Organic and Natural Tampons Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434022 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Organic and Natural Tampons Market Size

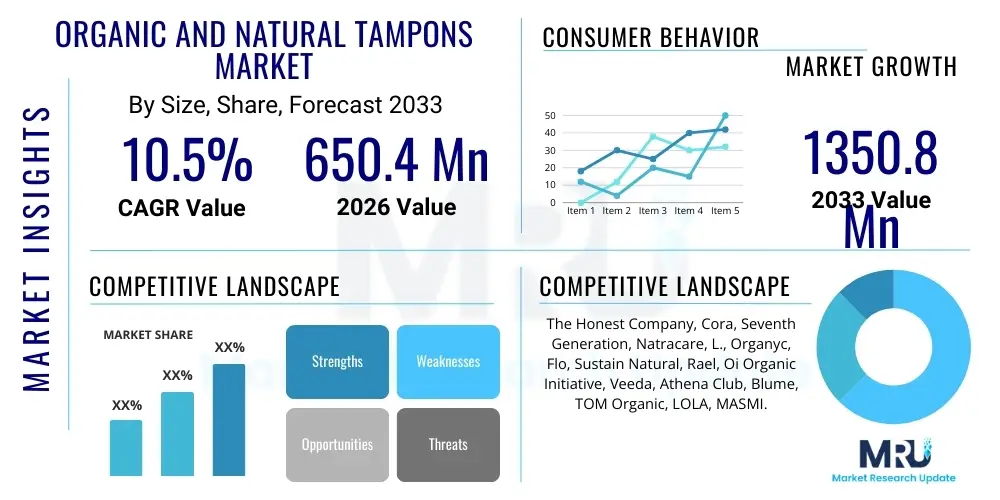

The Organic and Natural Tampons Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. This significant growth trajectory is underpinned by rising consumer awareness regarding personal health, the environmental impact of conventional feminine hygiene products, and increasing preference for sustainable and chemical-free alternatives. The market is estimated at USD 650.4 million in 2026 and is projected to reach USD 1350.8 million by the end of the forecast period in 2033. This expansion is heavily influenced by rapid adoption in developed economies and emerging consumer education initiatives in developing regions.

Organic and Natural Tampons Market introduction

The Organic and Natural Tampons Market encompasses menstrual hygiene products crafted exclusively from materials free from pesticides, chlorine bleaching, dyes, fragrances, and synthetic fibers. These products, primarily utilizing 100% certified organic cotton or sustainably sourced bamboo/plant-based alternatives, are marketed toward consumers prioritizing health safety and environmental stewardship. The fundamental product description involves certified materials that minimize the risk of irritation, allergic reactions, and exposure to potential endocrine-disrupting chemicals often associated with conventional products. The certified organic designation ensures traceability and adherence to rigorous ecological standards throughout the supply chain, enhancing consumer trust and product premiumization.

Major applications of organic and natural tampons center around standard menstrual protection across various absorbency levels (light, regular, super). However, beyond core functionality, these products serve a crucial role in mitigating the environmental burden associated with conventional plastic-based applicators and synthetic non-biodegradable components. The core benefits driving adoption include reduced exposure to chemical irritants, lowering the risk of Toxic Shock Syndrome (TSS) associated with synthetic fibers, superior breathability, and full biodegradability of the materials, contributing positively to waste management reduction strategies. Consumers are increasingly viewing these tampons not just as necessities but as ethical consumption choices.

Driving factors sustaining market growth are multifaceted. Firstly, robust consumer health campaigns emphasize the necessity of chemical-free intimate care, pushing users away from conventional brands. Secondly, global movements towards sustainability and plastic reduction heavily favor biodegradable and compostable materials, which organic tampons inherently offer. Furthermore, supportive regulatory environments and the increasing availability of third-party certifications (like GOTS or OEKO-TEX) provide necessary assurance regarding product authenticity and quality, thereby encouraging premium pricing and greater retail penetration in mainstream markets, including pharmacies and large supermarket chains, beyond just specialty health stores.

Organic and Natural Tampons Market Executive Summary

The Organic and Natural Tampons Market is experiencing robust acceleration driven by shifts in consumer priorities towards wellness and sustainability. Business trends indicate a strong focus on innovation in applicator design, with a pronounced movement away from plastic towards bio-plastics and cardboard, coupled with significant growth in the non-applicator segment, especially favored in European and specific Asian markets. Brand positioning increasingly relies on ethical sourcing, transparency in ingredient disclosure, and community engagement, moving the competitive landscape beyond mere price comparison. Strategic partnerships between manufacturers and sustainability advocacy groups are becoming common, reinforcing brand narratives centered on ecological responsibility and feminine health empowerment. Investment in supply chain resilience for organic raw materials remains a critical success factor.

Regional trends reveal North America and Europe as the primary revenue generators, characterized by high consumer awareness, established disposable income levels, and mature regulatory standards favoring organic certification. However, the Asia Pacific region, particularly countries like China and India, is emerging as the fastest-growing market segment. This accelerated growth is fueled by increasing urbanization, rising female participation in the workforce, and aggressive marketing campaigns by global and local players educating consumers on the long-term benefits of natural menstrual care. In Latin America and MEA, market penetration is lower but shows promising growth, often led by e-commerce platforms bypassing traditional restrictive retail channels, democratizing access to these specialized products.

Segmentation trends highlight the dominance of 100% Organic Cotton as the preferred material type due to its established safety profile and widely recognized certification standards. In terms of product type, while applicator tampons still hold a significant share in markets like the US, the non-applicator segment is gaining momentum globally, especially among environmentally conscious younger demographics. Distribution channel analysis confirms that online retail platforms are critical accelerators, offering discreet purchasing, wider product variety, and direct-to-consumer subscription models that enhance customer loyalty and convenience. The absorbency segment remains stable, driven by biological needs, with Regular and Super absorbency levels accounting for the largest share of transactional volume globally, reflecting typical usage patterns.

AI Impact Analysis on Organic and Natural Tampons Market

User queries regarding the impact of Artificial Intelligence (AI) on the Organic and Natural Tampons Market primarily revolve around operational efficiency, personalized consumer engagement, and supply chain optimization. Key themes often investigated include how AI can enhance the traceability of organic cotton sourcing, thereby validating sustainability claims, and how predictive analytics can forecast demand fluctuations based on user menstrual cycles and regional purchasing patterns. Concerns frequently raised center on data privacy related to personalized health tracking and the accuracy of AI-driven marketing that tailors product suggestions based on intimate health data. Expectations focus on leveraging AI to streamline inventory management, minimize waste by improving production precision, and automate quality control processes to ensure certified organic standards are consistently met during manufacturing.

AI’s influence is profound in transforming the front-end consumer experience through sophisticated personalization and on the back-end through advanced operational optimization. AI-powered recommendation engines on e-commerce sites can analyze individual purchasing history, stated health preferences, and cyclical data to suggest optimal product mixes (e.g., varying absorbency packs) and subscription refill schedules, significantly boosting customer retention (AEO focus: personalized feminine care routines). Furthermore, AI is crucial in conversational marketing, utilizing chatbots to answer complex questions about certifications, ingredients, and sustainability practices 24/7, building brand trust through instant, accurate transparency. This enhanced digital engagement strategy is vital for premium-priced, trust-dependent products like organic tampons, ensuring high-quality consumer education.

Operationally, AI contributes significantly to ensuring the integrity of the organic supply chain—a cornerstone of this market segment. Machine learning algorithms are now being deployed to analyze sensor data from cotton farms and processing facilities, verifying adherence to organic farming standards, identifying potential contaminants early, and optimizing resource use (water, energy) during material processing. This traceability enhanced by AI provides verifiable proof of ethical sourcing, which is highly valued by consumers and regulatory bodies. Moreover, generative design algorithms can optimize the structure and material density of the tampons themselves, seeking minor improvements in comfort and absorption efficiency while strictly adhering to organic material constraints, pushing the boundaries of product innovation within sustainable parameters.

- AI enhances personalized subscription models based on cycle prediction, improving customer lifetime value (CLV).

- Machine learning optimizes organic material sourcing and traceability, ensuring supply chain integrity and reducing fraud.

- Predictive analytics forecasts demand surges and local inventory needs, minimizing stockouts and reducing overproduction waste.

- AI-powered chatbots provide instant, detailed responses regarding product certifications and chemical-free composition, boosting consumer confidence.

- Computer vision systems automate quality control during manufacturing, ensuring material uniformity and compliance with organic standards.

DRO & Impact Forces Of Organic and Natural Tampons Market

The Organic and Natural Tampons Market operates under a powerful confluence of drivers and restraints, framed by significant opportunities that define its future trajectory. Key drivers include the escalating global demand for sustainable and biodegradable products, coupled with mounting health concerns over chemicals found in conventional menstrual products, particularly endocrine disruptors and irritants. These drivers are fundamentally reshaping consumer loyalty and spending habits, favoring transparency and certified natural ingredients. However, the market faces restraints, primarily the higher retail price point compared to mass-market conventional alternatives, creating a barrier to entry for low-to-middle-income consumers, particularly in price-sensitive emerging markets. Additionally, the complex and rigorous process of achieving and maintaining organic certifications adds to operational costs, challenging scalability for smaller entrants.

Opportunities for market expansion are abundant, particularly in product diversification and geographical penetration. The ongoing innovation in eco-friendly applicators (bioplastics derived from sugarcane or fully compostable cardboard designs) allows brands to capture the environmentally conscious segment more effectively. Furthermore, expanding distribution into mass-market retailers and leveraging the rapid growth of e-commerce platforms, especially in regions with limited physical retail infrastructure, presents substantial growth opportunities. The market can also capitalize on the broader wellness trend by focusing educational efforts on younger demographics and establishing early brand relationships through digital channels and educational partnerships, solidifying long-term customer commitment to natural care.

The impact forces within this market are strongly dictated by social trends and regulatory pressure. Societal pressure towards environmental sustainability acts as a powerful external force compelling manufacturers to adopt ethical and zero-waste practices. Simultaneously, increasing regulatory scrutiny, particularly in the EU and North America, regarding chemical disclosure and material safety, reinforces the need for certified organic products, effectively favoring players who prioritize transparency. These forces collectively accelerate the shift from synthetic to natural fibers and incentivize investments in sustainable sourcing and manufacturing technologies, ultimately raising the barrier to entry for non-compliant or less ethical conventional producers, thereby structurally favoring the organic segment.

Segmentation Analysis

The Organic and Natural Tampons Market is systematically segmented based on Material Type, Product Type, Absorbency Level, and Distribution Channel to provide a granular view of consumer preferences and market dynamics. The Material Type segmentation is paramount, differentiating products based on the core fiber composition, with 100% Organic Cotton dominating due to strong brand trust and established certification mechanisms. Product Type distinguishes between applicator and non-applicator formats, reflecting significant regional differences in usage habits and varying environmental priorities regarding waste reduction. Understanding these segments is crucial for brands aiming to tailor their product portfolio and marketing strategies effectively across diverse geographical markets, ensuring alignment with both consumer expectations and regulatory mandates regarding biodegradability and material sourcing.

- Material Type: 100% Organic Cotton, Organic Cotton Blend, Bamboo/Plant-based Materials.

- Product Type: Applicator Tampons (Cardboard, Bioplastic), Non-Applicator Tampons.

- Absorbency Level: Light, Regular, Super, Super Plus.

- Distribution Channel: Online Retail (E-commerce, Company Websites), Offline Retail (Supermarkets, Pharmacies/Drug Stores, Convenience Stores).

Value Chain Analysis For Organic and Natural Tampons Market

The value chain for organic and natural tampons begins with rigorous upstream analysis, focusing heavily on the sourcing and ethical cultivation of raw materials, primarily certified organic cotton or sustainable bamboo fibers. This phase involves strict auditing of farms and processing facilities to ensure compliance with global organic standards (e.g., GOTS or USDA Organic), minimizing the use of synthetic pesticides and minimizing environmental damage. Key activities at this stage include fiber cleaning, processing, and transportation to the manufacturing hubs. The premium placed on certified materials often results in higher upstream costs, which are critical inputs that necessitate strong relationships with audited, reliable suppliers capable of guaranteeing consistent quality and traceability, forming the foundation of the product’s core value proposition.

The core manufacturing and midstream activities involve sophisticated processes such as carding, forming the tampon shape, wrapping, and inserting it into the specific applicator type (if applicable). Quality control is intensely focused on ensuring the product remains free from contamination and that the absorbency standards are consistently met. Downstream analysis encompasses the distribution channel, which is highly diversified. Direct distribution through company websites and subscription services offers maximum margin control and direct consumer relationship building, enabling personalized marketing and feedback loops. Indirect distribution leverages large retail chains (supermarkets, pharmacies) to achieve broad market penetration and visibility, often relying on established third-party logistics (3PL) providers to manage inventory and delivery efficiency across vast geographical areas.

The final stage involves consumer uptake and post-consumption considerations. The distribution channel dynamics reveal a dual strategy: maximizing visibility through traditional offline retail for impulse and immediate purchases, while leveraging online platforms for recurring purchases and educating consumers on the environmental benefits and proper disposal of the biodegradable components. The emphasis on transparency throughout the value chain—from farm to consumer—is not just an operational necessity but a key marketing differentiator. The efficiency of the distribution system, particularly in managing global logistics for bulky, low-margin (per unit) products, significantly dictates the final shelf price and market competitiveness, requiring continuous optimization of both direct and indirect logistical networks.

Organic and Natural Tampons Market Potential Customers

The primary demographic for Organic and Natural Tampons consists of environmentally conscious women aged 18 to 45 who possess moderate to high disposable incomes and prioritize personal health and ethical consumption. These end-users, or buyers, are typically proactive researchers of product ingredients, often influenced by wellness blogs, social media trends, and scientific reports linking chemical exposure to health risks. They actively seek certifications (such as GOTS or the ability to track the supply chain) as proof of product integrity. This core group is willing to pay a premium for guaranteed chemical-free, hypoallergenic products that align with their values of minimizing environmental impact, particularly valuing compostable applicators or non-applicator options.

Secondary customer segments include women experiencing heightened sensitivity or allergies to synthetic fibers, dyes, or perfumes commonly found in conventional tampons, for whom natural alternatives are a necessity rather than merely a preference. Furthermore, the rising awareness among millennial and Gen Z consumers about sustainability fuels demand. These younger buyers are often motivated by the zero-waste movement and actively participate in digital communities discussing ethical consumerism. Institutions, such as universities, healthcare clinics, and eco-friendly hotels, represent potential bulk buyers seeking to provide sustainable menstrual care options to their patrons, expanding the market reach beyond individual consumers and into institutional procurement channels, driven by corporate social responsibility (CSR) mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.4 Million |

| Market Forecast in 2033 | USD 1350.8 Million |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Honest Company, Cora, Seventh Generation, Natracare, L., Organyc, Flo, Sustain Natural, Rael, Oi Organic Initiative, Veeda, Athena Club, Blume, TOM Organic, LOLA, MASMI. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic and Natural Tampons Market Key Technology Landscape

The technology landscape in the Organic and Natural Tampons Market is less focused on chemical synthesis and more on advanced material science, sustainable processing, and manufacturing precision. A crucial technological area involves the development of proprietary methods for processing organic fibers (such as air-laid or wet-laid technology) that ensure optimal absorbency and structural integrity without relying on harsh chemicals or binders. This includes innovation in fiber locking techniques that maintain core shape integrity even when saturated, providing reliable leak protection crucial for consumer confidence. Furthermore, the adoption of advanced non-woven textile manufacturing technologies is essential for producing high-quality, dense, yet breathable tampons that meet strict safety standards while maximizing the use of costly organic raw materials efficiently.

Another significant technological advancement centers on applicator innovation, specifically the engineering of materials that function as effectively as plastic but are fully biodegradable or compostable. This involves refining bioplastic compounds derived from sustainable sources like cornstarch or sugarcane, ensuring they possess the necessary rigidity for hygienic insertion while meeting stringent compostability certifications (e.g., EN 13432). Simultaneously, advancements in high-speed manufacturing machinery designed specifically for organic cotton—which is often less uniform than conventional cotton—are vital. These machines must handle sensitive materials gently while achieving mass-market production speeds, integrating optical sorting and automated quality inspection systems (often AI-enhanced) to maintain product consistency and purity.

The final technological dimension involves digital and traceability technologies applied throughout the supply chain. Utilizing blockchain and sophisticated ERP systems allows for end-to-end tracking of organic cotton from the source field to the finished product. This technological infrastructure provides the verifiable proof of organic status that is highly sought by discerning consumers and necessary for compliance audits. These systems ensure that claims regarding purity, absence of GMOs, and ethical labor practices are substantiated by immutable digital records, fundamentally supporting the premium price point and brand trust associated with the organic category. These traceability technologies are becoming non-negotiable elements in the modern organic feminine care sector.

Regional Highlights

- North America (U.S. and Canada) represents the largest market share, driven by high consumer awareness regarding chemical exposure, robust marketing by domestic brands, and strong retail infrastructure supporting specialty health products. The U.S. remains the primary innovation hub for direct-to-consumer subscription services in this segment.

- Europe (Germany, U.K., France, Nordic Countries) exhibits high penetration rates for natural products, characterized by strong regulatory frameworks and a cultural predisposition toward sustainability and zero-waste lifestyles. Non-applicator tampons and innovative compostable packaging are highly favored in this region.

- Asia Pacific (APAC) is projected to register the fastest CAGR, propelled by rapid socioeconomic development, increasing urbanization, and growing female spending power. While the current market size is smaller, consumer education campaigns and accessible e-commerce penetration are fueling accelerated adoption in countries like Australia, China, and South Korea.

- Latin America (LATAM) shows steady, moderate growth, primarily concentrated in urban centers of Brazil and Mexico, where ethical consumerism is beginning to take root. Market growth is heavily reliant on expanding access via digital retail and overcoming logistical challenges.

- Middle East and Africa (MEA) remain emerging markets, where demand is often localized in high-income urban populations and driven by expatriate communities. Opportunities exist through focused educational initiatives and partnerships with local health and wellness retailers to address cultural and retail barriers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic and Natural Tampons Market.- The Honest Company

- Cora

- Seventh Generation (Unilever)

- Natracare

- L. (Procter & Gamble)

- Organyc (Corman S.p.A.)

- Flo

- Sustain Natural

- Rael

- Oi Organic Initiative

- Veeda

- Athena Club

- Blume

- TOM Organic

- LOLA

- MASMI

Frequently Asked Questions

Analyze common user questions about the Organic and Natural Tampons market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between organic and conventional tampons?

Organic tampons are made from 100% certified organic cotton, free from chlorine bleaching, pesticides, dyes, fragrances, and synthetic fibers, minimizing chemical exposure and environmental pollution, unlike conventional synthetic-blend products.

Is the use of organic tampons effective in reducing the risk of Toxic Shock Syndrome (TSS)?

While the risk of TSS cannot be completely eliminated, studies suggest that 100% organic cotton tampons, due to their natural composition and avoidance of super-absorbent synthetic materials, may present a lower relative risk compared to certain synthetic high-absorbency conventional options.

Which geographical region exhibits the highest growth potential for the organic tampon market?

The Asia Pacific (APAC) region is projected to experience the highest compound annual growth rate (CAGR), driven by increasing disposable income, rising health awareness, and expanding penetration of e-commerce platforms facilitating accessibility.

Are organic tampon applicators biodegradable, and what materials are used?

Yes, many organic tampons utilize biodegradable or compostable applicators, typically made from sustainably sourced cardboard or bio-plastics derived from plant starch (e.g., cornstarch or sugarcane), aligning with zero-waste consumer preferences.

How does the pricing of organic tampons compare to conventional feminine hygiene products?

Organic tampons generally command a 15% to 30% price premium over conventional counterparts due to the higher cost of certified raw materials, rigorous sourcing standards, and complex small-batch manufacturing and quality assurance processes required to maintain organic integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager