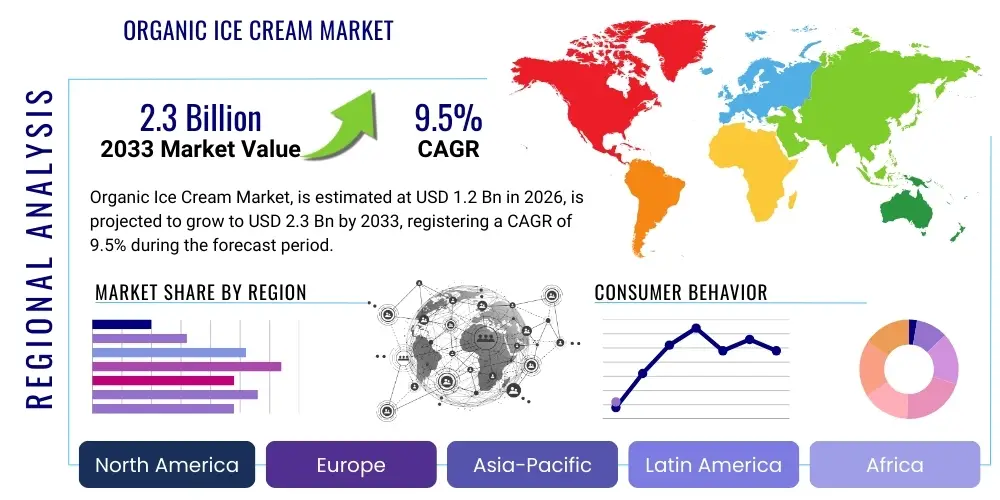

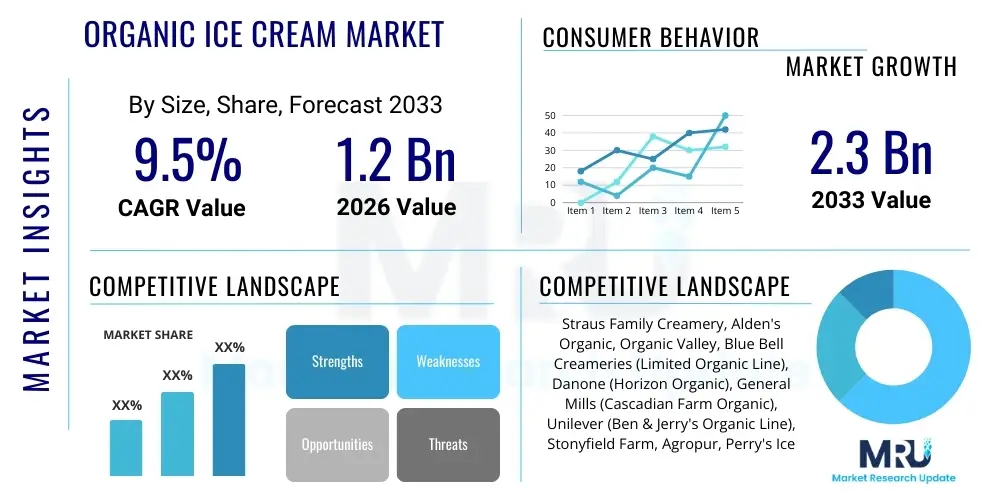

Organic Ice Cream Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434927 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Organic Ice Cream Market Size

The Organic Ice Cream Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

Organic Ice Cream Market introduction

The Organic Ice Cream Market encompasses the production, distribution, and consumption of frozen desserts made using ingredients sourced through certified organic farming practices. This designation ensures that the raw materials, primarily dairy components, sweeteners, and flavorings, are cultivated without synthetic pesticides, herbicides, GMOs, or artificial growth hormones. The premium positioning of organic ice cream is fundamentally driven by a shifting consumer preference toward cleaner label products, perceived nutritional superiority, and ethical sourcing, aligning with broader sustainability and health trends observed across the global food and beverage industry.

Key applications of organic ice cream extend beyond traditional dessert consumption to include specialized dietary products, such as lactose-free or plant-based organic formulations targeting specific allergies or lifestyle choices. The product description emphasizes transparency and minimal processing, often resulting in shorter ingredient lists that resonate deeply with consumers seeking natural food options. Major benefits driving market traction include avoidance of synthetic additives, supporting environmentally responsible agriculture, and capitalizing on the perception that organic dairy offers higher levels of beneficial nutrients, such as Omega-3 fatty acids, compared to conventional counterparts.

The principal driving factors accelerating market expansion involve increasing disposable income in developed economies, enabling consumers to afford premium organic goods, coupled with extensive marketing campaigns highlighting the superior taste and ethical benefits of certified organic production. Furthermore, rigorous governmental standards and certification processes provide consumers with a strong assurance of product quality, further strengthening trust in organic branding. Manufacturers are continually innovating across flavor profiles and base ingredients, utilizing unique combinations of organic fruits, spices, and non-dairy alternatives to capture diverse consumer segments, ensuring dynamic growth within this high-value category.

Organic Ice Cream Market Executive Summary

The Organic Ice Cream Market is characterized by robust business trends centered on strategic acquisitions, capacity expansion in manufacturing, and aggressive portfolio diversification by multinational food conglomerates aiming to capture the lucrative health and wellness segment. A notable trend is the integration of blockchain technology and advanced supply chain traceability systems to authenticate organic status from farm to shelf, responding directly to consumer demand for ingredient transparency and verifiable sourcing. Competitive strategies are increasingly focusing on sustainable packaging solutions, such as biodegradable materials, which further enhances the ethical appeal of organic brands and differentiates them within the crowded frozen dessert sector.

Regionally, North America and Europe remain the undisputed leaders in both consumption and production, driven by established organic certification infrastructure, high consumer awareness regarding health and environmental issues, and strong retail penetration of organic specialty stores and mainstream supermarkets. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, spurred by rising urbanization, increasing affluence among the middle class, and the rapid westernization of dietary habits, particularly in China and India. This regional transition necessitates localized flavor innovation and adaptations in distribution logistics to accommodate varied climate and retail formats.

Segment trends highlight a significant pivot away from traditional dairy-based organic ice cream towards innovative plant-based organic alternatives, utilizing bases like oat milk, coconut milk, and almond milk. This shift is primarily fueled by the growing vegan and flexitarian populations, coupled with increasing concerns about lactose intolerance and dairy sustainability. Furthermore, the single-serving format is gaining popularity due to its convenience and portion control benefits, especially among younger, urban consumers. Premium organic indulgent flavors continue to dominate the flavor segment, but smaller, local manufacturers are successfully leveraging unique, regionally-inspired organic ingredients to disrupt established market share.

AI Impact Analysis on Organic Ice Cream Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Organic Ice Cream Market frequently revolve around three core themes: enhancing supply chain integrity and efficiency, optimizing flavor development and personalization, and ensuring rigorous quality control and certification compliance. Consumers and industry stakeholders are highly interested in how AI can verify the organic status of raw materials instantaneously, minimizing fraud and safeguarding brand authenticity, which is critical given the premium pricing of organic products. There is also a strong expectation that AI tools, particularly machine learning algorithms, will be utilized to predict subtle shifts in consumer preferences, enabling manufacturers to launch trending flavors with precision and minimized time-to-market.

Operational concerns often center on leveraging AI for predictive maintenance of highly specialized organic processing equipment and managing the volatile supply chain of seasonal organic ingredients. For instance, questions often arise about using AI to forecast the optimal harvest time for organic berries or cocoa based on climate data and historical yield, thereby ensuring consistent quality and reduced waste. Furthermore, AI's role in optimizing cold chain logistics is a major area of interest, as maintaining the thermal integrity of organic ice cream is paramount to quality and shelf life, minimizing spoilage and maximizing freshness upon delivery to the end consumer.

In essence, the prevailing user sentiment suggests that AI’s primary contribution to the organic ice cream sector will be twofold: achieving operational efficiencies necessary to mitigate the high input costs associated with organic production, and simultaneously enhancing the personalization and transparency aspects that consumers value most in premium food products. AI is anticipated to bridge the gap between sustainable, high-cost production methods and consumer expectations for consistency, quality, and ethical verification throughout the entire product lifecycle.

- AI-driven predictive demand forecasting optimizing organic ingredient sourcing and minimizing perishable stock waste.

- Machine Learning algorithms analyzing vast consumer feedback and social media data for hyper-personalized flavor creation and successful product launch probability assessment.

- Implementation of AI vision systems for enhanced real-time quality control, ensuring strict adherence to organic material handling and contamination prevention standards.

- Optimization of cold chain logistics and temperature monitoring using AI to predict and prevent thermal deviations that compromise product integrity.

- Blockchain integration supported by AI for automated, immutable recording of organic certification data across the entire value chain, boosting transparency.

- AI-based yield prediction models assisting organic farmers in optimizing resource use, improving sustainability, and securing stable input supply for manufacturers.

DRO & Impact Forces Of Organic Ice Cream Market

The Organic Ice Cream Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively define its growth trajectory and competitive landscape. The primary drivers are rooted in the global rise of health and wellness consciousness, where consumers actively seek clean-label foods perceived as superior in nutrition and free from synthetic chemicals. This is strongly supported by the increasing global emphasis on environmental sustainability, driving demand for products that support responsible farming practices and biodiversity. These drivers create a compelling force toward premiumization, allowing brands to justify higher price points based on ethical and quality assurances.

Conversely, significant restraints hinder more rapid market penetration. Chief among these is the inherently high cost of production associated with certified organic farming, stringent regulatory compliance, and often lower yields compared to conventional farming. This translates directly into higher retail prices, making organic ice cream a discretionary luxury item inaccessible to lower-income segments, thus limiting the total addressable market. Furthermore, the delicate nature of organic ingredients and the absence of certain synthetic stabilizers often lead to shorter shelf lives and complex cold chain management requirements, increasing operational expenditure and risk of spoilage.

Despite these challenges, substantial opportunities exist, particularly in the rapid expansion of the plant-based organic segment, targeting consumers with dietary restrictions or ethical objections to dairy. Emerging markets in APAC and Latin America represent vast, untapped potential as affluence grows and globalized media increases awareness of organic benefits. Innovation in functional organic ice creams, incorporating organic prebiotics, probiotics, or specialized superfoods, offers manufacturers a pathway to further differentiate their products and solidify their position within the premium functional food ecosystem. Successfully navigating the high-cost restraint through supply chain efficiencies and strategic technological investments will be critical to capitalizing on these opportunities.

Segmentation Analysis

Segmentation analysis provides a critical framework for understanding the diverse consumer landscape and operational dynamics within the Organic Ice Cream Market, enabling manufacturers to tailor products and distribution strategies effectively. The market is fundamentally segmented across various dimensions including Flavor Type, Form (Tubs vs. Novelties), Distribution Channel, and crucially, Base Ingredient (Dairy vs. Non-Dairy). Understanding which flavors appeal to specific demographics and which base ingredients are trending geographically allows companies to focus Research and Development (R&D) efforts and resource allocation precisely. For instance, the segmentation by Base Ingredient is currently the most disruptive area, reflecting the broader dietary shifts towards veganism and flexitarianism, demanding rapid innovation in non-dairy organic formulations that mimic the texture and richness of traditional dairy.

Segmentation by Distribution Channel is paramount, differentiating between sales through supermarkets/hypermarkets, which dominate volume sales, and specialty retail stores/online platforms, which cater to the premium, niche organic buyer. Effective segmentation dictates the appropriate pricing strategy and promotional activities, distinguishing between impulse purchases (novelties) and planned household consumption (tubs). The geographical segmentation also plays a crucial role, as consumer preferences for sweetening agents and preferred fat content vary significantly across North America, Europe, and Asia, necessitating regional formulation adjustments to ensure market acceptance and regulatory compliance.

This granular approach ensures that marketing spend is optimized, targeting the high-value consumer profiles that prioritize organic certification and are willing to pay the associated premium. Analyzing the intersection of segments, such as organic, plant-based, novelty ice cream, identifies high-growth niches. Continuous monitoring of these segmented trends provides proactive market intelligence necessary to sustain competitive advantage, especially against mainstream competitors entering the organic space through brand extensions or aggressive pricing strategies.

- By Base Ingredient:

- Organic Dairy Ice Cream (e.g., Cow Milk, Goat Milk)

- Organic Non-Dairy Ice Cream (e.g., Oat Milk, Almond Milk, Coconut Milk, Cashew Milk)

- By Flavor:

- Chocolate

- Vanilla

- Strawberry

- Coffee/Mocha

- Fruity Flavors (Non-Berry)

- Custom/Gourmet Flavors

- By Form:

- Tubs/Take-Home Containers (Pints, Quarts, Gallons)

- Novelties (Sticks, Bars, Sandwiches, Cones)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores (Organic & Natural Food Stores)

- Online Retail

- Food Service (Cafés, Restaurants)

- By Sweetener Type:

- Organic Cane Sugar

- Organic Agave

- Organic Fruit Juices/Syrups

Value Chain Analysis For Organic Ice Cream Market

The value chain for the Organic Ice Cream Market is significantly more complex and constrained than that of conventional ice cream, primarily due to the stringent requirements for certified organic sourcing and processing. The upstream segment involves meticulous selection and sourcing of certified organic raw materials, including organic dairy farms, organic sweetener suppliers, and organic flavor extract producers. This phase is characterized by high operational costs and dependency on weather patterns and seasonal yields, necessitating strong, long-term contractual relationships with certified organic farmers to ensure a stable supply of high-quality milk or plant base, which forms the foundation of the final product. Suppliers must adhere to strict regulatory compliance, often requiring advanced traceability systems to verify the organic status of inputs.

The midstream phase—manufacturing and processing—involves receiving, processing, pasteurizing, blending, freezing, and packaging the organic ice cream. Certification bodies play a crucial role here, auditing manufacturing practices to prevent cross-contamination with non-organic ingredients, requiring dedicated equipment or rigorous cleaning protocols. The formulation stage requires substituting synthetic stabilizers and emulsifiers, which are often prohibited in organic standards, with organic alternatives, demanding specific R&D expertise. This stage is highly capital intensive, focusing heavily on hygiene and maintaining the cold chain from the moment the product is frozen, a critical step to preserve quality and texture without chemical stabilizers.

Downstream analysis focuses on distribution and sales. The distribution channel is bifurcated into direct sales (e.g., through company-owned stores or dedicated online platforms) and indirect sales (e.g., via third-party cold chain logistics providers to retailers). Indirect distribution, particularly through large supermarket chains and specialty organic food retailers, accounts for the largest volume. The effectiveness of the cold chain logistics is the single most critical factor in the downstream operation, as any break in temperature control invalidates the product. Marketing and branding are also integral downstream activities, emphasizing the ethical sourcing, clean label, and premium nature of the product to justify the higher price point to the end consumer.

Organic Ice Cream Market Potential Customers

The primary segment of potential customers for the Organic Ice Cream Market comprises health-conscious Millennials and Gen Z individuals residing in urban and suburban areas with above-average disposable income. These end-users are not only seeking indulgent desserts but are actively prioritizing nutritional content, demanding products free from artificial additives, hormones, and genetically modified organisms (GMOs). This demographic is highly informed, utilizing social media and digital platforms to research brand authenticity and ethical sourcing practices, making transparency a crucial factor in their purchasing decision. They are often willing to pay a significant premium for products that align with their personal values regarding health and environmental stewardship.

A secondary, rapidly growing customer segment includes individuals managing specific dietary restrictions, particularly those with lactose intolerance or those adhering to vegan or vegetarian lifestyles. The increasing availability and quality of organic, plant-based ice creams have successfully captured this buyer group, who view the organic certification as an additional layer of assurance regarding the purity of non-dairy base ingredients. Furthermore, parents of young children represent a significant consumer base, seeking organic alternatives to minimize their children's exposure to pesticides and artificial colors, viewing organic ice cream as a safer, premium treat option.

Finally, institutional buyers and food service establishments focusing on high-end or specialized menus—such as gourmet restaurants, health spas, and upscale catering services—constitute significant bulk purchasers. These buyers use organic ice cream to enhance their premium offerings and meet the demands of their affluent clientele who expect high-quality, ethically sourced ingredients in all menu items. The purchasing criteria for this segment focus intensely on consistent supply, bulk pricing flexibility, and detailed organic certification credentials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Straus Family Creamery, Alden's Organic, Organic Valley, Blue Bell Creameries (Limited Organic Line), Danone (Horizon Organic), General Mills (Cascadian Farm Organic), Unilever (Ben & Jerry's Organic Line), Stonyfield Farm, Agropur, Perry's Ice Cream, Whole Foods Market (365 Organic), Haagen-Dazs (Organic Line), Trader Joe's (Organic Private Label), Luna and Larry's Coconut Bliss, Van Leeuwen Ice Cream. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Ice Cream Market Key Technology Landscape

The technological landscape in the Organic Ice Cream Market is focused less on radical process invention and more on leveraging existing technologies to meet the stringent quality, traceability, and sustainability demands inherent in organic production. Advanced High-Temperature Short-Time (HTST) pasteurization and Ultra-High-Temperature (UHT) sterilization techniques are critical for processing organic dairy and non-dairy bases, ensuring microbial safety while minimizing thermal damage to the delicate natural flavor profile, which is crucial given the limitations on chemical additives. Furthermore, continuous flow freezers and specialized blending equipment are utilized to optimize the incorporation of organic ingredients and achieve the smooth, high overrun texture desired by consumers, often employing sophisticated monitoring systems to maintain consistency batch-to-batch.

Traceability technologies, particularly the application of blockchain, are becoming paramount. Since consumers pay a premium specifically for certified organic status, manufacturers are implementing digital ledger technology to record every transaction and transformation step—from the organic farm’s harvest date and certification number to the final packaging date and distribution route. This provides immutable proof of origin and prevents fraudulent labeling, thereby protecting brand integrity and complying with international organic standards. Coupled with this is the use of Internet of Things (IoT) sensors throughout the cold chain, offering real-time data on temperature, humidity, and location, allowing for immediate corrective action should storage conditions threaten the highly perishable organic product.

Beyond processing and traceability, sustainable packaging technology is a major area of investment. Companies are shifting towards plant-based plastics, recyclable cardboard, and compostable liners to reduce the environmental footprint, aligning with the core ethical principles of organic consumers. Additionally, formulation science employs analytical technologies such as mass spectrometry and high-performance liquid chromatography to verify the absence of pesticide residues and synthetic ingredients, reinforcing the clean-label promise. The strategic integration of these technologies allows organic ice cream producers to maintain high quality, assure regulatory compliance, and operate efficiently despite the high operational constraints.

Regional Highlights

North America, particularly the United States, represents the largest and most mature market for organic ice cream globally. This dominance is attributed to high consumer awareness regarding organic food benefits, established and trusted organic certification bodies (like the USDA Organic seal), high disposable incomes, and the widespread availability of specialized organic retailers. The region also acts as a primary innovation hub, pioneering new plant-based organic formulations and single-serve novelty formats.

Europe is the second-largest market, characterized by stringent regulatory environments and strong consumer loyalty to local organic brands. Countries such as Germany, the UK, and France exhibit high per capita consumption, driven by governmental policies favoring sustainable agriculture and a deep cultural appreciation for quality dairy products. The European market sees robust demand for organic, low-sugar, and specific allergen-free options.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. Market expansion is fueled by the burgeoning middle-class population in countries like China and India, increased access to modern retail channels, and a growing willingness to pay a premium for imported or internationally recognized organic brands. Although the infrastructure for organic sourcing is still developing, the demand is outpacing local supply, presenting significant export opportunities for established Western organic brands.

- North America: Market leader; driven by high consumer spending, strong organic infrastructure, and demand for non-dairy organic varieties. Key countries include the United States and Canada.

- Europe: Mature market with high penetration; characterized by strict quality standards and focus on sustainable, locally sourced organic inputs. Key countries are Germany, the UK, France, and Italy.

- Asia Pacific (APAC): Highest growth potential; rapid urbanization and increasing income levels are driving demand for premium imported organic desserts. Key emerging markets include China, India, Japan, and Australia.

- Latin America (LATAM): Emerging demand concentrated in major metropolitan areas; growth linked to expanding retail footprint and growing interest in wellness, though pricing remains a significant barrier. Key markets are Brazil and Mexico.

- Middle East & Africa (MEA): Niche market with high growth in urban centers of the GCC countries, primarily driven by luxury food imports and expatriate consumption. Local organic production is nascent but growing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Ice Cream Market.- Straus Family Creamery

- Alden's Organic

- Organic Valley

- Blue Bell Creameries (Select Organic Offerings)

- Danone (Through Horizon Organic Brand)

- General Mills (Through Cascadian Farm Organic)

- Unilever (Specific Ben & Jerry's Organic Lines)

- Stonyfield Farm (Lactalis)

- Agropur

- Perry's Ice Cream

- Whole Foods Market (365 Organic Private Label)

- Trader Joe's (Organic Private Label)

- Luna and Larry's Coconut Bliss

- Van Leeuwen Ice Cream

- Crave Brothers Farmstead Cheese (Potential Organic Entry)

- Tillamook County Creamery Association (Developing Organic Lines)

- Ample Hills Creamery (Focus on Natural Ingredients)

- Three Twins Ice Cream

- Grom (Unilever subsidiary with strong natural focus)

- Clover Stornetta Farms

Frequently Asked Questions

Analyze common user questions about the Organic Ice Cream market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between organic and conventional ice cream?

The primary difference lies in the sourcing and processing of ingredients. Organic ice cream is made exclusively from ingredients certified to be grown without synthetic pesticides, herbicides, GMOs, or artificial hormones, ensuring a cleaner product label and supporting sustainable farming practices. Conventional ice cream lacks these stringent requirements, often utilizing synthetic additives for stability and cost efficiency.

Why is organic ice cream typically more expensive than standard ice cream?

Organic ice cream is more expensive due to the higher operational costs associated with organic farming. These costs stem from lower yields, rigorous certification processes, more complex storage requirements, and the need to use premium, natural stabilizers instead of cheaper synthetic alternatives, all of which contribute to a higher final retail price.

Which region currently dominates the global Organic Ice Cream Market?

North America, specifically the United States, currently dominates the global Organic Ice Cream Market in terms of market value and consumption. This is driven by high consumer awareness, established organic retail networks, and significant consumer spending power allocated toward health and wellness products.

Are non-dairy options significant drivers of the Organic Ice Cream Market growth?

Yes, non-dairy organic options are highly significant drivers, exhibiting the fastest growth rates within the segment. The surge is fueled by the rising population of vegans, flexitarians, and individuals with lactose intolerance who seek ethically sourced, certified pure alternatives to traditional dairy-based frozen desserts.

How do manufacturers ensure the integrity and traceability of organic ingredients?

Manufacturers ensure integrity through mandatory third-party certification audits, often leveraging advanced supply chain technologies like blockchain and IoT sensors. These technologies provide immutable digital records documenting the organic status of ingredients from the farm to the processing facility, guaranteeing transparency and authenticity to the consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager