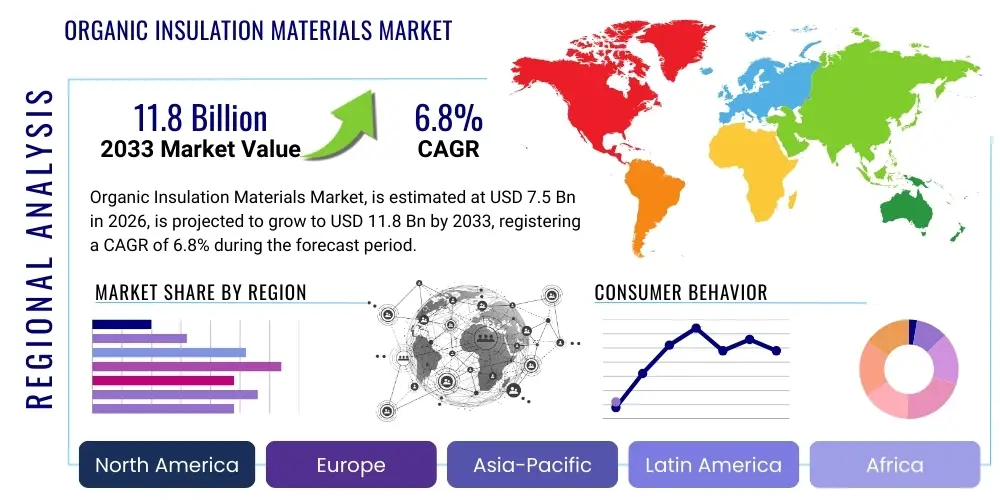

Organic Insulation Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438873 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Organic Insulation Materials Market Size

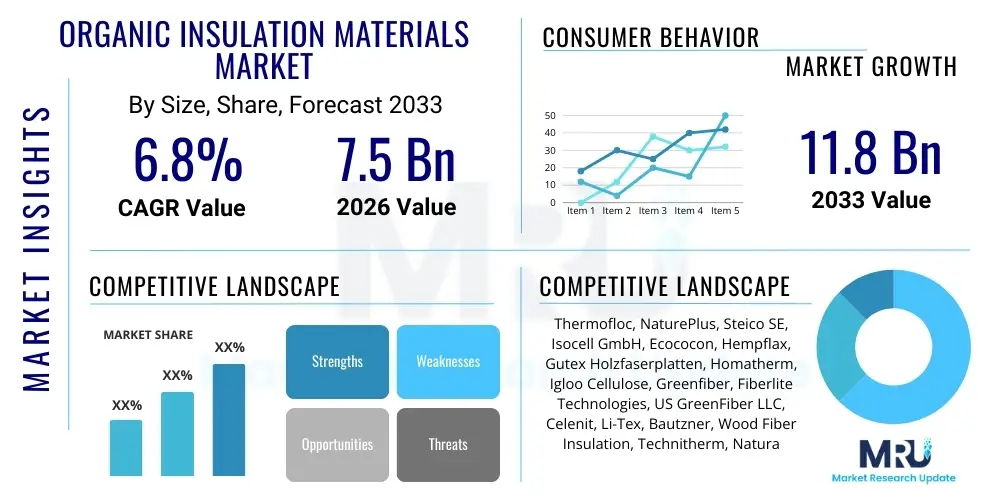

The Organic Insulation Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.8 Billion by the end of the forecast period in 2033.

Organic Insulation Materials Market introduction

The Organic Insulation Materials Market encompasses thermal and acoustic materials derived from natural, renewable resources, primarily plant-based fibers such as cellulose, wood fiber, hemp, cork, and cotton, or animal-based materials like sheep's wool. These materials are utilized extensively in the construction sector to improve energy efficiency in residential, commercial, and industrial buildings. The growing global emphasis on sustainable building practices, reducing carbon footprints, and improving indoor air quality is the foundational driver for this market. Unlike traditional synthetic insulation, organic options often possess superior breathability, moisture regulation capabilities, and significantly lower embodied energy, aligning perfectly with green building certifications like LEED and BREEAM. The market is characterized by ongoing innovation focused on enhancing fire resistance and achieving competitive R-values compared to conventional mineral wool or foam products, making them increasingly viable for both new construction and deep energy retrofitting projects across diverse climatic zones globally.

Major applications of organic insulation materials span various components of the building envelope, including external walls, internal partitions, roofs, floors, and attics. For instance, cellulose insulation, derived from recycled paper, is widely used in blown-in applications for tight, irregular spaces, offering excellent thermal performance and sound dampening. Wood fiber boards are crucial for exterior wall systems, providing robust structural integrity along with high thermal mass, which helps stabilize indoor temperatures and reduce peak heating and cooling loads. The inherent benefits of these materials, such as non-toxicity, biodegradability, and the ability to sequester carbon during their growth phase, contribute significantly to the overall sustainability profile of modern construction projects, directly addressing consumer demands for healthier living environments and governmental mandates aimed at achieving net-zero energy targets in the built environment by the middle of the century.

Key driving factors accelerating market adoption include increasingly stringent energy efficiency regulations implemented by governments worldwide, especially across the European Union and North America, which prioritize low-carbon materials. Furthermore, escalating public awareness regarding the negative health impacts associated with volatile organic compounds (VOCs) released by synthetic construction materials is pushing consumers and architects toward natural alternatives. The continuous development of certification standards and improved installation techniques for materials like hempcrete and cork insulation is also boosting confidence among contractors and developers, solidifying organic insulation's position as a premium, environmentally responsible solution within the high-performance building sector.

Organic Insulation Materials Market Executive Summary

The Organic Insulation Materials Market is experiencing robust expansion driven by global sustainability mandates and significant technological advancements in material processing. Business trends indicate a strong focus on strategic partnerships between raw material suppliers, specialized manufacturing companies, and large construction conglomerates to optimize supply chain efficiency and scale production capacity, particularly for cellulose and wood fiber products which currently dominate the volume share. Capital investments are increasingly directed toward optimizing fire-retardant treatments using non-toxic additives and improving moisture resistance, crucial factors for widespread adoption in commercial and high-rise residential projects. The market structure remains moderately fragmented, but consolidation is expected as major players acquire smaller, niche technology providers to secure proprietary processing techniques and diversify their product portfolios across different organic sources, such as exploring industrial-scale processing of materials like kenaf and straw which offer competitive thermal properties and localized sourcing advantages in agricultural regions.

Regionally, Europe maintains its leadership position, propelled by aggressive decarbonization goals, mature green building frameworks, and consumer willingness to pay a premium for certified eco-friendly materials, with Germany and Scandinavian countries being primary hubs for wood fiber innovation. Asia Pacific, particularly China and Japan, is emerging as the fastest-growing region, fueled by rapid urbanization coupled with governmental initiatives to shift towards sustainable infrastructure development and reduce reliance on imported fossil fuels. North America is characterized by increasing adoption, particularly in residential renovation sectors, where energy rebate programs and increasing awareness of indoor air quality are stimulating demand for cellulose and cotton insulation. Regional market dynamics are further shaped by the availability of local biomass resources; for example, North America has a strong supply base for recycled paper used in cellulose production, while Europe benefits from extensive managed forest resources supporting wood fiber manufacturing.

Segment trends highlight the dominance of plant-based materials, primarily cellulose, due to its low cost, widespread availability of feedstock (recycled paper), and ease of installation, making it highly competitive in the retrofit market. However, wood fiber insulation is gaining substantial traction, especially in structural and exterior insulation applications where its higher density and thermal mass are valued, demanding a higher average selling price (ASP). The Application segment shows the Residential sector as the primary consumer, driven by immediate homeowner benefits related to energy savings and comfort. Commercial applications are forecast to exhibit the fastest growth rate as large-scale developers increasingly integrate sustainability goals into their project specifications, recognizing the long-term cost benefits and potential for premium valuation associated with certified green buildings, thereby driving demand for high-performance organic insulation solutions that meet rigorous fire safety and structural standards.

AI Impact Analysis on Organic Insulation Materials Market

User inquiries regarding AI's influence on the Organic Insulation Materials Market primarily revolve around three core themes: efficiency in raw material sourcing and quality control, optimization of manufacturing processes to minimize waste and cost, and enhancing predictive modeling for installation and building performance. Users are concerned about how AI can stabilize the fluctuating supply chains of organic feedstock (e.g., consistency of recycled paper or quality of wood chips) and whether machine learning algorithms can rapidly analyze and adjust the composition of natural fire retardants during the production phase to ensure compliance without compromising sustainability targets. Expectations center on AI driving down the premium price point of organic insulation, making it more accessible compared to traditional foam products, by enabling hyper-efficient factory automation and predictive maintenance across production lines, which historically have been complex due to the inherent variability of natural fibers. Furthermore, users anticipate AI-powered Building Information Modeling (BIM) tools to better simulate the long-term moisture behavior and thermal performance of organic materials in diverse climates, mitigating contractor risk and promoting wider acceptance.

The integration of Artificial Intelligence and Machine Learning (ML) is set to revolutionize the supply chain management of organic feedstocks, optimizing logistics from farm or collection center to the manufacturing plant. AI algorithms can analyze satellite imagery and real-time sensor data to predict yields and quality of crops like hemp or cork, enabling manufacturers to secure reliable contracts and minimize waste during initial processing stages. In manufacturing, computer vision systems combined with ML are utilized for real-time quality assurance, instantly detecting impurities or inconsistencies in fiber density and moisture content during the blending and forming stages of products like cellulose or wood fiber boards. This precision significantly reduces production variability, ensuring that the final organic insulation material consistently meets specified R-values and structural integrity requirements, which are essential for gaining regulatory approval and contractor trust in highly performance-driven construction projects.

Beyond manufacturing, AI is crucial in the application phase, particularly through predictive analytics integrated into architectural design software. These advanced tools utilize generative design to optimize the thickness and placement of organic insulation within a building envelope, factoring in regional climate data, building orientation, and specific occupant behavioral patterns, leading to truly optimized energy performance. Furthermore, AI-driven digital twins of buildings allow facility managers to monitor the performance and structural health of organic insulation over its lifecycle, alerting to potential issues like moisture buildup long before physical damage occurs. This capability addresses a significant market restraint related to concerns over the long-term durability and moisture sensitivity of some organic materials, thus increasing confidence in their investment value and accelerating their adoption in high-specification commercial and institutional buildings globally.

- AI-enabled supply chain transparency and optimization for volatile raw material sourcing.

- Machine learning algorithms improve real-time quality control, ensuring consistent fiber density and R-value compliance.

- Predictive maintenance schedules for manufacturing equipment to minimize downtime associated with natural fiber processing.

- Generative design tools optimizing insulation thickness and placement for maximum energy efficiency in BIM models.

- Smart building management systems using AI to monitor installed organic insulation performance and longevity.

DRO & Impact Forces Of Organic Insulation Materials Market

The Organic Insulation Materials Market is profoundly shaped by a confluence of powerful drivers, inherent restraints, and emerging opportunities that collectively determine its trajectory and competitive landscape. The primary driver is the accelerating global transition towards sustainable construction and net-zero energy buildings, spurred by international climate agreements and increasing regulatory pressure, particularly in developed economies. These regulations necessitate the use of materials with low embodied carbon, high recyclability, and non-toxic compositions, areas where organic insulation naturally excels, directly competing with high-embodied-energy conventional materials. However, the market faces significant headwinds, primarily related to the perception of lower fire resistance compared to inorganic materials, necessitating complex and sometimes costly non-toxic treatment processes, and volatility in the cost and seasonal availability of specific organic feedstocks, such as agricultural byproducts, which affects pricing stability for manufacturers and end-users.

The key restraining force remains the higher initial cost compared to conventional fiberglass and rigid foam insulation, often necessitating incentives or premium market positioning, especially for advanced materials like high-density wood fiberboard or cork. Additionally, despite significant technological improvements, misconceptions persist among a segment of builders and consumers regarding the long-term performance, particularly concerning moisture handling and pest resistance, which requires extensive education and robust third-party certification to overcome. These restraints necessitate substantial R&D investments to ensure organic products achieve competitive metrics, particularly the thermal conductivity (Lambda value), without compromising the material's environmental benefits. Overcoming these entrenched perceptions and cost barriers is paramount for organic materials to move from niche green building segments into mainstream construction.

Opportunities for exponential market growth lie in the massive global potential of building retrofitting and renovation projects, particularly in mature markets like Europe and North America where aging housing stock desperately requires thermal upgrades to meet modern energy standards. Organic insulation materials, especially blow-in cellulose and flexible fiber mats, are highly suitable for retrofitting due spaces, offering minimal disruption and superior acoustic properties. Furthermore, continuous innovation in bio-composite materials, such as the development of structural insulation panels combining organic fibers with bio-resins, presents opportunities to capture market share in high-performance prefabricated construction systems. The increasing focus on circular economy principles also favors organic insulation, as manufacturers explore enhanced end-of-life recycling and reuse strategies, positioning these materials as leaders in the sustainable material economy and further justifying their premium valuation.

Segmentation Analysis

The Organic Insulation Materials Market is intricately segmented based on material source, product type, and application, reflecting the diverse needs of the construction industry and the variety of available natural fibers. Segmentation by Source (Plant-based vs. Animal-based) highlights the dominance of plant materials, driven by scalability, cost-effectiveness, and ease of mass production, primarily through recycled and agricultural waste streams. Segmentation by Type (Cellulose, Wood Fiber, Hemp, Cork, etc.) reflects the chemical composition and processing required, directly correlating with the product's thermal performance (R-value), density, and suitability for different building elements. Finally, the segmentation by Application (Residential, Commercial, Industrial) dictates the required performance specifications, such as fire ratings and structural load-bearing capacity, with residential markets prioritizing ease of installation and cost, while commercial applications demand stringent fire safety and regulatory compliance standards.

The cellulose segment commands the largest share by volume, owing to its highly competitive pricing, extensive distribution network established through the recycling industry, and versatility in application (blown-in or spray-applied). However, the Wood Fiber segment is rapidly gaining ground, particularly in high-performance and premium European markets, valued for its exceptional thermal mass, breathability, and use in integrated external thermal insulation composite systems (ETICS). Hemp and Cork represent important niche markets, offering unique properties—hemp excels in moisture regulation and durability, while cork provides natural resistance to water and pests—making them desirable for specialized high-end projects or regions with indigenous sourcing advantages. These segmentation dynamics reflect a dual market structure: a high-volume, cost-sensitive segment (cellulose) and a high-performance, quality-driven segment (wood fiber, hemp, cork), compelling manufacturers to optimize their product offerings and distribution strategies across this spectrum.

Understanding these segments is crucial for strategic market entry and product development. For instance, manufacturers targeting the burgeoning prefab construction sector must focus on dense, dimensionally stable insulation types like wood fiber boards or compressed agricultural fibers, which integrate seamlessly into modular wall and roof components. Conversely, companies focused on renovation and retrofitting should emphasize flexible, cavity-filling materials like loose-fill cellulose or sheep’s wool. The interplay between source availability, manufacturing complexity, and end-user performance requirements defines the market's competitive landscape, with continuous innovation aimed at elevating the performance characteristics of all organic material types, specifically focusing on non-toxic treatments that improve fire resistance without compromising the material's inherent sustainability profile, thus ensuring competitiveness against synthetic insulation alternatives.

- Source

- Plant-based (Cellulose, Wood Fiber, Hemp, Cork, Cotton, Straw)

- Animal-based (Sheep's Wool)

- Type

- Loose Fill/Blown-in Insulation (Cellulose)

- Batt and Roll Insulation (Cotton, Sheep's Wool)

- Rigid Boards/Panels (Wood Fiber, Cork)

- Structural Insulated Panels (SIPs) Core

- Application

- Residential Construction (New Build and Retrofit)

- Commercial Buildings (Office, Retail, Hospitality)

- Industrial & Institutional (Warehouses, Schools, Hospitals)

Value Chain Analysis For Organic Insulation Materials Market

The value chain for organic insulation materials begins at the upstream stage with the sourcing and collection of renewable feedstocks, such as recycled newspaper (for cellulose), managed forestry wood chips (for wood fiber), or agricultural harvests (hemp, flax). This initial phase is highly sensitive to seasonal variations, commodity market fluctuations, and logistics costs, requiring robust agreements with waste management facilities, farmers, and timber companies. The midstream processing involves specialized, energy-intensive manufacturing steps, including fiber cleaning, defibrillation, blending with non-toxic fire retardants (like borates or ammonium phosphate), and forming the material into final product formats (batts, boards, or loose fill). Efficiency in the midstream is critical, as it directly influences the final R-value, density, and cost-competitiveness of the insulation product against synthetic alternatives, demanding continuous technological investment in proprietary manufacturing processes tailored to the unique characteristics of natural fibers.

The downstream segment encompasses the distribution and sales network, which is often bifurcated into direct sales to large construction firms and indirect sales through specialized builders' merchants and DIY retail channels. Direct distribution is crucial for large commercial projects where technical support, certification documentation, and bulk supply are paramount, often involving partnerships with specialized green building material distributors who possess technical knowledge regarding installation specifications. Indirect channels, particularly lumberyards and home improvement stores, focus more on the residential retrofit and small builder market, requiring extensive training for sales personnel to effectively communicate the long-term benefits and application instructions of organic materials to general contractors and homeowners unfamiliar with their characteristics. The successful navigation of this downstream landscape depends heavily on effective marketing that emphasizes environmental performance, indoor air quality, and adherence to regional building codes, which varies significantly between geographic markets.

The increasing complexity in distribution channels also highlights the importance of certified installers. Since proper installation is essential for achieving the advertised performance metrics of organic insulation (especially for blown-in cellulose and tightly fitted wood fiber systems), manufacturers often implement stringent installer training and certification programs. This focus on skilled application ensures customer satisfaction and mitigates performance failure risks often associated with natural materials, thereby reinforcing trust in the product line. Consequently, the value chain is increasingly integrating digital tools for tracking product provenance (supply chain transparency) and providing technical documentation instantly to installers, solidifying the market’s shift towards high-quality, professional installation rather than simple material supply, differentiating high-quality organic insulation providers from commodity synthetic competitors.

Organic Insulation Materials Market Potential Customers

The primary end-users for Organic Insulation Materials are broadly segmented into three categories: residential builders and homeowners, commercial real estate developers, and governmental/institutional entities focused on public infrastructure. Residential customers represent the largest volume segment, driven by homeowners seeking to improve energy efficiency in existing homes (retrofitting) or new home builders targeting highly efficient, sustainable, and often luxury construction. These customers are highly motivated by the long-term operational cost savings associated with superior thermal performance, the desire for improved indoor air quality (avoiding VOCs), and an emotional preference for using natural, biodegradable materials. Furthermore, the accessibility of materials like blow-in cellulose insulation makes it a popular choice for DIY renovation projects, particularly in attics and wall cavities, leveraging existing distribution channels like large home improvement retailers and local contractors specialized in energy audits and home performance upgrades.

Commercial real estate developers constitute the fastest-growing customer segment, increasingly utilizing organic insulation in high-value projects such as certified green offices, retail spaces, and hospitality complexes. For this segment, the primary motivators are achieving crucial green building certifications (e.g., LEED Platinum, Passive House) which enhance property valuation, marketability, and appeal to environmentally conscious tenants. They often utilize high-density organic panels, such as wood fiber boards, in external wall systems due to their excellent thermal buffer capabilities, acoustic dampening properties, and ability to integrate seamlessly with sophisticated façade designs. Meeting stringent fire safety codes and ensuring structural stability in multi-story buildings is paramount in this sector, requiring organic material manufacturers to provide comprehensive technical data, fire testing reports, and long-term durability warranties to secure large-scale contracts with architecture and engineering firms.

Governmental and institutional buyers, including public housing authorities, educational facilities, and healthcare systems, form a stable customer base motivated by long-term public benefit mandates, sustainability targets, and commitments to reducing the carbon footprint of public assets. These entities often issue tenders that prioritize materials based on life-cycle assessment (LCA) data, local sourcing, and environmental product declarations (EPDs), giving a distinct advantage to manufacturers of organic insulation who can demonstrate verifiable sustainability metrics. Their procurement decisions emphasize durability, minimal maintenance requirements, and alignment with municipal or national decarbonization roadmaps, often leading to large, long-term contracts for high-volume products like cellulose insulation used in massive public building retrofitting initiatives designed to comply with municipal carbon reduction timelines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermofloc, NaturePlus, Steico SE, Isocell GmbH, Ecococon, Hempflax, Gutex Holzfaserplatten, Homatherm, Igloo Cellulose, Greenfiber, Fiberlite Technologies, US GreenFiber LLC, Celenit, Li-Tex, Bautzner, Wood Fiber Insulation, Technitherm, Natural Building Technologies, Havelock Wool, Warmcel |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Insulation Materials Market Key Technology Landscape

The technology landscape for organic insulation materials is dominated by sophisticated processing techniques aimed at enhancing the inherent fire, moisture, and pest resistance of natural fibers while maintaining low embodied energy. A critical area of technological innovation is in the formulation of non-toxic flame retardants. Traditional treatments often involved chemical compounds that contradicted the 'natural' ethos of these materials. Current advancements focus on using mineral-based additives like borates, alumina trihydrate, and bio-based coatings derived from proteins or natural extracts, applied through high-precision spraying or impregnation systems. Furthermore, modern manufacturing facilities utilize highly efficient defibrillation and blending machinery that optimizes fiber geometry and distribution, ensuring a homogenous mix that maximizes air pockets within the insulation structure, which is vital for achieving high thermal resistance (R-value) in final products like cellulose loose fill and wood fiber boards. These technological improvements are essential for meeting the rigorous safety and performance standards demanded by global building codes and fire safety regulations, which are becoming increasingly strict across major construction markets.

Another significant technological focus lies in developing advanced binding agents and production processes for rigid organic panels, such as high-density wood fiber insulation. Innovations here involve using bio-based resins or specialized thermal pressing techniques that activate natural wood lignins, minimizing or eliminating the need for petrochemical binders, thereby preserving the material’s environmental credentials. The manufacturing of compressed straw and hemp panels also utilizes innovative pressurization and moisture control technologies to create load-bearing, dimensionally stable insulation products suitable for modular and prefabricated construction systems, where precision and strength are paramount. These advancements allow organic materials to transition from simple cavity fill applications to integrated structural components, broadening their potential application scope significantly and increasing their economic competitiveness against synthetic panelized systems like expanded polystyrene (EPS) or polyisocyanurate (PIR).

The market is also witnessing the rapid integration of digitalization and automation into manufacturing plants. Continuous flow processing systems, guided by sensors and automated quality control, ensure consistent product output despite the natural variability of raw organic feedstocks. Furthermore, nanotechnology and advanced surface treatments are being explored to imbue natural fibers with enhanced hydrophobicity (water resistance) without impeding the material's natural breathability—a unique selling proposition for organic insulation. These technological investments, while initially high, ultimately lead to reduced production waste, improved consistency, and the ability to produce certified, high-performance insulation products that can confidently compete on technical specifications with traditional insulation types, positioning organic materials as mainstream choices in sustainable and high-efficiency building designs globally.

Regional Highlights

- Europe: Europe, particularly the DACH region (Germany, Austria, Switzerland) and Scandinavia, is the undisputed leader in the Organic Insulation Materials Market, driven by deeply entrenched environmental policies, aggressive energy efficiency mandates (e.g., the Energy Performance of Buildings Directive - EPBD), and a highly mature green building culture. Germany is a global hub for wood fiber insulation technology and production, leveraging its sustainable forestry management. The high cost of energy and robust government incentives for renovation and low-carbon construction (such as tax breaks and grants) strongly favor organic materials, supporting a consumer base willing to invest in premium, natural, high-performance insulation. This region focuses heavily on Passive House standards, where superior breathability and thermal mass properties of wood fiber and hemp are particularly valued, fueling steady demand growth.

- North America (NA): The North American market is characterized by strong growth in the residential retrofit sector, primarily driven by the cost-effectiveness and wide availability of cellulose insulation derived from recycled newspaper, often supported by federal and state energy rebate programs. While the U.S. market is still heavily reliant on conventional insulation, increasing consumer awareness regarding indoor air quality and the rising adoption of green building certifications (e.g., LEED) are accelerating the demand for materials like cotton, recycled denim, and locally sourced cellulose. Canada, with its stringent building codes and extreme temperature variations, shows rising interest in high-density organic panels for superior thermal performance and reduction of thermal bridging in new, energy-efficient housing projects.

- Asia Pacific (APAC): The APAC region represents the fastest-growing market, albeit from a smaller base, primarily due to rapid urbanization, massive infrastructure development, and increasing governmental commitments to sustainability, particularly in China, Japan, and South Korea. While cost sensitivity remains a key factor, Japan’s emphasis on earthquake-resistant and environmentally friendly construction materials, combined with China's push for sustainable urbanization, is stimulating demand. The market here often relies on utilizing abundant local agricultural waste streams (like rice straw and bagasse) for insulation manufacturing, though technological transfer and adaptation of European wood fiber processing standards are crucial for scaling up high-performance product availability across the diverse climatic conditions present throughout the region.

- Latin America (LATAM): The LATAM market is nascent but exhibits high potential, particularly in countries like Brazil and Chile, where sustainable building is slowly gaining traction, often motivated by niche high-end architectural projects and the need for seismic-resistant materials. The market faces challenges related to inconsistent building codes and limited local high-quality production capacity, leading to reliance on imports for specialized materials like cork. However, localized production utilizing agricultural byproducts, especially sugarcane residue, presents a significant growth opportunity if supported by favorable regulatory frameworks and investment in modern processing technologies to ensure product performance meets global standards.

- Middle East and Africa (MEA): The MEA market for organic insulation is still in its infancy, mainly focused on premium projects in the Gulf Cooperation Council (GCC) states targeting international green standards for commercial buildings. The extreme heat necessitates high R-values, traditionally met by thick petrochemical foams. However, the African continent, particularly South Africa and Morocco, is exploring low-cost, locally sourced materials like earth and agricultural fibers for low-income housing and self-built projects, driven by resource scarcity and the need for affordable, climate-appropriate construction solutions, signaling long-term potential for bio-based insulation integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Insulation Materials Market.- Thermofloc

- NaturePlus

- Steico SE

- Isocell GmbH

- Ecococon

- Hempflax

- Gutex Holzfaserplatten

- Homatherm

- Igloo Cellulose

- Greenfiber

- Fiberlite Technologies

- US GreenFiber LLC

- Celenit

- Li-Tex

- Bautzner

- Wood Fiber Insulation

- Technitherm

- Natural Building Technologies

- Havelock Wool

- Warmcel

Frequently Asked Questions

Analyze common user questions about the Organic Insulation Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Organic Insulation Materials Market?

The primary driver is the accelerating global shift towards sustainable construction practices and stringent energy efficiency regulations, particularly in Europe and North America, which prioritize materials with low embodied carbon and non-toxic compositions, favoring organic options like cellulose and wood fiber.

How do organic insulation materials compare to traditional synthetic insulation in terms of performance and cost?

Organic materials often have superior breathability, moisture handling, and acoustic properties, and competitive R-values when installed correctly. However, they typically carry a higher initial price point than commodity synthetic insulation like fiberglass, though this is offset by lower embodied energy and long-term health benefits.

Which type of organic insulation material dominates the market by volume?

Cellulose insulation, derived primarily from recycled paper, dominates the market volume due to its cost-effectiveness, extensive raw material availability, and versatility, making it highly suitable for retrofit and blown-in applications across residential properties globally.

What are the key technological advancements addressing fire safety in organic insulation?

Key advancements focus on the use of non-toxic, mineral-based flame retardants, such as borates or alumina trihydrate, applied through advanced blending processes, ensuring that organic materials meet rigorous safety standards without compromising their environmental profile.

Which geographical region leads the Organic Insulation Materials Market in terms of adoption and innovation?

Europe, specifically the German-speaking countries and Scandinavian nations, leads the market, driven by mature green building regulations (e.g., Passive House standards) and robust governmental support for low-carbon, high-performance construction materials like high-density wood fiber boards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager