Organic Hair Care Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439071 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Organic Hair Care Products Market Size

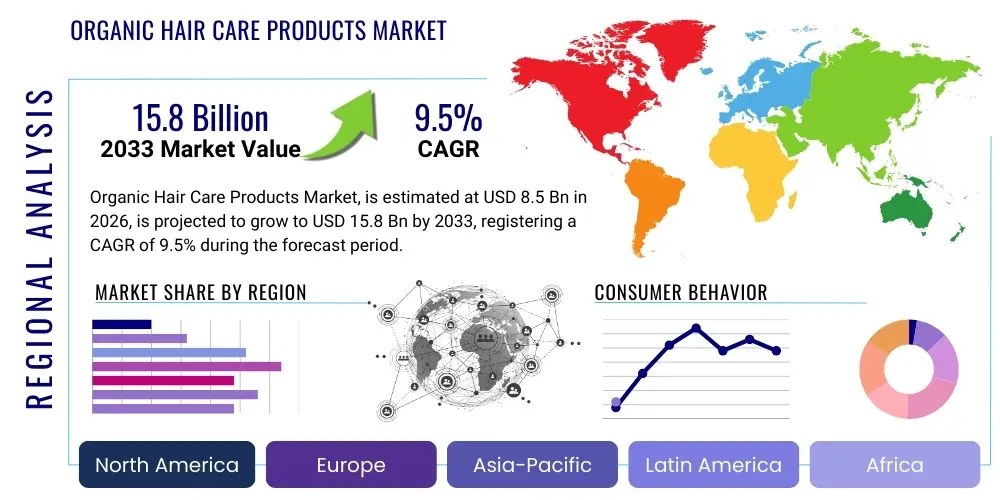

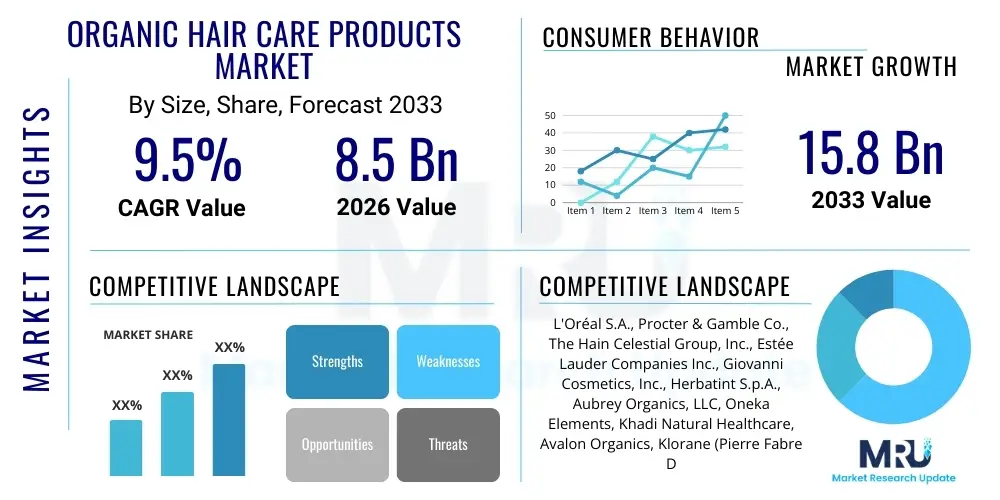

The Organic Hair Care Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $15.8 Billion by the end of the forecast period in 2033.

Organic Hair Care Products Market introduction

The Organic Hair Care Products Market encompasses a wide array of personal care items formulated with natural, sustainably sourced, and chemical-free ingredients, specifically excluding synthetic additives such as parabens, sulfates, and petrochemicals. This market category includes essential products like shampoos, conditioners, hair oils, styling gels, and hair colorants, all developed adhering to stringent organic certification standards mandated by global regulatory bodies. The primary driver of this market expansion is the escalating consumer awareness regarding the detrimental effects of synthetic chemicals on both hair health and the environment, leading to a profound shift towards cleaner, safer beauty alternatives. These products are often characterized by their use of plant extracts, essential oils, and certified organic raw materials, positioning them as a premium segment within the broader personal care industry.

The core product description revolves around transparency in sourcing and manufacturing, emphasizing eco-friendly packaging and ethical business practices. Major applications span daily cleansing, intensive conditioning, targeted treatment for specific hair concerns (such as dandruff or hair fall), and cosmetic enhancement, catering to diverse consumer demographics globally. Unlike conventional products, organic hair care items are often marketed based on their inherent benefits, which include gentler formulations suitable for sensitive scalps, reduced risk of allergic reactions, and long-term improvements in hair texture and overall vitality. The efficacy of these products is attributed to nutrient-rich botanical ingredients that provide vitamins, antioxidants, and fatty acids essential for healthy hair growth and maintenance.

Key benefits driving market adoption include enhanced hair and scalp compatibility, sustainability credentials, and support for clean beauty principles. The market’s momentum is significantly bolstered by favorable governmental regulations that encourage the use of natural ingredients and restrict the incorporation of known harmful substances in consumer goods. Furthermore, aggressive marketing campaigns by established beauty giants and niche organic brands, coupled with endorsements from beauty professionals and clean living influencers, continue to educate consumers and validate the higher price point often associated with certified organic offerings. The rising incidence of lifestyle diseases and concerns over endocrine disruptors in traditional cosmetics further accelerate this transition toward organic alternatives, securing the market's robust growth trajectory over the forecast period.

Organic Hair Care Products Market Executive Summary

The global Organic Hair Care Products Market is exhibiting robust commercial expansion, primarily fueled by shifting consumer preferences prioritizing health and sustainability. Business trends indicate a strong focus on strategic acquisitions and partnerships between large multinational corporations and specialized organic startups, aimed at rapidly expanding product portfolios and accessing niche consumer segments. Furthermore, manufacturers are investing heavily in research and development to improve the shelf life and sensory attributes of organic formulations, thereby overcoming historical barriers related to product stability and efficacy. The market is characterized by increasing product innovation, particularly in the treatment and styling categories, utilizing novel organic compounds derived from exotic botanicals and advanced extraction technologies. Direct-to-consumer (D2C) sales channels, especially through e-commerce platforms, are gaining prominence, offering brands greater control over messaging and facilitating personalized customer experiences.

Regional trends highlight the dominance of North America and Europe, attributed to high consumer awareness, strong purchasing power, and stringent regulatory frameworks that standardize organic certifications. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by rising disposable incomes, rapid urbanization, and a growing middle class adopting Westernized beauty standards while demanding natural ingredients. Governments in APAC countries are increasingly supporting local production of herbal and Ayurvedic organic formulations, contributing to regional market heterogeneity and growth. Meanwhile, Latin America and the Middle East & Africa are showing nascent growth, primarily focused on imported premium organic brands, though domestic manufacturing is gradually expanding to meet local demand for ethically sourced and halal-certified products.

Segmentation trends reveal that the Shampoo and Conditioner segments maintain the largest market share due to their fundamental role in daily hair hygiene, acting as entry points for consumers transitioning to organic routines. Within the distribution landscape, specialized organic and natural stores, alongside online retail channels, are witnessing the most significant growth, reflecting consumers' desire for authenticated products and convenient access. The organic hair color segment, though smaller, is projected to achieve the highest CAGR, driven by innovation in natural dyeing agents that minimize chemical exposure while providing long-lasting color results. Consumer gender segmentation shows strong adoption among the female demographic, although the male grooming segment, focusing on organic beard care and scalp treatments, is growing at a noticeable pace, indicating market diversification across consumer types and specialized needs.

AI Impact Analysis on Organic Hair Care Products Market

Common user inquiries regarding AI’s influence on the Organic Hair Care Products Market frequently center on personalization, supply chain transparency, and predictive formulation capabilities. Users are keen to understand how AI can tailor organic product recommendations based on individual hair type, environmental factors, and lifestyle data, moving beyond generic advice. Concerns also revolve around the potential for AI-driven manufacturing to maintain the integrity and purity required for organic certification, especially concerning complex ingredient sourcing and quality control. Key expectations focus on AI enhancing sustainability through optimized resource management in cultivation and production, and utilizing machine learning for faster discovery of novel, high-efficacy organic active ingredients, thereby accelerating product development cycles while upholding environmental standards demanded by organic consumers.

- AI-Driven Personalization: Using algorithms to analyze consumer genetics, scalp microbiome data, and climate conditions to recommend precise organic ingredient mixes and product usage schedules.

- Supply Chain Optimization: Leveraging predictive analytics and blockchain integration to ensure traceability and authenticity of organic raw materials, verifying ethical sourcing and certification compliance.

- Predictive Formulation: Utilizing machine learning to simulate the stability, efficacy, and sensory profile of new organic formulations, significantly reducing R&D time and physical testing needs.

- Demand Forecasting: Enhancing inventory management and reducing waste by accurately predicting regional and seasonal consumer demand for specific organic hair care products.

- Automated Quality Control: Implementing computer vision and sensor technology in manufacturing lines to monitor purity and consistency, ensuring the final product meets strict organic standards.

- Customer Service Enhancement: Deploying AI chatbots and virtual assistants tailored to answer complex questions about organic ingredients, certifications, and sustainable practices.

DRO & Impact Forces Of Organic Hair Care Products Market

The Organic Hair Care Products Market expansion is primarily driven by heightened consumer awareness regarding the long-term health implications associated with synthetic chemical usage, coupled with a pervasive global trend towards environmental stewardship and clean beauty. Restraints include the significantly higher cost of certified organic raw materials and complex manufacturing processes necessary to preserve the efficacy of natural ingredients without synthetic preservatives, which translates into higher retail prices, potentially limiting adoption among budget-sensitive consumers. Opportunities abound in the burgeoning demand for specialized organic treatments, such as anti-pollution and blue light protection formulations, and in expanding geographical reach into untapped emerging economies where modern retail penetration is increasing. The overall market dynamics are governed by critical impact forces, including stringent regulatory barriers for organic certification, intense competitive rivalry among established chemical-free brands and legacy personal care corporations entering the space, and the continuous influence of digital media and celebrity endorsements shaping consumer perceptions and purchasing decisions towards sustainable luxury items.

Drivers compelling market growth encompass several sociological and economic factors. The increasing prevalence of skin sensitivities and allergic reactions linked to conventional chemicals is pushing consumers, particularly those with delicate skin or chronic conditions, toward gentler, certified organic alternatives. Furthermore, the robust growth of the e-commerce sector has significantly improved product accessibility, enabling niche organic brands to reach global audiences without massive investment in physical distribution infrastructure. Sustainability initiatives are critical; consumers are actively seeking brands committed to ethical sourcing, fair trade practices, and biodegradable packaging, making corporate social responsibility a major purchasing driver in this market segment. These factors collectively create a positive feedback loop where consumer demand for cleaner products stimulates further investment and innovation in organic formulation technologies, ensuring sustained market vibrancy.

Conversely, the primary restraints pose substantial challenges to scaling organic production. The sourcing of organic ingredients is often seasonal and dependent on climatic conditions, leading to supply chain volatility and inconsistent pricing, complicating large-scale manufacturing planning. Additionally, the limited shelf stability of many natural preservatives compared to synthetic counterparts necessitates sophisticated packaging technologies and careful logistical planning, increasing operational complexity. The market also faces the challenge of ‘greenwashing,’ where non-certified brands utilize misleading natural claims, confusing consumers and diluting the value proposition of truly certified organic products. This necessitates continuous consumer education and reinforces the importance of clear, internationally recognized organic labels. Overcoming these restraints requires technological advances in natural preservation methods and robust regulatory oversight to protect certified brands and consumer trust.

The key opportunities for market participants lie in demographic and functional diversification. Targeting specialized consumer groups, such as children (organic baby hair care), pregnant women, and the elderly, represents significant untapped potential. Innovation in delivery formats, such as waterless and solid organic hair care bars, provides opportunities to align with sustainability goals by reducing water use and minimizing plastic waste. Moreover, the integration of traditional medicinal knowledge, like Ayurveda and traditional Chinese medicine (TCM), into modern organic formulations offers a differentiation strategy highly appealing in Asian markets. The strategic impact forces mandate that companies must not only focus on product quality and efficacy but also prioritize transparent communication regarding ingredient provenance and sustainability metrics to gain a competitive edge in this highly conscious consumer landscape. Successfully navigating the intersection of premium pricing, stringent certification, and high consumer expectations will dictate market leadership in the coming years.

Segmentation Analysis

The Organic Hair Care Products Market is meticulously segmented based on product type, distribution channel, and end-user, allowing for a nuanced understanding of consumer behavior and preference across different demographics and retail environments. This granular breakdown helps market participants tailor product development, pricing strategies, and marketing efforts to target specific high-growth areas. The core segmentation reflects the evolution of consumer needs, moving from basic cleansing products to highly specialized treatment items, all while maintaining the fundamental requirement for certified organic ingredients. Understanding the interplay between these segments is crucial for accurate forecasting and strategic business planning, particularly as distribution channels globalize and specialized product categories gain traction.

- By Product Type:

- Shampoo

- Conditioner

- Hair Oil

- Hair Styling Products (Gels, Mousses, Serums)

- Hair Colorants/Dyes

- Hair Treatment Products (Masks, Scalp Treatments)

- By Distribution Channel:

- Online Retail (E-commerce platforms, Company websites)

- Offline Retail

- Supermarkets and Hypermarkets

- Specialty Stores (Organic and Natural Stores)

- Pharmacies and Drug Stores

- By Consumer Gender:

- Female

- Male (Targeting specific grooming needs)

- Unisex/Family Packs

- By End-User Application:

- Household/Individual Use

- Commercial Use (Salons, Spas, Professional Hair Care Services)

Value Chain Analysis For Organic Hair Care Products Market

The value chain for the Organic Hair Care Products Market is complex, starting with the upstream analysis involving the sourcing and processing of certified organic raw materials. This initial stage is critical and resource-intensive, requiring strict adherence to organic farming standards, ethical harvesting, and often sophisticated extraction techniques (like cold-pressing or supercritical fluid extraction) to maintain the integrity of natural compounds. Key upstream players include certified organic farmers, specialized ingredient suppliers (e.g., essential oil distillers), and certification bodies (e.g., USDA Organic, Ecocert) whose approvals are essential for market credibility. The high volatility and specialized handling requirements of these natural ingredients significantly influence production costs and scalability compared to conventional inputs.

Midstream activities encompass formulation, manufacturing, and packaging. Organic manufacturers must invest in specialized facilities that prevent cross-contamination with non-organic substances, requiring dedicated machinery and rigorous cleaning protocols. Formulation is highly sensitive, focusing on stability and shelf life using natural preservation systems. Packaging, often requiring sustainable or recycled materials (Post-Consumer Recycled plastics or glass), adds complexity and cost. Downstream analysis focuses on distribution and retailing, encompassing both direct and indirect channels. Indirect distribution relies heavily on professional logistics partners skilled in handling sensitive cosmetic products, often utilizing specialized organic wholesalers who cater to niche stores and major retailers like Whole Foods or specialized European organic chains.

The choice between direct and indirect distribution significantly impacts margin and market reach. Direct channels, primarily through branded e-commerce websites, allow companies to capture higher margins, control brand messaging, and gather valuable consumer data for personalized marketing efforts. Indirect channels, encompassing supermarkets, specialty beauty stores, and online marketplaces (Amazon, etc.), provide mass market reach and consumer convenience but necessitate price markups and extensive promotional support. Professional salons and spas also serve as a crucial distribution channel, offering products through expert recommendation, which builds high levels of consumer trust. Successful companies in this market must balance cost-efficient indirect distribution with the brand control and premium experience offered by direct-to-consumer models to ensure sustainable competitive advantage.

Organic Hair Care Products Market Potential Customers

The primary potential customers in the Organic Hair Care Products Market are discerning consumers who prioritize health, wellness, and environmental sustainability over cost-effectiveness. This group is typically characterized by higher disposable incomes, residing predominantly in urban and suburban areas of developed economies (North America and Western Europe), and possessing a high level of education regarding clean living and ethical consumption. Within this core demographic, key segments include Millennials and Generation Z, who are early adopters of clean beauty trends and utilize digital platforms extensively for product research and validation. These buyers often seek transparency regarding ingredient sourcing and corporate social responsibility, viewing their purchases as an extension of their personal values. They are highly responsive to certifications such as cruelty-free, vegan, and fair trade, and actively seek products that offer performance comparable to, or superior to, traditional luxury brands.

A second major customer segment includes individuals suffering from sensitive skin, allergies, or chronic scalp conditions (such as dermatitis or psoriasis), who require products free from harsh chemicals, synthetic fragrances, and known irritants like sulfates and parabens. For this group, the primary motivation is therapeutic necessity and avoidance of adverse reactions, making product tolerance and dermatologist recommendations key purchasing criteria. This segment often relies on specialty pharmacies and medical advice for product discovery, focusing heavily on formulations that are hypoallergenic and clinically tested for sensitive use. While they may not be motivated purely by sustainability, the overlap between gentle formulations and organic ingredients often directs their purchase behavior towards certified organic brands.

Furthermore, professional hair salons and eco-conscious spas represent a critical business-to-business (B2B) customer segment. These establishments utilize organic hair care products not only in their service offerings (coloring, treatments) but also for retail sales, benefiting from the premium image and health appeal associated with organic certification. For salons, the use of organic products reduces chemical exposure for both clients and staff, aligning with wellness trends and attracting a higher-end clientele willing to pay a premium for chemical-free treatments. Targeting this professional channel requires different logistical and educational support, focusing on bulk supply, specialized training, and marketing collateral emphasizing the professional efficacy and health benefits of the organic product lines. Expanding market reach into commercial applications remains a vital strategy for long-term growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $15.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Procter & Gamble Co., The Hain Celestial Group, Inc., Estée Lauder Companies Inc., Giovanni Cosmetics, Inc., Herbatint S.p.A., Aubrey Organics, LLC, Oneka Elements, Khadi Natural Healthcare, Avalon Organics, Klorane (Pierre Fabre Dermo-Cosmetique), True Botanicals, Rahua, Carol's Daughter, John Masters Organics, Pura D'or, Yarok Hair Care, Intelligent Nutrients, Acure Organics, Innersense Organic Beauty |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Hair Care Products Market Key Technology Landscape

The technological landscape of the Organic Hair Care Products Market is defined by innovation primarily focused on optimizing ingredient extraction, enhancing formulation stability, and improving sustainable packaging solutions, rather than traditional chemical synthesis. Advanced extraction techniques, such as Supercritical Fluid Extraction (SFE) using CO2, are critical for obtaining pure, potent botanical extracts without using harsh chemical solvents. This technology preserves the thermosensitive compounds, ensuring the active ingredients maintain maximum efficacy in the final product. Furthermore, microencapsulation technology is increasingly employed to protect sensitive organic compounds (like vitamins and antioxidants) from degradation due to light or oxidation, thereby extending product shelf life and ensuring sustained release upon application, addressing a long-standing weakness of purely natural formulations.

In terms of formulation science, significant technological strides are being made in developing highly effective natural preservation systems. Companies are utilizing synergistic blends of organic acids, essential oils, and bio-fermented ingredients to replace parabens and formaldehyde-releasing agents, requiring specialized laboratory testing and compatibility studies. Research into the hair and scalp microbiome is also driving new product development, leveraging biotechnology to incorporate prebiotics and postbiotics derived from organic sources. These ingredients are designed to support a balanced scalp ecosystem, promoting natural hair health and reducing reliance on harsh treatments. This scientific focus moves the market beyond simply ‘natural’ ingredients to evidence-based organic bio-actives.

Sustainability and consumer experience are also major technological focus areas. Digital platforms incorporating AI are being developed to streamline the organic certification process and track the carbon footprint of individual products, enhancing transparency for consumers. Furthermore, manufacturing automation is being adapted to handle the unique physical properties of natural ingredients, ensuring batch consistency without compromising organic standards. Packaging technology is moving toward bio-based polymers, compostable materials, and innovative refill systems, demanding collaboration with specialized packaging suppliers to integrate these sustainable options without escalating costs prohibitively, maintaining the premium positioning of the organic product while reducing environmental impact.

Regional Highlights

- North America: This region holds a substantial market share, driven by high consumer spending on premium and certified organic products, particularly in the United States and Canada. The market is mature, characterized by high awareness regarding product ingredients and strong regulatory support for organic labeling (e.g., USDA Organic). E-commerce penetration is high, facilitating rapid growth for niche, digitally native brands. Demand is particularly strong for specialized products targeting clean scalp health and environmentally friendly packaging, positioning North America as a hub for organic hair care innovation and trend-setting.

- Europe: Europe represents a highly influential market, spearheaded by Germany, the UK, and France. The region is governed by rigorous organic standards (Ecocert, COSMOS) which ensure high product integrity and consumer trust. European consumers are deeply committed to sustainability, driving demand for locally sourced ingredients and products with minimal carbon footprints. The professional segment (salons) shows strong adoption of organic coloring and treatment lines, further solidifying the region's premium status and consistent market growth.

- Asia Pacific (APAC): APAC is the fastest-growing regional market, propelled by rapidly increasing middle-class populations in China, India, and South Korea, coupled with growing awareness of clean beauty principles. While traditional herbal remedies have always been popular, there is a modern convergence with Western organic certification standards. The region presents significant growth opportunities due to its large population base, increasing preference for premium imported brands, and localized development of organic formulations utilizing regional botanical resources.

- Latin America (LATAM): The LATAM market is characterized by emerging growth, with Brazil and Mexico being the key contributors. Market expansion is driven by a growing focus on natural ingredients and hair treatment services. While cost sensitivity remains a factor, the demand for high-quality, exotic ingredient-based organic products is rising, particularly among affluent urban consumers. Challenges include complex import regulations and establishing robust local organic certification infrastructure.

- Middle East and Africa (MEA): This region is experiencing slow but steady growth, heavily reliant on imported premium organic brands, primarily satisfying demand in the UAE and Saudi Arabia. Market growth is stimulated by health tourism and high disposable incomes. There is a specific demand for Halal-certified organic products. Local manufacturing is underdeveloped but poised for expansion, focusing on leveraging indigenous resources like argan oil and shea butter within certified organic frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Hair Care Products Market.- L'Oréal S.A.

- Procter & Gamble Co.

- The Hain Celestial Group, Inc.

- Estée Lauder Companies Inc.

- Giovanni Cosmetics, Inc.

- Herbatint S.p.A.

- Aubrey Organics, LLC

- Oneka Elements

- Khadi Natural Healthcare

- Avalon Organics

- Klorane (Pierre Fabre Dermo-Cosmetique)

- True Botanicals

- Rahua

- Carol's Daughter

- John Masters Organics

- Pura D'or

- Yarok Hair Care

- Intelligent Nutrients

- Acure Organics

- Innersense Organic Beauty

Frequently Asked Questions

Analyze common user questions about the Organic Hair Care Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary certifications validating a product as organic hair care?

The primary certifications ensuring a hair care product meets organic standards include USDA Organic (United States), Ecocert (Europe), and the COSMOS standard (global). These certifications strictly regulate ingredient sourcing, processing methods, and the minimum percentage of organic content required in the final formulation, verifying the product's claims against greenwashing.

How does the shelf life of organic hair care products compare to conventional products?

Organic hair care products typically possess a shorter shelf life than conventional counterparts due to the absence of synthetic preservatives like parabens. Manufacturers overcome this constraint using natural preservation systems (e.g., organic acids, plant extracts) and specialized packaging technology, often resulting in a product stability window of 6 to 12 months after opening.

Which segments are currently driving the most revenue growth in the organic hair care market?

The core segments driving revenue are organic shampoos and conditioners, due to their essential daily use. However, the highest growth rates (CAGR) are observed in specialized organic treatment products, such as hair masks, scalp serums, and chemical-free hair colorants, reflecting consumer willingness to invest in targeted wellness solutions.

What are the biggest challenges faced by manufacturers in the organic hair care supply chain?

Manufacturers face significant challenges including the high cost and volatility of certified organic raw materials, the complexity of maintaining formulation stability using natural preservatives, and the constant need to combat 'greenwashing' claims from competitors to protect the integrity of true organic certification and consumer trust.

Which geographical region is expected to exhibit the fastest growth rate for organic hair care products?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This acceleration is attributed to rising disposable incomes, rapid consumer adoption of global clean beauty trends, increasing awareness of chemical safety, and expanding distribution channels, particularly in emerging markets like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager