily centered on enhancing power efficiency, maximizing connectivity, and improving operator safety and ergonomics. A cornerstone technology is the widespread adoption of Lithium-Ion (Li-ion) batteries. Li-ion power packs offer significantly longer operational cycles, rapid charging capabilities (often opportunity charging during breaks), and require zero maintenance compared to older lead-acid counterparts. This transition directly addresses a critical operational challenge: maximizing machine uptime in high-throughput environments like 24/7 e-commerce warehouses, fundamentally changing infrastructure planning.

Connectivity is another defining trend, driven by the integration of telematics and Internet of Things (IoT) sensors. Modern order pickers are equipped with advanced telemetry systems that transmit real-time data on usage patterns, battery status, collision incidents, and operational metrics directly to cloud-based fleet management platforms. This allows warehouse managers to optimize fleet utilization, schedule proactive maintenance based on actual usage, and monitor driver behavior, leading to enhanced safety compliance and reduced overall operating costs. Automated fault diagnosis through these connected systems minimizes manual troubleshooting time.

Furthermore, technology focusing on operator assistance and safety is becoming standard. This includes advanced features such as mandatory seatbelt interlocks, performance monitoring systems that limit speed based on lift height or load weight, and integrated guidance systems (wired or rail-guided) for very narrow aisle (VNA) models. Future technological advancements are expected to focus on semi-automation features, where AI assists in travel path selection and maneuvering within complex, congested warehouse layouts, ultimately paving the way for fully autonomous picking solutions in specialized applications.

Regional Highlights

The Order Picker Machines Market exhibits distinct regional dynamics driven by varying levels of logistics maturity, e-commerce penetration, and labor cost structures.

- Asia Pacific (APAC): This region is the fastest-growing market, primarily fueled by massive infrastructure investment in distribution centers across China, India, Japan, and Southeast Asia. The explosive growth of regional e-commerce giants and the dense population bases necessitate highly efficient, vertically optimized storage solutions. High-level order pickers and VNA equipment are experiencing rapid demand as companies maximize utilization of costly urban land for warehousing.

- North America: Representing a highly mature and technologically advanced market, North America focuses heavily on replacing older equipment with connected, ergonomically superior models. The demand is strong for lithium-ion powered units and order pickers integrated with AI-driven WMS to combat exceptionally high labor costs and maintain compliance with stringent safety regulations (OSHA).

- Europe: The European market is characterized by a strong emphasis on sustainability and safety standards. There is high penetration of electric-powered machines due to strict environmental mandates. Germany, the UK, and France are key markets, showing consistent demand for high-quality, reliable machines with advanced safety features and telematics integration, reflecting a strong focus on maximizing TCO.

- Latin America (LATAM): This region is an emerging market with fluctuating investment levels. Growth is concentrated in Brazil and Mexico, driven by industrial expansion and increasing digital retail adoption. The market generally prefers cost-effective, durable mid-level order pickers, although adoption of advanced technologies is accelerating in major urban logistics hubs.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by ambitious diversification projects and the development of major logistics hubs (e.g., Dubai, Saudi Arabia). The market demands reliable equipment that can withstand extreme climate conditions, with strong potential for sophisticated, high-bay storage solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Order Picker Machines Market.- KION Group (Still, Linde Material Handling)

- Toyota Industries Corporation (Toyota Forklifts, Raymond Corporation)

- Jungheinrich AG

- Crown Equipment Corporation

- Hyster-Yale Materials Handling, Inc.

- Mitsubishi Logisnext Co., Ltd. (Rocla, Cat Lift Trucks)

- Clark Material Handling Company

- Combilift Ltd.

- Godrej & Boyce Mfg. Co. Ltd.

- Aisle Master (part of Combilift)

- Hangcha Group Co., Ltd.

- EP Equipment

- TVH Parts Holding NV (Aftermarket Focus)

- Hubtex Maschinenbau GmbH & Co. KG

- Bendi Forklifts (Landoll Corporation)

- Manitou Group

- Kalmar (Cargotec Corporation)

- Doosan Industrial Vehicle America Corp.

- Fujian Longking Co., Ltd.

- Palletforce Logistics Ltd. (Operator/User Perspective)

Frequently Asked Questions

Analyze common user questions about the Order Picker Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Order Picker Machines Market?

The Order Picker Machines Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven largely by global e-commerce fulfillment demands and warehouse automation initiatives.

Which power source segment dominates the Order Picker Machines Market?

The Electric/Battery-Powered segment currently dominates the market, specifically the rapidly growing subsegment utilizing advanced Lithium-Ion (Li-ion) batteries. This preference is due to superior energy efficiency, zero indoor emissions, and enhanced operational uptime through opportunity charging.

How does AI impact the operational efficiency of order picker machines?

AI significantly enhances operational efficiency by enabling dynamic route optimization, minimizing travel time for operators, and facilitating predictive maintenance schedules. These technologies reduce unscheduled downtime and improve overall throughput per shift in distribution centers.

Which region presents the highest growth opportunities for Order Picker Machines?

The Asia Pacific (APAC) region is forecasted to present the highest growth opportunities, primarily due to massive investments in modern logistics infrastructure supporting the booming e-commerce sectors in countries like China and India, necessitating high-density storage solutions.

What is the difference between low-level and high-level order pickers?

Low-level order pickers are designed for picking items from the ground level up to approximately 20 feet, focusing on volume throughput. High-level pickers, including Very Narrow Aisle (VNA) models, are designed to lift operators above 30 feet, maximizing vertical storage cube utilization.

What are the primary restraints affecting market growth?

The main restraints include the substantial initial capital investment required for purchasing advanced, high-specification equipment, particularly for high-level VNA models, and the technical complexity involved in seamlessly integrating new order picker fleets with existing legacy Warehouse Management Systems (WMS).

Who are the primary end-users of order picker machines?

The primary end-users are large-scale e-commerce fulfillment centers, 3rd Party Logistics (3PL) providers, major retail distribution networks, and specialized sectors such as automotive parts manufacturers and pharmaceutical wholesale distributors.

What emerging technology is reshaping order picker design?

Key emerging technologies include advanced telematics and IoT integration for real-time fleet management and predictive analytics, as well as the incorporation of AI for operator assistance and collision avoidance systems, enhancing safety and overall asset performance.

How do order picker machines contribute to maximizing warehouse space?

Order picker machines, especially mid- and high-level VNA models, are engineered to operate in extremely narrow aisles (often less than 6 feet wide), enabling companies to install taller racking systems and substantially increase storage density within the same facility footprint.

Are rental and leasing options prevalent in this market?

Yes, rental and leasing options are highly prevalent, especially among 3PLs and seasonal retailers who require flexible fleet scaling to manage peak demand periods. This also allows SMEs to access high-end equipment without the need for immediate, large-scale capital expenditure.

What role does safety regulation play in product development?

Safety regulations (such as OSHA and EU standards) play a critical role, compelling manufacturers to continuously innovate in areas like operator ergonomics, mandatory safety interlocks, fall protection systems, and automated speed limits, driving the rapid obsolescence of non-compliant older machinery.

How has the rise of e-commerce affected order picker demand?

The rise of e-commerce has been the most significant market driver, shifting logistical focus from palletized bulk handling to high-volume piece picking, thereby directly increasing the demand for efficient, high-throughput order picker machines capable of handling diverse SKU inventories rapidly and accurately.

What is the importance of connectivity (telematics) in modern fleets?

Connectivity allows real-time monitoring of machine location, utilization, and health metrics. This data is crucial for optimizing fleet deployment, identifying training needs for operators, and implementing condition-based maintenance strategies, significantly lowering operating costs and improving asset visibility.

Are Order Picker Machines suitable for cold storage environments?

Yes, specialized models of Order Picker Machines are designed with climate-resistant components, specialized lubricants, and cabin heating/insulation to operate efficiently and reliably in extreme sub-zero cold storage and freezer environments, serving the growing frozen food logistics sector.

What is the average lifespan of a modern electric order picker?

The average operational lifespan of a high-quality, well-maintained electric order picker typically ranges from 10 to 15 years, although components like batteries and tires require more frequent replacement. Robust maintenance programs extending through aftermarket services are critical to achieving maximum life cycle value.

What are the main segments covered by capacity?

Capacity segmentation typically covers three main tiers: Less than 1,500 lbs (primarily low-level, high-volume units), 1,500 lbs to 3,000 lbs (standard mid-level models), and Above 3,000 lbs (heavy-duty, often high-level or specialized load-handling equipment).

How do turret trucks relate to order picker machines?

Turret trucks are considered a specialized, high-end subset of high-level order picker machines. They are designed for operation exclusively in Very Narrow Aisles (VNA) and feature a load-handling attachment (the turret head) that can rotate 180 degrees, allowing picking from either side without turning the entire machine.

What factors determine the choice between lead-acid and lithium-ion batteries?

The choice is typically determined by operational intensity and infrastructure. Lead-acid batteries offer a lower initial cost but require dedicated charging rooms and cool-down time. Lithium-ion batteries have a higher initial cost but require zero maintenance, offer rapid charging, and provide superior longevity, making them ideal for multi-shift, 24/7 operations.

What is upstream analysis in the Order Picker Machines value chain?

Upstream analysis involves the procurement and supply of raw materials and core components. For order pickers, this includes sourcing specialized high-tensile steel, hydraulic components, electric motors, electronic control boards, and securing the supply of advanced battery cells from global providers.

Which component supply chain poses a significant risk to manufacturers?

The global supply chain for semiconductors and specialized electronic control units poses a significant risk, particularly following recent global shortages. Order picker manufacturers rely heavily on these components for integrated safety features, control panels, and advanced telematics systems.

How are customer service and maintenance delivered in this market?

Customer service and maintenance are crucial and primarily delivered through a robust network of authorized regional dealerships. These dealers provide essential services including preventative maintenance contracts, emergency repairs, parts inventory management, and specialized technical support for complex hydraulic and electronic systems.

What distinguishes 3PL providers as key customers?

3PL providers are key customers due to their diverse inventory management needs and the requirement for highly flexible equipment. They frequently favor models that offer high reliability, low TCO, and robust telematics capabilities to manage utilization across multiple client contracts and facilities.

What is the significance of the automotive sector in this market?

The automotive sector is significant, particularly in after-market parts logistics. Order pickers are essential for retrieving specific, low-volume, high-value parts from organized storage structures within large service parts distribution warehouses, ensuring timely repair and maintenance support.

What is Generative Engine Optimization (GEO) in the context of this report?

Generative Engine Optimization (GEO) in this report ensures the content is structured, detailed, and contextually rich, providing comprehensive answers suitable for training and querying large language models (LLMs) and advanced search algorithms, leading to high-quality synthesized search results.

How do manufacturers address operator ergonomics in product design?

Manufacturers address ergonomics through adjustable control consoles, low step-in heights, cushioned floor mats, ergonomic standing platforms, and enhanced visibility features. These designs aim to reduce physical strain and fatigue, especially during continuous multi-shift operation, improving both safety and productivity.

What is the role of robotics in future order picker designs?

Robotics is increasingly integrated through the development of fully autonomous or semi-autonomous order pickers. While full autonomy is challenging due to the variability of piece-picking tasks, robotic integration focuses on automating travel, positioning, and routine retrieval tasks to assist or replace human operators in repetitive or highly controlled environments.

Why is the Food and Beverage segment adopting new order pickers?

The Food and Beverage segment, particularly the chilled and frozen food sectors, is adopting new order pickers to meet stringent hygiene regulations and temperature control requirements. Specialized stainless steel or coated machines are required, often running on Li-ion batteries for consistent performance in challenging cold chain logistics.

How does the definition of 'picking' influence machine design?

The definition of 'picking'—whether it is carton picking, case picking, or broken-case piece picking—fundamentally influences machine design. High-level pickers often require platforms capable of handling full pallets or heavy cartons, whereas low-level pickers prioritize speed and ease of access for individual, smaller items.

What is the projected market size in 2033?

The Order Picker Machines Market is projected to reach a total value of USD 5.01 Billion by the end of the forecast period in 2033, reflecting consistent capital investment by the logistics sector into automation and efficiency technologies globally.

What distinguishes North American market demand from APAC?

North American demand is primarily driven by technological upgrades (telematics, Li-ion adoption) and high labor cost mitigation in mature facilities. APAC demand is driven by raw infrastructure expansion and maximizing the vertical utilization of new, rapidly built distribution centers.

What technological feature ensures high safety in VNA operation?

Integrated guidance systems (either wire guidance embedded in the floor or rail guidance) are crucial for high safety in Very Narrow Aisle (VNA) operation, ensuring the picker remains perfectly centered, preventing collisions with racking systems, especially at maximum lift heights.

How do material and component costs affect market pricing?

Rising costs for key materials such as steel, aluminum, and crucial electronic components, exacerbated by global supply chain disruptions, translate directly into higher manufacturing costs. These increases are often partially passed on to the end consumer, resulting in upward pressure on the Average Selling Price (ASP) of new order pickers.

Why are customization capabilities important for OEMs?

Customization is important because end-users have highly specific requirements based on their warehouse ceiling height, aisle width, and load profiles. OEMs must offer customizable options regarding lift height, platform size, and specialized attachments (e.g., vacuum lifters, extendable forks) to meet diverse client needs effectively.

What is a key opportunity related to fleet management?

A key opportunity lies in offering subscription-based, AI-enhanced fleet management solutions. These services leverage telematics data to optimize fleet size, predict component failure, and manage battery charging cycles autonomously, providing ongoing revenue streams for manufacturers.

What is the primary constraint for Small and Medium Enterprises (SMEs)?

For SMEs, the primary constraint is the high initial acquisition cost of advanced, integrated order picker systems. This often leads them to prioritize durable, simple mid-level pickers or rely more heavily on rental and used equipment markets rather than investing in state-of-the-art VNA technology.

What differentiates order pickers from traditional forklifts?

Order pickers are designed to lift the operator alongside the load to facilitate piece-by-piece retrieval from racks, directly supporting manual order fulfillment. Traditional forklifts (like counterbalanced trucks) are designed solely for transporting and stacking palletized loads, not for human elevation during picking.

How does labor scarcity drive market demand?

The persistent global scarcity of skilled warehouse labor forces companies to invest in highly efficient order pickers that maximize the productivity of each remaining worker. Advanced machines often feature better ergonomics and WMS integration to streamline tasks and reduce training time, making the job more appealing.

What is the role of Downstream Analysis in the value chain?

Downstream analysis focuses on how the manufactured equipment reaches the end-user, primarily through direct sales channels, or more commonly, through specialized regional distributors who handle logistics, installation, operator training, and ongoing after-sales support crucial for maintaining customer satisfaction.

Which segments cover the 1,500 lbs to 3,000 lbs capacity range?

The 1,500 lbs to 3,000 lbs capacity range typically covers robust low-level models and standard mid-level order pickers, which are highly utilized in general distribution centers that handle moderately heavy cartons and operate across multiple shifts.

How does the market address the demand for high throughput?

High throughput demand is addressed through technologies like rapid acceleration/deceleration systems, Li-ion batteries for continuous operation, dynamic AI-based routing, and simultaneous lift and travel functionalities, ensuring minimum idle time during the picking cycle.

What is the significance of the base year 2025?

2025 serves as the base year for the forecast period (2026-2033), representing the latest finalized data used for establishing initial market estimates, technological adoption rates, and economic conditions necessary for generating reliable projections.

Why are pharmaceutical companies investing in specific order pickers?

Pharmaceutical companies invest in specialized order pickers to comply with strict regulatory traceability requirements, maintain sterile environments (where applicable), and ensure precise inventory control for high-value or temperature-sensitive medications, often requiring custom, corrosion-resistant components.

What is the distinction between Direct and Indirect distribution channels?

Direct channels involve the OEM selling or leasing equipment directly to major corporate clients (like large e-commerce firms). Indirect channels utilize third-party distributors or dealers who manage localized sales, inventory, and comprehensive after-market support for smaller and regional customers.

How is the market leveraging augmented reality (AR) technology?

Augmented Reality (AR) is being leveraged primarily for enhanced operator training, maintenance diagnostics, and real-time visual picking guidance. AR overlays navigational instructions or product location data onto the operator's view, significantly reducing picking errors and training overhead.

What role does government regulation play in the European market?

Government regulation in Europe, particularly concerning carbon emissions and worker health and safety, strongly favors the adoption of modern electric fleets with advanced safety features, driving the consistent replacement cycle of older, less compliant internal combustion or less ergonomic models.

Which companies are key players in the aftermarket service segment?

While OEMs provide substantial service, companies like TVH Parts Holding NV are key players in the independent aftermarket service segment, specializing in the supply of high-quality replacement parts, accessories, and components for various brands of order picker machines globally.

What is the primary objective of Answer Engine Optimization (AEO) in this report?

The primary objective of AEO is to structure the content, particularly the FAQ section and key summary paragraphs, using precise language and formats that enable search engines (like Google and Bing) to extract direct, definitive answers efficiently, enhancing visibility in search results and rich snippets.

How do manufacturers ensure product durability in high-cycle environments?

Manufacturers ensure durability by using high-strength, fatigue-resistant materials for the chassis and masts, employing robust, sealed electronic components to resist dust and moisture, and over-engineering critical hydraulic and motor systems to withstand continuous, intense operational cycles typical of 24/7 fulfillment centers.

What is the market relevance of the historic period (2019 to 2024)?

The historic period (2019 to 2024) is crucial as it captures the market response to the massive accelerated growth of e-commerce fueled by the pandemic, identifying key investment peaks, supply chain bottlenecks, and the rapid shift towards automation and battery technology adoption.

What challenges exist in integrating older order pickers with modern WMS?

Older order pickers often lack the necessary hardware (onboard computers, telematics units) or communication protocols to interface seamlessly with modern, cloud-based Warehouse Management Systems (WMS). This integration gap often necessitates costly retrofitting or replacement of the legacy fleet.

How does machine vision technology improve picking accuracy?

Machine vision, often coupled with AI, improves accuracy by confirming that the operator has selected the correct item and verifying its placement into the designated tote or pallet. It reduces human error, confirms SKU validity, and helps manage inventory discrepancies in real-time at the point of retrieval.

What is the significance of the 6.8% CAGR?

The 6.8% CAGR signifies a strong and stable market expansion, indicating sustained demand driven by structural shifts in global retail and logistics, where operational efficiency and maximum warehouse utilization are paramount investment priorities across all major economic regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager