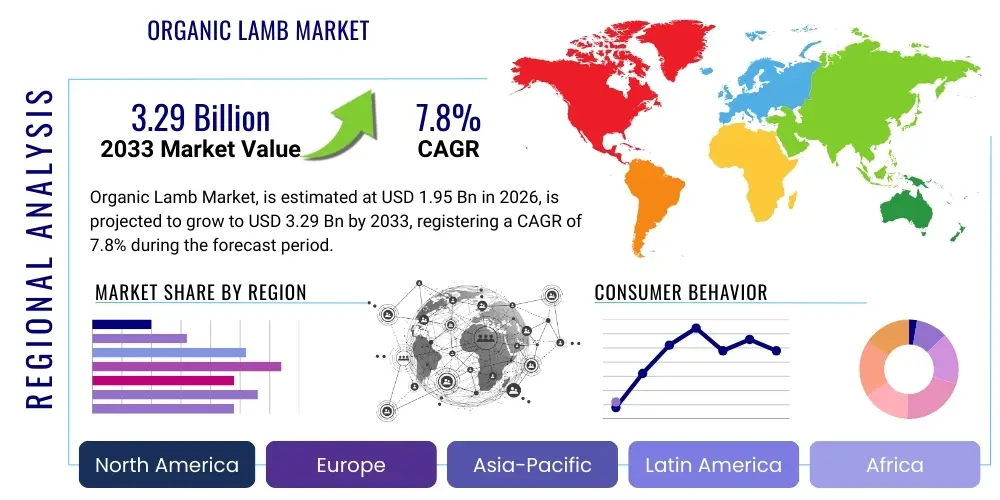

Organic Lamb Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436487 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Organic Lamb Market Size

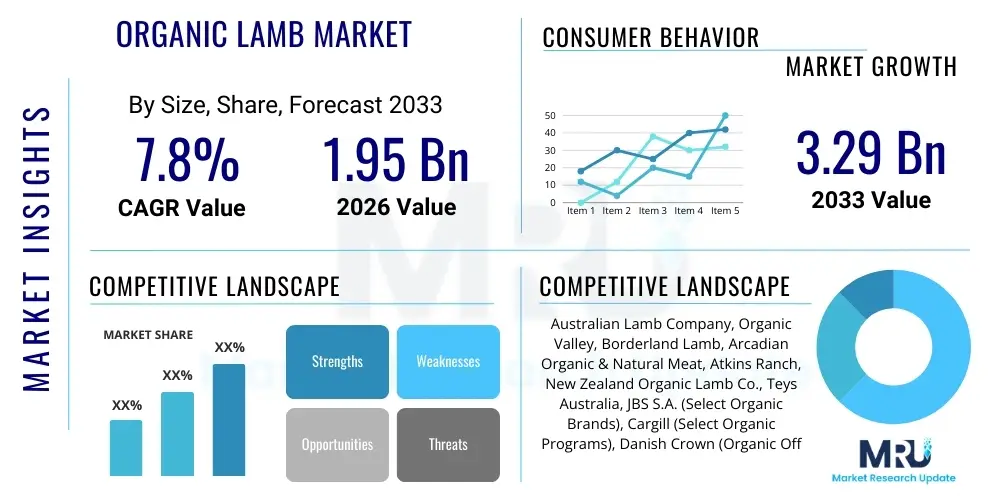

The Organic Lamb Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $3.29 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by a sustained global shift toward health-conscious consumption patterns and increasing consumer preference for ethically sourced, traceable meat products. The premiumization trend associated with certified organic goods, coupled with growing disposable income in developing economies, further cements the robust growth trajectory anticipated for this specialized sector of the meat industry.

Organic Lamb Market introduction

The Organic Lamb Market encompasses the production, processing, distribution, and sale of lamb meat derived from sheep raised according to strict organic farming standards. These standards typically prohibit the use of synthetic pesticides, chemical fertilizers, growth hormones, antibiotics (used routinely for growth promotion), and genetically modified organisms (GMOs) in feed. The primary product description centers on a meat source valued for its perceived superior nutritional profile, absence of chemical residues, and adherence to high animal welfare practices, which resonate strongly with modern ethical consumers. Major applications of organic lamb include high-end culinary preparations in the Horeca sector (hotels, restaurants, catering) and direct household consumption through specialized retail channels.

Key benefits driving the market include enhanced consumer trust due to stringent certification processes, better environmental stewardship achieved through rotational grazing and soil health management, and the perceived health advantages of consuming meat free from artificial inputs. Furthermore, the market benefits from strong governmental support in many regions, particularly Europe and North America, where subsidies and regulations favor organic production. This commitment to sustainable agriculture is a powerful demand generator, appealing especially to millennial and Gen Z consumers who prioritize ecological impact in their purchasing decisions. The limited supply chain complexity compared to mass-produced meat further aids in maintaining high quality and traceability, essential characteristics for the premium organic segment.

The driving factors for market growth are multifaceted, centering on escalating consumer awareness regarding food safety and animal welfare, coupled with rising global income levels that allow for increased expenditure on premium food items. The continuous expansion of organized retail infrastructure, including dedicated organic food aisles and specialized online delivery platforms, significantly improves product accessibility. Additionally, technological advancements in smart farming and precise monitoring of livestock health are subtly enhancing operational efficiencies within the traditionally labor-intensive organic farming sector, making adherence to strict standards more manageable and economically viable for producers.

Organic Lamb Market Executive Summary

The Organic Lamb Market is poised for significant expansion, characterized primarily by robust business trends emphasizing supply chain integrity, high-value premium pricing, and strategic market entry into specialized food service channels. The core business focus revolves around maintaining rigorous certification standards (such as USDA Organic, EU Organic, or equivalent bodies) which serve as the primary competitive differentiator. Challenges persist around managing the higher input costs associated with organic feed and land management, though these are typically mitigated by the substantial price premium consumers are willing to pay for certified products. Strategic partnerships between farmers, processors, and major retailers are essential for ensuring consistent supply and efficient market penetration, moving beyond niche status toward mainstream consumer acceptance.

Regionally, Europe remains the dominant market, driven by historical agricultural practices, mature organic regulatory frameworks, and high consumer participation in organic food purchasing. North America follows closely, demonstrating accelerated growth fueled by demand from affluent consumer bases and aggressive marketing efforts by major food retailers. Emerging regional trends indicate significant potential in the Asia Pacific (APAC), particularly in developed economies like Australia and New Zealand (major exporters) and rapidly urbanizing countries like China, where concerns over food quality are driving interest in imported organic meats. However, developing organic supply chains in APAC face hurdles related to standardization and consumer education regarding complex organic labeling.

Segment trends highlight the dominance of the fresh/chilled segment over frozen products, reflecting consumer preference for minimal processing and perceived higher quality in the premium category. Distribution channel analysis shows significant movement through specialized retail stores and online platforms, leveraging direct consumer engagement and enhanced storytelling capabilities related to the product's origin and ethical standards. Furthermore, the increasing adoption of organic lamb in the food service sector—particularly high-end fine dining—is a crucial growth driver, as chefs seek ingredients that meet both flavor profile and sustainability criteria. The market is also seeing vertical integration attempts, where larger agricultural operations seek to control the entire supply chain, from pasture management to final packaging, optimizing efficiency and certification compliance.

AI Impact Analysis on Organic Lamb Market

Common user questions regarding AI’s influence on the Organic Lamb Market predominantly revolve around improving traceability, optimizing animal welfare without human intervention, and predicting supply chain disruptions to maintain the premium organic integrity. Users are keen to understand how AI can help reduce the typically higher costs associated with organic farming, particularly through precision agriculture techniques tailored to rotational grazing and natural pest management. Key themes include the implementation of image recognition for disease detection, algorithms for optimizing grazing patterns based on soil health and weather data, and the application of machine learning (ML) to process complex certification documentation and audit trails. Consumers are also interested in AI-driven personalization of product offerings and enhanced transparency regarding the lamb’s journey from farm to table, ensuring that the ethical claims are verifiable.

The application of Artificial Intelligence within the Organic Lamb value chain centers heavily on enhancing the efficiency and compliance of farming practices. AI-powered drone surveillance and satellite imagery, for example, can monitor pasture conditions and animal distribution, ensuring rotational grazing is optimized to maintain soil health—a core requirement of organic certification. Machine learning algorithms are instrumental in analyzing data from wearable sensors on livestock, allowing farmers to predict health issues or behavioral changes indicative of stress, enabling proactive intervention without resorting to prohibited prophylactic antibiotics. This precision approach allows organic farmers to adhere more strictly to welfare standards while minimizing operational costs associated with manual monitoring and reactive veterinary care.

Beyond the farm gate, AI is revolutionizing the supply chain and consumer interface. Predictive analytics can forecast demand fluctuations more accurately, minimizing waste of highly perishable fresh organic lamb and optimizing processing schedules. Furthermore, AI-driven natural language processing (NLP) tools are increasingly used to sift through and verify complex third-party certifications and audit data, streamlining the compliance process and enhancing trust. For consumers, AI facilitates better personalized marketing by analyzing purchase habits and preferences for specific cuts or ethical attributes, ensuring that the premium price point is justified by a highly tailored shopping experience and transparent documentation accessible via blockchain-linked smart labels.

- AI optimizes precision grazing patterns using satellite data, ensuring optimal soil health and organic compliance.

- Machine Learning algorithms predict livestock health issues (e.g., disease, stress) based on biometric data, reducing reliance on conventional medical interventions.

- AI-driven supply chain analytics improve demand forecasting and reduce spoilage rates for high-value organic fresh meat.

- Automated image recognition systems monitor animal welfare standards, verifying compliance with free-range and ethical farming requirements.

- NLP tools streamline the complex paperwork and auditing required for organic certification, enhancing efficiency and traceability documentation.

DRO & Impact Forces Of Organic Lamb Market

The Organic Lamb Market is influenced by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), creating distinct Impact Forces. Key drivers include rising consumer income, increasing awareness of the environmental and health benefits of organic consumption, and the strong governmental regulatory support for sustainable farming in developed economies. Conversely, the market faces significant restraints, primarily revolving around the high cost of organic certification and associated input materials (especially feed), the relatively lower yields compared to conventional farming, and the fragmentation of the organic supply chain which limits scale and consistency. These restraints contribute to the substantial price differential that can deter price-sensitive consumers.

Opportunities for market growth are centered on technological advancements, particularly in smart farming and supply chain traceability (e.g., blockchain), which promise to lower production costs and increase consumer trust in ethical claims. Moreover, market penetration into new geographical areas, especially in rapidly growing urban centers across Asia Pacific and parts of the Middle East, represents a vast potential for market expansion. Developing new product lines, such as ready-to-eat organic lamb meals or specialized cuts targeting specific dietary trends (like Paleo or Ketogenic diets), also presents viable avenues for revenue diversification and market saturation within existing consumer segments. The emphasis on sustainability is an enduring opportunity, positioning organic lamb favorably against less ethical protein sources.

The primary impact force shaping this market is the synergistic push toward health and sustainability, elevating organic lamb from a niche product to a mainstream premium commodity. This force places intense pressure on conventional producers to justify their practices while rewarding organic producers with loyalty and higher margins. However, the counteracting force of supply chain elasticity—the difficulty in rapidly scaling organic production due to land conversion requirements and certification timelines—creates a persistent tension between high demand and constrained supply. Navigating this constraint, potentially through efficient resource utilization and governmental subsidies, will be critical for sustained long-term growth and stability in the price structure.

Segmentation Analysis

The Organic Lamb Market segmentation provides critical insights into consumer preferences, purchasing behaviors, and distribution dynamics, allowing stakeholders to tailor their product and marketing strategies effectively. The market is primarily segmented based on the product form (fresh/chilled versus frozen), the specific application (household versus food service), and the primary distribution channel utilized. Analyzing these segments helps in understanding which product formats command the highest premium and where the strongest growth opportunities reside globally. The fresh/chilled segment generally dominates due to its association with higher quality and readiness for immediate preparation, reflecting the consumer preference for minimal preservation techniques in organic products.

Segmentation by application reveals a dual-market structure: the household segment, driven by grocery retail and direct-to-consumer sales, focuses heavily on smaller, portion-controlled packaging suitable for family meals; conversely, the food service segment (Horeca) requires bulk supply, consistency, and specific quality cuts tailored for high-volume culinary operations. The Horeca sector is often viewed as a key influencer, as high-profile usage of organic lamb can enhance its reputation among household consumers. Furthermore, understanding the regional variations in how these segments perform—such as the dominance of high-street butchers in Europe versus large supermarkets in North America—is essential for optimizing logistical investments.

The dynamic interplay between these segments is continually evolving, particularly with the rise of e-commerce platforms, which have effectively merged distribution channels and increased consumer access to previously localized organic supply chains. This shift necessitates adaptive strategies focusing on packaging integrity for shipping and maintaining the cold chain throughout the extended distribution process. Future growth is anticipated to be driven significantly by the food service segment as global travel and dining recover, and by the specialized retail sector which can effectively communicate the complex value proposition of organic meat.

- By Product Type:

- Fresh/Chilled

- Frozen

- By Application:

- Food Service (Horeca)

- Household/Retail Consumption

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores/Organic Food Retailers

- Online Retail

- Butcher Shops/Farmers Markets

Value Chain Analysis For Organic Lamb Market

The value chain for the Organic Lamb Market is highly sensitive to external factors, emphasizing rigorous control at every stage to maintain organic certification and product integrity. The upstream analysis focuses on organic feed production (must be GMO and chemical-free, often requiring dedicated organic land), breeding and rearing according to strict animal welfare standards, and the initial farming operations. This stage is capital and labor-intensive, requiring high adherence to rotational grazing schedules, natural pest control, and detailed record-keeping. Key upstream constraints include the high cost of certified organic feed and the lengthy process required for land conversion to meet organic standards, which limits scalability and necessitates high upfront investment from primary producers.

Midstream activities involve processing and certification, which represent a crucial choke point in the value chain. Processing facilities must maintain stringent segregation protocols to prevent cross-contamination with conventional meat, often requiring dedicated or thoroughly cleaned lines, significantly increasing operational costs. Certification bodies play an intermediary role, auditing compliance from farm to slaughter. The downstream segment encompasses distribution channels, including cold chain logistics, warehousing, and retail presentation. Given the perishable nature and premium price of organic lamb, efficient, uninterrupted cold chain management is paramount. Direct distribution to specialty stores or through farm-to-table initiatives helps maintain margin control and ensures rapid market delivery, minimizing time-related quality degradation.

Distribution channels are categorized into direct and indirect routes. Direct channels involve farmers selling directly to consumers (farmers markets, farm stores) or directly supplying restaurants, offering maximum margin retention and transparency. Indirect channels, which form the bulk of the market, utilize intermediaries such as wholesalers, distributors, and large-scale retailers (supermarkets and hypermarkets). The growth of online retail acts as a hybrid channel, leveraging digital platforms to facilitate direct-to-consumer sales while outsourcing sophisticated cold chain logistics. Maintaining product differentiation and communicating the organic story effectively at the retail level is essential for realizing the premium pricing justified by the stringent and costly upstream processes.

Organic Lamb Market Potential Customers

The potential customers for the Organic Lamb Market are diverse but primarily concentrated within high-income demographics that prioritize health, ethics, and environmental stewardship in their food choices. The core end-users include affluent households, particularly those with young children, who are highly motivated by concerns over synthetic additives and antibiotic residues found in conventional meats. These buyers are willing to absorb the premium price point to secure perceived health benefits and superior quality. They rely heavily on stringent certifications (USDA Organic, Soil Association, etc.) as assurance of product integrity, making them highly responsive to transparent labeling and traceability information.

Another significant customer segment is the specialized Food Service Industry (Horeca), encompassing high-end restaurants, boutique hotels, and institutional caterers focused on gourmet or sustainability-focused menus. Chefs and procurement managers in this sector seek organic lamb not only for its ethical sourcing but also for its consistent quality and flavor profile, using it as a cornerstone for premium menu items that justify higher dining costs. The institutional segment, including schools and hospitals adopting ‘clean food’ mandates, is emerging as a growth area, particularly in regions with strong governmental pushes for healthier public procurement.

Finally, environmentally conscious consumers and 'flexitarians' (those reducing but not eliminating meat consumption) represent a growing subset. For these buyers, organic lamb is an ethical compromise—a choice made when consuming meat, prioritizing low environmental impact and high animal welfare. They are frequent users of specialized organic stores and online retailers that provide detailed provenance information. Marketing efforts must therefore focus on communicating sustainability credentials, animal welfare standards, and the absence of harmful inputs to successfully capture the loyalty and spending of this value-driven customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $3.29 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Australian Lamb Company, Organic Valley, Borderland Lamb, Arcadian Organic & Natural Meat, Atkins Ranch, New Zealand Organic Lamb Co., Teys Australia, JBS S.A. (Select Organic Brands), Cargill (Select Organic Programs), Danish Crown (Organic Offerings), Pioneer Organic Farms, Superior Farms, Good & Gather (Target Organic), Tönnies Group (Organic Division), Waitrose (Organic Sourcing), D’Artagnan, Wren Livestock, Eversfield Organic, Graig Farm Organics, Midfield Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Organic Lamb Market Key Technology Landscape

The Organic Lamb Market is increasingly integrating various advanced technologies aimed at improving compliance, efficiency, and consumer trust, mitigating the inherent challenges of high input costs and strict regulatory adherence. A crucial technology is the application of IoT (Internet of Things) sensors and connected devices, which monitor livestock health, location, and behavior in real-time. These sensors provide vital data streams regarding grazing patterns, ensuring that rotational grazing protocols—essential for organic soil health certification—are strictly followed and digitally documented. Furthermore, environmental monitoring sensors track soil moisture, nutrient levels, and pasture quality, allowing farmers to optimize natural resource use and minimize environmental footprint, which reinforces the organic premium.

Another dominant technological trend is the implementation of blockchain for enhanced supply chain transparency and traceability. Traditional paper-based certification processes are prone to errors and delays; however, blockchain technology creates an immutable, decentralized ledger detailing every step of the lamb’s life cycle—from the organic feed batch used to the precise date of slaughter and processing. This level of granular traceability is paramount for the organic consumer who demands absolute proof of ethical claims. Using QR codes linked to blockchain data on packaging allows customers to instantly verify the product's organic status and provenance, significantly boosting consumer confidence and justifying the premium pricing strategy.

Lastly, advanced genetics and precision animal husbandry technologies, while constrained by the prohibition of GMOs in organic standards, focus on selective breeding programs to enhance natural disease resistance and feed efficiency within organically raised flocks. Furthermore, data analytics and cloud computing are utilized to manage the vast datasets generated by IoT and blockchain systems, providing producers with actionable insights into optimizing herd management, forecasting yield, and predicting market fluctuations. These technological adoptions are crucial for modern organic producers looking to scale operations without compromising the strict integrity required by organic governing bodies, thereby bridging the efficiency gap between organic and conventional farming methods.

Regional Highlights

The global distribution of the Organic Lamb Market reveals distinct patterns of consumption and production maturity across major continents. Europe holds the largest market share, characterized by high consumer awareness, deeply ingrained organic food culture, and stringent regulatory support from the European Union, which provides subsidies to organic farmers. Countries such as the UK, Germany, and France are primary consumers, with high penetration of organic products in both retail and food service sectors. The European market focuses heavily on local sourcing and biodiversity preservation within organic farming frameworks.

North America, led by the United States and Canada, represents the fastest-growing region in terms of consumption value. Growth is fueled by rising disposable incomes, aggressive marketing by large grocery chains, and increasing health and wellness trends. While domestic production is growing, the region heavily relies on imports, particularly from Oceania, to meet high consumer demand for certified organic lamb. The North American trend favors pre-packaged, ready-to-cook organic cuts available through major supermarket channels and specialized online organic food delivery services.

The Asia Pacific (APAC) region is marked by high production from major exporting nations like Australia and New Zealand, which have well-established, large-scale organic sheep farming operations focusing on export markets. Within consuming nations like China and South Korea, the organic lamb market is still emerging but shows high growth potential driven by rapidly increasing affluence and escalating concerns over domestic food safety standards. Lack of standardized regional organic certification and fragmented local supply chains present challenges, yet increasing urbanization and Western dietary influences provide fertile ground for market expansion, relying heavily on premium imported products.

- Europe: Market leader due to mature organic standards, substantial consumer awareness, and strong governmental subsidies supporting organic agriculture (e.g., UK, Germany).

- North America (USA & Canada): Fastest-growing consumer base, high reliance on imports, driven by affluent consumers and robust specialized retail distribution channels.

- Asia Pacific (APAC): Major production hub (Australia, New Zealand) focusing on exports; emerging consumer markets (China, South Korea) showing rapid growth potential driven by food safety concerns.

- Latin America & Middle East/Africa (MEA): Developing markets; growth concentrated in affluent urban centers (e.g., UAE, Saudi Arabia, Brazil) importing premium organic products for high-end food service and specialty retail.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Organic Lamb Market.- Australian Lamb Company

- Organic Valley

- Borderland Lamb

- Arcadian Organic & Natural Meat

- Atkins Ranch

- New Zealand Organic Lamb Co.

- Teys Australia

- JBS S.A. (Select Organic Brands)

- Cargill (Select Organic Programs)

- Danish Crown (Organic Offerings)

- Pioneer Organic Farms

- Superior Farms

- Good & Gather (Target Organic Sourcing)

- Tönnies Group (Organic Division)

- Waitrose (Exclusive Organic Sourcing)

- D’Artagnan

- Wren Livestock

- Eversfield Organic

- Graig Farm Organics

- Midfield Group

Frequently Asked Questions

Analyze common user questions about the Organic Lamb market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Organic Lamb Market?

The Organic Lamb Market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, driven by increasing consumer demand for ethically sourced and chemical-free meat products.

How do organic lamb farming practices differ significantly from conventional farming?

Organic lamb is raised without synthetic hormones, growth promoters, or routine antibiotics. The farming systems mandate rigorous rotational grazing, non-GMO organic feed, and adherence to high animal welfare standards, focusing on natural health management.

Which geographical region dominates the global consumption of organic lamb?

Europe currently dominates the global organic lamb market share, attributed to its mature regulatory landscape, established consumer preference for organic food, and strong governmental support for sustainable agricultural practices across the continent.

What is the primary constraint hindering rapid market expansion and reducing the price premium?

The chief restraint is the high production cost, primarily due to expensive organic feed, lower yields per animal compared to intensive farming, and the substantial investment and time required for maintaining and auditing strict organic certification compliance.

How is technology, specifically AI and Blockchain, transforming the Organic Lamb supply chain?

AI is used for precision grazing optimization and predictive health monitoring to ensure animal welfare and compliance. Blockchain technology provides immutable, transparent traceability records from the farm to the consumer, drastically improving trust in organic claims.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager