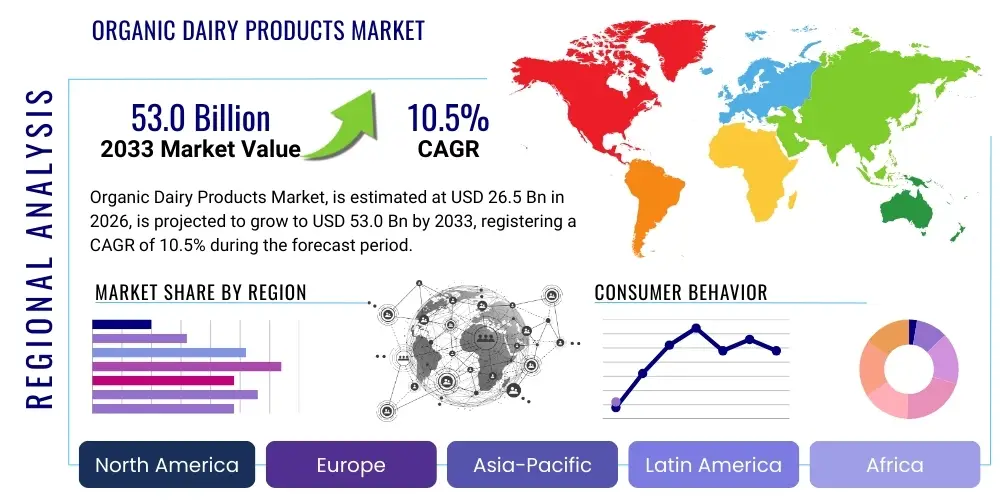

Organic Dairy Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431613 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Organic Dairy Products Market Size

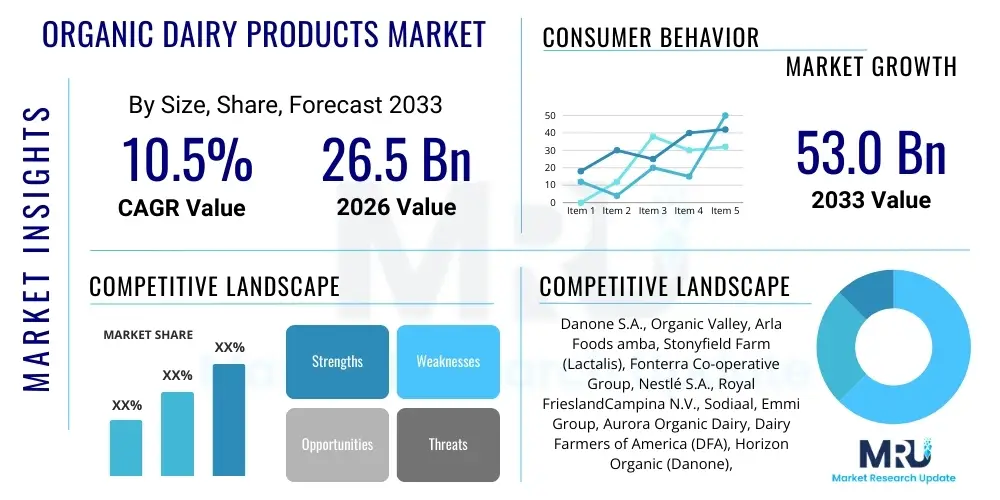

The Organic Dairy Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $26.5 billion in 2026 and is projected to reach $53.0 billion by the end of the forecast period in 2033.

Organic Dairy Products Market introduction

The Organic Dairy Products Market encompasses milk, yogurt, cheese, butter, and other derivatives produced under strict organic farming standards. These standards prohibit the use of synthetic pesticides, fertilizers, antibiotics, and growth hormones, emphasizing animal welfare and sustainable environmental practices. The rising global consumer focus on health and wellness, coupled with increasing awareness regarding the benefits of additive-free food, serves as the primary engine for market expansion. Furthermore, the perceived superior nutritional profile and the commitment to sustainable sourcing resonate strongly with affluent consumers in developed economies, making organic dairy a premium category.

Major applications of organic dairy products span household consumption, where they replace conventional alternatives in daily diets, and the commercial food service sector, including bakeries, cafes, and restaurants that prioritize premium or natural ingredients. The inherent benefits of these products—such as reduced exposure to chemical residues, improved animal welfare, and higher omega-3 fatty acid content in some products—drive their adoption. Key driving factors include robust consumer spending power, expansion of dedicated organic retail channels, and supportive regulatory frameworks that ensure stringent organic certification integrity.

The market environment is characterized by intense competition among global dairy giants and specialized organic producers. Product innovation, particularly in value-added segments like organic Greek yogurt, lactose-free organic milk, and probiotic organic drinks, remains crucial for sustaining growth. Regional dynamics show North America and Europe as mature markets, while the Asia Pacific region is emerging rapidly due to urbanization, changing dietary patterns, and rising disposable incomes fueling demand for premium food items.

Organic Dairy Products Market Executive Summary

The Organic Dairy Products Market trajectory is robust, underpinned by secular business trends emphasizing clean labels and ethical sourcing. Strategic collaborations between organic farms and large dairy processors are enhancing supply chain efficiencies and expanding product availability in mainstream retail channels. Business growth is focused on extending shelf life through advanced processing technologies, while simultaneously maintaining the nutritional integrity expected by organic consumers. The shift towards plant-based alternatives poses a moderate competitive pressure, yet the core demand for animal-derived, nutrient-dense organic products remains strong, particularly among families and health-conscious adults who value protein quality and traceability.

Regional trends indicate Europe maintaining market dominance, driven by well-established organic farming infrastructure and high consumer acceptance, particularly in Germany and France. However, Asia Pacific, notably China and India, represents the highest growth potential, fueled by rapid economic development and increasing preference for imported or certified premium products. North America is characterized by high rates of product substitution, where consumers actively switch from conventional to organic options, supported by extensive promotional activities and private label organic offerings by major retailers.

Segmentation trends highlight that Organic Milk continues to hold the largest market share due to its daily consumption utility, but the Organic Yogurt segment is witnessing the fastest growth rate, propelled by demand for functional foods rich in probiotics. Distribution trends underscore the growing importance of online retail, which offers transparency in sourcing information and convenience for recurring purchases. Furthermore, the commercial end-use segment is expanding as institutional buyers and high-end hospitality chains increasingly incorporate organic dairy into their offerings to meet client expectations for quality and sustainability.

AI Impact Analysis on Organic Dairy Products Market

User inquiries regarding AI's impact on the organic dairy sector frequently center on supply chain optimization, predictive farming efficiency, and consumer personalization. Consumers often ask if AI-driven traceability systems can guarantee the authenticity of organic claims more effectively than current manual methods. Key thematic concerns involve the ethical use of AI in monitoring animal welfare on organic farms and the potential for AI to standardize practices without sacrificing the unique, localized nature of organic farming. Expectations revolve around using AI for predictive maintenance of specialized organic processing equipment, demand forecasting to minimize wastage (a major sustainability concern), and personalized marketing that highlights the specific organic attributes valued by individual consumers, such as grass-fed certification or specific regional sourcing.

- Supply Chain Transparency: AI and Blockchain technologies enable real-time tracking of organic feed origin, animal health records, and processing stages, enhancing consumer trust in organic certification claims.

- Predictive Farming: AI algorithms analyze sensor data (weather, soil quality, animal behavior) to optimize organic grazing schedules, manage herd health proactively without antibiotics, and predict optimal harvest times for organic feed crops.

- Waste Reduction: Advanced AI-driven demand forecasting models improve inventory management for highly perishable organic dairy products, drastically reducing spoilage at retail and distribution levels.

- Quality Control: Machine vision systems monitor organic milk quality and consistency during processing, identifying contaminants or deviations much faster than traditional laboratory checks, ensuring adherence to organic standards.

- Personalized Product Development: AI analyzes consumer demographic and purchase history data to identify niche demand for specialized organic dairy products, such as A2 organic milk or low-sugar organic yogurts.

- Optimized Energy Usage: AI manages energy consumption in organic dairy cooling, pasteurization, and storage facilities, supporting the sustainability goals inherent in organic production.

DRO & Impact Forces Of Organic Dairy Products Market

The dynamics of the Organic Dairy Products Market are shaped by powerful Drivers and significant Restraints, coupled with emerging Opportunities, which collectively dictate the market’s trajectory and intensity of competition. The primary driver is the accelerating consumer shift towards health and wellness, characterized by the belief that organic foods offer superior nutritional value and safety due to the absence of synthetic inputs. This is complemented by strong regulatory support in key markets like the EU and North America, which maintains high entry barriers and protects the integrity of the organic label, further bolstering consumer confidence and driving premium pricing.

Conversely, the market faces significant restraints, most notably the high cost of production associated with strict organic standards, including specialized feed, land conversion periods, and lower yields compared to conventional farming. This results in premium retail pricing, making organic products less accessible to price-sensitive consumers, especially during periods of economic volatility. Another constraint is the relatively limited supply chain and the challenge of scaling organic production quickly enough to meet surging demand without compromising ethical and environmental standards, leading to occasional supply shortages in peak demand seasons.

Opportunities are abundant, particularly in product diversification and geographic expansion. The development of value-added organic dairy products, such as specialized lactose-free, protein-enhanced, or fortified organic beverages, opens up new consumer segments. Geographically, emerging economies in APAC present a significant untapped market opportunity, driven by increasing urbanization and the desire for Western-style, high-quality, certified food products. These impact forces necessitate strategic resource allocation and continuous innovation by market players to maintain competitive advantage.

Segmentation Analysis

The Organic Dairy Products Market is meticulously segmented based on product type, distribution channel, and end-use, allowing for precise market targeting and strategic resource deployment. Analysis reveals that the liquid milk segment holds the largest volume share, serving as the foundational commodity for organic consumers, while value-added segments like yogurt and cheese exhibit high-growth potential driven by functional food trends and usage in gourmet cooking. Distribution is heavily reliant on established retail infrastructure, although the rapid growth of e-commerce is disrupting traditional buying patterns by offering greater inventory depth and subscription services.

- By Product Type:

- Organic Milk (Whole, Skim, Low-Fat, A2 Milk)

- Organic Yogurt (Set, Stirred, Drinking, Greek, Skyr)

- Organic Cheese (Hard, Soft, Processed)

- Organic Butter and Spreads

- Organic Cream (Heavy, Light, Sour Cream)

- Organic Frozen Desserts and Novelties (Ice Cream, Gelato)

- Others (Kefir, Buttermilk, Whey Protein)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores (Organic Stores, Farmers' Markets)

- Online Retail and E-commerce Platforms

- By End-Use:

- Household/Retail Consumers

- Commercial/Food Service (Hotels, Restaurants, Cafes, Institutional Feeders)

Value Chain Analysis For Organic Dairy Products Market

The value chain for organic dairy products is notably complex and regulated, beginning with stringent upstream activities focused on organic feed cultivation and certified organic farming practices. Upstream activities involve careful sourcing of non-GMO, organic seeds and adherence to strict grazing and animal welfare standards, which often requires significant capital investment and adherence to multi-year conversion periods for land certification. The efficiency and integrity of the organic farm itself are critical, as any deviation from certification standards can lead to loss of the organic label, highlighting the importance of specialized inputs and diligent management.

Midstream processing involves specialized infrastructure to prevent cross-contamination between organic and conventional dairy, including dedicated lines for pasteurization, homogenization, and packaging. Direct and indirect distribution channels then move the highly perishable products to market. Direct distribution often includes farm-to-consumer models or localized specialty store partnerships, offering maximum control and profit margins. Indirect distribution, primarily through large hypermarkets and established logistics providers, ensures broad market reach but introduces greater risk regarding product handling and temperature control.

The downstream analysis focuses on marketing, brand positioning, and consumer engagement. Success in this segment relies heavily on effective communication of the organic value proposition, emphasizing traceability, ethical sourcing, and health benefits, often leveraging digital platforms. Key stakeholders include certification bodies (e.g., USDA Organic, EU Organic) which act as crucial quality gates, and large retailers who control shelf space and determine pricing strategies, ultimately linking premium pricing back to the high costs incurred throughout the upstream stages.

Organic Dairy Products Market Potential Customers

The primary end-users and buyers of organic dairy products are diverse but generally fall into two major categories: health-conscious affluent households and high-end commercial establishments committed to quality and sustainability. Households constitute the largest consumer base, driven by parents seeking safer, additive-free options for children, individuals with higher disposable income prioritizing premium food, and consumers dedicated to sustainable consumption patterns. These buyers are typically less price-sensitive and highly responsive to branding that emphasizes specific ethical attributes, such as grass-fed or regenerative farming certifications.

The commercial segment encompasses a growing clientele of high-quality hotels, luxury cruise lines, premium bakery chains, and specialized organic restaurants. These institutions utilize organic dairy not only to meet the demands of their discerning clientele but also as a core component of their corporate social responsibility and marketing efforts. Institutional buyers value reliable supply, consistent quality, and certifications that align with global sustainability standards. The rising prevalence of workplace cafeterias and educational institutions offering optional organic meal programs further expands the potential customer base within the commercial domain, reflecting a broader societal trend towards wellness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $26.5 billion |

| Market Forecast in 2033 | $53.0 billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danone S.A., Organic Valley, Arla Foods amba, Stonyfield Farm (Lactalis), Fonterra Co-operative Group, Nestlé S.A., Royal FrieslandCampina N.V., Sodiaal, Emmi Group, Aurora Organic Dairy, Dairy Farmers of America (DFA), Horizon Organic (Danone), General Mills (Yoplait), Clover Sonoma, EkoNiva. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Dairy Products Market Key Technology Landscape

The Organic Dairy Products Market leverages several advanced technologies primarily aimed at maintaining high product quality, ensuring supply chain integrity, and optimizing production efficiency while adhering to organic principles. Key processing technologies include Ultra-High-Temperature (UHT) treatment and sophisticated pasteurization techniques tailored to preserve the nutritional profile and natural flavor of organic milk without the use of chemical preservatives. Furthermore, specialized filtration technologies, such as microfiltration, are increasingly utilized to extend the shelf life of organic milk while minimizing thermal impact, catering directly to consumer demand for minimally processed foods.

Beyond processing, traceability and monitoring technologies are paramount for upholding the organic certification. IoT sensors and connected farm management systems are deployed on organic farms to monitor animal health, feed consumption, and environmental conditions in real-time. This digital infrastructure ensures compliance with strict animal welfare standards—a core tenet of organic certification—and provides auditable data trails from farm to consumer. Blockchain integration, while nascent, is rapidly gaining traction as a verifiable mechanism for documenting the organic journey, countering fraud, and offering transparent provenance data to the end buyer.

In the consumer-facing sphere, advanced packaging technology plays a crucial role in reducing environmental impact and minimizing food waste, aligning with the sustainability ethos of the organic market. Biodegradable, compostable, or recyclable packaging materials are being adopted, alongside barrier technologies that naturally extend product freshness. Lastly, big data analytics and AI-driven systems are utilized for optimizing complex organic logistics, predicting localized demand shifts, and ensuring perishable organic dairy products are moved efficiently across distribution networks, thereby supporting both profitability and environmental responsibility.

Regional Highlights

The global Organic Dairy Products Market exhibits distinct growth patterns influenced by regional regulatory environments, consumer health awareness, and disposable income levels. Europe holds the largest market share, characterized by high penetration rates, consumer loyalty to domestic organic brands, and strong government incentives supporting organic farming. Countries like Germany, France, and Denmark are leaders in both production and consumption, driving innovation in areas such as organic processed cheese and functional milk beverages. The robust regulatory framework of the European Union ensures standardized, high-quality organic output, reinforcing consumer trust and sustaining premium pricing.

North America, particularly the United States, represents a highly developed and competitive market where organic dairy is deeply integrated into mainstream grocery retail. Growth is driven by aggressive marketing campaigns highlighting the absence of rBST/rBGH hormones and antibiotics, alongside strong demand for specialty organic products like grass-fed butter and organic lactose-free milk. The region faces competition from subsidized conventional dairy, necessitating continuous product differentiation and effective communication of the organic value proposition to maintain growth momentum.

Asia Pacific (APAC) is projected to be the fastest-growing region, although starting from a smaller base. Rapid urbanization, increasing middle-class populations in China and India, and growing health concerns related to food safety are accelerating the shift towards certified organic imports and domestic production. Consumers in APAC often perceive organic products as safer and higher in quality, driving premiumization. However, challenges related to establishing reliable cold chains and ensuring the authenticity of imported organic certifications require significant infrastructural investment.

- North America: Market maturity, high consumer expenditure on premium dairy; strong growth in organic A2 milk and yogurt alternatives; emphasis on ethical sourcing and animal welfare claims.

- Europe: Dominant market share; established regulatory framework (EU Organic); high penetration in Germany, France, and Scandinavian countries; focus on local, biodynamic, and grass-fed certifications.

- Asia Pacific (APAC): Highest CAGR forecast; rapid growth in China, Japan, and India driven by food safety concerns and rising disposable incomes; high demand for imported organic milk powder and infant formula.

- Latin America (LATAM): Emerging market; growing domestic organic production in Brazil and Argentina; increased exports to North America and Europe; market primarily focused on fluid milk and specialty cheeses.

- Middle East and Africa (MEA): Nascent market; concentrated demand in urban centers (UAE, Saudi Arabia, South Africa); reliant on high-value imports; niche market driven by expatriate populations and high-income local consumers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Dairy Products Market.- Danone S.A.

- Organic Valley (CROPP Cooperative)

- Arla Foods amba

- Stonyfield Farm (Lactalis)

- Fonterra Co-operative Group

- Nestlé S.A.

- Royal FrieslandCampina N.V.

- Sodiaal

- Emmi Group

- Aurora Organic Dairy

- Dairy Farmers of America (DFA)

- Horizon Organic (Danone)

- General Mills (Yoplait)

- Clover Sonoma

- EkoNiva

- Lactalis Group

- Straus Family Creamery

- United Natural Foods, Inc. (UNFI)

- Tnuva Group

- Hain Celestial Group

Frequently Asked Questions

Analyze common user questions about the Organic Dairy Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Organic Dairy Products Market?

The Organic Dairy Products Market is projected to experience a strong Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period from 2026 to 2033, driven by increasing consumer health awareness and sustainability demands.

Which product segment holds the largest share in the Organic Dairy Market?

The Organic Milk segment (including whole, skim, and flavored organic milk) currently accounts for the largest market share due to its status as a staple consumer product and its high rate of adoption as a substitute for conventional milk.

How do organic dairy products differ from conventional dairy regarding production?

Organic dairy products are derived from cows raised without the use of synthetic growth hormones, antibiotics, or pesticides in their feed or environment. Organic certification mandates specific animal welfare standards, including access to pasture and adherence to non-GMO feed requirements.

Which geographical region exhibits the fastest growth potential for organic dairy?

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate, fueled by expanding middle classes, rising disposable incomes, rapid urbanization, and heightened consumer concerns regarding food safety and quality in countries like China and India.

What are the key restraints impacting the expansion of the Organic Dairy Market?

The primary restraint is the high cost of production, which results in a significant price premium at retail. This premium limits market penetration among price-sensitive consumers, posing a challenge particularly in emerging markets or during economic downturns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager