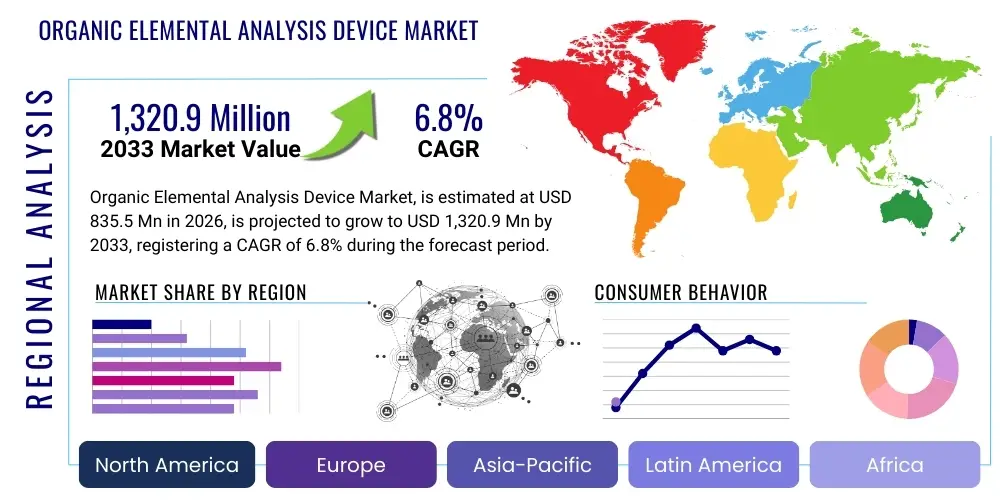

Organic Elemental Analysis Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438945 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Organic Elemental Analysis Device Market Size

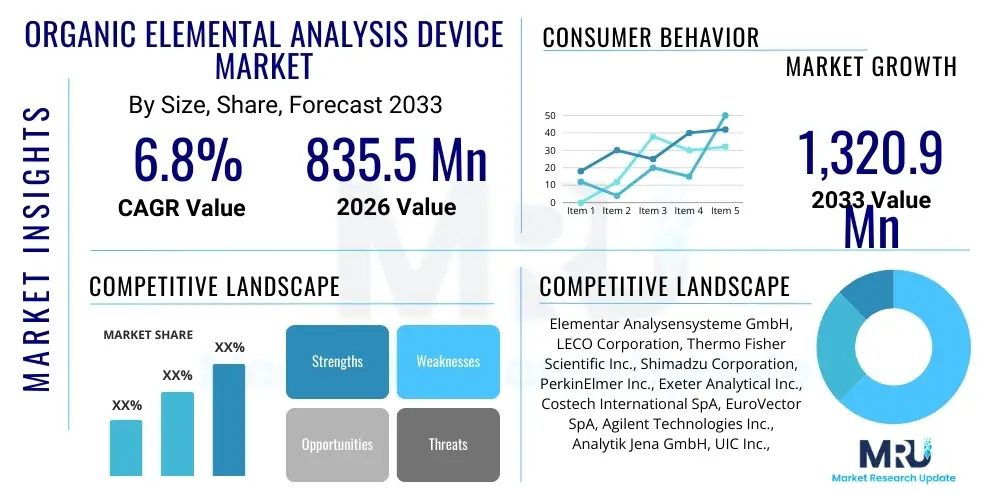

The Organic Elemental Analysis Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 835.5 Million in 2026 and is projected to reach USD 1,320.9 Million by the end of the forecast period in 2033. This consistent growth trajectory is driven primarily by escalating demand for quality control and assurance across regulated industries, alongside the necessity for precise measurement of elemental composition (Carbon, Hydrogen, Nitrogen, Sulfur, Oxygen) in complex organic and synthetic matrices. The increasing stringency of environmental monitoring standards globally also mandates the deployment of highly accurate elemental analyzers, particularly in petrochemical and chemical manufacturing sectors, ensuring compliance and operational integrity.

Organic Elemental Analysis Device Market introduction

The Organic Elemental Analysis Device Market encompasses instruments and associated consumables used for the quantitative determination of the elemental composition of organic substances. These devices primarily analyze for elements such as Carbon (C), Hydrogen (H), Nitrogen (N), Sulfur (S), and Oxygen (O), often referred to collectively as CHNS/O analysis. The core principle generally involves the combustion of the sample under controlled conditions, followed by the separation, detection, and quantification of the resulting gaseous products. These highly specialized analytical tools are indispensable in determining purity, empirical formula, and structural properties of novel compounds, making them cornerstones of modern research and industrial quality assurance laboratories.

Major applications of organic elemental analyzers span diverse high-stakes industries, including pharmaceutical development, where they ensure the integrity and active ingredient purity of drug substances; petrochemical and energy sectors, crucial for characterizing crude oil, refined fuels, and biofuels; and environmental science, vital for pollution monitoring and soil analysis. The inherent benefits of these devices include high accuracy, rapid throughput, and the ability to handle a variety of sample matrices, ranging from solids and liquids to volatile substances. Technological advancements, such as automation and micro-sampling capabilities, have further broadened their utility across research and high-volume testing environments, enhancing operational efficiency and data reliability.

Driving factors for market expansion include the global increase in R&D expenditure, particularly within life sciences and materials science, where new compound synthesis necessitates rigorous elemental verification. Furthermore, tightening regulatory frameworks, such as those imposed by the FDA, EMA, and various environmental protection agencies, necessitate validated and traceable analytical methods, boosting the adoption of advanced, certified elemental analysis devices. The growing focus on developing sustainable and alternative energy sources, such as next-generation batteries and advanced biofuels, also requires precise elemental mapping to optimize performance and quality, reinforcing the market’s positive growth outlook.

Organic Elemental Analysis Device Market Executive Summary

The Organic Elemental Analysis Device Market is characterized by robust business trends focusing on integration, automation, and miniaturization. Key industry players are increasingly investing in developing benchtop models that offer higher sample throughput and lower detection limits, addressing the critical needs of pharmaceutical and contract research organizations (CROs) for speed and sensitivity. The market exhibits competitive dynamics centered on providing comprehensive service contracts and application support, ensuring maximum uptime and optimized method development for complex matrices. Business strategies often revolve around strategic mergers and acquisitions to consolidate technological expertise and expand geographic footprints, particularly in fast-growing Asian markets, while maintaining a strong portfolio of consumables which represent a substantial recurring revenue stream for device manufacturers.

Regionally, North America continues to dominate the market share, driven by a highly mature pharmaceutical industry, significant governmental funding for scientific research, and stringent quality control regulations in chemical manufacturing. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period, fueled by rapid industrialization, burgeoning investments in food safety analysis, and the expansion of academic and government research institutions in countries like China and India. Europe maintains a strong position, underpinned by rigorous environmental standards and a deep-rooted petrochemical industry that relies heavily on elemental analysis for compliance and process optimization.

Segment trends highlight the growing preference for automated CHNS/O analyzers due to their ability to provide comprehensive elemental data simultaneously, reducing analysis time and minimizing human error. The consumables segment, including reagents, catalysts, and sample encapsulation materials, is experiencing steady growth, directly correlated with the installed base of instruments and the increasing volume of routine testing. From an application perspective, the pharmaceutical and biotechnology sectors remain the primary revenue generators, driven by stringent regulatory requirements for new chemical entity (NCE) characterization. Meanwhile, the environmental analysis segment is seeing accelerated adoption as global bodies impose stricter limits on permissible sulfur and nitrogen content in fuels and emissions.

AI Impact Analysis on Organic Elemental Analysis Device Market

Common user questions regarding AI’s impact on organic elemental analysis center primarily on data processing efficiency, predictive maintenance capabilities, and the potential for autonomous method development. Users are keen to understand how AI can handle the massive datasets generated by high-throughput analyzers, seeking solutions for automated data validation, outlier detection, and rapid correlation analysis with spectroscopic data. Concerns also focus on integrating AI-driven systems with existing Laboratory Information Management Systems (LIMS) and ensuring the trustworthiness and explainability of AI-generated results in a highly regulated environment. The expectation is that AI will move the process beyond mere measurement towards intelligent material characterization, significantly reducing the time spent on manual interpretation and optimization.

The adoption of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize the operational workflow and analytical capabilities within the Organic Elemental Analysis Device Market. AI excels at processing complex calibration curves, identifying matrix effects, and optimizing combustion parameters in real time based on historical data, leading to superior accuracy and reduced need for repeated calibration. Furthermore, predictive modeling powered by ML can anticipate instrument wear and schedule proactive maintenance, thereby maximizing instrument uptime and ensuring data integrity across large laboratory networks. This shift from reactive servicing to predictive operation offers substantial cost savings and improves overall laboratory efficiency, a critical factor in competitive CRO environments.

Beyond operational improvements, AI tools are expected to dramatically accelerate R&D by enabling automated structural elucidation and purity assessment. By analyzing elemental data in conjunction with data from other analytical techniques (e.g., mass spectrometry, NMR), AI can quickly propose chemical structures for novel compounds, a task that currently requires extensive expert intervention. This integration of multi-modal data analysis minimizes bottlenecks in the drug discovery and materials development pipelines. While the current integration is nascent, the long-term trend points toward fully autonomous elemental analysis systems capable of method selection, sample preparation optimization, and self-diagnosis, significantly lowering the barrier to entry for complex analysis.

- AI enhances data processing speed, automatically validating results and flagging anomalies.

- Machine learning models optimize combustion parameters for superior analytical accuracy across diverse matrices.

- Predictive maintenance algorithms reduce instrument downtime and lower operational costs.

- AI facilitates the integration of elemental data with spectroscopic information for rapid structural elucidation.

- Autonomous systems streamline quality control by automating method development and standard calibration.

DRO & Impact Forces Of Organic Elemental Analysis Device Market

The Organic Elemental Analysis Device Market is driven by rigorous regulatory requirements in core sectors, coupled with increasing R&D activities globally. Restraints primarily involve the high capital expenditure required for sophisticated instruments and the necessity for specialized, trained personnel to operate and maintain them. Opportunities lie in the rapidly expanding analytical needs of emerging economies and the technological trend toward miniaturization and portability, which opens up new decentralized testing markets. These forces combine to create a dynamic impact environment where regulatory stringency acts as the primary accelerator, while technology development is focused on mitigating cost and complexity restraints, thereby expanding the market reach and penetration.

Drivers: A principal driver is the globally increasing stringency of quality control standards in the pharmaceutical and food and beverage industries, demanding mandatory elemental content verification for product safety and regulatory approval. Furthermore, stringent environmental regulations, particularly concerning sulfur and nitrogen emissions from industrial sources and transportation fuels, necessitate widespread and accurate elemental analysis. The continuous synthesis of new chemical compounds in materials science, catalysts, and drug discovery also fuels demand, as elemental analysis is fundamental for characterizing these novel entities. The shift toward alternative and sustainable energy sources, such as biofuels and advanced battery materials, requires precise elemental characterization to ensure performance and longevity, providing a sustained demand source for the market.

Restraints: The most significant restraint is the high initial investment cost associated with high-precision organic elemental analyzers, which can pose a barrier to adoption for small to medium-sized laboratories or academic institutions with limited capital budgets. Additionally, the operation and maintenance of these complex devices require highly skilled technical expertise, leading to high operational costs and a dependency on manufacturer support for troubleshooting and repairs. Furthermore, the complexity of sample preparation, particularly for non-standard or highly volatile samples, can sometimes limit sample throughput and introduce potential sources of error, hindering full-scale automation and efficiency.

Opportunities: Significant market opportunities are emerging from the push for greater portability and miniaturization of elemental analyzers, enabling on-site testing and field deployment, particularly beneficial for environmental monitoring and remote industrial quality control. The rapid expansion of contract research and manufacturing organizations (CROs/CMOs) in developing regions presents a substantial opportunity for increasing the installed base. Moreover, integrating elemental analysis devices with advanced software platforms (like LIMS and ERP systems) and incorporating AI for predictive analysis and data interpretation offers novel value propositions, driving upgrades and new system purchases across mature markets seeking enhanced efficiency and compliance capabilities. The growing focus on forensic science and specialized material failure analysis also represents a niche, high-value opportunity.

Segmentation Analysis

The Organic Elemental Analysis Device Market is systematically segmented based on product type, technology, application, and end-user, enabling a detailed assessment of market dynamics within specific operational niches. Understanding these segments is crucial for manufacturers to tailor their product development and marketing strategies effectively. The segmentation highlights the diverse analytical needs across various industries, from high-throughput quantification in pharmaceuticals to complex matrix analysis in petrochemicals and specialized R&D in academia. The instruments segment, while high in initial cost, forms the foundation, while the recurring revenue generated by the consumables segment provides stability to market vendors, ensuring continuous market engagement and long-term customer relationships.

The segmentation by technology is crucial as it dictates accuracy, speed, and sample handling capabilities. Combustion-based methods (Dumas, flash combustion) currently dominate due to their robustness and versatility, especially for CHNS analysis. However, pyrolysis and specialized furnace methods are gaining traction for precise Oxygen (O) determination and handling difficult matrices. By application, the market concentration remains highest in regulated environments—pharmaceuticals and environment—where data traceability and accuracy are non-negotiable, driving demand for premium, certified instruments and high-quality certified reference materials for calibration and validation processes, further reinforcing market stability.

- By Product Type:

- Instruments (Analyzers, Detectors)

- Consumables and Accessories (Reagents, Catalysts, Quartz tubes, Boats, Filters)

- Software and Services (LIMS integration, Maintenance Contracts, Calibration Services)

- By Technology:

- Combustion-based Analysis (Dumas Method, Flash Combustion)

- Pyrolysis-based Analysis

- Specialized Furnace Analysis

- By Application:

- Pharmaceutical and Biotechnology R&D and QA/QC

- Petrochemical and Energy

- Environmental Monitoring and Testing

- Academic Research and Government Laboratories

- Food and Beverage Testing

- Polymer and Materials Science

- By End User:

- Research Institutions and Universities

- Industrial Laboratories (Chemical, Oil & Gas)

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

- Regulatory and Government Agencies

Value Chain Analysis For Organic Elemental Analysis Device Market

The value chain for the Organic Elemental Analysis Device Market begins with upstream activities involving specialized raw material suppliers, focusing on ultra-high purity gases, specialized refractory ceramics for combustion tubes, and high-quality detection materials. Component manufacturing then takes place, converting raw materials into critical analytical sub-components such as detectors, furnace control systems, and automated sample handlers. The core stage involves the Original Equipment Manufacturers (OEMs) who design, assemble, calibrate, and validate the complete elemental analysis devices, adhering strictly to international quality standards such as ISO and pharmacopoeial guidelines. This phase requires intense R&D investment to ensure precision and compliance with increasingly complex analytical demands.

The midstream of the value chain is dominated by distribution channels, which are bifurcated into direct sales and indirect channels. Direct sales are often utilized for high-value contracts with major pharmaceutical companies and large government laboratories, offering bespoke installation and long-term service agreements. Indirect channels involve authorized regional distributors and third-party resellers who handle logistics, local technical support, and after-sales service in geographically dispersed or emerging markets. The efficiency of the distribution network is crucial, especially for the time-sensitive delivery of consumables and specialized reagents that have limited shelf life and require careful handling to maintain analytical integrity.

Downstream activities involve the end-users—spanning industrial QC labs, academic research centers, and environmental testing facilities—who utilize the devices for their core analytical requirements. The value chain concludes with post-sales support and services, including maintenance, repair, training, and the continuous supply of specialized consumables (catalysts, boats, reagents). The profitability throughout the chain is significantly influenced by the recurring revenue from the consumables segment, often providing higher margins than the initial instrument sale. Optimizing the supply chain logistics and ensuring the purity and quality of consumables are key competitive advantages in maintaining customer loyalty and ensuring device performance over its lifecycle.

Organic Elemental Analysis Device Market Potential Customers

The primary potential customers for Organic Elemental Analysis Devices are sophisticated laboratories across highly regulated and R&D-intensive industries that require precise elemental quantification for product development, quality assurance, and regulatory compliance. End-users are broadly categorized into institutions focused on chemical synthesis and product safety. The pharmaceutical industry is the largest buyer, using these devices to confirm the empirical formula of New Chemical Entities (NCEs), assess drug substance purity, and perform quantitative residual analysis as part of rigorous Good Manufacturing Practices (GMP) and regulatory submissions. Their purchasing decisions are heavily influenced by data integrity features, compliance validation, and the system’s ability to integrate into existing LIMS infrastructure.

Another major customer segment includes laboratories within the petrochemical and energy sectors, where elemental analyzers are essential for controlling process quality and meeting environmental mandates. They specifically use these devices to measure sulfur and nitrogen content in crude oil, refined fuels, and lubricants to comply with global standards aimed at reducing air pollution. The consistent need for routine, high-volume analysis in these sectors means reliability, automation capabilities, and low operational costs are critical buying criteria. Furthermore, governmental and academic research laboratories constitute a steady customer base, driven by public funding for fundamental research in chemistry, materials science, and environmental studies, where these analyzers are indispensable tools for synthesizing and characterizing new compounds.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 835.5 Million |

| Market Forecast in 2033 | USD 1,320.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elementar Analysensysteme GmbH, LECO Corporation, Thermo Fisher Scientific Inc., Shimadzu Corporation, PerkinElmer Inc., Exeter Analytical Inc., Costech International SpA, EuroVector SpA, Agilent Technologies Inc., Analytik Jena GmbH, UIC Inc., VELP Scientifica Srl, Xiamen Kejing Instrument Co., Ltd., JFE Advantech Co., Ltd., Skalar Analytical B.V., Alpha MOS SA, Metrohm AG, Anton Paar GmbH, P&P Scientific, Microlab. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Elemental Analysis Device Market Key Technology Landscape

The technological landscape of the Organic Elemental Analysis Device Market is defined by innovation aimed at enhancing throughput, improving sensitivity, and ensuring compliance. Modern analyzers increasingly feature fully automated systems, including integrated autosamplers capable of running dozens of samples unattended, which is critical for high-volume quality control environments in pharmaceuticals and large industrial labs. The core analytical technology, primarily flash combustion combined with gas chromatography separation and thermal conductivity detection (TCD), is continuously being refined to achieve lower detection limits and expand the range of sample types that can be accurately analyzed, including difficult matrices like polymers and complex oils. Advanced furnace designs and catalyst formulations are essential to ensure complete oxidation and reduction, guaranteeing high accuracy for elements like Nitrogen and Sulfur.

A notable trend is the development of hyphenated techniques, combining elemental analysis with other spectroscopic methods (e.g., coupling elemental analyzers with Isotope Ratio Mass Spectrometry or IRMS). This allows for highly specialized analysis, particularly relevant in forensic science, geology, and environmental studies where isotopic profiling is necessary to determine the origin or authenticity of materials. Furthermore, manufacturers are focusing heavily on developing devices specifically tailored for oxygen determination, which often employs high-temperature pyrolysis techniques rather than standard combustion. The integration of advanced microprocessors and robust software packages enables sophisticated data handling, including automated calculation of empirical formulas, error correction, and compliance with electronic record regulations (e.g., 21 CFR Part 11).

Another area of intense development is the move towards micro-sampling and micro-analysis, minimizing the required sample size while maintaining or improving accuracy. This is highly valuable in preclinical drug discovery where sample amounts are often limited. Furthermore, advancements in specialized detectors, such as Electron Capture Detectors (ECD) or flame photometric detectors (FPD) when analyzing halogens or sulfur, are driving improved precision for trace elemental analysis. The competition in the market pushes manufacturers to continuously improve consumables quality, ensuring optimal combustion efficiency and detector lifetime, which directly impacts the total cost of ownership for the end-user, making consumable longevity and efficiency a major technological selling point.

Regional Highlights

Regional dynamics within the Organic Elemental Analysis Device Market reveal distinct growth patterns influenced by regulatory environments, industrial maturity, and R&D investment levels. North America currently holds the largest market share, characterized by its mature pharmaceutical and biotechnology sectors, which allocate significant budgets towards analytical instrumentation for quality control and new drug development. The region benefits from substantial federal funding for scientific research and has a well-established infrastructure of CROs, which are major consumers of high-throughput elemental analyzers. Stringent environmental regulations in the US and Canada also drive the demand for specialized analyzers capable of trace analysis of pollutants in water and soil, cementing the region's dominance.

Europe represents a stable and high-value market, primarily driven by strict European Union (EU) environmental directives, particularly concerning fuel quality and emissions (e.g., Euro standards). The region's robust petrochemical industry, centered in countries like Germany and the Netherlands, relies heavily on these devices for process monitoring and compliance. Furthermore, Europe has a strong academic research base and a highly integrated network of government-funded research institutions that contribute significantly to the demand for advanced analytical instrumentation. Emphasis on green chemistry and sustainable materials research within the EU also acts as a continuous catalyst for market adoption.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This exponential growth is primarily attributed to rapid industrialization, increasing governmental and private investment in domestic pharmaceutical manufacturing (especially in China and India), and the subsequent need for rigorous quality control systems. As APAC countries adopt global quality and environmental standards, the demand for certified elemental analyzers for food safety, petrochemical refining, and environmental monitoring skyrockets. The expanding presence of global analytical instrument manufacturers establishing local manufacturing and service hubs in this region further supports market acceleration.

Latin America and the Middle East & Africa (MEA) are emerging markets experiencing moderate growth. In MEA, market growth is heavily linked to the expansion of the oil and gas sector, where elemental analysis is critical for oil exploration, refining processes, and product quality testing. South Africa, Saudi Arabia, and UAE are key drivers in this region. Latin America, particularly Brazil and Mexico, shows potential driven by agricultural chemistry, rising pharmaceutical production, and increased academic research funding, though infrastructure development and import dependencies remain factors influencing the pace of adoption.

- North America: Dominates the market share due to massive R&D spending, a highly regulated pharmaceutical industry, and strong demand from environmental testing laboratories.

- Europe: Characterized by stable demand fueled by strict EU environmental policies, a strong petrochemical sector, and significant academic research activity.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR, driven by industrial expansion, growth of domestic pharmaceutical and chemical industries, and increased focus on global quality standards adoption in countries like China and India.

- Middle East & Africa (MEA): Growth is tied heavily to the oil and gas industry’s need for precise fuel characterization and quality assurance processes.

- Latin America: Emerging market growth supported by increasing investment in agricultural research and developing pharmaceutical manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Elemental Analysis Device Market.- Elementar Analysensysteme GmbH

- LECO Corporation

- Thermo Fisher Scientific Inc.

- Shimadzu Corporation

- PerkinElmer Inc.

- Exeter Analytical Inc.

- Costech International SpA

- EuroVector SpA

- Agilent Technologies Inc.

- Analytik Jena GmbH

- UIC Inc.

- VELP Scientifica Srl

- Xiamen Kejing Instrument Co., Ltd.

- JFE Advantech Co., Ltd.

- Skalar Analytical B.V.

- Alpha MOS SA

- Metrohm AG

- Anton Paar GmbH

- P&P Scientific

- Microlab

Frequently Asked Questions

Analyze common user questions about the Organic Elemental Analysis Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Organic Elemental Analysis Devices?

The demand is primarily driven by pharmaceutical quality control (determining purity and empirical formula of drug substances), strict environmental monitoring (measuring sulfur and nitrogen content in fuels and emissions), and fundamental academic research in chemistry and materials science for compound characterization.

How does the integration of automation technology impact the efficiency of elemental analyzers?

Automation, including integrated autosamplers and automated data processing, significantly increases sample throughput, reduces analysis time, minimizes human error, and ensures compliance with regulatory standards (e.g., 21 CFR Part 11) for electronic record keeping, making high-volume quality assurance processes more efficient.

Which regions are expected to show the fastest growth in the Organic Elemental Analysis Device Market?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is projected to register the fastest growth rate. This acceleration is due to rapid industrialization, massive investments in domestic R&D, and the increasing adoption of global quality and environmental regulatory standards across key industrial sectors.

What technological advancements are currently defining the competitive landscape?

Key technological advancements include the development of compact, highly automated CHNS/O analyzers, enhanced detector sensitivity for micro-sampling, improved furnace designs for difficult matrices, and the integration of predictive maintenance tools powered by Artificial Intelligence to maximize instrument uptime and accuracy.

What is the significance of the consumables segment within the elemental analysis market?

The consumables segment (reagents, catalysts, quartz tubes) is highly significant as it provides a stable and recurring revenue stream for manufacturers. Continuous consumption is directly correlated with the installed base of instruments and test volumes, making the quality and efficiency of consumables critical for overall system performance and customer retention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager