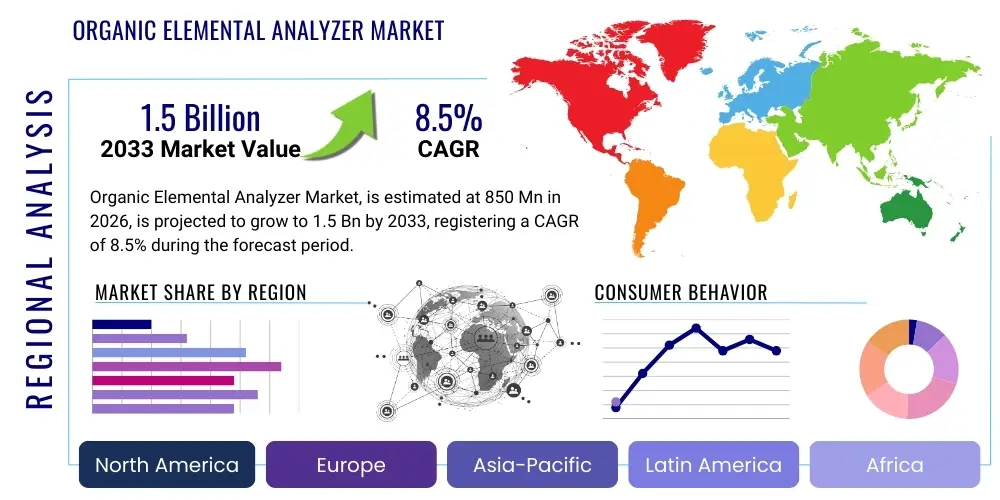

Organic Elemental Analyzer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439755 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Organic Elemental Analyzer Market Size

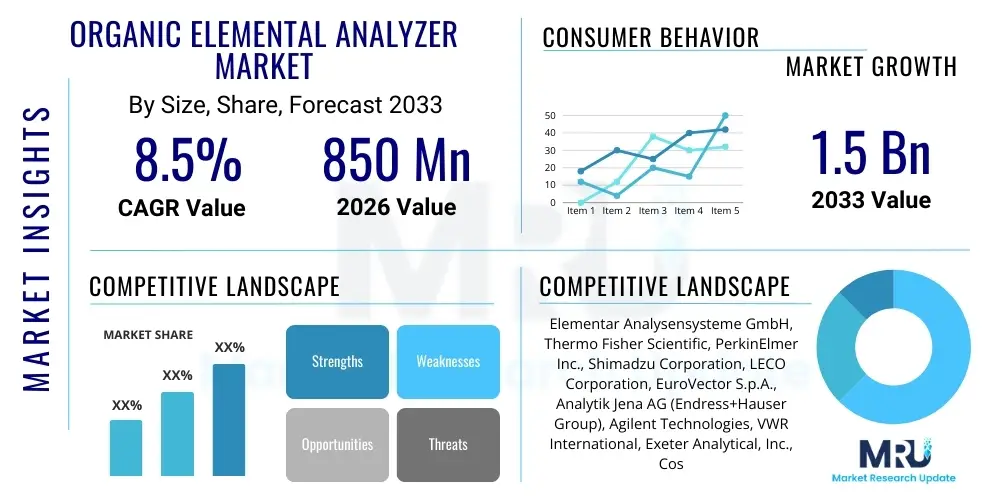

The Organic Elemental Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1.5 billion by the end of the forecast period in 2033. This growth is underpinned by increasing stringency in quality control standards across various industries and a surge in research and development activities demanding precise elemental composition analysis.

Organic Elemental Analyzer Market introduction

The Organic Elemental Analyzer (OEA) market encompasses sophisticated analytical instruments designed to determine the elemental composition of organic and some inorganic samples. These analyzers primarily quantify carbon, hydrogen, nitrogen, sulfur, and oxygen (CHNS/O) content, which are fundamental building blocks of organic compounds. Modern OEAs utilize various techniques, predominantly high-temperature combustion, followed by chromatographic separation and detection, to provide highly accurate and reproducible results. These instruments are critical for ensuring product quality, purity, and compliance with regulatory standards across a multitude of sectors, from pharmaceuticals to environmental science. The inherent benefits of OEAs, such as their precision, speed, and automation capabilities, make them indispensable tools in contemporary analytical laboratories.

Major applications of organic elemental analyzers span a broad spectrum of industries. In the pharmaceutical and biotechnology sectors, they are crucial for characterization of active pharmaceutical ingredients (APIs), excipients, and drug products, ensuring batch consistency and purity. The chemical and petrochemical industries rely on OEAs for quality control of raw materials, intermediates, and final products, including polymers, fuels, and catalysts. Environmental testing laboratories utilize these analyzers to monitor pollutants in water, soil, and air, such as nitrogen and sulfur content in various matrices. Furthermore, the food and beverage industry employs OEAs for nutritional analysis, while agricultural research benefits from the precise determination of elemental composition in soil and plant samples.

Driving factors for the organic elemental analyzer market include the escalating demand for quality control and assurance across global supply chains, increasingly stringent regulatory frameworks mandating comprehensive product characterization, and the continuous growth in research and development activities in materials science, life sciences, and chemistry. Technological advancements, such as enhanced automation, improved detection limits, and integration with advanced data analysis software, further propel market expansion. The expanding number of industrial and academic research laboratories, particularly in emerging economies, also contributes significantly to the adoption of these essential analytical instruments.

Organic Elemental Analyzer Market Executive Summary

The Organic Elemental Analyzer market is experiencing robust growth, driven by an escalating need for precise elemental analysis in diverse industries. Business trends indicate a strong focus on automation, integration of advanced software for data interpretation and management, and the development of more compact and user-friendly systems. Manufacturers are increasingly offering modular and customizable solutions to cater to specific application requirements, enhancing the versatility and adoption of OEAs. There is also a growing emphasis on instruments that offer higher throughput and lower operational costs, responding to the dynamic demands of both high-volume industrial laboratories and academic research settings. Sustainability initiatives are also influencing product development, with a push towards more energy-efficient and reagent-conscious designs.

Regionally, the market exhibits varied growth trajectories. North America and Europe, as mature markets, continue to be significant revenue contributors, driven by stringent regulatory frameworks, well-established pharmaceutical and chemical industries, and substantial R&D investments. These regions are characterized by a high adoption rate of advanced analytical techniques and a strong emphasis on quality assurance. Asia Pacific, however, is projected to be the fastest-growing region, fueled by rapid industrialization, expanding biotechnology and pharmaceutical sectors, increasing environmental concerns, and growing government initiatives supporting scientific research and development infrastructure. Latin America and the Middle East & Africa are also emerging as promising markets, albeit at a slower pace, with increasing foreign investments in industrial and research sectors.

In terms of segment trends, the pharmaceutical and biotechnology sector consistently holds the largest share due to the critical need for precise elemental analysis in drug discovery, development, and quality control. The environmental testing segment is also witnessing substantial growth, propelled by rising global awareness regarding pollution and stricter environmental protection regulations that necessitate accurate monitoring of elemental pollutants. Furthermore, the chemical and petrochemical industries remain key users, driven by the demand for material characterization and process optimization. The market is also seeing a rise in demand for analyzers capable of simultaneous CHNS/O analysis, offering comprehensive data from a single run and thereby improving laboratory efficiency and cost-effectiveness.

AI Impact Analysis on Organic Elemental Analyzer Market

Common user questions regarding AI's impact on the Organic Elemental Analyzer (OEA) market frequently revolve around its potential to enhance data accuracy, automate complex interpretation, and streamline method development. Users are keen to understand how AI can reduce human error, accelerate analysis times, and provide deeper insights from raw data. Concerns often include the reliability of AI algorithms in critical applications, data security, and the initial investment required for AI integration. Expectations are high for AI to revolutionize predictive maintenance, optimize instrument calibration, and facilitate the handling of large datasets generated by high-throughput OEA systems, ultimately making these sophisticated instruments more accessible and efficient for a broader range of analytical challenges.

The integration of Artificial Intelligence (AI) and machine learning (ML) is poised to significantly transform the Organic Elemental Analyzer market by enhancing various stages of the analytical workflow. AI algorithms can process vast amounts of data generated by OEAs, identifying subtle patterns and anomalies that might be missed by manual inspection, thereby improving the accuracy and reliability of elemental composition results. This capability is particularly valuable in complex matrices or when dealing with trace elements, where precise detection and quantification are paramount. Moreover, AI can learn from historical data to predict potential instrument malfunctions, enabling proactive maintenance and minimizing downtime, which is crucial for laboratories operating under tight deadlines.

Furthermore, AI can streamline and optimize the OEA method development process, which traditionally involves significant trial and error. By leveraging machine learning, analysts can develop robust and efficient analytical methods more rapidly, significantly reducing the time and resources expended. AI-powered software can suggest optimal parameters for combustion temperatures, flow rates, and calibration curves based on sample characteristics and desired analytical outcomes. This automation of complex decision-making not only improves efficiency but also contributes to greater consistency across different analyses and laboratories, paving the way for more standardized and robust elemental analysis protocols in the future. The ability of AI to interpret multivariate data also supports the identification of correlations between elemental composition and material properties, unlocking new insights for research and quality control.

- AI-driven predictive maintenance for OEA instruments, reducing downtime and improving operational efficiency.

- Enhanced data analysis and interpretation through machine learning algorithms, leading to more accurate and reliable elemental results.

- Automated method development and optimization, accelerating the setup of new analytical protocols and improving consistency.

- Improved anomaly detection in complex sample matrices, ensuring higher quality control and research outcomes.

- Integration of AI for advanced calibration and self-correction, minimizing human intervention and maintaining instrument precision over time.

- Intelligent sample management and prioritization, optimizing laboratory workflow and throughput.

DRO & Impact Forces Of Organic Elemental Analyzer Market

The Organic Elemental Analyzer market is propelled by several key drivers, including the increasing global demand for stringent quality control and assurance across a myriad of industries, particularly pharmaceuticals, chemicals, and environmental testing. The escalating investment in research and development activities across both academic and industrial sectors fuels the need for precise elemental characterization of novel materials and compounds. Additionally, the proliferation of strict regulatory frameworks and standards, such as those set by pharmacopoeias and environmental agencies, mandates the use of reliable analytical techniques like OEAs. Ongoing technological advancements, leading to more automated, accurate, and user-friendly instruments, further stimulate market growth by improving efficiency and expanding application possibilities. The global expansion of manufacturing capabilities, particularly in emerging economies, also contributes to increased adoption for process control and product quality verification.

Despite the strong growth drivers, the market faces several restraints that could impede its expansion. The high initial capital investment required for purchasing and installing organic elemental analyzers can be a significant barrier, especially for smaller laboratories and research institutions with limited budgets. The complexity of operating and maintaining these sophisticated instruments necessitates skilled personnel, and the shortage of such expertise in certain regions can be a limiting factor. Furthermore, the inherent complexity of sample preparation for various matrices can be time-consuming and labor-intensive, adding to the operational challenges. Competition from alternative analytical techniques, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) or X-ray Fluorescence (XRF) for specific elemental analyses, also poses a restraint, particularly when those techniques offer broader elemental coverage or different sample handling benefits for specific applications.

Opportunities for market growth primarily lie in the rapid industrialization and scientific infrastructure development within emerging economies across Asia Pacific, Latin America, and the Middle East & Africa. These regions present untapped potential for OEA adoption as their pharmaceutical, chemical, and environmental sectors mature and their regulatory landscapes evolve. There is also a significant opportunity in the development of highly customized and application-specific OEA solutions, catering to niche market demands and specialized research areas. The integration of OEAs with other advanced analytical techniques, such as mass spectrometry or chromatography, to create comprehensive multi-modal platforms, offers avenues for enhanced analytical capabilities and market differentiation. Additionally, continuous innovation in miniaturization and the development of portable OEAs could open new application areas and increase accessibility, particularly for field-based environmental monitoring and on-site quality control. The impact forces affecting the market include a moderate threat of new entrants due to high R&D costs and intellectual property barriers, moderate to high bargaining power of buyers driven by product differentiation and competitive pricing, moderate bargaining power of suppliers for critical components, a moderate threat of substitute products offering alternative analytical solutions, and a high intensity of competitive rivalry among established players vying for market share through continuous innovation and strategic partnerships.

Segmentation Analysis

The Organic Elemental Analyzer market is extensively segmented by type, element, application, and end-user, reflecting the diverse analytical needs across various industries. This segmentation provides a granular view of market dynamics, allowing for a comprehensive understanding of specific market niches and their growth drivers. Each segment caters to distinct requirements, from the fundamental method of elemental determination to the specific elements being analyzed, and ultimately to the end-use industry that benefits from the precise analytical outputs. The detailed segmentation helps manufacturers tailor their product offerings and marketing strategies to target specific customer groups more effectively, while enabling stakeholders to identify key growth areas and investment opportunities within the broader market landscape. Understanding these segments is crucial for strategic planning and competitive positioning within the evolving analytical instrumentation industry.

- By Type: High Temperature Combustion, Pyrolysis, Wet Chemical Oxidation.

- By Elements: Carbon (C), Hydrogen (H), Nitrogen (N), Sulfur (S), Oxygen (O), Other Elements.

- By Application: Pharmaceutical & Biotechnology, Chemical & Petrochemical, Environmental Testing, Food & Beverage, Academia & Research, Agriculture, Materials Science, Clinical & Forensics.

- By End-User: Research Laboratories, Quality Control Laboratories, Contract Research Organizations (CROs), Manufacturing Facilities, Government Agencies.

Value Chain Analysis For Organic Elemental Analyzer Market

The value chain for the Organic Elemental Analyzer market begins with upstream activities, primarily involving the sourcing of specialized raw materials and components. This includes high-purity gases, advanced sensors, detectors (such as thermal conductivity detectors or infrared detectors), precise flow controllers, and sophisticated electronic components. Research and development also represent a critical upstream activity, where manufacturers invest heavily in developing new technologies, improving analytical performance, and ensuring compliance with evolving industry standards. Suppliers of these high-tech components and specialized materials play a crucial role in the quality, performance, and cost-effectiveness of the final OEA instruments. Robust relationships with these upstream suppliers are essential for maintaining a competitive edge and ensuring a stable supply chain.

Moving downstream, the value chain encompasses the manufacturing, assembly, and rigorous quality testing of the elemental analyzers. This stage often involves highly specialized engineering and precision manufacturing processes to ensure the accuracy, reliability, and longevity of the instruments. Following manufacturing, distribution channels play a pivotal role in reaching the diverse customer base. Distribution can occur through direct sales channels, where manufacturers engage directly with large institutional clients, government agencies, or key research laboratories, allowing for customized solutions and direct technical support. Alternatively, indirect distribution channels involve working with a network of authorized distributors, resellers, and regional agents who have established local market presence and provide sales, installation, and post-sales support, particularly in geographically dispersed markets or for smaller clients.

The final stages of the value chain involve post-sales services, which are critical for customer satisfaction and long-term market presence. This includes installation, user training, calibration services, preventive maintenance, repair, and the supply of consumables and spare parts. Both direct and indirect distribution channels contribute to providing these services. Direct channels often handle complex service contracts and provide specialized application support, leveraging their in-depth product knowledge. Indirect channels, through their regional networks, offer localized support and quicker response times for routine maintenance and troubleshooting. The effectiveness of these downstream activities significantly influences customer loyalty and brand reputation, solidifying the market position of OEA manufacturers.

Organic Elemental Analyzer Market Potential Customers

The Organic Elemental Analyzer market serves a broad and diverse range of potential customers, primarily classified by their end-user industry and application needs. Pharmaceutical and biotechnology companies represent a significant segment of potential buyers, utilizing OEAs for critical applications such as characterization of active pharmaceutical ingredients (APIs), excipients, and drug products, ensuring purity, stability, and batch-to-batch consistency. These industries heavily rely on precise elemental analysis for quality control, regulatory compliance, and research and development into new drug formulations. The stringent quality standards and regulatory mandates within these sectors make OEAs indispensable tools for product lifecycle management.

Another major segment of potential customers includes the chemical and petrochemical industries. These sectors employ OEAs for the quality control of raw materials, intermediates, and final products, including polymers, catalysts, fuels, and specialty chemicals. Precise elemental composition analysis is crucial for optimizing manufacturing processes, ensuring product specifications, and adhering to environmental and safety regulations. Environmental testing laboratories, both governmental and private, constitute a growing customer base, using OEAs to monitor pollutants in water, soil, and air, assessing environmental impact, and ensuring compliance with local and international environmental standards. The increasing global focus on environmental protection and sustainability directly translates into higher demand for these analytical instruments.

Furthermore, academic and research institutions are significant end-users, where OEAs are fundamental for various scientific studies in chemistry, materials science, environmental science, and agriculture, aiding in the characterization of novel compounds and materials. The food and beverage industry utilizes OEAs for nutritional analysis, quality control of ingredients, and detection of contaminants. Agriculture and agricultural research also benefit from elemental analysis for soil fertility assessment and plant nutrient uptake studies. Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) also represent a substantial customer base, as they provide specialized analytical services to other industries, requiring robust and versatile OEA platforms to meet diverse client needs efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elementar Analysensysteme GmbH, Thermo Fisher Scientific, PerkinElmer Inc., Shimadzu Corporation, LECO Corporation, EuroVector S.p.A., Analytik Jena AG (Endress+Hauser Group), Agilent Technologies, VWR International, Exeter Analytical, Inc., Costech International S.p.A., Hach Company, Metrohm AG, Anton Paar GmbH, SCP SCIENCE, Bruker Corporation, HORIBA Scientific, Sartorius AG, Gilson, Inc., JASCO Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Elemental Analyzer Market Key Technology Landscape

The Organic Elemental Analyzer market is characterized by a dynamic technology landscape driven by continuous innovation aimed at improving accuracy, speed, and analytical versatility. The core technology largely revolves around high-temperature combustion and pyrolysis methods. In high-temperature combustion, samples are rapidly oxidized in an oxygen-rich environment at temperatures up to 1800°C, converting organic compounds into simple inorganic gases like CO2, H2O, N2, and SO2. These gases are then separated and quantified using techniques such as gas chromatography (GC) with thermal conductivity detection (TCD) or non-dispersive infrared (NDIR) detection for specific elements. Pyrolysis, often used for oxygen determination, involves thermal decomposition in an inert atmosphere, followed by similar detection methods. Advanced furnace designs, including dual-furnace systems, are continuously being refined to ensure complete combustion and minimize matrix effects across a wide range of sample types.

Beyond the fundamental combustion and detection principles, the technology landscape emphasizes automation and software integration. Modern OEAs feature advanced autosamplers capable of handling a large number of samples, reducing manual intervention and increasing throughput. Sophisticated software platforms are integral, providing intuitive user interfaces for method development, instrument control, data acquisition, processing, and comprehensive reporting. These software solutions often incorporate advanced algorithms for peak integration, calibration curve generation, and quality control checks, ensuring data integrity and ease of compliance with regulatory requirements. The trend towards modular designs also allows for greater flexibility, enabling users to configure instruments for specific elemental analysis needs, such as dedicated CHNS or oxygen-only systems, or combined CHNS/O capabilities.

Emerging technological advancements include the development of miniaturized and portable elemental analyzers, offering potential for on-site analysis in environmental monitoring, agricultural applications, or field research, reducing the need for extensive sample transportation to centralized laboratories. Improvements in sensor technology are also enhancing detection limits and analytical precision, enabling the analysis of trace elements with greater confidence. Furthermore, there is a growing focus on integrating OEAs with other analytical techniques, such as isotope ratio mass spectrometry (IRMS), to provide comprehensive elemental and isotopic information from a single platform. This multi-technique approach offers deeper insights into sample origin, authenticity, and biogeochemical cycles, expanding the utility of elemental analysis in highly specialized research domains.

Regional Highlights

- North America: A mature market characterized by robust R&D spending, stringent regulatory environments, and a significant presence of pharmaceutical, chemical, and environmental industries. The region exhibits high adoption of advanced analytical instruments and continuous demand for quality control and research applications, particularly in the United States and Canada.

- Europe: Similar to North America, Europe is a key market driven by strong research initiatives, a well-established industrial base, and stringent environmental and product safety regulations. Countries like Germany, the UK, France, and Switzerland are major contributors due to their strong pharmaceutical, chemical, and food & beverage sectors.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC benefits from rapid industrialization, expanding manufacturing capabilities, increasing investments in R&D, and growing awareness regarding environmental protection. Countries such as China, India, Japan, and South Korea are leading this growth, fueled by rising disposable incomes and government support for scientific infrastructure.

- Latin America: An emerging market showing steady growth, driven by increasing industrial development, particularly in Brazil and Mexico. Growing investments in pharmaceutical production, chemical manufacturing, and agricultural research are contributing to the rising demand for organic elemental analyzers in the region.

- Middle East and Africa (MEA): This region is experiencing nascent growth, primarily due to increasing investments in the oil and gas sector, burgeoning pharmaceutical industries, and growing environmental concerns in countries like Saudi Arabia, UAE, and South Africa. Development of research infrastructure and academic institutions also supports market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Elemental Analyzer Market.- Elementar Analysensysteme GmbH

- Thermo Fisher Scientific

- PerkinElmer Inc.

- Shimadzu Corporation

- LECO Corporation

- EuroVector S.p.A.

- Analytik Jena AG (Endress+Hauser Group)

- Agilent Technologies

- VWR International

- Exeter Analytical, Inc.

- Costech International S.p.A.

- Hach Company

- Metrohm AG

- Anton Paar GmbH

- SCP SCIENCE

- Bruker Corporation

- HORIBA Scientific

- Sartorius AG

- Gilson, Inc.

- JASCO Corporation

Frequently Asked Questions

What is an Organic Elemental Analyzer (OEA) and what does it measure?

An Organic Elemental Analyzer (OEA) is a specialized analytical instrument used to determine the quantitative elemental composition of organic and some inorganic materials. It primarily measures the percentages of carbon (C), hydrogen (H), nitrogen (N), sulfur (S), and oxygen (O) in a sample, which are crucial for material characterization, quality control, and research across various industries.

What are the primary applications of Organic Elemental Analyzers?

OEAs find extensive use in industries such as pharmaceuticals for drug characterization, chemicals for product purity and quality control, environmental testing for pollutant monitoring, food and beverage for nutritional analysis, and academia for research in chemistry and materials science. They are essential for ensuring product quality, purity, and compliance with regulatory standards.

How does an OEA typically work?

Most OEAs operate by rapidly combusting a sample at high temperatures (up to 1800°C) in an oxygen-rich environment, converting the elements into simple gaseous compounds (e.g., CO2, H2O, N2, SO2). These gases are then separated using gas chromatography or selective absorption and detected by thermal conductivity detectors (TCD) or infrared (IR) detectors, which quantify their concentrations.

What are the key benefits of using an Organic Elemental Analyzer?

The key benefits of OEAs include high accuracy and precision in elemental quantification, rapid analysis times, automation capabilities for high sample throughput, and the ability to handle a wide range of sample matrices (solids, liquids, volatile compounds). They provide essential data for quality control, research, and regulatory compliance, making them indispensable in modern laboratories.

What recent technological advancements are impacting the OEA market?

Recent advancements include enhanced automation and robotics for sample handling, improved detection limits for trace analysis, integration with advanced software for data processing and AI-driven insights, and the development of modular systems for greater application flexibility. There's also a trend towards more compact and energy-efficient designs, and potential for integration with other analytical techniques for comprehensive analysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Organic Elemental Analyzer (OEA) Market Size Report By Type (GC Chromatography, Frontal Chromatography, Adsorption-Desorption), By Application (Energy, Chemical Industry, Environment, Agriculture, Geology, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Organic Elemental Analyzer Market Statistics 2025 Analysis By Application (Energy, Chemical Industry, Environment, Agriculture, Geology), By Type (GC Chromatography, Frontal Chromatography, Adsorption-Desorption), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Organic Elemental Analyzer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Adsorption-Desorption, GC Chromatography, Frontal Chromatography), By Application (Environment, Chemical Industry, Energy), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager