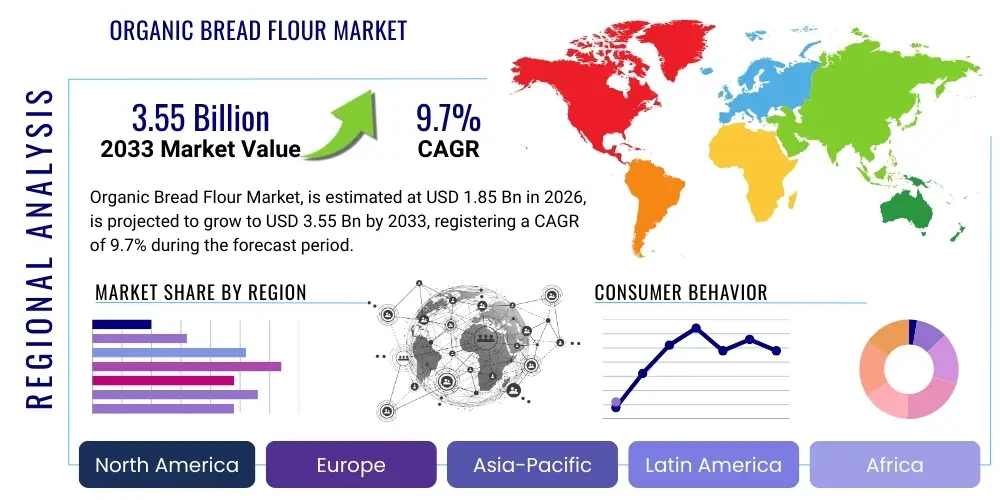

Organic Bread Flour Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435355 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Organic Bread Flour Market Size

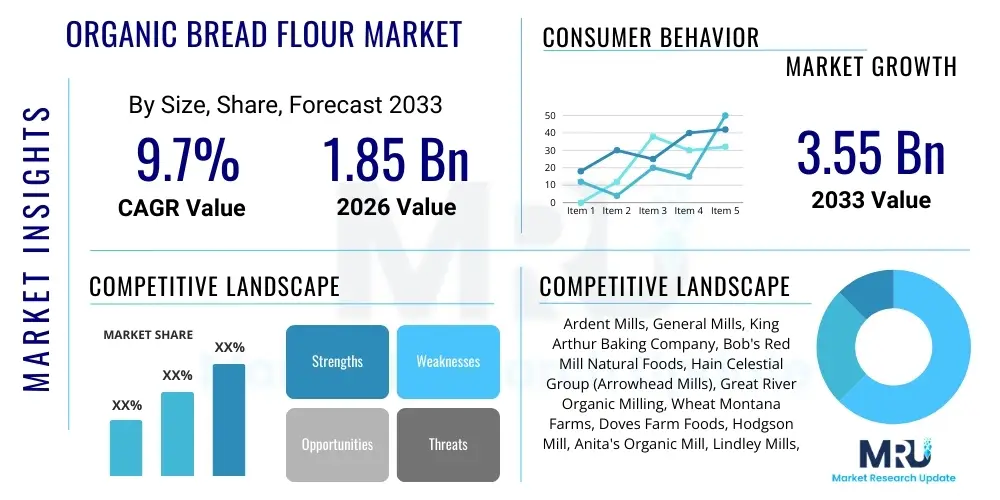

The Organic Bread Flour Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.7% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.55 Billion by the end of the forecast period in 2033.

Organic Bread Flour Market introduction

The Organic Bread Flour Market encompasses the production, distribution, and sale of flour derived from organically grown grains, primarily used in baking bread and related products. This market segment distinguishes itself through strict adherence to organic certification standards, ensuring that the grains are cultivated without synthetic pesticides, herbicides, or genetically modified organisms (GMOs). The escalating consumer preference for clean-label, non-GMO, and sustainably produced food items serves as the fundamental driver propelling this market's expansion globally. Organic bread flour offers distinct nutritional benefits and superior flavor profiles compared to conventional counterparts, making it highly desirable among artisan bakers, commercial food manufacturers focused on premium offerings, and health-conscious household consumers. The primary applications span across traditional sourdough, whole-grain loaves, specialty gluten-free options (when incorporating organic non-wheat grains), and various types of enriched bread products sold through retail channels and food service establishments. Key product variations include organic whole wheat flour, organic all-purpose flour, and specific organic ancient grain flours like spelt or rye.

The benefits associated with the adoption of organic bread flour extend beyond nutritional value and encompass significant environmental advantages. Organic farming practices foster enhanced soil health, increase biodiversity, and minimize chemical runoff, aligning strongly with contemporary environmental, social, and governance (ESG) standards increasingly valued by corporate consumers and investors. Furthermore, the perceived quality and premium positioning of organic ingredients allow manufacturers to command higher price points, offering better margin opportunities across the value chain, from farmers to processors and retailers. Major applications driving demand include the burgeoning artisan bakery sector, which emphasizes traditional methods and high-quality, traceable ingredients, and the large-scale commercial baking industry responding to consumer demand for organic certifications on mass-produced items like sandwich bread and rolls. The integration of organic flours into ready-to-bake mixes is also a significant application area contributing to market growth.

Driving factors underpinning the robust growth trajectory of this market include the growing incidence of food sensitivities and allergies, prompting a search for minimally processed ingredients, and the widespread governmental support and subsidies promoting organic agriculture in key regions such as North America and Europe. Demographic shifts favoring wellness and preventative health measures also play a crucial role, as consumers increasingly associate organic labels with better overall health outcomes. Moreover, enhanced transparency in supply chains, facilitated by digital tracking and better certification mechanisms, boosts consumer trust in organic claims, thereby fueling further adoption. Challenges, however, persist, notably relating to the higher cost of production for organic grains and the inherent volatility in supply due to weather dependency and strict rotation requirements mandated by organic standards. Despite these restraints, the overriding trend toward premiumization and health consciousness ensures continued market momentum.

Organic Bread Flour Market Executive Summary

The Organic Bread Flour Market exhibits strong growth dynamics, driven primarily by evolving consumer preferences favoring organic and natural food ingredients, coupled with increasing environmental awareness. Business trends indicate a significant push toward vertical integration among major millers and processors, aiming to secure reliable organic grain sources and stabilize pricing amidst supply fluctuations. There is a marked emphasis on sustainability certifications beyond basic organic mandates, such as regenerative organic certification, which enhances brand differentiation and market attractiveness. Strategic partnerships between organic grain farmers and large commercial bakeries are becoming common, ensuring dedicated supply lines for high-volume organic bread production. Furthermore, product innovation focuses on blending organic wheat flour with ancient grains and alternative flours (e.g., organic einkorn, organic buckwheat) to meet demands for enhanced texture, specialized nutritional profiles, and specific dietary needs like low-gluten or high-fiber offerings. The trend toward online retail expansion is particularly prominent, offering specialized organic brands direct access to niche consumer segments globally.

Regional trends highlight North America and Europe as the dominant markets, benefiting from established organic certification infrastructure, high consumer spending power, and strong regulatory support for organic farming. Europe, specifically countries like Germany and France, demonstrates substantial growth, fueled by long-standing artisan baking traditions and high levels of organic food penetration in retail. The Asia Pacific region is emerging as the fastest-growing market, led by rapid urbanization, rising disposable incomes in countries like China and India, and increasing westernization of dietary habits, spurring demand for specialty baked goods. Regulatory harmonization and easing of trade barriers for organic goods are key factors accelerating regional trade. Investment flows are concentrated on improving milling infrastructure capable of processing diverse organic grain varieties efficiently while maintaining strict contamination control to uphold organic integrity, particularly in emerging Asian markets where local supply chains are less mature.

Segment trends underscore the supremacy of the Organic Whole Wheat Flour segment, reflecting the consumer focus on high-fiber and minimally processed foods for health benefits. However, the Organic All-Purpose Flour segment maintains relevance due to its versatility in both household and commercial baking. Application-wise, the Artisan Bakeries segment continues to register premium growth, capitalizing on the demand for high-quality, traditional breads. Crucially, the online retail distribution channel is witnessing exponential growth, offering convenience and access to a broader range of specialized organic flours often unavailable in conventional supermarkets. This shift necessitates investment in robust e-commerce platforms and efficient cold-chain or climate-controlled warehousing to preserve the integrity of the organic product. Overall, the market remains characterized by intense focus on traceability, transparency, and product integrity, influencing all strategic decisions from sourcing to end-user delivery.

AI Impact Analysis on Organic Bread Flour Market

User queries regarding the impact of Artificial Intelligence (AI) on the Organic Bread Flour Market predominantly revolve around optimizing supply chain efficiency, ensuring authenticity and traceability of organic claims, predicting grain yield fluctuations, and enhancing quality control during milling. Consumers and industry stakeholders are highly concerned about how AI can mitigate the inherent volatility associated with organic grain sourcing, such which includes managing pest control in chemical-free environments and optimizing irrigation based on hyper-local weather patterns. Key expectations center on AI's ability to provide predictive analytics for demand forecasting, thereby minimizing waste and inventory holding costs across the often complex organic distribution network. Additionally, the industry seeks AI solutions for advanced fraud detection, ensuring that conventional flours are not misrepresented as premium organic products, a critical concern given the higher price differential and reliance on trust in this segment.

AI’s influence is profound in transforming agricultural practices at the farm level, particularly through precision agriculture tailored for organic cultivation. Machine learning algorithms analyze satellite imagery, soil data, and microclimate information to provide optimized planting, rotation, and harvesting schedules, maximizing organic yields while minimizing resource use. This technological integration helps organic farmers overcome traditional challenges related to scale and productivity, directly impacting the availability and cost stability of organic grains used for bread flour. Furthermore, in the milling process, AI-powered vision systems and sensors are employed for granular quality sorting, detecting subtle defects or contaminations that could compromise organic certification or end-product quality. This advanced quality assurance is essential for maintaining the premium positioning of organic bread flour in competitive global markets.

In the downstream segment, AI significantly impacts consumer interaction and marketing strategies. Generative AI tools are being used by companies to create highly personalized marketing content emphasizing the sustainability and health benefits of their organic flours, effectively targeting health-conscious consumer niches. On the logistics front, AI optimizes delivery routes and manages inventory across vast distribution networks, from the miller to the supermarket shelf or the artisan bakery. Predictive maintenance schedules for milling equipment, informed by machine learning models analyzing operational data, reduce unexpected downtime, ensuring consistent supply of fresh organic flour. Ultimately, AI serves as a crucial enabling technology, enhancing efficiency, ensuring compliance with stringent organic standards, and reinforcing the trust fundamental to the organic food ecosystem.

- AI optimizes organic farming yields through predictive analytics and precision agriculture (soil health, irrigation).

- Machine Learning models enhance supply chain traceability, validating organic certification status from farm to shelf.

- AI-powered vision systems improve milling quality control by detecting impurities and foreign materials in organic grain batches.

- Predictive maintenance schedules for milling machinery minimize operational disruptions and ensure consistent supply.

- Generative AI supports targeted marketing and personalized nutritional education for organic bread flour consumers.

- Algorithms forecast consumer demand fluctuations, optimizing inventory management and reducing food waste within the organic supply chain.

DRO & Impact Forces Of Organic Bread Flour Market

The Organic Bread Flour Market dynamics are shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces influencing its trajectory. The primary Driver is the pervasive and non-negotiable consumer shift toward healthy eating and preference for certified organic ingredients, especially post-pandemic, where immune health and clean labels have gained paramount importance. This is amplified by robust regulatory support in major Western economies promoting sustainable agriculture. However, the market faces significant Restraints, most notably the high production cost of organic grains due to labor intensity and lower comparative yields, which translates to higher retail prices, potentially limiting mass-market adoption. Additionally, the inherent vulnerability of organic supply chains to climate change impacts and cross-contamination risks poses a constant logistical challenge. The key Opportunity lies in the untapped potential of emerging economies in Asia and Latin America, alongside technological advancements (like AI in farming) that can lower production costs and enhance supply chain transparency. These forces create a high-impact environment where sustainability and price equilibrium are critical competitive factors.

Driving factors are further supported by the increasing global awareness regarding the environmental detriment caused by conventional farming practices, making organic products an ethical choice for a growing consumer base. Furthermore, the proliferation of specialized bakeries and gourmet food segments worldwide actively seeking premium organic inputs strengthens the demand side. Investment in new organic milling capacity and infrastructure, particularly focused on diverse ancient grains, is also driving availability and product variety. Conversely, the strict and often disparate international certification standards represent a major restraint, creating bureaucratic hurdles and increasing complexity for global trade and exporting businesses attempting to scale operations across multiple jurisdictions. The perception that organic flour has a shorter shelf life or requires more specialized storage than conventional flour also contributes to distribution challenges in warmer climates.

Opportunities for market players include capitalizing on the trend toward regenerative agriculture, offering products with certifications that go beyond basic organic to appeal to highly discerning consumers willing to pay a super-premium. Developing effective, natural pest control solutions at the farm level and improving storage technologies to extend the shelf life of organic flour are crucial areas for innovation. Moreover, the growth of direct-to-consumer (D2C) models, leveraging e-commerce and specialized logistics, allows smaller organic millers to bypass traditional retail bottlenecks and build direct relationships with consumer bases, thereby improving margin capture. The overall impact forces suggest a market trajectory where high demand meets persistent supply challenges, necessitating continuous innovation in both agricultural technology and efficient logistics to maintain accelerated growth.

- Drivers: Strong consumer demand for healthy, clean-label, and traceable organic ingredients; rising awareness of environmental benefits of organic farming; expansion of artisan and specialty bakeries.

- Restraints: High production costs and resulting premium pricing of organic flour; volatility and complexity in the organic grain supply chain; stringent international certification requirements; risk of cross-contamination.

- Opportunity: Expansion into high-growth emerging markets; technological advancements (AI, precision farming) reducing cost barriers; increasing adoption of regenerative organic certification; growth of online and D2C distribution channels.

- Impact Forces: High sustainability and premiumization pressure; technological disruption focusing on traceability and yield stability; intensified competition among large conventional millers entering the organic segment.

Segmentation Analysis

The Organic Bread Flour Market is segmented based on Source, Application, Type, and Distribution Channel, reflecting the diverse requirements of the end-user base and the variety of grains utilized. The segmentation provides critical insights into consumer behavior and specific high-growth niches within the broader market. Analyzing these segments helps stakeholders tailor their product offerings, marketing strategies, and distribution networks to optimize penetration and revenue generation. The Source segment is fundamental, differentiating products derived from traditional wheat versus specialized ancient and alternative grains, a distinction that significantly impacts nutritional profile and price point. The Type and Application segments dictate the functional usage of the flour, ranging from highly specialized artisan baking requirements to general household consumption, while Distribution Channel analysis is essential for identifying the most efficient routes to market, highlighting the growing importance of online retail.

- By Source: Wheat, Rye, Spelt, Other Grains (Oats, Corn, Barley).

- By Application: Artisan Bakeries, Commercial Baking, Household Use, Food Service (Restaurants, Cafes).

- By Type: Organic Whole Wheat Flour, Organic All-Purpose Flour, Organic Self-Rising Flour, Organic Specialty Flours (High Gluten, Bread Specific).

- By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Direct Sales (Farmer Markets, Specialty Stores).

Value Chain Analysis For Organic Bread Flour Market

The value chain for the Organic Bread Flour Market commences with Upstream activities centered on organic grain cultivation, which requires strict adherence to certified standards, meticulous soil management, and high capital investment in organic land transitions. This phase is characterized by intense reliance on favorable weather and specialized farming knowledge. Once harvested, the raw grains are processed in the Midstream segment by organic-certified millers. Milling operations involve cleaning, tempering, and grinding, requiring dedicated machinery and rigorous segregation protocols to prevent any co-mingling with conventional grains, which drives up operational costs but ensures product integrity. Quality control and laboratory testing for contaminants are crucial steps in this stage, leading to the final organic bread flour product ready for distribution. The efficiency of the midstream segment often dictates the final product quality and the stability of pricing for subsequent steps in the chain.

Downstream activities involve the distribution and marketing of the finished organic flour to various End-Users. Distribution channels are bifurcated into Direct and Indirect sales. Direct sales involve selling large volumes of flour directly to industrial users, such as major commercial bakeries or large food service companies that require consistent bulk supply. Indirect sales channel the product through intermediaries, including wholesalers, distributors, and finally, retail outlets like supermarkets, specialty stores, and the rapidly growing online retail platforms. This downstream complexity requires efficient logistics, often demanding specialized climate-controlled warehousing to maintain product freshness and prevent spoilage, which is particularly critical for whole-grain organic flours due to their higher oil content and shorter shelf life. Effective supply chain management and strong retail partnerships are crucial for optimizing market reach and maintaining visibility with the end consumer.

The Value Chain is increasingly influenced by transparency requirements; consumers demand to know the origin of the grain and the specifics of the organic process. This has necessitated significant investment in digital tracking technologies and blockchain implementation throughout the chain, linking the farm field to the consumer's kitchen. The distribution channel efficiency, particularly the last-mile delivery for online retail, is a critical factor determining customer satisfaction and brand loyalty. The interplay between Upstream supply stability and Downstream market access defines the overall profitability and competitiveness of participants in the Organic Bread Flour Market, with successful companies often engaging in strategic alliances or achieving vertical integration to secure both sourcing and distribution advantages.

Organic Bread Flour Market Potential Customers

Potential customers in the Organic Bread Flour Market are broadly categorized into three main segments: professional food manufacturers, specialized food service providers, and household consumers. Professional food manufacturers, encompassing large commercial baking operations and producers of organic pre-packaged goods (like mixes, cereals, and snack bars), are the largest volume buyers. They require consistent, high-quality bulk organic flour that meets specific protein and gluten content specifications for automated production processes. Their buying decisions are primarily influenced by price stability, supply reliability, and rigorous adherence to organic certification and food safety standards. These industrial buyers often enter into long-term supply contracts directly with millers or large distributors to manage cost volatility and ensure continuous raw material availability.

The second major group includes specialized food service providers, such as artisan bakeries, high-end restaurants, and independent cafes focused on premium, locally sourced, and healthy menus. These customers prioritize specialty organic flours (e.g., high-extraction heritage grain flours) that offer superior flavor, texture, and fermentation characteristics essential for traditional or complex baking techniques like sourdough. While their volume requirement is lower than commercial bakeries, their demand for unique, high-quality organic varieties often drives market innovation and supports smaller, niche millers. Traceability and the ability to market the specific origin of the organic ingredients (farm-to-table narrative) are highly valued by this segment, serving as a key differentiating factor in their end-products.

Finally, the household consumer segment, comprising individuals purchasing organic bread flour for home baking, represents a rapidly expanding category, particularly through online and specialty retail channels. This consumer group is typically health-conscious, environmentally aware, and often willing to pay a premium for organic certification, non-GMO status, and perceived nutritional superiority. They seek convenient packaging sizes, clear labeling, and product information that highlights the sourcing and environmental benefits. The rise of home baking spurred by lifestyle changes and the desire for full control over ingredients has significantly boosted the relevance and purchasing power of this end-user segment, making them crucial targets for targeted retail marketing and branding efforts focusing on health and wellness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.55 Billion |

| Growth Rate | 9.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ardent Mills, General Mills, King Arthur Baking Company, Bob's Red Mill Natural Foods, Hain Celestial Group (Arrowhead Mills), Great River Organic Milling, Wheat Montana Farms, Doves Farm Foods, Hodgson Mill, Anita's Organic Mill, Lindley Mills, Central Milling, Sunrise Flour Mill, The Farmer Ground Flour, Natures Path Foods, Shipton Mill, Stonehouse Mill, Wholegrain Milling, Organic Spices Inc., Kialla Pure Foods |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Bread Flour Market Key Technology Landscape

The technology landscape in the Organic Bread Flour Market is rapidly evolving, primarily driven by the need to reconcile the inherent complexities of organic farming—such as lower yields and susceptibility to pests—with the industrial requirements for consistency, efficiency, and scalability. Key technological advancements are concentrated in two primary areas: farm-level precision organic agriculture and milling/supply chain integrity solutions. On the farm, IoT sensors, drone mapping, and advanced weather modeling are utilized to optimize irrigation, nutrient delivery, and crop rotation schedules, ensuring maximum yield within organic constraints. Furthermore, specialized mechanical weeding equipment and biological pest control systems minimize reliance on chemicals, adhering strictly to organic certification mandates. These precision technologies are crucial for making organic grain production economically viable at a larger scale, which directly impacts the downstream cost of organic bread flour.

In the milling sector, advancements focus heavily on achieving superior quality and maintaining rigorous segregation. Modern organic mills utilize sophisticated air classification and optical sorting technologies, often powered by AI, to meticulously clean and grade grains, removing any foreign material or non-organic contamination with high precision. Furthermore, specialized low-temperature milling processes, designed to protect the nutritional integrity and flavor profile of organic whole grains, are becoming standard. Packaging technology also plays a vital role, with vacuum packaging and specialized atmosphere control used to extend the naturally shorter shelf life of organic whole wheat flour by mitigating oxidation and rancidity, a significant technical hurdle for whole-grain products.

Crucially, digital technology underpins the entire value chain for transparency and traceability—cornerstones of the organic market. Blockchain platforms are increasingly adopted to create immutable records tracing the journey of the grain from the specific organic farm plot through the milling process to the final retail package. This level of traceability not only ensures compliance with organic standards but also acts as a powerful marketing tool, building consumer trust. Furthermore, advanced inventory management systems and logistics software integrate temperature and humidity tracking, essential for preserving the quality of organic ingredients during transportation and storage, especially across long international supply routes, thereby mitigating risks associated with spoilage and quality degradation.

Regional Highlights

The global Organic Bread Flour Market exhibits significant regional disparities in terms of maturity, consumption patterns, and production capacities. North America, particularly the United States and Canada, stands as a mature and major consumer market, characterized by high levels of consumer awareness regarding health and sustainability, supported by well-established organic certification bodies like the USDA Organic program. The region boasts a strong domestic organic grain production base, though demand often outstrips local supply, necessitating imports. Commercial baking giants and specialty retailers in North America have heavily invested in incorporating organic flours into their product lines, positioning the region as a leader in terms of market value and product innovation, particularly in specialty grain flours and high-protein organic blends tailored for specific bread types.

Europe represents another cornerstone of the global market, driven by deep-rooted artisan baking traditions, stringent regional organic standards (EU Organic Regulation), and high government subsidies supporting organic farming. Countries like Germany, France, and the UK are major consumption hubs, where organic products are integrated into mainstream retail at higher rates compared to other global areas. The European market distinguishes itself through strong demand for heritage and locally sourced organic grains like organic spelt and rye, often used in traditional regional bread varieties. Supply chain complexity in Europe is managed through robust national organic associations and efficient logistical networks, although increasing pressure on land use and regulatory hurdles related to pesticide use continue to challenge farmers trying to convert to or sustain organic production.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, albeit from a smaller current base. This growth is fueled by rapid economic expansion, urbanization, and a notable shift in dietary habits towards Western-style baked goods, combined with a growing affluent population increasingly concerned with food safety and quality. While organic infrastructure, certification, and local production capacity are still developing in many APAC nations, the demand for imported organic bread flour, particularly from North America and Europe, is soaring in markets like Japan, South Korea, Australia, and coastal China. Investment in local organic farming and milling is accelerating, encouraged by government initiatives aiming to reduce reliance on conventional food imports and improve domestic food security standards, signaling a major future opportunity for global players to establish local manufacturing hubs.

Latin America and the Middle East & Africa (MEA) regions currently hold smaller market shares but are exhibiting promising growth potential, particularly in specific urban centers. Latin America, with countries like Brazil and Argentina, possesses significant agricultural resources and a growing movement toward sustainable farming. The consumption of organic bread flour is largely concentrated among high-income consumers and specialized health food stores. In the MEA region, market growth is primarily driven by tourism and expatriate communities in the Gulf Cooperation Council (GCC) states and South Africa, creating niche demand for imported premium organic products. However, logistics challenges, political instability, and inconsistent organic regulation remain significant factors constraining broader market expansion in these regions, requiring market entrants to adopt highly localized and resilient distribution strategies focusing on high-value segments.

- North America: Dominant market share due to high consumer awareness, established organic retail channels, and strong demand for health-focused, clean-label products. Key countries: US, Canada.

- Europe: Strong growth driven by traditional baking culture, stringent EU organic regulations, and government support for organic agriculture. Key countries: Germany, France, UK.

- Asia Pacific (APAC): Fastest-growing region; expanding middle class, increasing Westernization of diets, and rising demand for imported, certified organic ingredients. Key countries: China, India, Japan, Australia.

- Latin America: Emerging market with focus on high-value niche segments; growth contingent on developing local organic processing infrastructure.

- Middle East & Africa (MEA): Growth concentrated in urban, affluent centers and import-reliant markets, driven by premium product demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Bread Flour Market.- Ardent Mills

- General Mills

- King Arthur Baking Company

- Bob's Red Mill Natural Foods

- Hain Celestial Group (Arrowhead Mills)

- Great River Organic Milling

- Wheat Montana Farms

- Doves Farm Foods

- Hodgson Mill

- Anita's Organic Mill

- Lindley Mills

- Central Milling

- Sunrise Flour Mill

- The Farmer Ground Flour

- Natures Path Foods

- Shipton Mill

- Stonehouse Mill

- Wholegrain Milling

- Organic Spices Inc.

- Kialla Pure Foods

Frequently Asked Questions

Analyze common user questions about the Organic Bread Flour market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Organic Bread Flour Market?

The Organic Bread Flour Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 9.7% during the forecast period spanning 2026 to 2033, driven by increasing health consciousness and demand for clean-label ingredients globally.

How does AI impact the supply chain efficiency and transparency of organic bread flour?

AI significantly enhances supply chain efficiency through predictive demand forecasting and optimizes inventory management, reducing waste. Furthermore, AI-integrated blockchain technology ensures high traceability and transparency, validating the organic status from the farm to the end consumer, building crucial market trust.

What are the primary restraints affecting the growth and mass adoption of organic bread flour?

The primary restraints include the relatively high cost of production for organic grains, leading to premium pricing compared to conventional flour, and the inherent volatility and complexity associated with sourcing and maintaining a steady supply within strict organic certification parameters.

Which distribution channel is experiencing the fastest growth in the Organic Bread Flour Market?

Online Retail is currently the fastest-growing distribution channel. This rapid expansion is attributed to the convenience, broader product variety (especially niche organic specialty flours), and direct access to specialized brands not always available in traditional supermarkets or hypermarkets.

Which regions currently dominate the Organic Bread Flour consumption landscape?

North America and Europe currently dominate the Organic Bread Flour consumption market. These regions benefit from established organic infrastructure, high consumer spending power, and strong regulatory frameworks supporting organic agricultural practices and consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager